Crypto World

Strategy (MSTR) Stock: Analyst Slashes Target 60% Yet Keeps Buy Rating

TLDR

- Strategy stock dropped 5.7% to $125.66 Wednesday, tracking toward its lowest close since September 2024

- Canaccord Genuity maintained a Buy rating while cutting its price target from $474 to $185, a 60% reduction

- The company’s 713,502 Bitcoin holdings are valued at $53.6 billion as Bitcoin trades around $73,000

- Strategy’s premium to Bitcoin assets compressed to 1.06x from previous multiples exceeding 2x

- Analyst expects Bitcoin to rally 20% in 2026 and Strategy to reach a 1.25x valuation multiple

Strategy stock extended its losing streak Wednesday with a 5.7% decline to $125.66. The drop followed Canaccord Genuity’s decision to cut its price target by 60%.

The firm lowered its target from $474 to $185. Canaccord maintained its Buy rating despite the substantial reduction.

Strategy shares are down 72% since July. Wednesday’s decline put the stock on pace for its lowest close since September 9, 2024.

The price target cut reflects Bitcoin’s sharp decline. The cryptocurrency dropped to around $73,000 after hitting record highs above $126,000 in October.

Strategy holds 713,502 Bitcoins worth approximately $53.6 billion. The company’s average purchase price is $76,052 per coin.

Bitcoin Premium Evaporates

Strategy’s valuation premium has collapsed. The stock’s market-to-net-asset-value ratio now stands at 1.06. Investors previously paid more than 2x the value of Strategy’s Bitcoin holdings.

Bitcoin recently traded below Strategy’s average cost. This sparked worries about the company’s debt and dividend payments.

Canaccord analyst Joseph Vani dismissed those concerns. Strategy carries $8 billion in convertible debt against $53.6 billion in Bitcoin assets.

Vani said dividend payments on preferred stock can be funded through modest share sales. He described Strategy’s structure as built to survive a prolonged crypto downturn.

Bitcoin Rebound Expected

The analyst believes Bitcoin has been incorrectly treated as a risk asset. Vani argues it should trade as a store of value based on scarcity and verifiability.

“MSTR shares remain a bit of a lightning rod for media attention when BTC is weak,” Vani wrote. He suggested the business model was designed for market volatility.

Canaccord projects Bitcoin will rebound approximately 20% in 2026. The firm acknowledged uncertainty around timing the recovery.

Strategy won’t recapture its previous premium anytime soon. Canaccord expects shares to reach a 1.25x multiple relative to Bitcoin assets.

Strategy reports fourth-quarter earnings Thursday. The company will likely post an unrealized loss due to Bitcoin’s quarterly decline.

Vani emphasized Bitcoin’s outlook matters more than quarterly results. Strategy’s performance remains directly tied to cryptocurrency prices.

The company pioneered the digital-asset treasury strategy. Strategy issues equity and debt to accumulate Bitcoin holdings.

Bitcoin hit its lowest point in over a year Tuesday. The cryptocurrency’s weakness has pressured Strategy stock throughout the downturn.

Canaccord believes Bitcoin’s sell-off may be nearing an end. The firm sees the cryptocurrency as undervalued at current levels.

Strategy’s convertible debt remains manageable relative to its Bitcoin position. The company’s holdings provide substantial coverage for its obligations.

Crypto World

Crypto Markets Catch Some Relief as BTC Climbs Back Over $68K

A broad-based rally lifted cryptocurrencies this morning, with BTC and ETH pushing back above key psychological levels, helped by strong spot Bitcoin ETF inflows.

Crypto markets saw a moderate bounce on Wednesday as buyers returned across major tokens, reversing some recent losses. Today, Feb. 25, total crypto market cap climbed about 6% to roughly $2.42 trillion.

Bitcoin (BTC) rose from around $62,900 late Tuesday to about $68,200 at publishing time, posting a 6.2% daily gain and pushing its weekly change just slightly into the green.

Ethereum (ETH) outperformed BTC, jumping over 10% to trade back over $2,060, and up a solid 4.6% on the week. Across the rest of the top-10 crypto assets — all trading higher — Solana (SOL) posted the biggest daily gain, up over 12%.

Unstable Footing

Despite the rebound, some on-chain indicators suggest stress hasn’t fully cleared. Analysts at glassnode said in an X post that Bitcoin’s Realized Profit/Loss Ratio (90-day SMA) has fallen below 1, signaling a shift into an excess loss-realization regime.

“Historically, breaks below 1 have persisted for 6+ months before reclaiming it, a recovery that typically signals a constructive return of liquidity to the market,” the analysts wrote.

Market sentiment is still shaky. The Crypto Fear and Greed Index ticked up to 11 from 8 a day earlier, pointing to a slight easing in fear, but it remains deep in “extreme fear” territory.

Big Movers and Liquidations

Looking at the top-100 assets by market cap, Filecoin (FIL) led gains, surging over 22%, followed by Polkadot (DOT), up almost 22% as well on the day, and Uniswap’s UNI, up 17%.

On the downside, losses were limited: MemeCore (M) slipped 2.8%, while Midnight (NIGHT) lost half a percent.

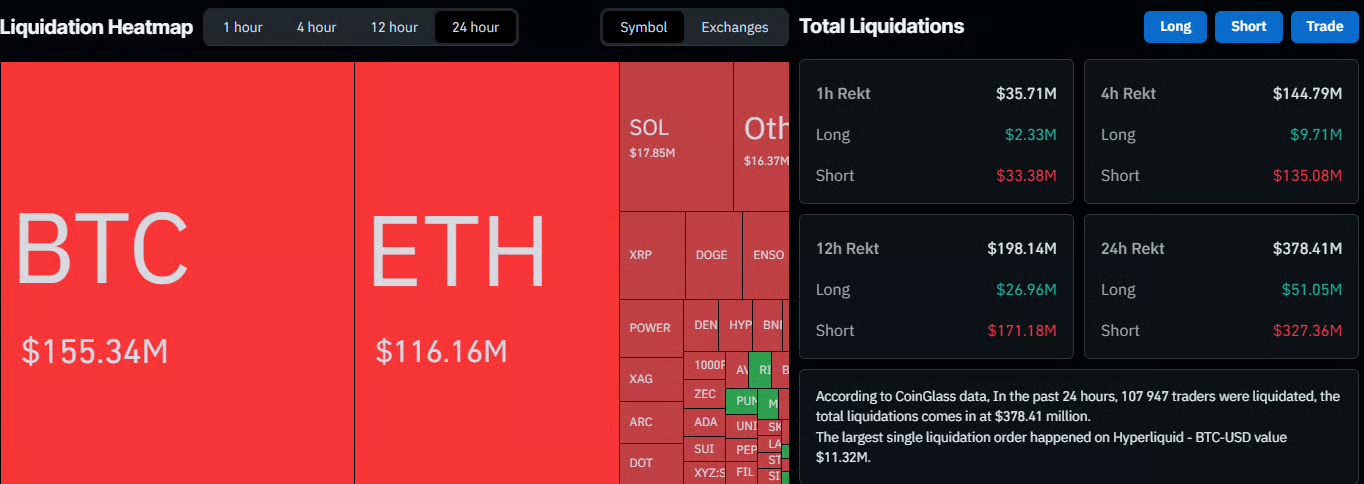

According to CoinGlass data, roughly 97,300 traders were liquidated over the past 24 hours, with total losses of $316.2 million. Short positions accounted for the bulk at $258.7 million, while BTC liquidations totaled $8.6 million, ETH slightly above $6 million, and SOL $1.6 million.

