Crypto World

Swift Adds Blockchain Ledger to Enable 24/7 Cross-Border Payments

Swift has unveiled plans to integrate a blockchain-based shared ledger into its core infrastructure, marking one of the most significant evolutions of the global payments network in decades. Announced at Sibos 2025 in Frankfurt, the initiative aims to enable real-time, 24/7 cross-border payments and the regulated movement of tokenized value at global scale. The project brings together more than 30 financial institutions from 16 countries and starts with a conceptual prototype developed alongside Consensys. Rather than replacing existing rails, the ledger is designed to extend Swift’s trusted role into digital finance while preserving compliance, resilience, and operational rigor.

Key takeaways

- Swift plans to add a blockchain-based shared ledger to support instant, always-on cross-border payments.

- The initiative was announced at Sibos 2025 in Frankfurt and involves over 30 global banks from 16 countries.

- The first use case focuses on real-time, 24/7 interbank cross-border payments.

- The ledger will be interoperable with existing payment rails and emerging digital networks.

- Smart contracts will be used to embed compliance, controls, and transaction rules directly into payment flows.

Market context: The move comes as financial institutions globally face pressure to modernize cross-border payments amid growing demand for instant settlement, tokenized assets, and regulated digital money, while central banks and regulators push for higher transparency and resilience.

Why it matters

Cross-border payments remain one of the most complex and costly parts of the financial system, often constrained by time zones, batch processing, and fragmented infrastructure. By introducing a shared digital ledger, Swift is signaling that legacy financial infrastructure can evolve without abandoning regulatory discipline.

For banks, the initiative promises improved transparency, faster settlement, and reduced operational friction, all while maintaining compatibility with existing correspondent banking models. For the broader market, it represents a pragmatic bridge between traditional finance and distributed ledger technology.

The project also highlights a broader industry shift toward tokenized value and programmable money, with Swift positioning itself as a neutral orchestrator rather than a competing blockchain network.

What to watch next

- Progress of the conceptual prototype being developed with Consensys.

- Expansion of use cases beyond cross-border payments into other forms of tokenized value.

- Governance frameworks and compliance standards agreed by participating banks.

- Further announcements on interoperability with public and private blockchain networks.

Sources & verification

- Official Swift announcement detailing the blockchain-based ledger initiative.

- Statements from Swift CEO Javier Pérez-Tasso delivered at Sibos 2025.

- Public comments from participating global banks on their involvement.

- Swift’s published FAQs outlining scope, benefits, and development phases.

Swift’s blockchain ledger and the future of cross-border payments

Swift’s decision to incorporate a blockchain-based shared ledger into its technology stack represents a strategic response to a rapidly changing payments landscape. For decades, Swift has served as the backbone of global financial messaging, connecting institutions across more than 200 countries and territories. The new ledger does not replace that role but extends it into a digital environment where value can move instantly and continuously.

The initiative was formally announced during the opening plenary of Sibos 2025, where Swift CEO Javier Pérez-Tasso acknowledged that the move might surprise parts of the market. He framed the development as a convergence rather than a contradiction, arguing that traditional finance and blockchain technology can coexist within a regulated system. According to Pérez-Tasso, banks are increasingly prepared for this transition and are asking Swift to take on a broader coordinating role.

At the core of the project is a shared digital ledger designed to record, sequence, and validate transactions between financial institutions in real time. Built with interoperability as a guiding principle, the ledger is intended to connect seamlessly with both established payment rails and emerging digital networks. Smart contracts will enforce transaction rules, embedding compliance and risk controls directly into payment flows rather than layering them on afterward.

The first use case under development is real-time, 24/7 cross-border payments, an area where inefficiencies have long persisted. Current systems often rely on batch processing and reconciliation across multiple intermediaries, leading to delays and uncertainty. A shared ledger, accessible around the clock, could significantly improve predictability and transparency while reducing settlement times.

Swift has emphasized that operational excellence remains central to the design. The ledger is being developed in parallel with ongoing enhancements to existing rails, APIs, and ISO 20022 messaging standards. This layered approach reflects Swift’s view that innovation should strengthen, not undermine, the reliability and security that global finance depends on.

Collaboration is another defining feature of the initiative. Financial institutions from regions spanning Europe, North America, Asia-Pacific, the Middle East, and Latin America are actively involved in shaping the ledger’s functionality and governance. Participating banks include major global and regional players such as Bank of America, HSBC, JP Morgan Chase, Deutsche Bank, BNP Paribas, Citi, BBVA, and many others.

Executives from these institutions have described the project as a foundational upgrade rather than an incremental change. Many point to the importance of interoperability and common standards, particularly as tokenized assets and digital currencies gain traction. A shared ledger coordinated through Swift’s neutral network could help avoid fragmentation and support multi-currency, atomic settlement across jurisdictions.

Several banks highlighted the relevance of the initiative for liquidity management and always-on payments. In a global economy that increasingly operates beyond traditional business hours, the ability to move regulated value in real time is becoming a competitive necessity. The ledger is positioned as an enabler of this shift, supporting both wholesale and, eventually, broader client-facing use cases.

Swift has also linked the project to its broader work on digital assets and interoperability. Alongside the ledger, the organization is developing solutions that allow value to move between private and public networks without compromising compliance. This reflects an understanding that the future financial system will likely consist of multiple interconnected platforms rather than a single dominant rail.

From a governance perspective, the initiative is being developed in stages, beginning with a prototype. Timelines for broader availability will depend on testing, regulatory alignment, and industry adoption. Swift has been clear that the ledger will evolve in close consultation with its community, maintaining alignment with global regulatory standards.

The broader significance of the project lies in its signal to the market. By embracing blockchain-based infrastructure while reaffirming its commitment to trust and resilience, Swift is attempting to chart a middle path between innovation and stability. If successful, the shared ledger could become a key component of next-generation global payments, supporting tokenized value, instant settlement, and interoperability at scale.

As Pérez-Tasso concluded during Sibos, the ledger represents a platform not just for today’s needs but for future transformation. Its ultimate impact will depend on execution, collaboration, and the industry’s willingness to converge on shared standards. For now, it marks a notable step in the gradual modernization of global financial infrastructure.

“This is a powerful platform for the future. And it can be even more transformational in the future.” – Javier Pérez-Tasso, Swift CEO

Citi is among a growing group of banks working with us to shape our blockchain-based ledger – extending Swift’s infrastructure to support tokenised value at scale.

Through industry-wide collaboration, we’re enabling a future where value moves seamlessly in a multi-model,… pic.twitter.com/AAJmkJkUmH

— Swift (@swiftcommunity) February 6, 2026

Crypto World

DeFi lending platform Compound Finance hijacked again

DeFi users reported suspicious functionality on the website of lending platform Compound Finance on Sunday.

