Crypto World

The Autonomous Agent Redefining Artificial Intelligence

Innovation is the key differentiator in the rapidly evolving landscape of artificial intelligence (AI). While tech giants like OpenAI, Google, and Anthropic often dominate the headlines, a Chinese startup has quietly emerged, poised to reshape the global AI arena: Manus AI, developed by Butterfly Effect. Touted by many as “the world’s first truly autonomous AI agent,” Manus represents a significant leap forward in the quest for artificial general intelligence (AGI). But what sets Manus apart from its competitors, and how does it challenge established leaders? In this article, we delve into Manus’s capabilities, architecture, and potential impact on the future of AI worldwide.

What Is Manus AI?

Derived from the Latin word for “hand,” Manus is an AI generalist agent capable of transforming abstract thoughts into concrete actions. Unlike conventional chatbots or AI assistants that require continuous human prompting and supervision, Manus operates independently—initiating tasks, navigating the web, gathering information, and managing complex workflows with little to no human input.

A defining characteristic of Manus is its ability to adapt its response strategies in real time. This is not merely a predictive model that outputs pre-programmed answers; instead, it is an intelligent system equipped with strategic autonomy, able to dynamically adjust its approach based on live information collected from the digital environment.

How Manus Works: Multi-Agent Architecture and Asynchronous Operation

Manus’ standout feature lies in its multi-agent architecture. Rather than relying on a single monolithic neural network, as seen in most mainstream AI models, Manus intelligently breaks tasks into smaller components and assigns them to specialised sub-agents. Each sub-agent is fine-tuned to execute specific parts of the workflow, ensuring enhanced efficiency and precision. This occurs seamlessly within a unified system, relieving users of the need to integrate multiple AI tools manually.

Equally important is its cloud-based asynchronous operation. Unlike typical AI assistants that require continuous engagement and prompt-response cycles, Manus functions quietly in the background. It autonomously carries out tasks and alerts users only when results are ready. This workflow is designed to streamline productivity, allowing users to delegate responsibilities with confidence that Manus will independently handle the process from start to finish without the need for intervention.

Real-World Use Cases: Manus in Action

Manus’ official demonstrations illustrate its wide-ranging applications and how it surpasses existing agents. Some of the standout examples include:

- Advanced Data Analysis: Manus can perform in-depth evaluations of stock performance, such as providing visual dashboards for companies like Tesla. It also conducts market research and comparative analyses, such as assessing insurance products.

- Personalised Education: It can create tailored presentations and educational content, adjusting the material based on the learner’s profile and objectives.

- Travel Planning: Manus analyses weather, safety data, rental prices, and user preferences to craft detailed, fully personalised travel itineraries and guides.

- E-commerce Optimisation: For online retailers, Manus processes sales data from platforms like Amazon and proposes strategies to enhance commercial performance.

These real-world examples illustrate how Manus is not merely reactive—it is proactive. It conducts research, organises information, and delivers ready-to-implement solutions with minimal human guidance, ensuring maximum efficiency.

Manus vs OpenAI and DeepSeek: The General AI Race

The most striking claim made by Manus’ developers is that it outperforms OpenAI’s Deep Research model in the GAIA Benchmark—a widely respected metric for evaluating generalist AI agents. Surpassing such a powerful model signals Manus’s capacity to disrupt the status quo.

Historically, models like Deep Research and OpenAI’s GPT-4 have been considered the gold standard in advanced reasoning and autonomy. Yet, Manus’s greater efficiency, lower operational costs, and modular architecture make it a desirable alternative, particularly in industries that demand complex, customised workflows.

Moreover, Chinese models such as DeepSeek-R1 have already proven their capability to deliver advanced reasoning at a fraction of the cost compared to their Western counterparts. Manus’s emergence further accelerates this shift towards more affordable, robust, and scalable AI solutions—escalating the competition in the global AI landscape significantly.

Geopolitical Context and Manus’ Controversies

Unsurprisingly, Manus’s rapid ascent has not been free of scrutiny. Various experts and analysts from the United States have voiced scepticism, questioning the opacity surrounding the project’s funding, access restrictions, and the underlying technology. Some critics have gone so far as to allege that the Butterfly Effect may have leveraged knowledge derived from OpenAI’s models to train its agent.

This unfolds against the intensifying technological rivalry between China and the United States. Both nations have enacted stringent restrictions on exchanging critical technologies such as semiconductors and AI software. Manus, representing a significant breakthrough in autonomous AI capabilities, has only heightened this ongoing competition.

Manus AI: Pioneering the Next Frontier in Autonomous Intelligence

Setting aside geopolitical tensions, Manus epitomises a broader trend in artificial intelligence development: the move towards agents capable not only of interpreting human input but also of autonomously executing actions. The vision of an internet where machines generate, distribute, and consume content—independent of human intervention—is fast becoming a reality.

The practical implications are vast for businesses and organisations. Manus’ capacity to autonomously manage tasks allows companies to offload routine, time-consuming processes, freeing up human resources for strategic decision-making. Whether streamlining administrative duties, performing data-driven market analyses, or even managing supply chains, Manus’ modular, autonomous framework offers unprecedented scalability and flexibility.

Manus AI is not merely another AI assistant; it is a fully autonomous agent embodying the future trajectory of artificial intelligence. Its multi-agent architecture, asynchronous operation, and ability to adapt in real time position it as a formidable contender in the quest for AGI.