ETFs and Macro Conditions

On Tuesday, Feb. 24, spot Bitcoin exchange-traded funds recorded over $257 million in net inflows, pushing total net assets to about $81.3 billion. Spot Ethereum ETFs also saw net inflows yesterday of $9.23 million.

On the macro side, U.S. Treasury yields ticked a bit higher as investors digested Trump’s State of the Union, where he leaned hard on the economy and floated ideas ranging from a government-backed retirement plan to limits on institutional home buying, CNBC reported.

Attention now turns to upcoming U.S. economic data releases, including weekly initial jobless claims due Thursday and the producer price index (PPI) report scheduled for Friday, while traders continue to monitor geopolitical developments involving the U.S. and Iran.

Crypto World

Why altcoins like Filecoin, Polkadot, Aptos, Morpho are soaring

A crypto rally is happening today, with Bitcoin and most altcoins being in the green.

Bitcoin (BTC) price jumped to $68,000, while the market capitalization of all coins rose by 6% to over $2.34 trillion.

Filecoin (FIL) rose by over 25% to $1.10, while Polkadot (DOT) jumped by 21%. Other tokens like Aptos (APT), Morpho (MORPHO), Uniswap (UNI), and Avalanche (AVAX) soared by over 15%.

Bitcoin and these altcoins jumped as investors embraced a risk-on sentiment across the board. For example, American stocks, including the Dow Jones, Nasdaq 100, and S&P 500, rose by 250, 260, and 35 points, respectively.

The risk-on sentiment happened as investors bought the dip as they waited for the Nvidia earnings, which will come out after the US market closes. NVIDIA is the most influential American company because of its size and role in the artificial intelligence industry.

Additionally, the tokens jumped as the futures open interest rebounded cautiously, a sign that demand is rising. Open interest rose by over 6% in the last 24 hours to $99.4 billion, much higher than this week’s low of $93 billion.

Filecoin’s open interest rose to $154 million, while Morpho soared to over $34 million. The futures open interest of other tokens like Aptos and Polkadot continued soaring.

Still, it is too early to determine whether this is the start of a new crypto bull run or whether it is just a dead-cat bounce. In the past, most crypto market rallieshave turned out to be dead-cat bounces.

A dead-cat bounce is a situation where an asset in a free-fall rebounds temporarily and then resumes the downtrend.

Crypto World

Here’s why Chainlink price is soaring today

Chainlink price rebounded by over 14% on Wednesday, reaching its highest level since February 5.

Chainlink (LINK) token rose to a high of $9.35, up by over 30% from its lowest level this month. This rebound has brought its market capitalization to over $6.6 billion.

Top reasons why the LIN price is soaring

Chainlink price rose as the crypto market rally resumed, with Bitcoin and most altcoins being in the green. Bitcoin jumped to $67,000, while the market capitalization of all tokens rose by over 5% to over $2.33 trillion.

LINK token is also benefiting from sustained demand from American investors. Data compiled by SoSoValue shows that spot LINK ETFs have accumulated over $10 million in assets this month, bringing their cumulative total to over $85 million.

These funds now have over $71 million in assets, with Grayscale’s GLNK having $61 million. Bitwise’s CLNK has $9.75 million in assets. In contrast, spot Bitcoin and Ethereum ETFs have shed billions of assets in the past few months.

Chainlink price is also rising after integrating with Canton, one of the biggest players in the real-world asset tokenization industry. The integration introduces data streams on equities, smart data, proof of reserves, and CCIP.

Other recent integrations in the network are Robinhood, Arc, the layer-1 network built by Circle, World, and MagaEth.

Meanwhile, Chainlink has continued to accumulate LINK tokens as part of its Strategic LINK Reserves. Data shows that these reserves have jumped to over 2.17 million currently worth over $19.7 million. These purchases will continue growing in the coming years as Chainlink plans to use its off-chain fees to accumulate more tokens.

Still, the main risk is that the ongoing Chainlink price rebound is a dead-cat bounce, also known as a bull trap. A bull trap is a situation where an asset in a freefall bounces back and then resumes the downtrend.

Chainlink price prediction: Technical analysis

The daily timeframe chart shows that the LINK price has remained in a bear market in the past few months despite its strong fundamentals.

It dropped from a high of $27 to the current $9.4. It has remained below all moving averages and the key support level at $10, which was its lowest level on April 6 last year.

LINK price remains below the 50-day and 100-day Exponential Moving Averages and the Supertrend indicator. Also, it formed a small double-bottom pattern at $8.036 and a neckline at $9.18.

Therefore, the most likely scenario is where it remains under pressure in the coming weeks as risks, including the potential attack on Iran, remain. A complete rebound will be confirmed if it moves above the key resistance level at $10 and flips the short and medium-term moving averages.

Crypto World

Tether, issuer of USDT, invests $200 million in Whop to expand stablecoin payments

Tether, the crypto company behind the world’s largest stablecoin USDT , is investing $200 million in online marketplace Whop to boost stablecoin payments.

The deal values the startup at $1.6 billion, Whop CEO Steven Schwartz said in an X post.

Whop runs a digital marketplace where creators sell access to software tools, trading groups, online communities and learning courses. The platform said it has 18.4 million users and that participants earn about $3 billion each year. It’s growing fast, with gross transaction volume increasing about 25% month-over-month, it added.

As part of the deal, Whop will integrate Tether’s crypto wallet tool, allowing users to hold and transact in stablecoins such as Tether’s USDT and U.S.-focused USAT directly on the platform. The integration also gives creators the option to accept digital dollar payments and settle globally without relying on banks or card networks, the press release said.

The funding round is aimed at supporting Whop’s expansion across Latin America, Europe and Asia-Pacific while adding lending and borrowing tools powered by decentralized finance infrastructure.

With the investment, Tether pushes its stablecoins deeper into consumer-facing platforms and everyday online commerce. The company’s flagship stablecoin, the $185 billion USDT token, is a popular tool to access and transact in U.S. dollars in emerging countries.

Crypto World

Tokenized U.S. Treasuries Rise Over $1B Since 2026 Began

Across the on-chain securitization landscape, tokenized US Treasuries are gaining traction as a growing liquidity layer for traditional debt markets. The market for tokenized U.S. government securities has climbed by more than $1 billion since the start of 2026, even as macroeconomic headwinds persist and concerns about rising national debt linger. By the time of writing, the total value of tokenized Treasuries hovered around $10.8 billion, up from roughly $8.9 billion on January 1, according to data tracked by RWA.xyz. The move reflects a broader push toward on-chain representations of real-world assets, catalyzed by institutional participation and new infrastructure that aims to streamline on-chain settlement and custody for government debt.

The tokenized US Treasury market is framed as a real-world asset (RWA) on the blockchain, where each token represents a claim on a pro-rata slice of underlying government securities. This model promises faster settlement, programmable features, and easier cross-border access for investors who want exposure to highly liquid, benchmark-grade debt. The growth is not only about the asset class itself; it signals a sea change in how traditional fixed income can be accessed through digital rails. In a space characterized by volatility, the demand for ultra-liquid, widely recognized collateral has brought a new degree of stability to the on-chain finance ecosystem. In parallel, data from Token Terminal shows the market’s ascent accelerating, with the asset class described as having surged 50x since 2024, underscoring the scale of uptake among on-chain market participants.

