Crypto World

Tom Lee’s BitMine ETH holdings are down $8B as crypto crashes

BitMine’s ethereum (ETH) holdings have made unrealized losses of over $8 billion today as part of a wider crypto crash that the firm’s chairman, Tom Lee, described as “a feature, not a bug.”

The former JP Morgan strategist became chairman of the bitcoin (BTC) mining firm BitMine Immersion Technologies in June 2025 as it pivoted towards buying up ether (ETH).

Since August 24, 2025, when ETH’s hit an all-time high of $4,946, BitMine has spent over $10.6 billion purchasing over 2.76 million ETH, according to data from DropsTab.

Five months on, and ETH has fallen by almost 60%, resulting in BitMine’s ETH holdings losing over $8 billion in unrealized losses.

The firm has invested $16.4 billion in ETH since it pivoted last year and has no realized profit to date. It owns 4.29 million ETH, just over 3.5% of the entire circulating supply.

Read more: Tom Lee’s BitMine is performing as bad as Strategy

After users began to point out that BitMine’s ETH holdings hit over $6 billion in unrealized losses, Lee claimed that these sort of downturns are “a feature, not a bug,” and noted that the point of his ETH is to “outperform over the cycle (think up ETH).”

Just one day before, he noted that this crypto winter isn’t like other crypto winters, and that while prices are lagging, daily transactions are still surging.

He also noted that Binance’s actions on October 10 may have contributed to the “languished” price actions today.

ETH, BTC fall in wider crypto crash

CoinGecko claims that around $820 billion has been shed from the overall cryptocurrency market cap since January 15 this year.

ETH has shed $146 billion from its market cap over the past month, while BTC’s has lost $490 billion since last month.

Read more: Eric Trump removes ‘thank me later’ from ETH promo

This crash may not have been foreseen by the Trump family, as if somebody held onto any ETH they bought when Donald Trump’s son Eric endorsed buying ETH last year, they’d be down 31% today.

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

AXP Shares Plunge 8% as Block’s AI-Driven Workforce Cuts Trigger Financial Sector Alarm

TLDR

- Block revealed plans to eliminate more than 4,000 positions (approximately 40% of staff), attributing the decision to AI capabilities

- The announcement triggered concerns about potential AI-driven disruption facing legacy financial institutions like American Express

- AXP shares plummeted nearly 8% during Friday’s trading session

- Significant put option volume indicated traders positioning for additional downside, with put-to-call ratio reaching 2.6

- Year-to-date, AXP has declined 11.39% while implied volatility surged

Shares of American Express $AXP plummeted nearly 8% during Friday trading after Block’s dramatic workforce reduction announcement sent shockwaves through financial services stocks.

Block revealed plans to eliminate over 4,000 positions, representing approximately 40% of its employee base. The disclosure came as part of the company’s fourth-quarter and full-year 2025 financial results.

In explaining the dramatic restructuring, Block’s founder and CEO Jack Dorsey pointed to artificial intelligence as the driving force. His shareholder letter stated: “A significantly smaller team, using the tools we’re building, can do more and do it better.”

Dorsey emphasized that “intelligence tool capabilities are compounding faster every week,” making clear this represents an ongoing transformation rather than an isolated cost-cutting measure.

The announcement resonated powerfully with market participants. The logic was straightforward: if a digitally-native payments platform like Block can eliminate nearly half its workforce through AI implementation, what implications does this hold for established financial institutions?

This reasoning placed American Express squarely in investors’ sights. Even with its robust infrastructure and substantial technology investments spanning decades, the market viewed AXP as potentially exposed to similar pressures.

The selloff was swift and substantial. AXP shed nearly 8% throughout the session, settling at $307.95. Intraday trading ranged between $307.67 and $321.01.

Options Activity Reflects Heightened Anxiety

The equity decline was accompanied by notable derivatives market movement that reinforced bearish sentiment.

Approximately 22,400 put contracts traded on Friday, representing roughly five times typical daily volume. Considerable interest centered on March and June 2026 $280 strike puts, which saw approximately 4,700 contracts traded.

The put-to-call ratio surged to around 2.6, a definitive indication that traders were securing downside hedges rather than positioning for upside moves.

At-the-money implied volatility increased by over six points, signaling heightened expectations for significant price movements in AXP shares going forward.

Wider Market Picture

Friday’s decline extends a challenging period for the stock. AXP has now surrendered 11.39% year-to-date, marking a difficult opening to 2026 for shares that recently touched a 52-week peak of $387.49.

Typical daily trading volume averages approximately 3.1 million shares. Friday’s volume registered just 379,000, indicating the decline was sentiment-driven rather than the result of widespread selling pressure.

American Express maintains a market capitalization around $212 billion, operates with a gross margin of 60.65%, and offers shareholders a dividend yield of 1.06%.

Current technical indicators for the company show a “Buy” signal, though that guidance hasn’t prevented the recent downward trajectory.

AXP has incorporated AI technologies into its business operations for years and has navigated numerous technological transitions throughout its history. Nevertheless, Block’s workforce announcement proved sufficient to prompt Friday’s investor exodus.

The concentration of put option interest in March and June 2026 expirations indicates market participants are anticipating sustained volatility for AXP shares through the middle of the year.

