CryptoCurrency

Top Stablecoin Yield Strategies Boosted by DeFi Development

Investors want a predictable yield. Users want a safe yield. Founders want a scalable yield. The platforms that win in 2026 are the ones that can deliver all three, and they’re doing it by combining powerful Stablecoin Yield Strategies with expert DeFi development frameworks.

If your goal is to build a product that attracts long-term capital, institutional partnerships, and meaningful TVL, these are the strategies you must master.

Inside this blog, you’ll discover the proven tactics top builders use to design stablecoin yield products that grow, convert, and retain value.

Why Stablecoin Yield Strategies Are Surging in 2026

Stablecoins have matured into a core pillar of global digital finance. By December 2025, their total market capitalization exceeded 300 billion dollars, up from 205 billion at the start of the year. This growth reflects genuine adoption across retail users, fintech innovators, and institutions rather than speculative market cycles.

Transaction activity strengthens this narrative. Stablecoin transfer volume grew 83% YoY, surpassing USD 4 trillion in the first half of 2025. By September, the monthly adjusted volume had reached $1.25 trillion, highlighting how stablecoins now power payments, remittances, liquidity operations, and cross-border flows.

In the middle of this shift, strong DeFi development is becoming the engine behind more advanced and sustainable yield strategies. Stablecoins now deliver 4% to 5% APY on conservative platforms, while established protocols such as Aave and Compound typically offer 3% to 8% APY, with rates fluctuating based on market demand and collateral conditions. Certain custodial solutions even advertise higher returns. This clear yield premium over traditional banking makes stablecoins an increasingly attractive treasury asset for fintech companies, funds, and enterprises seeking predictable on-chain income.

What truly sets stablecoin yields apart is programmability. Automated liquidity routing, real-time portfolio rebalancing, and conditional payout logic give businesses capabilities traditional finance cannot match. This blend of efficient automation and attractive returns is precisely why stablecoin yield strategies continue to gain momentum as we move through 2026.

Want to see what your stablecoin yield platform could earn? Let’s calculate it.