Notably, the march of tokenized Treasuries has been bolstered by significant, real-world institutional backing. March 2024 marked the debut of BlackRock’s USD Institutional Digital Liquidity Fund, commonly referred to as BUIDL, a vehicle designed to bring high-grade liquidity into the digital-asset domain. As of now, BUIDL has extended its footprint to a market cap exceeding $1.2 billion, illustrating how traditional asset managers are applying digital liquidity concepts to convert cash-like assets into tokenized forms that can reside on-chain while preserving regulatory guardrails and oversight. That development highlights the growing willingness of large asset managers to participate in tokenized markets, even as broader crypto markets faced a downturn in late 2025 and early 2026.

Infrastructure and policy developments have kept pace with these market dynamics. In December 2025, the Depository Trust & Clearing Corporation (DTCC), the leading clearinghouse network for global markets, announced plans to launch an asset-tokenization service beginning with US Treasuries. The initiative, described as a Canton-based effort, aims to tokenize a broad spectrum of assets over time, with the first focus on Treasurys. DTCC’s leadership indicated that the service would eventually extend to exchange-traded funds (ETFs) and equities, signaling a broader push to bring regulated, on-chain settlement and post-trade processing to a wider array of asset classes. The DTCC footprint is substantial: the firm settled hundreds of trillions in value across its networks in 2024, underscoring the potential leverage such a platform could wield in terms of liquidity and risk management for tokenized assets.

Beyond the tokenization service, the macro environment remains a factor shaping demand for tokenized government debt. The tokenized Treasuries narrative has persisted even as the crypto market faced a broad downturn that began in October 2025. Observers point to macro uncertainty, rising US debt levels, and a cautious risk sentiment as a backdrop for the adoption of tokenized RWAs. The World Uncertainty Index, tracked by the Federal Reserve Bank of St. Louis, remained elevated through 2025, signaling a demand for liquid, highly credit-rated collateral that can function as a reliable settlement layer in volatile conditions. In this context, tokenized Treasuries—backed by the same cash-like liquidity that underpins traditional money markets—offer an appealing on-chain alternative for institutions seeking efficient liquidity and programmable exposure with robust risk controls.

Industry participants argue that tokenization could unlock new revenue streams for the networks and platforms that mint these assets. By enabling the on-chain representation of US government debt, the market opens opportunities for liquidity providers, market makers, and custody rails to monetize settlement and settlement-related services in a regulated, tokenized framework. Proponents also point to a broader trend where traditional finance is exploring Layer-2 and sidechain solutions to tokenize trillions in RWAs, a narrative that has gained traction in industry discussions and related reporting. While the pace of adoption may vary by jurisdiction and regulatory posture, the underlying demand for asset-backed tokens with deep liquidity remains palpable, potentially shaping how institutions think about cash equivalents in a digital era.

The Depository Trust and Clearing Corporation to launch US Treasury tokenization service

DTCC’s decision to initiate asset tokenization on the Canton network marks a pivotal step in bridging regulated markets with blockchain-enabled post-trade workflows. The project, announced in December 2025, intends to tokenize US Treasuries first, leveraging the Canton pilot to test settlement, custody, and compliance controls in a tokenized environment. While the immediate focus is Treasuries, DTCC’s leadership has signaled that the platform will broaden to a wider range of asset classes, potentially including ETFs and equities as part of a phased expansion plan. This move aligns with a broader industry push to bring regulated, on-chain settlement capabilities to traditional asset classes, reducing settlement risk and enabling programmable liquidity features for high-quality collateral.

DTCC’s scale and reach—settling trillions in transactions across its networks—underscore the potential for tokenization to affect the entire market infrastructure. The firm’s ecosystem is designed to support complex multi-party processes, and the Canton-based exchange of tokenized assets could similarly improve efficiency, transparency, and risk management for on-chain representations of debt and other financial instruments. As tokenized Treasuries begin to circulate on Canton and related rails, observers will be watching for interoperability standards, custody guarantees, and regulatory alignment that will determine how quickly tokenized assets gain broader adoption across institutions and asset managers.

US Treasuries have long been the backbone of global and corporate finance due to their liquidity and accessibility. With tokenization, the traditional cash-like role of short-dated Treasuries could gain an additional dimension—programmable features, automated redemption and settlement workflows, and potential yield enhancements through structured products built atop tokenized debt. Yet as with any regulatory-adjacent innovation, the path to scale hinges on clear guidance, standardized protocols, and robust risk controls that can reassure both market participants and policymakers alike. Still, the momentum around tokenized RWAs—driven by market data, institutional participation, and infrastructure bets—suggests that the coming years could witness a more visible integration of on-chain representations into mainstream fixed-income trading and settlement.

Why it matters

For investors, tokenized Treasuries offer a familiar, highly liquid exposure channel that can be integrated into digital portfolios with programmable features and potential cost efficiencies in settlement. The on-chain representation of US government debt could enable new liquidity strategies, cross-border access, and more seamless movement of capital between traditional and crypto-native ecosystems.

For networks and platforms, the scale of the market cap growth signals an opportunity to monetize settlement and custody services, while supporting risk-managed access to high-grade collateral. The DTCC’s tokenization initiative illustrates how regulated infrastructure can serve as a bridge between conventional markets and blockchain-based mechanics, potentially driving further adoption across asset classes beyond Treasuries.

From a policy and regulatory perspective, tokenization raises important questions about custody, compliance, and reporting. As more assets move on-chain, regulators will scrutinize how on-chain representations are reconciled with traditional clearing, settlement, and risk-management frameworks. The ongoing collaboration between traditional financial institutions and blockchain-native firms will be essential to establishing algorithms and standards that can sustain growth without compromising resilience.

Summed up, the tokenization of US Treasuries reflects a broader trend toward institutional embrace of RWAs and on-chain settlement. It is a development that could recalibrate the economics of liquidity provision in digital markets while reinforcing the role of trusted incumbents—like DTCC—in shaping the governance and reliability of tokenized asset ecosystems. The narrative remains nuanced: there is clear momentum and significant capital behind this shift, but it will require careful navigation of regulatory landscapes and interoperability challenges to translate early wins into durable, scalable liquidity for tokenized debt.

What to watch next

- Timeline and milestones for DTCC’s Canton-based US Treasuries tokenization rollout, including any regulatory approvals.

- Expansion plans to ETFs and equities on the tokenization platform and the pace of experimentation with additional asset classes.

- Adoption metrics from institutional participants and observable liquidity improvements in tokenized Treasuries.

- Regulatory developments or policy clarifications impacting on-chain RWAs and regulated tokenization structures.

Sources & verification

- RWA.xyz data on tokenized Treasuries and market cap levels (https://app.rwa.xyz/treasuries).

- Token Terminal data indicating a 50x surge since 2024 for tokenized Treasuries (https://x.com/tokenterminal/status/2003096211583311913).

- BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL) and its current market position (https://cointelegraph.com/news/blackrock-buidl-3x-1-8-b-3-weeks-bitcoin-lacks-momentum).

- DTCC announcements regarding Canton-network-based asset tokenization and planned expansion (https://cointelegraph.com/news/dtcc-tokenize-us-treasurys-canton-blockchain).

- Federal Reserve Bank of St. Louis’ World Uncertainty Index as a contextual gauge for market sentiment (https://fred.stlouisfed.org/series/WUIGLOBALWEIGHTAVG).

Crypto World

When ETF options start driving bitcoin

Hi readers,

Welcome to our institutional newsletter, Crypto Long & Short. This week:

- Gregory Mall on how ETFs have shifted a growing share of bitcoin volatility into U.S. equity options markets

- Top headlines institutions should pay attention to by Francisco Rodrigues

- Mid-caps show surprising strength in Chart of the Week

Thanks for joining us!