While concerns surrounding transparency and geopolitical impact persist, Manus represents a pivotal advancement in AI development. As the industry continues to evolve rapidly, Manus serves as a clear indicator that the era of autonomous, proactive AI agents is no longer a distant vision—it is already here, actively reshaping how we interact with technology at every level of society and business.

Crypto World

Kraken Secures Federal Reserve Master Account: WSJ

Kraken Financial has gained direct access to US Federal Reserve’s payment systems via a Kansas City Fed approval, though without full banking privileges such as interest on reserves.

US cryptocurrency exchange Kraken has become the first company to secure a master account from the US Federal Reserve, The Wall Street Journal reported Wednesday.

Kraken Financial, the exchange’s banking unit, has gained access to the Fed’s key payment systems, allowing the platform to move money on the same rails used by banks and credit unions, according to The WSJ.

The Federal Reserve Bank of Kansas City, which oversaw its application, and Kraken, trading as Payward, are expected to announce the approval Wednesday.

The news marks a significant milestone for the crypto industry in the US, though the approval does not provide the full range of services available to banks, including payment of interest on reserves held at the central bank.

Several crypto companies in the US have been pursuing a master account with the Fed for years, with Caitlin Long’s Custodia Bank doubling down on efforts to obtain one through a court petition in late 2025.

A “historic shift” for the US crypto industry

The decision marks a “historic shift” for the crypto industry in the US, journalist Eleanor Terrett wrote in an X post, highlighting that it signals a softer tone at the Fed, which critics had previously described as hostile to crypto under the prior administration.

“The decision also impliedly recognizes that the Fed believes Kraken has sufficient anti-money laundering and sanctions compliance practices to curb illicit finance risk, and that Wyoming’s regulatory framework for special purpose depository institutions is in line with Federal banking standards,” Terrett said.

Kraken did not immediately respond to Cointelegraph’s request for comment.

Magazine: Clarity Act risks repeat of Europe’s mistakes, crypto lawyer warns

Crypto World

Donald Trump Blasts Banks, Urges CLARITY Act Passage

Ripple CEO Brad Garlinghouse backed President Trump’s remarks, saying they were aligned with public interest.

U.S. President Donald Trump has accused the traditional banking lobby of undermining the GENIUS Act and holding the CLARITY Act “hostage” to protect their profits, injecting himself directly into the legislative battle over stablecoin yields.

The intervention marks a significant escalation in the fight over whether crypto platforms can offer interest-like rewards on stablecoins, a practice banks argue will trigger a mass exodus from traditional deposit accounts.

Trump Fires Back at Banks Over Stablecoin Standoff

In a post on Truth Social, Trump framed the dispute as an existential threat to American innovation.

“The Genius Act is being threatened and undermined by the Banks, and that is unacceptable — We are not going to allow it,” he wrote. “The U.S. needs to get Market Structure done, ASAP. Americans should earn more money on their money.”

The GENIUS Act, signed into law in July 2025, created the first federal framework for stablecoins but barred issuers from paying interest directly to holders. It left a critical question unanswered: whether third-party platforms like Coinbase could pass yield on to customers.

Banks have since lobbied aggressively to close this “loophole” in the CLARITY Act, the broader market structure bill that would establish clear jurisdiction for digital assets.

Their stance led to disagreement with some players in the crypto industry, which reached a boiling point in January when Coinbase CEO Brian Armstrong withdrew support for the bill ahead of a scheduled Senate markup, citing proposed amendments that would ban passive yield on stablecoins.

The White House set a deadline of March 1 for stakeholders to resolve their differences, yet no public compromise had emerged by that date.

You may also like:

“The Banks should not be trying to undercut The Genius Act or hold The Clarity Act hostage,” Trump posted. “They need to make a good deal with the Crypto Industry because that’s what’s in best interest of the American People.”

Earlier in the year, Geoff Kendrick, global head of crypto research at Standard Chartered, warned that stablecoins could pull as much as $500 billion in deposits from banks by 2028, with U.S. regional lenders most exposed.

Industry Cheers While Banks Face a Cartel Accusation

Trump’s remarks drew immediate praise from crypto leaders, with Ripple CEO Brad Garlinghouse calling it “an extremely pointed message… about what’s in the best interest of the American people.”

Senator Cynthia Lummis echoed the urgency, urging Congress to move quickly to pass the act. Meanwhile, Eric Trump, the president’s son and a World Liberty Financial co-founder, accused big banks of “mass panic” over losing the “digital finance race.”

However, some, like Charles Hoskinson, have slammed the legislation, with the Cardano founder describing it as a “horrific, trash bill,” and warning that its “security by default” framework would trap new projects under SEC jurisdiction and “destroy all future American cryptocurrency projects.”

He argued that while legacy tokens like Cardano might be grandfathered in, future innovation would be forced overseas. This puts him at odds with Garlinghouse, who has argued that “clarity beats chaos” and that the industry cannot let “perfection be the enemy of progress.”

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Bitcoin (BTC) price hits $71,800 as investors rotate into havens during Middle East escalation

Bitcoin rallied to a one-month high of $71,800, effectively dismissing the risk-off sentiment that has restricted upside in U.S. equities over the past week.