Crypto World

Korea’s tokenization shift is about capital markets

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

Global tokenized real-world assets have now crossed the $25–30 billion mark in on-chain value, growing at triple-digit rates year over year. Major asset managers, global banks, and market infrastructures have moved beyond pilots and into live issuance of tokenized bonds, funds, and deposits. Yet for all this momentum, the most important development is not happening in crypto-native markets. It is happening inside regulated capital markets, and Korea is emerging as one of the clearest examples.

Summary

- Tokenization, not deregulation: Korea isn’t creating “crypto securities” — it’s embedding blockchain inside existing capital-markets law, keeping disclosure, custody, and investor protections intact.

- Infrastructure over hype: The shift is from sandbox experiments to system-level integration, where faster settlement, transparency, and compliance drive scale.

- Capital markets win first: Early beneficiaries are brokerages, custodians, and regulated issuers — not exchanges or DeFi — signaling tokenization’s institutional phase.

Korea is not “embracing crypto securities” in the way headlines often suggest. Nor is it dismantling its securities laws to accommodate blockchain experimentation. Instead, it is modernizing capital markets using blockchain technology while keeping the existing regulatory framework for securities firmly in place.

In practice, Korea is treating tokenized securities much like the transition from paper certificates to electronic registration decades ago: not as a new asset class, but as a more efficient way to issue, settle, and manage the same financial instruments.

From sandbox to system

For years, tokenization lived in regulatory sandboxes — useful for testing, but structurally limited. Korea is now moving past that phase. By formally recognizing tokenized securities within its capital-markets framework, regulators are signaling that blockchain belongs inside the system, not alongside it.

Securities law still governs disclosure, custody, suitability, and market conduct. Issuers do not gain shortcuts by going on-chain. Intermediaries remain accountable. Investor protections are preserved. The innovation lies in the plumbing: faster settlement, improved transparency, and reduced operational friction.

This approach may appear conservative compared to DeFi narratives, but it is precisely what enables scale. Institutions do not deploy balance sheets into regulatory ambiguity. Retail investors do not gain confidence from experimental venues. Korea’s model solves both problems by anchoring tokenization to familiar legal foundations.

Why Korea is uniquely positioned

Korea’s capital markets combine deep retail participation with sophisticated demand for structured and alternative products. That combination makes tokenization especially powerful.

Tokenized securities allow fractional exposure to assets that were previously illiquid, high-denomination, or operationally complex — including real estate, private credit, and revenue-generating intellectual property. Retail access expands, but through regulated issuance and distribution channels rather than speculative token listings.

This is likely to redirect attention and capital away from short-lived, exchange-driven token cycles toward regulated products with real cash flows, disclosures, and secondary-market structure. The shift is subtle but profound. Tokenization stops being about what can be listed quickly and starts being about what can be issued, held, traded, and settled reliably.

The real opportunity is not issuance hype. It is infrastructure. As tokenized securities become embedded into settlement and post-trade processes, the benefits compound. Shorter settlement cycles reduce counterparty risk. On-chain transparency improves auditability. Operational costs decline. Once these efficiencies are realized, reverting to legacy workflows becomes economically irrational.

Who actually wins

Contrary to popular perception, the early winners in Korea’s tokenization market will not be crypto exchanges, DeFi protocols, or speculative token projects. They will be:

- Brokerages and securities firms that can distribute tokenized products compliantly;

- Infrastructure providers building custody, settlement, and compliance layers;

- Issuers that understand both capital-markets regulation and on-chain execution.

This is not a replacement for traditional finance. It is a technological upgrade to how parts of it function.

Global implications

Korea’s move matters beyond its borders. Each major jurisdiction that formally recognizes tokenized securities strengthens the global case that blockchain is becoming a standard financial ledger, not a parallel system.

That shift reduces legal uncertainty for global real-world asset issuers and accelerates the need for cross-border standards. When tokenized securities are treated consistently across markets, interoperability stops being a technical aspiration and starts becoming a commercial necessity.

Just as importantly, Korea demonstrates that retail-heavy markets can adopt tokenization without sacrificing regulatory credibility. For policymakers elsewhere, this is a critical proof point. Innovation does not require deregulation. It requires clarity.

The questions still to be answered

This transition is not complete, and several issues remain open. Secondary market structure is the most pressing. Will tokenized securities trade only OTC, or will regulated exchange-style venues emerge? How will liquidity obligations, price transparency, and market-making requirements be defined?

Infrastructure access is another. Who qualifies as a tokenization operator? How open will this layer be to fintechs versus established incumbents? The balance struck here will shape competition and innovation for years.

Retail eligibility and suitability rules will also matter. Concentration limits, disclosure standards, and investor education will determine how inclusive tokenized markets become without introducing systemic risk. These are not technical footnotes. They are structural decisions that define whether tokenization delivers on its promise.

The bottom line

Korea is executing a legitimacy pivot — from sandbox to system. It is becoming one of the world’s most advanced proving grounds for real-world asset tokenization. For the first time, atypical assets such as K-pop intellectual property, webtoons, and real estate have a clear statutory home. What were once speculative fractional exposures can now become regulated, audited, and legally enforceable financial instruments.

