Crypto World

This Trending Meme Coin Explodes by 100% Weekly: What Comes Next?

Is this the new crypto sensation or just another scam?

The cryptocurrency market experienced a severe pullback in the past few weeks, culminating in a sharp crash on February 6.

The meme coin sector was significantly affected by the red wave, and most leading tokens in that niche have posted substantial losses. However, the lesser-known pippin (PIPPIN) defied the carnage and its valuation soared by over 100% in the past week.

Swimming Against the Tide

PIPPIN is a Solana-based meme coin that began trading in late 2024. It is themed around an AI-generated unicorn character named “Pippin,” which has become the logo of the token.

The meme coin had its glory days toward the end of 2025, when its price reached an all-time high of almost $0.60, and its market capitalization surpassed $500 million. While January was also positive, the beginning of February offered a deep correction.

In the past week, though, the asset entered another major uptrend, which contrasts with the overall bearish environment in the crypto market. As of press time, PIPPIN is worth roughly $0.38, or a 114% increase on a weekly basis.

Analysts are curious if the bull run is sustainable since there isn’t an evident catalyst driving the move north. X user ALTS GEMS Alert claimed the price has initiated a “strong bounce” from the demand zone at around $0.26, predicting that if buyers remain active, PIPPIN could soar to $0.40 and even $0.60.

Satori chipped in, too. The analyst told their over 700,000 followers on X that they have added the coin to their watchlist, arguing it has potential for much more impressive gains ahead.

You may also like:

A Ticking Time Bomb?

At the same time, some industry participants warned investors to stay away from PIPPIN, claiming its valuation is driven by pure speculation, and its utility is questionable.

X user Dippy.eth described the asset as “the largest scam of the past year,” arguing it has reached the first “take profit” zone. “0 technologies, 0 real metrics, 0 real users, 0 attention from real CT degens,” they added.

Crypto_Jobs is also pessimistic, envisioning a possible plunge to as low as $0.21. Some indicators, such as PIPPIN’s Relative Strength Index (RSI), support the bearish scenario. The technical analysis tool measures the speed and magnitude of recent price changes to help traders identify potential reversal points.

It ranges from 0 to 100, and readings above 70 suggest the valuation has risen too much in a brief period and could be due for imminent correction. Currently, the RSI stands at around 85.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Bitmine Ignores $7.8B Paper Losses, Buys $83M Worth of ETH as Market Dips

Tom Lee’s BitMine added 40,000 ETH during the dip, brushing off $7.8 billion losses as Ethereum trades near lows.

BitMine, the Ethereum-focused treasury firm chaired by Fundstrat’s Tom Lee, bought roughly $83 million worth of ETH on Monday, with its existing holdings sitting deep in the red.

The purchases came during another volatile session for Ethereum, with on-chain data showing heavy selling from other large holders and ETH trading near multi-month lows.

BitMine Adds to ETH Stash While Others Exit

Data from the analytics platform Lookonchain, posted on February 10 and 11, shows Bitmine executed two large purchases of 20,000 ETH each from institutional platforms BitGo and FalconX.

Last week, the firm bought 40,613 ETH, and the week prior, it added 41,788 tokens. It now holds approximately 4.32 million ETH, acquired at an average cost of $3,850 per coin. However, at current levels around $2,040, Lookonchain estimates BitMine’s average entry price leaves its position down more than $7.8 billion on paper.

Despite that, Lee has publicly dismissed the recent sell-off as disconnected from Ethereum’s on-chain activity. In comments reported earlier this month, he said BitMine viewed the pullback as attractive, given his view of strengthening Ethereum fundamentals, such as record-high daily transactions. He attributed the price weakness to factors like a rally in gold and a lack of leverage rather than problems with the Ethereum network itself.

Lee also stressed that Bitmine has no debt obligations that would force it to sell any of its ETH, a position that is in contrast to other large players like Trend Research, which, according to Lookonchain, has sold nearly all of its Ethereum since early February, locking in losses of about $747 million after depositing more than 650,000 ETH to Binance during the drop.

Ethereum Price Struggles Amid Heavy On-Chain Movement

Looking at the market, ETH is down about 1% over the past 24 hours, and nearly 13% in the last seven days. The world’s second-largest cryptocurrency by market cap has also lost more than 34% of its value over the past month, according to CoinGecko data.

You may also like:

It fell below $2,000 on February 5 for the first time in months, but despite the volatility and evident selling from some large holders, other data points to a potential reduction in available sell pressure. For example, analyst CoinNiel recently reported that exchange reserves for ETH have dropped to multi-year lows, suggesting longer-term holders are moving assets off trading platforms.

The market now presents a clear divide: one side is cutting losses after a severe downturn, while the other, led by firms like Bitmine, is doubling down on a long-term conviction play, betting that current prices do not reflect the network’s underlying utility.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Dow Jones Index gains steam ahead of key earnings, US inflation, and NFP data