The largest cryptocurrency stalled just below $72,000, a level it last reached on Feb. 8 before sliding back to $65,000.

Precious metals also rallied on Wednesday, with gold and silver up 1.8% and 5.3%, respectively, since midnight UTC. Bitcoin is up by 4.8% over the same period.

The move to haven assets comes as war continues to rage in the Middle East, with Israel saying it hit several security headquarters across Iran while Iran attacked U.S. sites in Dubai and Qatar.

Equities are little changed since midnight, lagging the broader crypto market.

Derivatives positioning

- Over the past 24 hours, global crypto futures open interest (OI) has increased by 8% to nearly $103 billion. Trading volume also rose, albeit by less than OI, indicating renewed interest in holding positions rather than trading in and out. That adds credibility to the price bounce.

- Open interest in futures tied to the top 10 tokens rose. DOGE led with a 10% increase.

- Perpetual funding rates and cumulative volume delta for most major cryptocurrencies, including bitcoin and ether, are positive, a sign of buying pressure building up in another hint of a continued price recovery.

- Bitcoin and ether’s (ETH) 30-day implied volatility indexes remain steady at levels seen before the start of the Middle East conflict, a sign there is no panic in the market.

- On Deribit, BTC and ETH puts still trade notably pricier than calls in a sign of lingering downside fears.

- The $125,000 strike call expiring end-March, a bet that prices will surge beyond that level in four weeks, is the most traded option of the past 24 hours. Deribit said that the bulk of the activity represents the closing of existing short positions rather than fresh purchases (bullish bets).

- Block flows featured demand for bitcoin call spreads and call ratio spreads, a sign of moderate bullish sentiment. In ETH’s case, traders chased both call and put spreads.

Token talk

- The altcoin market is beginning to show signs of strength after almost a month of consolidation. Ether (ETH) rose by 5% since midnight UTC, with daily trading volume remaining consistent at $25 billion.

- But it was the lower-liquidity, lower-market-cap tokens that outperformed the majors; KITE, AERO, and TAO all increased by double digits in the past 24 hours, while the likes of PUMP and DCR have rallied by around 6% since midnight UTC.

- The crypto Fear and Greed index has risen from multi-year lows of 5/100 in February to 19/100, suggesting a measure of optimism is entering the broader crypto market.

- The CoinDesk Computing Select Index (CPUS) was the best-performing benchmark over the past 24 hours, rising by 7% while the BTC-weighted CoinDesk 20 (CD20) increased by around 5% over the same period.

Crypto World

Self-Custodial Lightning for Mobile Payments

Lightning has promised fast, cheap Bitcoin payments for years. But for most people, using it still means choosing between an easy custodial wallet or a self-custodial setup that requires extra work – managing channels, getting inbound liquidity, and staying online so payments don’t fail.

Cake Wallet says its latest release is built to remove that friction. In the newest update, the wallet is rolling out self-custodial Lightning support designed for everyday use, so people can send and receive near-instant payments on mobile without having to run Lightning like a hobby and without giving up control of funds. Users can also move BTC back on-chain at any time.

A Lightning UX for the people

At the center of the launch is an integration powered by the Breez SDK and Spark. Cake’s announcement positions this as the missing bridge between non-custodial in principle and usable in practice, removing the need for users to manage channels, inbound capacity, liquidity, or continuous uptime monitoring.

In a short statement, Cake Labs CEO Vikrant Sharma has described the point of the release as refusing to force users into “a choice between convenience and sovereignty.”

Spark’s role is also worth unpacking. It’s a Bitcoin-native layer-2 built for payments and settlement, designed to let developers build natively on Bitcoin while remaining compatible with Lightning. In other words, the infrastructure is being engineered so wallet teams can offer a smoother Lightning experience without pushing users into a purely custodial model.

Privacy-First

Cake is also leaning into a privacy-first framing. In its release, the company says users can receive over Lightning without revealing a Spark address, and that Spark transactions are not published to Spark block explorers by default, reducing unnecessary exposure of activity.

The company has been moving toward a privacy-by-default approach on Bitcoin for some time, adding tools like Silent Payments and PayJoin v2 to make on-chain activity harder to trace and group together.

Human-Readable Lightning Addresses and Spending Options Inside the App

Lightning can be fast and cheap, but it still struggles with day-to-day UX details, like having to generate a new invoice and paste it into a chat for every payment.

Cake Wallet is trying to remove that step by introducing custom Lightning addresses, allowing users to receive via an @cake.cash username instead of sharing invoices or complex payment strings. Cake says the address can be created immediately, with no minimum balance requirement.

The update also brings Lightning directly into Cake Pay, the company’s prepaid debit card and gift card service. In Cake’s documentation, Cake Pay is explained as a way to buy gift cards or add a debit card to Apple Pay or Google Pay, designed to make crypto spending more practical without turning the experience into a data trail.

All Your Bitcoin, Lightning, and Storage in One App

Many Bitcoin users still use one app for everyday payments and another for long-term storage.

Cake Wallet says this update brings those workflows into one place: on-chain Bitcoin, Lightning, privacy tools, and hardware wallet support. Users can move funds between cold storage, on-chain, and Lightning inside the app, without switching tools or manually copying addresses.

With additions like human-readable Lightning addresses and Lightning-enabled Cake Pay for gift cards and prepaid debit cards, the update is clearly pushing toward everyday usability. If it delivers on reliability in real-world conditions, it finally makes Lightning a practical payment layer you can keep on your phone.

