Crypto World

The New Financial Stack – Smart Liquidity Research

Blockchain for Trust. AI for Decisions. Agents for Execution. For years, fintech and crypto conversations have been noisy, fragmented, and overly technical. New users get lost. Investors struggle to see the system-level picture. Builders over-optimize one layer while ignoring the rest.

What’s emerging now is a clean, composable financial stack—one that mirrors how real-world systems actually work:

-

Trust is guaranteed by blockchains

-

Decisions are powered by AI

-

Execution is handled by autonomous agents

Once you see it, you can’t unsee it.

This post breaks down that stack and explains why it’s becoming the default architecture for the next generation of financial systems.

Layer 1: Blockchain = Trust & Settlement

Blockchains don’t exist to be “cool tech.”

They exist to solve one thing extremely well: trust without intermediaries.

At this layer, blockchains provide:

-

Immutable ledgers (no rewriting history)

-

Permissionless access (anyone can verify)

-

Deterministic settlement (code executes exactly as written)

-

Transparent rules (no hidden terms, no backroom edits)

In the new financial stack, blockchains are not the brain.

They are the court of record.

Think of blockchain as:

It doesn’t decide what to do.

It guarantees that whatever is decided is executed fairly and verifiably.

Trust is infrastructure now.

Layer 2: AI = Intelligence & Decision-Making

If blockchains answer “Can this be trusted?”

AI answers “What should be done next?”

Modern financial systems are too complex for static dashboards and manual strategies:

-

Markets are real-time

-

Data is multi-dimensional

-

Opportunities are fleeting

-

Risks change every second

AI thrives here.

At this layer, AI systems:

-

Analyze price, liquidity, volatility, and order flow

-

Incorporate sentiment, macro signals, and on-chain data

-

Simulate outcomes and probabilities

-

Continuously adapt strategies based on feedback

Crucially, AI does not need custody or authority.

>It doesn’t hold funds.

> It doesn’t settle trades.

> It doesn’t break trust assumptions.

AI’s role is intelligence, not control.

Think of it as:

-

The strategist

-

The analyst

-

The decision engine

This separation keeps systems safe and powerful.

Layer 3: Agents = Execution & Action

Decisions without execution are just opinions.

This is where agents enter the stack.

Agents are autonomous software entities that:

-

Operate continuously (24/7)

-

Act within predefined constraints

-

Execute actions on-chain or via APIs

-

Monitor outcomes and react in real time

Agents turn intent into action.

Examples:

-

Rebalancing portfolios when conditions shift

-

Executing trades within strict risk limits

-

Managing liquidity positions automatically

-

Paying for APIs, data, or services on demand

-

Coordinating with other agents in markets

Agents are the hands of the system.

They don’t decide why.

> They don’t define truth.

> They simply do the work, precisely and relentlessly.

How the Stack Works Together

The power comes from the separation of concerns:

| Layer | Role | Question It Answers |

|---|---|---|

| Blockchain | Trust & Settlement | “Is this valid?” |

| AI | Intelligence & Strategy | “What should we do?” |

| Agents | Execution & Automation | “How do we do it now?” |

Each layer is strong because it is narrow.

-

Blockchains stay simple and verifiable

-

AI stays flexible and adaptive

-

Agents stay fast and operational

No single component needs to do everything—and that’s the point.

Why This Matters for Builders

If you’re building:

-

Stop putting AI logic directly on-chain

-

Stop treating wallets as user interfaces

-

Stop shipping dashboards instead of outcomes

Instead:

-

Use blockchain as your trust anchor

-

Use AI as your decision layer

-

Use agents to deliver results automatically

The winners won’t be “apps.”

There will be systems that run themselves.

Why This Matters for Investors

This stack clarifies where value actually accrues:

-

Blockchains capture value through settlement, fees, and security

-

AI layers capture value through performance and insight

-

Agent networks capture value through execution, scale, and reliability

If a project claims to do all three at once, be skeptical.

If it nails one layer and integrates cleanly with the others, pay attention.

The Big Shift

We’re moving from:

This isn’t about replacing humans.

It’s about freeing humans from micromanaging systems that machines can run better.

The new financial stack is already here.

Those who understand it early will build—and invest in—the infrastructure everyone else ends up using.

REQUEST AN ARTICLE

Crypto World

Nigel Farage Invests in UK Bitcoin Firm Led by Former Chancellor Kwasi Kwarteng

Stack BTC Plc has raised $347,204 from several entities, including Nigel Farage, leader of the Reform UK party, and Blockchain.com.

The fundraising was carried out through the issuance of 5,200,000 new ordinary shares at 5 pence per unit, with plans to use the proceeds to buy and grow UK businesses, build a Bitcoin (BTC) treasury, and fund general working capital.

Stack’s BTC Fundraise

A March 9 press release shows that Farage’s financing was made as a show of his long-standing support for British businesses and advocacy for BTC. Throughout his career, the politician has championed local independent companies and talked about his belief in the OG cryptocurrency’s potential as a financial asset and digital currency.

“London and the UK have historically been the center of the world’s financial markets, and I believe we can and should be a major global hub for the crypto industry,” said Farage in the press release.

He also mentions the importance of UK SMEs, which provide jobs to about 60% of the private sector workforce, adding that Stack’s approach of acquiring and growing businesses is a strategy for long-term capital and support.

Blockchain.com will be providing institutional-grade services to support Stack’s BTC stockpile plan on top of its investment. The firm was officially registered under the UK Financial Conduct Authority (FCA) on February 10, 2026, a development that allows it to legally operate as a crypto asset business in the region.

Kwasi Kwarteng, Stack’s Executive Chairman and former UK Chancellor, welcomed the two as investors, saying the partnership aligns closely with the company’s goals.

“Nigel’s unwavering support for British business and belief that Bitcoin is set to rapidly expand its role in finance is perfectly aligned with the company’s ethos and business plans,” he wrote.

He added that the crypto service provider’s infrastructure will help ensure the firm maintains the highest standards of custody services for its BTC treasury.

Shares To Begin Trading in March

The new shares will be available for trading on the Aquis Growth Market from 12 March 2026, with investors also receiving warrants that can be exercised once certain conditions have been met in the future.

Stack will now have 68,130,000 ordinary shares in circulation, each carrying one voting right. Of the total issued share capital, the company’s existing concert party now collectively accounts for 45.21%.

Farage currently controls 4,300,000 shares (6.31%), while Kwarteng holds 3,700,000 shares (5.43%), with the remaining units distributed among other directors and parties.

Stack announced earlier in March that it would begin operating as a BTC treasury company, with plans to start its reserves with a 21 BTC purchase. The firm intends to fund this future stockpile through equity issuance, acquisitions, and operating profits.

The company will now join established players in the UK BTC treasury space, including the Smarter Web Company and Satsuma Technology, which respectively hold 2,692 BTC and 620 BTC, per data from BitcoinTreasuries.