The incident is the latest in a string of website hijackings that have affected Maple Finance, OpenEden and Curvance.

It’s the second time attackers have compromised Compound’s front end in less than two years.

Read more: Compound Finance and Celer Network websites compromised in ‘front-end’ attacks

Compound’s security provider later published an update on the project’s governance forum, reassuring users that the incident had been rectified and “all other credentials on the affected infrastructure account have been rotated.”

The post explains that the project’s website redirected users to “a phishing site hosted on a lookalike domain (‘compOOnd’),” but “no user loss of funds [was] identified.”

Compounding errors

Previously, the Compound front end was hacked in July 2024, along with other Squarespace-based DeFi domains.

There are worries that such attacks may become more common as AI tools lower the bar for would-be phishing scammers.

Read more: AI just bypassed the Cloudflare protection that DeFi needs

Luckily, any users of Compound were better protected yesterday.

According to the forum post, the app.compound.finance subdomain, on which users connect wallets and make transactions, “is served via IPFS, allowing [security providers] to independently verify its integrity.”

Sunday’s incident is the latest in a string of blunders for what was once one of DeFi’s top protocols.

Last year, the Compound DAO came under scrutiny over conflict-of-interest concerns related to service provider Gauntlet.

In 2022, an operational error bricked the cETH market (worth over $800 million at the time) for a week while a fix was implemented. The previous year, almost $150 million of excess rewards were distributed, also by mistake.

Got a tip? Send us an email securely via Protos Leaks. For more informed news and investigations, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Mastercard and Google Team Up to Build Trust for AI-Powered Shopping

Verifiable Intent creates a tamper-resistant, cryptographic record of what a user authorized when an AI agent acts on their behalf.

Mastercard has unveiled Verifiable Intent, a new open, standards-based trust framework co-developed with Google, designed specifically for “agentic commerce” — a world where artificial intelligence (AI) systems don’t just assist shoppers, but actively plan, decide, and complete purchases autonomously.

The core problem Verifiable Intent aims to solve is visibility: when a consumer delegates a purchase to an AI agent, the clear “click buy” or “tap to pay” moment that traditionally signals intent disappears. Mastercard’s Chief Digital Officer Pablo Fourez argues that this creates a new challenge for every party involved — consumers need assurance their instructions were followed, merchants need confirmation an agent is authorized to buy, and issuers need to distinguish legitimate activity from fraud.

To address this, Verifiable Intent creates a tamper-resistant, cryptographic record of what a user authorized when an AI agent acts on their behalf — linking identity, intent, and action into a single, privacy-preserving audit trail.

The framework uses Selective Disclosure, a privacy control technique, to ensure that only the minimum necessary information is shared between parties and only when needed, allowing merchants and issuers to verify transactions without access to sensitive consumer data.

It leverages widely adopted standards from the FIDO Alliance, EMVCo, the Internet Engineering Task Force, and the World Wide Web Consortium, and is designed to work across agentic protocols, devices, wallets, and platforms. Mastercard says Verifiable Intent will be integrated into its Agent Pay APIs in the coming months.

Crypto Rails Join the Fray

Not everyone sees traditional payment networks as the right foundation for AI-driven commerce, however, highlighting a growing debate about whether AI agents will ultimately transact through incumbent networks like Mastercard or bypass them entirely in favor of crypto-native infrastructure.

“Very soon there are going to be more AI agents than humans making transactions. They can’t open a bank account, but they can own a crypto wallet. Think about it,” Coinbase CEO Brian Armstrong posted on X today.

In September, EigenCloud, Ethereum’s largest restaking protocol with nearly $9 billion in total value locked, announced a partnership with Google Cloud to serve as the verifiable backbone for AI agent payments.

Meanwhile, the Ethereum Foundation launched a dedicated AI initiative called the dAI Team, with a stated mission to make Ethereum the preferred settlement and coordination layer for the emerging “machine economy.”

The following month, attention turned to x402 protocols, which enable AI agent payment systems and increase the practicality of agentic AI-led finance.

Taken together, these developments paint a picture of an industry racing to solve the same core problem from two very different directions. Mastercard and traditional finance are building trust layers on top of existing payment rails, while crypto proponents are betting that blockchain infrastructure is better suited to a world where AI agents are first-class economic actors.

Crypto World

140,000 BTC Exit Short-Term Holders as Capitulation Pressure Builds in Bitcoin

Short-term holders are currently facing about 24% unrealized losses.

Bitcoin’s short-term holders have continued to realize losses, as on-chain data found sustained selling pressure across most of the past week.

According to the latest analysis by Axel Adler Jr., the Short-Term Holder Spent Output Profit Ratio (STH SOPR), a metric that measures whether coins held for less than 155 days are being sold at a profit or loss, remained below the neutral level of 1.0 for seven of the last eight days between March 2 and March 9.

A reading below 1.0 indicates that the cohort is selling at prices lower than their acquisition cost.

Bitcoin’s Weak Hands Are Selling

As of March 9, the intraday average STH SOPR stood at 0.987, and only six out of 35 observed blocks, or about 17%, closed above the 1.0 threshold. The 7-day moving average for the metric remained near 0.992, which further supports the view that loss realization among short-term holders has persisted for several consecutive days rather than appearing as a single isolated event.

During the same period, the metric crossed above 1.0 only once, on March 4, when the price of Bitcoin briefly reached $74,000 before returning to loss-selling territory. The lowest weekly reading occurred on March 6 at 0.979, while March 8 registered 0.991. Both of these instances confirm that most transactions from this cohort were executed below cost basis.

Adler explained that the first clear signal of a change in market conditions would be STH SOPR closing above 1.0 for several consecutive days alongside rising prices.

Capitulation

In addition to the profitability metric, Adler examined changes in terms of the overall supply held by short-term investors. Over the past two weeks, the total volume of coins within the short-term holder cohort declined from approximately 6.06 million BTC to about 5.92 million BTC. This essentially indicated that roughly 140,000 BTC left the cohort.

You may also like:

Such a reduction reflects either capitulation through realized losses or the natural aging of coins into long-term holder status after surpassing the 155-day holding threshold. At the same time, the cohort’s realized price remained around $89,028, while the market price traded near $67,000 during the period analyzed.

The difference represents an unrealized loss of roughly 24% for the average short-term holder. Adler observed that this gap between the realized price and the current market value creates a structural supply overhang in the market. As prices recover, some short-term investors who purchased at higher levels may use rallies as opportunities to exit positions without losses, and would potentially add supply and reduce the strength of upward moves.

The combination of the two indicators points to an ongoing “cohort cleansing,” in which the more price-sensitive segment of the market is gradually exiting through selling pressure rather than through a recovery in profitability.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Bitcoin, Ethereum, and Solana ETFs flash red as prices stay resilient

U.S. Bitcoin, Ethereum, and Solana ETFs saw rare same‑day outflows on March 9, but positive weekly flows and steady spot prices point to rotation, not capitulation.

