Crypto World

Tether releases open-source mining software for Bitcoin

Tether has open-sourced its Bitcoin mining operating system, aiming to make mining operations easier and more accessible for operators of all sizes.

Summary

- Tether released its Mining OS under an open-source license.

- The software supports both home and industrial mining setups.

- The move reduces reliance on paid management platforms.

The announcement was made by Tether chief executive officer Paolo Ardoino on Feb. 3, who said the company’s Mining OS is now fully open source.

In a post on X, Ardoino described the software as a modular platform designed to support operations across multiple locations, with encrypted peer-to-peer networking and broad hardware compatibility.

Open-source platform targets small and large miners

The software, officially known as MiningOS or MOS, was unveiled as open source during the Plan ₿ Forum in San Salvador on Feb. 2. It is designed to manage and automate Bitcoin (BTC) mining infrastructure through a single interface.

MOS allows operators to monitor hardware performance, energy usage, cooling systems, and site operations from one dashboard. Its modular design lets users customize features through independent components linked by a shared system.

Unlike many commercial mining tools, MOS runs locally and does not rely on centralized servers. It uses peer-to-peer networking technology to enable direct communication between devices, which Tether says improves reliability and privacy.

The platform has been released under the Apache 2.0 license, meaning it can be used, modified, and distributed freely. It is built to run on lightweight devices for small setups, while also supporting large-scale deployments with thousands of machines.

Tether (USDT) is also preparing a companion Mining SDK, which will allow developers to build custom tools and extensions on top of the system. The company said the framework will be finalized with input from the open-source community.

Part of Tether’s broader Bitcoin strategy

By open-sourcing MOS, Tether is seeking to reduce reliance on proprietary mining software such as Hive OS and Foreman, which often charge recurring fees. The company says this approach can help smaller operators compete more effectively with large public mining firms.

The move fits into Tether’s wider involvement in Bitcoin infrastructure. The business has expanded its role in network support and backed mining projects that prioritize operational efficiency and renewable energy in recent years.

Although Tether scaled back some mining operations in late 2025 due to rising energy costs, the MOS release is focused on software development rather than hardware ownership. The company has framed the project as a long-term investment in decentralized infrastructure.

Additionally, Tether’s direct exposure to Bitcoin has been growing. In addition to traditional holdings, it has treated Bitcoin as a strategic reserve by allocating a portion of its profits to its acquisitions since 2023. As of early 2026, Tether held about 96,185 BTC, valued at more than $8 billion at the time, placing it among the largest corporate Bitcoin holders globally.

The open-source release may promote greater industry cooperation regarding mining tools and standards. At a time when mining costs and network complexity are still high, widespread adoption of MOS could help simplify operations and reduce entry barriers.

Crypto World

BTC zoomes above $65,000 as bullish ‘double-bottom’ hopes build

Bitcoin reclaimed $65,400 early Wednesday as a weaker U.S. dollar and a risk-on tone across Asian equities gave crypto markets their first clean bounce in weeks.

The broader crypto market cap had slipped to $2.19 trillion earlier this week, practically retesting the lows hit during the Feb. 5 crash. That proximity is what makes the current move interesting.

If the level holds, the market is looking at a textbook “double bottom” with roughly 10% upside, according to Alex Kuptsikevich, chief market analyst at FxPro. If it doesn’t, he warned, “a failure to rebound will signal the end of the recovery, opening the potential for a further 25% decline.”

A double bottom is a classic bullish chart pattern that signals a potential trend reversal after a downtrend. Imagine the price dropping to a low, then bouncing up a bit, forming resistance and then falling back to test that same low point. This creates a W-shaped structure with two “bottoms.” Once price breaks above the middle peak, a bullish reversal is confirmed.

The focus, therefore, is on whether the ongoing recovery rally extends beyond the brief bounce to $2.47 trillion market cap seen roughly 10 days ago.

Altcoins rise as dollar dips

In the meantime, major tokens are tracking bitcoin higher. Ether rose 4.2% over the past day, solana gained 7%, and XRP added 3%. The moves came as MSCI’s gauge for Asian equities climbed 1.4% to a record, led by South Korea and Taiwan, where AI-linked chipmakers hit all-time highs ahead of Nvidia’s earnings report later Wednesday.

The dollar provided a tailwind for risk assets. The Bloomberg Dollar Spot Index edged lower after President Trump’s State of the Union address, in which he doubled down on tariff plans despite the Supreme Court striking down his global import taxes.

He further suggested tariffs could eventually replace the income tax system entirely.

A weaker dollar has historically been constructive for bitcoin, though the relationship has been inconsistent during this drawdown cycle.

But conviction remains thin despite the bounce notwithstanding. Bloomberg reported that analysts it surveyed described a “crisis of confidence” in bitcoin after its nearly 50% decline from all-time highs, with no obvious new catalysts for growth.

FxPro’s Kuptsikevich went further, saying the market likely hasn’t bottomed yet and that “real capitulation is still ahead.”

Crypto World

Anchorage Digital holds Strategy holds bitcoin holder Strategy’s preferred stock

Anchorage Digital, the first crypto firm to secure a U.S. banking charter, said Wednesday that its holding perpetual preferred stock in bitcoin treasury firm Strategy on its balance sheet.

Anchorage’s CEO Nathan McCauley called it “conviction compounding.”

“Institutions don’t just talk about Bitcoin, they structure around it. When the company that operationalizes Bitcoin infrastructure puts capital alongside the company that operationalized the Bitcoin treasury strategy…that’s a signal,” McCauley said on X.

Saylor responded by saying that “conviction is contagious,” hinting at a possibility of other firms soon following Anchorage’s lead in buying Strategy’s yield-generating preferred stock.

Anchorage’s investment is a capital vote for the bitcoin treasury playbook popularized by Michael Saylor’s Strategy. The flex also highlights deepening ties among bitcoin’s institutional faithful, even as prices wobble. Strategy is the world’s largest publicly listed bitcoin holder, boasting a coin stash of 717,722 BTC, worth $46.64 million.

Strategy’s perpetual preferred stock, Short Duration High Yield Credit (STRC), ranks senior to common shares like MSTR while offering investors steady yields without an expiration date.

Launched in mid-2025, STRC pays 11.25% annual dividends to holders. This is paid monthly in cash, with its rate adjusted each month to keep trading stable around the $100 par value.

San Francisco-based Anchorage Digital, the first federally chartered U.S. crypto bank offers custody, trading, staking, and stablecoin services to institutions. The firm is establishing U.S.-compliant stablecoin rails for international banks, offering faster movement of assets across borders.