Tokenized securities will not replace traditional finance overnight. But in Korea, they are on track to quietly replace how parts of it work. This shift has little to do with crypto price cycles. It has everything to do with where capital markets are structurally heading over the next decade — and Korea is positioning itself ahead of that curve.

Crypto World

Nvidia Partners with Groq on New Inference Platform as OpenAI Seeks Speed

Key Points

- A fresh inference computing platform is in development at Nvidia to accelerate AI model execution for OpenAI and similar enterprises.

- Groq, a chip startup, will supply the processor for this platform, which Nvidia plans to unveil at its upcoming GTC conference in San Jose.

- Performance issues with Nvidia’s existing hardware have left OpenAI dissatisfied, particularly for development-related workloads.

- A massive $20 billion licensing agreement between Nvidia and Groq halted OpenAI’s independent negotiations with the startup.

- Last September, Nvidia pledged up to $100 billion toward OpenAI in exchange for equity ownership.

According to a Wall Street Journal article released Friday, Nvidia is creating a specialized processor designed to enhance the speed and efficiency of AI inference operations.

When AI systems like ChatGPT answer user questions, they’re performing inference computing. This differs substantially from training operations, where Nvidia has maintained market leadership for years.

Nvidia’s GTC developer conference in San Jose next month will serve as the launch venue for this platform. At its core sits a processor manufactured by emerging company Groq.

Neither Reuters nor Nvidia provided immediate confirmation of these details. OpenAI similarly remained silent when asked for comment.

The context surrounding this development is significant. Earlier this month, Reuters revealed that OpenAI has expressed frustration over performance limitations in Nvidia’s current hardware lineup—particularly when handling software development queries and facilitating AI-to-AI interactions.

OpenAI is pursuing hardware solutions capable of managing approximately 10% of its inference workload. Nvidia appears determined to retain this business.

The Hunt for Enhanced Processing Power

Prior to Nvidia’s intervention, OpenAI had initiated discussions with two chip manufacturers—Cerebras and Groq—seeking superior inference processing capabilities.

Those negotiations ended abruptly. Nvidia secured Groq through a $20 billion licensing arrangement, eliminating OpenAI’s option to work directly with the startup.

This represents a calculated strategic maneuver. By acquiring Groq’s technology through licensing, Nvidia simultaneously blocked a potential competitor from reaching OpenAI while gaining access to Groq’s chip innovations for its own infrastructure.

The Deeper Financial Connection

The commercial ties between Nvidia and OpenAI extend well beyond hardware procurement.

Last September, Nvidia announced plans to commit up to $100 billion to OpenAI. This arrangement provided Nvidia with ownership shares in the AI developer while furnishing OpenAI with resources to acquire cutting-edge processors.

Nvidia now occupies dual roles as both hardware vendor and financial stakeholder—a strategic position that creates powerful incentives to maintain control over OpenAI’s chip requirements.

On February 27, the day prior to this news emerging, NVDA stock declined 4.16%.

Should the inference platform receive official confirmation at next month’s GTC event, it would mark Nvidia’s targeted answer to mounting demands from clients requiring faster, purpose-built AI processing capabilities.

Groq’s inclusion in the platform architecture indicates Nvidia’s readiness to forge startup partnerships rather than engage in pure competition—particularly when such collaborations prevent competitors from accessing major clients.

Nvidia’s GTC developer conference is scheduled for San Jose next month, where the company is anticipated to formalize this announcement.

Crypto World

Lockheed Martin Shares Jump 2.7% Following Military Contract Announcements

TLDR

- Lockheed Martin shares gained 2.7% during Friday’s session, climbing to approximately $659 with trading volume surging 34% above typical levels.

- Fourth-quarter revenue exceeded forecasts at $20.32B versus the expected $19.84B, though earnings per share fell short at $5.80 compared to the $6.33 consensus.

- Successful testing of Lockheed’s Next Generation Command and Control (NGC2) platform by the U.S. Army, with additional testing scheduled for April 2026.

- The company received an $18.8M contract modification from the U.S. Navy for continued work on the Trident II (D5) Life Extension 2 initiative, extending through August 2030.

- Shares have surged more than 31% since the start of the year, approaching record territory, while the company announced a $3.45 quarterly dividend payment.

Shares of Lockheed Martin (LMT) advanced 2.7% in Friday’s trading session, touching an intraday peak of $662.47 before closing near $659.24. This represented a notable jump from the prior session’s close at $641.63.

Lockheed Martin Corporation, LMT

Trading activity was notably robust. Approximately 2.59 million shares exchanged hands, representing a 34% increase compared to the typical daily volume of around 1.93 million shares.

The upward momentum followed announcements of two distinct military contract developments within the same week, further cementing LMT’s critical role as a primary defense supplier to the U.S. military.

The U.S. Army wrapped up prototype testing of Lockheed’s Next Generation Command and Control (NGC2) platform with the 25th Infantry Division. This advanced system integrates sensor information directly with weapons platforms, enabling military personnel to detect and neutralize threats more rapidly.

This “sensor-to-shooter” functionality represents a crucial element of contemporary combat operations. Insights gained from this recent evaluation are already informing platform improvements, with additional testing scheduled for April 2026 as part of the “Lightning Surge 3” field exercise.