Summary

- Bitcoin, Ethereum, and Solana ETFs all booked one‑day net outflows, signaling a sharp but concentrated de‑risking across major U.S. spot products.

- Weekly flows remain positive for BTC, ETH, and SOL, suggesting ETF desks are rotating risk within crypto rather than exiting the asset class.

- Despite red ETF prints, Bitcoin trades in the high‑$60K band, Ethereum near $2,000, and Solana just under $90, underscoring a resilient spot tape.

U.S. crypto ETFs flashed a rare warning signal on March 9 as spot products for Bitcoin, Ethereum, and Solana all recorded simultaneous net outflows, even as underlying prices held firm near recent ranges.

ETF flows: risk-on, but defensive

On-chain analytics firm Lookonchain reported that U.S. Bitcoin ETFs saw a one-day net outflow of 5,409 BTC, while Ethereum ETFs shed 36,599 ETH and Solana products lost 68,933 SOL, underscoring a sharp but concentrated bout of de-risking across majors. A separate summary of the same dataset framed the move as a short-term shock inside a still-positive weekly trend, noting that “Bitcoin ETFs experienced a one-day net outflow of 5,409 BTC… however, the seven-day net inflow stood at a positive 8,154 BTC,” with Ethereum and Solana showing similar one-day outflows but net inflows over seven days.

In that analysis, Solana stood out as the most volatile leg of the trade: “Solana ETFs displayed the most dramatic shifts… with a one-day net outflow of 68,933 SOL… Contrarily, the seven-day net inflow reached +266,247 SOL,” a pattern more consistent with fast money rotation than structural capitulation.

Macro structure: liquidity, not faith

The flows come against a macro backdrop where crypto still trades as a high‑beta expression of global liquidity rather than a simple tech proxy.

As one ETF strategist put it in the Lookonchain-linked commentary, recent moves “could influence trading strategies, as traders monitor whether these outflows represent profit-taking or a shift in investor confidence amid broader market volatility,” highlighting that desks are treating ETF flows as a real‑time barometer of positioning, not a referendum on the asset class itself.

Price action: resilient tape

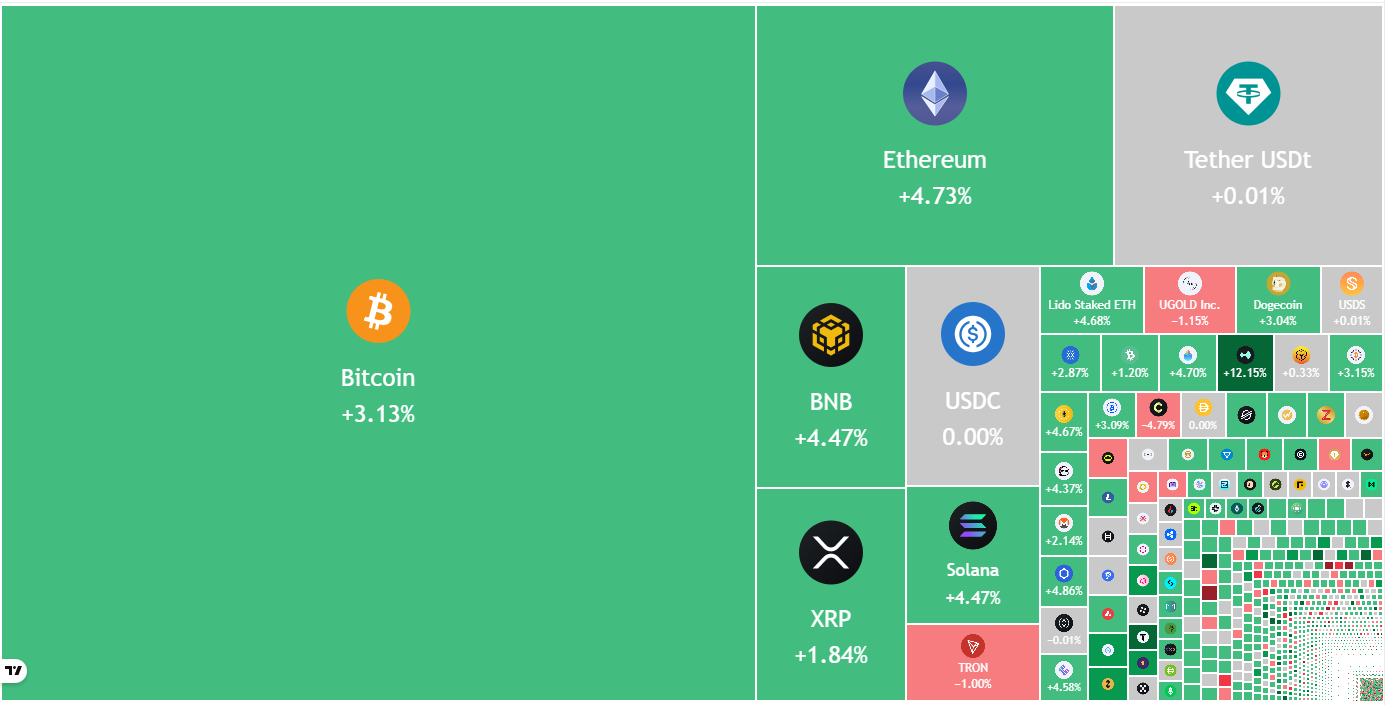

Despite the ETF outflows, majors held up. Bitcoin recently traded around the high‑$60K band, with multiple spot dashboards placing it near $68K–$69K and up roughly 1–3% over the last 24 hours at press time.

Ethereum changed hands near $2,000–$2,050, gaining about 3–4% on the day, while Solana hovered around $85.20, up 3.69% in 24 hours as it continued to “grind sideways just under $90.”

For traders, the message is blunt: ETF red prints are back, but as long as weekly flows stay positive and spot refuses to break, the underlying market structure still looks like rotation within a risk bucket rather than an exit from it.

Crypto World

Crypto Traders Ignore High Oil Prices As BTC, Altcoins Rally

Key points:

-

Rising oil prices have not hurt crypto sentiment as buyers attempt to push Bitcoin above $69,000

-

Buyers are attempting to propel several major altcoins above their overhead resistance levels, indicating demand at lower levels.

A sharp rally in oil prices failed to deter cryptocurrency buyers who pushed Bitcoin (BTC) above $69,000 on Monday. Although the spot BTC exchange-traded funds witnessed outflows on Thursday and Friday, the week saw net inflows of $568.45 million per SoSoValue data. That was the second successive week of net inflows, a first in five months.

While some analysts believe that BTC may have bottomed out, on-chain analyst Willy Woo said in a post on X that BTC was solidly in the middle of a bear market from a long-range liquidity perspective and was forming a bull trap.