The post Nigel Farage Invests in UK Bitcoin Firm Led by Former Chancellor Kwasi Kwarteng appeared first on CryptoPotato.

Crypto World

Can a 90-Year-Old Brand Compete With Crypto-Native Gambling?

The gambling industry respects history. A brand that has survived decades of regulation changes, technological shifts, and market upheaval earns a certain kind of credibility that cannot be bought or manufactured. William Hill has that credibility in abundance. But 2026 is testing whether credibility alone is enough when a new generation of platforms is rewriting the rules around game selection, payment speed, and player rewards. ZunaBet represents that new generation, and putting it alongside William Hill highlights just how much distance has opened up between the traditional model and what comes after it.

William Hill: Heritage as a Foundation

William Hill has been part of the gambling landscape since 1934. What started as a UK bookmaking operation has grown into a global brand with an online presence spanning multiple markets. The acquisition by Caesars Entertainment in 2021 reshaped parts of the business, particularly in the United States where it now operates under the Caesars Sportsbook name in several states. In the UK and other international markets, the William Hill name endures as one of the most recognized in the industry.

The sportsbook reflects that long history. Horse racing coverage runs deep, a natural strength for a brand with British bookmaking roots. Football, tennis, basketball, cricket, rugby, golf, and numerous secondary sports are all available with respectable market depth. Live in-play betting keeps pace with modern expectations, offering updated odds across major events. The sports betting product is mature and well-constructed, built through decades of refinement rather than a single launch cycle.

The online casino sits alongside the sportsbook with a modest but functional game library. Slots, table games, and live dealer options from established providers cover the standard categories. Total game counts vary by market but generally land in the range of several hundred to a couple of thousand. It is a competent casino that meets basic expectations without pushing boundaries on scale or variety.

William Hill handles payments through familiar traditional methods. Debit cards, bank transfers, PayPal, Skrill, Neteller, and other conventional options are available depending on the market. Withdrawals follow standard banking timelines — faster for e-wallets, slower for bank-based methods, and occasionally complicated by cross-border processing for international users. It is the same infrastructure the industry has relied on for years.

Loyalty at William Hill depends on the market. UK players have historically had access to the William Hill Plus Card and various promotional offers. Free bets, enhanced odds, and occasional bonuses make up the reward structure. The approach is promotion-driven rather than tier-based, meaning what a player receives back fluctuates with whatever campaigns happen to be live at any given time.

ZunaBet: No Legacy, No Limitations

ZunaBet arrived in 2026 under Strathvale Group Ltd with an Anjouan gaming license and a team that collectively brings more than 20 years of gambling industry experience. That experience informed the build, but it did not constrain it. Instead of iterating on traditional platforms, the team constructed ZunaBet around cryptocurrency as its core operating layer. The result is a platform that shares very little DNA with legacy operators.

Game selection tells the story fastest. ZunaBet carries 11,294 titles across 63 providers. Pragmatic Play, Evolution, Hacksaw Gaming, Yggdrasil, and BGaming anchor the top of the list, while dozens of additional studios push the variety well beyond what most players encounter on any single platform. Slots dominate the numbers, but live dealer rooms and RNG table games receive enough attention that casino players of all preferences find genuine depth. Stacking this catalog against what most traditional operators offer reveals a gap measured not in percentages but in multiples.

The sportsbook was designed as a full product from the outset. Football, basketball, tennis, hockey, and other mainstream sports get thorough coverage. Esports betting runs as a built-in category rather than a supplementary afterthought, with dedicated markets on CS2, Dota 2, League of Legends, and Valorant. Virtual sports and combat sports complete an offering that serves both traditional bettors and a younger audience whose sporting interests extend well into the digital arena.

Payments are crypto only. Over 20 coins are accepted — BTC, ETH, USDT on multiple chains, SOL, DOGE, ADA, XRP, and others. ZunaBet takes no processing fees. Withdrawals happen through the blockchain without bank interaction, without variable timelines, and without the geographic inconsistencies that plague traditional payment setups. A player anywhere in the world gets the same fast, fee-free experience.

New players receive up to $5,000 plus 75 free spins through a welcome offer split across three deposits. The first deposit earns 100% up to $2,000 and 25 spins. The second earns 50% up to $1,500 and 25 spins. The third earns 100% up to $1,500 and 25 spins. Distributing the bonus across three stages keeps the platform rewarding players well into their early weeks rather than front-loading everything into a single moment.

Native apps cover iOS, Android, Windows, and MacOS. A dark-themed responsive design delivers fast load times across devices, and live chat support stays available 24/7.

What Loyalty Actually Looks Like on Each Platform

Strip the branding away and loyalty comes down to a simple question — what does your regular play actually earn you? William Hill and ZunaBet give very different answers.

William Hill distributes value through periodic promotions. A free bet might appear before a major horse racing event. Enhanced odds might run during a football derby weekend. A deposit match could surface around a quiet midweek period. These offers have value when they show up, but they arrive on the platform’s schedule and vary based on which market you are in. Players cannot look at their activity from the past month and calculate a precise return because no fixed system exists to deliver one.

ZunaBet removes the guesswork entirely. Its dragon evolution loyalty program tracks players across six tiers — Squire at 1% rakeback, Warden at 2%, Champion at 4%, Divine at 5%, Knight at 10%, and Ultimate at 20%. A dragon mascot called Zuno evolves as players move up. Upper tiers unlock extras like up to 1,000 free spins, VIP club access, and double wheel spins.

The rakeback model gives regular players something promotional systems cannot — consistency. Every session, every wager, every week generates a return at a known rate. A player sitting at 15% or 20% rakeback does not need to check a promotions page to know what they are earning. That predictability compounds into serious value over time, and it is one of the main reasons players who try rakeback-based systems rarely want to go back to traditional promotional models.

Getting Paid: Days vs Minutes

Every online gambler has a withdrawal story. Waiting days for funds to clear, wondering whether verification is holding things up, checking bank balances repeatedly. This is the reality of traditional payment infrastructure, and William Hill operates within it just like every other legacy operator. E-wallets offer some relief with faster processing, but card and bank withdrawals still land in the one-to-five business day range. International players may face additional friction through currency conversion and cross-border processing fees.

ZunaBet does not participate in any of that. Withdrawals go out on-chain. No banks are involved. No business day schedules apply. No platform fees are charged. Whether you cash out on a Monday morning or a Saturday night, the process is the same. Whether you are in Nairobi or New York, the speed is the same. Crypto infrastructure does not differentiate between geographies or time zones, which gives ZunaBet a payment experience that is structurally faster and simpler than anything built on traditional rails.

Once a player gets used to instant crypto withdrawals with zero fees, the idea of waiting three to five business days for a bank transfer feels like a relic of a different era. That shift in expectation is happening across the international gambling market in real time.

Where History Meets the Future

William Hill has survived world wars, regulatory overhauls, the transition from retail to digital, and a corporate acquisition. That resilience deserves respect. The brand carries weight, the sportsbook remains competitive, and the trust built over nine decades has genuine value for players who prioritize tradition and established regulatory standing.