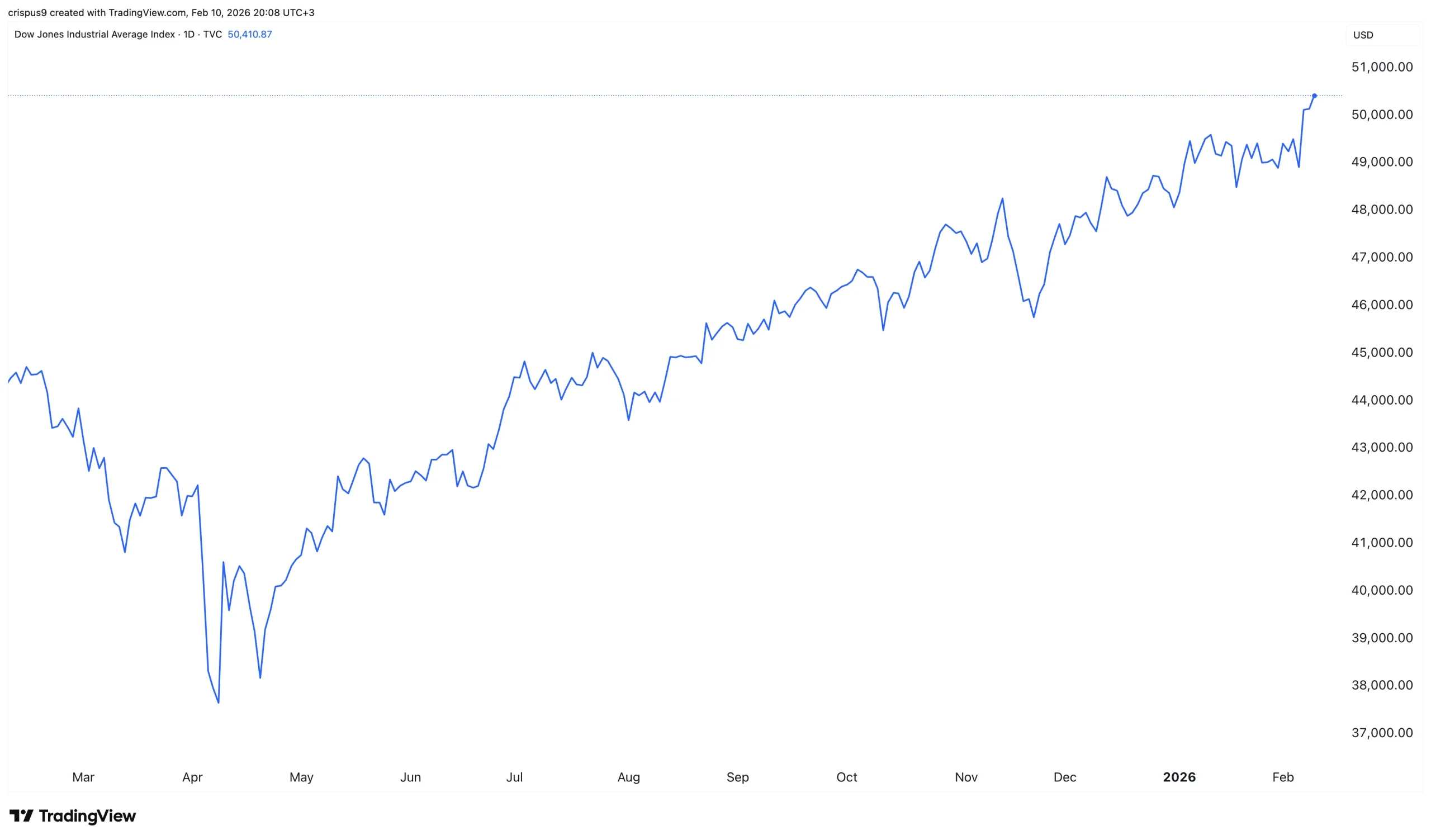

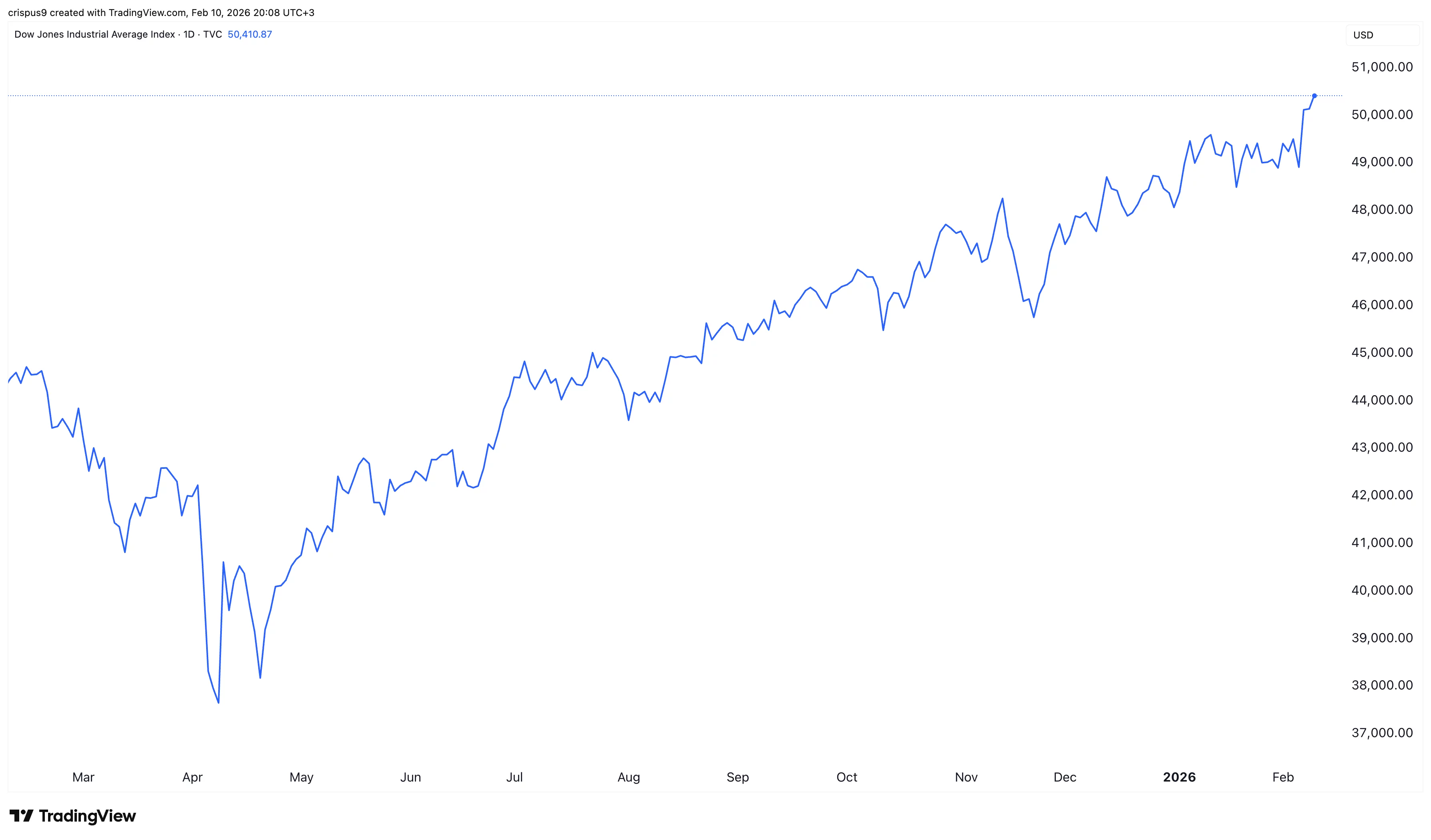

The Dow Jones Index continued its strong bull run, reaching a new all-time high on Tuesday, as investors waited for the upcoming corporate earnings and key macro data.

Summary

- The Dow Jones Index continued its strong bull run ahead of the upcoming earnings.

- It has jumped by 37% from its lowest level in April last year.

- The US will publish key macro data on Wednesday and Friday.

Dow Jones, which tracks 30 diverse companies, reached a record high of $50,520, three days after it crossed the important $50,000 milestone. Other blue-chip indices like the S&P 500 and the Nasdaq 100 continued their uptrend.

Dow Jones Index rallies

The Dow Jones has done well in the ongoing earnings season. Data compiled by FactSet show that most American companies have reported strong financial results, with 76% of S&P 500 companies reporting a positive surprise.

The blended earnings growth of all S&P 500 Index companies that have reported is 13%. If this is the final number, it will be the fifth consecutive quarter of double-digit growth.

Dom key companies in the Dow Jones will publish their numbers this week. The most notable ones will be Cisco and McDonald’s. Other notable companies to watch this week will be Applied Materials, Arista Networks, T-Mobile, Shopify, and Ford.

US stocks to react to key macro data

The Dow Jones Index will also react to upcoming U.S. macroeconomic data.

The first will be the delayed U.S. non-farm payrolls report, which comes out on Wednesday. Economists polled by Reuters expect the upcoming report to show that the economy created 70,000 jobs in January, higher than the 50k it created in December. The unemployment rate is expected to remain at 4.4%.

These numbers come as some major American companies have recently announced layoffs. Amazon is shedding over 16,000 layoffs on top of the 15,000 it announced last year.

Other top companies, including UPS, Dow Inc., Verizon, Citigroup, and Salesforce, have announced large layoffs. According to Challenger & Gray, companies announced over 108k layoffs.

The most important data will come out on Friday when the United States will publish the latest consumer inflation report. Economists expect the data to show that inflation softened a bit in January, with the headline CPI falling to 2.5%.

A lower inflation figure than expected will be highly bullish for the Dow Jones as it will lead to higher odds of Federal Reserve interest rate cuts this year.

Crypto World

No Systemic Failures, Rising On-Chain Assets

Chainlink’s Nazarov said real-world assets could surpass cryptocurrencies in total value.

Bitcoin and the rest of the cryptocurrencies can’t shake off the doldrums. Despite the ongoing weakness, this cycle has at least avoided major institutional failures that were seen in past bear markets.

And as investors weather the drawdowns, real-world assets (RWAs) are quietly expanding on-chain regardless of crypto prices.