Usually, when negative news fails to sink the price to a new low in a bearish trend, it suggests that the selling may be drying up. That doesn’t guarantee a sharp rally in the near term, as markets tend to consolidate in a range for a while before starting the next leg higher.

Could buyers push BTC and major altcoins above their resistance levels? Let’s analyze the charts of the top 10 cryptocurrencies to find out.

S&P 500 Index price prediction

The S&P 500 Index (SPX) closed below the 6,775 level on Friday, indicating that the bears are attempting to take charge.

The moving averages have completed a bearish crossover, and the relative strength index (RSI) has dipped into the negative territory, indicating the path of least resistance is to the downside. The next crucial support to watch out for on the downside is 6,550. If the level cracks, the correction may deepen to 6,147.

Buyers will have to drive the price above the moving averages to signal strength. That improves the prospects of a rally to the 7,290 level.

US Dollar Index price prediction

The US Dollar Index (DXY) is facing resistance near the 99.50 level, but the bulls have kept up the pressure.

The upsloping 20-day exponential moving average (98.17) and the RSI above the 63 level suggest that the bulls are in command. If the price closes above the 99.50 level, the index may retest the critical overhead resistance at the 100.54 level. A close above the 100.54 resistance suggests the start of a new up move.

Sellers will have to tug the price below the moving averages to retain the index inside the 95.50 to 100.54 range.

Bitcoin price prediction

BTC fell below the 20-day EMA ($68,553) on Friday, but the bears could not sink the price below the support line. That suggests demand at lower levels.

If the price maintains above the 20-day EMA, the likelihood of a break above the $74,508 resistance increases. Such a move suggests that the BTC/USDT pair may have bottomed out in the short term. The Bitcoin price may then soar to $84,000, where the bears are expected to mount a strong defense.

This positive view will be invalidated in the near term if the price turns down and breaks below the support line. The pair may then drop to the vital support at $60,000.

Ether price prediction

Ether (ETH) broke below the 20-day EMA ($2,018) on Friday, but the bears could not sink the price to the $1,750 level.

That suggests selling dries up at lower levels. The bulls are attempting to push the price back above the 20-day EMA. If they manage to do that, the ETH/USDT pair may climb to the 50-day SMA ($2,249). Sellers will attempt to halt the relief rally at the 50-day SMA, but if the bulls prevail, the pair may jump to $2,600.

Contrary to this assumption, if the Ether price turns down from the $2,111 level and breaks below $1,916, it signals that the pair may remain inside the range for a while longer.

BNB price prediction

BNB (BNB) fell below the 20-day EMA ($633) on Friday, but the bears could not pull the price to the $570 level.

That attracted buyers who are trying to push the price back above the 20-day EMA. If they succeed, the BNB/USDT pair may retest the overhead resistance at $670. Sellers are expected to fiercely defend the $670 level, as a close above it opens the doors for a rally to $730 and then $790.

Instead, if the BNB price turns down from the current level or the $670 resistance, it suggests that the range-bound action may continue for a few more days. Sellers will have to yank the pair below the $570 level to start the next leg of the downtrend toward $500.

XRP price prediction

XRP (XRP) has been trading just below the 20-day EMA ($1.39) for several days, indicating that the bulls continue to exert pressure.

A close above the 20-day EMA will be the first sign of strength. The XRP/USDT pair may then rally to the $1.61 level and subsequently to the downtrend line of the descending channel pattern. Buyers will have to break and sustain the XRP price above the downtrend line to signal a short-term trend change.

Conversely, if the price turns down from the 20-day EMA and breaks below $1.27, it suggests that the bulls have given up. That may sink the pair to the support line, which is likely to attract buyers.

Solana price prediction

Solana (SOL) has been consolidating between $76 and $95 for several days, indicating a balance between supply and demand.

The flattish 20-day EMA ($85) and the RSI just below the midpoint do not give a clear advantage either to the bulls or the bears.

The next trending move is expected to begin on a close above $95 or below $76. If buyers drive the Solana price above $95, the rally may reach $117. Alternatively, a break and close below $76 suggests that the bears have overpowered the bulls. The SOL/USDT pair may then slump to the Feb. 6 low of $67.

Related: Bitcoin at $67K despite oil shock is ‘strongest indicator’ bottom may be in

Dogecoin price prediction

Dogecoin (DOGE) fell below the $0.09 support on Sunday, but the bears could not sustain the lower levels. The bulls bought the dip and are attempting to reclaim the level.

If the relief rally turns down from the 20-day EMA ($0.09), it suggests that the bears remain in control. That heightens the risk of a drop to Feb. 6 low of $0.08.

Buyers are likely to have other plans. They will attempt to push the Dogecoin price above the moving averages. If they can pull it off, the DOGE/USDT pair may surge to the breakdown level of $0.12. Buyers will have to achieve a close above the $0.12 resistance to suggest that the pair may have bottomed out at $0.08.

Cardano price prediction

Cardano (ADA) slipped below the $0.25 support on Sunday, but the bears are struggling to sustain the lower levels.

The bulls will attempt a recovery, which is expected to face selling at the 20-day EMA ($0.27). If the price turns down sharply from the 20-day EMA, the bears will strive to sink the ADA/USDT pair to the support line of the descending channel pattern. If the Cardano price rebounds off the support line with strength, it suggests that the pair may remain inside the channel for some more time.

The bulls will have to drive and maintain the price above the downtrend line to signal a potential short-term trend change.

Bitcoin Cash price prediction

Bitcoin Cash (BCH) has been witnessing a tough battle between the bulls and the bears at the $443 level.

The bulls are attempting a relief rally, but the bears are likely to halt any recovery attempt at the 20-day EMA ($478). If the Bitcoin Cash price turns down sharply from the 20-day EMA, it increases the likelihood of a break below the $443 level.

If that happens, the BCH/USDT pair will complete a bearish head-and-shoulder pattern. That may start a downward move to $375.

Contrarily, a close above the 20-day EMA suggests that the selling pressure is reducing. The pair may then rally to the 50-day SMA ($525).