Crypto World

Vitalik Buterin sold 17,000 ETH this month as ether fell 37%

Vitalik Buterin earmarked 17,000 ether, worth about $43 million, for privacy projects in January. A month later, his wallet balance is down by roughly that amount, and the token he’s selling has lost more than a third of its value.

Arkham Intelligence data shows Buterin’s attributed wallets held about 241,000 ETH at the start of February. That figure now sits at 224,000 ETH after a steady series of outflows through the month, including $6.6 million over three days earlier in February and roughly another $7 million in the past three days alone.

The sales were executed through decentralized exchange aggregator CoW Protocol, broken into numerous smaller swaps rather than single large transactions.

The approach is standard practice for minimizing slippage on size, but it also means the selling has been a slow, consistent bleed rather than a one-time event.

The timing is uncomfortable. Ether has dropped 37% over the past month, according to CoinDesk market data, trading near $1,900 on Wednesday, and Buterin’s ongoing sales add headline pressure to a token already struggling for a narrative.

More than 30% of ETH supply remains locked in staking, but yields have compressed to around 2.8%, making the lock-up less attractive relative to risk-free alternatives.

Buterin announced the $43 million allocation in January, saying he had set aside 16,384 ETH to fund privacy-preserving technologies, open hardware, and secure software systems.

He described the effort as something he would personally lead as the Ethereum Foundation entered a period of “mild austerity” while maintaining its technical roadmap. The capital, he said, would be deployed gradually over several years.

Ether’s sell-off has widened the pain for corporate ETH holders. Bitmine Immersion Technologies, one of the largest, is estimated to be carrying billions in unrealized losses after ether fell roughly 60% in six months — dropping well below its average purchase price.

Crypto World

Cardano price eyes rebound as whales accumulate $213M in ADA

Cardano price is under pressure near $0.27 as whale accumulation grows and technical signals point to continued consolidation.

Summary

- ADA is trading near $0.27 after losing more than 70% from its 2025 highs.

- Large holders have accumulated over 819 million tokens despite the long downtrend.

- Technical indicators show weak momentum, with key resistance near $0.30.

Cardano was trading at $0.275 at press time, down 2.7% in the past 24 hours. The token sits near the midpoint of its weekly range between $0.2581 and $0.3004.

Cardano (ADA) has gained 6.5% over the past week, but it is still down 25% in the last 30 days and just over 60% lower year-over-year. Over the past six months alone, the price has fallen roughly 71% from the $0.90 region to current levels.

CoinGlass data shows $339 million in 24-hour trading volume, down 6.6%, while open interest also fell slightly. Lower volume and open interest during consolidation often reflects reduced speculative activity rather than panic selling.

Cardano whales stack up ADA

On Feb. 25, on-chain analytics firm Santiment reported that Cardano whales and sharks holding between 100,000 and 100 million ADA have accumulated 819.4 million ADA over the past six months, worth roughly $213.9 million at current prices.

During the same period, ADA’s price fell from around $0.90 to $0.26, a drop of more than 71%.

Large holders increasing positions while price declines can signal long-term accumulation. It suggests that high-capital participants view current levels as attractive. This type of activity often appears during late-stage downtrends, when weaker hands exit and stronger hands build positions.

However, accumulation alone does not guarantee an immediate reversal. Price confirmation is still required.

Development across the ecosystem continues to move forward, further boosting long-term price outlook. The Midnight privacy chain is close to launching on mainnet, a step that may unlock new applications in privacy‑focused finance.

Institutional involvement is rising as well. Grayscale Investments has increased its ADA position, and ADA has been approved as loan collateral on Coinbase.

Access is also being widened through futures listings and exchange-traded fund filings, bringing it further into established financial markets. These factors may improve liquidity pathways and long-term utility, which can support price if demand returns.

Cardano price technical analysis

Cardano’s daily chart shows a clear multi-month downtrend. Since the $0.90 region, price has formed consistent lower highs and lower lows. That structure confirms a bearish trend on higher timeframes.

Price is trading below both the 20-day and 50-day moving averages. The 50-day SMA, currently near the $0.27–$0.28 area, acts as dynamic resistance. As long as ADA trades beneath it, sellers hold structural control.

Bollinger Bands are compressing. Volatility has declined, as shown by the upper and lower bands tightening significantly. Often, this kind of squeeze precedes a sharp breakout, but the direction will only become clear once the price breaks.

Momentum is showing early signs of stabilization. After bouncing from below 30, the relative strength index now ranges in the high-30s to low-40s, indicating that selling pressure is easing. Still, momentum has yet to turn bullish.

Horizontal structure is clearly defined. The $0.25–$0.26 zone has acted as firm support, with multiple daily reactions showing demand absorption. Buyers continue defending that area. If this level breaks with strong volume, downside could accelerate toward the psychological $0.20 level.

The mid-Bollinger band and earlier rejection points are both in the $0.29–$0.30 range, where recent attempts at recovery have stalled. A clear move above $0.30 would alter the short-term structure, setting sights on $0.32.

Crypto World

Bitcoin Adoption Surges as Price Stagnates

Bitcoin adoption by institutions, banks, merchants, public companies, and state actors surged through 2025, even as the price retraced from its peak. A River report published this week notes that, despite Bitcoin down roughly 50% from its all-time high, adoption is compounding in ways that don’t immediately show up in the price. The study argues that there is no bear market in Bitcoin adoption and that trust in the asset has grown faster than for any other store of value in history. What began as an experimental project is now a globally recognized asset class with adoption patterns approaching those of the internet.

Key takeaways

- Institutions accumulated 829,000 BTC in 2025, spanning businesses, governments, funds, and exchange-traded funds (ETFs).

- Registered investment advisors have been net buyers for eight consecutive quarters, with approximately $1.5 billion funneled into Bitcoin ETFs per quarter over the past two years.

- Approximately 60% of the top US banks are actively building Bitcoin products, aided by a more favorable regulatory environment that allows custody and product offerings.

- Crypto treasury purchases dominated 2025 activity, with corporate buyers increasing exposure as adoption among treasuries grew about 2.5 times last year.

- Merchant adoption accelerated: US merchants accepting Bitcoin tripled, global usage rose 74% in 2025, and the Lightning Network saw a 300% jump in payments, now estimated to process over $1.1 billion in monthly volume.