Crypto World

Ex-OpenAI Researcher Hedge Fund Bets Big on BTC Miners in SEC Filing

Leopold Aschenbrenner, a former OpenAI researcher who departed the lab’s superalignment cadre to launch the San Francisco‑based hedge fund Situational Awareness LP, has steered his portfolio toward the AI compute backbone. The latest 13F filing for Q4 2025 reveals a dramatic scale‑up: the fund reports about $5.52 billion in US equity exposures across 29 positions, up from a few hundred million dollars at the start of 2025. Rather than chasing consumer AI software, the strategy bets on the infrastructure that powers the AI boom—power plants, data centers, and the hardware that underpins high‑end computation. The concentration is clear: a small cadre of AI infrastructure names and energy plays that the fund believes will capture the surge in demand for AI workloads.

Key takeaways

- The Q4 2025 13F shows Situational Awareness with roughly $5.52 billion in US equity holdings across 29 positions, signaling a deliberate tilt toward AI infrastructure and energy‑intensive compute.

- Top holdings include CoreWeave, Bloom Energy, Intel, Lumentum, and Core Scientific, reflecting a strategy anchored in data center capacity and related hardware ecosystems.

- The amended Schedule 13D reveals a 9.4% stake in Core Scientific, amounting to 28,756,478 shares with shared voting and disposition power, indicating a levered view on the company’s expansion into AI hosting and HPC environments.

- Beyond pure mining, the fund has increased exposure to Bitcoin miners and energy players such as IREN, Cipher Mining, Riot Platforms, Bitdeer, and Applied Digital, signaling a broader bets on AI compute throughput via specialized energy infrastructure.

- Aschenbrenner’s strategy also includes a noted short in Infosys, reflecting a view that large‑language model adoption and AI coding tools could pressure traditional outsourcing software services models.

Tickers mentioned: $BTC

Market context: The shift underscores a growing convergence between crypto mining and AI compute ecosystems, where megawatt‑dense sites and long‑term data‑center arrangements are increasingly treated as scarce, high‑value assets in the new compute economy.

Sentiment: Neutral

Price impact: Neutral. The moves reflect strategic positioning in a sector undergoing structural changes rather than immediate price catalysts.

Trading idea (Not Financial Advice): Hold. The cross‑section of AI infrastructure and mining assets suggests exposure to broader compute demand, but the concentration in a handful of names warrants careful risk management.

Market context: The AI compute narrative is evolving from a focus on chip supply and software models to ownership of the physical and energy assets that enable massive data‑center deployments. The post‑halving environment has encouraged miners to pivot toward hosting AI workloads, recasting megawatts and data‑center capacity as strategic assets rather than mere hash rate capacity.

Why it matters

The portfolio strategy signals a shift in how investors view AI reverberations across sectors. By placing heavy bets on AI infrastructure players like CoreWeave and Bloom Energy, the fund aligns with the premise that the next era of AI growth will be defined by the reliability and scalability of compute foundations. CoreWeave, a major AI cloud firm, has pursued long‑term HPC hosting contracts, reinforcing the idea that enterprise‑grade compute capacity will anchor AI deployment for years to come. That dynamic is echoed in the fund’s positioning around Core Scientific and other miners‑turned‑infrastructure operators, highlighting a broader trend where mining assets are repurposed as high‑density compute farms capable of supporting AI workloads.

Moreover, the mix of energy‑oriented firms with traditional chip and optics players points to a convergence of energy efficiency, power reliability, and advanced hardware as the bedrock of AI scalability. The emphasis on Bloom Energy and similar energy infrastructure names acknowledges that the economics of AI compute increasingly hinge on dependable, low‑cost power and resilient facilities. In this context, the bitcoin ecosystem—often used as a proxy for large‑scale, independent energy demand—appears intertwined with broader infrastructure plays, rather than living in its own isolated corner of markets. Bitcoin (CRYPTO: BTC) remains a barometer for how much compute demand miners can leverage, particularly as large data centers seek to optimize energy intensity and uptime amid rising competition for grid capacity.

The presence of a substantial Core Scientific stake via an amended Schedule 13D demonstrates the degree to which the fund leverages governance and ownership rights to influence a company’s expansion into AI hosting and HPC. This move aligns with a broader industry pattern where miners diversify beyond hashing to become multipurpose data‑center operators that can monetize surplus capacity across AI workloads, rendering traditional hash rate metrics less decisive in evaluating value creation.

Finally, the Infosys short reflects an acceleration of AI coding tools and large‑language models that, in the hedge fund’s view, could erode the traditional outsourcing model long relied upon by software services giants. If AI tools increasingly curtail demand for routine outsourcing tasks, equities tied to that segment may face new headwinds, even as AI infrastructure assets benefit from expanding compute demand. The net effect is a nuanced stance: bets that the core compute economy—powered by energy, data centers, and HPC—will drive durable value, tempered by selective shorts on areas perceived as vulnerable to AI displacement.

What to watch next

- Next 13F filing cycles (early 2026) to reveal whether the $5.5B positioning is sustained or expanded across additional AI infrastructure names.

- Any new or amended Schedule 13D/13G disclosures around Core Scientific or other holdings, signaling shifts in control or strategy.