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

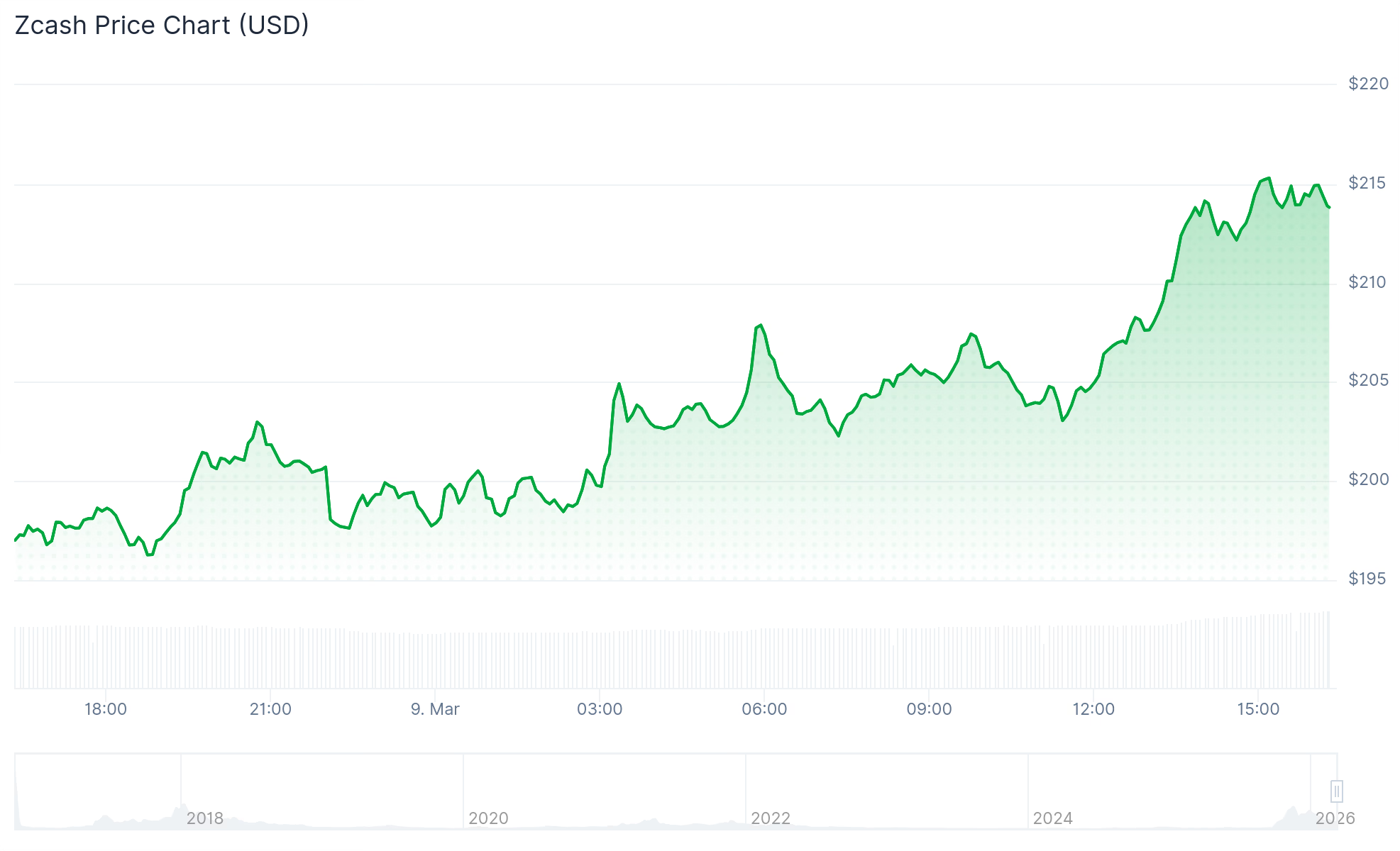

Zcash price forecast as ZEC extends gains above $200

- Zcash gained 9% to above $215 but faces resistance and could dump hard.

- The altcoin rose amid Bitcoin’s rebound to above $69,000 on Monday.

- Privacy coin narrative and venture funding have helped ignite ZEC’s uptick.

Zcash (ZEC) rose nearly 9% after bouncing from recent lows, placing the token among the top gainers among the 100 largest cryptocurrencies by market capitalisation.

The privacy-focused coin retested resistance above $215 as altcoins broadly posted modest gains over the past 24 hours.

Sentiment improved after Bitcoin climbed above $69,000, helping lift the wider market.

ZEC advanced alongside other privacy-oriented tokens, including Tornado Cash, Oasis Network, and Dash.

Monero (XMR) also recorded gains, with the token rising nearly 3% over the past 24 hours.

What could help Zcash price higher?

While the broader market rebound has supported Zcash (ZEC), other factors may also be contributing to the token’s recent bounce.

ZEC appears to be drawing momentum from a new report by the United States Department of the Treasury, which acknowledged that crypto privacy tools such as token mixers can serve legitimate purposes.

The report states that such tools may be used for “legitimate financial privacy purposes,” marking a shift in tone from previous official positions regarding mixers and other privacy-focused technologies.

“Lawful users of digital assets may leverage mixers to enable financial privacy when transacting through public blockchains,” the Treasury said in its report to Congress.

The token has also benefited from ecosystem developments.

The team behind a new Zcash-powered mobile wallet recently secured $25 million in a funding round backed by several venture capital firms active in the digital asset sector.

Zcash Open Development Lab (ZODL) has secured over $25 million in funding from a16z, Paradigm, Winklevoss Capital, Coinbase Ventures, Cypherpunk Technologies, Maelstrom (family office of Arthur Hayes), Chapter One, David Friedberg, Haseeb Qureshi, Mert, Balaji and others.

If you… https://t.co/yeTadbUCR5 pic.twitter.com/PyisPQLWVJ

— Josh Swihart 🛡 (@jswihart) March 9, 2026

According to ZODL, the backing “signals strong investor confidence” in shielded ZEC transactions.

Players that participated in the funding include Paradigm, a16z crypto, Winklevoss Capital, and Coinbase Ventures.

Others were Cypherpunk Technologies and Arthur Hayes’ family office, Maelstrom.

Josh Swihart, the former CEO of Zcash developer Electric Coin Company (ECC), founded Zodl (formerly Zashi) in 2024.

Zcash price: breakout or dump below $175?

Zcash (ZEC) was among the standout performers in the privacy-focused segment of the crypto market in 2025.

The token rallied from lows near $50 in September to a peak of about $700 by mid-November.

However, the gains proved difficult to sustain as the broader market turned lower.

As Bitcoin declined and the wider crypto market followed, ZEC retraced sharply, slipping to below $220.

The token fell further to around $184 on February 5, 2026, during a broader market sell-off that coincided with the departure of core developers from Electric Coin Company (ECC).

Following the sharp downturn, ZEC is currently down about 58% on a year-to-date basis.

Zcash price chart by TradingView

The daily chart indicates that Zcash (ZEC) has rebounded from a key support level near $200.

If upward momentum strengthens, the token could test initial resistance in the $290–$300 range, with a potential move toward $400 if buying pressure persists.

The relative strength index (RSI) has turned higher around the 50 level, suggesting the possibility of continued bullish momentum.

However, the moving average convergence divergence (MACD) points to weakening upside strength, which could give sellers an opportunity to push the price back toward recent lows.

On the downside, ZEC could decline to levels last seen in October 2025 if bearish pressure intensifies.