- Five new nation-states joined the ranks of Bitcoin holders in 2025, including Luxembourg and Saudi Arabia through sovereign funds, and the Czech Republic, Brazil, and Taiwan via central-bank or state-linked channels; total state involvement spans at least 23 countries.

Tickers mentioned: $BTC

Sentiment: Bullish

Price impact: Neutral. Adoption trends have accelerated even as price movements remained subdued, suggesting a decoupling between on-chain demand and spot prices.

Trading idea (Not Financial Advice): Hold. Structural demand from institutions and governments signals a sustained baseline, even if near-term price action remains uneven.

Market context: The 2025 dynamics unfold amid shifting liquidity, evolving risk appetite, and a steadily clearer regulatory framework for institutional crypto activity, including custody and product offerings, complemented by ongoing ETF and sovereign-interest flows.

Why it matters

The breadth of Bitcoin’s institutional footprint is reshaping how investors view the asset. The 829,000 BTC added in 2025 showcases a persistent appetite from a diverse set of players, including governments and large funds, rather than a temporary speculative surge. This level of accumulation intersects with broader questions about Bitcoin’s maturity as a store of value and potential hedge in diversified portfolios. The River analysis highlights that much of the uptake is happening through channels that touch ordinary investors—through brokerage accounts, retirement plans, and corporate balance sheets—underscoring how widespread exposure has become.

On the payments and merchant side, the acceleration is equally notable. The number of merchants accepting Bitcoin in the United States has tripled, while global usage rose by a material margin in 2025. The Lightning Network, a layer-2 solution designed to enable faster microtransactions, grew its activity by about 300% in the year, with monthly volume surpassing an estimated $1.1 billion. These metrics point to a real-world utility trajectory that complements the broader narrative of Bitcoin as a digital money and store of value rather than a purely speculative vehicle.

State participation also expanded meaningfully. In 2025, five new nation-states joined the ranks of Bitcoin holders, including Luxembourg, Saudi Arabia, the Czech Republic, Brazil, and Taiwan. River estimates place the total number of sovereign or state-backed exposures at roughly two dozen countries, illustrating how Bitcoin’s role in public policy and central-bank curiosity is broadening beyond the early-adopter phase. The evolving mix of buyers—from sovereign funds to central banks to corporate treasuries—helps to illustrate why many observers describe Bitcoin as a global, increasingly diversified asset class rather than a niche technology experiment.

“We expect that in the coming years, Bitcoin adoption will not only continue its current trend, but meaningfully accelerate.”

The narrative painted by River aligns with a growing chorus that Bitcoin’s long-run fundamentals are increasingly decoupled from day-to-day volatility. Some market observers argue that as volatility converges toward the range of gold and broad equity indices, the hurdle for more risk-averse institutions lowers, potentially widening the pool of capital that views Bitcoin as a strategic, long-horizon exposure.

For readers seeking a concise anchor, River’s ongoing research emphasizes that Bitcoin is built on trust and, in their view, remains the world’s most credible scarce digital asset. While headlines will continue to swing with price action, the substance of adoption—across institutions, banks, merchants, and states—appears to be widening rather than narrowing.

What to watch next

- Regulatory clarity in the United States regarding custody and Bitcoin-based products offered by banks and financial institutions.

- Continued ETF inflows and any new filings or approvals that broaden access to Bitcoin-related funds for retail and institutional investors.

- Further sovereign or central-bank engagement, including potential expansion of state-backed mining or reserves allocations.

- Development and scaling of the Lightning Network to sustain higher transaction volumes for merchants and payment processors.

- Corporate treasury strategies and a potential uptick in public-company BTC holdings as part of balance-sheet optimization.

Sources & verification

- River, Bitcoin Adoption 2026 report and related materials (river.com/content/bitcoin-adoption-2026).

- River’s data on 2025 BTC accumulation by institutions (River status report linked in the same publication).

- Related coverage on public-company Bitcoin holdings and treasury adoption (Cointelegraph link: cointelegraph.com/news/public-companies-bitcoin-holdings-prices-crypto-dat).

- Lightning Network growth and estimated monthly volume (> $1.1B) referenced in River’s framework and corroborating coverage (cointelegraph.com/news/bitcoin-lightning-network-1b-monthly-volume).

- Context on sovereign and institutional participation as described in River’s analysis (River article and commentary embedded in the 2026 update).

Institutional adoption reshapes Bitcoin’s 2025 narrative

Bitcoin (CRYPTO: BTC) adoption by institutions, banks, merchants, public companies, and state actors accelerated throughout 2025, even as the asset’s price retraced from record levels. A River analysis published in 2025 underscored that the pace of adoption continued to outstrip price movements, signaling a maturation of the ecosystem that extends beyond speculative interest. The report states that “there is no bear market in Bitcoin adoption” and that trust in the asset has expanded at a pace unmatched by any prior store of value, with patterns of usage and ownership increasingly resembling the diffusion of the internet itself. The narrative frames Bitcoin not merely as a volatile crypto asset but as a globally recognized store of value with global reach and an expanding base of mainstream participants.

In terms of on-chain activity, River tallies show that institutions accumulated 829,000 BTC in 2025, spanning purchases by businesses, government entities, funds, and ETFs. The research notes a persistent trend among registered investment advisors, who have been net buyers for eight consecutive quarters, and highlights that Bitcoin ETFs absorbed roughly $1.5 billion in new money per quarter across the last two years. These numbers illuminate a broader trend: exposure is increasingly consolidated through regulated vehicles and diversified ownership channels, moving Bitcoin from a niche asset to a staple element of diversified portfolios.

Layering into custody and product access, the report points to a striking statistic: around six in ten of the top US banks are actively pursuing or developing Bitcoin-related offerings. River emphasizes a favorable regulatory environment in the United States, which has opened the door for banks to custody Bitcoin and to offer related products to retail and institutional clients. The combination of improved access and enhanced custody capability is a potent driver of continued adoption, the analysis argues, even if the immediate price action remains volatile.

Beyond traditional financial players, corporate balance sheets emerged as a major source of demand. The year 2025 saw corporations emerge as the largest buyers of BTC, with a notable share driven by treasury-management strategies. River notes that corporate demand grew roughly 2.5 times year over year, underscoring the strategic role that Bitcoin is playing in reserve management for some companies. The shift from proof-of-concept experiments to real-world treasury deployments marks a meaningful transition in Bitcoin’s evolution as a corporate- and institution-facing asset.

