Crypto World

Trump taps Kevin Warsh for Fed Chair, sets stage for high-stakes battle over central bank independence

President Donald Trump on Friday named former Federal Reserve Governor Kevin Warsh to succeed Jerome Powell as chair of the U.S. central bank, capping months of speculation and intensifying scrutiny over the future independence of the Fed at a moment of persistent inflation, slowing growth, and mounting political pressure.

Summary

- The Warsh pick ends a months-long search and sets up a contentious confirmation process that puts Fed independence squarely in the spotlight.

- Warsh is considered an experienced central banker despite his past calls for a “regime change” at the Fed and Trump’s push for aggressive interest-rate cuts.

- A Justice Department probe into Jerome Powell fuels growing debate over how much influence the White House should have over monetary policy.

The nomination of Warsh, 55, a veteran of Wall Street and the Fed, is widely seen as a bid to install a chair aligned with Trump’s calls for lower interest rates, even as markets remain skeptical that Warsh would act as a political proxy. While the pick is unlikely to spark immediate market volatility, it sets up a contentious confirmation process and a broader debate over how far the White House can—and should—go in influencing monetary policy.

Trump announced the decision on Truth Social, praising Warsh as a proven leader who could go down as “one of the GREAT Fed Chairmen, maybe the best.” The move ends a prolonged and unusually public search that at one point included more than a dozen candidates and was closely watched by investors, economists, and lawmakers.

Warsh previously served as a Fed governor from 2006 to 2011, spanning the global financial crisis, and has since been a frequent commentator on monetary policy. His experience and credibility helped reassure markets, which showed only modest reaction following the announcement. Stock futures were slightly lower Friday morning but well off their lows once Warsh emerged as the clear choice.

Warsh has been sharply critical of the current Fed leadership. He told CNBC that he wanted a “regime change” at the central bank, arguing that its credibility had eroded under the existing leadership. That stance could place him at odds with an institution built around consensus and gradualism.

Trump’s decision comes as the Fed faces one of its most challenging environments in decades. Inflation remains above the central bank’s 2% target, government borrowing continues to rise, and the labor market is soft.

Fed faces unusual political pressure

Tensions escalated recently after the Justice Department subpoenaed Powell over a costly renovation of the Fed’s Washington, D.C., headquarters. Powell has characterized the investigation as a “pretext” to force easier monetary policy, a claim that has deepened concerns about political interference.

Trump and senior administration officials have openly questioned long-standing norms around Fed independence, floating ideas that include tighter White House oversight and changes to how interest-rate decisions are made, potentially requiring consultation with the president.

The Warsh nomination followed a competitive vetting process led by Treasury Secretary Scott Bessent. Finalists included current Fed Governor Christopher Waller, BlackRock bond chief Rick Rieder, and National Economic Council Director Kevin Hassett.

Confirmation path is far from clear

Republican Sen. Thom Tillis of North Carolina reportedly said he would block all Fed nominations until the Justice Department concludes its probe into Powell, calling the investigation unfounded.

By contrast, Senate Banking Committee Chair Tim Scott praised Warsh’s “deep knowledge of markets and monetary policy.”

Markets, for now, expect continuity rather than disruption. Traders are pricing in no more than two additional rate cuts this year, with the benchmark fed funds rate settling near 3%, a level policymakers view as neutral.

One unresolved question is Powell’s future. Though Fed chairs traditionally step down entirely when replaced, Powell still has two years left in his term as governor and could remain on the board, potentially serving as a check on Trump’s efforts to reshape the institution.

The Supreme Court is already weighing a related case involving another Fed governor, a decision that could ultimately redefine presidential authority over the central bank.

Crypto World

Jupiter and Noah Bring Neobank Features to Jupiter Global

Editor’s note: In today’s crypto landscape, partnerships between regulated banking infrastructure and DeFi platforms signal a pivotal step toward mainstream adoption. The Jupiter Noah collaboration merges trusted settlement rails with a leading Solana-based platform, enabling neobank-like features that bridge crypto and fiat for millions of users. This editorial note offers context for the release, outlining why the integration matters and how it could impact everyday finance, payroll, remittance, and treasuries. The content that follows preserves the core press release details while highlighting the potential real-world benefits of connecting digital assets to the traditional economy.

Key points

- Neobank features integrated into Jupiter Global via Noah’s regulated banking infrastructure.

- USD and EUR virtual accounts enable earning, holding and spending globally with seamless fiat-crypto settlement.

- Instant on-chain earnings pushes to local bank accounts and compliant, cross-border transfers.

- Currency expansion begins with SGD and MYR, with plans for AED, IDR, JPY, THB and more.

Why this matters

By embedding Noah’s regulated settlement infrastructure into Jupiter Global, a traditional finance rails are aligned with on-chain activity, creating practical use cases like salaries, payroll, remittance and cross-border payments. This partnership aims to end the two-tier finance model by offering reliable off-ramps and real-world spending power for crypto holders, ultimately accelerating mainstream adoption and global financial inclusion.

What to watch next

- Currency expansion: SGD and MYR launch, with plans for AED, IDR, JPY, THB and more.

- Wider adoption as salaries and payroll use cases roll out for global workers and employers.

- Further integration milestones with Jupiter’s 50M+ wallets and the Solana ecosystem.

Disclosure: The content below is a press release provided by the company/PR representative. It is published for informational purposes.

Jupiter and Noah partner to bring neobank features to Jupiter Global, making crypto feel like banking, and banking feel like crypto for 50+ million users

London, February 24th, 2026 – Noah, the global payments infrastructure provider, and Jupiter, the DeFi Superapp, have partnered to connect decentralised finance and the traditional banking ecosystem, reshaping how millions of people globally access and use money.

As the global leader in on-chain finance, Jupiter powers 90% of trading volume on Solana — the world’s second-largest blockchain by TVL (DefiLlama).

By integrating Noah’s regulated banking infrastructure directly into this ecosystem, the platform can now operate as a neobank. Jupiter Global users, via USD and EUR virtual accounts, can earn, hold and spend globally, moving between crypto and fiat seamlessly and instantly. This unlocks a wave of new use cases across payroll, remittance, and institutional treasury; transforming Jupiter from a trading platform into a global settlement layer and sovereign financial hub.

To put it in real-world terms, the integration means a developer in Thailand can now offer services internationally, a trader in Singapore can now off-ramp Solana profits directly to their local bank account, a worker living abroad can now make sure their family receives more of their financial support without large sums being lost to fees, plus many more examples.

Through the partnership, users can now:

- Receive salaries, payments and international transfers into virtual USD and EUR accounts that settle directly as stablecoins without delays or high fees

- Push on-chain earnings instantly to local bank accounts in key markets, helping them unlock even more real-world value from the digital assets

- Benefit from Noah’s institutional-grade compliance

With these features, and with Noah effectively bringing neobank capabilities to Jupiter’s 50 million+ wallets, the partnership addresses the so-called “last-mile problem” that has long held crypto back from mainstream adoption.

“For too long, the crypto economy and the real economy have operated as isolated ecosystems. We are building the bridge,” said Shah Ramezani, Founder and CEO of Noah. “By plugging regulated settlement infrastructure directly into Jupiter, we are turning a trading wallet into a comprehensive financial tool. This isn’t just about moving money; it’s about giving millions of users a direct line to the real economy, allowing them to convert on-chain wealth into real-world spending power instantly, without friction.”

Sovereign financial hub

For Noah, the partnership provides distribution at scale and further establishes it as the go-to infrastructure provider for yet another major financial platform. Its banking licences already allow it to serve 60+ countries and currencies.

More broadly, the partnership also signals the end of today’s two-tier finance model. For decades, the fast and transparent nature of blockchain transactions has promised to solve the slow, expensive and inequitable flaws at the heart of today’s global financial system. Yet they’ve failed to cut through to the mainstream when it comes to salaries, rent, and everyday purchases due to a lack of reliable off-ramps. Noah’s integration in Jupiter Global now makes this possible.

“Our goal is to build a compliant, on-chain neobanking experience,” said Thomas Stoffels, Jupiter Global Lead at Jupiter. “For our DeFi audience, the ability to off-ramp directly to a bank account – or receive a wire transfer from a client directly into the app – is a game changer. We’re bridging the gap between the speed of Solana and the utility of the traditional banking system.”