But the market William Hill operates in looks very different in 2026 than it did even five years ago. Players who have grown up with crypto wallets see no reason to wait days for a withdrawal. Players accustomed to streaming libraries with thousands of options expect the same scale from their casino. Players who understand percentages prefer knowing their exact rakeback rate over hoping a useful promotion appears at the right time.

ZunaBet was built for exactly these players. Over 11,000 games from 63 providers. Rakeback scaling to 20% through a transparent tier system. A sportsbook that treats esports with the same respect as traditional markets. Crypto payments that work identically for every player on earth without fees or delays. It is a platform that was not designed to compete with history — it was designed to make the case for what happens next.

William Hill wrote important chapters in the story of gambling. ZunaBet is writing the next one. For players choosing between heritage and momentum in 2026, that distinction is becoming the deciding factor.

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

Ethereum price risks falling below $1,000 as theory points lower

Ethereum price consolidates near the point of control after rejecting $4,800 resistance. Market Auction Theory suggests a potential rotation toward $870, risking a drop below $1,000.

Summary

- Range Structure: Ethereum trades within a macro range between $4,800 resistance and $870 support.

- Current Level: Price consolidating near the point of control (POC).

- Downside Risk: Market Auction Theory favors rotation toward $870, risking a move below $1,000.

Ethereum (ETH) price is currently trading within a large macro trading range that has defined price behavior over an extended period. The upper boundary of this range sits near $4,800, while the lower boundary is positioned around $870.

This broad structure has acted as the framework for Ethereum’s price action as the market continues to rotate between areas of high and low value.

Ethereum price key technical points

- Range Structure: Ethereum continues to trade within a macro range between $4,800 resistance and $870 support.

- Point of Control: Price is currently consolidating around the POC, a major equilibrium level.

- Downside Target: Market Auction Theory suggests a potential rotation toward the $870 range low.

Ethereum’s rejection from the range high resistance near $4,800 marked a significant technical development for the broader market structure. Range highs often act as areas of heavy supply where sellers begin to step into the market. When price is unable to sustain acceptance above these levels, it typically signals that bullish momentum is weakening and that a corrective rotation may follow.

Following the rejection at resistance, Ethereum’s price rotated lower and has now returned to the point of control, which represents the area where the highest volume within the range has been traded. The POC often functions as a magnet for price during periods of consolidation because it reflects a fair value zone where both buyers and sellers previously agreed on price.

At the moment, Ethereum is attempting to hold above this level as the market enters a short-term consolidation phase. From a technical standpoint, it is common for price to temporarily stabilize around the POC before deciding on the next directional move. In many cases, this area can provide a short-term bounce or relief rally as buyers attempt to defend the equilibrium zone.

This comes as BMNR shares climbed over 4% on Monday, revisiting the key $20 resistance as Ethereum rebounded and the company continued accumulating, highlighting renewed interest in Ethereum-linked assets.

However, when analyzing the broader structure through the lens of Market Auction Theory, the larger directional bias may still favor further downside. This theory suggests that once price loses acceptance near the value area high, the market often seeks to rotate toward the value area low, where the next significant liquidity pool exists.

In Ethereum’s current structure, the value area high aligns closely with the previous rejection near $4,800, while the value area low sits near the range low around $870. If the auction process continues to develop in this direction, the market may gradually move lower as price searches for the next major area of value.

Such a move would place Ethereum below the psychological $1,000 level, which represents an important milestone for traders and investors. Psychological price levels often act as areas where market sentiment can shift quickly, particularly if broader bearish conditions remain intact.

However, rising institutional accumulation of Ethereum signals growing confidence in the asset and renewed momentum for the expansion of decentralized finance, which could influence long-term market sentiment despite short-term downside risks.

Another factor supporting the downside scenario is the broader macro market structure. Ethereum’s inability to sustain higher highs within the range suggests that bullish momentum remains limited. Until a strong structural breakout occurs, the dominant market behavior is likely to remain rotational rather than trending.

What to expect in the coming price action

Ethereum is currently holding near the point of control, where short-term consolidation or a temporary bounce may occur. However, the broader market structure remains bearish following the rejection at $4,800 resistance.

If Market Auction Theory continues to play out, price may gradually rotate toward the range low near $870, increasing the probability that Ethereum could trade below $1,000 in the coming weeks or months.

Crypto World

EU Regulated Blockchain Securities Market Sees First Bank Join

A Swiss-regulated crypto bank has joined a European Union–backed, blockchain-based settlement venue for tokenized securities, signaling a step toward weaving digital asset infrastructure into traditional capital markets. Zug-based Amina announced it is becoming a listing sponsor on 21X, Europe’s first fully regulated DLT trading and settlement venue, making the bank the platform’s inaugural regulated participant. The move aligns with Amina’s partnership with Tokeny, a Luxembourg-based provider of technology for issuing and managing tokenized financial assets, enabling issuers to access a regulated path to on-chain securities. The collaboration aims to tackle a long-standing hurdle for institutional adoption: the interoperability of tokenized-asset platforms within a regulated ecosystem. 21X, operating under the EU’s DLT pilot regime, received an infrastructure permit in December 2024 to run a regulated market for blockchain-based securities in a regulatory sandbox.

The push to connect regulated banks with tokenized issuances and trading comes amid a broader push to demonstrate viable, compliant on-chain markets. Industry observers have long pointed to the challenge of cross-platform interoperability as a bottleneck to scale. A Baker McKenzie analysis cited in June ascribes the obstacle to the “lack of interoperability of tokenized asset platforms,” arguing that scale will only be achieved when multiple market players transact across common or interconnected venues. In that context, Amina’s participation on 21X could help test how a conventional bank operates within a regulated blockchain venue, potentially lowering both onboarding friction and counterparty risk for institutional issuers.

Launched in 2023, the EU’s DLT pilot regime is designed to provide a regulatory sandbox for experimenting with blockchain-based trading and settlement of financial instruments. Regulators use the framework to gauge how distributed-ledger technology could fit into existing market infrastructure before broad-scale adoption. While the pilot has sparked excitement about real-world applications, participants have warned that the regime’s current limits may hinder European on-chain markets from scaling to compete with other jurisdictions. The involvement of regulated banks like Amina will be watched closely as a potential signal of practical viability for the model.

The momentum around tokenized real-world assets remains notable. In the United States, major financial institutions such as BNY Mellon, Nasdaq, and S&P Global have supported the expansion of the Canton Network, underscoring growing interest in interoperable, permissioned blockchains for finance. In Europe, venues like 21X are being tested under the EU’s DLT pilot regime to determine how regulated participants might issue, manage, and trade tokenized securities in a controlled environment. In February, eight EU-regulated digital-asset companies publicly urged policymakers to accelerate legislation, warning that delays could leave Europe trailing the United States and other markets in tokenized-finance development.