On the payments front, River documented acceleration in merchant adoption and consumer usage. In the United States, the number of merchants accepting Bitcoin rose dramatically—twice on the doorsteps of mainstream commerce—and global usage rose 74% in 2025. The Lightning Network, designed to facilitate faster and cheaper microtransactions, expanded its footprint by approximately 300% in 2025 and is now estimated to process over $1.1 billion in monthly volume. The growth of Lightning is a tangible indicator of the network’s practical utility, moving Bitcoin from a store of value to an on-ramp for everyday payments in a growing number of contexts.

State involvement also expanded meaningfully. River identifies five new nation-states becoming Bitcoin owners in 2025, including Luxembourg and Saudi Arabia via sovereign-backed channels and the Czech Republic, Brazil, and Taiwan through central-bank or state-linked arrangements. While the precise mechanisms vary, the cumulative effect is a broader and more formalized exposure to Bitcoin across sovereign balance sheets. River’s broader estimate places the number of states with some Bitcoin exposure at roughly 23, whether through mining, seizures, or direct holdings.

The broader takeaway is clear: Bitcoin’s volatility is converging toward the realm of traditional assets such as gold and major stock indices, reinforcing the asset’s maturation in the eyes of a growing cohort of risk-conscious investors. The report suggests that as volatility subsides, institutions with more conservative mandates may become comfortable with increasing allocations over time, potentially unlocking additional pools of capital that have historically been wary of crypto markets.

In wrapping up, River frames Bitcoin as a trust-based, scarce digital asset that has evolved from a speculative experiment into a globally recognized instrument with tangible use cases—from corporate treasuries to real-time payments and beyond. While the market will continue to echo a variety of price scenarios, the underlying growth in adoption signals a lasting shift in how Bitcoin is perceived and used on a global scale.

Crypto World

Kash Raises $2M for Social Media Prediction Markets

Kash, a social-native prediction market platform, has raised $2 million in pre-seed funding to transform how conviction is expressed online. Built directly into social media, and starting with X, Kash turns everyday posts into live, tradable markets on real-world events, embedding forecasting into the social feed itself.

Backed by leading venture investors including Big Brain Holdings, Spartan Group, Coinbase Ventures, Kosmos Ventures, Halo Capital, MoonRock Capital, Polaris Fund, and Fabric VC, Kash is positioning prediction markets where attention already lives: inside the platforms that shape global conversation.

Rather than debating outcomes in comment threads, users can now express conviction through simple interactions with @kash_bot. No new clunky apps. No complex external trading interfaces. Just scroll, quote-post, predict, and let the market price the truth in real time.

“We’re embedding an entirely new financial vehicle where people already live, and enabling users to place, and even permissionlessly create prediction markets, directly from their feed,” said Lucas Martin Calderon, Founder and CEO of Kash.

“People already hold opinions on elections, macro, sports, and culture. Kash transforms those opinions into tradable positions and rewards those who are right.”

Bridging Institutional Infrastructure and Consumer Attention

Before founding Kash, Lucas worked at the intersection of blockchain security and AI, collaborating with governments and tier-one banks to architect secure on-chain systems. He later worked alongside leading crypto hedge funds on high-frequency trading strategies, gaining firsthand experience in how markets aggregate and price information at scale.

Those experiences pointed to a clear shift: prediction markets are approaching an inflection point. The world has never been more uncertain, and as information accelerates and trust fragments, markets will determine what is credible. Kash brings that mechanism directly into where information spreads fastest.

Posts become markets. Engagement becomes a signal. Every prediction is settled transparently on-chain. Leaderboards, dynamic multipliers, and weekly competitive games make forecasting social and participatory, while the underlying infrastructure ensures trustless execution and automated resolution, which virally grow across social media feeds.

Kash is also extending its infrastructure beyond its core product, working with several companies to embed prediction markets directly into their own platforms and communities, unlocking new forms of engagement and user acquisition. This is the first time large social media accounts can engage with their audience in an entirely new way, making people have skin-in-the-game around any short-lived narrative.

“Prediction markets are one of the most robust truth-finding mechanisms in finance. The missing piece has been distribution. Kash solves that by embedding markets natively into X, where the information and opinions already flow.” said Lata Persson from Fabric VC. “We’re excited to back Lucas and the Kash team, who bring a rare combination of deep experience in how institutional markets aggregate information, and a clear-eyed view of where consumer attention lives.”

Why This Moment Matters

Prediction markets have historically lived on niche trading platforms. Meanwhile, billions of users debate outcomes daily on social media without economic accountability.

Kash sits at the convergence of two forces:

- The financialization of attention

- The growing demand for real-time, trustless information systems

“We’re not building a feature, we’re defining a new behaviour,” said Lucas. “Prediction markets shouldn’t be confined to professional traders. They should be native to how people interact with uncertainty every day.”

To support this evolution, Kash is forming a Prediction Market Council, bringing together researchers, investors, and operators to define standards and guide the responsible expansion of this emerging category.

Kash’s Technology Is Ridiculously Impressive

Kash is the first and only prediction market protocol that enables:

- permissionless prediction market creation: any user can create any market

- short-lived flash markets: Kash can create markets that last as little as 15 mins to weeks

- leverage: users can trade with leverage, native to the protocol

- natively embeds within social media feeds: leveraging familiar and existing user habits

This is only possible through Kash’s custom Bonding Curve Automated Market Maker mechanism, which Lucas created from scratch, fully adapted to social media dynamics and permissionless flash markets for the first time.

Furthermore, Kash is pioneering how AI is used in prediction markets when it comes to market creation and resolution. Kash is the first protocol that will commercialise the most advanced multi-agentic high-reasoning LLM Council that trustlessly verifies its outcomes using zero-knowledge proof cryptography.

Path to Launch

Kash has launched its pre-testnet simulation on X through “Kash Flash: The Sovereign Signal,” a weekly competitive prediction series identifying the platform’s most accurate forecasters. Top performers earn “Signal” Tickets, granting early access, testnet privileges, and enhanced mainnet participation.

With pre-seed capital secured, Kash is scaling infrastructure, expanding its team, and accelerating toward a broader launch. As social platforms continue to dominate global attention, Kash is building the infrastructure that turns conversation into markets, and markets into signals.

About Kash

Kash is a social-native prediction market platform embedded into X, enabling users to trade on real-world events directly within their feed. Founded by Lucas Martin Calderon, Kash combines institutional-grade infrastructure with social-native design to make forecasting accessible, competitive, and economically meaningful.

