Crypto World

Trading Techniques of the Inside Bar Pattern

Candlestick patterns are an important part of a comprehensive trading strategy. However, it may be difficult to choose the pattern you can rely on. In this case, traders focus on the most popular setups that have proven to work across various markets and timeframes. One of such patterns is the inside bar pattern.

In price action trading, the inside bar is often analysed as a pause in market structure, reflecting short-term volatility compression that may lead to either trend continuation or trend reversal.

In this article, we will break down the basics of the inside bar pattern, examine examples of this formation on real-market price charts, and discuss how to interpret its signals for trading purposes.

What Is an Inside Bar Candle Pattern?

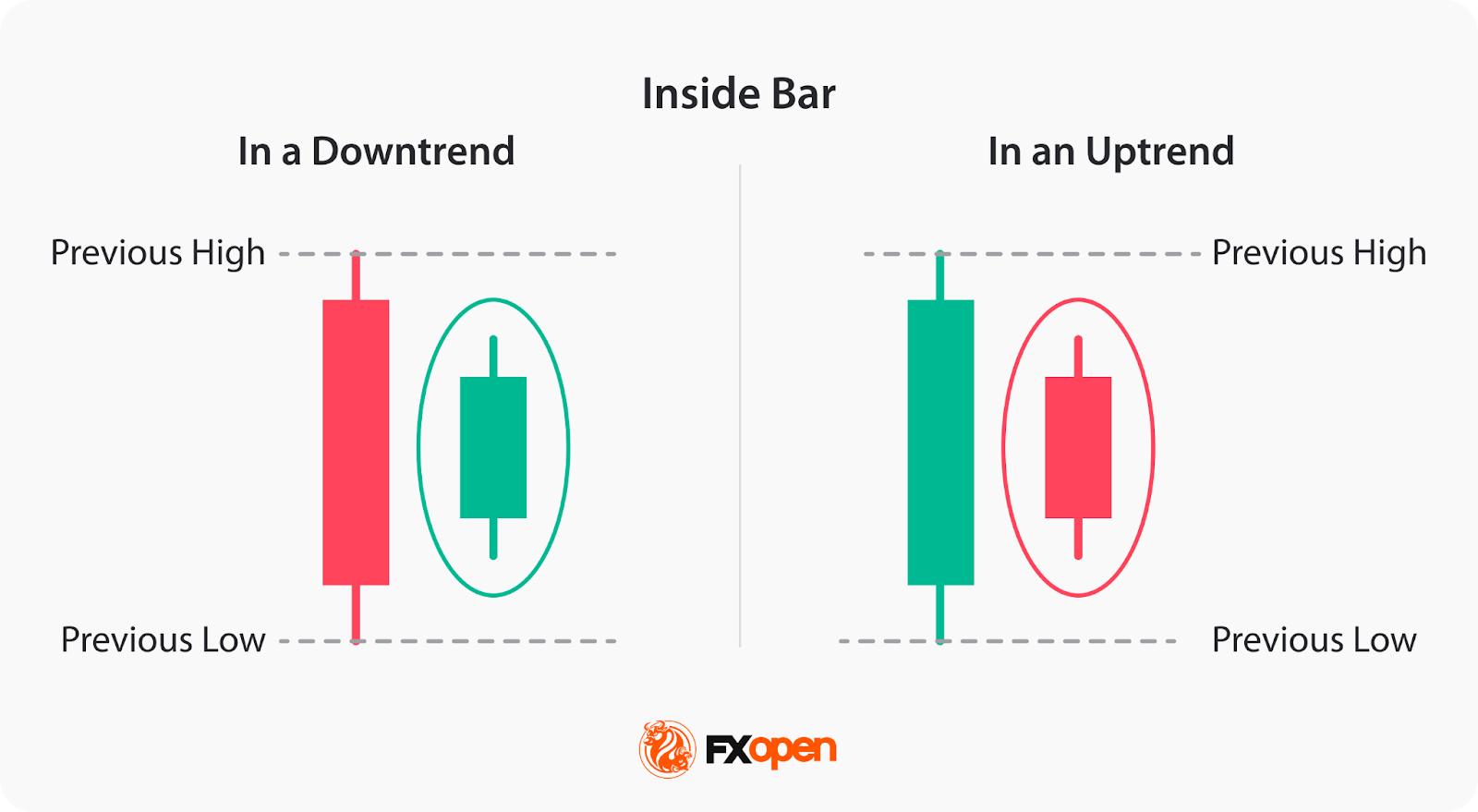

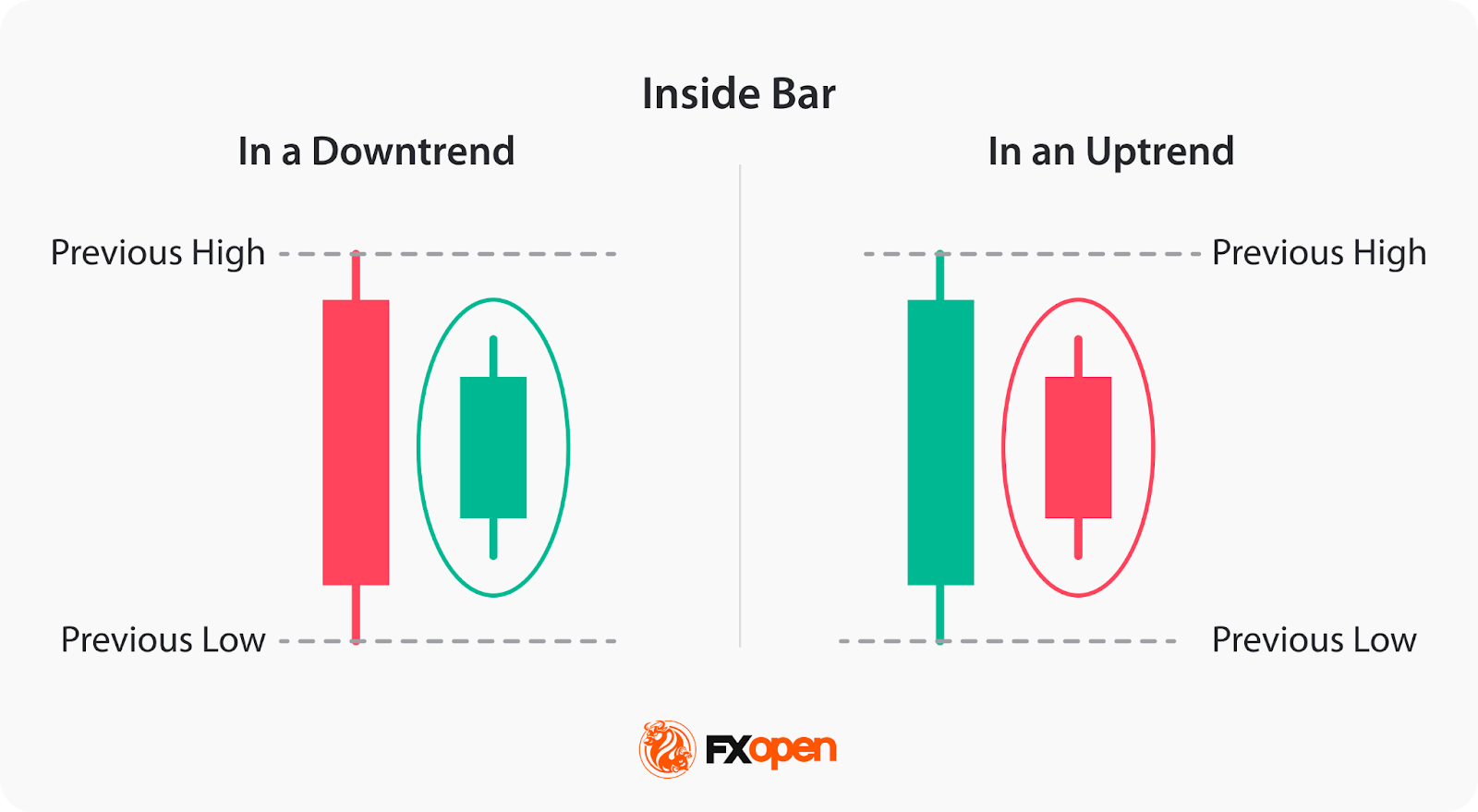

An inside bar is a two-candlestick formation that appears on a price chart when a candlestick’s high and low range is contained within the high and low range of the preceding candle. In other words, the entire price action of one candle is confined within the previous candlestick’s price range.

The preceding candle is commonly referred to as the mother bar, while the following candle is the inside bar itself. This formation highlights range contraction and a brief consolidation phase, where buying and selling pressure temporarily reach equilibrium.

Still, the pattern doesn’t signal a trend reversal or a trend continuation. The price may continue moving in the prevailing trend or turn around. Also, the pattern may appear in both an uptrend and a downtrend.

The inside bar can be observed across different financial instruments such as stocks, cryptocurrencies*, ETFs, indices, and forex currency pairs and can be traded using contracts for difference (CFDs) provided by FXOpen. In the forex market, traders most often apply the inside bar pattern to liquid currency pairs, where higher trading volume may support trade execution.

Identifying the Inside Bar on Trading Charts

To identify this formation on trading charts, traders follow these steps:

- Look for two candlesticks: Traders start by identifying two candlesticks that look like the inside bar.