Meanwhile, Lockheed was awarded an $18.8 million contract modification related to the Trident II (D5) Life Extension 2 initiative. This program supports the nation’s submarine-based nuclear deterrent capabilities, with work continuing through August 30, 2030.

The majority of activities will take place at Lockheed’s Alabama facility in Huntsville. While the contract value may appear modest in isolation, the extended timeline and strategic significance of the program carry considerable weight with market participants.

Q4 Earnings: Revenue Beat, EPS Miss

LMT’s latest quarterly financial report, released January 29, revealed revenue of $20.32 billion compared to analyst projections of $19.84 billion — exceeding expectations by approximately $480 million. This represented a 9.1% increase from the prior-year period.

Earnings per share registered at $5.80, falling short of the $6.33 consensus estimate by $0.53. The company had delivered $7.67 EPS during the comparable quarter one year earlier.

Wall Street analysts are projecting full-year EPS of $27.15 for the ongoing fiscal period.

Analyst Targets and Dividend

Numerous analysts have adjusted their price targets higher in recent weeks. Citigroup increased its target from $592 to $673, while keeping a “neutral” stance. RBC Capital Markets raised its target from $615 to $650 with a “sector perform” designation. Robert W. Baird moved to $640 while maintaining an “outperform” rating.

The consensus view from MarketBeat shows a “Hold” recommendation with an average price target of $612.50 — notably beneath current trading levels.

Lockheed announced a quarterly dividend of $3.45 per share, scheduled for payment on March 27 to investors on record as of March 2. This translates to an annualized dividend of $13.80, producing a yield of approximately 2.1%. The company’s payout ratio currently stands at 64.22%.

The defense contractor carries a market capitalization of $151.68 billion, with a price-to-earnings ratio of 30.68 and a beta coefficient of 0.23. The stock’s 50-day moving average sits at $578.05, while the 200-day moving average is $508.04.

LMT has climbed more than 31% since the beginning of the year and is trading in proximity to record highs. Institutional ownership accounts for 74.19% of outstanding shares.

Crypto World

Not the Bottom Yet? CryptoQuant Data Exposes Bitcoin’s Brutal Deleveraging

The combination of both metrics suggests the current regime is consolidative or mid-cycle bearish, with definitive capitulation likely to occur soon.

Current market dynamics point to a reset in motion, with Bitcoin undergoing deleveraging. However, the leading digital asset is yet to form a bottom for this bear cycle, despite cooling market conditions.

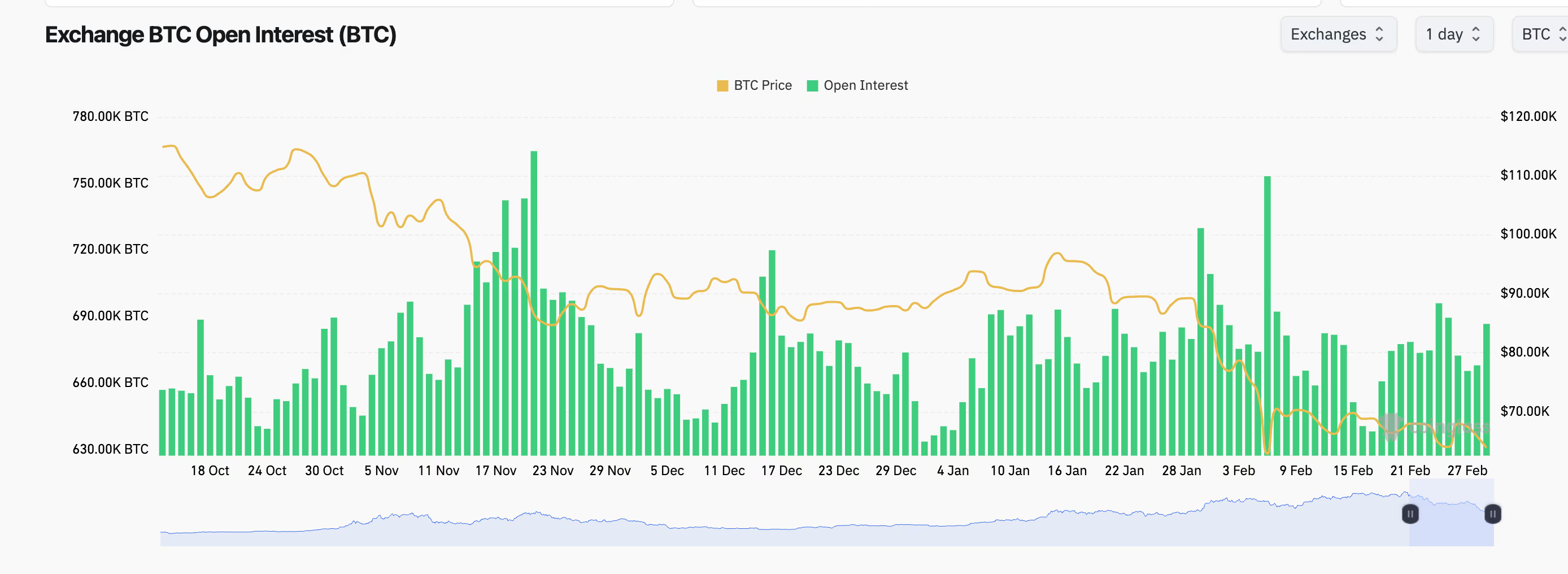

According to a report from CryptoQuant, metrics such as falling open interest and Bitcoin basis compression on the Chicago Mercantile Exchange (CME) indicate ongoing deleveraging.