For more information: Visit kash.bot | Announcement on X @kash_bot | Follow @lmc_security

Crypto World

Global Firms Complete Intraday Repo with Tokenized Gilts on Canton Network

TLDR

- Global financial firms executed the first cross-border intraday repo using tokenized U.K. government bonds on the Canton Network.

- The transaction included a cross-currency exchange involving tokenized gilts and tokenized deposits in a non-sterling currency.

- The repo aimed to demonstrate real-time collateral movement without relying on traditional market cut-off times.

- Participants included LSEG, Euroclear, DTCC, Tradeweb, Citadel Securities, Societe Generale, Archax, and Cumberland DRW.

- TreasurySpring embedded interest and risk terms directly into smart contracts supporting the repo structure.

Global financial firms executed a new cross-border intraday repo using tokenized U.K. bonds on the Canton Network, and the move introduced real-time collateral mobility across markets while expanding access to previously underused assets, and it marked an early step in broader institutional blockchain adoption.

The group carried out the trade with tokenized gilts and tokenized cash, and it validated the network’s ability to support fast settlement across jurisdictions. Furthermore, firms used the platform to complete a cross-currency exchange that involved digital gilts against non-sterling deposits.

Cross-Border Repo Execution

LSEG and Euroclear joined the test to move collateral at intraday speed, and the teams aimed to reduce delays tied to traditional cut-off windows. Furthermore, DTCC and Tradeweb supported the workflow to validate synchronized settlement across regions.

Citadel Securities and Societe Generale joined the exercise to assess faster liquidity access, and digital asset firms Archax and Cumberland DRW handled operational elements. Moreover, TreasurySpring applied smart-contract terms to embed rate and risk features directly into each transaction.

The repo involved tokenized gilts drawn from a $2 trillion market, and the test demonstrated that digital instruments can move with fewer frictions across borders. Likewise, the structure allowed firms to complete intraday financing without waiting for legacy batch settlement processes.

Digital Asset executive Kelly Matheison stated that “only about $28 trillion of high-quality liquid assets are usable as collateral today,” and she argued that timing constraints limit broader deployment. Therefore, she explained that real-time transfer rails could unlock more efficient balance-sheet use.

Tokenization as a Settlement Tool

Digital Asset, the primary developer of the Canton Network, raised support from Goldman Sachs, DRW, BNY, and Nasdaq, and the backing underscored rising institutional interest in shared ledgers. Additionally, the firm said Canton aims to help institutions use assets around the clock rather than within limited windows.

Matheison stated that “timing restricts access to global collateral,” and she emphasized that blockchain-based settlement removes constraints tied to geography and market hours. Consequently, the platform allows ownership transfers to occur in real time.

The firms tested the Canton model to shift collateral faster across regions, and the design allowed intraday repo returns without overnight exposure. Furthermore, the shared ledger enabled both sides to verify movements instantly.

The test also showed that synchronized asset transfers reduce manual steps, and the participants reviewed the workflow to confirm operational reliability. Therefore, the model supports more efficient trading schedules.

Crypto World

Bitcoin Signals Suggest a 6 Month Wait Before Liquidity Returns

Bitcoin price has rebounded slightly after recent selling pressure, yet broader technical signals remain cautious. The crypto king recently broke down from a triangle pattern, raising concerns of further downside.

While the move may appear to be stabilizing, underlying metrics suggest potential prolonged weakness.