- Updates on long‑term HPC contracts and data‑center expansions tied to CoreWeave and similar operators, which would validate the thesis of AI hosting as a growth engine.

- Further moves in mining‑to‑infrastructure transitions, including additional energy‑asset investments from the broader field, and how such moves interact with regulatory and grid‑capacity constraints.

- Regulatory or policy developments affecting large‑scale AI compute deployments and crypto mining operations, which could influence capital flows into AI infrastructure equities.

Sources & verification

- Situational Awareness 13F Filing, Q4 2025 — 13f.info

- Amended Schedule 13D for Core Scientific — filing PDF

- Fortune profile on Leopold Aschenbrenner and the fund’s size — fortune.com

- Hut 8 research/coverage on AI data center pivot and compute revenue — cointelegraph.com

- CoreWeave and AI data center partnerships — cointelegraph.com

Market reaction and key details

Situational Awareness has built a narrative around a recalibration of AI investment risk, moving from a focus on peak‑AI software potential to the tangible, capital‑intensive backbone that makes AI feasible at scale. The 13F results highlight how a single fund can tilt an entire sub‑sector toward a handful of strategic names, elevating the importance of long‑term contracts, energy reliability, and data‑center capacity in determining which players benefit most from the AI era. While the broader market continues to wrestle with volatility and regulatory questions, the fund’s emphasis on compute infrastructure—paired with a measured portfolio tilt toward miners pivoting to AI hosting—illustrates a disciplined approach to navigating the evolving landscape of AI, crypto, and high‑performance computing.

What to watch next

Crypto World

First Crypto Firm with Direct Fed Access

Crypto exchange Kraken has become the first digital asset company to secure access to the Federal Reserve’s core payments infrastructure.

This marks a watershed moment in the integration of crypto into the U.S. financial system, even as the exchange eyes a public listing.

Kraken Becomes First Crypto Firm to Win Access to Fed’s Core Payments System

According to a report by The Wall Street Journal, Kraken’s Wyoming-chartered banking arm, Kraken Financial, has been granted a so-called “master account” at the Federal Reserve.

The approval gives the firm direct access to the same payment rails used by thousands of U.S. banks and credit unions to move money across the financial system.

The move allows Kraken Financial to settle U.S. dollar transactions directly through the Fed’s infrastructure, rather than relying on intermediary banks.

Notably, the firm will not receive the full suite of services traditional banks enjoy, such as earning interest on reserves held at the central bank.

Still, the approval represents a significant breakthrough for an industry that has long struggled to access core banking plumbing.

“This is a watershed milestone in the history of digital assets,” WSJ reported, citing Senator Cynthia Lummis, a vocal advocate for crypto innovation.

From Wyoming Bank Charter to Fed Master Account: Kraken’s Long March Toward Wall Street Legitimacy

The development builds on groundwork laid in 2020, when Kraken became the first digital asset company in U.S. history to receive a bank charter recognized under federal and state law.

The firm obtained a Special Purpose Depository Institution (SPDI) charter from Wyoming. This enabled it to offer regulated deposit-taking, custody, and fiduciary services tailored to blockchain companies.

“Our vision is to become the world’s trusted bridge between the crypto economy of the future and today’s existing financial ecosystem,” Kraken said at the time.

Access to a Fed master account significantly advances that vision.

Direct settlement capability could allow Kraken to handle transactions more quickly and seamlessly for institutional clients and professional traders. This reduces counterparty risk and operational friction.

The approval also lands at a politically favorable moment. Under President Donald Trump, who has pledged to make the U.S. the “crypto capital of the world,” regulatory attitudes toward digital assets have shifted markedly compared to prior years.

Now, there are more industry-friendly appointments and legislative momentum around crypto frameworks.

What It Means for Kraken’s Prospective IPO

Strategically, the milestone could strengthen Kraken’s positioning ahead of a widely anticipated initial public offering.

The exchange has been expanding aggressively, completing six acquisitions in roughly a year. The company is reportedly targeting a $500 million raise at a valuation of around $15 billion.

Direct access to the Fed’s payments system enhances Kraken’s institutional credibility at a pivotal time.

For prospective IPO investors, the combination of a bank charter, expanding product suite, and now direct integration with U.S. monetary infrastructure may make the exchange’s public debut more compelling.

Still, questions remain over whether quick acquisition-driven growth translates into durable revenue momentum.

Notwithstanding, with Fed access secured, Kraken has undeniably crossed a line that crypto firms have spent years trying to reach. It has brought digital assets one step closer to the heart of the U.S. financial system.

Crypto World

Bitcoin price climbs above $71k as Middle East tensions fail to trigger fresh sell-off

Bitcoin price pushed back above $71,000 on Wednesday, defying geopolitical jitters tied to escalating Middle East tensions and a spike in global oil prices, as on-chain data suggests selling pressure may be drying up.

Summary

- Bitcoin rose above $71,000, gaining over 5% and challenging the upper end of its recent consolidation range.

- Exchange inflows dropped to 28,235 BTC, a level historically linked to reduced selling pressure and potential accumulation phases.

- Technical indicators such as Balance of Power turning positive suggest short-term buyer momentum is strengthening.