Global Reach, Local Focus

The integration is launching with support for Singapore Dollar (SGD) and Malaysian Ringgit (MYR) and is due to expand to other local currencies over the coming months – including AED, IDR, JPY, THB and more. This focus on the APEC region is part of Jupiter’s mission to position Jupiter Global as the primary financial tool for users in some of the world’s fastest-growing crypto hubs. Further currencies, including across Europe and Latin America, will be added later down the line to further support Jupiter’s diverse global user base.

Crypto World

BitMine’s $93 Million Ethereum Buy Fails To Trigger Price Rise

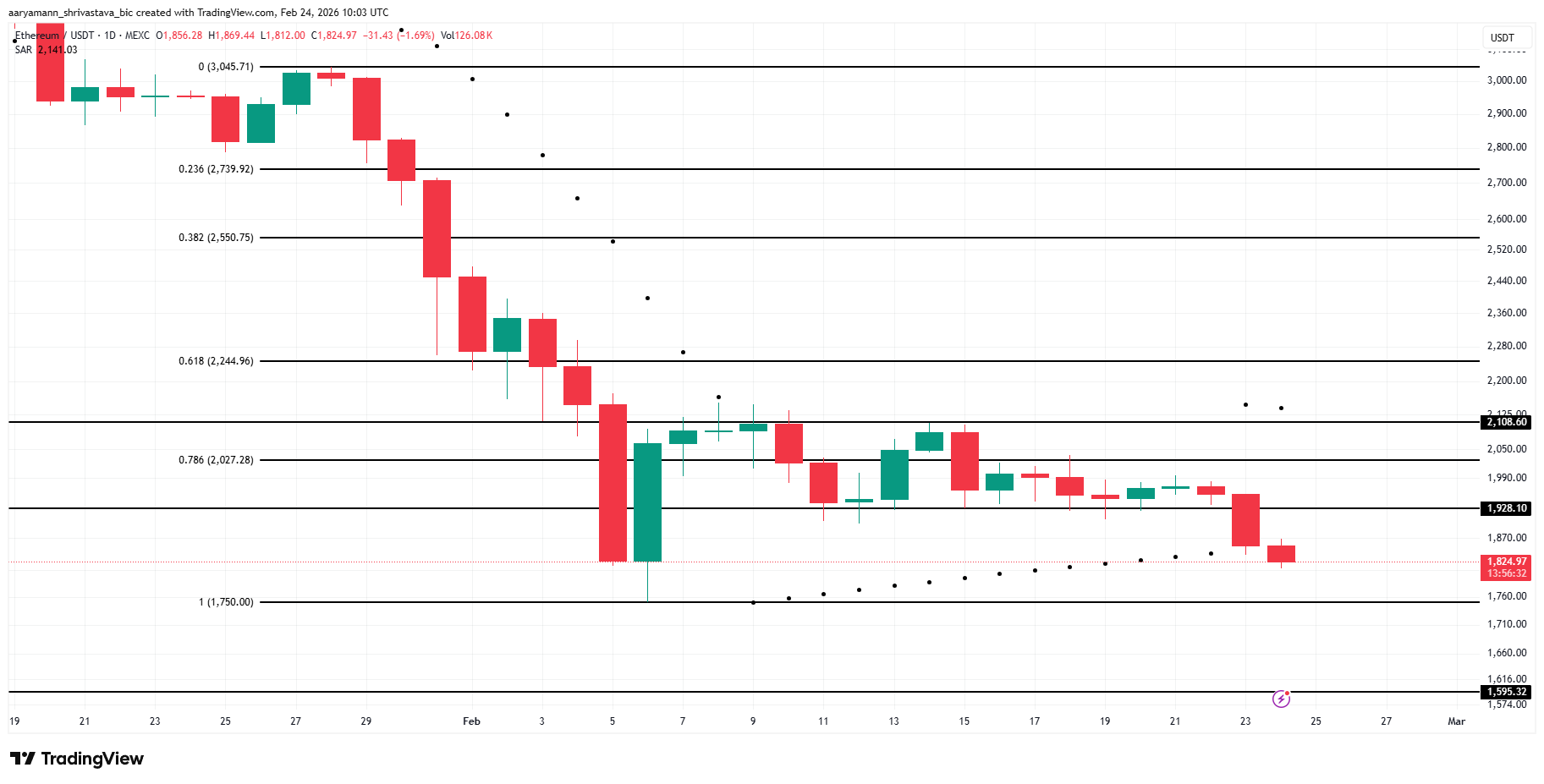

Ethereum price recently failed to sustain a breakout above $2,100, forcing the altcoin into a consolidation phase. The rejection reinforced resistance and shifted short-term momentum lower. External developments fueled expectations of recovery, but limited investor participation muted their impact.

ETH has since slipped back into a structured range. Broader crypto market conditions remain fragile, amd the current structure reflects hesitation rather than renewed confidence.

BitMine Maintains Its Alchemy of 5%

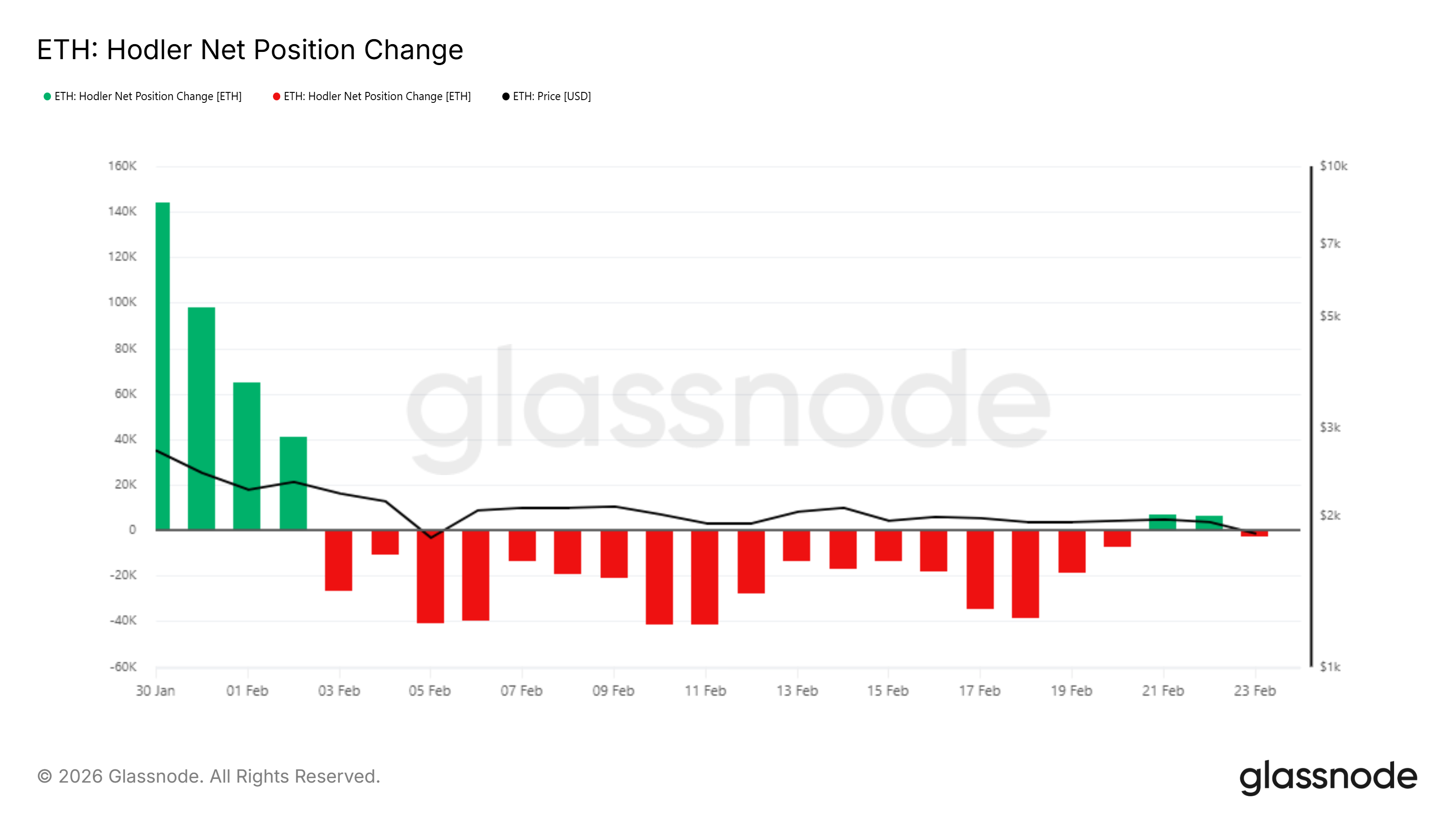

On February 23, BitMine announced it had acquired an additional 51,162 ETH over the week, worth more than $93 million. The purchase represented one of the larger institutional Ethereum buys in recent weeks. However, the announcement failed to generate sustained upward price movement.