RWAs Keep Moving On-Chain

In a recent post on X, Chainlink co-founder Sergey Nazarov highlighted that, unlike the previous cycle, which saw the collapse of FTX and multiple lenders during large price drops, this cycle has not produced large systemic risks. He said that crypto systems have managed price and liquidity drawdowns more effectively, thereby creating a more “reliable” environment for both retail and institutional capital.

Nazarov also said that the migration of real-world assets onto blockchains is accelerating independently of cryptocurrency prices. He pointed to ongoing RWA issuance and the growth of on-chain perpetual markets for traditional commodities such as silver, which are rivaling traditional markets, particularly during periods when permissioned trading becomes more restrictive or risky.

According to Nazarov, the growth of RWAs is driven by the value of 24/7/365 markets, on-chain collateral management, and access to reliable market data, rather than fluctuations in Bitcoin or other crypto assets.

He identified three trends expected to shape the next stage of crypto adoption. First, on-chain perpetual markets and tokenized real-world assets provide long-term, durable value. Second, institutional adoption is being driven by fundamental technological advantages, including permissionless, always-on DeFi markets. Third, infrastructure supporting RWAs is in increasing demand, as more complex assets require reliable systems for tokenization, data management, and market operation.

Nazarov added that if current trends continue, RWAs on-chain could surpass cryptocurrencies in total value, and potentially redefine the industry while continuing to support cryptocurrency growth by bringing more capital on-chain.

You may also like:

Developer Activity Across RWA Projects

Data shared by Santiment shows strong developer activity across RWA projects over the past 30 days. Hedera (HBAR) ranked first, followed by Chainlink (LINK) and Avalanche (AVAX). Stellar (XLM) and IOTA (IOTA) placed fourth and fifth. Chia Network (XCH), VeChain (VET), Lumerin (LMR), Creditcoin (CTC), and Injective (INJ) completed the top ten.

The rankings also revealed that RWA-focused blockchain projects continue to see steady development activity despite market turbulence.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Why BlockDAG leads ahead of Bitcoin Cash, Hyperliquid, and Monero with 200x ROI potential

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Leading cryptos to buy now span BCH, XMR, HYPE, and BlockDAG as traders seek utility, growth potential, and strong momentum.

Summary

- Bitcoin Cash, Monero, and Hyperliquid show strong utility, but BlockDAG leads with speed, smart contracts, and early-sale upside.

- Fast payments, true privacy, and DeFi rewards highlight top contenders, yet BlockDAG’s tech and timing make it stand out today.

- As traders seek scalable, high-growth crypto, BlockDAG’s speed, smart features, and early access drive major attention.

The past year has shown that cryptocurrencies can be some of the most profitable assets in a portfolio, covering a wide range of niches, from payments and privacy to decentralized finance. But with thousands of tokens on the market, it can be overwhelming to figure out which ones are actually worth buying right now.

Traders are increasingly looking for projects that combine solid technology, growth potential, and strong market momentum. In this guide, we highlight some of the top candidates for the best crypto to buy today, including established coins like Bitcoin Cash (BCH) and Monero (XMR), the rising DeFi token Hyperliquid (HYPE), and the high-performance newcomer BlockDAG (BDAG).

Whether someone is a long-term investor or just starting out, understanding each project’s unique features can help them make smarter moves and seize opportunities before the wider market catches on.

1. BlockDAG: Final week to enter before exchange listings

BlockDAG isn’t just another crypto project; its network is powered by a unique DAG-based protocol capable of handling more than 10,000 transactions per second (TPS) at launch. Essentially, it combines speed and efficiency with smart contract functionality on a single platform. This means high-speed payments and automated contract operations can run side by side without slowing the network.

On top of its technical capabilities, BlockDAG is offering a final private sale before its February 16 exchange listings. Under this, tokens are priced at just $0.00025, with the entire purchase delivered to wallets on launch day, so there’s no vesting period to worry about.

Buyers can even start trading nine hours before public markets open, giving them a chance to position themselves before wider demand shapes the price. Plus, with the launch price set at $0.05, current buyers are looking at an instant 200× jump when the listings go live.

For anyone looking at both technology and timing, BlockDAG stands out. It’s quite rare for such a high-performance platform to allow traders to enter at a bargain this close to public trading. In short, it’s a mix of speed, smart tech, and a clear, last-chance entry that isn’t common in crypto launches, making BlockDAG the best crypto to buy today.

2. Bitcoin Cash: Fast, low-cost payments for everyone

Bitcoin Cash is a peer-to-peer digital currency designed for fast, low-cost transactions, making it a practical alternative to Bitcoin for everyday payments. Currently, BCH is facing resistance near $535, but if buyers push past this level, it could climb toward $562 and even $604, showing strong upside potential. The $497 level is a key support to watch, as holding above it signals that the market sentiment remains positive.

BCH’s advantage lies in its faster block times and lower fees, which are appealing for users tired of Bitcoin’s slower confirmations. With increasing merchant adoption and ongoing development upgrades, BCH could be an attractive option for investors looking for a crypto with real-world utility and solid growth prospects.

3. Hyperliquid: The high-risk, high-reward crypto

Hyperliquid is a relatively new and highly speculative token gaining attention for its strong community and innovative use cases in decentralized finance. It recently broke the $35.50 resistance, showing that buyers are interested in higher levels, but the market still faces selling pressure. If the price sustains above this level, it could surge toward $44, signaling a potential end to the corrective phase.

HYPE’s appeal lies in its fast-paced ecosystem and frequent opportunities for staking or liquidity provision, which can generate rewards for holders. For traders looking for a higher-risk, higher-reward asset, HYPE presents an exciting chance to enter before wider adoption. Watching the $28.79 support is crucial, as holding this floor could confirm bullish momentum.

4. Monero: Untraceable transactions, maximum security

Monero is a privacy-focused cryptocurrency that ensures transactions are completely untraceable, making it a favorite for users seeking financial confidentiality. Currently, XMR is finding support at $360, with potential resistance at $412 and $461.

If buyers can push above the 20-day EMA, Monero could rise toward $500, offering a strong upside opportunity. Its core value comes from advanced privacy features like ring signatures and stealth addresses, which make it unique among major cryptocurrencies.

Monero also benefits from growing interest in privacy coins amid increased regulation in mainstream finance. For investors seeking a coin with strong fundamentals and a clear niche in the market, XMR offers both technological innovation and the potential for significant gains.

Which is the best crypto to buy today?

All four projects highlighted here have unique strengths that make them worth considering. Bitcoin Cash stands out for fast, low-cost transactions and growing merchant adoption, while Monero offers unmatched privacy for those who value financial confidentiality. Hyperliquid is a speculative but exciting DeFi token, backed by a strong community and opportunities for staking rewards.

Yet among these options, BlockDAG clearly takes the lead as the best crypto to buy today. Its DAG-based protocol delivers blazing-fast transaction speeds and smart contract functionality on a single platform. Plus, with the ongoing private sale, buyers can secure early trading access and a potential 200× ROI!

For traders looking for a combination of cutting-edge technology, scalability, and perfect timing, BlockDAG offers a rare chance to get in early and capture massive gains. Savvy traders are already taking action, as the private sale wraps up in just seven days, which is when BDAG hits exchanges.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

JPMorgan cuts Coinbase (COIN) price target to $290 ahead of earnings

The crypto market downturn has been particularly hard on leading American exchange Coinbase (COIN), which has seen its stock plunge more than 50% since bitcoin’s early October record above $126,000, including a 27% decline in 2026 alone.