The market for tokenized real-world assets has drawn attention to the breadth of potential applications. Data from RWA.xyz places the total value of tokenized real-world assets at about $26.5 billion, illustrating the scale of interest across asset classes and geographies. The industry has already witnessed notable milestones: Kraken’s tokenized-securities trading on its xStocks platform opened to European users, offering blockchain-based versions of US-listed equities, and Liechtenstein’s Ondo secured regulatory approval to provide tokenized equities to European investors. These developments, alongside ongoing regulatory dialogue and the expansion of regulated venues, paint a picture of a market moving from pilot-stage experimentation toward incremental adoption among institutions.

As the ecosystem evolves, observers will watch for concrete indicators of broader participation, including more banks endorsing on-chain settlement rails, issuers selecting 21X or other regulated venues for tokenized outcomes, and the pace at which interoperable standards emerge across platforms. While it remains to be seen how quickly tokenization can scale to the level of traditional capital markets, Amina’s entry into 21X marks a meaningful data point in the ongoing journey toward regulated, institution-friendly on-chain markets.

Related: Crypto exchanges gain as tokenized commodity market climbs to $7.7B

Strong growth of tokenized real-world assets

The trajectory of tokenized assets is underscored by ongoing institutional interest in blockchain infrastructure for asset tokenization. In the United States, major participants have backed initiatives to broaden tokenization-enabled markets, while Europe continues to experiment with regulated venues such as 21X. The push toward interoperability and compliant issuance remains central to unlocking scale, even as regulators balance innovation with investor protection.

In September, Kraken launched tokenized securities trading for European users via its xStocks platform, which provides blockchain-based representations of US-listed equities. Two months later, Ondo received regulatory approval in Liechtenstein to offer tokenized equities trading to European investors, signaling continued momentum in Europe’s tokenization efforts.

The broader market narrative remains anchored in tangible data points. Market trackers show tokenized real-world assets expanding beyond niche pilots, with more institutions evaluating how tokenization can streamline issuance, custody, and settlement within regulated frameworks. Still, industry participants emphasize that any acceleration will depend on the creation of interoperable networks and clear regulatory guidance that harmonizes cross-border flows.

At the same time, the conversation around tokenization continues to reference the European DLT pilot regime as a proving ground for governance, risk controls, and settlement mechanics. Critics caution that the framework’s current scope may constrain full-scale on-chain markets in Europe, yet proponents see it as a crucial early step toward a more resilient, regulated digital-asset infrastructure.

Why it matters

For market participants, Amina’s entrance into 21X represents more than a symbolic endorsement of on-chain infrastructure. It signals that a regulated bank is willing to operate within a tokenized-securities venue, bringing traditional counterparty risk management, custody standards, and KYC/AML processes into an on-chain trading and settlement workflow. If the model proves scalable, issuers looking to tokenize real-world assets—ranging from securities to structured-finance instruments—could gain a more predictable path to access capital markets through regulated environments rather than ad hoc private ledgers.

For platform operators, the first fully regulated bank participant underscores the importance of robust interoperability and compliance layers. The Baker McKenzie citation underscores a recurring industry theme: that scaling tokenization requires a network of interoperable platforms rather than isolated silos. The involvement of regulated banks may incentivize other actors to participate, potentially driving higher liquidity and broader issuance on platforms like 21X.

For investors, the evolution of tokenized markets within regulated contexts could translate into clearer risk controls and more familiar governance structures. Regulators’ continued experimentation—paired with industry participation—may reduce friction around custody, settlement finality, and cross-border access, all of which have historically deterred large institutions from engaging with tokenized assets.

What to watch next

- Progress on 21X’s regulatory milestones, including any new listing sponsors or issuances on the venue.

- Additional banks or financial institutions joining regulated blockchain trading and settlement rails in Europe.

- Regulatory developments affecting the EU DLT pilot regime and cross-border tokenization standards.

- Tokeny’s integration pipeline and any new issuer programs enabling tokenized securities under regulated frameworks.

- Updates to market data on tokenized real-world assets, including new asset classes and liquidity indicators.

Sources & verification

- Announcement of Amina becoming the listing sponsor on 21X, via BusinessWire: AMINA Becomes First Regulated Bank on 21X Europe’s First Fully Regulated DLT Trading and Settlement Venue.

- Baker McKenzie, tokenization in financial services analysis on interoperability and scale.

- EU DLT pilot regime background and regulatory sandbox description.

- RWA.xyz data on the tokenized real-world asset market size ($26.5 billion).

- Related coverage on tokenized securities and regulated venues (Kraken xStocks, Ondo Liechtenstein approval).

Key narrative details

Crypto World

US Court Dismisses All Claims Against Binance in Anti-Terrorism Case

Editor’s note: A US federal court’s dismissal of all Anti-Terrorism Act claims against Binance marks a definitive legal vindication for the company. In a 62-page decision, the court found no evidence that Binance aided terrorists, participated in, or conspired with terrorist organizations, despite claims by 535 plaintiffs alleging material support related to 64 terrorist attacks. The ruling reinforces Binance’s stated commitment to compliance, governance, and constructive engagement with regulators worldwide, and signals that the company will vigorously defend its reputation and operations.

Key points

- The court dismissed all Anti-Terrorism Act claims against Binance in the case, across every allegation.

- The court found no evidence Binance aided terrorists, linked itself to attacks, or conspired with terrorist organizations.

- The ruling addresses claims by 535 plaintiffs alleging material support related to 64 terrorist attacks.

- While plaintiffs may seek to amend, Binance emphasizes it will defend its position and will continue to engage with regulators.

This dismissal is a complete vindication of all false allegations.

Why this matters

The ruling delivers a decisive legal victory and underlines Binance’s ongoing investment in compliance infrastructure, regulatory engagement, and robust governance. It reinforces that Binance’s operations do not support terrorism in any form and provides a clear clarification to the market about the company’s posture and risk controls.

What to watch next

- Whether plaintiffs file an amended complaint within the 60-day window.

- Binance’s ongoing regulatory engagement worldwide and governance actions.

Disclosure: The content below is a press release provided by the company/PR representative. It is published for informational purposes.

US Federal Court Dismisses All Claims Against Binance in Anti – Terrorism Lawsuit

Court rejects allegations that Binance assisted, participated in, or conspired with terrorists. This represents a decisive legal dismissal of all claims

Binance, the world’s largest cryptocurrency exchange by registered users, announced today that a U.S. federal court in the Southern District of New York has dismissed all claims brought against the company under the Anti-Terrorism Act (ATA). The lawsuit involved 535 plaintiffs who alleged that Binance provided material support related to 64 terrorist attacks.

In a 62-page decision, the Court found that plaintiffs failed to establish any of their central allegations: that Binance assisted terrorists, that Binance associated itself with terrorist attacks, that Binance participated in or sought to advance those attacks, or that Binance engaged in any conspiracy with terrorist organizations.