A decisive close below $175 may open the door to further losses, with the next key support level around $120.

Crypto World

Wyoming Senator Revives Crypto Tax Exemption Debate

Cynthia Lummis, one of Wyoming’s two US senators, who announced plans to leave the chamber in 2027, has revived a push for a de minimis tax exclusion on small cryptocurrencies transactions as the Senate debates a digital asset market structure bill.

In a CNBC interview on Wednesday, Lummis said that the House Ways and Means Committee and Senate Finance Committee were considering a $300 exemption to allow crypto users to better use Bitcoin (BTC) for transactions without paying capital gains taxes.

The Wyoming senator’s statement followed her introduction of a standalone bill in July 2025 proposing a de minimis tax exemption for crypto transactions under $300, with a $5,000 limit annually.

“We’re trying to figure out how to weigh, the appropriate way, to decide when a sale — for example of Bitcoin — should be subject to capital gains and when it should be allowed to be used as a simple means of exchange the same way we use the US dollar,” said Lummis.

Lummis, who sits on the Senate Banking Committee, said that her Democrat colleagues were still not voting “yes” on the crypto market structure bill, which passed the House of Representatives as the CLARITY Act in July 2025.

The committee had been scheduled for a markup on the bill in January, but the chair, South Carolina Senator Tim Scott, postponed the meeting indefinitely after Coinbase CEO Brian Armstrong said that the exchange could not support the legislation “as written,” citing concerns with tokenized equities.

Related: Crypto turnaround at Fed as Kraken scores account and Trump nominee goes to Senate

The Wyoming senator has been one of the most outspoken proponents for the market structure bill in Congress. However, Lummis announced in December that she would not seek reelection to the Senate, making her last day in January 2027.

Donald Trump gets deeper into crypto-banking clash on stablecoins

Concerns over the market structure bill, ranging from tokenized equities, responsibilities for US financial regulators, ethics over potential conflicts of interest, and stablecoin yield have effectively stalled progress of the legislation in the Senate.

However, last week US President Donald Trump took to social media to urge banking groups to “make a good deal” with the crypto industry, adding that banks could not hold the CLARITY Act “hostage.” As of Monday, the Senate Banking Committee had not rescheduled its markup of the bill.

Magazine: The debate over Bitcoin’s four-year cycle is over: Benjamin Cowen

Crypto World

Bitcoin up, Dubai real estate down since Iran war began

Since the onset of the Iran war, Dubai real estate has crashed worse than bitcoin (BTC).

The Dubai Financial Market (DFM) Real Estate Index closed trading at 13,353 on Monday, down 18.1% from 16,306 on February 27, the most recent trading session before Operation Epic Fury’s opening airstrikes at 1:15am New York time on February 28.

In contrast, BTC was trading at $65,492 when the first bombs fell on Iran. It briefly dipped to $63,000, but had rallied to $69,000 by 12:30pm Monday in New York — a 5.4% jump since the war began.

Dubai real estate lost nearly a fifth of its value over the same 10 days.

The city’s real estate market wipeout has erased all year-to-date gains and is threatening to reverse its 2025 gains which provide a mere 15% additional downside cushion before prices would revert to 2024 levels.

A chart of the DFM Real Estate Index shows step-like changes on each trading day along with a hard floor. For example, across four hours today, the index of real estate companies traded no lower than precisely 13,353.20.

Certain exchanges artificially limit price moves, including DFM at 5% daily.

Nearby exchange Boursa Kuwait has entirely suspended trading since March 1.

Private aircraft demand to leave Dubai is up at least 300% amid airport closures, and people are paying thousands or even six figures to flee.

Dubai bombings, drone strikes, airport closures

Dubai spent years marketing itself as a stable, tax-advantaged home for crypto influencers and it duly attracted plenty of crypto companies and influencers.

Bybit, Telegram’s TON Foundation, and Deribit have headquarters in Dubai, and many other crypto companies have offices in the city, including Binance, OKX, and Crypto.com.

Overall, 9,800 millionaires relocated to the United Arab Emirates (UAE) in 2025 alone, bringing $63 billion with them.

Then, Iran fired missiles at Dubai’s airport, luxury hotels, and civilian areas. UAE regulators closed its own stock exchanges for two full days to prevent a panic selloff.

Emaar Properties, the developer behind the Burj Khalifa, fell from 17AED on February 27 to 13.30AED today, a 22% haircut. Aldar Properties, Abu Dhabi’s largest listed developer, dropped 5% the day markets reopened. The bond market for UAE developers is only trading intermittently, with spreads blowing out across the region.

Read more: Odds swing wildly as Polymarket bets on Iran’s successor collapse

Dubai’s crypto-friendly property boom depended on foreign capital, and that capital is now heading for the exits.

In the secondary market, an aggregator tracking distressed property deals shows an average price reduction of 4.9% — for property owners who’ve had enough time to update their asking price, including several properties over 10% lower than their price days ago.

Even before the war, Fitch had warned of declines up to 15% on supply concerns alone. Analysts had already cautioned that new condo supply was set to surge in the second half of 2026, right as demand is cratering.

BTC, for all its reputation as a notoriously volatile asset, is positive since the bombs started falling. Dubai real estate, the supposedly safe store of value backed by marble lobbies and palm-shaped islands, just delivered a massive drawdown.

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Two Largest DAT Companies Double Down on Crypto Buys

Strategy just bought nearly 6x more BTC than last week, while Tom Lee’s Bitmine also purchased more ETH than usual.

The largest digital asset treasury (DAT) companies for Bitcoin (BTC) and Ethereum (ETH) added more crypto than usual to their stockpiles last week.

Michael Saylor’s Strategy announced on Monday, March 9, that its latest weekly Bitcoin purchase totaled 17,994 BTC at an average price of about $70,946 per coin. Last week’s buy is nearly 6x larger than the previous week’s buy of 3,015 BTC — which itself marked a notable uptick in accumulation after weekly buys shrank since late January.

The latest purchase bring’s Strategy’s stockpile to 738,731 BTC as of March 8, or about $50.65 billion at current prices. The publicly traded firm remains the largest Bitcoin DAT by holdings, followed by MARA Holdings with 53,822 BTC.

Meanwhile, the second largest DAT company and the largest Ethereum DAT, Tom Lee’s Bitmine Immersion Technologies, announced in a press release today its most recent purchase of 60,976 ETH, bringing its total Ethereum holdings to 4,534,563 ETH as of March 8.

Per the release, last week’s purchase is well above the firm’s recent weekly purchase average of 45,000-50,000 ETH. The previous week, Bitmine bought 51,000 ETH. Bitmine is currently staking 3,040,483 ETH, or about 67% of the 4.5 million ETH that it holds in its treasury.