Attempting to catch up to that fast tumble, JPMorgan’s Ken Worthington slashed his price target on COIN to $290 from $399 ahead of the company’s fourth quarter earnings report coming after the close on Thursday.

Worthington remains a bull on the stock and his reduced target still suggests 75% upside from COIN’s current price of $1655.

Worthington projects adjusted EBITDA of $734 million, down from $801 million in the third quarter. That would mark a sharp drop from prior quarters, driven mainly by lower trading volumes, weaker crypto prices and slower growth in USDC stablecoin balances, he said.

Worthington estimates spot crypto trading volume of $263 billion for the quarter. He also pointed to lower USDC in circulation, modeling stablecoin-related revenue of $312 million. Those headwinds were partially offset by a full quarter of contributions from Deribit, the crypto derivatives exchange Coinbase acquired in August.

Including Deribit, JPMorgan models total transaction revenue of $1.06 billion, with Deribit contributing about $117 million on an estimated $586 billion in trading volume. In the previous quarter, the exchange reported $1 billion in transaction revenue.

On the subscription and services side, the bank expects revenue of $670 million, below Coinbase’s prior guidance range of $710 million to $790 million, reflecting softer crypto prices, lower staking yields and slower USDC growth. Worthington also expects operating expenses to come in below guidance as the company reins in costs.

Other sell-siders weigh in

Barclays analyst Benjamin Budish said his estimates sit roughly 10% below consensus on adjusted EBITDA, driven by weaker retail trading and blockchain rewards revenue. “We are notably lower on retail trading revenues, based on read-throughs from Robinhood, and blockchain rewards revenues,” Budish wrote, adding that consensus estimates may not yet fully reflect publicly available volume data.

Barclays estimates Coinbase exchange volume of about $261 billion in the quarter. He said Robinhood’s (HOOD) reported retail crypto volumes, which have historically tracked closely with Coinbase’s, fell about 15% quarter over quarter.

Compass Point struck a more bearish tone. Analyst Ed Engel said he is negative on the stock into earnings, expecting disappointment in the subscription and services segment. “While investors place a premium multiple on COIN’s S&S segment, we expect 4Q results to affirm overall revenue remains tied to overall crypto prices,” Engel wrote. He also expects January trading revenue to reflect what he described as Coinbase’s weakest retail engagement since the third quarter of 2024.

Beyond the headline numbers, investors are likely to focus on commentary on trading activity early in 2026, the sustainability of USDC-related income, and whether newer initiatives, such as Deribit and Coinbase’s futures business, can meaningfully offset swings in spot crypto markets.

Crypto World

What Are The Chances Of Ethereum Price Recovery To $2,500

Ethereum has shown early signs of recovery after a prolonged period of weakness that pushed prices sharply lower. ETH has attempted to stabilize near key support levels, but further upside depends on sustained backing from investors and broader market conditions.

At present, Ethereum appears to have at least one of these factors working in its favor, keeping recovery prospects alive.