“This dismissal is a complete vindication of all false allegations,” said Eleanor Hughes, Binance’s General Counsel. “The court has unambiguously rejected the false and damaging narrative that Binance assisted terrorists. We have always maintained that these claims were without merit, and today’s ruling confirms that. We will continue to defend ourselves aggressively against any litigation or reporting that misrepresents who we are and how we operate.”

A Full and Complete Legal Victory

The Court’s decision to dismiss all claims, across every allegation, represents a decisive legal victory.

While the Court has allowed plaintiffs 60 days to file an amended complaint in light of a recent appellate decision, Binance is confident that no amended pleading will be able to cure the fundamental deficiencies the Court identified. The underlying claims have been thoroughly examined and rejected.

Commitment to Compliance and Legal Integrity

Binance has consistently invested in industry-leading compliance infrastructure, regulatory engagement, and legal governance. Today’s ruling affirms that Binance’s operations do not support, facilitate, or enable terrorism in any form.

The company will continue to engage constructively with regulators worldwide, operate within established legal frameworks, and pursue vigorous legal action where necessary to correct false and misleading narratives about its business.

About Binance

Binance is a leading global blockchain ecosystem behind the world’s largest cryptocurrency exchange by trading volume and registered users. Binance is trusted by more than 310 million people in 100+ countries for its industry-leading security, transparency, and unmatched portfolio of digital asset products. For more information, visit: https://www.binance.com

Crypto World

Nasdaq Partners with Boerse Stuttgart’s Seturion for tokenized Settlement

Nasdaq said it is working with Boerse Stuttgart Group’s tokenized settlement platform Seturion to connect its European trading venues to infrastructure designed to settle tokenized securities using distributed ledger technology.

According to Monday’s announcement, the collaboration will initially focus on structured products and aims to support faster settlement of tokenized assets across European capital markets.

Seturion supports multiple asset classes across public and private distributed ledger networks and allows transactions to be settled using either central bank money or on-chain cash. Boerse Stuttgart said the platform is intended to be open to a broader network of financial institutions across Europe.

Under the partnership, Nasdaq will link its European trading venues to Seturion so that tokenized securities traded on those markets can be settled through the platform. The companies said they plan to expand participation to additional issuers, brokers and financial institutions over time.

The partnership aims to address fragmentation in Europe’s post-trade infrastructure, where securities settlement is handled by multiple national systems with differing rules and processes. By using distributed ledger technology, the companies say a shared platform could help reduce settlement times and operational complexity across European markets.

The European Central Bank in April said there was “an urgent need to integrate Europe’s fragmented capital markets, not only in the area of post-trade but also in supervision and other areas.”

The system is designed to operate within existing European regulatory frameworks, including MiFID II and the DLT Pilot Regime, which allow financial institutions to test distributed ledger technology in trading and settlement of tokenized securities.

In February, Boerse Stuttgart Group said it would merge its cryptocurrency business with Frankfurt-based digital asset trading company Tradias as part of a strategy to expand its presence in institutional crypto markets.

Related: Kraken wins Kansas City Fed approval for limited master account access

Traditional exchanges push deeper into tokenized securities

Exchange operators are increasingly exploring tokenized versions of traditional securities as part of efforts to modernize capital market infrastructure.

Nasdaq said today that it was partnering with Kraken, a US-headquartered crypto exchange, and tokenization infrastructure provider Backed to develop a gateway aimed at supporting tokenized equities while preserving issuer control.

In September, Depository Trust & Clearing Corporation said it plans to bring a subset of US Treasury securities onto the Canton Network, with the long-term goal of expanding tokenization to a broader range of assets eligible for custody at its subsidiary, the Depository Trust Company. The market infrastructure operator processed around $3.7 quadrillion in 2024.

In January, the New York Stock Exchange and its parent company Intercontinental Exchange said they were developing a platform for trading tokenized stocks and exchange-traded funds that would support 24/7 trading and blockchain-based settlement.

Last week, Intercontinental Exchange announced it had taken a board seat in OKX after investing in the crypto exchange and plans to offer NYSE-listed tokenized stocks and derivatives to OKX users starting in 2026.

Tokenized public equities have grown to about $1.01 billion in total onchain value, according to data from RWA.xyz.

Magazine: What’s a ‘Network State’ and are there real-life examples? Big Question

Crypto World

Top Five Crypto Projects to Watch in 2026

The crypto industry is entering a cycle of adjustment that has shifted from speculative behavior to structural fundamentals due, in part, to the passage of major legislation such as the GENIUS Act in the United States and MiCA in the EU. This shift places greater weight on how individual networks generate revenue, manage supply, and attract sustained user activity.

As a result, investors are increasingly examining protocol upgrades, token mechanics, and real usage metrics when assessing long-term price potential rather than relying on short-term narratives. In practical terms, that means looking at projects with real traction – so here are five that could break out in 2026 based on trading ranges, on-chain usage, and adoption trends.

HYPE and the $100 Scenario

Hyperliquid recently announced the HIP-3 upgrade, which adds gold and silver to the list of assets it covers. These changes helped the price of its native HYPE token rise to about $33. Some market watchers are suggesting it can eventually fly past its current all-time high of just under $60 and hit as much as $100 in 2026.

Looking at HYPE’s technical picture above reinforces this constructive fundamental view. For example, the 50-day exponential moving average is trending higher and could soon cross above the 200-day EMA. That would form a “golden cross,” a pattern many analysts view as a bullish buy signal.

Furthermore, the MACD has extended above its signal line on the daily chart, meaning there is increasing bullish momentum. The RSI is also around 60, which suggests strong buying pressure but still leaves room for more upside before the asset starts to look overbought.

But reaching $100 would require more than just price expansion. It would mean that volume growth, buybacks, and burns would continue, and there would be deeper liquidity across tokenized assets on Hyperliquid.

If the platform maintains its lead in on-chain derivatives and successfully integrates more institutional-grade margin tools, the token could consolidate its value. And based on its current volume profile, facilitating $2.6 trillion worth of trades in 2025, and market penetration, a move toward $100 before year-end is within the boundaries of fundamental growth – assuming the ecosystem continues to attract high-liquidity markets.