- Compare the high and low range: After that, they check if the high and low range of the subsequent candle, inside bar, is entirely contained within the high and low range of the preceding candlestick, mother bar.

- Confirm the pattern: Once they identify that the subsequent candle meets the criteria, traders confirm it as an inside bar.

The reliability of the pattern’s signals may vary by timeframe, with many traders favouring the H1, H4, or daily charts, as higher timeframes tend to filter out market noise and reduce the risk of false breakouts.

In the forex market, inside bars tend to form more frequently during lower-liquidity periods, such as the Asian session, while breakouts are more commonly observed during high-liquidity phases like the London and New York session overlap.

Many traders incorporate multi-timeframe analysis when evaluating inside bar setups. A formation that appears on a lower timeframe but aligns with a higher-timeframe trend or key level may carry more significance than a pattern that develops in isolation. For example, an inside bar forming on an hourly chart within a daily uptrend may be interpreted as a continuation signal rather than a reversal attempt, particularly when supported by broader market structure.

Inside Bar vs Outside Bar

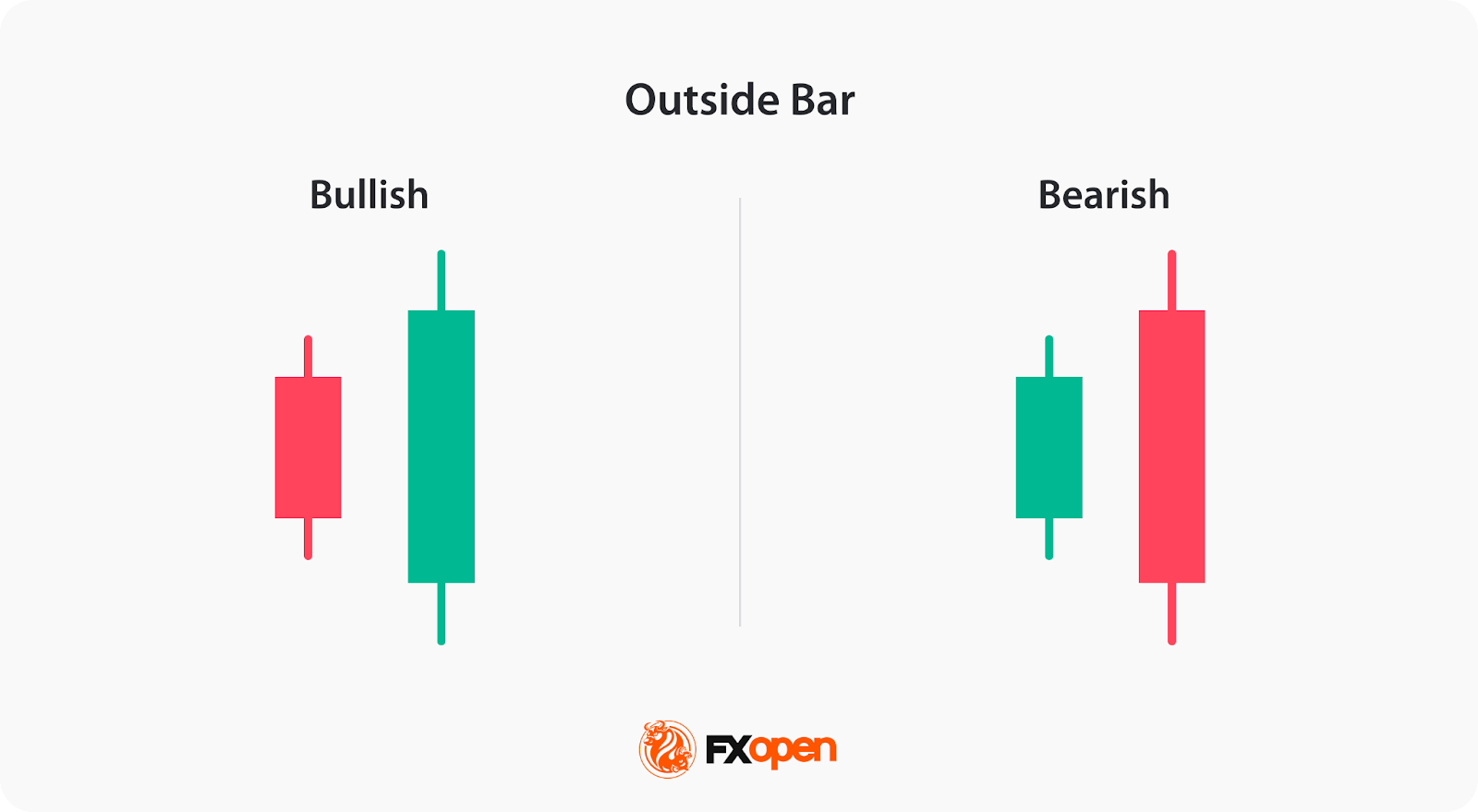

The inside candle pattern occurs when the high and low of a candle are contained within the range of the preceding candlestick, indicating consolidation or indecision in the market. It suggests a potential reversal or continuation of the current trend.

On the other hand, an outside bar—often considered a form of engulfing pattern—appears when a candlestick completely exceeds the previous candle’s high–low range. As Al Brooks defines it in his Trading Price Action Trends, an outside bar occurs when “the high of the current bar is above the high of the previous bar and the low is below the low of the previous bar,” reflecting increased participation from both buyers and sellers. A bearish outside setup typically forms near the top of an uptrend and may signal a downward reversal, while a bullish outside setup forms near the bottom of a downtrend and may suggest an upward reversal.

