Crypto World

Wall Street Adds BMNR Stock; DeFi Lenders Are Pressured by Illiquidity

Large institutional investors continued to add exposure to crypto treasury companies over the past week, even as bear-market illiquidity forced another round of shakeouts across decentralized finance (DeFi).

The biggest corporate shareholders of Bitmine Immersion Technologies, including Morgan Stanley and Bank of America, increased exposure to the Ether (ETH) treasury company during Q4 2025 despite a broader market sell-off.

Still, ongoing bear-market illiquidity is forcing some protocols to wind down operations, with DeFi lender ZeroLend shutting down. Crypto analytics platform Parsec has also shuttered, citing crypto market volatility as the main reason.

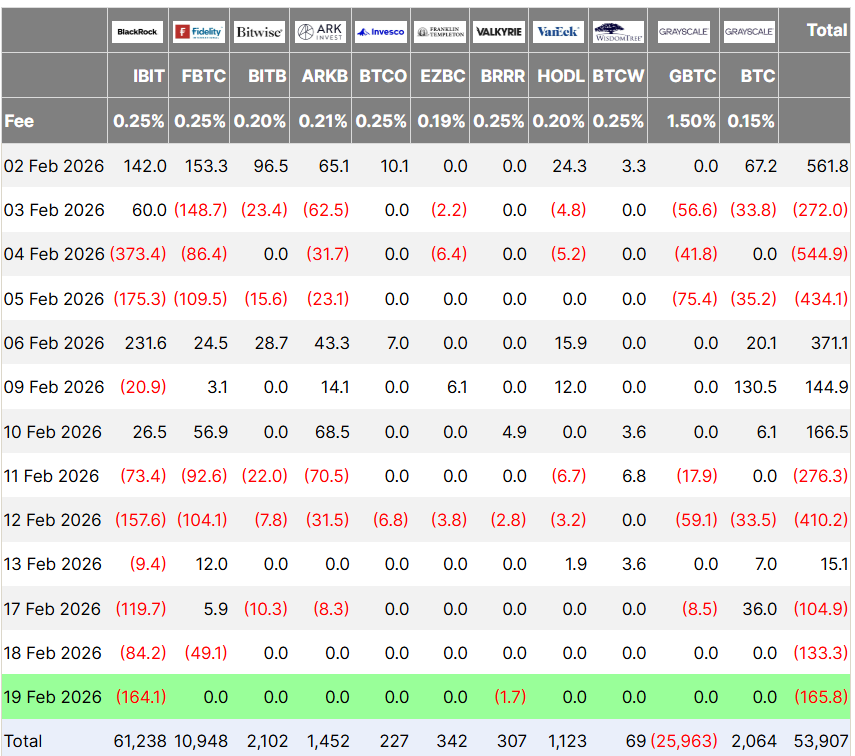

Meanwhile, Bitcoin (BTC) and ETH each rose about 2.6% during the past week, amid mounting outflows from US spot Bitcoin exchange-traded funds (ETFs), which logged three consecutive days of selling leading up to Thursday’s $165 million outflow, Farside Investors data shows.

Ether ETFs started the week with $48 million in inflows on Tuesday, but reversed to log two successive days of outflows, including $41 million in outflows on Wednesday and $130 million on Thursday.

Morgan Stanley, other top holders add Bitmine exposure amid sell-off

The largest shareholders of Bitmine Immersion Technologies (BMNR) stock increased their investments in the leading Ethereum treasury company in the fourth quarter of 2025 despite a wider crypto market crash and poor stock price performance.

Morgan Stanley, the top reported holder, increased its position by about 26% to more than 12.1 million shares, valued at $331 million at the quarter’s end, according to its Form 13F filing with the US Securities and Exchange Commission. ARK Investment Management, the second-biggest holder, increased its stake by about 27% to more than 9.4 million shares worth $256 million, its filing shows.

Several other top institutional holders also increased exposure. BlackRock increased its BMNR holdings by 166%, Goldman Sachs by 588%, Vanguard by 66% and Bank of America by 1,668%.

Wall Street adds BMNR exposure despite 48% stock slide

Each of the top 11 largest shareholders increased exposure to BMNR during Q4 of 2025, including Charles Schwab, Van Eck, Royal Bank of Canada, Citigroup and the Bank of New York Mellon Corporation, according to official filings compiled by crypto investor Collin.

The accumulation came despite a sharp drop in Bitmine’s share price. BMNR fell about 48% in the fourth quarter of 2025 and about 60% over the past six months, trading near $19.90 in premarket action Thursday, according to Google Finance.