Bitcoin’s Past Might Dictate Hints At Its Future

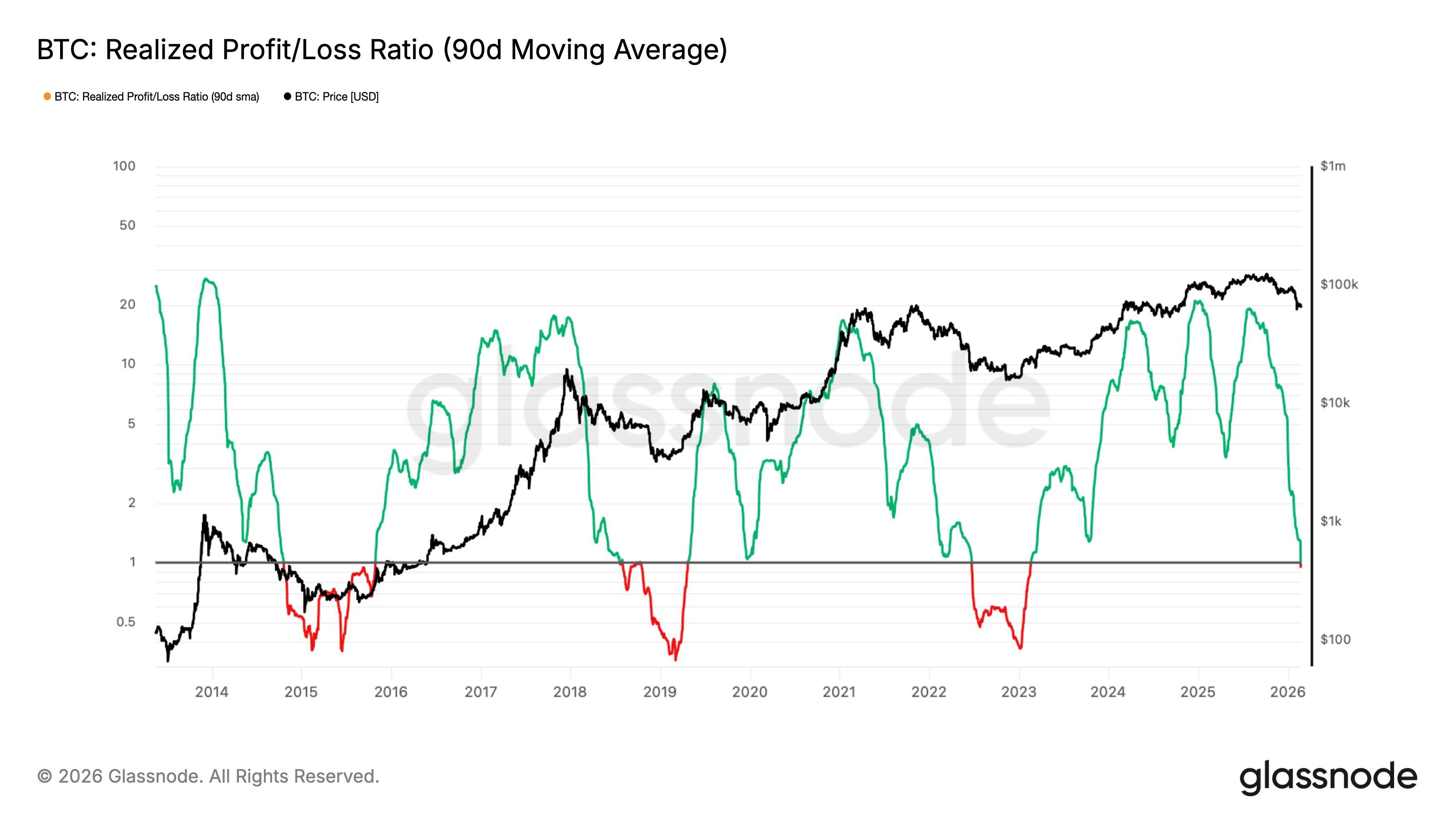

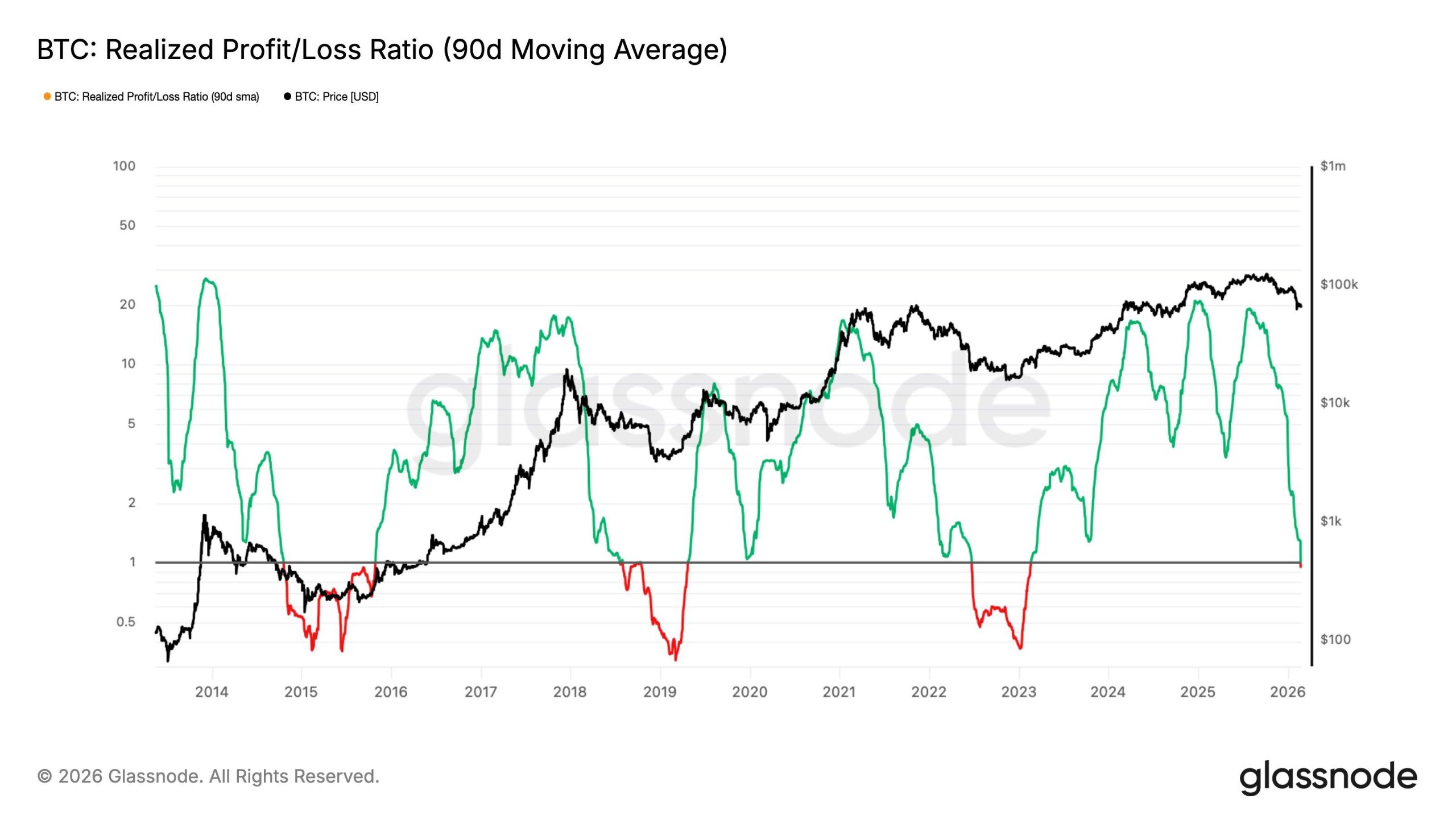

The Realized Profit/Loss Ratio (90D-SMA) has fallen below 1, signaling Bitcoin’s transition into an excess loss-realization regime. This metric measures whether investors are realizing more profits or losses over a rolling 90-day period. A reading below 1 confirms that losses dominate.

Historically, breaks below this threshold have persisted for six months or longer before recovering. Reclaiming levels above 1 has typically aligned with constructive liquidity returning to the crypto market. Until that shift occurs, sentiment may remain defensive and capital inflows limited.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