More Pain For BTC?

The CME basis compression is a futures yield curve that reflects demand for leveraged long exposure. The curve has been in a downward trend since 2025, following patterns that preceded the 2019 and 2022 bear markets. However, the slope remains positive to this day. While the curve’s current slope suggests leverage demand and risk appetite are cooling, the market has not yet reached conditions historically associated with capitulations. It confirms gradual ongoing deleveraging, but not capitulation.

The yield curve compression currently signals weaker demand for leveraged long exposure, as market participants become less willing to pay a premium for bitcoin (BTC) exposure. This points to weakening bullish conviction and a more neutral or bearish backdrop. However, longer-dated contracts are still trading at a premium to spot and short-dated futures.

In essence, the curve reflects an environment where price rallies may face resistance until a definitive cyclical bottom forms. Past cycle bottoms have formed only when the yield curve slope turned negative, signaling backwardation and acute deleveraging. This means that BTC still has more downside to come.

Cyclical Bottom Coming Soon

Additional proof that the Bitcoin market is undergoing a gradual reset in positioning rather than the acute stress needed to form a bottom is the decline in futures open interest. This metric has fallen sharply from its 2025 peak, following a trend seen during the 2022 bear market.

CryptoQuant found that the CME Bitcoin futures open interest has plummeted by 47%, similar to the 45% plunge witnessed in 2022. Such a move reflects a major unwind of leveraged positions following a period of increased participation. This unwind is characterized by prolonged liquidation, reduced speculative demand, and lower hedging activity, confirming an ongoing deleveraging cycle.

You may also like:

The combination of a declining open interest and a positive yield curve suggests the current regime is consolidative or mid-cycle bearish, with definitive capitulation likely to occur soon.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

BTC tries to reclaim $64,000 as funding rates hit three month low

Bitcoin is looking to reclaim $64,000 on possible short squeeze after earlier falling to as low as $63,000 following U.S. and Israeli strikes on Iran.

At the same time, perpetual futures funding rates dropped to -6%, according to CoinGlass, marking the second lowest level in the past three months. The last time funding was this negative was on Feb. 6, when bitcoin bottomed near $60,000.

Perpetual funding rates represent the periodic payments exchanged between traders in perpetual futures markets. When rates are positive, traders holding long positions pay those holding shorts. When rates turn negative, shorts pay longs.

Deeply negative funding typically signals aggressive short positioning and bearish sentiment, as traders are willing to pay a premium to maintain downside bets.

Meanwhile, coin margined open interest rose from 668,000 BTC to 687,000 BTC over the past 24 hours.

Measuring open interest in BTC terms removes the distortion caused by price swings. Rising open interest alongside negative funding suggests growing participation, with an increasing share of traders positioned for further downside.

In the past 24 hours, more than $500 million in crypto positions have been liquidated, according to CoinGlass data. The bulk of those liquidations were long positions, which accounted for over $420 million, highlighting the scale of forced selling as prices moved lower.