While the inside bar reflects volatility compression and consolidation, the outside bar typically signals volatility expansion and a stronger momentum shift in price action. Both are widely used by traders for technical analysis and identifying potential trades.

Traders can analyse outside and inside bars on forex, stocks, and other markets using the FXOpen TickTrader platform.

Trading the Inside Bar Pattern

Trading with the inside bar candlestick pattern involves using it as a signal for potential breakouts or continuation of the prevailing trend. Here are the steps traders usually follow when trading with the pattern:

Determine the Direction of the Preceding Trend

Traders may use trendlines or moving averages (EMA or SMA) to define overall market bias and confirm trend direction.

When the formation develops within a strong, established trend and aligns with that trend’s direction, it is typically interpreted as a continuation setup. However, when the same structure appears after an extended directional move and forms at significant technical levels such as higher-timeframe support, resistance, or supply and demand zones, it may instead reflect trend exhaustion and potential reversal conditions. For this reason, traders evaluate both trend context and location before assigning directional bias to the pattern.

In some cases, several inside bars may form consecutively, creating a coiling pattern that reflects extended price compression and can precede a stronger volatility expansion.

Wait for a Breakout

The formation indicates consolidation and potential price compression. Traders often wait for a breakout from the setup’s range to initiate a trade. A breakout above the high of the formation suggests a bullish signal, while a breakout below the low indicates a bearish signal.

However, failed or false breakouts—sometimes referred to as fakey setups—can occur when price briefly breaks the mother bar range before reversing, often due to low liquidity or weak momentum.

Breakouts that occur near key support and resistance levels confirmed by additional tools are often considered stronger. John Murphy’s Technical Analysis of the Financial Markets highlights the value of indicators such as RSI and MACD in confirming breakout strength. Low-volume moves carry a higher risk of false breakouts.

Some traders monitor these false breaks as potential reversal signals, particularly when they occur against an extended trend.

Consider Additional Confirmation

Many traders wait for 2-3 candlesticks to form in a breakout direction. Also, to avoid false breakouts, traders may look for additional confirmation indicators to support their trading decisions. An increasing volume at the breakout or a signal from a trend indicator may provide additional confluence. Common confirmation tools include Average True Range (ATR) and volume indicators, which may help assess volume and volatility conditions.

Set Their Entry Points

Traders typically apply several entry models when trading an inside bar setup. The most common approach is a breakout entry using stop orders placed beyond the high or low of the mother bar.

In trend-continuation conditions, traders may also use a break-and-retest model, entering after price closes beyond the formation and then retests the breakout level as support or resistance.

Set Stop-Loss and Take-Profit Orders

Although there are no strict rules, traders typically set stop-loss orders above the bearish and below the bullish pattern, considering the timeframe and the entry point, so they aren’t too wide. Some traders trail stops below swing highs or lows during strong trends. Monitoring volatility through tools such as ATR may also help traders determine whether to widen or tighten stops as the market transitions from consolidation to expansion.

For take-profit targets, traders might consider significant swing points or key support/resistance levels. As part of risk management, traders often apply predefined risk-to-reward ratios (such as 1:2 or 1:3) and adjust position sizing.

Live Market Example

Below, we provide an example of an inside bar breakout strategy with a bullish inside bar stock pattern on a Tesla chart. This setup represents a typical bullish continuation pattern, where the breakout is confirmed by candles closing above the mother bar’s high and holding above a nearby resistance level.

Following the inside bar breakout trading strategy, the trader waits for the breakout above the high of the mother bar marked by a horizontal line. The stop loss is set below the candle’s low, and the take profit is at the next resistance level.

Final Thoughts

While the inside bar pattern can be a useful tool for identifying trend reversals and continuations, it’s important not to rely solely on this pattern for your trading decisions. In practice, traders often combine the inside bar with technical indicators, broader market context, and structured risk management tools to form a complete trading strategy.

If you want to develop your own trading strategy, you can use FXOpen’s TickTrader trading platform. If you have a strategy and you would like to trade it across over 700 instruments with tight spreads and low commissions (additional fees may apply), you can consider opening an FXOpen account.

FAQ

Is an Inside Bar Bullish or Bearish?

The inside bar setup does not inherently indicate a bullish or bearish bias. It simply represents a period of consolidation or market indecision. Thus, a formation in an uptrend can be bullish and signal a continuation of the trend, or bearish and signal a trend reversal. The same concept applies to a downtrend, where the indicator may be bearish and the trend will continue, or bullish and the trend will reverse.

What Does a Bullish Inside Bar Mean?

The meaning of an inside bar candle pattern that is bullish refers to the pattern, after which the price moves upwards. When this pattern forms during an uptrend, it suggests a temporary pause or consolidation before the uptrend potentially resumes. When it is formed in a downtrend, it signals a trend reversal.

What Is the Inside Bar Strategy?

In the inside bar strategy, traders wait for the pattern to form and look for a breakout above the high of the formation to enter a long position or below the low to enter a short trade. A stop-loss order might be placed below the low of the pattern in a long trade and above the high of the pattern in a short trade. Profit targets can be determined based on the trader’s trading plan, technical indicators, or key support and resistance levels.

How May You Confirm an Inside Bar Signal?

As the inside bar provides both continuation and reversal signals, it is critical to confirm them. First, traders wait for the pattern to form and the following candles to close above or below it. Second, traders use volume or momentum indicators to identify the strength of the price movements. Another option is to use chart patterns that also provide continuation or reversal signals. Confirmation may also come from alignment with support and resistance or volatility conditions measured by ATR.

Are Inside Bars More Popular in Downtrends?

No, the inside bar pattern can be used in both uptrends and downtrends. No statistics can confirm that the pattern is more preferable in a downtrend. Traders can use it in their trading strategies regardless of the trend they trade in.

Which Timeframe Is Most Popular for Inside Bar Trading?

The inside bar pattern can form on any timeframe, but many traders consider it more reliable on higher timeframes, such as the H1, H4, and daily charts. Higher timeframes tend to reduce market noise and filter out minor price fluctuations, which may lower the risk of false breakouts. Lower timeframes, such as 5-minute or 15-minute charts, can also be used, but they often require stricter confirmation and more active risk management.

Is the Inside Bar a Breakout or Continuation Pattern?

The inside bar is described as a neutral consolidation pattern rather than a strictly breakout or continuation setup. It reflects a pause in price action caused by range contraction and reduced volatility. Depending on market context, an inside bar may lead to a breakout, signal a trend continuation, or occasionally precede a trend reversal. Traders usually rely on the prevailing trend, support and resistance levels, and confirmation tools, such as momentum readings from RSI or MACD, increased volume, or volatility conditions measured by ATR, to determine how to trade the setup. However, in the Encyclopedia of Chart Patterns, Bulkowski presents that the pattern provides continuation signals in 62% of cases.

How Reliable Is the Inside Bar in Forex Trading?

The reliability of the inside bar in forex trading depends largely on market conditions and confirmation. The common required conditions for any trade are liquid currency pairs and active trading sessions, such as the London or New York sessions. When combined with tools like support and resistance, momentum indicators, and clear risk management rules, the inside bar can be a useful component of a broader trading strategy. On its own, however, it should not be treated as a guaranteed signal.