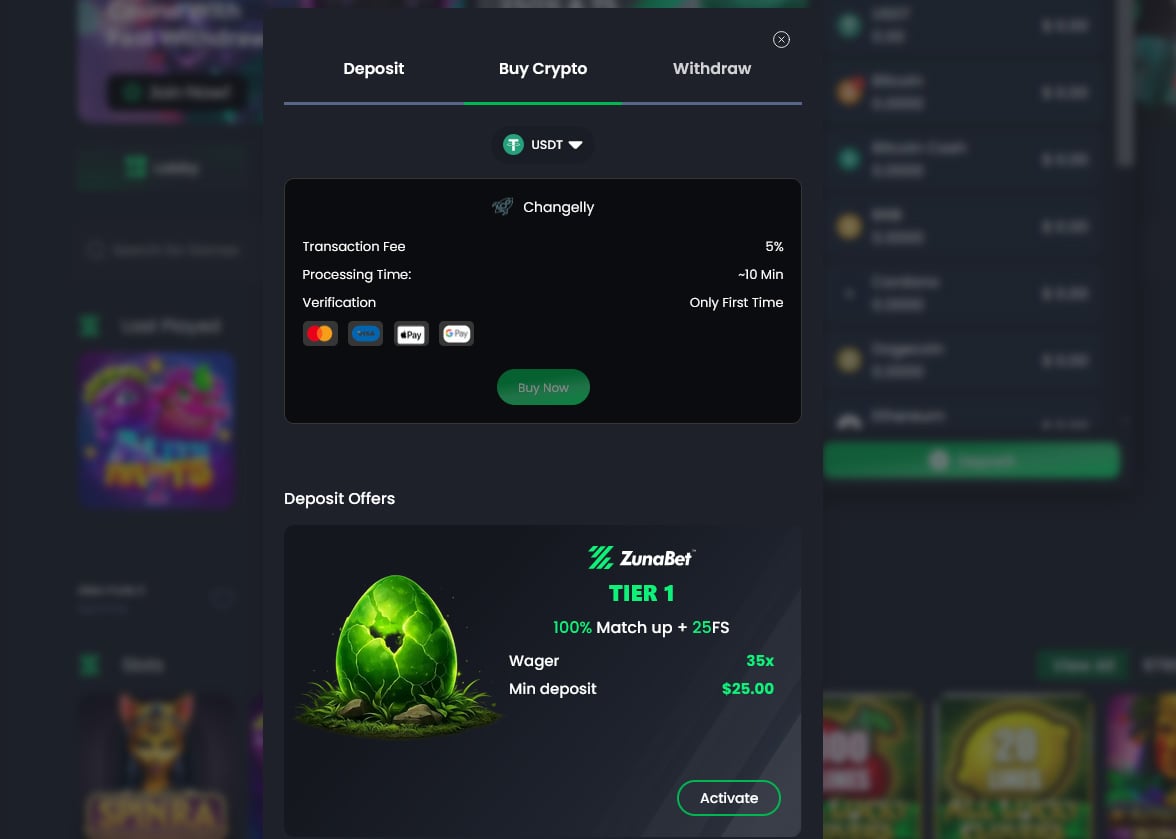

BNB’s $2,000 Target

Ranked as the fourth-largest cryptocurrency by market cap, BNB was trading near $640 as of this writing, nearly 54% off its peak. However, from a technical standpoint, the asset is showing early signs of stabilization after a downtrend that began toward the end of January.

The 10- and 20-day exponential moving averages were of special interest, with TradingView data showing them flattening out while the RSI climbed higher for the first time in several weeks. That implies the selling pressure may be reducing, with the reversal leading some supporters to suggest that the next bull run will push BNB to $2,000.

Price forecast estimates indicate that BNB is expected to increase gradually over time, with a near-term price target of $610 and an expected average price of $640–$820 at approximately the mid-point of the forecast horizon.

Analyst Duo Nine supports this scenario and anticipates the first price target for BNB will be just below $700. If that level is reclaimed, the market watchers believe $900 will be the threshold.

However, reaching $2,000 in 2026 would require that the BNB Chain register more activity on-chain, and there would also need to be more clarity about how regulators treat tokens linked to exchanges.

Solana to $300

A strong run at the tail end of last year gave traders hope that 2026 could be the year Solana (SOL) finally hits the $300 milestone.

The coin’s narrative revolves around withstanding change in the market and keeping a loyal developer base focused on high-throughput applications. According to recent data, the network has the second-largest market share in DeFi and has at times had more 24-hour DEX trading volume than Ethereum.

Over the past week, SOL has gained more than 9%, outpacing the broader market. According to chartist Ali Martinez, the coin is currently range-bound, with support at $76 and resistance around the $90 level. A move above $90 would signal a potential shift toward upside continuation, with analyst Crypto Patel suggesting last month that once SOL outgrows its corrective phase, it could go past $300, even hitting $500 or $1000.

But to reach these elevated price points, there needs to be continued development, a stable network with solid performance, and wider Layer 1 infrastructure usage, driven by the clarity of the regulatory environment in key markets.

However, it must also be noted that Ethereum and other fast chains remain highly competitive, and outages, as seen in the past, could also impact SOL’s risk profile, making it more difficult to pass the record-breaking price milestone.