Crypto World

Tether Freezes $4.2B in USDT Linked to Crime in 3 Years: Report

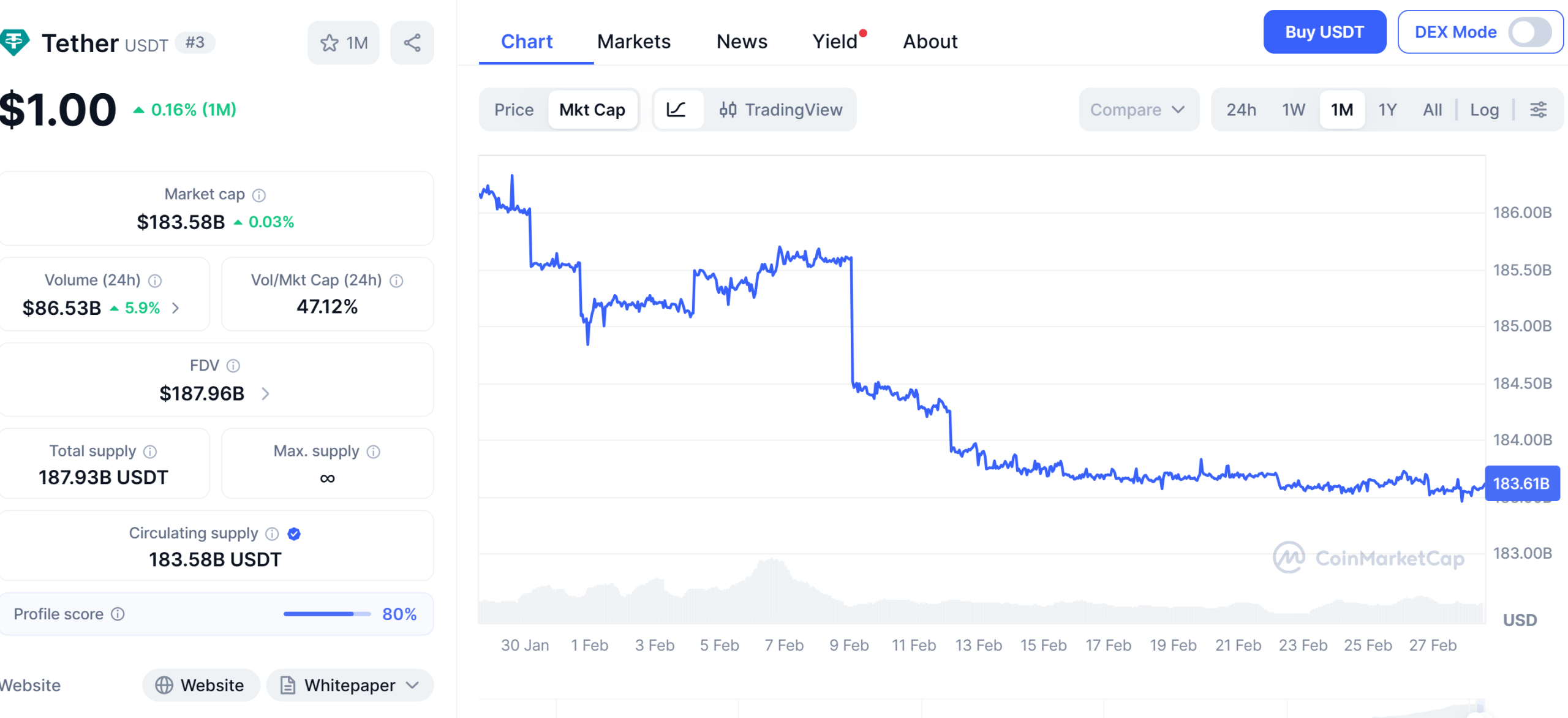

Stablecoin issuer Tether has reportedly frozen roughly $4.2 billion worth of its USDt tokens connected to suspected criminal activity over the past three years.

Most of the blocked funds were restricted since 2023, as regulators and law enforcement agencies intensified scrutiny of crypto-related fraud and sanctions evasion, the El Salvador-based firm reportedly told Reuters on Friday.

Tether’s dollar-pegged USDt (USDT) token is the largest stablecoin in circulation, with more than $180 billion outstanding, up sharply from about $70 billion three years ago.

Tether can freeze tokens directly on the blockchain by blacklisting wallet addresses when requested by authorities.

Related: Tether-backed Oobit adds crypto-to-bank transfers for local payment networks

Tether helps governments freeze funds

On Tuesday, Tether announced that it has assisted the US Department of Justice in seizing nearly $61 million in USDt tied to “pig-butchering” scams, a scheme in which criminals build relationships with victims before persuading them to send money.

Earlier this month, the company also froze approximately $544 million in cryptocurrency at the request of Turkish authorities, blocking funds tied to an alleged illegal online betting and money-laundering operation.

According to blockchain analytics firm Elliptic, by late 2025, stablecoin issuers Tether and Circle had blacklisted around 5,700 wallets holding about $2.5 billion, with roughly three-quarters of the addresses containing USDt when they were frozen.

Related: Tether USDT supply set for biggest monthly decline since 2022 FTX collapse

USDt supply shrinks

As Cointelegraph reported, USDt is on track for its largest monthly supply drop in three years, with circulating supply falling about $1.5 billion in February after a $1.2 billion decline in January, according to blockchain data. The contraction echoes the period following the FTX collapse in late 2022 and may point to tighter liquidity in crypto markets.

Tether said the figures reflect short-term distribution changes rather than weakening demand, noting USDC (USDC) also saw a multibillion-dollar reduction during the same period.

Magazine: Bitcoin may take 7 years to upgrade to post-quantum — BIP-360 co-author

Crypto World

What next for bitcoin as Iran attacks U.S. bases in Kuwait, Bahrain, UAE

What started as an Israeli strike on Iran hours earlier has escalated into the broadest Middle Eastern military conflict in decades, posing a risk to financial markets, including cryptocurrencies.

Per reports on Bloomberg, CNN and Reuters, Iran launched waves of missiles and drones targeting not just Israel but U.S. bases and interests across the Gulf. Bahrain confirmed an American military base had been attacked. Qatar and the UAE said they intercepted missiles over their territory. Explosions were heard in Dubai. Bahrain closed its airspace entirely.

Iran’s semi-official Tasnim news agency said all U.S. bases and interests in the region would be targeted.

President Trump said the U.S. had begun “major combat operations in Iran” aimed at eliminating the country’s missile inventory, navy, and nuclear infrastructure. “The lives of courageous American heroes may be lost and we may have casualties,” he said. “That often happens in war.”

Bitcoin, which had already fallen below $64,000 on the initial Israeli strikes, held above $63,000 as the retaliatory wave hit. The relative stability is partly mechanical. Weekend liquidity is thin, and many leveraged positions that would amplify a sell-off were already flushed during the week’s slide from $70,000.

But the real test comes when traditional markets reopen on Monday. Bitcoin tends to absorb the first wave of geopolitical selling because it’s the only large liquid asset that trades on a Saturday afternoon.