Bitcoin seller exhaustion? Exchange flows fall to near-cycle lows

According to analysis from CryptoQuant, the recent military intervention in Iran sent shockwaves through energy markets, with WTI crude jumping above $75 and Brent topping $82 after successive 6% gains. While the broader macro backdrop remains fragile and the bear market structure technically intact, Bitcoin has shown notable relative strength.

At the time of the CryptoQuant assessment, Bitcoin (BTC) was trading near $68,637 and approaching what analysts describe as an accumulation zone. A key metric backing that thesis is Exchange Inflow, the amount of BTC transferred to exchanges, often a precursor to selling.

Historically, readings below 40,000 BTC have coincided with weak selling pressure and market bottoms, while levels above 90,000 BTC have marked cycle tops.

On March 3, 2026, exchange inflows registered just 28,235 BTC, dramatically lower than prior cycle highs that ranged between 97,587 BTC and 134,619 BTC. The subdued inflow suggests sellers may be exhausted, even as global instability persists.

Bitcoin price action and key levels

Based on the attached daily chart, Bitcoin is currently trading around $71,795 after posting a strong green daily candle, up more than 5%. The move follows a sharp correction from late January highs near $95,000, with price finding a local bottom in early February around the $63,000–$65,000 region.

Since that capitulation-style drop, Bitcoin has been consolidating in a broad range between roughly $65,000 support and $72,000 resistance. The recent breakout attempt above $71,000 puts price back near the upper boundary of this consolidation band.

Immediate resistance now sits around $72,000–$73,000, followed by the heavier supply zone near $78,000–$80,000, where prior breakdown momentum accelerated. On the downside, first support lies at $68,000, with stronger structural support near $65,000.

A loss of that level would reopen the path toward the February low near $63,000.

Volume has picked up modestly on the recent rebound, though it remains below the spike seen during the early February sell-off.

Meanwhile, the Balance of Power indicator has turned positive, currently reading around 0.77, signaling buyers are gaining short-term control after weeks of sideways churn.

While the broader macro picture remains uncertain, Bitcoin’s ability to rally through geopolitical stress, combined with low exchange inflows, suggests the market may be transitioning from distribution to early-stage accumulation.

A decisive daily close above the $72,000–$73,000 zone would strengthen the case for a broader recovery attempt.

Crypto World

FATF Highlights Risks in Stablecoin P2P Transfers via Self-Custody Wallets

Peer-to-peer transfers made through self-custody crypto wallets are a key weak point in the stablecoin ecosystem because they can take place without a regulated intermediary, the Financial Action Task Force (FATF) said in a new report urging countries to tighten oversight as stablecoins spread into payments and cross-border transfers.

In its targeted report on stablecoins, unhosted wallets and P2P transactions, the global anti-money laundering watchdog said transactions conducted directly between users through unhosted wallets can occur without regulated intermediaries such as exchanges or custodians.

The FATF said this structure can create gaps in Anti-Money Laundering (AML) oversight because the transactions occur outside entities required to monitor activity and report suspicious transfers. The report highlighted growing regulatory attention on stablecoins as their use expands across trading, payments and cross-border transfers.

The watchdog called on jurisdictions to assess the risks created by stablecoin arrangements and apply “proportionate” mitigation measures, which can include enhanced monitoring when self-custody wallets interact with regulated platforms and clearer AML and counterterrorism financing obligations for entities involved in issuing and distributing stablecoins.

P2P stablecoin transfers seen as regulatory blind spot

The FATF said P2P transfers via self-custody wallets represent a “key vulnerability” because they can bypass AML controls typically enforced by regulated intermediaries.

These transfers occur directly between users without the involvement of virtual asset service providers (VASPs) or financial institutions subject to compliance obligations, potentially limiting authorities’ ability to detect suspicious activity.

Related: Stablecoins, sanctions and surveillance: Why 2025 reshaped crypto’s regulatory reality

The FATF noted that transactions on public blockchains remain traceable because activity is recorded on-chain. However, the pseudonymous nature of wallet addresses can make attribution more difficult.