*Important: At FXOpen UK, Cryptocurrency trading via CFDs is only available to our Professional clients. They are not available for trading by Retail clients. To find out more information about how this may affect you, please get in touch with our team.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

Ripple-linked network transactions jump to 2.7M as price stays muted

XRP drifted lower in quiet trading as declining volume and repeated rejection near $1.44 kept the token trapped inside a tightening range.

News Background

- XRP continues to move largely in line with broader crypto sentiment, with no major token-specific catalysts driving recent price action. The token has spent much of the past week consolidating between roughly $1.34 and $1.44 as traders wait for a clearer directional signal.

- Despite muted market participation, activity on the XRP Ledger has picked up.

- Daily transaction counts have climbed to around 2.7 million, according to market data, reflecting rising network usage tied in part to real-world asset tokenization projects building on the chain. The value of tokenized assets on the network has approached roughly $461 million.

- While growing network activity suggests improving ecosystem fundamentals, traders remain focused on short-term technical levels as liquidity across crypto markets remains relatively thin.

-

Price Action Summary

- XRP slipped slightly to around $1.38 during the latest session

- The token traded inside a roughly $1.34–$1.44 range

- The session high near $1.44 came on a brief volume spike before sharp rejection

- Price later drifted back toward $1.38 as participation declined

Technical Analysis

- The most important move in the past session came when XRP briefly pushed toward $1.44 during a burst of trading activity before sellers quickly rejected the advance. That rejection reinforced the $1.43–$1.44 zone as near-term resistance.

- Following the failed breakout, XRP formed a series of lower highs on declining volume, suggesting momentum faded after the initial rally attempt. The token has since moved sideways near $1.38, with several tests of this level indicating it is acting as short-term support.

- Volume trends remain a key signal. Overall trading activity has contracted to well below its recent average, indicating traders are waiting for confirmation before taking larger positions.

- This type of compression — with price trapped between resistance near $1.44 and support closer to $1.34–$1.38 — often precedes a larger directional move once liquidity returns.

What traders say is next?

- Market participants are watching whether XRP can maintain support above the $1.34–$1.35 area.

- If that level holds, the token could remain in consolidation before attempting another breakout toward $1.44 and potentially $1.50 if momentum returns.

- A breakdown below $1.34, however, would weaken the consolidation structure and could expose the next downside zone around $1.30–$1.32.

Crypto World

What next as Bitcoin steady above $70,000

Bitcoin touched $71,612 on Tuesday evening before settling back to $70,036 by Wednesday’s Asian session, as oil price slide revved up risk sentiment.

A key catalyst was a Wall Street Journal report that the International Energy Agency had proposed the largest crude reserve release in its history, exceeding the 182 million barrels released in 2022 after Russia’s invasion of Ukraine.

The proposal responds to Persian Gulf production cuts that have removed roughly 6% of global oil output since the Iran war began, sending jet fuel and cooking gas prices soaring worldwide.

Brent crude dropped below $90 per barrel on Wednesday after plunging 11% in the prior session. That matters for crypto because oil has been the transmission mechanism connecting the Middle East conflict to every risk asset on the planet. Higher oil means stickier inflation, which means no rate cuts, which means tighter liquidity and further pressure for risk assets.

Bitcoin was trading at $70,036 on Wednesday morning after reaching as high as $71,612 on Tuesday evening, up 2.5% on the week. The move from Monday’s low near $66,000 to Tuesday’s high amounts to roughly 8.5% in two days, though the overnight pullback gave back some of those gains.

“Bitcoin trading above $70,000 tells you buyers are trying to push this market out of consolidation, but it still has to prove it can hold,” said Daniel Reis-Faria, CEO of ZeroStack, said in a mail. “The difference this time is that leverage had cooled off a bit before the move higher, which gives it a more stable setup.”

“Now it comes down to whether Bitcoin can stay above $70,000 and build from there, or whether it slips back into the same pattern we’ve been in for weeks,” he added.

Elsewhere, FxPro analysts noted that bitcoin is forming a series of higher local lows since the end of February, the first structural sign of buyers gaining confidence within the range.

But they flagged $73,000 as the level that matters, where last week’s peak and the 50-day moving average sit together.

The broader market was calm. Ether held at $2,034, down 0.3% on the day but up 2.8% on the week. BNB was flat at $643. XRP edged up 0.3% to $1.38 with a 1.7% weekly gain. Solana added 0.2% to $86.42 but remains down 0.8% over seven days, still the weakest major on a weekly basis.

Dogecoin was up 1% to $0.093, holding onto some of Tuesday’s Musk-driven gains.

The Fed meeting on March 17-18 remains the next major event. With oil potentially easing on the IEA reserve release, the stagflation scenario that had been pricing into markets last week looks slightly less severe.

If crude stays below $90, the argument for rate cuts later this year gets marginally stronger. Bitcoin’s 90-day correlation with the S&P 500 is still at 0.78. Whatever the Fed signals, crypto will trade it.

Crypto World

XRP-linked firm to acquire Australian financial services license

Ripple announced plans on Wednesday to secure an Australian Financial Services License through the proposed acquisition of BC Payments Australia Pty Ltd, per a release shared with CoinDesk.

The acquisition, which is still subject to completion, would allow Ripple to offer its full payments stack in Australia, covering onboarding, compliance, funding, foreign exchange, liquidity management, and payout through a single integration.

Australian customers currently using Ripple Payments include Hai Ha Money Transfer, Stables, Caleb & Brown, Flash Payments, and Independent Reserve.

“Australia is a key market for Ripple, and an AFSL strengthens our ability to scale Ripple Payments across the region,” said Fiona Murray, managing director for Asia Pacific, in a statement.

The regional numbers back up the push. Ripple said its APAC payments volume nearly doubled year-on-year in 2025, though it didn’t disclose specific figures.

That growth sits alongside the $100 billion in total processed volume the company reported last week when it announced managed custody, virtual account collections, and stablecoin settlement capabilities across 60 markets.

Ripple also said it is participating in Project Acacia, an initiative led by the Reserve Bank of Australia and the Digital Finance Cooperative Research Centre focused on digital asset infrastructure.

The licensing approach is notable. Rather than applying for an AFSL directly, Ripple is acquiring a company that already holds one. That’s a faster path to market but means the license is contingent on the deal closing, which hasn’t happened yet.

XRP was trading at $1.38, up 0.3% on the day and 1.7% on the week.

Crypto World

Bitcoin price stabilizes at $70K as open interest drops

Bitcoin price is stabilizing near $70,000 as declining derivatives leverage and falling retail inflows hint at a possible base forming in the market.

Summary

- Bitcoin is trading near $70,000, close to the upper end of its weekly range.

- Retail inflows to Binance have dropped sharply while open interest across exchanges continues to trend lower, signaling reduced leverage.

- Technical indicators show BTC consolidating between $67K and $71K as volatility tightens ahead of a potential breakout.

At press time, Bitcoin (BTC) was trading at $70,718, up 4.2% over the past 24 hours. The asset is now near the top of its recent weekly range thanks to the move.

Following February’s volatility, Bitcoin has shown signs of consolidation over the last seven days, trading between $65,962 and $73,669. The cryptocurrency is still 46% below its October 2025 all-time high of $127,080 despite the recent upswing.

Alongside the price increase, market activity has increased. With a 49% rise and a 24-hour trading volume of $53.8 billion for BTC, traders appear to be returning to the market.