Instead of triggering accumulation, long-term holders resumed distribution. On-chain data suggests some investors likely used the headline as liquidity to reduce exposure. This reaction highlights that the Ethereum price remains more sensitive to broader market cues than individual corporate acquisitions.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Ethereum Holders Are Struggling

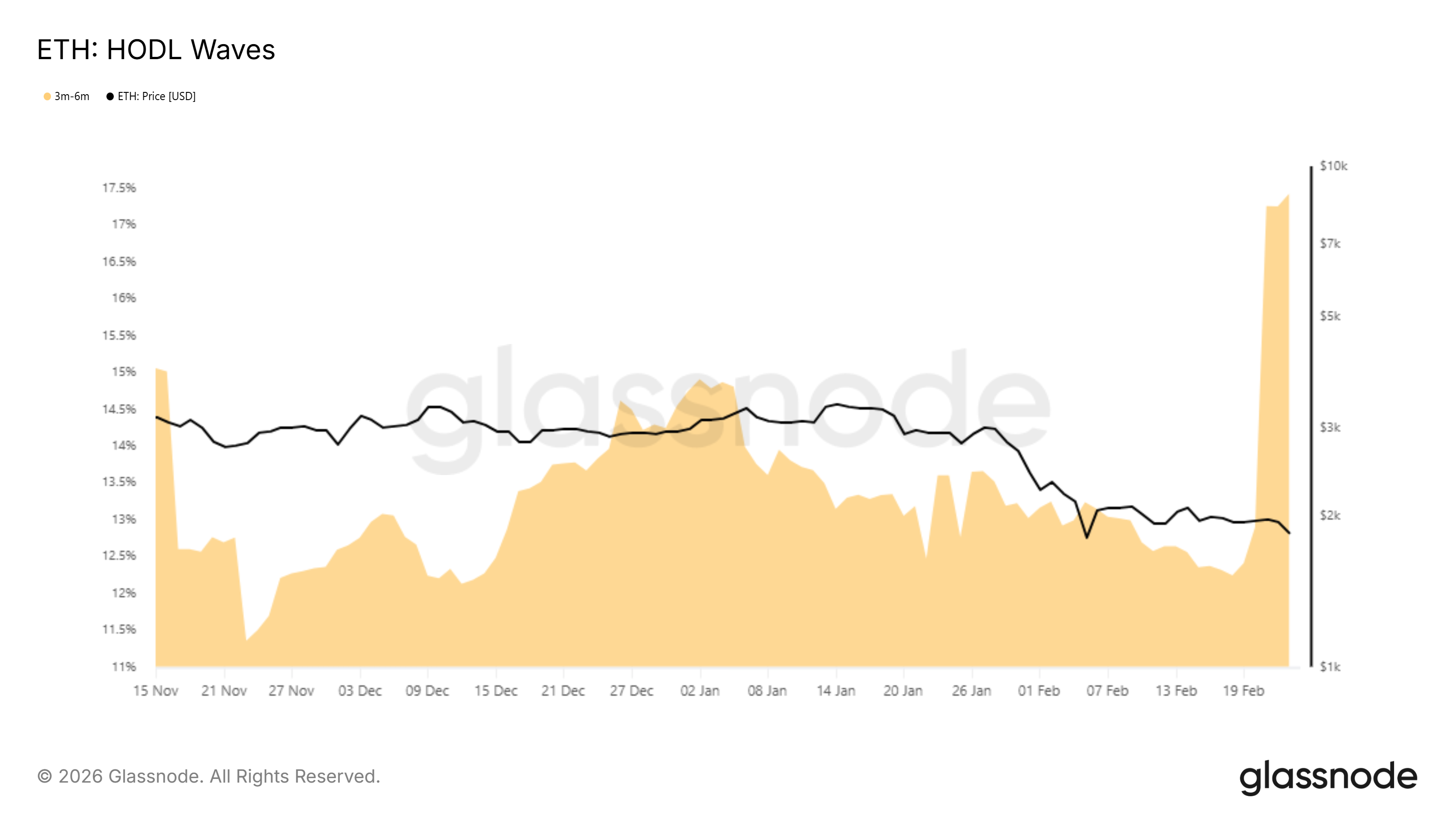

Ethereum’s HODL waves provide insight into investor behavior. Short-term holders have matured into mid-term holders, with the 3- to 6-month supply rising by 5% over the past week. This shift indicates investors are waiting rather than exiting positions.

Underwater holders appear reluctant to realize losses. Their decision to hold supports price stability. However, this same caution may be limiting fresh buying activity. Investors are prioritizing recovery confirmation before committing additional capital to ETH.

ETH Price Could Slide Further

Ethereum is trading at $1,824 at the time of writing after losing the $1,928 support level. The Parabolic SAR indicator now sits above the candlesticks, signaling a confirmed short-term downtrend. This technical setup suggests sellers currently control momentum.

The next major support for ETH stands at $1,750. A decisive break below that level could expose the cryptocurrency to further downside toward $1,595. Weak macro conditions and persistent outflows may amplify volatility if support fails to hold.

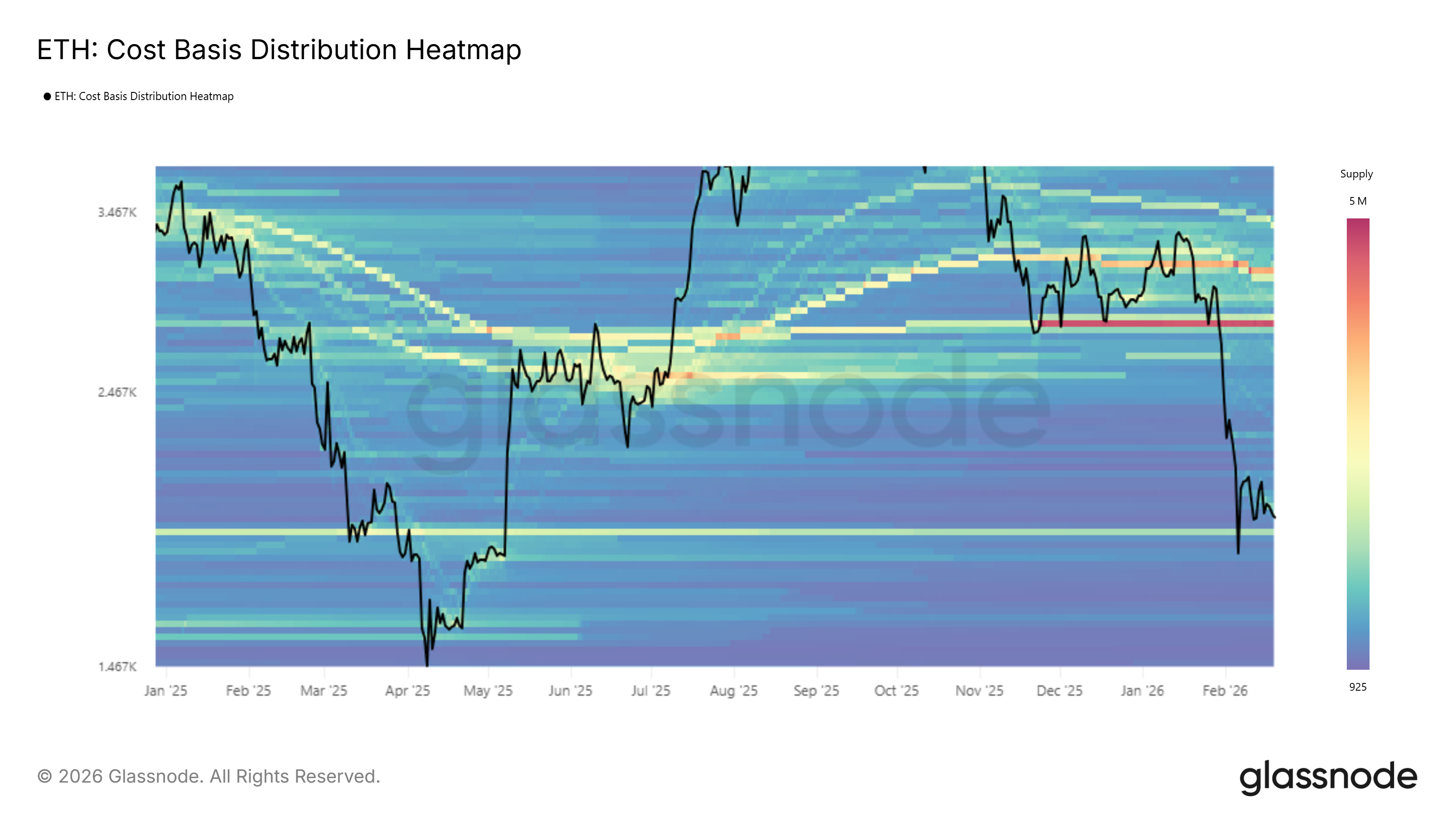

The CBD heatmap identifies a significant demand zone between $1,880 and $1,900. Ethereum slipped below this range during the recent decline. If buyers from this zone opt to sell to limit losses, downside pressure could accelerate across spot and derivatives markets.