How Modern DeFi Development Shapes Stablecoin Yield

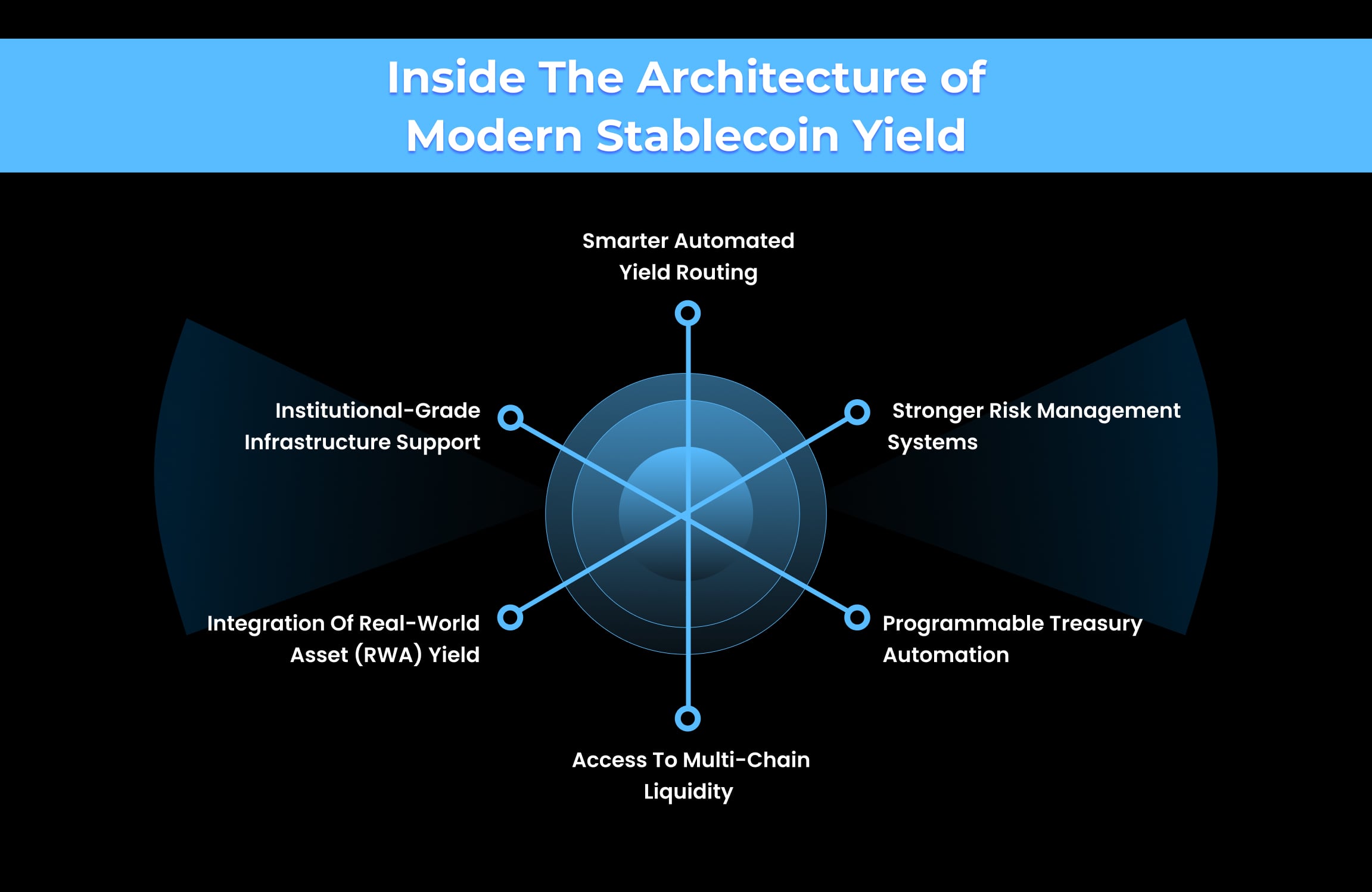

Modern DeFi development has completely reshaped how stablecoin yields are created, optimized, and delivered to users and institutions.

- Smarter Automated Yield Routing: Modern platforms now use intelligent automation to scan lending markets, liquidity pools, and cross-chain opportunities and instantly route capital to the best-performing sources. This ensures stablecoin yields stay optimized even when market conditions shift rapidly.

- Stronger Risk Management Systems: Advanced collateral engines, built-in insurance layers, and automated liquidation logic now protect deposits from sudden market volatility. These improvements help yield platforms deliver more stable and predictable returns.

- Programmable Treasury Automation: Businesses can automate rebalancing, conditional payouts, liquidity shifts, and routing logic through programmable smart contracts powered by advanced DeFi development. These capabilities streamline treasury workflows and help organizations earn more efficiently.

- Access to Multi-Chain Liquidity: Stablecoins can now move seamlessly across Ethereum, Solana, Tron, Base, and Layer 2 ecosystems, unlocking deeper and more diversified yield opportunities. This multi-chain flexibility reduces platform risk and expands income potential.

- Integration of Real-World Asset (RWA) Yield: Tokenized treasury bills, corporate credit pools, and regulated money market instruments now generate reliable on-chain income for stablecoins. This creates a real-world foundation for yield that traditional crypto strategies could never provide.

- Institutional-Grade Infrastructure Support: Modern platforms now incorporate compliance modules, auditing tools, permissioned liquidity pools, and enterprise-ready reporting powered by expert DeFi development services. This level of maturity makes stablecoin yield strategies attractive to institutions, funds, and global treasury teams.

Together, these advancements make stablecoin yield strategies more intelligent, accessible, and scalable than ever before.

Leading Stablecoin Yield Strategies Used by Top Builders

As Stablecoin yield strategies mature, builders are aligning with approaches supported by modern DeFi development to deliver safer, smarter, and more scalable on-chain income.

- Delta-Neutral Models for Market-Neutral Returns

Delta-neutral strategies remain a core choice for sophisticated builders because they generate yield without relying on market direction. These models earn from funding rate differentials rather than price changes by balancing long spot exposure with an equivalent short perpetual futures position. Platforms using this approach deliver consistent returns even in volatile markets, making them appealing for institutional treasuries evaluating partners through a professional DeFi development company.