Derivatives data also shows rising activity. According to CoinGlass data, Bitcoin futures trading volume increased 13% to $76 billion, while open interest climbed 5.72% to $46 billion.

Despite the short-term increase, longer-term data show that leverage across exchanges has been trending lower.

Retail flows and leverage show cooling market conditions

A Mar. 10 report from CryptoQuant contributor Amr Taha points to a sharp decline in retail Bitcoin inflows to Binance over the past month.

The analysis tracks cumulative Bitcoin deposits to the exchange over 30 days, separating activity from smaller investors and large holders. According to the data, retail inflows to Binance dropped significantly between Feb. 6 and Mar. 10.

During that period, retail deposits fell from around $14.1 billion to roughly $6.3 billion, a drop of about $7.8 billion. The current level is the lowest recorded since mid-May 2024, suggesting smaller investors are sending fewer coins to exchanges.

Open interest across derivatives markets has also been declining. The report notes that several major exchanges have seen a reduction in futures positioning in recent weeks.

Bitcoin open interest on Binance was $3.45 billion on March 10, down from the $3.8 billion level noted on April 7, 2025. That earlier reading coincided with a period when Bitcoin formed a major market bottom.

According to Taha, widespread drops in open interest often signify a reduction in traders’ leverage. Once excessive speculation is removed from the market, periods of deleveraging can occasionally result in more stable price action.

Bitcoin price technical analysis

From a technical standpoint, Bitcoin is still recovering from the sharp decline seen in February. The price is still below the 20-day moving average, which is the midline of the Bollinger Bands. This level often acts as resistance when markets are trying to recover from a downtrend.

At the same time, the chart shows that Bitcoin is moving sideways between $67,000 and $71,000, indicating that the market may be establishing a base following the recent sell-off. Several recent candles have longer wicks and smaller bodies, which shows hesitancy among traders.

Volatility has also started to contract. Bollinger Bands are gradually narrowing, a pattern that comes before a more significant shift in either direction.

Momentum indicators show a slight improvement. The relative strength index is now hovering around 50, a neutral reading, having recovered from oversold levels near 20–30 during February’s decline.

$66,000 to $67,000 continues to be the crucial support range for Bitcoin in the near future. Holding this level could help maintain the current consolidation structure.

On the upside, $71,000 to $72,000 stands as the next resistance area. A break above that range could signal stronger recovery momentum, while rejection there may keep Bitcoin trading sideways in the near term.

Crypto World

Ripple targets Australian financial services license with latest acquisition

Ripple has announced plans to secure an Australian financial services license by acquiring a local payments firm in the country.

Summary

- Ripple plans to obtain an Australian Financial Services License through the acquisition of BC Payments Australia.

- New regulations set to take effect by June 30, 2026, would require crypto companies operating in Australia to obtain a license.

Ripple said it will obtain the AFSL license through the acquisition of BC Payments Australia Pty Ltd, a payments company linked to the European Banking Circle Group. A deal is still underway and is expected to close on April 1 after the standard closing process is finalized.

“Australia is a key market for Ripple,” Ripple’s APAC Managing Director Fiona Murray said in an accompanying statement, adding that it will help Ripple Payments “manage the full lifecycle of a transaction, from onboarding and compliance through funding, FX, liquidity management, and final payout, while integrating both traditional banking rails and digital assets.”

Ripple’s decision to pursue the license comes as Australia’s financial regulator has unveiled updated regulations for the country’s crypto sector.

Starting June 30, 2026, crypto firms operating in Australia would be required to obtain an Australian Financial Services License before they are allowed to offer certain financial services to local customers.

Over the past years, Ripple has expanded its global regulatory footprint by focusing on securing licenses across key markets around the world.

In 2025 alone, Ripple managed to secure payment licenses in Singapore, the UAE, and the UK. The company was also granted conditional approval for a national trust banking charter by the U.S. Office of the Comptroller of the Currency alongside a handful of other firms.

Securing these regulatory approvals has helped Ripple strengthen its push for broader institutional adoption of the XRP (XRP) ecosystem and its flagship stablecoin RLUSD.

As previously reported by crypto.news, Ripple became one of the world’s top most valuable private companies, with its valuation reaching roughly $50 billion.

Crypto World

Crypto is Just Finance on Different Infrastructure: ASIC

Blockchain and crypto are technologies performing the same functions as existing financial infrastructure, so they shouldn’t be treated as separate asset classes when crafting legislation, according to the fintech chief of Australia’s securities regulator.

In a paper presented at the Melbourne Money & Finance Conference on Wednesday, Australian Securities and Investments Commission’s (ASIC’s) head of fintech, Rhys Bollen, said crypto should be regulated on “economic substance rather than technological form.”

Tokenized securities should fall within securities laws, and stablecoins should trigger payment services legislation, Bollen said, while noting that other elements of crypto may be subject to consumer protection laws.

Bollen’s approach contrasts with crypto-specific regulatory frameworks in other countries, such as the CLARITY Act in the US and the Markets in Crypto-Assets Regulation framework in Europe.

Bollen argued that the three main financial functions — capital allocation, payments and risk management — have evolved with technological advancements and that distributed ledger technologies, such as blockchain, shouldn’t be treated differently:

“Digital assets largely represent new technological instances of longstanding financial activities. While the mechanisms of issuance, transfer and record-keeping have changed, the underlying economic functions served by these instruments have not.”

“Regulatory systems have repeatedly adapted to technological change – from paper instruments to electronic records – without abandoning foundational principles such as consumer protection, market integrity and systemic stability,” Bollen added.

Australia isn’t crafting one big crypto bill

Australia is already starting to adopt this approach, with the main piece of crypto legislation, the Digital Asset Framework bill, seeking to merely amend parts of the Corporations Act, Bollen said.

“The Bill does not abandon the existing financial services framework. Instead, it introduces tailored amendments that integrate digital asset platforms into the established regulatory architecture.”

The Australian crypto market has also been given guidance through ASIC Information Sheet 225, which states that existing definitions of “financial product” and “financial service” under the Corporations Act can apply to digital assets.

“ASIC’s guidance explicitly rejects the notion that digital assets constitute a discrete asset class for regulatory purposes,” Bollen said. “Instead, it confirms that a digital asset may fall within the regulatory perimeter where it functions as a security, derivative, managed investment scheme interest or non-cash payment facility.”

Bollen said a focus on “economic characteristics rather than technological labels” would enable regulators to provide clearer rules to market participants while reducing “opportunities for regulatory arbitrage.”

Related: Ripple targets April for Australian financial license via acquisition

ASIC Information Sheet 225 is also focused on the regulation of intermediaries rather than tokens, with Bollen noting that most consumer harm in the digital asset industry has stemmed from the conduct of crypto platforms offering custody, trading, lending or yield services.

Decentralized offerings still tricky to regulate

Bollen acknowledged that classification issues may arise with decentralized products or services, though he said legal analysis should focus on practical control and benefit, rather than formal claims of decentralization:

“Where identifiable parties exercise influence over protocol design, governance, or economic outcomes, regulatory obligations can and should attach.”