Conversely, resilience among holders could shift momentum. A rebound toward $1,928 would signal improving structure. Reclaiming that level as support may open ETH’s path toward $2,108. A sustained breakout above that resistance would invalidate the current bearish thesis and restore bullish momentum.

Crypto World

Solana, Ethereum L2s (and XRP?) Just Got a Huge Buy Signal From Citrini Research

Everyone is talking about the Citrini Research report that sent the market into a tailspin yesterday. Buried in its 7,000 words of wisdom is a huge buy signal for Solana and Ethereum Layer 2s.

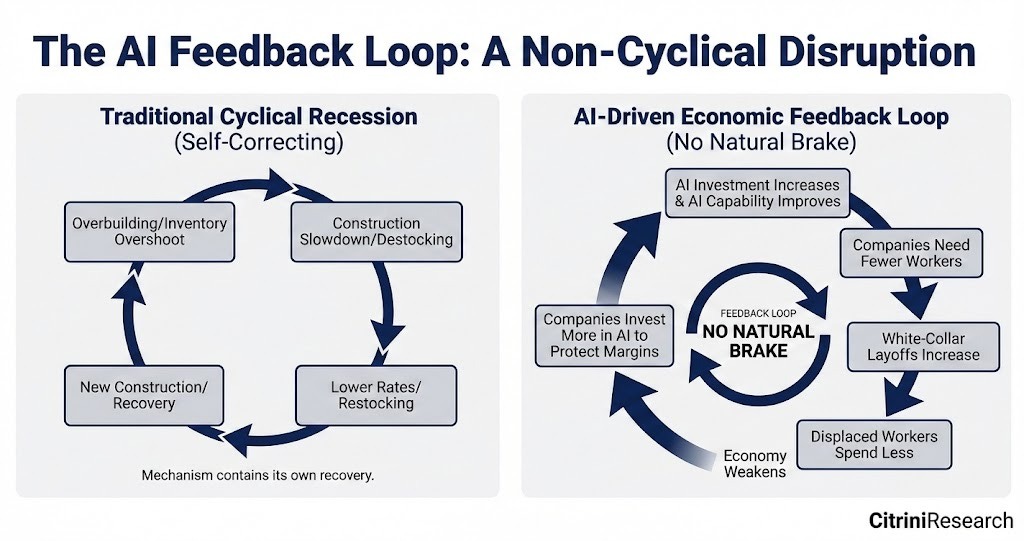

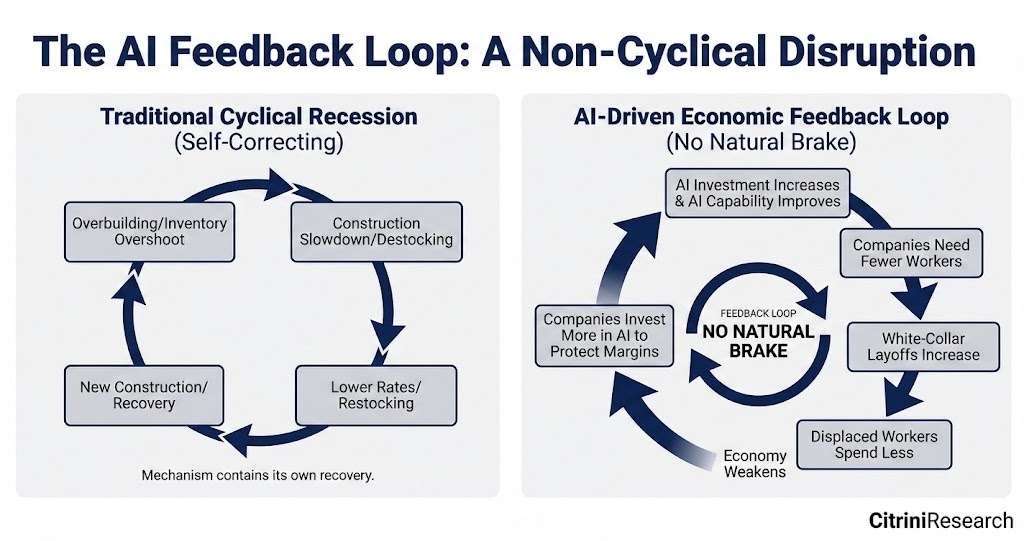

The report, entitled The 2028 Global Intelligence Crisis, is a work of fiction that explores a future scenario in which AI disruption leads to what it describes as a “negative feedback loop with no natural brake”.

In short, AI is going to displace white collar workers at an unprecedented rate. It should have been obvious, but we waited until 2028 for the penny to drop…

“It should have been clear all along that a single GPU cluster in North Dakota generating the output previously attributed to 10,000 white-collar workers in midtown Manhattan is more economic pandemic than economic panacea. The velocity of money flatlined. The human-centric consumer economy, 70% of GDP at the time, withered. We probably could have figured this out sooner if we just asked how much money machines spend on discretionary goods. (Hint: it’s zero.)

“AI capabilities improved, companies needed fewer workers, white collar layoffs increased, displaced workers spent less, margin pressure pushed firms to invest more in AI, AI capabilities improved…”

Here’s what that looks like schematically:

Entering an age of abundant intelligence

There is no self-correction as we would expect to see in a typical cyclical recession.

It goes something like this: construction (or other economic activity) slows, rates adjust downwards, allowing businesses to return to expanding output, until overproduction kicks in again, and so on.

In the AI doom loop, AI improves, fewer workers are needed, fewer workers mean less spending, the economy weakens, companies invest in more AI to protect margins, AI gets even better, and the cycle repeats – there is no natural break.

We thought it was a sectoral story. I’m not in Software-as-a-Service (SaaS), so there’s no need to worry. But it is more than software. Much more. It was a comforting notion that AI would usher in an era of creative destruction, as seen in past technological assaults on the old ways of doing things.

Yes, AI will destroy jobs, but, as in the past, new jobs and hitherto unimagined industries would emerge to replace them.

Trouble is, according to Citrini’s scenario, AI is a story of human intelligence displacement. The entire white collar workforce is imperilled. It is the consequence of abundant intelligence.

The authors of the Cetrini report remind us that advanced economies like the US are service-based. The report breaks that down so everyone can understand:

“The US economy is a white-collar services economy. White-collar workers represented 50% of employment and drove roughly 75% of discretionary consumer spending. The businesses and jobs that AI was chewing up were not tangential to the US economy, they were the US economy.”

Unfortunately for all of us – white collar, blue collar, whatever – machines don’t buy stuff.

AI agents destroy intermediation – bye bye credit cards, hello stablecoins

The report makes a robust case for how consumer agents will end the age of intermediation.

AI agents operate autonomously on behalf of their human owners, which means they can find the best flight or hotel on the market with ease because they never get tired, don’t find anything monotonous or dull, and never sleep.

The days of companies relying on our laziness or inertia are numbered. Add ‘vibe coding’ to the mix, and a new wave of startups can spin up delivery services apps in a few weeks to compete with DoorDash et al, or automate workflow in a bespoke way that fits your corporate needs more performantly than say Monday. Everywhere, fees are being compressed to near zero.