Sponsored

Sponsored

Ethereum Investors Change Stance

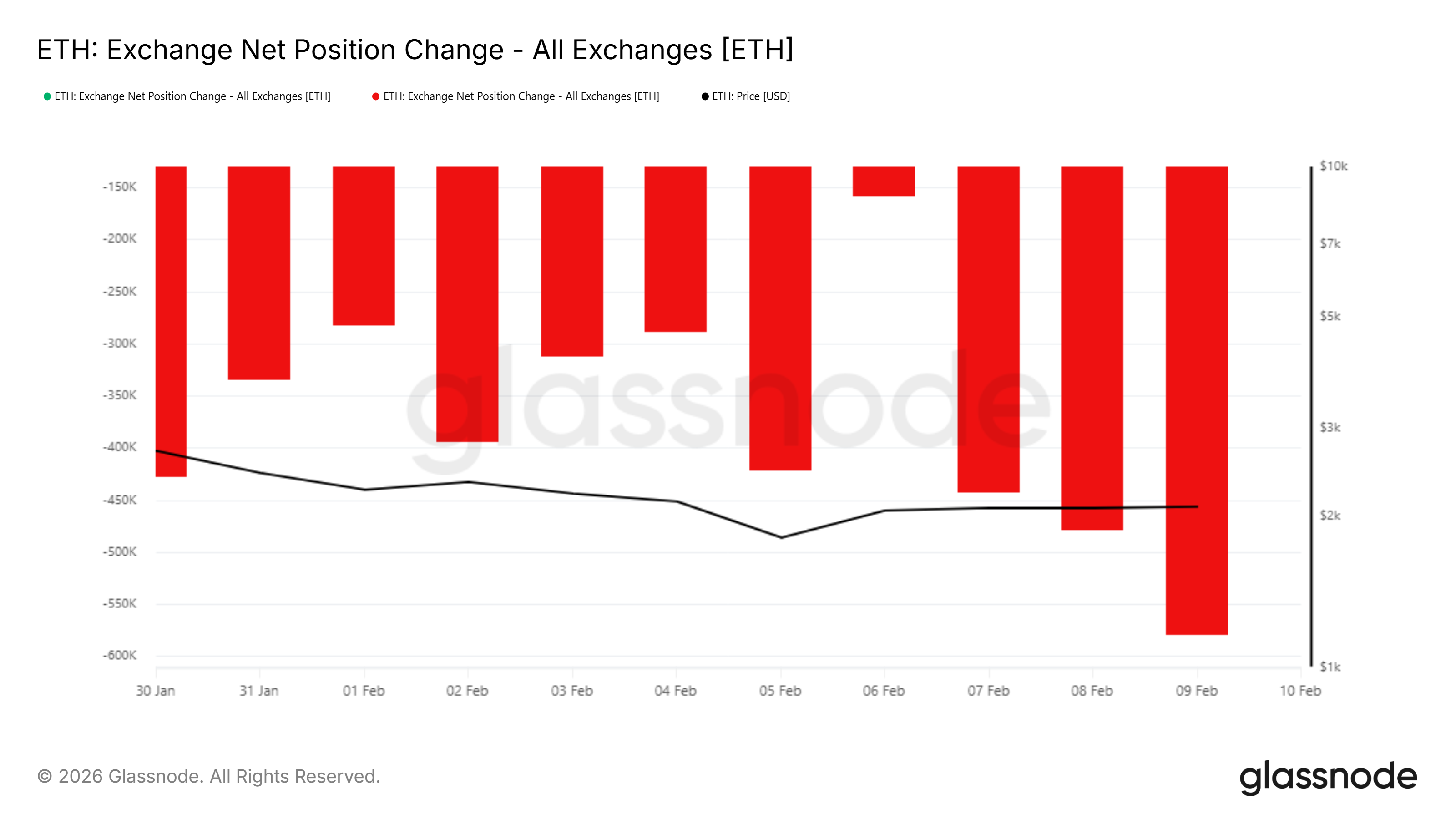

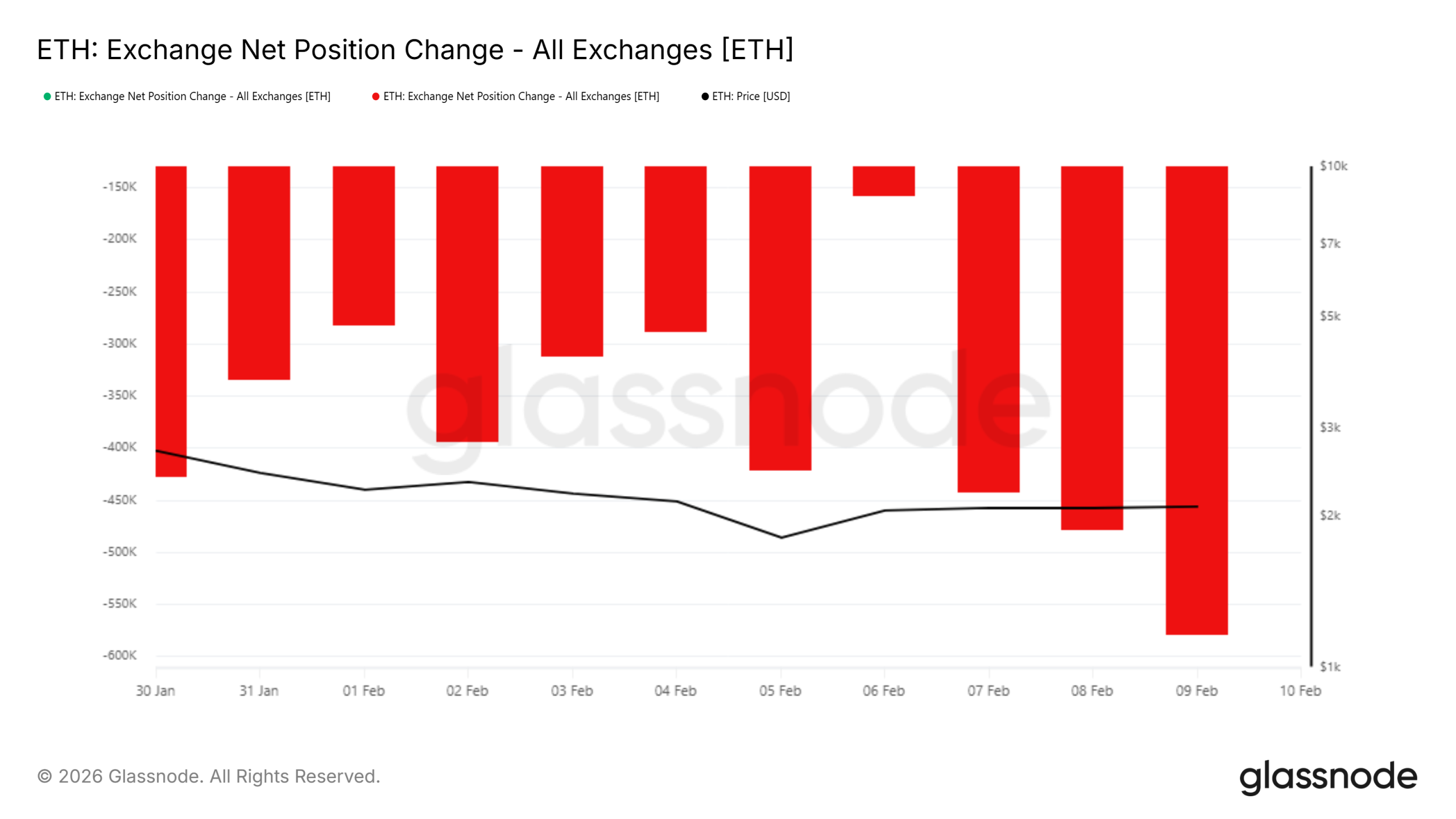

On-chain data suggests a notable shift in investor behavior. The exchange net position change indicator, which tracks capital flows into and out of exchanges, has turned negative for Ethereum. This signals that more ETH is leaving exchanges than entering them, a pattern typically associated with accumulation rather than distribution.

Such outflows suggest holders are choosing to buy and move ETH into private wallets instead of preparing to sell. Lower prices often encourage this behavior as investors position for potential rebounds. This shift in stance reflects improving confidence, even as the price has yet to fully reflect rising demand.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

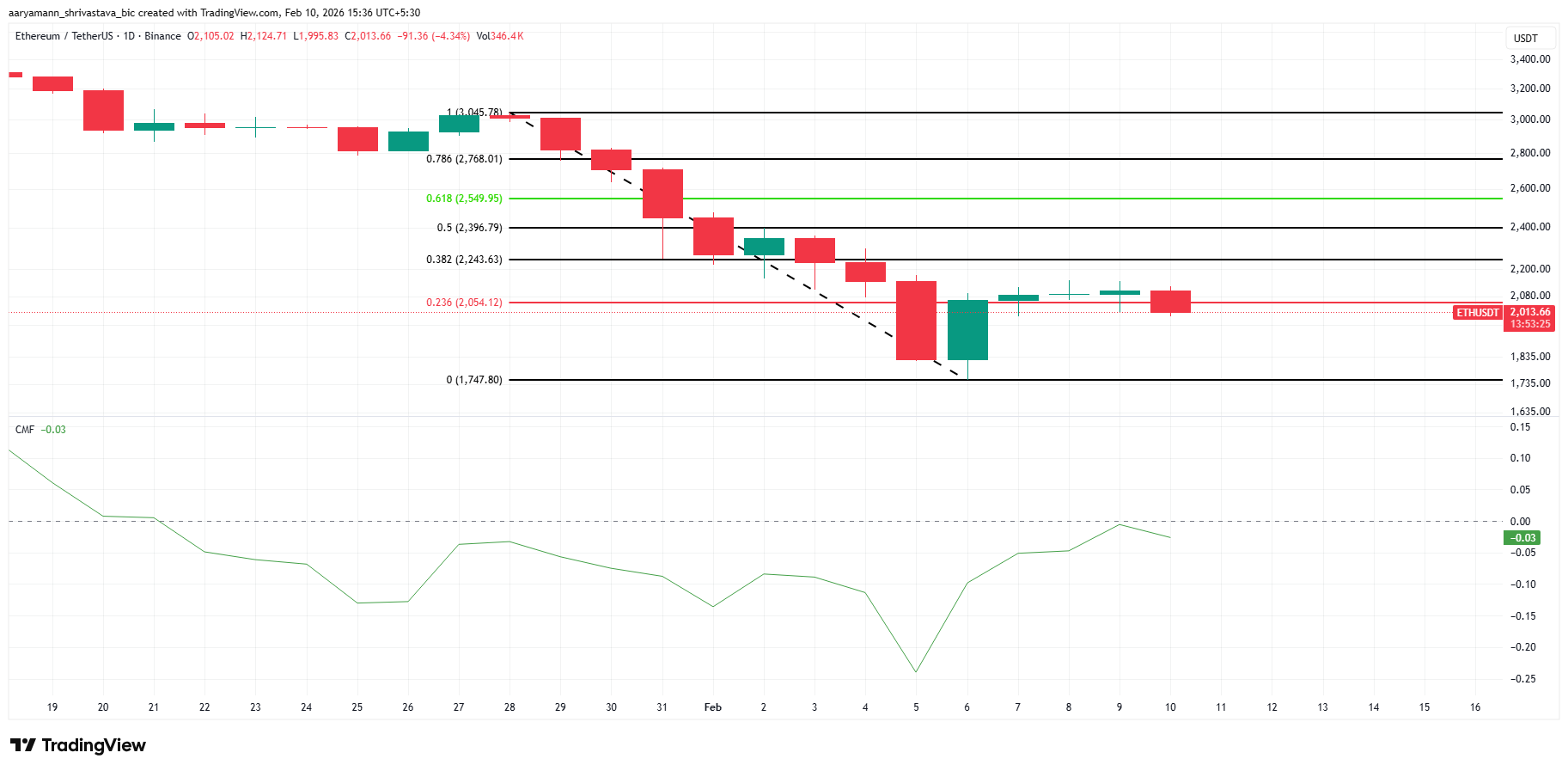

Broader momentum indicators support this narrative. The Chaikin Money Flow has shown a steady uptick over the past week, reinforcing the trend observed in exchange data. Rising CMF values indicate declining outflows and improving capital flow dynamics across Ethereum markets.