DeFi lender ZeroLend shuts down, blames illiquid chains

Decentralized lending protocol ZeroLend said it is shutting down completely after the blockchains it operates on suffered from low user numbers and liquidity.

“After three years of building and operating the protocol, we have made the difficult decision to wind down operations,” ZeroLend’s founder, known only as “Ryker,” said in a post the protocol shared to X on Monday.

“Despite the team’s continued efforts, it has become clear that the protocol is no longer sustainable in its current form,” he added.

ZeroLend focused its services on Ethereum layer-2 blockchains, once touted by Ethereum co-founder Vitalik Buterin as a central part of the network’s plan to scale and remain competitive.

However, Buterin said earlier this month that his vision for scaling with layer 2s “no longer makes sense,” that many have failed to properly adopt Ethereum’s security, and that scaling should increasingly come from the mainnet and native rollups.

DerivaDEX debuts Bermuda-licensed derivatives DEX

DerivaDEX has launched a Bermuda-licensed crypto derivatives platform, becoming what it says is the first DAO-governed decentralized exchange to operate under formal regulatory approval.

According to a statement from the platform, the exchange received a T license from the Bermuda Monetary Authority and has begun offering crypto perpetual swaps trading to a limited number of advanced retail and institutional participants.

The BMA’s T, or test license, is issued for a digital asset business seeking to test a proof of concept.

At launch, DerivaDEX supports major crypto perpetual products and said it plans to expand into additional markets, including prediction markets and traditional securities. The company said the platform combines offchain order matching with onchain settlement to Ethereum, while allowing users to retain non-custodial control of funds.

Parsec shuts down amid ongoing crypto market volatility

Onchain analytics company Parsec is closing down after five years, as crypto trader flows and onchain activity no longer resemble their past configurations.

“Parsec is shutting down,” the company said in an X post on Thursday, while its CEO, Will Sheehan, said the “market zigged while we zagged a few too many times.”

Sheehan added that Parsec’s primary focus on decentralized finance and non-fungible tokens (NFTs) fell out of step with where the industry has now headed.

“Post FTX DeFi spot lending leverage never really came back in the same way, it changed, morphed into something we understood less,” he said, adding that onchain activity changed in a way he never understood.

NFT sales reached about $5.63 billion in 2025, a 37% drawdown from the $8.9 billion recorded in 2024. Average sale prices also declined year-on-year, falling to $96 from $124, according to CryptoSlam data.

Kraken’s xStocks tops $25 billion in volume with more than 80,000 onchain holders

Kraken’s tokenized equities platform, xStocks, has surpassed $25 billion in total transaction volume less than eight months after launch, underscoring accelerating adoption as tokenization gains traction among mainstream investors.

Kraken disclosed Thursday that the $25 billion figure includes trading across centralized exchanges and decentralized exchanges, as well as minting and redemption activity. The milestone represents a 150% increase since November, when xStocks crossed $10 billion in cumulative transaction volume.

The xStocks tokens are issued by Backed Finance, a regulated asset provider that creates 1:1 backed tokenized representations of publicly traded equities and exchange-traded funds. Kraken serves as a primary distribution and trading venue, while Backed is responsible for structuring and issuing the tokenized instruments.

When xStocks debuted in 2025, it offered more than 60 tokenized equities, including shares tied to major US technology companies like Amazon, Meta Platforms, Nvidia and Tesla.

Kraken said onchain activity has been a key growth driver since launch, with xStocks generating $3.5 billion in onchain trading volume and surpassing 80,000 unique onchain holders.

Unlike trading that occurs solely within centralized exchanges’ internal order books, onchain activity takes place directly on public blockchains, where transactions are transparent and wallets can self-custody assets.

Growing onchain participation suggests users are not only trading tokenized equities but also integrating them into broader decentralized finance (DeFi) ecosystems.

Kraken said that eight of the 11 largest tokenized equities by unique holder count are now part of the xStocks ecosystem, signaling increased market share in the emerging tokenized equities sector.

DeFi market overview

According to data from Cointelegraph Markets Pro and TradingView, most of the 100 largest cryptocurrencies by market capitalization ended the week in the green.

The layer-1 blockchain Kite (KITE) token rose 38% as the biggest gainer in the top 100, followed by stablecoin payment ecosystem token Stable (STABLE), up over 30% during the past week.

Thanks for reading our summary of this week’s most impactful DeFi developments. Join us next Friday for more stories, insights and education regarding this dynamically advancing space.