Also today, the second-largest Ethereum DAT, Sharplink, released its 2025 financial report. Per a press release from the firm, it recorded a $734.6 million net losses last year, a solid chunk of which — $616.2 million — were unrealized losses on its ETH holdings.

Sharplink announced its rebrand to an Ethereum DAT in May of last year — with Consensys CEO and Ethereum co-founder Joseph Lubin as chairman of its board. The firm has accumulated 864,840 ETH to date, at an average cost of $3,588 per ETH, per CoinGecko data.

But, the spot price of ETH had a volatile year in 2025. ETH reached a new all-time high near $5,000 in August, only to end the year struggling near $3,000. ETH is currently trading just over $2,000 at publishing time.

Crypto World

Blockchain.com Expands into Ghana After 700% Nigerian Trading Growth

Blockchain.com is expanding its footprint in Africa with a launch in Ghana, deepening a regional push that has already shown strong traction in Nigeria over the past year. The company said it plans to offer Ghanaian users access to its trading platform as it builds out local infrastructure and pursues additional markets across the continent. The Nigeria rollout revealed robust demand, with the brokerage transaction volume up by more than 700% and trading activity centered on Bitcoin (BTC) (BTC) (CRYPTO: BTC), Tether (USDT) (USDT) (CRYPTO: USDT), and Tron (TRX) (TRX) (CRYPTO: TRX).

The Ghana expansion follows a period of rising activity ahead of a formal launch, with the company reporting a 140% increase in active users in the country over the past year and an 80% jump in transaction volumes. Blockchain.com stressed that its strategy in Ghana centers on building out local compliance and regulatory engagement, including a local compliance representation position. The move underscores a broader objective: to accelerate its regional infrastructure, forge partnerships with local payment rails, and position Ghana as a gateway to additional African markets.

“We are actively collaborating with Ghanaian officials and regulators to help build a regulatory framework and have already established local compliance representation in Ghana,” a Blockchain.com spokesperson told Cointelegraph. The emphasis on regulatory alignment mirrors a wider industry trend as exchanges seek clearer paths to operate within increasingly formal oversight regimes across the continent.

The company highlighted the importance of integrating with Ghana’s mobile money ecosystem, noting that such rails are a cornerstone of its strategy in the region. With mobile payments deeply embedded in everyday commerce, the ability to settle trades and fund wallets through popular mobile money channels is viewed as a key driver of uptake for digital assets among a broader cross-section of the population.

Blockchain.com’s Ghana announcement sits within a larger narrative of Sub-Saharan Africa’s rapid crypto growth. The firm already operates in more than 70 jurisdictions globally and has signaled plans to pursue additional African markets as part of a long-term growth plan. That strategy aligns with data from Chainalysis, which shows Sub-Saharan Africa emerging as a hotbed of on-chain activity. The region logged more than $205 billion in on-chain crypto value between July 2024 and June 2025, up 52% from the previous year, placing it among the world’s fastest-growing markets. Nigeria dominates that activity, accounting for more than $92 billion in on-chain value during the same period, with South Africa, Ethiopia, Kenya, and Ghana following closely behind.

The Ghana push also resonates with broader discussions about crypto as a tool for remittances and cross-border payments. At the World Economic Forum Annual Meeting in Davos, Vera Songwe, a former United Nations official, noted that stablecoins are increasingly used to reduce remittance costs, which traditionally run around $6 per $100 sent. In economies grappling with inflation and uneven access to traditional banking, such digital dollar alternatives are gaining appeal as faster, cheaper settlement mechanisms. Songwe’s remarks reflect a growing consensus among policymakers and researchers that digital assets can complement, rather than replace, existing financial systems when properly regulated and integrated.

Beyond Lagos and Nairobi, Africa’s crypto narrative features voices like Africa Bitcoin Corporation founder Stafford Masie, who has argued that Bitcoin is already serving as everyday money in some communities. Masie told the Coin Stories podcast that merchants in certain local economies accept satoshis for goods and services, underscoring a level of grassroots adoption that is outpacing formal channels in parts of the continent. This angle—where crypto acts as day-to-day currency rather than solely as a store of value—adds nuance to the Ghanaian expansion and the continent’s longer-term potential as a regional crypto hub.

Industry observers also point to regional price dynamics and currency volatility as catalysts for crypto uptake. Data from Borderless.xyz indicated that Africa recorded the highest median stablecoin-to-fiat conversion spreads among tracked regions in February, highlighting both demand for dollar-denominated liquidity and the challenges of local fiat markets. Taken together with Chainalysis’ Africa-focused data and Masie’s observations, the Ghana launch can be read as part of a broader pattern in which crypto infrastructure—paired with accessible payments rails—helps broaden financial options for a population that remains largely mobile-first and cash-centric in many communities.

Blockchain.com’s expansion in Ghana comes amid a wider push by global crypto exchanges to establish local footprints across Africa. The Ghana launch—backed by public relations coverage from PR Newswire—signals a willingness to engage with regulators and to tailor product offerings to local conditions. While the practical rollout will hinge on a complex mix of licensing, compliance, and partnerships, the company’s statements emphasize a pragmatic approach: build the necessary regulatory bridges, invest in regional teams, and connect digital assets to existing payment ecosystems to support everyday use cases.

Crypto adoption grows across Sub-Saharan Africa

Crypto use has surged in Sub-Saharan Africa in recent years. Chainalysis’ data for the 12-month period ending mid-2025 shows the region accumulating substantial on-chain value, with Nigeria taking the lead in absolute terms. South Africa, Ethiopia, Kenya, and Ghana are among the other notable centers of activity. Analysts say this demand is driven by cross-border remittances, currency volatility, and a youthful, mobile-first user base seeking access to financial services beyond traditional banks. The Ghana launch sits at the intersection of these dynamics, offering a test case for how a major platform can adapt its services to a regulatory environment and to local payment rails that shape user behavior.

In Davos, Songwe emphasized that stablecoins can offer meaningful improvements in remittance costs and speed, potentially reshaping how money moves across borders in Africa. The combination of lower fees, faster settlement, and broader digital adoption may accelerate not only trading and savings but also merchant adoption as more businesses accept digital assets as payment. The narrative around stablecoins, remittances, and cross-border rails is increasingly central to how policymakers, fintechs, and asset providers view Africa’s crypto opportunity.

As Africa’s crypto story unfolds, Masie’s remarks about Bitcoin as a practical medium of exchange in some regions illuminate a reality that policymakers and investors are watching closely. If more communities begin to adopt crypto for day-to-day transactions, the demand for user-friendly products, local-language support, and compliant, regionally integrated services could rise quickly. For Blockchain.com and similar firms, the Ghana market represents both a proving ground and a springboard for broader regional expansion, where the combination of regulatory clarity, accessible payment rails, and culturally aware service design could accelerate crypto’s mainstream viability on the continent.