Related: France arrests six suspects over crypto ransom kidnapping of magistrate

Illicit activity accounts for only 1% of the total crypto transaction volume

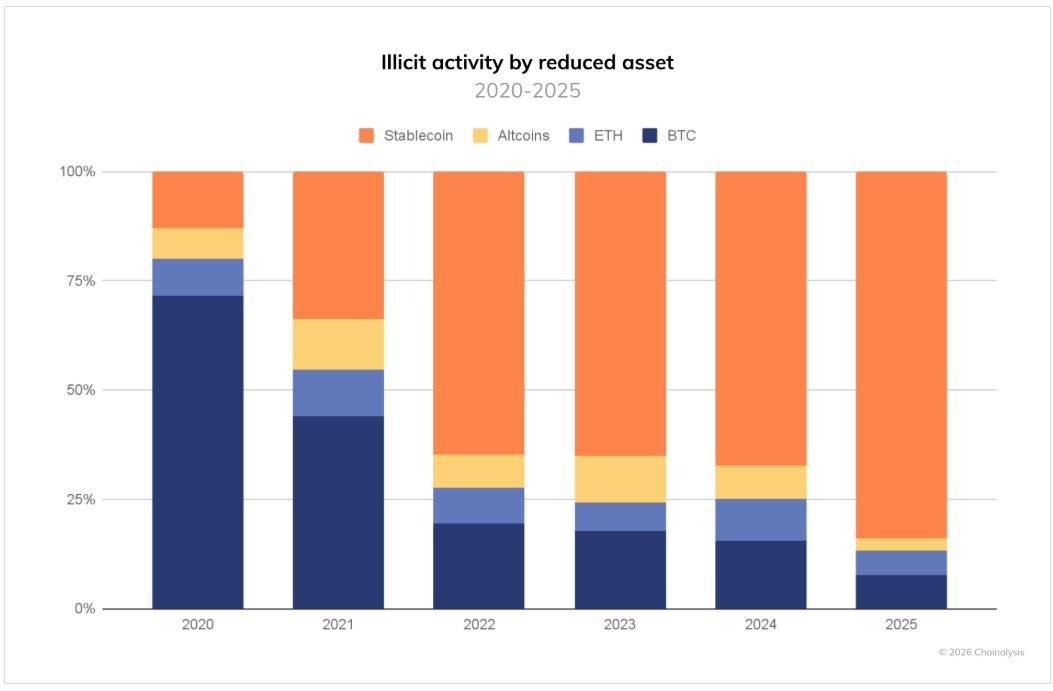

On Jan. 9, blockchain analytics firm Chainalysis found that illicit crypto addresses received at least $154 billion in 2025, with stablecoins accounting for 84% of illicit transaction volume.

The FATF reiterated the stat in its report, emphasizing the current usage of stablecoins in illicit transactions.

Chainalysis said illicit activity remains a small share of total on-chain volume, even as absolute dollar totals rose.

In the same report, Chainalysis said illicit transactions accounted for less than 1% of the total crypto transaction volume.

Magazine: Hong Kong stablecoins in Q1, BitConnect kidnapping arrests: Asia Express

Crypto World

OKX OnchainOS AI Toolkit for Autonomous Crypto Agents

OKX has just introduced a native AI layer on OnchainOS, its developer-focused onchain platform, designed to enable AI agents to act autonomously on blockchain networks.

The layer bridges traditional decentralized tooling with machine-native automation for trading, wallet management, payments and market data access.

More on OnchainOS

OnchainOS is the onchain toolkit and execution environment built by OKX’s Web3 team, intended to support developers and automated agents across multiple blockchain networks.

The platform ties together wallets, real-time market data, trading interfaces, and programmable execution in a single framework that AI agents can call into.

Unlike basic smart contract SDKs or standalone APIs, the goal of this AI layer is to let agents perform entire workflows (from reading prices to executing transactions) without developers wiring together separate components. It unifies familiar building blocks such as wallet infrastructure, liquidity routing, and onchain data feeds into a cohesive execution stack.

OKX says OnchainOS already supports more than 60 blockchain networks and aggregates liquidity across 500+ decentralized exchanges (DEXs), all while sitting on proven infrastructure that handles billions of API calls and high volumes of trading activity.

What the AI Layer Offers Developers and Agents

The new capabilities are grouped into a set of core modules that developers can build with:

- Wallet functionality: Agents can query balances, send transactions, and retrieve cross-chain history.

- Autonomous payments: Using the x402 pay-per-use protocol, agents can initiate and settle transactions without manual intervention and, in certain cases, with zero gas costs on OKX’s X Layer.

- Smart trading: Aggregated routing across hundreds of DEXs enables agents to source best prices for swaps and execute trades.

- Structured market data: Real-time onchain data feeds covering tokens, transfers, trades, and account information help agents decide when and how to act.

- DApp Connect: Direct integration of OKX Wallet into any decentralized app, expanding connectivity options.

These building blocks are designed to work together so that simple instructions can produce complex autonomous results. For example, an agent connected to OnchainOS could be instructed in plain language to swap ETH for USDC if a price threshold is reached, handling everything from price monitoring to execution onchain without further human input.

Multiple Access Paths for Builders

OKX offers three main ways developers and teams can integrate with OnchainOS:

- AI Skills: Agents interact through human-friendly descriptions of what they want to do, bypassing low-level API wiring.

- MCP (Model Context Protocol): A direct connection between OnchainOS and AI agent frameworks or LLM applications, meaning models like Claude Code, Cursor or OpenClaw can call onchain functionality natively.

- Open API: For developers who want detailed programmatic control, direct RESTful access to every capability is available.

Why Is This Big

Agents capable of autonomously operating onchain promise to reduce manual overhead for trading, arbitrage, portfolio rebalancing and data-driven decisions. While AI wallets today might handle simple tasks like sending tokens or checking prices, OnchainOS focuses on orchestrating multi-step workflows that combine market insight with execution logic – all within a unified system.

This could accelerate experimentation in algorithmic trading, liquidity management strategies, onchain risk monitoring, or dynamic portfolio rules – areas where developers have previously had to piece together separate APIs and feeds.

The Broader Context

The launch comes amid a period of growing interest in the mix of AI and blockchain. Coverage on this upgrade noted that the AI layer builds on OKX’s existing wallet and DEX infrastructure, pulling everything into a single execution framework for agents operating cross-chain.

OnchainOS’ scalability and reliability metrics, such as sub-100ms response times and sustained throughput at scale, are highlighted by OKX as foundational to supporting autonomous operations over time.

What’s Next?

OKX says OnchainOS with the new AI layer is available now to developers worldwide. Documentation and starter guides have been published to help builders deploy their first AI agents and decentralized applications using the toolkit.