- Multi-Layer Structured Yield and Tranching

Platform builders increasingly use tranching models to split yield into senior and junior layers. Senior tranches receive predictable base returns suitable for conservative liquidity, while junior tranches absorb volatility in exchange for higher upside potential. This modular structure allows platforms to cater to multiple investor profiles within a single yield engine, improving capital efficiency and user segmentation.

- RWA-Backed Stablecoin Income Streams

Tokenized real-world assets have become one of the most reliable sources of yield, especially for institutions that want regulated exposure. Backing stablecoins with U.S. Treasuries, money market instruments, or institutional credit provides transparent, low risk returns in the 4 to 5 percent range. The blend of on-chain settlement and off-chain asset stability has made RWA strategies a top choice for corporate treasuries and DAO reserve managers.

- Yield Tokenization for Fixed and Variable Income

Yield tokenization allows stablecoin deposits to be split into principal and yield components, creating fixed-income and variable-yield exposure from the same asset. This model, pioneered by protocols like Pendle, helps institutions lock in predictable APYs or speculate on future yield swings. It brings flexibility and efficiency to on-chain finance, and platforms are increasingly integrating specialized DeFi development services to support these tokenized yield models.

Get a ready-to-execute yield plan designed for your business model

These four strategies now define the industry standard for stablecoin yield, giving founders and institutions a clear path to designing products that combine safety, automation, and sustainable performance.

Common Failures and the Need for a Skilled DeFi Development Company

Below are the most common issues that cause stablecoin yield platforms to break, lose liquidity, or fail audits, all presented in a sharp, boardroom-ready table.

| Failure Type | What Goes Wrong | Impact on Projects |

|---|---|---|

| Weak Smart Contract Architecture | Outdated or poorly audited contracts | Exploits, liquidity drains, loss of user trust |

| No Automated Yield Routing | Manual or static allocations | Lower APY, missed opportunities, poor competitiveness |

| Poor Liquidity Management | Inefficient pool balancing or withdrawal planning | Liquidity crunches, higher slippage, stuck funds |

| Lack of Risk Controls | No insurance, no liquidation buffers, no dynamic thresholds | High volatility losses, unstable yield performance |

| Single-Chain Dependency | All liquidity is tied to one chain | Downtime risk, congestion issues, APY volatility |

| Weak Reporting & Analytics | No dashboards, incomplete data | Institutions reject the platform due to a lack of transparency |

| Poor UX / Onboarding | Complicated flows, unclear actions | Low retention, high abandonment rates |

| No Regulatory Preparedness | No KYC/AML modules, no compliance-ready design | Institutional clients cannot onboard |

Why These Failures Demand a Skilled DeFi Development Company

These recurring failures highlight why founders turn to expert teams offering reliable DeFi development services to build platforms that work at scale.

- To automate yield routing and improve APY performance using advanced DeFi development.

- To implement high-risk and liquidation protection tools.

- To integrate RWAs, cross-chain liquidity, and institutional modules.

- To deliver secure, audit-ready smart contracts built by a professional DeFi development company.

- To support compliance and enterprise-grade onboarding.

- To maintain, optimize, and upgrade the platform as market conditions evolve

With the right expertise, your stablecoin yield product becomes safer, more scalable, and far more attractive to institutions.

Conclusion

Stablecoin yield has become one of the most strategic opportunities in modern finance, but success no longer depends on ideas alone. Reliable yield demands strong architecture, automated strategies, cross-chain integrations, RWA support, and institutional-grade security. These are not features most teams can build internally, and the platforms that try often fall into the same cycle of failures, inefficiencies, and lost trust.

That is why choosing the right partner is no longer optional. A skilled DeFi development company brings the engineering depth, risk frameworks, and scalable architecture required to build a yield platform that institutions can trust. With the right guidance, your product becomes safer, more efficient, and truly built for long-term adoption.

If you want your stablecoin yield strategy to stand out in 2026, the most effective path is to leverage professional DeFi development services from a proven leader — Antier. Ready to build a high-performing stablecoin yield platform? Talk to Antier today.