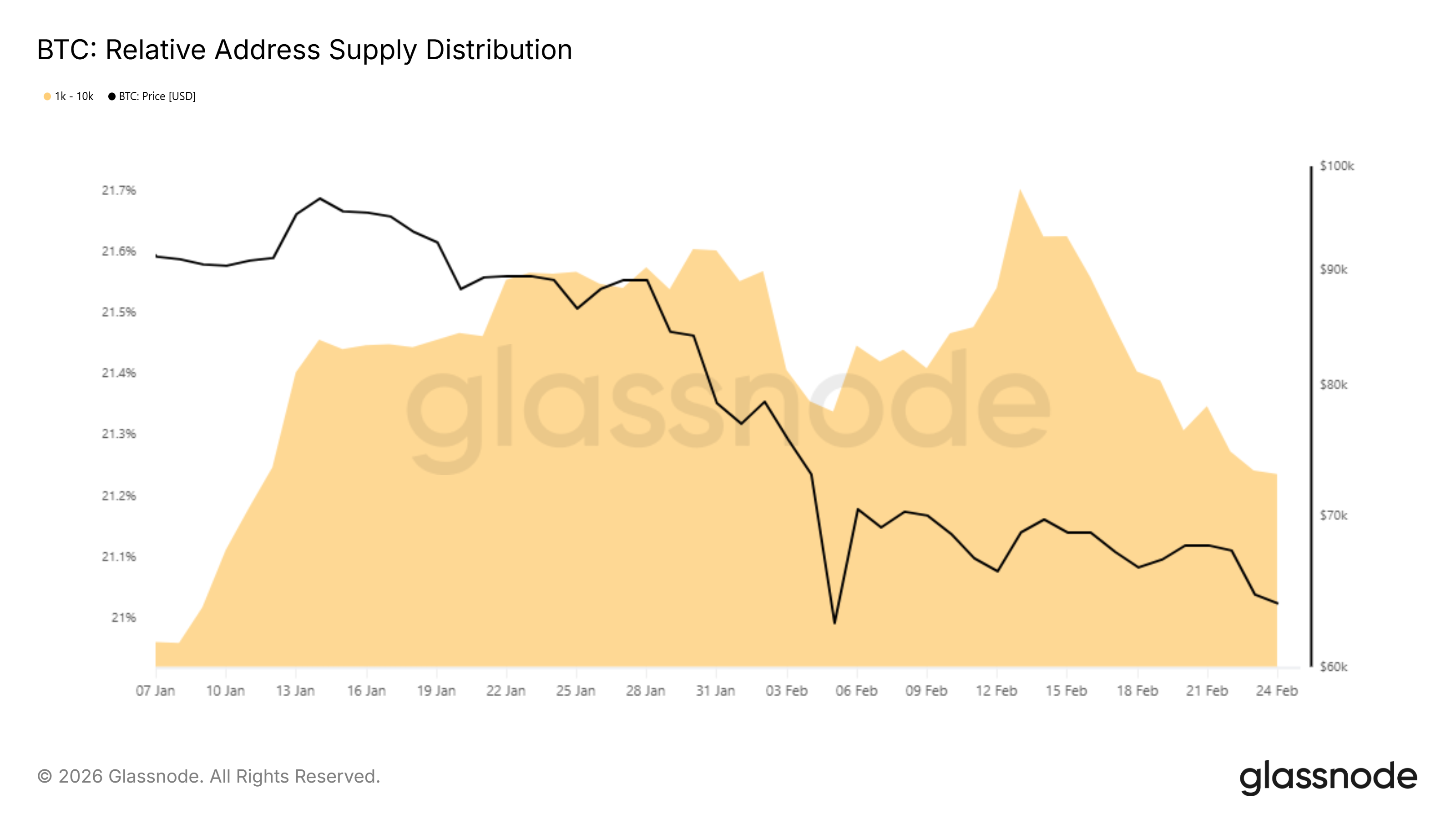

Supply distribution data reveals notable changes among large Bitcoin holders. Addresses holding between 1,000 and 10,000 BTC have gradually reduced exposure. Over the past 12 days, their share of total supply declined from 21.7% to 21.2%.

This shift represents a reduction of nearly 90,000 BTC, valued at approximately $5.8 billion. Although the pace of selling appears measured, distribution by large holders can weigh on price stability. Persistent offloading may limit upside attempts in the near term.

BTC Price Recovery Unlikely

Bitcoin is trading at $65,475 at the time of writing after bouncing from the $62,525 support level over the past 24 hours. The earlier triangle breakdown projected a potential 14% decline. However, immediate downside momentum appears to be slowing.

If macro bearish signals continue to dominate, Bitcoin could retest the $62,525 support. A decisive break below that level may expose BTC to the psychological $60,000 threshold. Losing this support could intensify panic selling and deepen the correction.

Conversely, renewed buying interest at current levels may shift short-term momentum. A breakout above the $67,394 resistance would invalidate the triangle pattern. Sustained strength beyond that point would signal improving structure for BTC and suggest a temporary bullish recovery despite broader liquidity concerns.

Crypto World

Coinbase Fully Launches Stock Trading for All U.S. Users With 8,000+ Stocks and ETFs Available

TLDR:

-

- Coinbase has fully launched stock trading for all U.S. users, following a limited rollout in December 2025.

- Over 8,000 stocks and ETFs are now available with 24/5 commission-free trading in USD or USDC stablecoins.

- Fractional share trading is supported, allowing U.S. investors to start buying stocks with as little as $1.

- Coinbase partnered with Yahoo Finance, adding trade buttons to asset pages for 150 million monthly visitors.

- Coinbase has fully launched stock trading for all U.S. users, following a limited rollout in December 2025.

Coinbase has fully rolled out stock trading to all U.S. users, following a limited launch in December 2025. The crypto exchange now offers access to over 8,000 stocks and ETFs through its platform.

Trading runs commission-free, 24 hours a day, five days a week. Users can conduct transactions in either USD or the USDC stablecoin. Fractional share trading is also supported, allowing investors to start with as little as $1.

Coinbase Brings Full Stock Trading Access to U.S. Users

Coinbase first introduced stock trading during its “System Update” product showcase in December 2025. At that time, only hundreds of stocks were available to a limited group of users.

With the full release, thousands of assets are now accessible to all eligible U.S. customers. The expansion marks a major step in the platform’s push beyond cryptocurrency trading.

The 24/5 commission-free trading model gives users consistent access throughout the trading week. Supporting both USD and USDC as funding options adds flexibility for crypto-native users.

Fractional shares make the platform more accessible to newer or smaller investors. Together, these features position Coinbase as a direct competitor to fintech platforms like Robinhood.

Users can fund their trades using the USDC stablecoin, which is a feature unique to Coinbase’s offering. This bridges the gap between traditional equities and digital asset investing.

It also reflects Coinbase’s broader strategy of integrating crypto and traditional finance in one place. The platform describes its long-term vision as becoming an “everything exchange.”

Looking further ahead, Coinbase plans to offer tokenized stocks, with details expected in the coming months. The company also intends to expand its stock perpetual products this spring through Coinbase Bermuda Ltd.

That move would give international traders 24/7 exposure to U.S. equities, subject to regulatory approval. Those products will not be available to U.S. persons.

Yahoo Finance Partnership Supports Broader Market Reach

Alongside the full rollout, Coinbase announced a partnership with Yahoo Finance to expand its audience. Yahoo Finance will add a “Trade [asset] on Coinbase” button to stock and crypto asset pages.

The site draws more than 150 million global monthly visitors each month. This gives Coinbase a direct channel to a large base of retail investors.

Yahoo Finance users will receive a one-month free trial of a Coinbase One Basic membership. The membership covers zero trading fees and USDC rewards for new users.