Magazine: Clarity Act risks repeat of Europe’s mistakes, crypto lawyer warns

Crypto World

AI will boost jobs; trillions in infrastructure

Artificial intelligence is being reframed as a fundamental utility rather than a purely productivity unlock, according to Jensen Huang, the founder of Nvidia. In a blog post this week, Huang portrays AI as essential infrastructure on par with electricity and the internet. He argues the facilities that design chips, operate data centers, and deploy AI applications represent the largest infrastructure buildout in human history. The sentiment is tempered by the recognition that the job of constructing and maintaining this ecosystem will be enormous, spanning a wide array of skilled trades. The analysis arrives as Nvidia (NVDA) continues to benefit from surging demand for AI hardware, a cycle that has propelled its stock higher in the past 18 months. (EXCHANGE: NVDA)

Huang’s “five-layer cake” concept frames AI infrastructure as a stacked, interdependent system. In his view, energy supplies the base; AI chips drive computation; the underlying infrastructure enables services and platforms; AI models provide reasoning and intelligence; and applications translate capabilities into real-world use cases. The blog argues that the architecture must be rebuilt almost from scratch to accommodate autonomous reasoning, real-time inference, and on-demand intelligence, rather than merely following stored instructions. This restructuring implies not only new factories and fabs but also a reimagining of operational workflows across industries. The five-layer framework has quickly become a touchstone for executives and policymakers contemplating how to allocate capital and talent in the AI era.

AI isn’t a single model. It’s a full stack.

Energy. Chips. Infrastructure. Models. Applications.

That’s the five-layer cake powering the largest industrial buildout in history — and the jobs, factories and AI applications rising with it. pic.twitter.com/rwxO6fdTnE — NVIDIA Newsroom

Huang notes that much of this infrastructure has yet to exist and requires a workforce that is still in short supply. The emerging demand for AI data centers—capable of housing powerful GPUs, high-speed networks, and robust cooling—will demand electricians, plumbers, steelworkers, network technicians, and operators. These are not entry-level roles; they require specialized training and experience, aligning with a broader push for skilled labor across advanced manufacturing and digital-enabled services. As the AI buildout accelerates, Huang argues, the scale of the opportunity will extend beyond any single country or sector, touching a wide spectrum of industries and geographies.

The AI boom’s corporate beneficiaries have become a focal point for investors. Nvidia, already a dominant supplier of AI accelerators, has emerged as one of the biggest winners in the current cycle. Its shares have surged more than 1,300% since 2023, a rally that followed the public release of ChatGPT and the ensuing AI race. The company’s role at the center of both the hardware ecosystem and the software-enabled AI pipeline has reinforced its status as a core proxy for AI demand, even as critics argue the cycle may be tempered by regulatory scrutiny, supply chain constraints, and macro headwinds. (EXCHANGE: NVDA)

Within this broader narrative, Huang’s comments echo a larger industry trend: the AI data-center expansion is reshaping employment patterns and wage prospects in specialized trades. A recent wave of corporate restructurings—at Block, Pinterest, and Dow—has highlighted how AI-enabled efficiency and automation are influencing staffing decisions. Block, Inc. announced a large-scale workforce reduction, a move its co-founder attributed in part to AI-enabled restructuring. Pinterest and Dow also cited AI as a driver for workforce reductions, underscoring a common theme: automation and AI adoption can compress roles while intensifying demand for high-skilled positions in AI hardware, data-center operations, and software engineering. Analysts at Goldman Sachs have characterized AI-driven layoffs as visible but modest, suggesting the macro impact on unemployment might be gradual even as the technology accelerates. (EXCHANGE: SQ)

The story also intersects with broader market dynamics. Nvidia’s ascent underscores the hardware supply chain’s centrality to AI-enabled growth, a trend that has implications for other technology equities and for sectors linked to data-center energy consumption. The AI infrastructure cycle is a reminder that the push into AI is not merely a software upgrade; it is a capital-intensive, global effort that requires policy alignment, capital allocation, and a capable workforce. As capital continues to flow into data centers, chip manufacturing, and related services, the demand for skilled labor, reliable power, and resilient networks is likely to remain a core feature of the investment landscape. (EXCHANGE: NVDA)

AI’s footprint in the economy is expanding rapidly, and Huang’s framework suggests a multi-decade horizon for the buildout. AI data centers will need not only hardware but also the operational expertise to install, maintain, and secure complex systems. The labor market for skilled trades—traditionally insulated from pure software cycles—could see persistent demand for technicians who can design, install, and upgrade AI-ready infrastructure. This reality may influence everything from wage dynamics to vocational training programs, and it could even shape incentives for crypto mining and other power-intensive activities that rely on cost-effective, scalable AI-capable hardware and energy platforms. The net effect is a gradual, rather than explosive, reallocation of resources toward AI-enabled capabilities across industries. (EXCHANGE: PINS; EXCHANGE: DOW)

As the AI narrative matures, investors and policymakers will be watching how the five-layer cake translates into real-world deployments and jobs. Huang’s estimate that “hundreds of billions” have already been invested, with trillions more to come, highlights the scale of the opportunity—and the risk of bottlenecks in supply chains, talent, and regulatory frameworks. In parallel, financial markets will assess whether the AI infrastructure cycle can sustain a broader earnings and growth trajectory for hardware suppliers, cloud providers, and software developers delivering AI-powered services. The cross-currents—tech capex, energy demand, labor shortages, and macro risk sentiment—will continue to shape how this AI era unfolds. (EXCHANGE: NVDA; EXCHANGE: SQ; EXCHANGE: PINS; EXCHANGE: DOW)

Why it matters

For investors, Huang’s framework reframes AI from a short-term optimization trend to a structural, capital-intensive expansion that will require a steady inflow of funding and a highly skilled workforce. The implied long horizon for infrastructure expenditure could sustain demand for AI accelerators, data-center gear, and software ecosystems for years, potentially supporting a more durable equity narrative for hardware-centric players and cloud providers. For builders and operators, the emphasis on a multi-layer stack underscores the importance of resilient, scalable energy, cooling, and networking capabilities. It also highlights the need for training pipelines that can deliver electricians, technicians, engineers, and operators who understand AI workloads from edge to core. For policy and macro participants, the discussion points to the macroeconomic implications of a large-scale industrial transition that could influence employment, wage dynamics, and regional competitiveness as nations compete to attract investment in AI-enabled infrastructure.

From a market-structure perspective, the AI infrastructure wave intersects with broader sectoral trends, including data-center consolidation, hyperscale capacity expansion, and the ongoing evolution of industrial tech. While the short-term price moves in any given stock or token can be volatile, the longer-term signal is one of sustained, capital-intensive growth in a space that sits at the convergence of compute, energy, and human capital. Crypto markets, which have historically been sensitive to energy pricing, risk sentiment, and technology cycles, may experience indirect effects as AI-driven optimization and automation influence energy demand, hardware pricing, and risk-off/ risk-on dynamics across tech-heavy equities. The net takeaway is a cycle that rewards suppliers of AI hardware, creators of AI software, and the labor ecosystem that will build and maintain the infrastructure of the AI era.

What to watch next

- Capital expenditure plans from Nvidia and peers to expand AI data-center capacity, with quarterly updates and guidance.

- Trends in skilled-labor supply for AI infrastructure, including training program developments and wage indicators for electricians, network technicians, and operators.

- Regulatory developments affecting AI deployment, energy efficiency standards, and data-center permitting in key markets.

- Announcements of new AI-enabled products or services from leading cloud providers and hardware suppliers, including integration of AI models into enterprise workflows.