Sponsored

Sponsored

A move above the zero line would mark inflows overtaking outflows, a bullish development for ETH. At the same time, Ethereum has managed to hold above the 23.6% Fibonacci retracement near $2,054. Maintaining this level often acts as a trigger for renewed participation, encouraging investors to deploy capital as downside risk appears more contained.

What Is ETH Price’s Next Target?

Ethereum is trading near $2,018 at the time of writing, signaling that demand remains present beneath current prices. The challenge lies in translating that demand into sustained upward movement. A successful bounce from the $2,000 level could push ETH through $2,205, a key short-term resistance. Beyond that, the psychological target of $2,500 comes into focus.

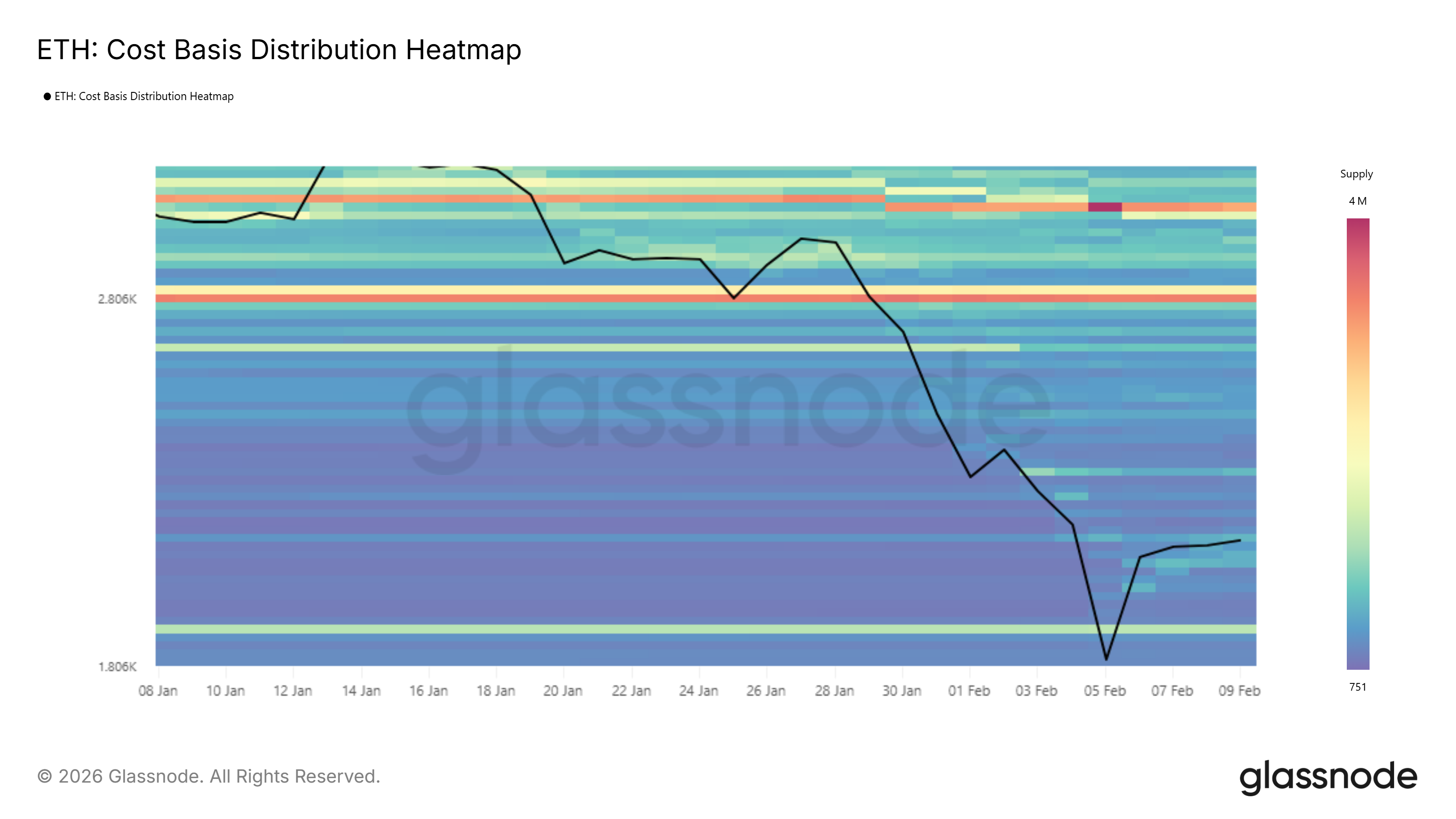

Reaching $2,500 may not prove difficult from a structural standpoint. Cost basis distribution data shows relatively light accumulation around this zone, suggesting limited overhead supply. As a result, ETH could move through this range with less resistance once momentum builds. Stronger accumulation clusters appear closer to $2,800, which is likely to act as a more meaningful barrier.

Before that scenario plays out, Ethereum must clear intermediate hurdles. A decisive move above $2,344 would confirm recovery strength and validate the path toward $2,500 and potentially higher levels. Failure to sustain current support, however, would undermine the bullish setup. A loss of the $2,000 level would expose ETH to renewed downside risk, with $1,796 emerging as the next major support area.

Crypto World

AAVE price risks fresh plunge under $100, bears eye 2-year lows

- Aave price could plummet under $100 and risk new multi-year lows.

- Bears can decisively take out the psychological level and test the $75-$80 range.

- However, dips can offer a buy-the-dip opportunity before a sharp rebound.

Aave fell to around $108 as decentralised finance tokens broadly moved into negative territory.

With broader market pressures weighing on sentiment, AAVE faces rising downside risks and is at risk of slipping below the key $100 support level.

The outlook reflects continued volatility across the sector, with a notable decline in total value locked, highlighting growing vulnerability to further price weakness.

Aave price retests $108

Aave’s AAVE token was trading near $370 in August 2025 but has since declined sharply amid persistent bearish sentiment across the crypto market.

Prices fell steadily through late 2025 before sliding more aggressively toward the $100 zone.

A double-top pattern formed in the latter months of last year, and the subsequent drop to around $95 last week marked a significant downturn for the DeFi token.

Although AAVE rebounded briefly to about $120, selling pressure has remained strong, with prices retesting the $108 support level.

The token is down roughly 15% over the past week and about 25% year-to-date.

It has also fallen around 67% since August 2025 and more than 80% from its all-time high above $667 in 2021.

The price weakness has coincided with a sharp decline in Aave’s total value locked, reflecting reduced liquidity and softer protocol revenues.

AAVE price forecast: bears eye 2-year lows

Bulls are not completely out of the picture despite the recent bloodbath.

However, sentiment is battered, and momentum is with bears.

For Aave, technical indicators signal this increasing bearish momentum.

While momentum oscillators remain in neutral territory and point to the possibility of a short-term bullish shift, moving averages continue to signal strong selling pressure for Aave.

A slide toward the psychologically important $100 level, after the token fails to hold above the $112 support zone, will reinforce this bearish outlook.

As reflected on the daily chart, a breakdown similar to the pattern that has defined AAVE’s price action since late 2025 could accelerate seller dominance and deepen near-term downside risks.

The current downturn could push the price toward the $75–$80 demand zone in the near term, an area that aligns with a key Fibonacci retracement level.

A move into this range would place Aave back at levels last seen in early 2024.

On the upside, renewed momentum would likely require a sustained weekly close above $140.

Such a move would depend on rising trading volumes, with $120 acting as initial support and $144 as a secondary resistance level before higher targets come into view.

