CryptoCurrency

Stablecoin Development Guide for Payments and Remittances

Stablecoins are quickly becoming the new base of global payments. More firms now want speed, lower cost, and clear rules, which is why interest in a stablecoin payment system is rising across banks, payment teams, and remittance groups. The message from the market is clear. Growth begins with compliance.

When a stablecoin follows strict rules, partners trust it, banks support it, and more regions open for use. This is where stablecoin payment solutions start to stand out and gain real adoption. If the goal is to build a stablecoin that can work in real payment flows and attract serious partners, the right plan matters. This guide shows each step and explains how a stablecoin development company can help shape a system that grows with the market.

Why Stablecoins Are Becoming the New Payment Infrastructure?

Stablecoins have quickly shifted from a trading instrument to the backbone of digital payments. The combined market cap of USDT and USDC has tripled since 2023 to $260 billion, and stablecoin transfer volume reached $27.6 trillion in 2024, surpassing Visa and Mastercard. Active wallets also grew from 19.6 million to more than 30 million in a year, showing why enterprises are now exploring a Stablecoin payment system to modernize settlement workflows.

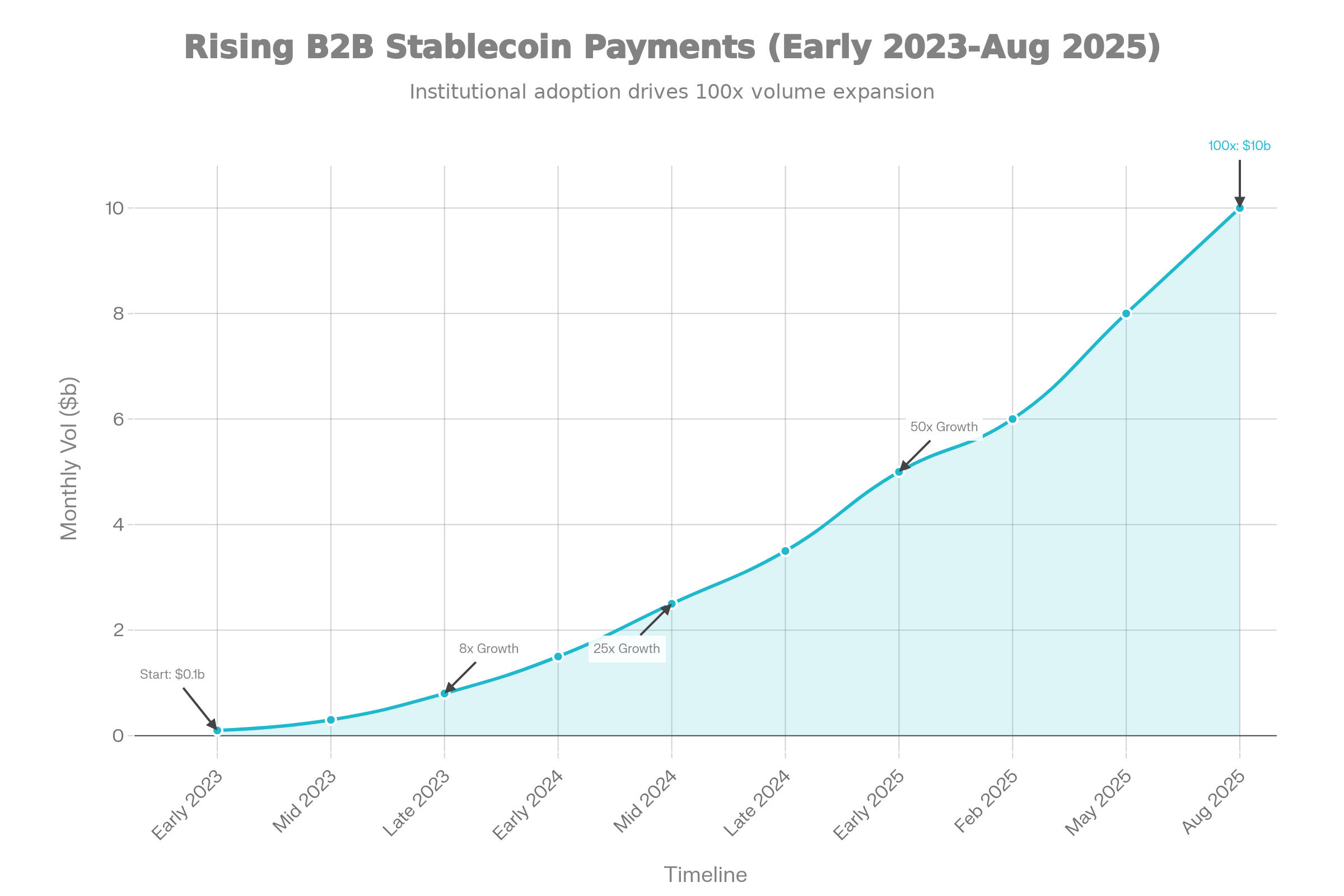

The biggest shift is happening in B2B commerce. Monthly stablecoin payments jumped from under $100 million in 2023 to more than $3 billion in 2025, with cumulative real-world transfers crossing $136 billion. Faster settlement is the top benefit for 48 percent of enterprises, especially when traditional cross-border payments take 3 to 5 days and cost 6 to 12 %. In comparison, stablecoins settle instantly and often cost less than a cent, making them ideal for next-generation stablecoin payment solutions.

Institutional confidence is rising as well. Nine out of ten firms are taking action on stablecoins, 86 percent say their infrastructure is ready, and regulatory concerns have dropped significantly. This is why Visa, Sony, Mastercard, JPMorgan, Stripe, and Fiserv are integrating stablecoin rails directly into their systems.

Regionally, adoption is accelerating as well. Latin America leads with 71% using stablecoins for cross-border payments, followed by Asia’s rapidly expanding corridors and Europe’s clear MiCA regulation. Together, these factors show why stablecoins are becoming the default payment infrastructure for fintechs, enterprises, and global remittance operators.

Claim your spot now and see the stablecoin plan in action.