Equities, oil, and bonds don’t have that option until Sunday evening futures or Monday’s open. If those markets gap sharply lower, bitcoin could face a second wave of risk-off selling as portfolio managers de-risk across all asset classes simultaneously.

That could potentially open a path to $60,000 or lower.

Previous Middle East escalations have followed a pattern where bitcoin drops on the initial shock and recovers once traditional markets absorb the news and the situation appears contained. Iran’s retaliatory strikes on Israel in April 2025 played out that way. So did earlier tensions in 2020.

This time the containment thesis is much harder to make. Missiles landing in Dubai, Kuwait, and Bahrain isn’t a bilateral exchange. It’s a regional war touching some of the most economically sensitive territory on the planet.

The downside risk is straightforward. If the conflict broadens, oil prices could surge on both sides of the Atlantic, potentially leading to global risk aversion and deeper losses in bitcoin. While the cryptocurrency is often seen as digital gold, it has historically traded more like a risk asset, not a safe haven.

The $60,000 floor that held during the Feb. 5 crash becomes the next line of defense, and it will be tested under far more severe conditions than a leverage flush.

Crypto World

U.S. Scam Center Seizes $580 Million in Southeast Asia Crypto Fraud

TLDR:

- U.S. authorities seized over $580M in crypto linked to Southeast Asia fraud networks.

- “Pig butchering” scams used social engineering to target Americans via U.S. platforms.

- Scam compounds often involve human trafficking and generate massive regional revenue.

- Multi-agency Strike Force aims to recover stolen crypto and pursue criminal leaders.

The U.S. Attorney’s Office in Washington, D.C. has frozen and seized more than $580 million in cryptocurrency. The funds are tied to “pig butchering” scams run by Southeast Asia–based criminal groups.

These schemes used social engineering to lure Americans into fake crypto investments. The seizures mark a significant step in U.S. efforts to combat cross-border crypto fraud.

Scam Center Strike Force Targets Southeast Asian Crypto Networks

The Scam Center Strike Force focuses on Chinese transnational criminal organizations operating in Myanmar, Cambodia, and Laos. These groups run cryptocurrency investment frauds designed to steal Americans’ life savings.

Victims are approached through U.S. social media platforms and text messages to gain trust. They are then tricked into transferring funds to fake crypto platforms.

Many operations take place in compounds where workers are often human trafficking victims. Armed guards and abusive conditions control these employees as they target Americans.

The scams generate revenue so large that it can equal nearly half of the local GDP. Authorities emphasize that freezing crypto is a key method to disrupt these organized networks.

The Strike Force is a collaboration between the U.S. Attorney’s Office, the Department of Justice, the FBI, and the U.S. Secret Service.

Other contributors include the IRS Criminal Investigation Unit and district offices across Washington, Rhode Island, and beyond. These agencies coordinate to identify leaders and recover stolen funds. The goal is to pursue forfeiture and return assets to victims where possible.

Law enforcement emphasizes the speed and scale of these operations. Within three months, the Strike Force froze over $580 million, showing rapid progress against fraud. Officials describe the fraud as highly organized, targeting Americans regardless of location or status.

The effort also highlights the growing role of cryptocurrency in transnational criminal activity.

Crypto Seizures as a Strategic Deterrent

Cryptocurrency seizure teams focus on identifying wallets and accounts used by scam networks.

Agencies employ cross-jurisdictional collaboration to track funds from Southeast Asia to the U.S. The U.S. Secret Service and FBI handle investigations through field offices in multiple states, ensuring coordination. This approach allows authorities to respond quickly to new scam operations.

Targeting high-value leaders remains a top priority for investigators. Seized funds provide data to trace wider criminal networks and identify co-conspirators.

The initiative also informs the public about safe crypto practices and emerging scam tactics. Legal procedures aim to return as much of the stolen crypto as possible to affected Americans.

The Strike Force’s efforts reinforce that U.S. law enforcement is actively monitoring cross-border crypto fraud. Seizures demonstrate both technical expertise and legal authority to disrupt complex schemes.

Authorities continue to monitor Southeast Asian networks for future criminal activity. The initiative provides a model for addressing international cryptocurrency fraud systematically.

Crypto World

Can BTC, ETH, and SOL Liquidity Work Together? LiquidChain (LIQUID) Crypto Presale Focuses on Staking and Settlement

Bitcoin, Ethereum, and Solana are three of the largest ecosystems in digital assets. Bitcoin anchors the market with deep liquidity and security. Ethereum supports most decentralized applications and DeFi protocols. Solana offers high-speed execution and low transaction costs for active trading environments.

Individually, each network dominates its niche. Collectively, however, they operate in parallel. Liquidity remains segmented. Applications are often deployed separately across chains. Capital moves, but rarely without added steps, wrapped assets, or bridging mechanisms.

This raises a structural question: can liquidity across BTC, ETH, and SOL operate within a coordinated system rather than remain siloed? LiquidChain (LIQUID) introduces its Layer 3 framework as a potential answer, with its crypto presale structured around staking incentives and cross-chain settlement infrastructure.