George Leimer, general manager at Yahoo Finance, noted the partnership targets everyday investors. He pointed to a growing trend of investors exploring digital assets alongside traditional securities.

The Yahoo Finance integration is currently focused on the U.S. market at launch. Coinbase has said it plans to expand its equities trading products internationally in the coming months.

A dedicated crypto hub through Yahoo Finance is also in development. That hub will feature news, data, and analysis from more than a dozen publishers.

Separately, Coinbase has partnered with Apex Fintech Solutions to handle clearing, custody, and execution services for its equities offering.

Crypto World

Canton’s Industry Working Group Advances Cross-Border Collateral Mobility With Tokenised Gilts

TLDR:

- Canton’s working group completed its fourth transaction round, introducing tokenised Gilts as repo collateral for the first time.

- The round featured the first cross-currency intraday repo using tokenised Gilts against non-GBP tokenised deposits on Canton.

- Archax joined as a new participant, using its tokenisation engine to create regulated digital representations of traditional Gilts.

- The working group plans to expand cross-border collateral mobility across European and global markets throughout all of 2026.

Canton’s industry working group has taken another step forward in advancing cross-border collateral mobility on Canton.

Digital Asset, alongside a consortium of leading financial institutions, completed a fourth set of transactions on the Canton Network on February 24, 2026.

The latest round builds on prior milestones by introducing tokenised Gilts and cross-currency repo activity. Together, these achievements move the industry closer to a scalable, always-on capital markets infrastructure that operates across borders and asset classes.

Working Group Builds on Previous Transaction Rounds

The industry working group has steadily expanded its scope across each successive round of transactions. Following the third set completed in December 2025, which covered multiple asset classes and currencies using tokenised deposits, this fourth round introduced new instruments and cross-currency structures. Each iteration has added complexity while maintaining institutional-grade standards across the board.

This latest round featured the first cross-border intraday repo transaction conducted using tokenised Gilts. It also marked the first cross-currency intraday repo using tokenised Gilts against non-GBP tokenised deposits.

These additions reflect the group’s commitment to broadening the range of assets that can move seamlessly across borders within the Canton ecosystem.

@digitalasset, in collaboration with @CantonNetwork participants, announced the completion of a fourth set of transactions showcasing continued momentum in cross-border intraday repurchase activity.

The group’s approach is methodical, advancing one transaction type at a time while ensuring each new layer meets real market requirements. This measured progression is what gives the working group its credibility across participating institutions.

Expanded Membership Strengthens the Consortium’s Reach

A key feature of this transaction round was the growth in active participation across the working group. Archax, a regulated digital asset exchange, broker, and custodian, joined as a new participant.

Existing members including LSEG, Euroclear, Citadel Securities, TreasurySpring, and IntellectEU also deepened their roles in this round.

Archax supported the transaction by leveraging its broker and custody permissions to hold traditional Gilts on behalf of clients.

It then used its tokenisation engine to create regulated digital representations of those assets. Graham Rodford, CEO and co-founder of Archax, described this function as central to the firm’s broader vision and participation strategy.

The growing membership across custodians, trading venues, clearinghouses, and technology providers adds structural depth to the working group. Participants now span the full transaction lifecycle, from execution to settlement and custody.

This breadth makes the group well-positioned to address production-scale challenges as the initiative moves beyond the pilot stage.

Cross-Border Collateral Mobility Takes Shape Across Currencies

The working group’s focus on cross-border collateral mobility is becoming more concrete with each round. TreasurySpring validated cross-currency intraday repo and reverse repo against UK Gilts, with haircuts and repo interest embedded directly into smart contracts.

Co-Founder Matthew Longhurst stated these transactions reflect real economic and risk terms across an institutional governance framework.

Euroclear UK & International played a central role as the UK’s central securities depository in tokenising Gilts for the transaction.

CEO Chris Elms noted that enabling real-time, cross-border collateral mobility helps unlock new liquidity sources for clients. EUI’s involvement brings regulated post-trade infrastructure directly into the Canton framework.

LSEG’s DiSH network served as the cash leg for the transactions, enabling instantaneous beneficial ownership transfer of commercial bank money across multiple currencies and jurisdictions.

Bud Novin, Head of Payment Systems at LSEG, confirmed that DiSH Cash supported the first tokenised intraday Gilt repo on Canton Network.

He added that LSEG DiSH is positioned as a trusted third-party solution for mobilising networks in tokenised markets.

Industry Players Align Around Scalable On-Chain Market Infrastructure

Beyond the transactions themselves, participants are increasingly focused on what comes next for the working group.

IntellectEU’s Anastasiia Vitmer pointed to how quickly the scope is expanding across assets, infrastructure, and active participants.

Her firm’s Catalyst Suite is being built to support any institutional use case on Canton Network as on-chain markets continue to mature.

DTCC’s Brian Steele reinforced that collaboration across the industry is essential to setting standards and accelerating digital asset adoption.

He added that this cross-border intraday repo use case confirms growing demand for seamless, scalable financial infrastructure. DTCC’s role reflects how traditional market infrastructure providers are engaging directly with on-chain models.

Digital Asset’s Kelly Mathieson stated that greater asset diversity and broader participation are paving the way for more efficient and liquid capital markets.

The working group plans to continue groundbreaking on-chain financing initiatives throughout 2026, with European markets and other key regions in focus.

Cumberland DRW’s Chris Zuehlke added that Canton continues to show how tokenisation can unlock real efficiency gains across an increasingly diverse set of assets and currencies.

-

Video5 days ago

Video5 days agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread: Boden – Corporette.com

-

Politics3 days ago

Politics3 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Entertainment7 days ago

Entertainment7 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Sports2 days ago

Sports2 days agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Politics2 days ago

Politics2 days agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Tech7 days ago

Tech7 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports6 days ago

Sports6 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Business3 days ago

Business3 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Crypto World24 hours ago

Crypto World24 hours agoXRP price enters “dead zone” as Binance leverage hits lows

-

Business3 days ago

Business3 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

Entertainment6 days ago

Entertainment6 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business7 days ago

Business7 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Tech3 days ago

Tech3 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat2 days ago

NewsBeat2 days ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

NewsBeat3 days ago

NewsBeat3 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Politics3 days ago

Politics3 days agoMaine has a long track record of electing moderates. Enter Graham Platner.

-

Crypto World7 days ago

Crypto World7 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Tech14 hours ago

Tech14 hours agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

NewsBeat9 hours ago

NewsBeat9 hours agoPolice latest as search for missing woman enters day nine