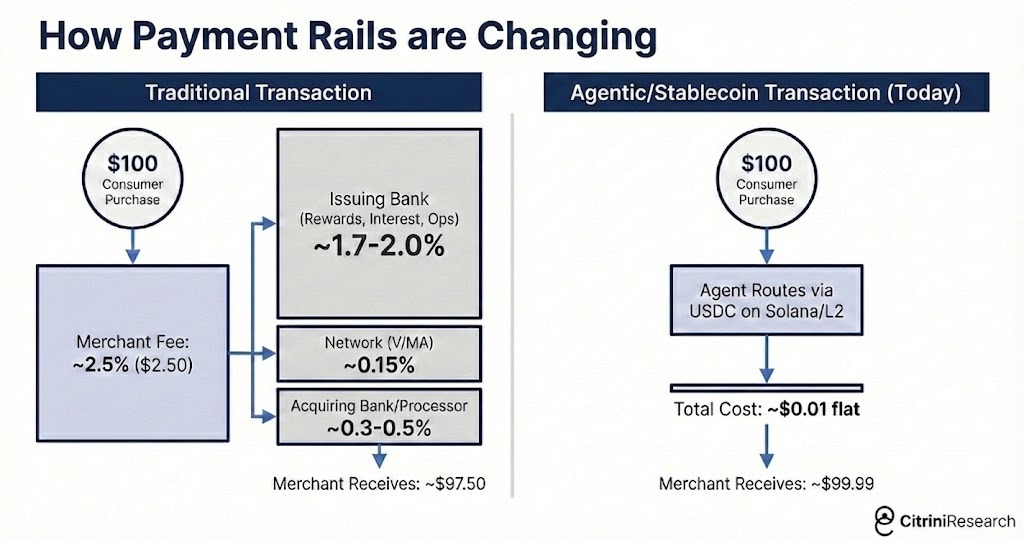

And then we come to our friends, the banks. Why pay fees to Mastercard and Amex when you can use a stablecoin running on a low-fee blockchain like Solana, or an Ethereum Layer 2 like Base, Arbitrum, Optimism, or Polygon?

“Once agents controlled the transaction, they went looking for bigger paperclips.

“There was only so much price-matching and aggregating to do. The biggest way to repeatedly save the user money (especially when agents started transacting among themselves) was to eliminate fees. In machine-to-machine commerce, the 2-3% card interchange rate became an obvious target.

“Agents went looking for faster and cheaper options than cards. Most settled on using stablecoins via Solana or Ethereum L2s, where settlement was near-instant and the transaction cost was measured in fractions of a penny.”

And what agentic AI will do for stablecoins could also be applied to cross-border payment protocols like Ripple’s XRP Ledger, although it doesn’t get a mention in this report.

Coinbase has already begun experimenting with a protocol that allows AI agents to make payments on-chain.

The tokenization, disintermediation, agentic AI narrative to beat the bear market blues

Crypto has been looking for a “new” narrative to lift the fog of the bear market. Well, it’s been hiding in plain sight: tokenization, disintermediation, and Agentic AI.

Will that solve the problem of an economy without enough workers getting paid wages and salaries to drive the consumption that companies depend on?

Probably not, but as the report contends, we’ve got time to figure out a solution for that. Taxing the hyperscaler ‘robber barons’ is suggested, but that’s unlikely to go down well with the Lords of the data centers.

In payments, as elsewhere, disruption is coming and everyone – investors, companies, and consumers – needs to start thinking about what it all means.

Consumer behavior is already shifting. Chargebacks911, a global leader in dispute resolution and chargeback prevention, is warning merchants and payments firms that agentic commerce will reshape disputes, as AI systems move from recommending purchases to executing them. Chargebacks are payment reversals initiated by a cardholder’s bank.

For years, most chargebacks fell into three categories: fraud, merchant error, or buyer’s remorse. Agent-initiated transactions create a fourth scenario. The purchase is technically authorised, but the result does not match the customer’s expectations.

“The payments industry has always treated the click as the signal of intent,” says Monica Eaton, founder and CEO of Chargebacks911.

“Agentic commerce removes the click. So now we need a new way to prove intent when a human was not directly involved.”

Keep an eye on your bank account, and welcome to the future.

Report co-author Alap Shah, explains more about the ideas in the report, such as AI-induced ‘ghost GDP’, where value accrues on the balance sheets of the hyperscalers but does not show up in the “human-centric consumer economy”:

The post Solana, Ethereum L2s (and XRP?) Just Got a Huge Buy Signal From Citrini Research appeared first on Cryptonews.

Crypto World

Terraform claims Jane Street behind $40B meltdown

Terraform Labs and its bankruptcy administrator have accused trading firm Jane Street of using insider information to front-run transactions and make a profit from the platform’s $40 billion crash.

Todd Snyder, the court-appointed administrator winding down Terraform Labs, reportedly filed the lawsuit against Jane Street, its co-founder Robert Granieri, and its two employees, Bryce Pratt and Michael Huang, in a Manhattan federal court on Monday.

The heavily redacted filing claims that Pratt, a former Terraform intern, was tasked with reestablishing communication with old Terraform employees.

He set up a group chat called “Bryce’s secret” with various Terrform employees and higher-ups, where he learned insider information and relayed it back to Jane Street, the suit says.

One discussion about an investment in Terraform Labs was allegedly used to make profitable trades based on material nonpublic information. According to the suit, one such trade involved Terraform Labs privately withdrawing 150 million TerraUSD from liquidity pool Curve3pool in May 2022.

A wallet linked to Jane Street withdrew 85 million TerraUSD from the same liquidity pool 10 minutes later, the suit notes.

Read more: How did so many Jane Street traders wind up at FTX?

Synder told the WSJ that “Jane Street abused market relationships to rig the market in its favor” during Terraform’s collapse, and that he’s seeking restitution from “those who exploited their position and reaped substantial profits at the expense of Terraform Labs’ creditors.”

Jane Street, however, says the suit is filled with “baseless, opportunistic claims.”

It said, “This desperate suit is a transparent attempt to extract money when it’s well-established that the losses suffered by Terra and Luna holders were the result of a multibillion-dollar fraud perpetrated by the management of Terraform Labs.”

Jane Street scrutinized for Terraform’s collapse

Terraform Labs’ crypto enterprise collapsed in May 2022 after its stablecoin TERRA depegged from the dollar. Its sister token LUNA crashed days later.

The incident wiped $40 billion from the crypto market, and the firm’s CEO, Do Kwon, was subsequently sentenced to 15 years in prison for wire fraud and conspiracy to defraud.

Jane Street is a multi-billion-dollar Wall Street quantitative trading firm that traded with Terraform Labs.

In 2023, federal prosecutors were reportedly probing Telegram messages from various Jane Street and Jump Trading employees to determine if the firms committed any market manipulation that led to Terra’s collapse.

Read more: How Jump Trading allegedly manipulated UST into collapse

Synder also launched a lawsuit against Jump Trading in December 2025 that claimed the firm made billions of dollars from a series of secret deals with Terraform while lying about the stablecoin’s capabilities.

Wintermute’s head of research, Igor Igamberdiev, claimed in 2023 that there’s a good chance that the wallet behind the 85 million TerraUSD withdrawal is linked to Jane Street and a Coinbase deposit he discovered.

This transaction is considered a major contributor to Terraform’s collapse.

The memory of the collapse is still raw, with many unwilling to let it lie. Indeed, Zerohedge, a financial news blog criticized for its pro-Russian coverage, has suggested by way of revenge that a “big crypto syndicate” should force a short squeeze on Jane Street’s trading pairs, “wiping them out overnight.”

Multiple big names at FTX had originally worked for Jane Street prior to the creation of FTX, including Sam-Bankman-Fried and Caroline Ellison. After Terra’s collapse, these two, along with three more former Jane Street traders. would go on to cause the destruction of FTX.