Why it matters

The Ghana expansion, alongside Nigeria’s sustained growth, demonstrates that Africa is not merely a speculative backdrop for crypto, but a dynamic testing ground for real-world use cases. Building out local compliance structures and engaging with regulators signals a shift from offshore operations toward regionally anchored models that can adapt to diverse regulatory regimes. For users, this could translate into more reliable access to trading, wallets, and payments that work with familiar mobile money platforms, reducing friction and increasing trust in digital assets.

From an industry perspective, the Ghana launch reinforces the importance of partnerships with payment providers and local banks to unlock liquidity and enable quick settlement. It also underscores the need for clear regulatory frameworks that protect consumers while allowing innovation to flourish. The combination of on-chain growth data, grassroots adoption, and the ongoing push for settlement efficiency suggests a longer-term trajectory where crypto services become embedded in everyday financial activity across Sub-Saharan Africa.

For builders and policymakers, the initiative highlights the critical balance between market access and compliance. As the region navigates licensing regimes, data privacy, and anti-money-laundering standards, a measured, transparent approach will determine whether crypto becomes a durable feature of Africa’s financial architecture or a transient trend. The Ghana moment should be read as part of a broader continental arc—one that could redefine how people in many economies access, move, and use digital value.

What to watch next

- Regulatory milestones in Ghana: licensing decisions, local governance structures, and the pace of market onboarding.

- Speed and scope of mobile-money integrations: new payment rails, KYC requirements, and onboarding timelines for retail users.

- Additional African market entries by Blockchain.com and peers, including partner networks and regional hubs.

- Post-launch adoption metrics in Ghana: active users, transaction volumes, and the mix of assets traded.

Sources & verification

- Blockchain.com Ghana launch press release and regional expansion statements (PR Newswire).

- Chainalysis report on Sub-Saharan Africa on-chain activity and regional growth (September report referenced).

- Vera Songwe remarks on stablecoins and remittances at the World Economic Forum in Davos.

- African crypto insights from Stafford Masie’s Coin Stories interview on Bitcoin as everyday money.

- Borderless.xyz data showing stablecoin-to-fiat conversion spreads by region (February).

Blockchain.com expands in Ghana as Africa strategy accelerates

Blockchain.com is expanding its Africa footprint with a formal push into Ghana, a move described by the company as a continuation of its strategy to grow beyond markets where it already operates. The Ghana initiative follows Nigeria’s rapid uptake, where the platform launched retail operations last year and reported a more than sevenfold rise in brokerage activity. In Nigeria, traders have prioritized Bitcoin (BTC) (BTC) (CRYPTO: BTC), Tether (USDT) (USDT) (CRYPTO: USDT), and Tron (TRX) (TRX) (CRYPTO: TRX), reflecting broad appetite for major digital assets as users experiment with wallets, trading, and payments on the go.

The Ghana plan emphasizes a local presence—comprising regulatory engagement, regional leadership, and partnerships with payment rails—that could accelerate user onboarding and broaden access to digital assets in a country where mobile money is deeply entrenched in daily life. The company’s stance is to establish a regulated, compliant operating framework from the outset, a strategy that aligns with global trends toward clearer oversight as crypto markets mature across the region.

Industry observers note that Africa’s crypto surge has a distinct social dimension. Chainalysis data show that Nigeria remains a dominant driver of on-chain activity for the continent, but the growth story extends beyond a single country. The $205 billion on-chain value figure for the region underscores the scale of activity and the potential for service providers that can offer user-friendly interfaces, robust security, and accessible funding and withdrawal channels to attract a broader base of customers who previously relied on informal channels for cross-border payments and savings.

From a macro perspective, the Ghana launch comes at a time when policymakers are increasingly evaluating how to balance innovation with consumer protection. Songwe’s Davos remarks about stablecoins and remittances reflect a recurring theme: digital currencies can lower costs and speed settlements for cross-border flows, provided that stablecoin issuance, custody, and compliance frameworks are designed with local realities in mind. In practice, this means building partnerships with local banks and payment processors and cultivating a regulatory environment that supports responsible crypto usage while preserving financial stability.

Masie’s account of Bitcoin’s role in some African communities adds texture to the Ghana narrative. If merchants already accept satoshis in daily transactions in parts of the continent, then the Ghana expansion could unlock practical uses beyond speculation, reinforcing the case for a networked economy where crypto acts as a complement to, rather than a substitute for, existing financial channels. In parallel, the ongoing discourse around stablecoins and on-chain liquidity continues to shape how fintechs approach product design, risk management, and customer education as they roll out new services in the region.

-

Politics6 days ago

Politics6 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Business3 days ago

Form 8K Entergy Mississippi LLC For: 6 March

-

Fashion3 days ago

Fashion3 days agoWeekend Open Thread: Ann Taylor

-

News Videos8 hours ago

News Videos8 hours ago10th Algebra | Financial Planning | Question Bank Solution | Board Exam 2026

-

Tech5 days ago

Tech5 days agoBitwarden adds support for passkey login on Windows 11

-

Sports4 days ago

Sports4 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

Sports2 days ago

Sports2 days agoThree share 2-shot lead entering final round in Hong Kong

-

Crypto World4 hours ago

Crypto World4 hours agoParadigm, a16z, Winklevoss Capital, Balaji Srinivasan among investors in ZODL

-

Sports2 days ago

Sports2 days agoBraveheart Lakshya downs Lai in epic battle to enter All England Open final | Other Sports News

-

Business6 days ago

Business6 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

NewsBeat4 days ago

NewsBeat4 days agoPiccadilly Circus just unveiled ‘London’s newest tourist attraction’ and it only costs 80p to enter

-

Business1 day ago

Business1 day agoSearch for Nancy Guthrie Enters 37th Day as FBI Probes Wi-Fi Jammer Theory

-

Politics3 days ago

Politics3 days agoTop Mamdani aide takes progressive project to the UK

-

Entertainment3 days ago

Entertainment3 days agoHailey Bieber Poses For Sexy Selfies In New Luscious Lip Thirst Traps

-

Sports7 days ago

Sports7 days agoJack Grealish posts new injury update as Man City star enters crucial period

-

Tech6 hours ago

Tech6 hours agoDespite challenges, Ireland sixth in EU for board gender diversity

-

Crypto World5 days ago

Crypto World5 days agoNew Crypto Mutuum Finance (MUTM) Reports V1 Protocol Progress as Roadmap Enters Phase 3

-

Tech4 days ago

Tech4 days agoACIP To Discuss COVID ‘Vaccine Injuries’ Next Month, Despite That Not Being In Its Purview

-

Entertainment5 days ago

Harry Styles Has ‘Struggled’ to Discuss Liam Payne’s Death

-

NewsBeat4 days ago

NewsBeat4 days agoGood Morning Britain fans delighted as Welsh presenter returns to host ITV show