How LiquidChain Coordinates Liquidity and Execution

LiquidChain is a Layer 3 settlement environment that sits above major blockchains. However, rather than competing directly with Bitcoin, Ethereum, or Solana, it attempts to connect them through unified liquidity pools and synchronized execution.

At the center of the model are shared liquidity structures. Instead of maintaining separate reserves across multiple ecosystems, assets from BTC, ETH, and SOL environments can be represented within a coordinated framework. The objective is to reduce duplicated liquidity and improve capital efficiency across decentralized markets.

Execution is handled through a high-performance virtual machine built for multi-chain operations. This is designed to process interactions involving multiple ecosystems in real time. By coordinating execution within a single layer, the protocol aims to streamline settlement processes that would otherwise require traditional bridging.

Security considerations are addressed through cross-chain proofs and messaging mechanisms. Bitcoin UTXOs, Ethereum account states, and Solana program states can be verified through cryptographic validation systems integrated into the Layer 3 design. The goal is to minimize additional trust assumptions while maintaining compatibility with the underlying chains.

The framework positions LiquidChain as a settlement coordinator rather than a replacement network. Bitcoin continues serving as a store-of-value backbone. Ethereum retains its smart contract depth. Solana maintains throughput advantages. LiquidChain attempts to aggregate liquidity and align execution across them.

$LIQUID Tokenomics, Staking, and Crypto Presale Structure

The $LIQUID token underpins participation in this coordinated system. Its ongoing crypto presale marks the initial distribution phase ahead of full network deployment. Over $560,000 has been raised already.

The total supply is set at 11,800,000,100 $LIQUID. Allocation includes 35% dedicated to development, supporting continued improvements to the Layer 3 infrastructure. LiquidLabs receives 32.5%, focused on ecosystem expansion and strategic initiatives. AquaVault accounts for 15% allocated toward business development and community activation. Rewards represent 10% of the supply, designated for staking incentives and ecosystem participation programs. Growth and listings account for 7.5%, intended to support exchange expansion efforts.

Staking forms a central component of the token’s early utility. Participants can lock $LIQUID to receive reward emissions distributed proportionally across the staking pool. As more tokens are staked, rewards are shared among a larger base, which gradually reduces annual percentage yields over time.

This reward structure is designed to encourage early buyers without fixing unsustainable returns. Early participants receive a larger proportional share of emissions when the staking pool is smaller. As adoption increases and more tokens enter staking, yields normalize based on total participation.

The crypto presale therefore represents more than token distribution. It serves as a mechanism to bootstrap liquidity alignment, incentivize early adoption, and fund continued protocol development.

A Framework for Cross-Chain Coordination

Bitcoin, Ethereum, and Solana each command big capital and developer ecosystems. Yet fragmentation remains one of decentralized finance’s most persistent structural constraints.

LiquidChain’s thesis centers on coordination rather than competition. By introducing a Layer 3 settlement environment supported by unified liquidity pools and dynamic staking incentives, the protocol seeks to create a shared execution framework across major chains.

Success will ultimately depend on technical implementation, developer integration, and broader ecosystem participation. Infrastructure projects require sustained adoption to validate their models.

Still, the core premise addresses a visible inefficiency: siloed liquidity across dominant ecosystems. Through its crypto presale, staking model, and layered settlement design, LiquidChain positions itself around the idea that cross-chain capital coordination may become a defining theme in the next phase of decentralized finance.

Explore LiquidChain and its ongoing crypto presale:

Presale: https://liquidchain.com/

Social: https://x.com/getliquidchain

Whitepaper: https://liquidchain.com/whitepaper

The post Can BTC, ETH, and SOL Liquidity Work Together? LiquidChain (LIQUID) Crypto Presale Focuses on Staking and Settlement appeared first on Cryptonews.

-

Politics6 days ago

Politics6 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Sports5 days ago

Sports5 days agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Fashion17 hours ago

Fashion17 hours agoWeekend Open Thread: Iris Top

-

Politics5 days ago

Politics5 days agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Business4 days ago

Business4 days agoTrue Citrus debuts functional drink mix collection

-

Politics1 day ago

Politics1 day agoITV enters Gaza with IDF amid ongoing genocide

-

Crypto World4 days ago

Crypto World4 days agoXRP price enters “dead zone” as Binance leverage hits lows

-

Sports7 hours ago

The Vikings Need a Duck

-

Business6 days ago

Business6 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Tech4 days ago

Tech4 days agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

Business6 days ago

Business6 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

NewsBeat3 days ago

NewsBeat3 days agoManchester Central Mosque issues statement as it imposes new measures ‘with immediate effect’ after armed men enter

-

NewsBeat2 days ago

NewsBeat2 days agoCuba says its forces have killed four on US-registered speedboat | World News

-

NewsBeat5 days ago

NewsBeat5 days ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

Tech6 days ago

Tech6 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat6 days ago

NewsBeat6 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Politics6 days ago

Politics6 days agoMaine has a long track record of electing moderates. Enter Graham Platner.

-

Business2 days ago

Business2 days agoDiscord Pushes Implementation of Global Age Checks to Second Half of 2026

-

NewsBeat4 days ago

NewsBeat4 days agoPolice latest as search for missing woman enters day nine

-

Sports5 days ago

2026 NFL mock draft: WRs fly off the board in first round entering combine week