Got a tip? Send us an email securely via Protos Leaks. For more informed news and investigations, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

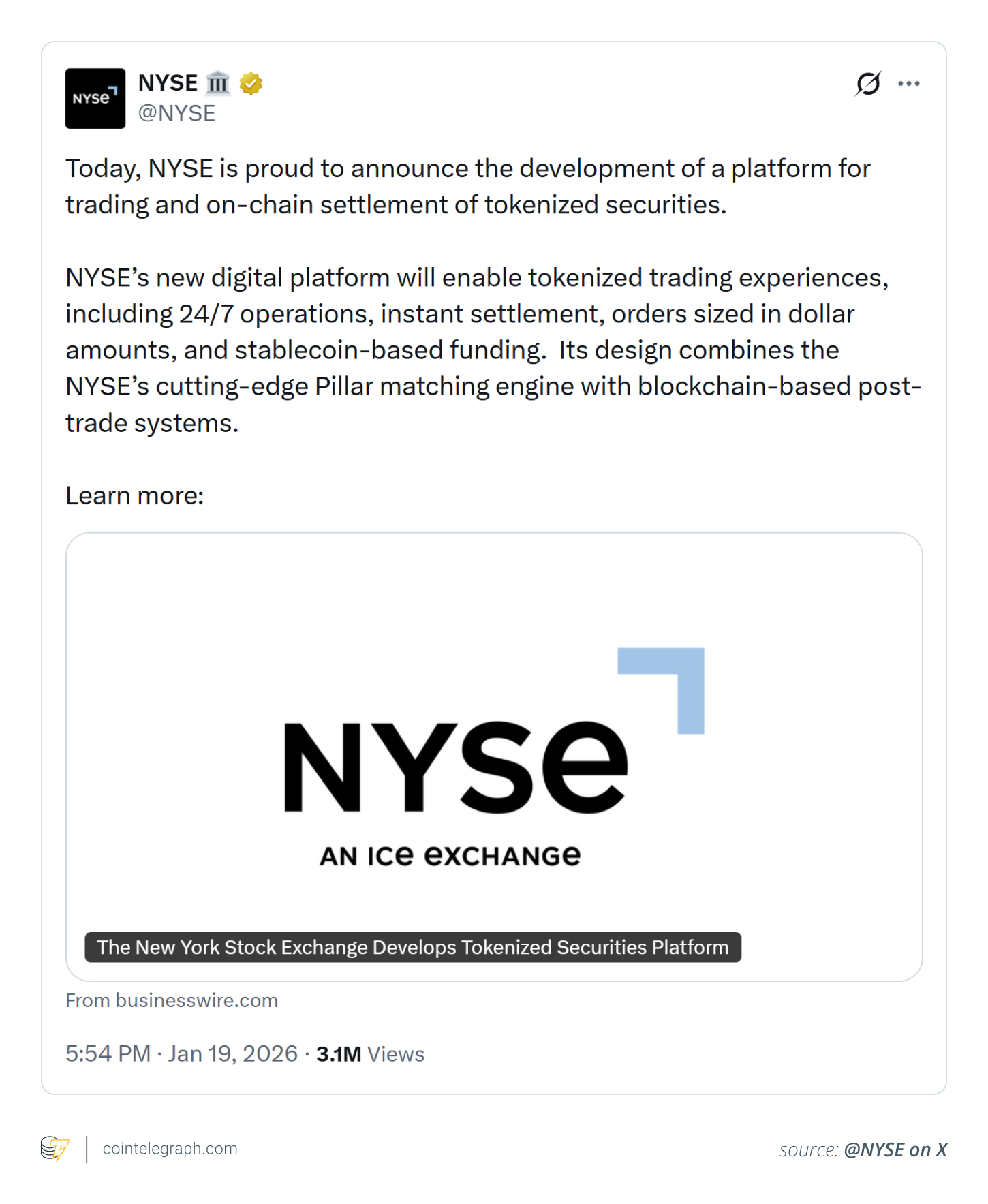

What NYSE’s Exploration of Onchain Systems Means for Financial Markets

Key takeaways

-

Intercontinental Exchange (ICE)’s blockchain-based initiative is about upgrading market infrastructure, not adopting cryptocurrencies. It intends to use blockchain for improving settlement, reconciliation and collateral efficiency.

-

Onchain delivery-vs.-payment settlement could significantly reduce counterparty risk and free up capital tied up in margins. It also shifts risk toward real-time liquidity needs and continuous funding requirements.

-

While 24/7 trading may expand global access, it does not necessarily solve deeper market-structure issues. It could introduce liquidity fragmentation, wider spreads and noisier price discovery during low-volume periods.

-

Stablecoins in this model act as institutional settlement rails rather than speculative assets. Their use inside regulated markets will require bank-grade custody, liquidity and compliance safeguards.

When Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange (NYSE), announced it was developing a blockchain-based platform for tokenized securities, some observers interpreted it as traditional finance fully integrating crypto.

However, the initiative is just a strategic redesign of market infrastructure. The focus is on utilizing distributed ledgers to optimize collateral management and eliminate delays in legacy settlement systems.

ICE has indicated that the platform would enable 24/7 trading, incorporate onchain settlement elements, support stablecoin-based funding and feature tokenized versions of regulated securities, subject to regulatory approval. If rolled out at scale, this would represent one of the most significant efforts by a major exchange operator to weave blockchain technology into market operations.

This article explores how the NYSE is integrating blockchain to segregate execution from settlement, why onchain settlement becomes critical, the importance of 24/7 trading and stablecoins as institutional funding rails. It discusses how tokenization is becoming a part of mainstream finance, hurdles in the integration of blockchain technology with legacy systems and issues regarding adaptation.

How the NYSE is using blockchain technology to separate execution from settlement

The platform maintains a clear separation between trading and settlement. ICE plans to continue using the existing NYSE Pillar matching engine, which already manages high-volume equity trading, as the primary trading layer. Blockchain technology would primarily enhance post-trade processes, such as settlement, record-keeping and reconciliation.

This distinction is important, as inefficiencies in financial markets generally stem not from price discovery during trading but from delays and complexities in clearing, settlement, cross-party reconciliation and collateral handling.

Tokenized securities refer to regulated assets like stocks or exchange-traded funds (ETFs) whose ownership is recorded on a blockchain for greater efficiency. The underlying legal rights continue to be governed by existing securities laws and corporate regulations.

Why onchain settlement likely matters more than 24/7 trading

Even with faster settlement cycles in US equities, most trades still depend on multiple intermediaries, such as clearinghouses, custodians and agents, that reconcile records across parties. This creates layers of operational complexity and lingering counterparty risk during the settlement window.

Onchain settlement changes this fundamentally by enabling near-simultaneous transfer of ownership and payment on a shared, immutable ledger. This process, also called delivery-vs.-payment (DvP), sharply reduces counterparty exposure and minimizes reconciliation errors. DvP could free up capital tied up in margins or buffers for more productive uses. It tackles the core inefficiencies and risks in post-trade infrastructure.

Faster settlement, however, is not without trade-offs. It eliminates the time buffers that currently allow markets to resolve errors, unwind failed trades or handle liquidity squeezes. Risk simply shifts toward real-time liquidity demands, requiring participants to fund positions continuously rather than leaning on intraday credit. From a broader view, this redistributes rather than removes systemic risk.

What 24/7 trading may (and may not) achieve

Continuous trading appeals to global investors familiar with round-the-clock crypto or futures markets. For US equities, extended hours already exist, but they typically feature lower liquidity, wider spreads and higher volatility compared with core sessions.

Fully 24/7 markets could offer better access for international participants and potentially smoother reactions to off-hour news. Yet several concerns remain:

-

Liquidity could thin out during quieter periods, forcing market makers to widen quotes or increase trading costs.

-

Overnight or low-volume trading might amplify price swings, particularly around major global events.

-

Price discovery could stay concentrated in traditional hours, with off-hours reflecting noisier or less representative signals rather than true efficiency gains.

Whether continuous trading truly enhances market quality or just spreads activity more thinly across time zones is still an open question.

Onchain settlement addresses deeper structural frictions in how trades are finalized, reducing risk and unlocking efficiency, while 24/7 trading mainly extends availability without necessarily fixing those underlying issues.

Did you know? Some stock exchanges already use microsecond-level timestamp synchronization from atomic clocks to track trade sequences. This means blockchain systems must integrate with ultra-precise time standards to avoid disputes over transaction ordering.

Stablecoins as institutional funding rails, not speculative plays

A key element in ICE’s proposal is the use of stablecoins to handle the cash side of trades. This would let funds settle 24/7, aligning with any move toward continuous securities trading and bypassing traditional bank-hour limitations. The process results in quicker, lower-friction movement of cash across borders and between counterparties.

If stablecoins are embedded in regulated market infrastructure, they are certain to face stringent compliance requirements. These include real-time compliance monitoring, high-grade custody arrangements, robust liquidity buffers and other safeguards on par with traditional settlement banks.

Stablecoins function strictly as wholesale settlement tools for institutions, not as retail payment or speculative instruments.

Tokenization steadily moving into mainstream finance

The NYSE-related efforts are part of a broader trend. Major asset managers, banks and market infrastructure providers are actively piloting or seeking approval to tokenize conventional assets. These include US Treasury bills, money market fund shares, ETF units and similar instruments.