Expert Insights

When ETF options start driving bitcoin

– By Gregory Mall, chief investment officer, Lionsoul Global

The launch of U.S. spot bitcoin ETFs marked a structural turning point. The iShares Bitcoin Trust ETF (IBIT) rapidly became one of the fastest-growing ETFs in history, drawing tens of billions into a regulated vehicle. Less discussed, but equally important, is what followed: the rapid expansion of IBIT options.

Over the past year, open interest in IBIT options has climbed into the multi-billion-dollar range. On selected high-volume sessions, activity has approached levels historically associated with Deribit, the cryptocurrency futures and options exchange. A meaningful share of bitcoin’s convexity now sits inside U.S. equity options markets rather than offshore crypto venues.

That shift matters because it changes how volatility is transmitted.

From offshore leverage to onshore gamma

For most of its history, bitcoin volatility was driven by offshore perpetual futures. Funding imbalances, leverage build-ups and liquidation cascades shaped price action.

ETF options introduce a different mechanism.

When investors buy calls or puts on IBIT, dealers typically sell that optionality and hedge delta exposure. If dealers are short gamma, which is common when investors are net long options, they must buy as price rises and sell as price falls. These hedging flows are inherently procyclical and can amplify underlying moves.

Because IBIT holds physical bitcoin, hedging does not remain confined to the wrapper. Arbitrage and creation and redemption flows transmit ETF positioning into the underlying market. Bitcoin increasingly participates in the same positioning mechanics that influence equity indices.

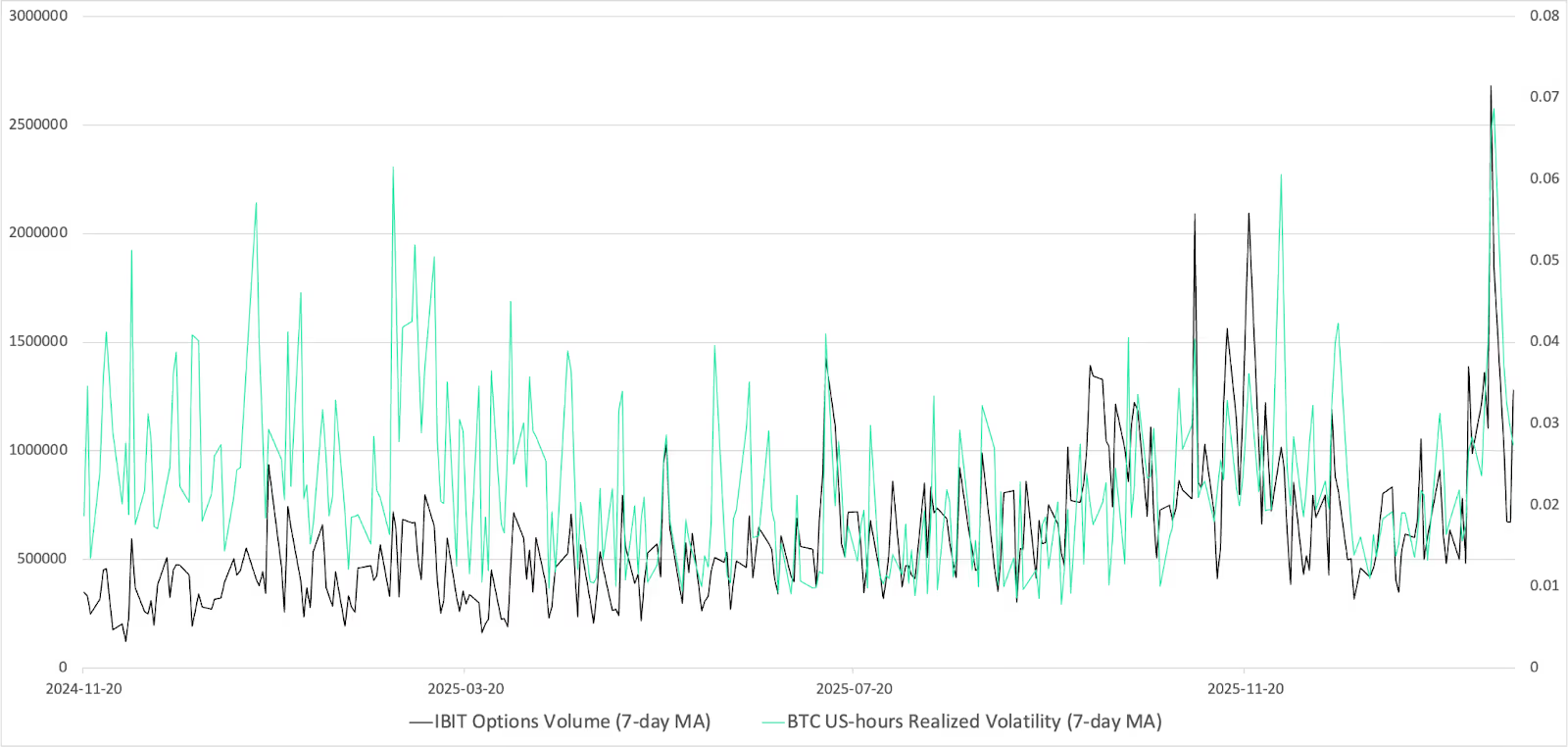

The structure of ETF options markets, where investors are generally net long optionality, suggests dealers are often warehousing short gamma during periods of elevated demand. This dynamic likely intensified during the February episode, when volatility had been subdued and crypto-native participants accumulated downside puts. Sustained option buying in a low-volatility regime leaves market makers short convexity across both ETF and offshore venues. When spot breaks, hedging flows can reinforce the feedback loop. In the graph below we show the movement of IBIT option volume and BTC U.S.-hours realized volatility. We can see that the relationship has strengthened over the past weeks.

Chart 1 illustrates the co-movement between IBIT option volume and BTC U.S.-hours realized volatility, showing that their relationship has strengthened in recent weeks. To formally evaluate this relationship, we regress bitcoin realized volatility on lagged IBIT options volume while controlling for BTC funding rates, equity returns (Nasdaq Composite), implied volatility (CBOE Volatility Index, or VIX), short-term interest rate changes and U.S. dollar movements. The results indicate that IBIT options trading activity is significantly associated with BTC volatility even after accounting for broader macroeconomic conditions.

Chart 1: Movement of IBIT option volume and BTC U.S.-hours realized volatility

Table 1: OLS regression IBIT options volume on BTC volatility

Table 2: BTC volatility distribution pre and post IBIT Options

We split the data into before vs. after IBIT options began trading. For each hour of the day (UTC), we measure how much bitcoin’s price moved in that hour. Then we convert it into a share of the day’s total volatility — so each column adds up to 100%. The highlighted band (14:00-16:00 UTC) lines up with peak U.S. trading activity, especially the U.S. cash equity open. After, IBIT options volatility becomes more concentrated in these U.S. hours — suggesting more price discovery and hedging flow is happening when U.S. markets are most active.

February as illustration

The early February selloff provides a useful example. Bitcoin fell sharply during one of the most extreme cross-asset deleveraging episodes in recent years. Yet IBIT recorded net creations rather than redemptions, which argues against retail panic.

In a thoughtful Substack post, Jeff Park suggested the catalyst was cross-asset positioning amidst some of the big multistrategy funds rather than crypto-specific stress. Correlations between bitcoin and high-beta software equities tightened materially, indicating multi-asset portfolios were being indiscriminately de-risked.

At the same time, the CME bitcoin basis widened dramatically. Near-dated basis moved from roughly three percent to close to nine percent. Such a move is consistent with multi-strategy funds unwinding delta-neutral basis trades by selling spot or ETFs and buying futures under gross exposure constraints.

