CryptoCurrency

Vitalik Buterin Urges New Gas Market for Ethereum

Ethereum co-founder Vitalik Buterin is promoting a new mechanism to mitigate sudden spikes in transaction costs on the network.

His latest proposal outlines a trustless, on-chain prediction market designed to help users secure future gas prices and manage volatility rather than react to it.

Sponsored

Sponsored

Buterin Backs Ethereum Gas Pricing Market

On December 6, Buterin argued that Ethereum needs a market-based signal for future demand for block space.

The structure would trade exposure to the network’s Base Fee by letting participants buy or sell gas commitments tied to a future window.

According to him, the aim is to give developers and heavy users a way to lock in costs and plan even when the spot price of gas remains low.

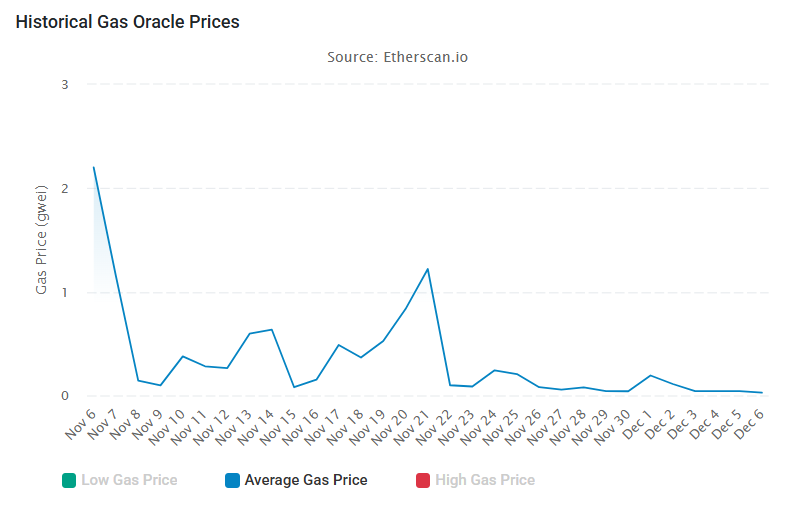

The proposal comes at an unusual time, as gas prices are near multi-year lows.

Etherscan data shows that Ethereum’s average gas price is about 0.468 Gwei, or roughly three cents. This is because much of the network’s retail activity has shifted to cheaper Layer 2 networks like Base and Arbitrum.

Yet, Buterin argues that current tranquility breeds complacency.

Sponsored

Sponsored

He stresses that an on-chain futures curve would provide a clear signal of long-term market expectations. It would permit users to prepay for block space and lock in costs regardless of future spikes.

“People would get a clear signal of people’s expectations of future gas fees, and would even be able to hedge against future gas prices, effectively prepaying for any specific quantity of gas in a specific time interval,” he stated.

Industry Experts Throw in Views

Supporters see the proposal as an underappreciated pillar of Ethereum’s long-term design. They argue that a trustless gas futures market would fill a structural gap rather than introduce another DeFi novelty.

In their view, a BASEFEE market would align expectations with transparent pricing and provide the ecosystem with a shared reference point for future network conditions.

So, a liquid market for gas exposure could change this dynamic by allowing developers to buy gas insurance to cap operating costs ahead of critical events. Heavy users could also offset future fee spikes by taking the opposite market position.

“If Ethereum is becoming the settlement layer for everything, then gas itself becomes a financial asset. So yeah a trustless gas futures market isn’t a “nice to have.” It feels like a natural evolution for a chain aiming for global-scale coordination,” the analyst stated.

Meanwhile, one industry advisor at Titan Builder noted that running this as a classic derivative market would be difficult because validators could manipulate outcomes by producing empty blocks.

He added that a delivered futures market for block space with a liquid secondary venue remains feasible. Such a structure may be enough to support public price discovery and hedging.