Meanwhile, the daily Relative Strength Index is hovering near neutral territory around 34, giving sellers some room to maintain pressure.

Analysts note this setup could increase the risk of a short-term false breakout before a clearer directional move emerges.

Crypto World

Kyle Samani Criticizes Hyperliquid in Explosive Post-Departure Market Commentary

Kyle Samani, the recently departed co-founder of Multicoin Capital, has launched a blistering attack on the high-flying Hyperliquid decentralized exchange (DEX), labeling it a systemic risk despite his former firm’s reported aggressive accumulation of its underlying HYPE token.

Key Takeaways:

- Kyle Samani publicly slammed Hyperliquid’s closed-source model days after leaving Multicoin Capital.

- On-chain analysts report Multicoin-linked wallets holding over $40 million in HYPE tokens.

- Hyperliquid recently surpassed Coinbase in volume following its HIP-4 prediction market launch.

Why is Samani Targeting Hyperliquid Now?

Samani stepped down from Multicoin Capital on February 5, 2026, ending a decade-long tenure.

Just three days later, on February 8, he broke his silence to target Hyperliquid, the biggest DEX in the world. His acerbic criticism highlights a deep ideological rift in the industry, with Kyle championing permissionless open-source protocols, which he claims Hyperliquid is not.

Samani also implies criminal or untoward things about the exchange, facilitating “crime and terror”, although he mistakenly calls the Bay Area-born Hyperliquid founder Jeff Wan an immigrant.

This clash of philosophies comes at a time when capital flows are ignoring ideology; investors pour $258 million into crypto startups regardless of technical decentralization, chasing the massive returns that high-performance apps are currently delivering.

With a dizzying plethora of features that give it some of the utility of a CEX, Hyperliquid has surged in recent months by prioritizing vertical integration and performance over open-source transparency.

“Walled Garden” or Market Leader?

Samani didn’t hold back, asserting that Hyperliquid “is in most respects everything wrong with crypto.”

His critique specifically targets the project’s closed-source architecture and permissioned validator set.

He argues this “walled garden” approach, combined with the founder’s choice to set up shop in the non-extradition jurisdiction of Singapore, creates unacceptable seizure risks.

Samani also alleged that the platform’s opacity acts as a shield for potential illicit financial activity.

This rhetoric taps into growing fears regarding unchecked crypto platforms, a narrative underscored recently when two high schoolers were charged in an Arizona home invasion targeting $66m in crypto, reminding the market of the darker side of unparalleled anonymity.

Despite Samani’s reservations, the market continues voting with its wallet. Hyperliquid recently overtook Coinbase in trading volume, doubling the centralized exchange’s figures in early 2026.

With a market cap above $7 billion, the HYPE token remains one of the 20 largest cryptocurrencies and among the top cryptos to diversify with. This calls to mind how the Post-Quantum QONE token sold out in 24 hours, proving that traders value cutting-edge tech narratives above the social media feuds.

The $40 Million Contradiction

The timing of these comments has also fueled speculation concerning internal disagreements at Multicoin.

A wallet widely believed to be linked to Multicoin was recently spotted accumulating over $40 million in HYPE tokens. This creates a stark contradiction: the firm Samani founded is betting heavily on the very asset he claims could ruin the industry.

Samani’s response to the firm’s purchasing behavior was blunt: “I don’t work at multicoin.” Since leaving, he has stated his intention to branch into other technologies, but announced he will remain chair of Forward Industries, a Solana treasury.

Samani’s clash with Hyperliquid underscores the deep divisions still rife in crypto as the industry awaits regulation by US lawmakers.

The post Kyle Samani Criticizes Hyperliquid in Explosive Post-Departure Market Commentary appeared first on Cryptonews.

Crypto World

AI mania is helping cap crypto’s upside, Wintermute says: Crypto Daybook Americas

By Francisco Rodrigues (All times ET unless indicated otherwise)

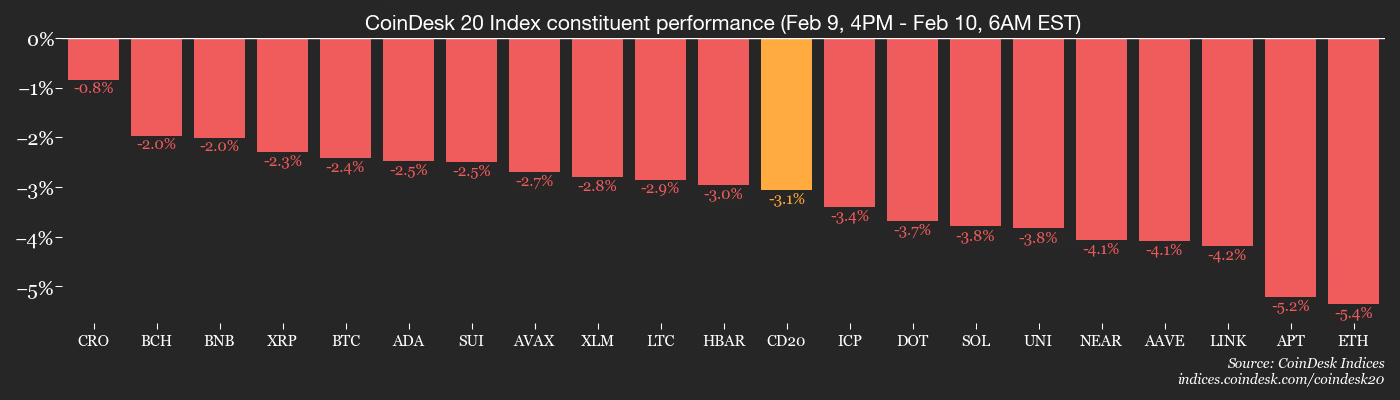

Bitcoin slipped to $68,500 on Tuesday, having failed to reclaim $70,000 after trading above that level for a while over the weekend. The CoinDesk 20 Index (CD20) dropped 0.23% over the past 24 hours.

The market appears to be stabilizing after last week’s decline to $60,000, which erased all the cryptocurrency’s gains since Donald Trump’s presidential election victory in November 2024.

The slide prompted over $2.7 billion in liquidations, flushing out leveraged positions. It may not, however, have reflected a fundamental change in the crypto market. Rather, it might have been tied to declining liquidity in the broader financial ecosystem.

Raoul Pal, CEO of Global Macro Investor, said last week’s selloff across crypto and tech stocks stemmed from temporary drains in U.S. dollar liquidity tied to Treasury operations and government funding dynamics.

And then there’s artificial intelligence (AI). Investments in that technology have been “absorbing available capital for months at the expense of everything else,” Wintermute wrote in a note. The trading firm wrote that stripping AI companies from the Nasdaq 100 index sees crypto’s negative skew nearly disappear.

“The underperformance during rallies and amplified selling during drops is almost entirely explained by AI rotation,” Wintermute OTC trader Jasper De Maere wrote. “For crypto to outperform again, air needs to come out of the AI trade.”

Elsewhere, Japanese government bond yields, which rose after Prime Minister Sanae Takaichi’s decisive election victory at the weekend, are dropping. That could avoid further unwinding of the yen carry trade, which might have seen up to $5 trillion invested overseas moving back to the country.

Arthur Hayes, a co-founder of crypto exchange BitMEX, pointed to Takaichi’s victory as a potential catalyst for the yen to lose value against the dollar, making the Japanese currency a less attractive investment. That could be a boon for risk assets, including cryptocurrencies.