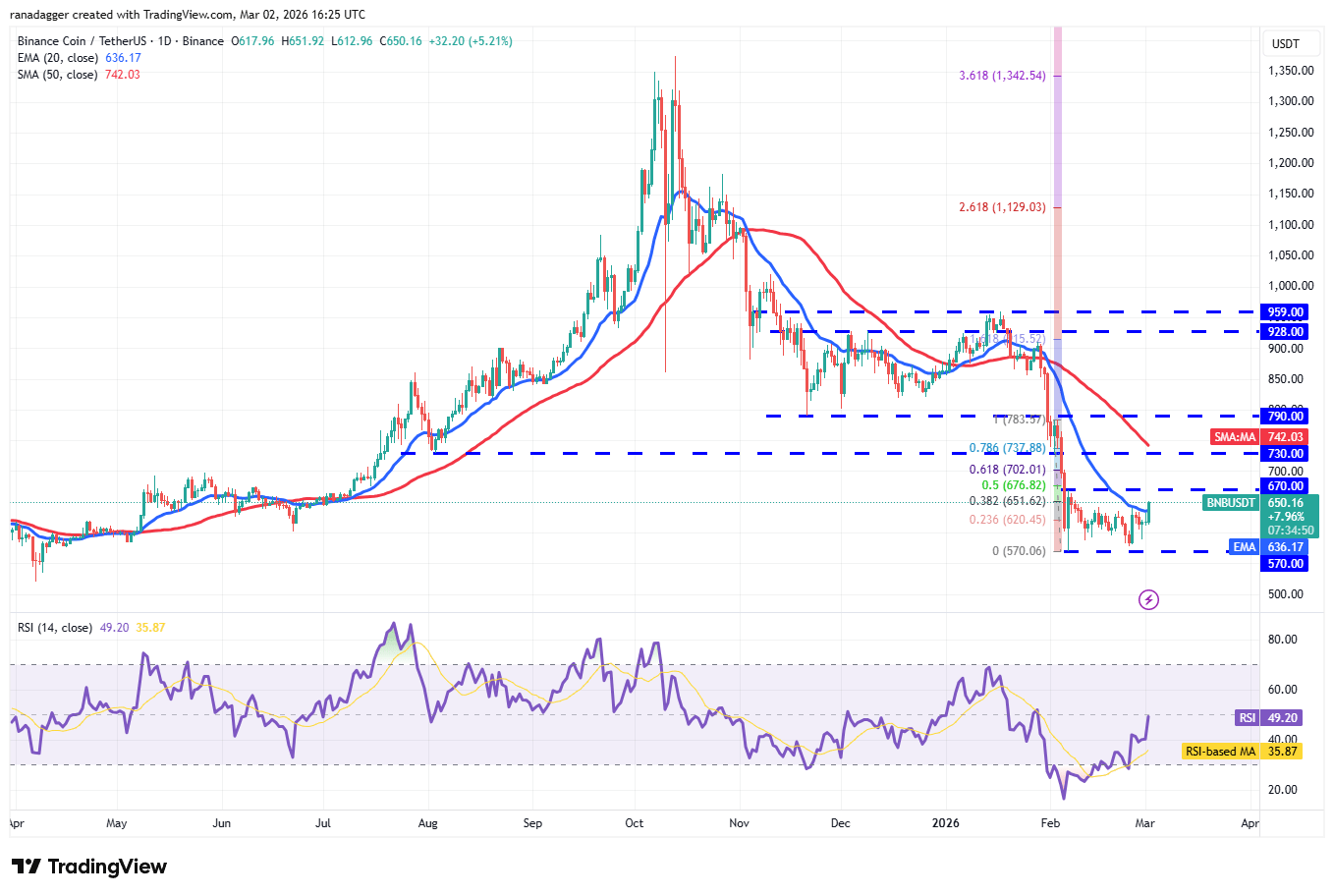

Uniswap’s $20 Projection

The case for Uniswap (UNI) climbing to $20 was strengthened on December 25, 2025, when tokenholders voted to flip the protocol’s fee switch, allowing a portion of its revenue to be used for a buy-and-burn program.

The move means that some of Uniswap’s profits are now being used to raise the value of UNI, and the results have been clear: the token has gone up more than 17% in the last week, bringing it to just under $4.00, according to CoinGecko.

Another indicator to consider is Uniswap’s market cap to TVL ratio. UNI currently holds the 37th spot in terms of market cap, with a value of around $2.5 billion. Meanwhile, DefiLlama puts the platform’s TVL at $3.12 billion, giving a ratio of 0.81 and indicating that UNI is quite undervalued.

With the token’s worth now tied to measurable revenue and supply reduction, and given that fundamentals have not been priced in, there is some upside potential that could push UNI to $20. This is more so, given that Uniswap recently won full dismissal of a scam token class action lawsuit, with the judge ruling the platform cannot be held liable for the misconduct of third-party token issuers.

WFI to Reach $100?

WFI is the native token of the WeFi ecosystem, which is building core infrastructure for a fully on-chain financial system and decentralized on-chain banks (deobanks). Crowned as the digital bank of the year for 2025 by Finance Feeds, WeFi has pushed WFI’s strong performance in the market.

The initiative offers its users the opportunity to manage their own crypto assets and use numerous services related to conventional banking, such as payment processing, fund transfers across borders, and savings account options.

According to data from CoinGecko, WFI has had an eventful 12 months, gaining well over 400% in the timeframe, which pushed it to a new all-time high of $3.00 in January 2026.

That yearly rise stands in sharp contrast to Bitcoin, Ethereum, and Ripple’s XRP, which are all heavily in the red for the same period.

If WeFi keeps growing its user base, and corporate stablecoin settlements expand as management anticipates, WFI’s demand profile could change materially, taking it from $3 to $20, $50, and potentially $100 in 2026.

Crypto World

Zcash Dev Team’s New Company Raises $25M in Seed Round

Zcash Open Development Lab, which Zcash devs formed after leaving Electric Coin Capital, raised funds from prominent crypto VCs.

The recently founded firm Zcash Open Development Lab (ZODL) — formed by the core developers of Zcash (ZEC) after they recently exited Electric Coin Capital — announced today, March 9, that it has secured over $25 million in seed funding to support the privacy-focused ecosystem.

A number of prominent venture capital firms and investors participated in the seed round, including Paradigm, a16z crypto, Winklevoss Capital, Coinbase Ventures, Cypherpunk Technologies, Maelstrom, Chapter One, Balaji Srinivasan, Haseeb Qureshi, and Mert.

In a separate X post today, the founder of ZODL and former CEO of ECC, Josh Swihart, explained the move, the recent organization shifts, and the org’s goals post-funding:

“ Ultimately, we intend to deliver a private, decentralized financial system as an alternative to legacy institutions. This funding allows us to bring these ambitions to life, without relying on Zcash dev fund grants to get there.”