Crypto World

Gold Price Analysis: The Dramatic 5% Plunge and Swift Recovery Explained

TLDR

- The precious metal plunged almost 5% before staging a 2% recovery as bargain hunters stepped in

- Dollar strength, with gains of approximately 1.5% this week, is limiting gold’s upward momentum

- Geopolitical tensions between the US and Iran are boosting safe-haven flows while simultaneously elevating crude prices

- Higher energy costs are intensifying inflation concerns, dampening prospects for Federal Reserve monetary easing

- Market participants now see 80% probability of multiple rate reductions this year, down from complete certainty of two cuts just days ago

The gold market experienced dramatic volatility as prices plummeted on Tuesday before staging a notable recovery Wednesday morning, with market participants balancing geopolitical risk appetite against greenback appreciation.

Spot gold advanced 1.6% to reach $5,171.89 per ounce during late London trading hours. This rebound followed a substantial 4.5% decline in the prior session, marking one of the most significant single-day retreats in recent trading history.

The yellow metal reached unprecedented heights above $5,595 per ounce during the final weeks of January. Year-to-date gains have approached 20%.

The previous session’s downturn resulted from a significant rally in the US Dollar Index, which climbed nearly 1.5% across two trading days to touch six-week peaks. Dollar appreciation typically pressures gold valuations by making the commodity costlier for international purchasers.

Portfolio rebalancing also contributed to selling pressure, as certain investors liquidated gold holdings to offset deficits elsewhere in their investment allocations.

Silver experienced an even sharper correction, falling over 8% Tuesday before rebounding 4.1% to $85.38 during Wednesday’s session. Platinum decreased 10% before recovering 2.8% to settle at $2,148.50 per ounce.

Iran Conflict Drives Safe-Haven Demand

The US-Israeli military operations against Iran have entered their fifth consecutive day. Israeli forces conducted additional strikes on Tehran Tuesday, targeting a facility in Qom where religious leaders had assembled to select a replacement for Supreme Leader Ayatollah Ali Khamenei, as reported by Israel’s Kan News. Iran’s semi-official Mehr news agency acknowledged the strike but indicated the structure was vacant during the attack.

The escalating conflict has created turbulence across worldwide financial markets and sustained elevated investor anxiety. Concerns regarding expanded regional destabilization continue mounting as Iran has threatened retaliation following American military actions against Iranian-affiliated installations.

Shipping activity through the Strait of Hormuz, a critical chokepoint handling approximately one-fifth of global oil and natural gas transport, has ground nearly to a standstill. President Trump announced the US would supply naval protection and insurance coverage for oil vessels navigating the strategic waterway, though maritime industry representatives characterized the solution as incomplete.

Rising Oil Prices Complicate Rate Cut Expectations

Elevated crude prices are intensifying inflation projections. This development is reducing the likelihood that central banking institutions, particularly the Federal Reserve, will implement rate reductions in the near term.

Market participants currently assign 80% probability to multiple quarter-point Fed rate cuts materializing this year. Just last Friday, financial markets had fully incorporated expectations for two rate reductions.

Elevated interest rate environments present challenges for gold since the asset generates no yield.

According to CFTC records, money managers’ net bullish positions in gold have declined since late January to approach decade-low levels. Market analysts suggest this diminished positioning may establish a floor for potential price declines.

In China, government PMI statistics indicated manufacturing sector contraction, while independent survey data revealed better-than-anticipated expansion, creating contradictory indicators from the planet’s second-largest economy.

Remember: Preserve all tokens like [[EMBED_0]], [[IMG_0]], [[LINK_START_0]], [[LINK_END_0]], [[SCRIPT_0]], [[FIGURE_0]] etc. exactly as they appear. These are placeholders for embeds, images, and links that must not be changed.

-

Politics5 days ago

Politics5 days agoITV enters Gaza with IDF amid ongoing genocide

-

Politics1 day ago

Politics1 day agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread: Iris Top

-

Tech3 days ago

Tech3 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

NewsBeat6 days ago

NewsBeat6 days agoCuba says its forces have killed four on US-registered speedboat | World News

-

Sports4 days ago

The Vikings Need a Duck

-

NewsBeat4 days ago

NewsBeat4 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

NewsBeat7 days ago

NewsBeat7 days agoManchester Central Mosque issues statement as it imposes new measures ‘with immediate effect’ after armed men enter

-

NewsBeat3 days ago

NewsBeat3 days ago‘Significant’ damage to boarded-up Horden house after fire

-

NewsBeat4 days ago

NewsBeat4 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat4 days ago

NewsBeat4 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

Business6 days ago

Business6 days agoDiscord Pushes Implementation of Global Age Checks to Second Half of 2026

-

Entertainment2 days ago

Entertainment2 days agoBaby Gear Guide: Strollers, Car Seats

-

Business6 days ago

Business6 days agoOnly 4% of women globally reside in countries that offer almost complete legal equality

-

Tech5 days ago

Tech5 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS

-

Politics3 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat3 days ago

NewsBeat3 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

Crypto World6 days ago

Crypto World6 days agoFrom Crypto Treasury to RWA: ETHZilla Retreats and Relaunches as Forum Markets on Nasdaq

-

NewsBeat2 days ago

NewsBeat2 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Tech3 days ago

Tech3 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI