Crypto World

Vitalik Buterin Warns Prediction Markets Are Becoming Overly Speculative

Ethereum co-founder Vitalik Buterin is voicing concern about the current direction of prediction markets, arguing that the sector is drifting away from useful economic tools and toward short-term betting.

Key Takeaways:

- Vitalik Buterin warns prediction markets are drifting toward short-term speculation and betting.

- He proposes using onchain markets and AI to hedge everyday expenses and inflation risk.

- Supporters say platforms like Polymarket and Kalshi can also serve as decentralized market intelligence.

In a recent post on X, Buterin said many platforms are “over-converging” into products centered on rapid price wagers and speculative trading rather than practical applications.

He warned that the trend risks turning prediction markets into little more than gambling venues instead of systems that support real-world economic planning.

Buterin Says Prediction Markets Should Shift From Betting To Hedging

Rather than focusing on event betting or short-term financial outcomes, Buterin suggested prediction markets should evolve into hedging mechanisms designed to protect consumers and businesses from price volatility.

He outlined a model in which onchain prediction markets work alongside large language models (LLMs).

The system would track price indices across categories of goods and services, such as food, housing or transportation, separated by region.

A user’s personal AI assistant would analyze spending patterns and construct a tailored portfolio of prediction-market positions representing expected future expenses.

The idea is to help households and companies offset rising costs. Individuals could hold traditional investments for growth while maintaining a basket of prediction-market shares tied to living expenses, creating a buffer against inflation in fiat currencies.

Supporters of prediction markets say the technology already has broader value beyond speculation.

These platforms crowdsource expectations about events, financial trends and economic conditions, producing signals some researchers argue can rival polling data.

Markets such as Polymarket and Kalshi have gained traction by offering alternative views on political and economic developments.

Advocates say they provide a decentralized source of intelligence that is harder to shape by centralized narratives.

State Opposition to Prediction Markets Builds Over Consumer Concerns

State opposition to prediction markets has been building for months.

In 2025, the SWC urged the CFTC to prohibit sports event contracts, arguing that such products bypass state safeguards such as age verification, responsible gaming rules and anti-money laundering requirements.

As reported, a new legislation to limit the interactions between government officials and the prediction markets is being supported by more than 30 Democrats in the US House of Representatives, including former Speaker Nancy Pelosi.

The lure behind new restrictions is a controversial Polymarket bet, which started as a bet of $32,000 but eventually became more than $400,000 shortly before the unexpected detention of Venezuelan President Nicolás Maduro.

The bill proposed by the New York Representative Ritchie Torres is the Public Integrity in Financial Prediction Markets Act of 2026.

Last month, Kalshi opened a new office in Washington, D.C., as it ramps up efforts to shape federal and state policy amid growing scrutiny of its products across the United States.

The company also hired veteran political strategist John Bivona as its first head of federal government relations.

The post Vitalik Buterin Warns Prediction Markets Are Becoming Overly Speculative appeared first on Cryptonews.

Crypto World

Tornado Cash Dev Roman Storm Could Face Retrial

A U.S. federal prosecutor has requested to retry the co-founder of the privacy-focused crypto protocol months after he received a mixed verdict.

A United States federal prosecutor has requested to retry Roman Storm, the co-founder of decentralized cryptocurrency mixer protocol Tornado Cash, according to court documents submitted on March 9.

In a letter to U.S. district judge of the District Court for the Southern District of New York, Katherine Polk Failla, U.S. Attorney Jay Clayton said the government wants to retry Storm on two charges.

Back during his highly publicized trial this summer, Storm received a guilty verdict on the lesser of the three charges brought against him — operating an unlicensed money-transmitting business. But the jury was unable to come to a verdict on the other two, namely violating U.S. sanctions and engaging in money laundering.

The U.S. Attorney said in the retrial request that he expects the trial on the two remaining counts to take three weeks, and asks that it begin in October of this year.

Storm took to X today in response to the retrial request, writing:

“A jury of 12 Americans heard 4 weeks of evidence and deadlocked: no verdict on money laundering, and no verdict on sanctions violations. The government’s response? Try again to make writing code a crime.”

Storm also noted in his X post that if found guilty on the two counts, he could face up to 40 years in prison. He also referenced recent regulatory shifts in the U.S. that have come out in defense of decentralized protocol developers.

Specifically, he noted, a new report from the U.S. Department of the Treasury to Congress this week states, “Lawful users of digital assets may leverage mixers to enable financial privacy when transacting through public blockchains.”

Also noted by Storm in today’s X post, last March, the U.S. Treasury removed Tornado Cash from its list of sanctioned entities, as The Defiant reported at the time. The protocol had been banned in the U.S. since 2022.

The US v Roman Storm

Tornado Cash is a non-custodial protocol that lets users anonymize their transactions on multiple Ethereum Virtual Machine-compatible blockchains. The platform and Storm personally have received overwhelming support from the crypto industry for their focus on privacy throughout a multi-year legal battle with the U.S. government.

Storm was first indicted by the U.S. government in August 2023. The U.S. Department of Justice alleged that Storm and his fellow co-founder Roman Semenov were aware of the platform’s usage by criminal organizations for laundering illicit funds, and claimed that the two are responsible for more than $1 billion in laundered crypto.

Prosecutors also alleged that the two developers in some cases helped launder funds, “including by laundering hundreds of millions of dollars on behalf of a state-sponsored North Korean cybercrime group sanctioned by the U.S. government,” referring to the notorious Lazarus Group.

Semenov has yet to face trial for the alleged charges, and remains on the FBI’s wanted list since 2023, when the indictment came out and a federal warrant for his arrest was issued.

In a motion to dismiss filed by Storm’s lawyers in 2024, the developer pleaded not guilty, and argued that he “is a developer, and his only agreement, together with the members of his U.S.-based company, was to build software solutions to provide financial privacy to legitimate cryptocurrency users.”

As the Defiant previously reported, the outcome of Storm’s legal battle could significantly influence the future of DeFi, especially in the U.S., and set a precedent for how responsible DeFi developers are for how users interact with protocols.

Last February, the third founding developer of Tornado Cash, Alexey Pertsev was released from prison to house arrest in the Netherlands, where is serving an over five year sentence for money laundering related to Tornado Cash. He was arrest in 2022 and found guilty in 2024. After his most recent attempt to appeal the decision in June, Pertsev was allowed to remove his ankle monitor, though his movement remains resitricted to The Netherlans and he is unable to work, per an X post from the dev in October.

In November of last year, the two co-founders of another crypto mixer protocol, Samourai Wallet, were found guilty in a U.S. federal court of “a conspiracy to operate a money transmitting business in which they knowingly transmitted criminal proceeds.”

Samourai Wallet’s Keonne Rodriguez and William Lonergan Hill were sentenced to five and four years in prison, respectively.

This article was generated with the assistance of AI workflows.

Crypto World

Treasury Report Identifies Technology Tools to Counter Digital Asset Crime

The report notes that AI, digital identity systems, blockchain analytics, and APIs can be harnessed to fight financial crime.

The U.S. Department of the Treasury has submitted a report to Congress examining how emerging technologies can be used to detect and prevent illicit financial activity involving digital assets. The report was required under the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act, signed into law in July 2025.

The report notes that victims reported over $9 billion in digital asset-related fraud losses to the FBI in 2024, with investment scams accounting for $5.8 billion, a 47 percent increase over the prior year. North Korean cybercriminals stole at least $2.8 billion in digital assets between January 2024 and September 2025, including $1.5 billion from Bybit in February 2025. Meanwhile, ransomware payments, predominantly made in digital assets, totaled approximately $734 million in 2024.

The report also examines the use of cryptocurrency mixers and similar obfuscation tools, finding that roughly $1.6 billion in deposits to major cross-chain bridges between 2020 and 2025 originated from mixing services.

To address these risks, Treasury identified four key technologies for broader adoption by financial institutions: artificial intelligence for transaction monitoring and fraud detection; digital identity tools to reduce onboarding fraud; blockchain analytics to trace suspicious activity; and application programming interfaces (APIs) to improve interoperability across compliance systems.

On decentralized finance (DeFi), the report recommends that Congress clarify which DeFi participants should be subject to anti-money laundering obligations.

Treasury acknowledged barriers to adoption, including high costs for smaller institutions and regulatory uncertainty, and committed to issuing new guidance, partnering with NIST on technical standards, and pursuing legislative options, including potentially allowing institutions to temporarily freeze digital assets suspected of involvement in illegal activity.

Crypto World

ETH Needs to Reclaim This Key Level to Reignite Sustainable Rally

Ethereum is still trading within a broader bearish structure, but the recent price action shows signs of short-term stabilization above a key support zone. After the sharp selloff seen in early February, ETH has managed to base around the $1,800 area, and buyers are hoping for another push higher, although the market still needs a stronger breakout to confirm a more meaningful recovery.

Ethereum Price Analysis: The Daily Chart

On the daily chart, ETH remains below the 100-day and 200-day moving averages, which keeps the higher timeframe trend tilted to the downside. The asset is also still trading inside a descending channel, while the $2,400 and $2,800 zones continue to act as the main resistance barriers on any larger rebound.

At the same time, the market has been holding above the blue demand region around $1,800 to $1,700, which is currently the most important support range. As long as ETH stays above this area, the structure can remain constructive in the short term, but a daily reclaim of the $2,400 region is still needed to suggest that the broader bearish pressure is starting to weaken.

ETH/USDT 4-Hour Chart

On the 4-hour chart, ETH is gradually moving higher from the late February lows and is now pressing toward the $2,150 resistance level once again. The formation of a rising short-term trendline from the recent swing lows also points to improving momentum, while the RSI has pushed back above the midline and supports the case for a stronger recovery attempt.

Still, the price has not broken out yet, and the $2,150 level remains the key trigger in the near term. A clean move above it could open the way toward the $2,400 supply zone, while another rejection would likely keep ETH stuck inside its current range and send it back toward the $1,800 support levels.

On-Chain Analysis

From an on-chain perspective, Ethereum’s exchange reserve continues to trend lower and has now dropped to around 16.1 million ETH, which is a notable long-term bullish signal. The persistent decline suggests that more coins are being moved away from exchanges, typically reflecting lower immediate sell pressure and a stronger preference for holding rather than distributing.

That said, the exchange reserve trend is a supportive background factor rather than a direct timing signal. In the short term, ETH still needs price confirmation through a breakout above nearby resistance, but the continued drawdown in exchange balances does strengthen the idea that downside pressure may be more limited than before if demand starts to improve.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Societe Generale-FORGE Deploys MiCA-Compliant EURCV Stablecoin on Stellar

Societe Generale-FORGE, the crypto arm of French banking company Societe Generale, has deployed its euro-denominated stablecoin on the Stellar blockchain, completing a multichain expansion first announced in 2025.

The stablecoin, known as EUR CoinVertible (EURCV), is designed to comply with the European Union’s Markets in Crypto-Assets (MiCA) framework and represents a tokenized euro issued by the company for use in digital asset markets.

According to the company, the Stellar deployment is intended to broaden the stablecoin’s use across blockchain-based financial applications and tokenized asset services.

SG-FORGE said Stellar offers high transaction throughput, low network fees and built-in support for tokenized assets. The network also includes a decentralized exchange that allows users to trade digital assets directly onchain.

Societe Generale-FORGE first launched the EUR CoinVertible (EURCV) stablecoin on Ethereum in April 2023. The stablecoin is fully backed by reserves consisting of bank deposits and high-quality liquid assets on a one-to-one basis, and has a current market cap of around $452 million, according to DefiLlama data.

The development comes weeks after SG-FORGE deployed EUR CoinVertible on the XRP Ledger, then marking the token’s third blockchain network after Ethereum (ETH) and Solana (SOL).

In January, the stablecoin was used by global banking network SWIFT in a pilot that demonstrated the exchange and settlement of tokenized bonds using both fiat and digital currencies.

Related: Stablecoin payments startup Kast raises $80M at $600M valuation: Report

European stablecoin push

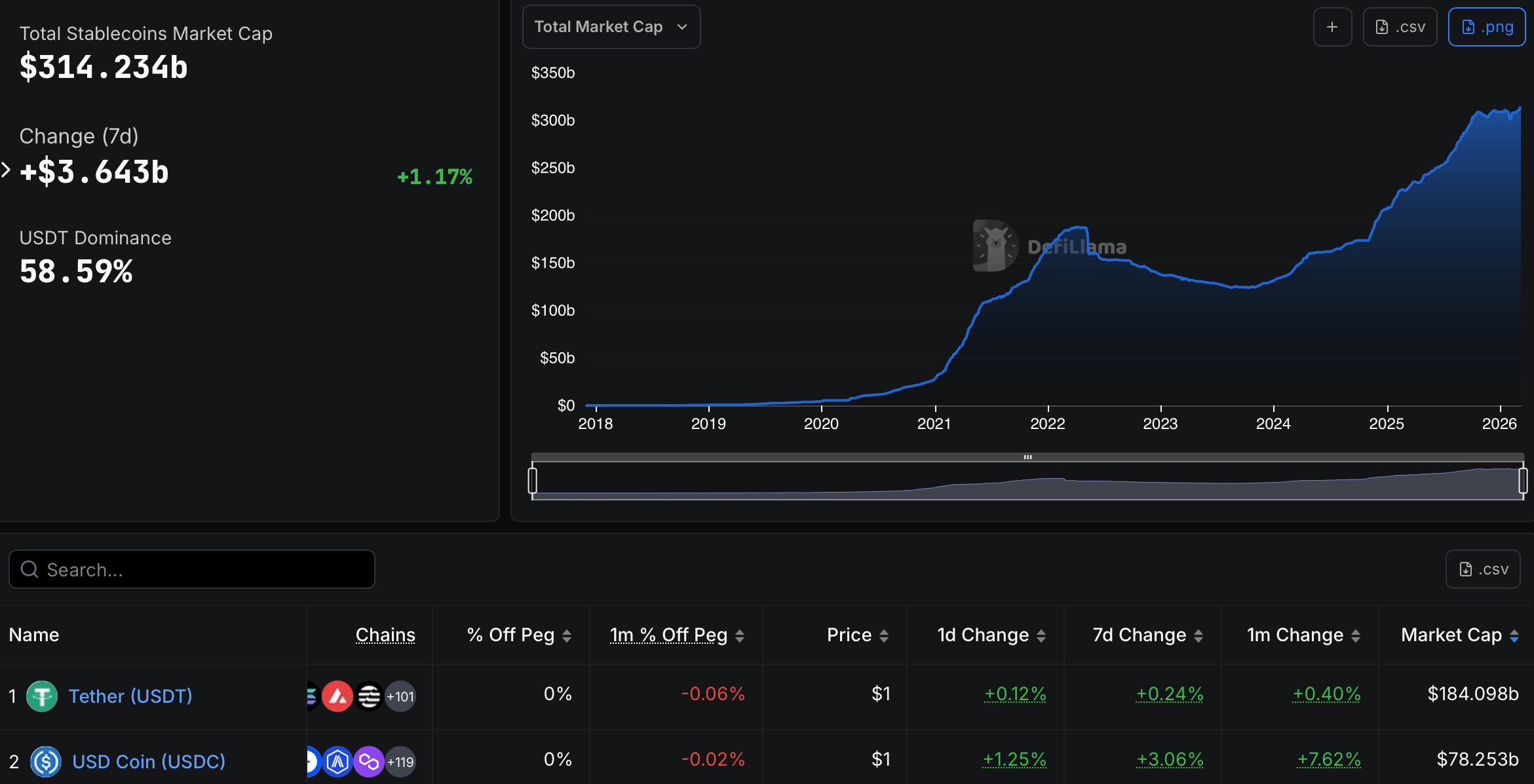

Despite growing interest in euro-denominated tokens, the stablecoin market remains dominated by US dollar-backed assets. Tether’s USDT (USDT) holds a market capitalization of about $185 billion, representing nearly 60% of the sector, while Circle’s USDC (USDC) accounts for roughly $78 billion.

Adoption of digital dollars accelerated in the US after the GENIUS Act passed in July 2025, providing regulatory clarity for stablecoin issuers. Total market capitalization has climbed from around $260 billion on July 20 to more than $314 billion today, per DefiLlama data.

Meanwhile, Europe has taken a more restrictive regulatory approach. The European Union’s MiCA framework introduced new rules for stablecoin issuers in June 2024, requiring companies operating in the European Economic Area to obtain an e-money license in at least one EU member state.

The regulation prompted several exchanges, including Coinbase, OKX, Bitstamp, Uphold and Binance, to remove or restrict support for stablecoins that had not secured authorization under the framework. Tether also decided it would discontinue its euro-pegged stablecoin EURT.

In November, European Central Bank officials warned that the growth of US dollar–backed stablecoins could weaken Europe’s monetary sovereignty by increasing reliance on dollar-denominated digital assets.

Magazine: The debate over Bitcoin’s four-year cycle is over: Benjamin Cowen

Crypto World

Where Is XRP Heading Next After 5% Weekly Increase?

XRP remains under pressure on both the USDT and BTC pairs, with the broader trend still leaning bearish despite some short-term stabilization. Buyers are defending key support zones for now, but the asset still trades below major resistance levels and has yet to show a convincing trend reversal.

Ripple Price Analysis: The USDT Pair

On the XRP/USDT chart, the asset is still moving inside a broad descending channel, which keeps the daily structure bearish. XRP is trading around $1.41 and remains below both the 100-day and 200-day moving averages, while the dotted trendline and the $1.80 zone continue to cap rebounds.

The main support remains the $1.20 area, which aligns with the lower boundary of the channel and has held recent downside attempts. If buyers manage to reclaim the $1.80 level and the 100-day moving average nearby, the next major resistance sits near $2.40 to $2.50, but until then, the market structure still favors sellers. The RSI has also recovered slightly, though momentum is still not strong enough to suggest a sustained bullish reversal.

The BTC Pair

Against Bitcoin, XRP also remains weak and continues to trade below both the 100-day and 200-day moving averages. The pair is currently sitting around 1,990 sats, right at the important horizontal support zone near 2,000 sats, while the 2,400 to 2,450 sats region remains the key resistance area overhead.

As long as XRP stays below that resistance cluster, the BTC pair remains structurally bearish. A breakdown below 2,000 sats could send the pair toward the lower support around 1,500 sats, while a recovery above 2,400 sats would be needed to improve the outlook and open the path toward 2,700 to 2,800 sats. For now, the trend still points to relative weakness versus Bitcoin.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Why banks are moving beyond single-provider stablecoin payment rails

Latest developments: Infrastructure providers are increasingly building network-based stablecoin payment systems instead of single-provider rails, said Borderless CEO, Kevin Lehtiniitty, in an interview on CoinDesk’s Markets Outlook.

- Borderless recently partnered with wallet infrastructure provider Dfns to launch an institutional stablecoin off-ramp aimed at banks, fintechs and enterprises.

- The system routes stablecoin payouts through multiple liquidity providers across global markets.

- The goal is to convert stablecoins into local fiat currencies more reliably while avoiding dependence on a single vendor.

Why it matters: Early enterprise stablecoin experiments often relied on bundled providers that handled the entire stack.

- These “black box” solutions packaged wallets, compliance tools and liquidity access into a single product.

- That model helped institutions run quick proof-of-concept pilots without rebuilding their payments infrastructure.

- But it also created vendor lock-in and introduced operational risk if a single provider experienced downtime.

The shift to “Stablecoin 2.0”: Institutions are now moving toward modular infrastructure where they control more of the stack internally.

- Large enterprises are selecting separate best-in-class tools for compliance, custody wallets and liquidity access.

- This approach mirrors how traditional financial infrastructure is built across multiple vendors.

- Lehtiniitty describes this shift as the transition from “Stablecoin 1.0” pilots to “Stablecoin 2.0” production systems.

How the network model works: Multi-provider networks help institutions manage regulatory uncertainty and improve pricing.

- No single company is licensed or regulated in every country, making global payout coverage difficult with one partner.

- A network structure lets institutions connect to multiple liquidity providers within the same corridor.

- Payments can automatically reroute if a provider experiences regulatory issues, banking disruptions or technical outages.

What comes next: Stablecoins may increasingly operate behind the scenes as financial infrastructure.

- Enterprises are exploring the technology for cross-border payments, especially in emerging market corridors.

- Stablecoins can also reduce the need for costly pre-funded accounts used in traditional remittance systems.

- Over time, the technology may become embedded in payment systems rather than marketed as a standalone product.

Crypto World

U.S. SEC chief Atkins said bond with sister agency CFTC to include joint meetings, exams

The U.S. Securities and Exchange Commission and the Commodity Futures Trading Commission — the sister agencies that will regulate most U.S. crypto activity — have been rivals in the past over crypto issues, but they’re now pursuing a formal memorandum of understanding to combine agency efforts, said SEC Chairman Paul Atkins.

“We are reorienting our approach toward a new golden age of regulatory coherence,” Atkins was set to say on Tuesday in remarks prepared for the FIA Global Cleared Markets Conference in Florida. “More than aligning our rules, a harmonized framework also demands coordinating our responses to the firms that operate within it, including those that have questions of interpretation or request exemptive relief.”

Atkins said he’s also directed his staff to begin setting up joint meetings with CFTC employees on product applications, and a new “harmonization” website will allow firms to request coordinated discussions with both agencies.

“Firms should not be shuffled back and forth between regulators when a product touches elements of both regulatory frameworks,” he said. “Nor should clarity depend on which agency happens to speak first.”

The division of roles between the SEC, which regulates securities and the exchanges on which they trade, and the CFTC, the commodities watchdog that oversees derivatives markets, has been a key source of friction in the process of establishing U.S. crypto trading. No formal rules have been set to say where crypto products belong, and years of regulatory actions and legal disputes have resulted.

Since the arrival of leaders appointed by President Donald Trump, the two agencies have embraced friendly crypto policies as a top priority, in line with the president’s requests. They’re now working on several, including policies to clarify how digital assets will be defined as securities and commodities.

The formalized cooperation will also extend to enforcement decisions and regulatory examinations, which will become a more routine element for crypto firms as they enter more deeply into federal oversight. That could save the companies from having to go through repetitive exams.

“Coordinated exam planning for dually regulated entities should become standard practice,” Atkins said. “Shared supervisory findings, subject to assurances of confidentiality, should be the norm rather than the exception.”

Atkins also revisited his intention to carve out a path for super-apps that allow users to conduct business across both agencies’ jurisdictions.

“In the technology world, a super-app integrates multiple services into a single seamless interface,” he said. “The user does not toggle between separate systems to complete related tasks. Instead, integration occurs invisibly behind the scenes.”

Read More: CFTC chair highlights wide crypto agenda, including rules on DeFi, prediction markets

Crypto World

Hyperliquid price nears $35 breakout as oil perps surge

Hyperliquid price is testing $35 as oil-linked perpetual contracts surge, driving record trading volume and attracting institutional attention.

Summary

- Hyperliquid is trading near the top of its weekly range of $35.20.

- A spike in oil perpetual contracts, driven by geopolitical tensions, has led to a surge in trading volumes

- HYPE is holding above the mid-Bollinger Band, with $35 acting as key resistance that could trigger a move toward $38–$40.

As buyers pushed the price toward the top of its weekly range, the token was trading at $34.69 at the time of writing, up 6.6% over the previous day. Hyperliquid (HYPE) has moved between $29.61 and $35.20 over the last seven days, and the most recent surge has brought the token near a possible breakout zone.

The asset is currently up on all major timeframes, with gains of 9% over the last week, 11% over the last 30 days, and 141% over the previous year. Despite the strong long-term growth, the token still sits about 41% below its September 2025 all-time high of $59.30.

Market activity has increased during the latest move higher. 24-hour trading volume reached $2.39 billion, a 21% increase from the previous day. CoinGlass data shows open interest at $1.40 billion, down slightly by 0.22%, suggesting some traders have taken profits while the price continues to climb.

Oil-linked perps drive major activity on the platform

A large share of the recent trading surge on Hyperliquid has been driven by activity in energy markets, especially the CL-USDC perpetual contract, which tracks West Texas Intermediate (WTI) crude oil.

In recent days, oil trading volume on the platform has climbed significantly as crude prices reacted to rising geopolitical tensions in the Middle East. Reports of military escalation between the US, Israel, and Iran, as well as possible threats to supply routes via the Strait of Hormuz, have raised concerns.

The oil market has moved sharply as a result of these developments, and WTI crude briefly traded between $110 and $120 per barrel.

As a result, trading activity on the CL-USDC market surged. Daily volume climbed above $1.2 billion, with some sessions ranging between $1.15 billion and nearly $2 billion. Before the latest geopolitical developments, daily trading in the contract was roughly $21 million.

Open interest in the oil-linked contract has also grown, reaching roughly $170-$195 million. At the same time, the HIP-3 permissionless perpetuals market on Hyperliquid has recorded more than $1.2 billion in total open interest.

The rapid price swings in crude markets have also triggered liquidations. Around $40 million in positions were wiped out within 24 hours, with short sellers accounting for most of the losses during the rally.

Overall platform activity has surged alongside the oil trade. Hyperliquid’s total daily perpetual volume recently climbed above $10 billion, with non-crypto markets such as commodities, equities, and metals becoming a larger share of trading.

In some trading sessions, these markets made up over 30% of the platform’s total volume.

The rise also shows that traders are turning to the platform as a round-the-clock venue to respond to geopolitical developments, particularly during hours when traditional exchanges such as the Chicago Mercantile Exchange are not open.

Hyperliquid price technical analysis

From a chart perspective, Hyperliquid is testing an important resistance area near $35. Because it rejected the price earlier in February, this level is important for traders.

A breakout could be indicated by a daily close above $35, opening the door for the $38–$40 range. Momentum indicators are currently showing a bullish bias. The token is trading above the Bollinger Band midline at around $30, which has acted as short-term support during upward trends.

Since late February, the price has formed a series of higher lows, suggesting that buyers have been stepping in whenever there are dips. The relative strength index, which is currently at roughly 62, indicates that while the market is still below overbought territory.

Additionally, volatility is starting to rise. The Bollinger Bands are widening, a pattern that is commonly observed when markets start preparing for a stronger directional move.

If the price breaks above $35, the move could open the way toward $38 and possibly $40 as the next upside levels. However, if the level holds as resistance and the price is rejected, the token could be pushed back toward the $30 support zone, where demand previously returned.

Crypto World

Polymarket Taps Palantir for Sports Market Monitoring

TLDR

- Polymarket partnered with Palantir Technologies and TWG AI to build a sports market integrity platform.

- The platform uses the Vergence AI engine to monitor trades in real time.

- The system screens prohibited users and detects suspicious trading activity.

- Shayne Coplan said the partnership will strengthen monitoring across sports prediction markets.

- The move comes as Polymarket expands its sports offerings and plans a return to the United States.

Polymarket has partnered with Palantir Technologies to build a monitoring platform for its sports prediction markets. The companies will deploy advanced analytics to detect suspicious trading and enforce compliance standards. The agreement comes as Polymarket expands its sports markets and prepares to re-enter the United States.

Polymarket Partners with Palantir and TWG AI to Launch Integrity Platform

Polymarket confirmed that it will work with Palantir Technologies and TWG AI to develop a sports integrity system. The platform will use the Vergence AI engine, which Palantir and TWG AI jointly operate. The companies said the system will monitor trades and flag irregular activity in real time. The announcement outlined plans to prevent manipulation and insider activity across sports prediction markets.

Polymarket said the system will screen prohibited users and support compliance reporting tools. It will also track market behavior to identify unusual trading patterns. The companies stated that the platform will help ensure trust and fairness as trading volumes grow. Shayne Coplan said, “Our partnership with Palantir and TWG AI allows us to apply world-class analytics and monitoring to sports markets.” He added that the tools will help leagues and teams maintain confidence in games.

Expansion of Sports Prediction Markets and Regulatory Backdrop

Polymarket and Kalshi have expanded sports event contracts as trading volumes increase. The expansion has drawn scrutiny from certain gaming authorities and state regulators. At the same time, DraftKings has launched DraftKings Predictions in 38 states. These states include California, Florida, Georgia, and Texas, where traditional sports betting remains restricted.

The U.S. Commodity Futures Trading Commission filed a friend-of-the-court brief supporting Kalshi last month. The agency asserted “exclusive jurisdiction” over futures markets, including gaming contracts. Kalshi faces a lawsuit alleging violations of Nevada gaming laws. CEO Tarek Mansour said Kalshi recorded over $1 billion in trading volume on Super Bowl Sunday.

The Wall Street Journal reported that Polymarket and Kalshi have discussed funding rounds with potential investors. The report said both companies seek valuations near $20 billion. Polymarket has also acquired a CFTC-regulated platform to facilitate its return to the United States. The company has opened a waitlist for users ahead of the relaunch.

Palantir Technologies, co-founded in 2003 by Peter Thiel and Alex Karp, develops data analytics software. The company provides tools to U.S. government agencies and enterprise clients. Through the Vergence AI engine, Palantir and TWG AI will power the new monitoring platform for Polymarket’s sports markets.

Crypto World

KBC taps Taurus for Belgium’s first regulated crypto trade

TLDR

- KBC partnered with Swiss fintech Taurus to support its regulated crypto trading service in Belgium.

- KBC became the first Belgian bank to offer Bitcoin and Ethereum trading within a regulated banking framework.

- The bank integrated Taurus-PROTECT to provide institutional-grade digital asset custody for its Bolero platform.

- Retail clients can trade Bitcoin and Ether on an execution-only basis under the EU MiCAR framework.

- KBC structured the service under a closed model that keeps crypto assets within the Bolero platform.

Major Belgian lender KBC has partnered with Swiss fintech Taurus to power its regulated crypto trading service. The bank will use Taurus-PROTECT to provide institutional custody for digital assets offered through its Bolero platform. The launch makes KBC the first Belgian bank to enable Bitcoin and Ethereum trading within a regulated banking framework.

KBC Group Launches Regulated Bitcoin Trading with Taurus Support

KBC Group confirmed it teamed up with Taurus SA to deploy Taurus-PROTECT for secure digital asset custody. The bank integrated the platform into Bolero, its self-directed investment service, to support regulated crypto trading. The service went live last month and offers retail clients access to Bitcoin on an execution-only basis.

KBC Group structured the offering under the European Union’s Markets in Crypto-Assets Regulation framework. The bank executes all Bitcoin transactions in compliance with MiCAR requirements and internal governance standards. Erik Luts, Chief Innovation Officer at KBC Group, said growing client demand drove the partnership.

“By working with Taurus, we can offer crypto services supported by banking-grade custody,” Luts said. He added that the bank applies the same security and control standards across its crypto operations. KBC Group confirmed that clients trade Bitcoin directly within Bolero without external transfers.

Ether Access Expands Through Closed Operating Model

KBC Group also introduced Ethereum trading under the same regulated structure. Retail clients can access Ether on an execution-only basis through Bolero. The bank keeps all purchased crypto assets within its closed operating model.

Under this model, clients cannot transfer Bitcoin or Ether to external wallets or exchanges. The structure removes the need for clients to manage private keys themselves. KBC Group said this approach reduces operational and fraud risks linked to retail custody.

Lamine Brahimi, Co-founder and Managing Partner at Taurus, addressed the collaboration. “We are proud to support KBC’s market-first initiative in Belgium with Taurus-PROTECT,” Brahimi said. He stated that Taurus designed the platform specifically for banks seeking institutional-grade custody.

Taurus-PROTECT provides digital asset storage with governance and compliance controls aligned with banking standards. KBC Group confirmed it applies the same oversight procedures used across its broader financial services. The bank said the platform ensures secure storage of both Bitcoin and Ether holdings.

KBC Group stated that all transactions occur within a fully regulated banking environment. The bank said it processes trades through established compliance systems and internal monitoring tools. The service became available to retail investors last month through the Bolero platform.

KBC Group emphasized that clients gain crypto exposure through a trusted banking channel. The bank maintains full custody responsibility for assets held on the platform. The announcement marked the official rollout of regulated Bitcoin and Ether trading in Belgium’s banking sector.

-

Business4 days ago

Form 8K Entergy Mississippi LLC For: 6 March

-

Fashion4 days ago

Fashion4 days agoWeekend Open Thread: Ann Taylor

-

News Videos1 day ago

News Videos1 day ago10th Algebra | Financial Planning | Question Bank Solution | Board Exam 2026

-

Crypto World1 day ago

Crypto World1 day agoParadigm, a16z, Winklevoss Capital, Balaji Srinivasan among investors in ZODL

-

Tech5 days ago

Tech5 days agoBitwarden adds support for passkey login on Windows 11

-

Sports5 days ago

Sports5 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

Sports3 days ago

Sports3 days agoThree share 2-shot lead entering final round in Hong Kong

-

Sports3 days ago

Sports3 days agoBraveheart Lakshya downs Lai in epic battle to enter All England Open final | Other Sports News

-

Business7 days ago

Business7 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

Politics4 days ago

Politics4 days agoTop Mamdani aide takes progressive project to the UK

-

NewsBeat5 days ago

NewsBeat5 days agoPiccadilly Circus just unveiled ‘London’s newest tourist attraction’ and it only costs 80p to enter

-

Business2 days ago

Business2 days agoSearch for Nancy Guthrie Enters 37th Day as FBI Probes Wi-Fi Jammer Theory

-

Entertainment4 days ago

Entertainment4 days agoHailey Bieber Poses For Sexy Selfies In New Luscious Lip Thirst Traps

-

NewsBeat18 hours ago

NewsBeat18 hours agoPagazzi Lighting enters administration as 70 jobs lost and 11 stores close across Scotland

-

Tech1 day ago

Tech1 day agoDespite challenges, Ireland sixth in EU for board gender diversity

-

Business2 hours ago

Business2 hours agoExxonMobil seeks to move corporate registration from New Jersey to Texas

-

Crypto World6 days ago

Crypto World6 days agoNew Crypto Mutuum Finance (MUTM) Reports V1 Protocol Progress as Roadmap Enters Phase 3

-

Tech5 days ago

Tech5 days agoACIP To Discuss COVID ‘Vaccine Injuries’ Next Month, Despite That Not Being In Its Purview

-

Entertainment6 days ago

Harry Styles Has ‘Struggled’ to Discuss Liam Payne’s Death

-

Business23 hours ago

Business23 hours agoSearch Enters 39th Day with FBI Tip Line Developments and No Major Breakthroughs