Still, prices are likely to remain rangebound for the time being. The Coinbase Premium Index, which measures demand from large U.S. investors on the exchange, remains negative, and spot bitcoin ETF flows also show hesitation, with daily net inflows coming in at just $145 million yesterday.

“While retail spreads attention across other asset classes, institutional flows through ETFs and derivatives now seem to dictate direction,” Wintermute wrote. Stay alert!

Read more: For analysis of today’s activity in altcoins and derivatives, see Crypto Markets Today

What to Watch

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

- Crypto

- Feb. 10: Mantle to host Mantle State of Mind Ep. 06 live from Consensus HK.

- Macro

- Feb. 10, 7 a.m.: Brazil inflation rate YoY (Prev. 4.26%), MoM (Prev. 0.33%)

- Feb. 10, 8:30 a.m.: U.S. retail sales MoM for December Est. 0.5% (Prev. 0.6%)

- Feb. 10 8:30 a.m.: U.S. employment cost index QoQ (Prev. 0.8%)

- Feb. 10, 2 p.m.: Argentina inflation rate YoY (Prev. 31.5%), MoM (Prev. 2.8%)

- Earnings (Estimates based on FactSet data)

- Feb. 10: Canaan (CAN), pre-market, -$0.03

- Feb. 10: Robinhood Markets (HOOD), post-market, $0.63

- Feb. 10: Upexi (UPXI), post-market, -$0.07

- Feb. 10: Lite Strategy (LITS), post-market

Token Events

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

- Governance votes & calls

- Unlocks

- Token Launches

- Feb. 10: Venice (VVV) token emissions to drop from 8 million to 6 million per year.

Conferences

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

Market Movements

- BTC is down 1.9% from 4 p.m. ET Monday at $69,041.32 (24hrs: -0.06%)

- ETH is down 4.94% at $2,016.57 (24hrs: -0.8%)

- CoinDesk 20 is down 2.59% at 3,086.55 (24hrs: +0.43%)

- Ether CESR Composite Staking Rate is up 7 bps at 2.82%

- BTC funding rate is at -0.006% (-6.6247% annualized) on Binance

- DXY is unchanged at 96.83

- Gold futures are unchanged at $5,077.00

- Silver futures are down 0.43% at $81.88

- Nikkei 225 closed up 2.28% at 57,650.54

- Hang Seng closed up 0.58% at 27,183.15

- FTSE is down 0.38% at 10,346.98

- Euro Stoxx 50 is unchanged at 6,060.67

- DJIA closed on Monday unchanged at 50,135.87

- S&P 500 closed up 0.47% at 6,964.82

- Nasdaq Composite closed up 0.90% at 23,238.67

- S&P/TSX Composite closed up 1.7% at 33,023.32

- S&P 40 Latin America closed up 1.97% at 3,767.79

- U.S. 10-Year Treasury rate is down 1.4 bps at 4.184%

- E-mini S&P 500 futures are up 0.09% at 6,989.25

- E-mini Nasdaq-100 futures are unchanged at 25,359.00

- E-mini Dow Jones Industrial Average Index futures are unchanged at 50,260.00

Bitcoin Stats

- BTC Dominance: 59.27% (+0.05%)

- Ether-bitcoin ratio: 0.02921 (-2.66%)

- Hashrate (seven-day moving average): 1,005 EH/s

- Hashprice (spot): $34.72

- Total fees: 2.92 BTC / $204,792

- CME Futures Open Interest: 118,215 BTC

- BTC priced in gold: 13.6 oz.

- BTC vs gold market cap: 4.6%

Technical Analysis

- The ratio of altcoins (excluding Top 10) to BTC weekly chart continues to maintain its core support, suggesting the broader altcoin market did not experience an extreme selloff during the bitcoin’s recent slide.

- The weekly RSI has been climbing, indicating some momentum in altcoins relative to BTC.

- There’s no clear breakout at the moment, but it’s worth keeping an eye on.

Crypto Equities

- Coinbase Global (COIN): closed on Monday at $167.25 (+1.29%), -1.44% at $164.84 in pre-market

- Circle Internet (CRCL): closed at $60.10 (+5.36%), -1.31% at $59.31

- Galaxy Digital (GLXY): closed at $21.15 (+7.03%), +0.61% at $21.28

- Bullish (BLSH): closed at $32.05 (+16.76%), unchanged in pre-market

- MARA Holdings (MARA): closed at $8.06 (-2.18%), -1.49% at $7.94

- Riot Platforms (RIOT): closed at $14.97 (+3.60%), -1.27% at $14.78

- Core Scientific (CORZ): closed at $18.55 (+10.35%)

- CleanSpark (CLSK): closed at $10.19 (+1.09%), -1.77% at $10.01

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $43.83 (+8.41%)

- Exodus Movement (EXOD): closed at $10.74 (+1.70%)

Crypto Treasury Companies

- Strategy (MSTR): closed at $138.44 (+2.6%), -2.61% at $134.82

- Strive (ASST): closed at $10.15 (-14.86%), +1.03% at $10.25

- SharpLink Gaming (SBET): closed at $7.11 (+1.14%), -0.7% at $7.06

- Upexi (UPXI): closed at $1.05 (-7.89%), +2.86% at $1.08

- Lite Strategy (LITS): closed at $1.05 (-0.94%), -2.86% at $1.02

ETF Flows

Spot BTC ETFs

- Daily net flows: $144.9 million

- Cumulative net flows: $54.82 billion

- Total BTC holdings ~1.27 million

Spot ETH ETFs

- Daily net flows: $57 million

- Cumulative net flows: $11.9 billion

- Total ETH holdings ~5.8 million

Source: Farside Investors

While You Were Sleeping

Crypto World

Blockchain.com wins UK registration nearly four years after abandoning FCA process

Cryptocurrency exchange and wallet provider Blockchain.com has won regulatory approval in the U.K nearly four years after seemingly giving up.

Blockchain.com was added to the Financial Conduct Authority’s (FCA) registry of licensed crypto companies on Tuesday under its trading name “BC Operations.”

The London-based company elected to withdraw its application for FCA licensing in March 2022 having not won approval ahead of an impending deadline. Blockchain.com pivoted to its registered business in Lithuania.

Registration in the U.K. allows Blockchain.com to carry out certain crypto-related activities in the U.K. on the basis that it complies with money laundering and counter-terrorist financing rules.

“Blockchain.com is now operating under the same rigorous standards as traditional finance and banks in the U.K.,” the company said in a post on X on Tuesday.

The FCA’s crypto company licensing regime, however, stops short of full financial services authorization — this is set to be introduced under a new licensing framework taking effect from October next year.

Read More: Ripple wins UK regulatory approval from Financial Conduct Authority

-

Tech6 days ago

Tech6 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics2 days ago

Politics2 days agoWhy Israel is blocking foreign journalists from entering

-

NewsBeat21 hours ago

NewsBeat21 hours agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports4 days ago

Sports4 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech4 days ago

Tech4 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat2 days ago

NewsBeat2 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports2 days ago

Sports2 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Business2 days ago

Business2 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports3 days ago

Former Viking Enters Hall of Fame

-

Politics2 days ago

Politics2 days agoThe Health Dangers Of Browning Your Food

-

Sports4 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business2 days ago

Business2 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat4 days ago

NewsBeat4 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business5 days ago

Business5 days agoQuiz enters administration for third time

-

Crypto World10 hours ago

Crypto World10 hours agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat1 day ago

NewsBeat1 day agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports21 hours ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World10 hours ago

Crypto World10 hours agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat5 days ago

NewsBeat5 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat4 days ago

NewsBeat4 days agoDriving instructor urges all learners to do 1 check before entering roundabout