As prices declined into that environment, existing short-gamma positioning may have amplified the downside through mechanical delta-hedging. Dealers’ short convexity must sell into weakness. The sharp rebound that followed on Friday the 6th is consistent with hedges being rebalanced once acute pressure subsided.

The episode illustrates a broader point. Bitcoin now participates in the same balance sheet and derivatives mechanics that govern equities and other risk assets.

Digital gold, or leveraged Nasdaq?

This evolution complicates the “digital gold” narrative. Bitcoin’s correlation with gold has historically been unstable and often close to zero over shorter horizons. BlackRock’s Head of Digital Assets, Robert Mitchnick, has argued that heavy speculative positioning can cause bitcoin to behave more like a leveraged Nasdaq proxy than a macro hedge. This observation is directionally correct. In Chart 3 we are showing that the BTC-Nasdaq correlation during U.S. trading sessions approximately doubled since inception of IBIT options. Increasingly, however, it is not only speculative longs that matter. Delta-neutral strategies and derivatives positioning inside traditional markets now contribute to volatility feedback loops.

Chart 2: Bitcoin’s correlation with Nasdaq pre- and post IBIT options

Bitcoin began outside the financial system. The success of IBIT and IBIT options shows it is now embedded within it. For long-term allocators, this does not invalidate the structural case for digital scarcity. It does mean that short-term price action is increasingly shaped by positioning, hedging and cross-asset flows.

Bitcoin is no longer trading outside the system. It is trading inside it.

The information contained herein is provided for informational and educational purposes only and should not be construed as investment, legal, or tax advice. Nothing contained in this document constitutes an offer to sell, or a solicitation of an offer to buy, any securities, investment products, or advisory services.

Lionsoul Global Advisors LLC is registered with the Texas State Securities Board (CRD #: 324883). The advisory services provided by Lionsoul Global Advisors are available exclusively to non-U.S. investors who meet applicable eligibility, accreditation, and qualification standards under relevant laws and regulations.

Headlines of the Week

– By Francisco Rodrigues

Trump’s Mar-a-Lago crypto summit would’ve been unthinkable just a few years ago. Now we’re not only getting that, but also a $17 billion trading volume debut of a crypto-linked ETF and more in a single week.

- Goldman Sachs, Franklin Templeton, and Nicki Minaj: Inside Trump’s surreal Mar-a-Lago crypto summit: The World Liberty Financial form at Mar-a-Lago included figures from traditional finance, crypto and real estate in an intimate setting, with panels touching on crypto and the future of tokenized real estate.

- To freeze or not to freeze: Satoshi and the $440 billion in bitcoin threatened by quantum computing: Quantum computing is slowly moving closer to reality, and as it does, nearly 7 million bitcoin could potentially be at risk. That includes Satoshi Nakamoto’s estimated 1 million BTC.

- ProShares’ stablecoin-ready ETF sees $17 billion debut, sparking speculation about Circle: ProShares’ IQMM money market ETF, designed to comply with U.S. stablecoin reserve requirement under the GENIUS Act, saw $17 billion in first-day trading. That sparked speculation that stablecoin issuers could be moving funds.

- Bitcoin balances on Binance hit highest since November 2024 – here’s what it means: Users’ bitcoin holdings in Binance-linked wallets are at their highest level since late 2024, which could have bearish implications on an already depressed market.

- Specialized AI detects 92% of real-world DeFi exploits: Purpose-built AI could detect vulnerabilities in 92% of 90 exploited decentralized finance (DeFi) contracts, accelerating concerns over offensive AI capabilities.

Chart of the Week

Mid-caps show surprising strength as large caps lag bitcoin

While Bitcoin is down 27.7% YTD and large-cap indices like the CD5 and CD20 are underperforming it (down 30% and 32% respectively), the CD80 is showing resilience with a shallower drawdown of only 20.91%. This represents a 7% relative outperformance against Bitcoin, a reversal of the typical “risk-off” dynamic where smaller assets crash harder than the lead. This strength suggests a “seller exhaustion” phase for mid-caps, where the heavy weightings of idiosyncratic performers like Hyperliquid (HYPE) and Canton Coin (CC) are decoupling from the broader institutional sell-off seen in large-caps.

Listen. Read. Watch. Engage.

Looking for more? Receive the latest crypto news from coindesk.com and explore our robust Data & Indices offerings by visiting coindesk.com/institutions.

Crypto World

What Is the Right White Label Tokenization Platform for You?

Tokenization at enterprise scale is fundamentally an architectural decision. While market conversations often emphasize speed of deployment, the true determinant of long-term viability lies in the structural integrity of the underlying white label tokenization platform.

Smart contract modularity, compliance logic programmability, interoperability layers, custody integrations, and upgrade mechanisms collectively define whether the system can withstand regulatory evolution and transaction scale. Selecting white label tokenization software without evaluating its contract architecture and governance design introduces systemic limitations that compound over time.

The decision framework must therefore begin at the infrastructure layer — not the user interface.

What Is a White-Label Tokenization Engine?

A white-label tokenization engine is a pre-built, customizable blockchain-based infrastructure that enables organizations to issue and manage tokenized assets under their own brand. A white-label tokenization engine is faster to market than a custom-built solution, but still allows for customization and configuration of compliance.

Core capabilities include:

- Token issuance and lifecycle management

- Compliance rule enforcement

- Investor onboarding and KYC integration

- Governance and voting modules

- Smart contract management

- Asset reporting dashboards

When supported by robust white label tokenization development services, such platforms allow enterprises to retain strategic control while minimizing infrastructure risk.

Why the Choice of Tokenization Engine Impacts Long-Term Scalability

Enterprises looking to establish themselves in regulated digital asset markets will find that scalability is about much more than just transaction throughput; it also includes aspects such as regulatory elasticity, architectural modularity, liquidity enablement, operational automation, and ecosystem interoperability.

In this case, the white label tokenization platform will become your programmable underpinning that helps determine if growth will be seamless or stifled by the architecture of your tokenization platform infrastructure

Choosing robust enterprise white label tokenization solution will allow you to scale without having to continually re-build your infrastructure to support the new level of growth. Instead, scalability will be part of the smart contract architecture, governance logic and integration stack from the very beginning.

1. Regulatory Elasticity and Compliance Automation

Regulatory environments are dynamic. Jurisdictional policies evolve, disclosure requirements expand, and investor eligibility criteria shift over time. A technically mature white label tokenization software solution must therefore incorporate a configurable compliance rule engine rather than static rule sets.

Scalable compliance architecture should support:

- Jurisdiction-based transfer restrictions

- Role-based investor permissions

- Whitelisting and blacklisting logic embedded at contract level

- Automated dividend and reporting triggers

- On-chain audit trail generation

When compliance is deeply integrated into smart contract logic, enterprises can scale across borders without redeploying infrastructure. Organizations leveraging robust white label tokenization development services benefit from programmable regulatory adaptability instead of reactive redevelopment cycles.

2. Modular Smart Contract Architecture and Upgradeability

Long-term scalability depends on modularity. Monolithic contract deployments restrict flexibility and introduce systemic risk during updates. A future-ready white label tokenization platform must employ structured contract patterns such as proxy upgrade mechanisms, modular deployment layers, and governance-controlled upgrade pathways.

Scalable architecture includes:

- Separation of logic and storage contracts

- Version-controlled contract upgrades

- Governance-based modification approvals

- Emergency pause and recovery mechanisms

- Deterministic permission hierarchies

A capable white label tokenization platform development company ensures that upgradeability does not compromise security, enabling protocol evolution without disrupting active tokenized assets.