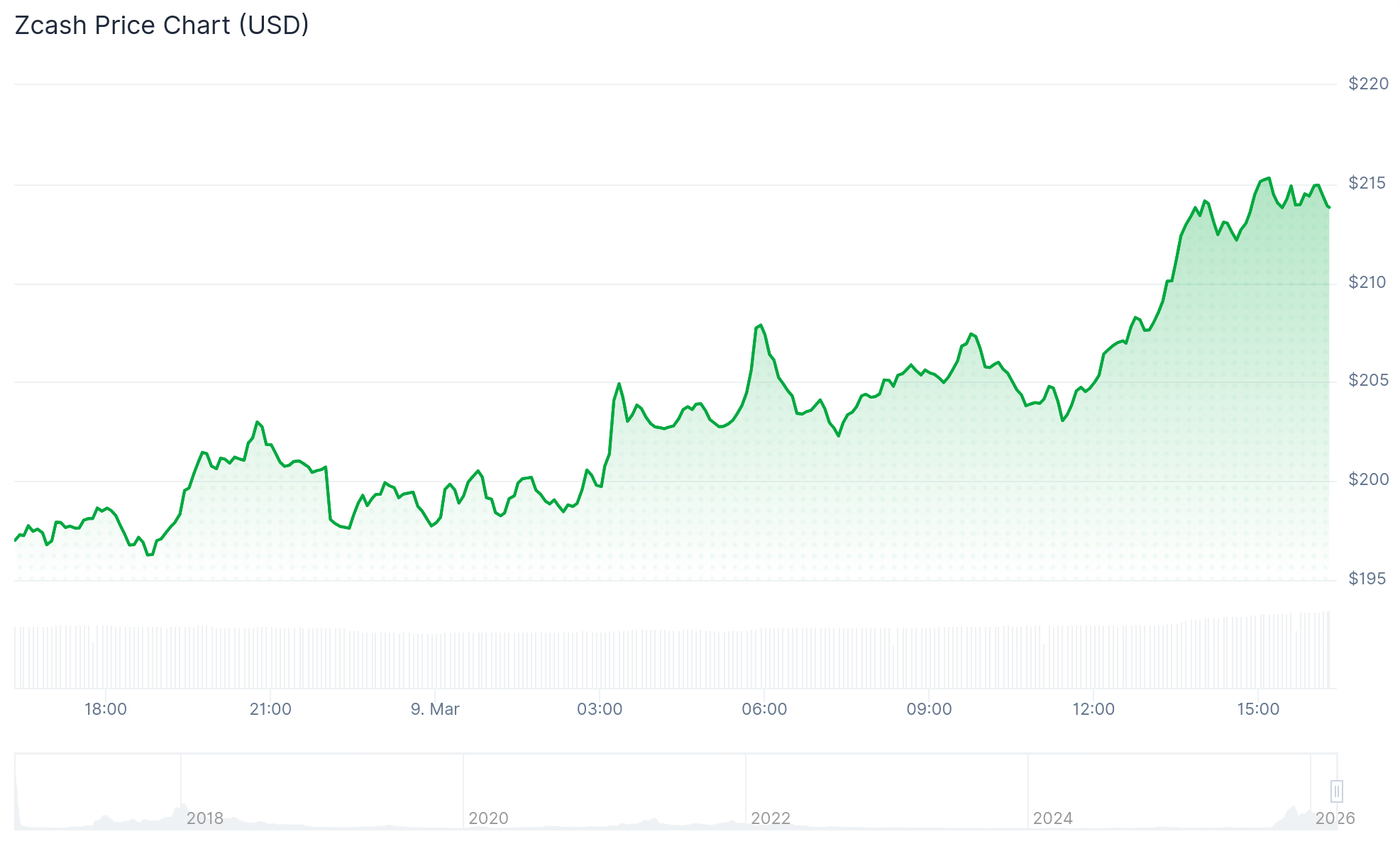

The price of ZEC rallied nearly 10% to over $215 on the news, making it the second-best performer among the top-100 crypto assets today.

ECC to ZODL

The fundraising round marks a major milestone for the new firm, which formed after a governance dispute in January that resulted in the entire core development and leadership team at ECC leaving.

ECC’s wallet app, Zalshi — now rebranded to Zodl — was a key focus of the dispute, as ECC and the nonprofit board overseeing it, Bootstrap, disagreed about the app’s development strategy.

Under Swihart’s leadership, the former ECC team swiftly moved to form a new entity and wallet, which are effectively rebrands of ECC and Zalshi, respectively. Swihart also clarified at the time that the team had no intentions of leaving the Zcash ecosystem or its core development.

This article was generated with the assistance of AI workflows.

Crypto World

White House Cyber Strategy Puts Crypto Under Federal Umbrella

The Trump administration’s cybersecurity framework names cryptocurrency and blockchain as technologies requiring federal protection, a first for a U.S. presidential strategy document.

The White House recently published President Trump’s Cyber Strategy for America, which states that the administration will pursue “supporting the security of cryptocurrencies and blockchain technologies” as part of a broader effort to “build secure technologies and supply chains that protect user privacy from design to deployment.”

This marks the first time a U.S. presidential cybersecurity document has explicitly named blockchain as a protected technology class, placing it alongside post-quantum cryptography and AI in the administration’s national security priorities.

The document also contains language with potential enforcement implications for crypto, calling on the government to “uproot criminal infrastructure and deny financial exit and safe haven,” framing cybercrime and intellectual property theft as “some of the greatest threats to global economies.” The administration also signed a companion executive order on the same day targeting cybercrime and fraud, which is expected to shape how agencies enforce the policy.

On the regulatory side, it commits the administration to streamlining compliance burdens across the board, pledging to “streamline cyber regulations to reduce compliance burdens, address liability, and better align regulators and industry globally” so that “the private sector has the agility necessary to keep pace with rapidly evolving threats.”

For crypto, the bottom line is a dual message: recognition as critical infrastructure worthy of federal protection, paired with a signal that the administration will pursue the illicit finance channels that the industry has long struggled to police.

Crypto World

Pudgy Penguins Launches ‘Pudgy World’ Browser Game

The PENGU token is up 7% in the past 24 hours.

Pudgy Penguins has officially launched Pudgy World, a free-to-play browser-based game.

Set across a fictional frozen landscape called The Berg, the game features 12 unique towns for players to explore. The central storyline tasks players with helping the character Pengu track down a missing friend named Polly, with mini-games woven throughout. The multiplayer setup means players can explore The Berg together in real time.

The launch marks a significant milestone for one of crypto’s most successful crossover brands. Pudgy Penguins was purchased by current CEO Luca Netz in 2022 and has since evolved from a forgotten relic of 2021’s NFT summer into one of the top collections in the NFT space.

What has set Pudgy Penguins apart from its peers is an aggressive push into mainstream consumer products. The brand’s IP coverage expanded steadily under Netz, with physical toys featured in Walmart and Amazon, a children’s book deal with Random House, and a mobile game called Pudgy Party, which became the top-ranked mobile racing game in Apple’s App Store within three days of its release.

The ecosystem’s PENGU token is up 7% in the past 24 hours, trading at a $440 million market capitalization.

Pudgy World is designed to bring the brand’s broad audience, spanning physical retail, social media, mobile gaming, and crypto, into a single, shared interactive space.

-

Politics7 days ago

Politics7 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Business3 days ago

Form 8K Entergy Mississippi LLC For: 6 March

-

Fashion3 days ago

Fashion3 days agoWeekend Open Thread: Ann Taylor

-

News Videos11 hours ago

News Videos11 hours ago10th Algebra | Financial Planning | Question Bank Solution | Board Exam 2026

-

Crypto World7 hours ago

Crypto World7 hours agoParadigm, a16z, Winklevoss Capital, Balaji Srinivasan among investors in ZODL

-

Tech5 days ago

Tech5 days agoBitwarden adds support for passkey login on Windows 11

-

Sports4 days ago

Sports4 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

Sports2 days ago

Sports2 days agoThree share 2-shot lead entering final round in Hong Kong

-

Sports2 days ago

Sports2 days agoBraveheart Lakshya downs Lai in epic battle to enter All England Open final | Other Sports News

-

Business6 days ago

Business6 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

NewsBeat4 days ago

NewsBeat4 days agoPiccadilly Circus just unveiled ‘London’s newest tourist attraction’ and it only costs 80p to enter

-

Politics3 days ago

Politics3 days agoTop Mamdani aide takes progressive project to the UK

-

Business1 day ago

Business1 day agoSearch for Nancy Guthrie Enters 37th Day as FBI Probes Wi-Fi Jammer Theory

-

Entertainment3 days ago

Entertainment3 days agoHailey Bieber Poses For Sexy Selfies In New Luscious Lip Thirst Traps

-

Sports7 days ago

Sports7 days agoJack Grealish posts new injury update as Man City star enters crucial period

-

Tech8 hours ago

Tech8 hours agoDespite challenges, Ireland sixth in EU for board gender diversity

-

Crypto World5 days ago

Crypto World5 days agoNew Crypto Mutuum Finance (MUTM) Reports V1 Protocol Progress as Roadmap Enters Phase 3

-

Tech5 days ago

Tech5 days agoACIP To Discuss COVID ‘Vaccine Injuries’ Next Month, Despite That Not Being In Its Purview

-

Entertainment5 days ago

Harry Styles Has ‘Struggled’ to Discuss Liam Payne’s Death

-

Business3 hours ago

Business3 hours agoSearch Enters 39th Day with FBI Tip Line Developments and No Major Breakthroughs