CryptoCurrency

US-Venezuela Conflict: Is a Bitcoin Crash Imminent? On-Chain Data Reveals Surprise Resilience

Bitcoin markets showed little sign of panic over the weekend, despite the geopolitical risk exploding as a result of a dramatic escalation between the United States and Venezuela that culminated in the capture of Venezuelan President Nicolás Maduro.

Although the headlines would normally shake risk assets, Bitcoin stood just below the $90,000 price, which brings the question as to whether there still is a possibility of a sudden sell-off or the market has become more resilient to geopolitical shocks.

Bitcoin Holds Steady as Venezuela Crisis Grips Global Headlines

This happened later on Friday, when the US conducted airstrikes in and around Caracas and declared that Maduro and his wife, Cilia Flores, were detained and were flown to the United States.

The US officials indicated that Maduro would be charged in New York in matters of narco-terrorism. The operation marked the most direct US military action in Latin America in decades and immediately dominated global news cycles.

Yet Bitcoin’s reaction was muted as Bitcoin briefly dipped below $90,000 before stabilizing and recovering, ranging between $91,000 and $93,000 through the weekend.

The lack of panic stood out given the scale of the news and contrasted with past episodes where conflict headlines drove abrupt sell-offs.

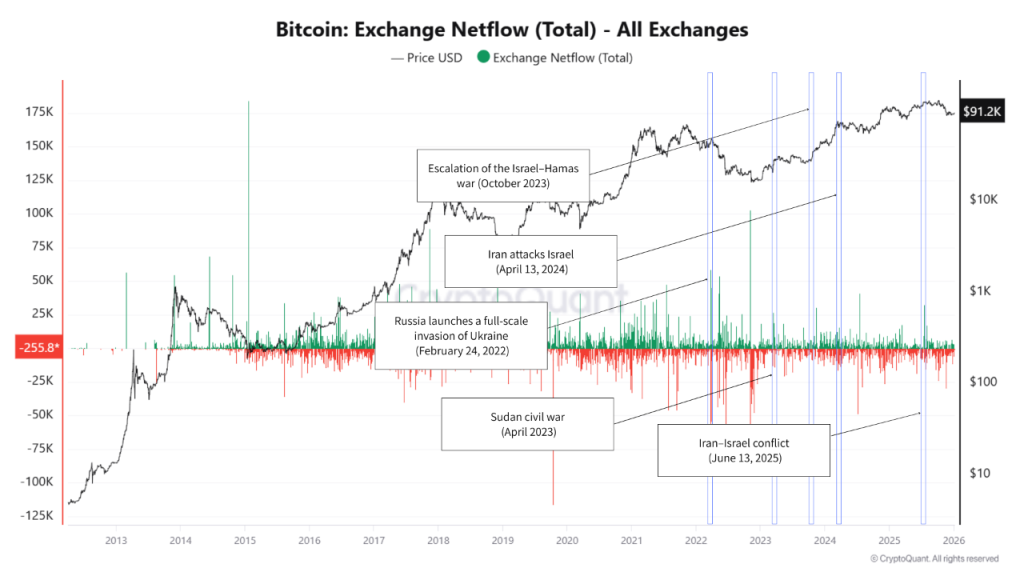

On-chain data helps explain the calm, as a recent CryptoQuant analysis focusing on Exchange Netflow, which tracks whether Bitcoin is moving onto or off exchanges, showed no surge in inflows linked to the Venezuela news.

Historically, spikes in exchange inflows signal preparation to sell; this time, the data suggested otherwise.

In past conflicts, including Russia’s invasion of Ukraine and flare-ups in the Middle East, prices were volatile, but sustained spikes in exchange inflows were limited.

That pattern has persisted since 2023, suggesting investors increasingly treat localized military conflicts as short-term noise rather than systemic threats.

That absence of inflows points to caution rather than fear, with holders choosing to sit tight instead of rushing for liquidity.

Crypto Shorts Wiped Out as Downside Fears Fail to Land

Derivatives data paints a similar picture, with Coinglass data showing that there were $257.3 million in crypto liquidations over the past 24 hours, driven largely by short positions.

Roughly $182.6 million came from traders betting on price declines, while long liquidations totaled $74.7 million.

The imbalance suggests recent price action moved against bearish positioning, reinforcing the idea that downside expectations tied to the conflict failed to materialize.

The market’s calm reaction is also tied to how investors distinguish between different types of geopolitical risk.

Historically, Bitcoin has responded more strongly to events that directly affect global capital flows, such as regulatory crackdowns, sanctions enforcement, or major US-China economic tensions.

By contrast, military actions confined to a single region have tended to cause brief volatility without altering broader market structure.

That distinction matters in Venezuela’s case, particularly because the country is not just a geopolitical flashpoint but also a notable crypto holder.

Publicly available data indicates the country holds at least 240 BTC, valued at roughly $22 million at current prices, as part of its reserves.

However, intelligence and market speculation point to far larger reserves accumulated over several years through sanctions workarounds.

While those estimates remain unverified and contested, they have fueled discussion about what might occur should the authorities of the US ultimately seize or freeze any crypto assets tied to the Venezuelan government.

Market participants noted that any confirmed US government seizure would most probably put the assets under long-term legal or custodial processing and leave them out of circulation and alleviate near-term supply pressure.

The post US-Venezuela Conflict: Is a Bitcoin Crash Imminent? On-Chain Data Reveals Surprise Resilience appeared first on Cryptonews.

The price of Bitcoin held near the $90,000 level on Saturday, even as geopolitical tensions between the United States and Venezuela escalated.

The price of Bitcoin held near the $90,000 level on Saturday, even as geopolitical tensions between the United States and Venezuela escalated. Trump threatened China with 155% tariffs starting Nov 1, following an $8.5B Australia minerals agreement. Over $329M in crypto liquidated.

Trump threatened China with 155% tariffs starting Nov 1, following an $8.5B Australia minerals agreement. Over $329M in crypto liquidated.