3. Multi-Asset and Multi-Chain Interoperability

Enterprises rarely tokenize a single asset class. Over time, expansion into real estate, debt instruments, equity, structured funds, or commodities becomes a strategic objective. The selected enterprise white label tokenization solutions framework must therefore support multi-asset issuance under a unified infrastructure.

Scalability requires:

- Compatibility with multiple token standards

- Configurable token economics models

- Cross-chain deployment capability

- API-driven interoperability with exchanges and custodians

- Bridge mechanisms for liquidity routing

An interoperable white label tokenization software stack prevents vendor lock-in and supports ecosystem expansion without structural redesign.

4. Liquidity and Secondary Market Enablement

Token scalability is incomplete without liquidity scalability. The ability to integrate secondary trading platforms, digital custodians, and automated settlement layers determines whether tokenized assets achieve sustainable market participation.

A scalable white label tokenization platform should enable:

- Transfer restriction logic aligned with exchange standards

- Custodial wallet compatibility

- Atomic settlement automation

- Fractional ownership models

- Yield distribution and dividend automation

Well-architected white label tokenization development services embed liquidity readiness within the core system rather than retrofitting it later.

5. Performance Engineering and Infrastructure Scaling

As investor participation increases, transaction volume grows. Scalability must extend to system performance, including gas optimization, throughput management, and infrastructure redundancy.

Enterprise-grade enterprise white label tokenization solutions incorporate:

- Layer-2 compatibility or sidechain deployment options

- Gas-efficient contract design

- Cloud-native infrastructure orchestration

- Horizontal scaling capability

- Disaster recovery and failover mechanisms

Without these controls, operational strain increases as adoption grows.

6. Data Orchestration and Reporting Scalability

Institutional markets demand transparency. As asset portfolios expand, reporting complexity intensifies. A scalable white label tokenization software framework must integrate:

- Real-time dashboard analytics

- Automated investor statements

- Regulatory reporting exports

- On-chain/off-chain data synchronization

- Event-driven accounting automation

Data orchestration scalability ensures compliance continuity and investor confidence during growth phases.

7. Governance and Operational Automation

As ecosystems grow, manual oversight becomes inefficient. A technically advanced white label tokenization platform should support automated governance mechanisms, including:

- On-chain voting modules

- Role-based administrative controls

- Multi-signature authorization flows

- Smart contract-based distribution automation

When governance logic is programmable, operational expansion does not proportionally increase administrative complexity.

Transform Your Asset Digitization Vision into Production-Ready Infrastructure

Step-by-Step Decision Framework for Enterprises

To select a white label tokenization platform, organizations need to evaluate the overall architecture, not just conduct a vendor comparison. Because both regulatory and other operational factors affect the issuance of tokenized assets, organizations must evaluate the depth of their infrastructure, as well as its compliance programmability, integration capabilities and upgrade options in order to implement properly.

Organizations must evaluate the criteria listed below when evaluating enterprise white label tokenization solutions for scalable enterprise implementations.

Step 1: Define Asset Class and Jurisdictional Scope

Before evaluating vendors, enterprises must clarify:

- Type of asset (real estate, funds, bonds, commodities)

- Target investor profile

- Operating jurisdictions

- Licensing requirements

Different assets require different compliance logic and token standards. A scalable white label tokenization platform must accommodate multi-asset issuance under varying regulatory environments.

Step 2: Evaluate Compliance and Governance Architecture

Compliance must be programmable. Enterprises should assess whether the platform supports:

- KYC/AML integration

- Investor accreditation verification

- Transfer restrictions

- Dividend and distribution automation

- Voting and governance modules

The strongest white label tokenization development services integrate compliance into smart contract logic rather than treating it as a manual overlay.

Step 3: Assess Smart Contract Architecture and Security

Security is non-negotiable. Key evaluation criteria include:

- Third-party audited smart contracts

- Modular architecture

- Multi-signature controls

- Role-based administrative permissions

- Incident response mechanisms

A credible white-label tokenization platform development company should demonstrate a strong audit history and transparent security documentation.

Step 4: Examine Integration and API Infrastructure

Tokenization does not operate in isolation. Enterprises must verify:

- API accessibility

- Banking and payment gateway integration

- Custodian connectivity

- ERP and CRM compatibility

- Reporting and analytics dashboards

A well-structured white label tokenization software solution integrates seamlessly into existing financial infrastructure.

Step 5: Review Customization Flexibility

White-label does not mean rigid. Evaluate:

- Branding capabilities

- UI/UX customization

- Token economics configuration

- Investor portal personalization

- Workflow modification flexibility

Customization ensures differentiation in competitive markets.

Step 6: Analyze Scalability and Performance

Infrastructure must support growth. Key technical considerations:

- Transaction throughput

- Gas optimization mechanisms

Cloud deployment flexibility - Load balancing architecture

- Disaster recovery systems

An enterprise-grade engine must support large investor volumes without performance degradation.

Must-Have Features in an Enterprise White-Label Tokenization Platform

A production-ready white label tokenization platform must go beyond basic issuance functionality and deliver infrastructure-grade capabilities aligned with regulatory compliance, security resilience, and institutional scalability. Enterprise adoption depends on how deeply the white label tokenization software embeds automation, governance logic, and interoperability within its core architecture.

- Multi-Asset Issuance Support – Enables structured token creation across diverse asset classes within a unified infrastructure.

- Configurable Compliance Engine – Embeds programmable transfer restrictions, investor eligibility rules, and jurisdictional controls directly into smart contracts.

Role-Based Governance Management – Implements hierarchical access controls and on-chain voting mechanisms for structured decision-making. - Automated Dividend and Yield Distribution – Streamlines financial payouts through smart contract-triggered settlement logic.

- Custodial Wallet Integration – Ensures compatibility with institutional-grade custody providers for secure asset management.

- Secondary Market Readiness – Supports compliant token transfers and exchange integrations to facilitate liquidity.

- Real-Time Reporting Dashboards – Provides synchronized on-chain and off-chain data visibility for regulatory and investor reporting.

- Smart Contract Upgradeability – Allows controlled protocol evolution without disrupting active tokenized assets.

Cost of a White-Label Tokenization Platform: What Enterprises Should Expect

The cost of implementing a white label tokenization platform varies significantly depending on architecture depth, compliance complexity, and customization scope. Enterprises must evaluate cost across multiple dimensions rather than focusing solely on licensing fees.

1. Platform Licensing or Base Infrastructure Cost

This includes core smart contract frameworks, admin panels, and issuance modules.

2. Customization & Integration Cost

- UI/UX personalization

- Custody integration

- API development

- Compliance configuration

Advanced white label tokenization development services increase upfront cost but reduce long-term re-engineering expenses.

3. Security & Audit Expenses

Smart contract audits, penetration testing, and compliance validation are non-negotiable for enterprise-grade deployments.

4. Infrastructure & Cloud Hosting

Costs depend on blockchain selection, transaction volume, and deployment model (public, private, or hybrid).

5. Ongoing Maintenance & Upgrade Costs

Includes contract updates, regulatory modifications, technical support, and feature enhancements.

Building Future-Ready Tokenization Infrastructure

Selecting the right white label tokenization platform is a long-term infrastructure decision that directly influences regulatory agility, liquidity scalability, governance automation, and ecosystem expansion. Enterprises that approach this evaluation with architectural rigor — assessing smart contract modularity, compliance depth, interoperability, and upgrade pathways — position themselves to build resilient and future-ready digital asset frameworks.

As a leading white label tokenization platform development company, Antier delivers enterprise-grade tokenization infrastructure engineered for security, configurability, and regulatory alignment. With deep expertise in blockchain architecture, compliance-driven smart contracts, and scalable deployment models, Antier empowers financial institutions, asset managers, and fintech innovators to launch and scale institutional tokenization ecosystems with confidence.