Regulatory filings demonstrate that tokenization is expanding into areas traditionally seen as conservative and infrastructure-heavy. The objective is operational efficiency rather than innovation for its own sake. Advantages include accelerated settlement, programmable conditions, reduced manual reconciliation and potentially wider participation.

If tokenized versions of multiple asset classes become commonplace, post-trade processes could converge toward shared, interoperable ledger architectures. This would reduce overlap and duplication across today’s fragmented ecosystem of clearinghouses, custodians, transfer agents and registrars. However, to facilitate such an outcome, institutions and regulators need to align on standards, interoperability and risk controls.

Did you know? In traditional markets, a single stock trade can trigger a string of back-office messages between brokers, custodians and clearing agents, which is a key reason financial firms spend billions annually on post-trade IT systems.

Custody, records and legal ownership still the hardest hurdles

The biggest barrier to tokenized markets isn’t the blockchain technology itself. There is legal ambiguity regarding ownership. Traditional finance relies on clear, well-established rules for beneficial ownership, shareholder rights, voting, dividends and who maintains the definitive record.

In a tokenized world, regulators will need to decide what counts as the authoritative source of truth, whether it is the onchain ledger, the transfer agent’s registry, the broker-dealer’s books or some hybrid. Each choice affects investor protections, how corporate actions are handled, how disputes are resolved and who bears liability.

Custody adds another layer of difficulty. Even in permissioned, institutional-grade blockchains, managing private keys or equivalent controls requires robust answers on asset segregation, key recovery in case of loss, bankruptcy remoteness and operational continuity. These issues demand new frameworks that match or exceed existing standards.

These legal and operational questions are likely to slow adoption more than any technical limitations.

Clearinghouses and the shift to real-time risk management

ICE has also indicated interest in bringing tokenized deposits or similar mechanisms into clearinghouse operations. It has suggested integrating blockchain-based settlement tools with clearing infrastructure.

Clearinghouses have a role to play in neutralizing counterparty risk. Shorter or near-instant settlement windows can shrink exposure periods and lower overall risk. However, they also result in less time to detect and respond to defaults, collateral deficiencies or sudden liquidity stress.

This pushes clearing participants and operators toward continuous position monitoring, automated intraday margin calls, dynamic collateral valuation and well-tested playbooks for outages, cyber events or technology failures.

From a regulatory perspective, resilience in always-on, 24/7 environments becomes critical. Traditional markets have scheduled downtime. Continuous systems cannot afford unplanned interruptions without risking cascading outages.

Did you know? The NYSE once shortened its trading day during World War I and even shut down completely for four months in 1914. This shows that market “hours” have always evolved with technology, geopolitics and infrastructure limits.

Who stands to gain and who might need to adapt

If onchain market infrastructure demonstrates reliability and receives regulatory approval, several participants could see meaningful advantages:

-

Global investors who want uninterrupted access to trading and settlement

-

Institutions that could unlock more efficient use of collateral and reduce trapped capital

-

Issuers interested in streamlined distribution channels and potentially broader reach.

On the flip side, intermediaries whose revenues rely heavily on today’s multi-step settlement workflows may face strong pressure to evolve or risk losing relevance. These include clearing agents, custodians and certain reconciliation services. Compliance teams would also shift from periodic, market-hours reporting to continuous oversight, adding complexity in the short term.

Whether these operational savings translate into lower costs for retail and institutional end investors depends on the level of efficiency passed through by exchanges, clearinghouses and other infrastructure providers.

A modernization effort, not a leap into crypto

The NYSE’s work on blockchain-based systems is an attempt to upgrade core financial infrastructure, including faster settlement, better collateral mobility and improved market access. In this case, blockchain serves as a technology layer for post-trade operations, not as an asset class. Success hinges on meeting the stringent requirements of regulated markets, including proven scalability, high operational resilience, full compliance alignment and broad institutional buy-in.

The success of this endeavor by the NYSE depends on several parameters, such as regulatory approvals, operational reliability and institutional willingness to migrate. The initiative signals that traditional exchanges are no longer treating tokenization as an experimental side project. Instead, they are evaluating whether blockchain-based systems can support the scale, stability and compliance demands of mainstream financial markets. This is a much higher bar than most crypto-native platforms have faced.

Cointelegraph maintains full editorial independence. The selection, commissioning and publication of Features and Magazine content are not influenced by advertisers, partners or commercial relationships.

Crypto World

Stripe says stablecoin adoption soars despite ‘crypto winter’

It may be “crypto winter,” but it’s a “stablecoin summer” as digital dollar adoption booms, payments giant Stripe said Tuesday in its annual letter.

Bridge, the stablecoin orchestration platform Stripe acquired in 2024, saw transaction volume more than quadruple last year, according to the letter.

The firm also said it will “soon” launch the mainnet of Tempo, the payments-focused blockchain it is developing with crypto firm Paradigm and started testing in December.

Stripe has increasingly focused on bringing crypto technology to its payment network, seeing stablecoins as an alternative for cross-border transfers and programmable payments. Stablecoins are a $300 billion class of cryptocurrencies tied to fiat money like the U.S. dollar that use blockchains for faster, cheaper settlement.

Their utility has led to stablecoins decoupling from crypto market cycles, the payment firm wrote. While bitcoin fell 50% from its October peak, and lost 6% over 2025, stablecoin payment volume doubled to about $400 billion, with around 60% resulting from business-to-business transactions, it said, citing a recent report by McKinsey and Artemis.

“Stablecoin payments are advancing quietly and inexorably as real-world uptake continues apace,” the firm wrote in the letter.

Highlighting the rising stablecoin demand, Meta (META), the parent company of Facebook, Instagram and Whatsapp plans to launch its own stablecoin later this year with an outside partner, CoinDesk reported on Tuesday.

Stripe said businesses processed $1.9 trillion on its platform last year, up 34% from 2024. The company also announced a tender offer valuing it at $159 billion.

Read more: Stripe’s stablecoin firm Bridge wins initial approval of national bank trust charter

Crypto World

Hut 8 stock price forms cup-and-handle ahead of earnings

Hut 8 stock price has risen for three consecutive months and is nearing its highest level this year as the company prepares to publish its financial results.

Summary

- Hut 8 share price has jumped for three consecutive months.

- The company has formed a cup-and-handle pattern.

- It will publish the financial results later on Tuesday.

Hut 8, a top company in the Bitcoin (BTC) mining and an upcoming artificial intelligence data center industry, rose to $57, up by over 1,285% from its lowest level in 2023. This surge has brought its market capitalization to over $6.2 billion.

Hut 8 has done well despite the ongoing Bitcoin price crash because of its pivot to the data center industry. It recently entered a major deal with Anthropic, the creator of Claude.

This deal will see it build the River Bend campus, which will have a capacity of 2,295 megawatts of infrastructure in three tranches. The deal will be worth billions of dollars in the next few years.

The next key catalyst for the Hut 8 stock price will be the upcoming earnings, which will come out on Tuesday.

Data compiled by Yahoo Finance shows that the revenue will be $95 million, up by 200% from the same period in 2024. Its annual revenue will be over $241 million, up by 48% on an annual basis.

Its deal with Anthropic and Google will help it grow its revenue this year to over $425 million, up by 76% on an annual basis. Analysts also expect the earnings-per-share will be a loss of 15 cents from a profit of 1.55 in the same period in 2024.

Wall Street analysts are largely bullish on the company. Some of the mosy bullish ones are HC Wainwright, Roth Mkm, and KBW, which have placed a target of $80, $80, and $75m respectively. The average target among analysts is $64, up by 12% from the current level.

Hut 8 stock technical analysis

The monthly timeframe chart shows that Hut 8 share price has staged a strong comeback in the past few years. It has jumped from a low of $3.65 in 2023 to the current level.

The stock has jumped in the last three consecutive months and is nearing its highest level this year at $66. It has also moved above the 50-month moving average.

A closer look shows that it has formed a cup-and-handle pattern whose upper side is at $82.70, its highest level on record. Such a move will mark a 40% increase from the current level.

The caveat, however, is that this pattern has formed on the monthly chart, meaning that its outcome may take months or years to complete.

Crypto World

Kraken Introduces Crypto-Style Perpetuals That Track Tokenized U.S. Assets

TLDR

- Kraken introduced regulated perpetual futures that track tokenized versions of major U.S. stocks and indices.

- The exchange made these products available to eligible users in more than 110 countries.