Sources & verification

- Jensen Huang’s blog post outlining the “five-layer cake” framework: https://blogs.nvidia.com/blog/ai-5-layer-cake/

- Article discussing AI data centers and bitcoin mining considerations: https://cointelegraph.com/news/ai-data-centers-local-resistance-bitcoin-mining

- NVIDIA becomes a leading AI boom beneficiary (AI hardware dominance): https://cointelegraph.com/news/nvidia-becomes-first-4t-market-cap-company-on-ai-boom

- Block, Inc. layoffs attributed to AI-driven restructuring: https://cointelegraph.com/news/jack-dorsey-block-cuts-4000-jobs-ai-restructuring

- Pinterest and Dow announcements linking AI to workforce reductions: https://cointelegraph.com/news/ai-use-work-causing-brain-fry-say-researchers

- Goldman Sachs analysis on AI-driven layoffs and unemployment trends: https://finance.yahoo.com/news/goldman-sachs-warns-ai-fueled-layoffs-could-raise-the-unemployment-rate-this-year-chart-154251740.html

What the story means for the market

The trajectory Huang sketches positions AI infrastructure as a multiyear, capital-intensive cycle that could recalibrate how investors value hardware suppliers, cloud platforms, and enterprise software tied to AI workloads. As the industry navigates talent shortages, energy considerations, and macro uncertainties, the sector’s performance will hinge on the pace of data-center expansion, the efficiency of AI training and inference pipelines, and the alignment of policy with rapid technology adoption.

//platform.twitter.com/widgets.js

Crypto World

Can XRP break $100 in a single day? Retail investors are searching for passive income opportunities

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Rising interest in XRP is pushing investors to explore passive income strategies, with platforms like NOW DeFi gaining attention for cloud mining and automated crypto earnings.

Summary

- Many XRP investors are looking for passive income options such as staking, DeFi yields, and cloud mining.

- Platforms allow users to participate in Bitcoin mining without hardware by renting hash power remotely.

- NOW DeFi offers features like free hash power rewards, AI mining optimization, and renewable-energy mining infrastructure.

As sentiment in the cryptocurrency market begins to recover, XRP has once again become one of the focal points for investors. Discussions surrounding XRP’s future price potential have intensified in recent weeks, with some analysts even speculating whether the asset could see a sharp surge in a very short period if market momentum continues to strengthen.

While the idea of XRP reaching $100 within a single day remains largely speculative, a more practical trend is becoming clear: an increasing number of retail investors are no longer focusing solely on price movements but are also searching for cryptocurrency investment methods that can generate consistent income.

Amid rising market volatility, passive income, automated earnings strategies, and low-barrier participation models are becoming new areas of interest. Particularly as popular assets like XRP regain market attention, some investors are turning their focus toward cloud mining, DeFi yield products, and automated digital asset platforms.

What passive income opportunities are XRP investors exploring?

In the current market environment, many investors are increasingly looking for opportunities that offer:

- Income models that do not rely on frequent trading

- Participation methods that require little technical expertise

- Platform-based services that can grow alongside the crypto market

Among these options, cloud mining is re-emerging as a popular choice among investors.

Compared with traditional hardware-based mining, cloud mining eliminates the need to purchase expensive mining machines or manage electricity, cooling, and maintenance costs. Users simply register on a platform and select a contract to participate in cryptocurrency mining through remote computing power.

For retail investors who are watching XRP’s price action while also seeking passive income opportunities, this model is becoming increasingly attractive.

Five passive income strategies XRP investors are paying attention to

1. Digital Asset Staking

Staking is one of the most common passive income strategies. By locking certain digital assets, users can earn rewards distributed by platforms or blockchain protocols.

This method is relatively easy to use, though returns are often closely tied to the volatility of the underlying asset.

2. DeFi Yield Protocols

DeFi protocols allow users to generate returns through liquidity provision, lending, or yield aggregation.

While flexible, these strategies often require a higher level of risk awareness and understanding.

3. Automated Trading Strategies

Some platforms offer quantitative or automated trading strategies designed to capture opportunities in volatile markets.

However, such products can be more complex and rely heavily on the platform’s trading algorithms.

4. Cloud Mining Platforms

Cloud mining is increasingly viewed as an alternative to traditional cryptocurrency mining.

Instead of purchasing hardware, users can access mining power through cloud-based platforms and participate in the mining rewards of cryptocurrencies such as Bitcoin.

For investors seeking a lower technical barrier and more automated income generation, this approach is gaining traction.

5. Platforms Combining Cloud Mining and DeFi

As more platforms integrate infrastructure with yield mechanisms, services that combine cloud mining with DeFi features are attracting a new wave of crypto users.

These platforms typically emphasize simplified registration, automated reward distribution, and streamlined user experiences.

Why NOW DeFi is attracting attention from XRP and crypto investors

Among the many platforms available today, NOW DeFi is gradually becoming a topic of discussion within the market.

For investors looking to shift from pure price speculation toward passive income strategies, NOW DeFi offers a more direct entry point. The platform combines cloud mining infrastructure with DeFi-based reward mechanisms while simplifying the participation process.

For many users who have previously focused on trading assets such as XRP, BTC, or ETH, platforms like NOW DeFi are increasingly seen as a potential “second income curve” within the crypto ecosystem.

Key features of NOW DeFi include:

Free Hash Power Rewards

New users can claim a free mining reward upon registration to experience the platform’s mining services.

Daily Earnings Settlement

The platform supports automated daily reward distribution, reducing the need for manual management.

AI Hash Power Optimization Technology

Dynamic resource allocation helps improve overall mining efficiency.

Renewable Energy Mining Infrastructure

The platform’s mining operations are located in regions rich in renewable energy resources.

According to platform information, its mining infrastructure is primarily distributed across:

- Norway

- Canada

- Iceland

- Sweden

- Paraguay

- Uruguay

These regions offer relatively low energy costs and stable renewable energy supplies, supporting efficient mining operations.

Example mining plans

| Plan | Investment | Contract Duration | Estimated Daily Earnings |

|---|---|---|---|

| Entry Plan | $100 | 2 Days | ~$4 |

| Mid-Tier Plan | $10,000 | Varies by plan | ~$165 |

| Advanced Plan | $50,000 | Varies by plan | ~$955 |

It is important to note that actual returns may vary depending on market conditions, network difficulty changes, and platform policies.

Why These Platforms Are Attracting More XRP Investors

XRP investors are typically highly sensitive to market trends and are often willing to explore new opportunities when the market becomes active.

When popular assets regain attention, investors often begin searching for answers to questions such as:

- Which platforms can provide passive income?

- Which strategies do not require constant trading?

- Which services are suitable for beginners?

As a result, during periods of heightened market interest, cloud mining platforms and automated yield services tend to gain additional visibility.

Conclusion

Whether XRP can truly reach $100 within a single day remains uncertain, but one clear trend is emerging across the cryptocurrency industry: investors are increasingly shifting their focus from single price movements toward more sustainable income models.

From staking and DeFi to cloud mining and automated yield services, passive income strategies are becoming an important consideration for retail investors managing digital asset portfolios.

For users interested in exploring alternative income opportunities beyond XRP price speculation, NOW DeFi offers a relatively simple way to participate. Users can register by visiting the official NOW DeFi website or downloading the mobile application. After registration, new users can claim the platform’s free hash power reward and begin participating in cloud mining without purchasing mining hardware.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

Dogecoin zooms as Elon Musk announces X Money launch date for April

Elon Musk said late Tuesday that the payments features on social application X will go live next month.