Choosing the Right Stablecoin Model for Compliance

Before you begin building, the most important decision you will make is choosing the right stablecoin model. This choice determines your regulatory path, licensing requirements, market acceptance, and long-term scalability. Here is the simplified breakdown every founder and payment executive should evaluate upfront:

- Fiat-Backed Stablecoins: Fiat-backed stablecoins remain the most trusted and compliance-aligned model. Every token is backed 1:1 with cash or high-quality liquid assets held in regulated financial institutions. This structure gives enterprises predictable value, easy auditing, and strong regulatory acceptance. A stablecoin development company typically recommends this architecture because it provides the cleanest path for licensing, reserve reporting, and payment integrations.

- Crypto Collateralized Stablecoins: Crypto collateralized models use digital assets like ETH or BTC as backing and are usually over-collateralized to maintain price stability. While suitable for decentralized ecosystems, they introduce volatility and additional oversight challenges for regulators. These factors make them less ideal for payment flows, remittances, and compliance-heavy environments that require clear reserve quality and institutional-grade safeguards.

- Algorithmic Stablecoins: Algorithmic stablecoins stabilize value through programmed supply adjustments instead of real reserves. After several global failures, regulators view this model as high risk. For enterprise payments, cross-border settlement, and remittance corridors, algorithmic models lack the transparency and guaranteed backing required to meet compliance expectations. Any teams exploring advanced architectures consider algorithmic designs as part of broader innovation discussions within a stablecoin development services provider, especially when evaluating future-ready models and programmable money capabilities.

Choosing the right model early saves months of compliance friction later. If your goal is to build a stablecoin that works seamlessly across banks, regulators, and global payment partners, a compliance-aligned architecture is not optional. It is the foundation your entire ecosystem will rely on.

Licensing Requirements for Stablecoin Payment Systems

Launching a compliant stablecoin starts with understanding the licensing rules in every region you plan to operate. Regulators expect issuers to meet strict authorization, reserve, and reporting standards, which directly shape how your stablecoin payment system development must be designed.