For organizations seeking a strategically aligned tokenization partner, Antier provides the expertise and infrastructure required to transform asset digitization into sustainable market advantage.

Frequently Asked Questions

01. What is a white-label tokenization engine?

A white-label tokenization engine is a customizable blockchain-based infrastructure that allows organizations to issue and manage tokenized assets under their own brand, offering faster market entry and compliance configuration.

02. Why is the choice of tokenization engine important for long-term scalability?

The choice of tokenization engine impacts long-term scalability by ensuring that the architecture supports not just transaction throughput but also regulatory elasticity, operational automation, and ecosystem interoperability.

03. What core capabilities does a white-label tokenization engine provide?

Core capabilities include token issuance and lifecycle management, compliance rule enforcement, investor onboarding and KYC integration, governance modules, smart contract management, and asset reporting dashboards.

Crypto World

A $100 million crypto campaign fund with a pro-Trump vibe has so far failed to show up

The crypto industry demonstrated in the last U.S. elections that $100 million spent on congressional campaigns could influence policy outcomes for the sector, so when an emerging crypto political action committee anonymously promised to bring that amount to the 2026 table, it suggested a significant new (unidentified) voice in digital assets politics.

But the Fellowship PAC never arrived.

A September press release received wide attention last year as a major leap in the industry’s already hefty campaign spending from the more established leading super PAC, Fairshake. Among its backers, the new group was reportedly to include Tether, the global leader in stablecoins with its USDT and more recent push into the U.S. with a separate affiliate and the USAT token, though representatives from the company declined to confirm any connection.

“Unlike past political efforts, the Fellowship PAC’s mission is defined by transparency and trust, ensuring political action directly supports the broader ecosystem rather than narrow or individual interests,” the PAC’s original September release said, seeming to suggest it would plot a different course than Fairshake. The release did not identify any officers, donors or key employees, nor did the PAC’s website.

Fellowship’s announcement credited President Donald Trump with a regulatory framework “that puts America on the path to become the global crypto capital.”

When asked about the involvement of Tether, which established its U.S. division around the same time as the Fellowship unveiling, company spokesperson Alex Welch said this week that the global Tether has no say in the PAC but was silent on whether the U.S. operations had any part in Fellowship.

“Tether International has no affiliation or oversight of Fellowship, so any inquiries can be directed to the Fellowship website and associated email,” Welch said in an email.

Repeated attempts to contact Fellowship went unanswered, though it established the website and an account on social media site X, where its most recent activity was reposting a comment from Tether CEO Paolo Ardoino earlier this month. It also registered as a super PAC with the Federal Election Commission, listing its treasurer as Mitchell Nobel, who directs digital-assets strategy at Cantor Fitzgerald, where Trump’s Secretary of Commerce Howard Lutnick was CEO. That firm has also handled Tether’s assets in recent years.

What Fellowship didn’t do, according to FEC records, was receive any money to operate with. Its current filings show zero funds on-hand.

Under U.S. election law, a PAC can’t be funded by a non-U.S. entity. Foreign money influencing U.S. politics has been a longtime concern, and it’s drawn new scrutiny during the Trump administration, including from those suggesting that Trump-supporting PACs may have improper ties to foreign donors. Political involvement from Tether — if it had emerged — may have attracted further scrutiny, even if confined to its U.S. operations, because such a subsidiary would have to represent that its money was generated domestically and its political decisions weren’t guided by foreign nationals.

Meanwhile, the industry’s top super PAC, Fairshake, has said it has $193 million and that the PAC and its affiliates have begun targeting their first campaigns, seeking to ensure pro-crypto candidates eventually join Congress. In the 2024 cycle, Fairshake — primarily funded by Coinbase, a16z and Ripple — supported more than 50 candidates from both parties who are now in the Senate and the House of Representatives.

Some of the earliest 2026 primaries are fast approaching, meaning any new entrants to political spending could arrive late to the party. It’s unclear whether the midterm congressional elections will yet see Fellowship’s “$100 million commitment to back pro-innovation, pro-crypto candidates who will safeguard America’s role as the global leader in digital assets and entrepreneurship.”

Crypto World

BTC, ETH, XRP Surge as On-Chain Data Shows ‘Explosive Buying’ From Whales

The total crypto market cap has added $150 billion in just over a day.

The cryptocurrency markets are on the move again, this time in the opposite direction compared to the most recent developments and price pressure.

Bitcoin, for example, skyrocketed by more than five grand since yesterday’s low. Recall that the asset plunged to a multi-week low of $62,500 atfter the latest uncertainty sparked from the US tariff regime by Trump over the weekend.

However, the largest cryptocurrency exploded off that local bottom in the following hours. Minutes ago, it flew to $68,000 for the first time since the weekend, and CoinGecko data currently shows that it’s up by over 6% in the past 24 hours alone.

Data shared by analyst CW shows “explosive buying,” according to the BTC CVD indicator. They attributed it to whales stepping up and buying the latest dip, while indicating that retail has remained on the sidelines.

The $BTC CVD indicator shows explosive buying.

Buying from whales is exploding. However, buying from retail investors (the orange group) is nothing.

Furthermore, the selling wall at 70k has disappeared. buying force is increase, while resistance has decrease. pic.twitter.com/huIaoqxOeW

— CW (@CW8900) February 25, 2026

Even more impressive gains come from some altcoins, including their leader. Ethereum has rocketed by over 10% daily and now trades well above $2,000 after it slipped and retested the $1,800 support yesterday. Recent analysis from Ali Martinez shows that ETH has either already bottomed or it’s very close to doing so.

XRP has jumped by 7% in the past day, and now sits above $1.45. This means that the cross-border token has reclaimed the coveted $1.36 support, which many analysts called its most significant level in terms of determining whether XRP still has legs to run.

You may also like:

SOL has pumped by over 12%, making it the biggest gainer from the larger-cap alts. DOGE follows suit, with a 10% jump to over $0.10. FIL, DOT, MORPHO, APT, and UNI have rocketed by over 20% daily.

The total value of wrecked positions has jumped to nearly $400 million daily, with shorts responsible for the lion’s share. BTC and ETH shorts are worth almost $300 million daily. More than 100,000 traders have been wrecked, while the single-largest liquidation order (worth $11.32 million) took place on Hyperliquid.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Solana Price Rises 9%, But Holder Shift Raises New Crash Risk

Solana price has rebounded nearly 9% after falling to around $75 on February 23, and it is still holding most of those gains above $82.

This kind of bounce normally attracts strong buyers because it suggests the worst may be over. But that is not what is happening this time. The investors who usually step in during recoveries — long-term holders — are stepping back instead. This creates an unusual disconnect between price and conviction, and it helps explain why Solana’s rebound is already facing pressure.