Dubbed X Money, the feature turns X into a fintech app with peer-to-peer transfers, bank deposits, a debit card, cashback re

The platform is licensed in over 40 U.S. states through subsidiary X Payments and has Visa as a partner for account funding.

Dogecoin rallied as much as 8%, before reversing gains, after the annoucement despite it containing zero references to crypto. It hit nearly $0.10 over the past day before settling around $0.093, making it the best-performing major crypto over both 24-hour and seven-day periods.

The reflexive move reflects a pattern that has played out multiple times since 2021. Musk says something about X payments, and DOGE pumps on speculation he’ll integrate it.

Musk has called dogecoin his “favorite cryptocurrency” and Tesla accepted DOGE for merchandise in 2022. But X Money as described is a pure fiat product, with peer-to-peer transfers, bank linking, debit card. That’s closer to Venmo with a social media app attached, not a crypto wallet.

As such, X’s head of product Nikita Bier said in February that crypto trading tools would come to X through Smart Cashtags, but clarified the platform wouldn’t execute trades or act as a brokerage.

It would provide data and links that redirect users to exchanges. Musk recently reposted a third-party forecast of X Money’s future features that included “crypto integration,” but the company hasn’t confirmed anything.

The more interesting question for crypto markets isn’t whether DOGE gets added. It’s the 6% yield.

Six percent on a balance inside a social media app used by hundreds of millions of people is higher than virtually every U.S. savings account and competitive with money market funds. Whether it’s subsidized by X to drive adoption, generated by lending deposits, or backed by some other mechanism matters enormously for how regulators view it.

The timing collides with Congress fighting over the CLARITY Act, which would set rules for yield-bearing stablecoin products.

The Senate Banking Committee is targeting mid-to-late March for markup. The core policy question is whether non-bank platforms should be allowed to offer deposit-like yields to consumers.

X Money isn’t a stablecoin product, but it’s targeting the exact same consumer demand, people looking for better returns than their bank offers, through a different regulatory path.

If X Money launches at scale with 6% APY before the CLARITY Act passes, it creates an awkward comparison. A fiat fintech product inside a social media app gets to offer yields that crypto stablecoin products are being legislated out of.

Crypto World

Ethereum’s on fire with record activity, but ether price and blockchain fees lag

Ethereum’s network activity has surged to all-time highs across multiple metrics, but the growth has failed to lift ether’s price or boost fee generation at the base layer.

A weekly report from analytics firm CryptoQuant published March 10 found that daily active addresses on Ethereum approached 2 million in February 2026, exceeding peaks seen during the 2021 bull market. Active addresses are unique blockchain wallet addresses that have sent or received a transaction within a specific timeframe, like the past 24 hours

Smart contract calls, or codes on blockchain telling it to do something specific, topped 40 million per day, and token transfers driven by internal contract interactions also set records. The findings point to broad adoption across DeFi, stablecoins and automated protocol activity, even as investment demand for ether has weakened.

Record network user activity typically bodes well for the market value of the blockchain’ native token. But that’s not the case with Ethereum.

It’s native token ether is down roughly 30% over the last six months, and the one-year change in Ethereum’s realized capitalization has turned negative, indicating net capital outflows from the market.

Exchange flow data from CryptoQuant shows ether moving to trading venues at a faster rate relative to bitcoin, a pattern consistent with elevated selling pressure.

Focus on capital flows

CryptoQuant argued that capital flows, rather than network activity, now explain ETH price dynamics more effectively.

In prior cycles, particularly 2018 and 2021, rising on-chain activity coincided with price rallies. That relationship has weakened. The firm’s scatter analysis showed recent observations clustering at high activity levels but relatively low prices, suggesting incremental usage growth now has less explanatory power for ether’s valuation.

The fee picture reinforces the disconnect. Data from DefiLlama shows Ethereum generated roughly $10.3 million in transaction fees over the past 30 days, placing it third behind Tron at nearly $25 million and Solana at about $20 million.

On a revenue basis, the gap widens further. Ethereum ranked fifth in 30-day protocol revenue at $1.22 million, trailing Tron as well as Polygon, Base and Solana. Base, an Ethereum layer-2 network built by Coinbase, generated roughly three times Ethereum’s protocol revenue over the same period.

The disparity reflects the growing role of Ethereum’s layer-2 ecosystem. Networks such as Base and Polygon process large volumes of transactions while paying relatively small settlement costs back to the base chain, distributing economic activity across the broader Ethereum ecosystem rather than concentrating it on the base layer.

Stablecoins remain a bright spot for adoption. Ethereum hosts approximately $162 billion in stablecoin supply, roughly 52% of the global market, according to DefiLlama. Yet that activity has not translated into proportional value capture for ether itself.

Ethereum may be busier than ever, but the blockchain’s native asset is capturing less of the value created on top of it.

-

Business5 days ago

Form 8K Entergy Mississippi LLC For: 6 March

-

Tech6 days ago

Tech6 days agoBitwarden adds support for passkey login on Windows 11

-

News Videos2 days ago

News Videos2 days ago10th Algebra | Financial Planning | Question Bank Solution | Board Exam 2026

-

Fashion4 days ago

Fashion4 days agoWeekend Open Thread: Ann Taylor

-

Crypto World2 days ago

Crypto World2 days agoParadigm, a16z, Winklevoss Capital, Balaji Srinivasan among investors in ZODL

-

Sports5 days ago

Sports5 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

Sports3 days ago

Sports3 days agoThree share 2-shot lead entering final round in Hong Kong

-

Sports3 days ago

Sports3 days agoBraveheart Lakshya downs Lai in epic battle to enter All England Open final | Other Sports News

-

Politics5 days ago

Politics5 days agoTop Mamdani aide takes progressive project to the UK

-

Business14 hours ago

Business14 hours agoExxonMobil seeks to move corporate registration from New Jersey to Texas

-

NewsBeat6 days ago

NewsBeat6 days agoPiccadilly Circus just unveiled ‘London’s newest tourist attraction’ and it only costs 80p to enter

-

Entertainment4 days ago

Entertainment4 days agoHailey Bieber Poses For Sexy Selfies In New Luscious Lip Thirst Traps

-

Business3 days ago

Business3 days agoSearch for Nancy Guthrie Enters 37th Day as FBI Probes Wi-Fi Jammer Theory

-

NewsBeat1 day ago

NewsBeat1 day agoPagazzi Lighting enters administration as 70 jobs lost and 11 stores close across Scotland

-

Tech2 days ago

Tech2 days agoDespite challenges, Ireland sixth in EU for board gender diversity

-

Entertainment6 days ago

Harry Styles Has ‘Struggled’ to Discuss Liam Payne’s Death

-

Crypto World6 days ago

Crypto World6 days agoNew Crypto Mutuum Finance (MUTM) Reports V1 Protocol Progress as Roadmap Enters Phase 3

-

Tech6 days ago

Tech6 days agoACIP To Discuss COVID ‘Vaccine Injuries’ Next Month, Despite That Not Being In Its Purview

-

Business1 day ago

Business1 day agoSearch Enters 39th Day with FBI Tip Line Developments and No Major Breakthroughs

-

NewsBeat6 days ago

NewsBeat6 days agoGood Morning Britain fans delighted as Welsh presenter returns to host ITV show