- The initial listings include tokenized versions of the S&P 500, the Nasdaq 100, Apple, Nvidia, Tesla, and the GLD gold ETF.

- The new perpetuals offer 24/7 trading and allow leverage of up to 20x for global users.

- Kraken stated that xStocks tokens remain fully backed 1:1 by the underlying assets.

Kraken introduced regulated perpetual contracts for tokenized equities and expanded access to 24/7 trading, and the launch broadens digital market offerings and follows its acquisition of xStocks in December. The move arrives as perpetual activity grows across global crypto markets.

Kraken expands perpetuals tied to tokenized U.S. stocks

Kraken released regulated perpetuals that track tokenized versions of major U.S. stocks, indices, and a gold ETF. The exchange made the products available to eligible users in more than 110 countries.

The initial lineup includes digital representations of the S&P 500, the Nasdaq 100, and stocks such as Apple and Nvidia. It also lists Tesla and the gold ETF SPDR Gold Shares (GLD) as tokenized assets.

The firm said the contracts take cues from crypto perpetuals, which run without expiry and operate continuously. It added that the structure enables long and short positioning with high leverage.

The company described the products as fully collateralized through xStocks’ framework. It noted that tokens remain backed 1:1 by the referenced assets.

Tokenized U.S. stocks and round-the-clock futures access

Kraken stated that the supported assets trade 24/7 and offer leverage up to 20x. It said this model provides continuous pricing even when U.S. exchanges close.

The exchange explained that tokenization anchors prices to underlying assets held in custody. It added that this backing helps maintain market alignment during global sessions.

Kraken highlighted its intent to rebuild equities trading for crypto-native environments. “This is what it looks like when traditional markets are rebuilt for a crypto-native, always-on world,” said Mark Greenberg.

The firm positioned the launch as part of a broader plan to expand its equities catalog. It confirmed that more stocks and ETFs will enter the platform in the coming months.

Growing competition in tokenized equities

Data from The Block showed over $600 billion in decentralized perpetual volume during January. It reported that Hyperliquid reached nearly $200 billion in monthly activity.

Perpetuals have grown as traders seek constant access and flexible capital use. The model continues to attract platforms developing new markets.

Ondo Finance recently announced plans to release perpetuals tied to its tokenized stocks. The firm signaled rising interest in expanding choices across tokenized assets.

Crypto World

SEC approves WisdomTree plan for 24/7 trading of tokenized money market fund

The U.S. Securities and Exchange Commission (SEC) has approved a special request from asset manager WisdomTree allowing shares of its Treasury Money Market Digital Fund to trade at $1 with a dealer on an intraday basis, regardless of the fund’s end-of-day net asset value.

Until now, investors in the fund, which trades under the ticker WTGXX, had to transact at the end of the day at the fund’s NAV, as is standard for traditional mutual funds. The new structure allows trades to occur around the clock through a broker-dealer acting as principal, with instant settlement on blockchain rails.

WisdomTree said the approval required exemptive relief from the SEC and regulatory clearance from FINRA to expand the activities of its broker-dealer subsidiary. Under the new model, trades occur against the dealer’s inventory rather than directly with the fund, enabling 24/7 liquidity while keeping the fund’s primary structure intact.

“This is a true innovation and improvement in the investor experience, and it demonstrates how blockchain can serve as a new set of rails for capital markets,” Will Peck, WisdomTree’s head of digital assets, said in a statement on Tuesday.

WisdomTree also introduced continuous dividend accrual for the fund, allocating interest based on how long each wallet held shares throughout the day. The feature tracks wallet activity onchain, ensuring that even mid-day transfers don’t miss a share of the yield.

The firm plans on making the functionality available to institutions first via its Connect platform, with potential retail access later through its Prime app.

The change marks a step in the broader push to tokenize parts of capital markets. Several large banks and asset managers have piloted blockchain-based systems to issue and settle traditional assets, aiming to cut settlement times and reduce operational friction. Tokenization refers to representing financial instruments as digital tokens on a blockchain, allowing ownership to move in near real time.

Money market funds backed by U.S. Treasuries have become a key test case. More than $10 billion worth of tokenized U.S. Treasuries are now in circulation, according to data provider rwa.xyz.

At the forefront is BlackRock and Securitize’s BUIDL fund, which holds over $2 billion in total value locked, a metric that reflects the dollar value of assets committed to the product onchain. Other offerings include products from stablecoin issuer Circle (CRCL) and Ondo Finance.

With the SEC’s approval, WisdomTree joins a growing group of firms seeking to bring traditional cash management tools onto blockchain infrastructure while staying within the existing regulatory framework.

Crypto World

PI holds $0.16 as 778K tokens leave exchanges: rebound brewing?

- PI price rose slightly on Tuesday, with buyers testing resistance above $0.16.

- Holder balances on centralized exchanges have reduced by over 700,000 PI tokens over the last 24 hours.

- The technical outlook for PI is mixed amid overall bearish sentiment.

Pi Network’s token is showing some resilience amid broader crypto market weakness, with price retesting resistance above $0.16 despite key losses for Bitcoin and major altcoins.

The PI token traded to its intraday highs on a slight uptick in daily volume as on-chain data reveals a sharp decrease in token balances on centralized exchanges (CEXs).

While the upward move from lows of $0.13 on February 11 suggests bullish resilience, PI must extend gains above the latest barrier level to give buyers an upper hand.

Testing the key level amid broader crypto sentiment means a potential downward flip could follow if profit-taking deals mount.

Pi Network sees over 700,000 PI exit exchanges

PiScan data reveals CEX balances have shrunk sharply in the past 24 hours, with more than 778,434 PI tokens leaving CEXs such as OKX, Bitget, and MEXC.

The outflows suggest strong holder conviction, and are key to the reduced selling pressure currently helping bulls hold the advantage.

Net outflows indicate accumulation rather than distribution.

Buyers could capitalize on this outlook to drive prices higher, more likely if the broader market sentiment improves.

Despite CEX outflows, the PI price is signalling upside potential amid Pi Network’s Open Network expansion.

The project has accelerated its KYC verifications and mainnet migrations.

Meanwhile, the Pi Core Team sees milestones such as the release of details on the Ecosystem Token Design as crucial steps.

The Pi Request for Comment (PRC) for community input is among ecosystem developments that are adding to investor confidence.

Pi Network technical outlook

Despite the intraday gains, Pi Network’s price remains 9% down this past week.

The token is also in the red over the past month and year-to-date time frames, about 11% and 20%, respectively.

PI’s technical picture shows sentiment is largely bearish, with oscillators neutral. However, moving averages are leaning “strong sell”.

Bulls could muster upward momentum if prices stabilize above the $0.15. Support here and increased volume could allow PI to target $0.18 and then $0.27.

However, bears may yet dominate if bulls fail to hold above a downtrend line going back to the October 10, 2025, crash.

Should short-term losses accelerate below $0.15, major support lies around $0.13, an area that marked PI’s all-time low on Feb 11.

Indicators like MACD and RSI on the daily chart are offering a mixed outlook.

The MACD suggests a bearish crossover, while the RSI sits at 46 and outlines a possible leg up.

PI price, like most cryptocurrencies, will likely track risk asset sentiment and performance in the short term. Macroeconomic and geopolitical factors will be key catalysts.

-

Video5 days ago

Video5 days agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Fashion4 days ago

Fashion4 days agoWeekend Open Thread: Boden – Corporette.com

-

Politics2 days ago

Politics2 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Sports22 hours ago

Sports22 hours agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Business7 days ago

Business7 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment6 days ago

Entertainment6 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Politics23 hours ago

Politics23 hours agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Tech6 days ago

Tech6 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports6 days ago

Sports6 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Business2 days ago

Business2 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Crypto World10 hours ago

Crypto World10 hours agoXRP price enters “dead zone” as Binance leverage hits lows

-

Business2 days ago

Business2 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

Entertainment6 days ago

Entertainment6 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business6 days ago

Business6 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat1 day ago

NewsBeat1 day ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

Tech2 days ago

Tech2 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat2 days ago

NewsBeat2 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Politics2 days ago

Politics2 days agoMaine has a long track record of electing moderates. Enter Graham Platner.

-

Crypto World6 days ago

Crypto World6 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Crypto World5 days ago

Crypto World5 days ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market

BIG WARNING: AI COULD PUSH GLOBAL ECONOMY INTO A RECESSION THIS DECADE.

BIG WARNING: AI COULD PUSH GLOBAL ECONOMY INTO A RECESSION THIS DECADE.