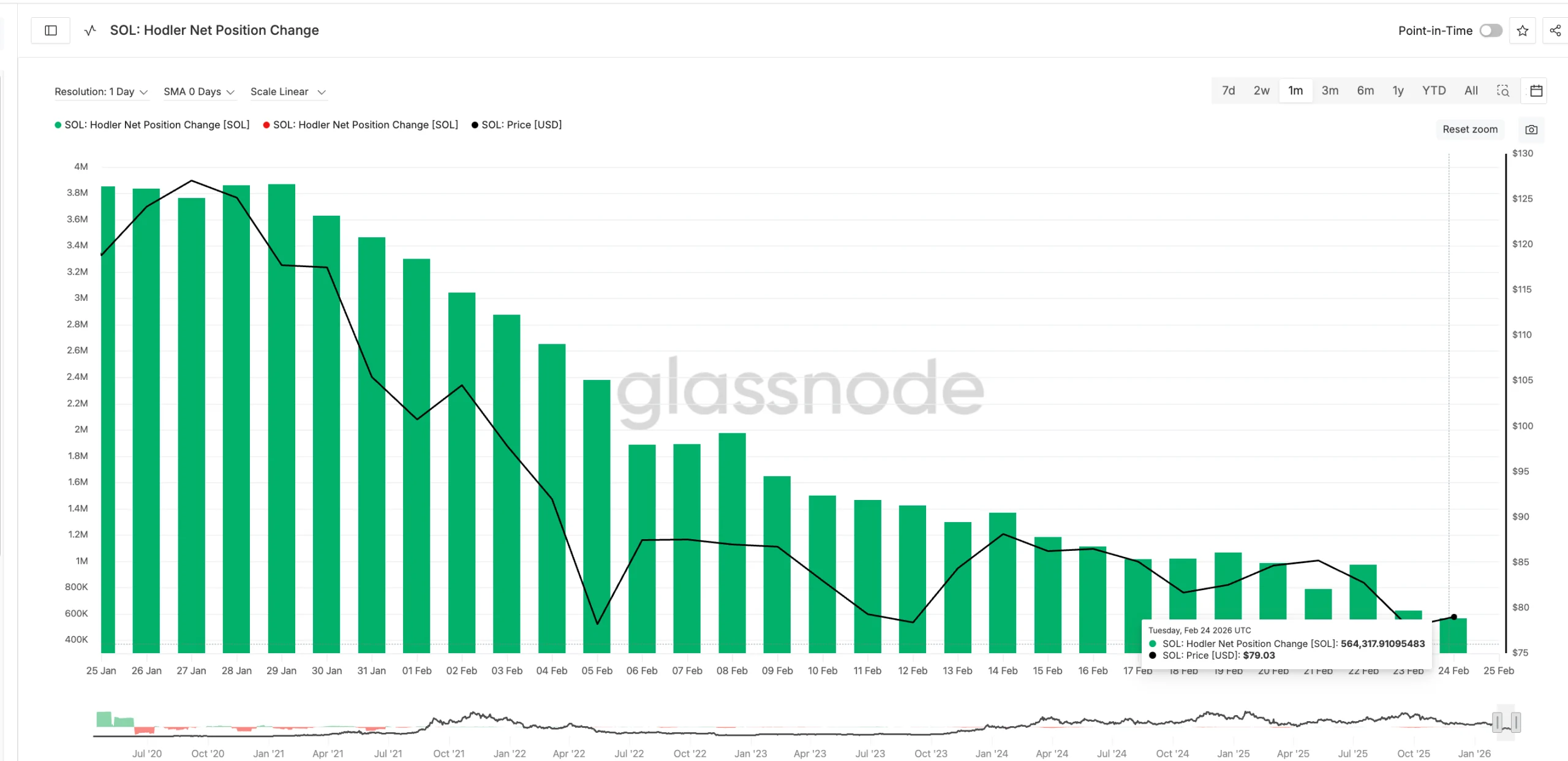

Long-Term Holder Buying Has Dropped Nearly 62% Despite the Price Bounce

The clearest sign of weakening conviction comes from the HODLer Net Position Change metric. This indicator measures how much long-term holders, defined as wallets holding Solana for more than 155 days, are adding or reducing over a rolling 30-day period.

On February 10, long-term holders added about 1.5 million SOL. By February 24, that number had fallen sharply to just 564,317 SOL. This marks a drop of about 62.5% in accumulation within two weeks. This decline happened even as Solana’s price stabilized and rebounded, which makes the shift especially important.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

In simple terms, Solana’s strongest holders were buying aggressively earlier in the month, but that confidence has faded significantly. When accumulation falls this sharply, it suggests these investors are no longer convinced the current bounce is the start of a sustained recovery. Despite the SOL price bounce, the Hodler positioning is at its lowest monthly level.

Disclaimer: This does not mean long-term holders are heavily selling, but it shows their buying momentum has weakened sharply.

This shift is not limited to the oldest holders. Mid-term holders, who have held Solana between one month and three months, have also been reducing their exposure. Their share of total supply fell from 19.52% on January 25 to about 14.08% on February 24. This represents a 27.9% relative decline in their supply share in just one month.

What makes this important is the timing. This reduction persisted even as Solana’s price rose over the past two days. Instead of buying the rebound, many holders appear to be using it as an opportunity to exit.

A 22 Million SOL Supply Wall Is Blocking the Recovery

The lack of strong buying becomes more concerning when combined with Solana’s cost basis distribution data, which reveals where investors last bought their coins.

This data shows a major concentration of supply between $82.81 and $83.79. More than 22.16 million SOL was accumulated in this range. This is one of the largest supply clusters currently sitting above the price.

This range represents a break-even zone for many holders who bought earlier and held through the previous dips. When price returns to their entry level, these investors often sell to recover losses or reduce risk in a weaker market.

This helps explain why Solana’s rebound is already slowing near $82.91. The price is running into a large group of holders waiting to exit at break-even.

At the same time, long-term holder accumulation has already dropped by more than 60%, which means there are fewer strong buyers available to absorb this supply. This imbalance between sellers and buyers makes it harder for the rebound to continue.

Solana Price Path Still Points to a 17% Drop

Solana’s technical structure adds another layer of risk to the current rebound. Before this bounce, Solana confirmed a bearish head-and-shoulders pattern and dropped to around $75.69.

Even after the recent rebound, the projected downside target from that pattern still points toward the $68.71 region. From the current price near $82.52, a drop to $68.71 would represent an additional decline of about 17%. This means the recent 9% bounce has not yet invalidated the broader bearish structure. Moreover, Solana tried to cross the $82.91 mark but failed, largely due to the supply cluster around that level highlighted earlier.

For the recovery to strengthen, Solana must first break and hold above $82.91, which is the immediate resistance created by the supply cluster. If that level is cleared, the next resistance sits near $86.82. A move above $91.33 would fully invalidate the bearish pattern and confirm that the downtrend has ended.

However, continued rejection at $82.91 would increase downside risk.

If Solana falls below $80.89 again, it could quickly retest $74.96. A break below that would reopen the path toward $68.71 and other lower levels, which remain the active downside projection from the bearish pattern.

-

Video6 days ago

Video6 days agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Politics3 days ago

Politics3 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread: Boden – Corporette.com

-

Sports2 days ago

Sports2 days agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Politics2 days ago

Politics2 days agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Sports7 days ago

Sports7 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Crypto World1 day ago

Crypto World1 day agoXRP price enters “dead zone” as Binance leverage hits lows

-

Business3 days ago

Business3 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Business3 days ago

Business3 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

Entertainment7 days ago

Entertainment7 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

NewsBeat2 days ago

NewsBeat2 days ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

Tech3 days ago

Tech3 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat3 days ago

NewsBeat3 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Tech24 hours ago

Tech24 hours agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

Politics3 days ago

Politics3 days agoMaine has a long track record of electing moderates. Enter Graham Platner.

-

Crypto World7 days ago

Crypto World7 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat19 hours ago

NewsBeat19 hours agoPolice latest as search for missing woman enters day nine

-

Crypto World19 hours ago

Crypto World19 hours agoEntering new markets without increasing payment costs

-

Sports2 days ago

2026 NFL mock draft: WRs fly off the board in first round entering combine week

-

Crypto World6 days ago

Crypto World6 days ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market