1. United States (GENIUS Act 2025)

- Three approval paths: bank subsidiaries, federal nonbank issuers, and state qualified issuers

- A CEO/CFO certification is mandatory

- Failed certifications trigger investigations

2. European Union (MiCA 2025)

- Two authorizations: E Money Tokens (EMTs) and Asset Referenced Tokens (ARTs)

- Full licensing required, plus ongoing compliance

- United Kingdom (Consultation Phase)

- Temporary holding limits (£20k individual, £10M business)

- Final framework expected in 2026

3. United Arab Emirates (CBUAE, VARA, DFSA)

- Dirham-backed issuer license for AED stablecoins

- Foreign stablecoins may register, but cannot offer payments in the UAE

- Monthly external audits are required

- VARA and DFSA require full disclosures, AML, and strict cybersecurity

4. Asia Pacific (HKMA, MAS, FSA)

- Hong Kong licensing begins August 2025

- Singapore rollout expected mid-2026

- Japan restricts issuance to licensed banks, trust companies, or fund transfer operators

What This Means for Issuers

For stablecoin issuers, the global regulatory trend is clear. Licensing requirements are now fully jurisdiction-specific, which means your operational and legal setup must align with each market’s individual framework. Regulators across regions are also moving toward 100% reserve backing as the standard expectation, ensuring every token is fully supported by high-quality assets. Most major markets additionally mandate monthly independent audits, reinforcing transparency and trust. These expectations shape how stablecoin development must be planned, especially for projects targeting cross-border payments, institutional integrations, and regulated financial environments.

On Ramps & Off Ramps Required for Real World Adoption

A compliant stablecoin needs strong security on the chain and a reliable operational system off the chain. Both layers work together to protect reserves, manage transactions, and support large-scale payment activity.

On chain

Your smart contracts must be:

- Audited

- Upgradable

- Protected with multi-signature governance

- Integrated with compliance oracles

Off chain

You need systems for:

- Custody

- Reserve management

- Ledger reconciliation

- Identity and access management

When these elements work together, you get a resilient architecture ready for payments and remittances. This foundation also supports future integrations with card issuers, wallet providers, and payment processors. A stablecoin development company can enhance the system by adding support for more networks, better API connections, automated compliance features, and wallet systems that make it easier for users to manage payments at scale.

Get the licensing guide and move your stablecoin idea forward.

Go To Market Strategy for a Compliant Stablecoin

- Lead with compliance clarity: Show licensing status, reserve backing methods, audit process, and regional approval readiness.

- Highlight real business outcomes: Focus on faster settlement, lower costs, wider reach, and stronger cash flow support.

- Build strong partnerships: Connect with banks, payment networks, custodians, liquidity providers, and on-ramp and off-ramp services.

- Offer simple onboarding: Provide clear API access, detailed documentation, and smooth integration steps for businesses.

- Strengthen market trust: Share transparent reports, case studies, and use cases, and participate in industry forums.

- Position for global scale: Design the launch so it can expand easily into high-demand corridors and enterprise payment flows.

Conclusion: Compliance Defines Stablecoin Success

Real progress in payments and remittances begins with a stablecoin that follows clear rules and earns trust from partners, regulators, and users. When compliance forms the base, the growth path becomes open. More payment firms join, more regions accept the product, and more users move funds with confidence.

Enterprises want a system that protects funds, meets legal standards, and supports steady use in real payment activity. They also want guidance that helps them plan for long-term growth and smooth delivery. This is where the role of a strong, stablecoin development company becomes important. A skilled team can shape the full structure, guide the checks and controls, and support the complete journey from idea to launch. The journey becomes clear when the work is guided by knowledge and careful planning. Many groups turn to Antier for support when they want clear structure, strong delivery, and a stable path to launch in global markets. Reach out to explore how your stablecoin idea can move from plan to real use with guidance that supports every step of the journey.

Frequently Asked Questions

01. Why are stablecoins becoming the preferred payment infrastructure?

Stablecoins are gaining popularity due to their speed, lower costs, and compliance with regulations, making them ideal for modernizing payment systems and attracting institutional partners.

02. How has the market for stablecoins changed recently?

The market cap of major stablecoins like USDT and USDC has tripled to $260 billion, with stablecoin transfer volumes surpassing traditional payment methods like Visa and Mastercard, indicating a significant shift towards digital payments.

03. What are the benefits of using stablecoins for businesses?

Stablecoins offer faster settlement times and lower transaction costs, with 48% of enterprises citing instant settlement as a key advantage compared to traditional cross-border payments, which can take several days and incur higher fees.