Crypto World

BTC volatility spikes as price slides from $85k to $60k

Summary

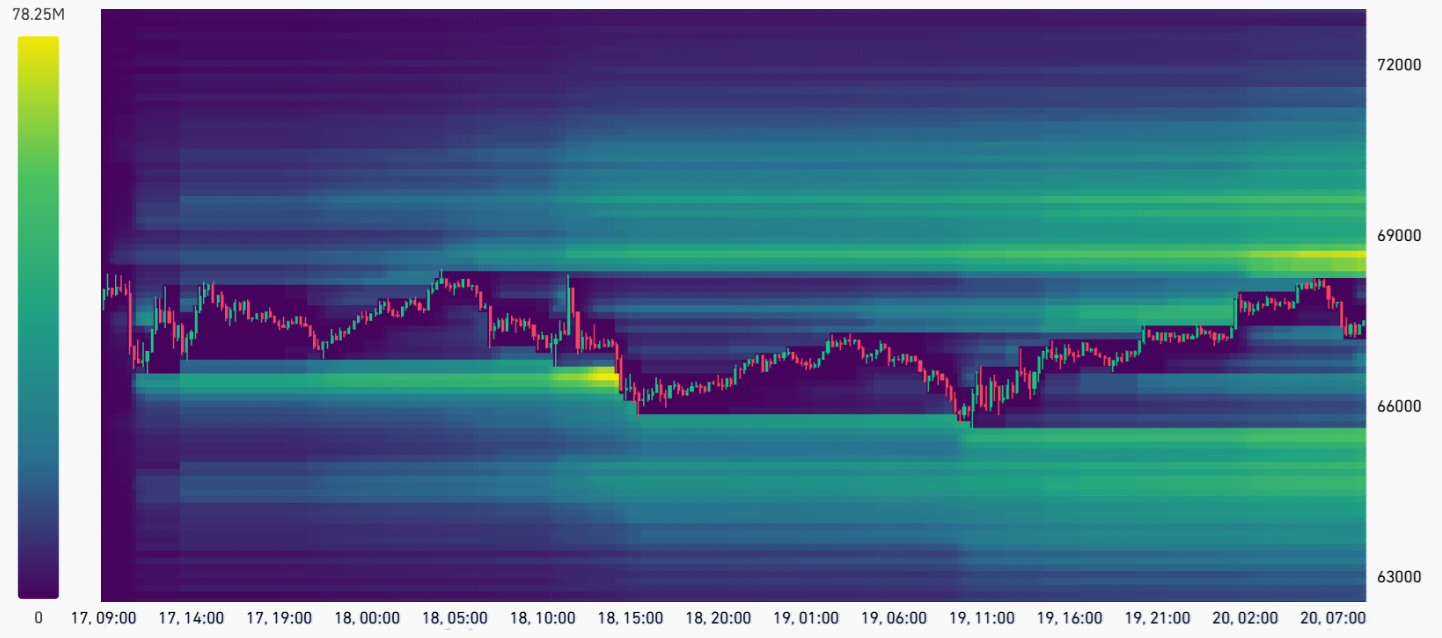

- BTC fell from about $85k to $60k before stabilizing near $66k, while March 2026 options IV spiked from just above 40% to nearly 65% then eased back toward 50%.

- Matrixport flags extreme pessimism, shrinking open interest, and persistent outflows as traders cut “tail risk” hedges and overall positioning, leaving liquidity and participation thin.

- The firm notes that high volatility, muted price sensitivity, and low liquidity have historically preceded strong upside moves in crypto, especially when macro conditions are quietly improving.

Crypto asset management company Matrixport stated in its latest research note that cryptocurrency markets are approaching a critical turning point, according to a report released by the firm.

The report indicated that a sharp decline in Bitcoin (BTC) led to a rapid increase in implied volatility in the options market, followed by a partial pullback. Bitcoin’s price briefly dropped sharply before stabilizing at a lower level, according to Matrixport’s analysis.

During the same period, the implied volatility of March 2026 expiry options climbed from approximately 40 percent to 65 percent, the report stated. The rebound indicated strong investor demand for hedging against downside risks during the decline, Matrixport noted. The subsequent drop in volatility to around 50 percent suggested that excessive “tail risk” hedges were gradually unwinding and short-term pressure had eased somewhat, according to the firm.

Matrixport stated that the market remains in a high-volatility environment. The report noted that investor sentiment is extremely pessimistic and liquidity continues to flow out of the market. Total position size has significantly decreased as traders reduce their hedging positions against collapse scenarios, weakening market participation, according to the analysis.

The report highlighted that historically, this type of combination—high volatility, low sensitivity, and decreased liquidity—has often preceded strong upward movements in cryptocurrency markets. Matrixport also noted that while there are signs of partial improvement in macroeconomic conditions, the lack of a clear reaction from cryptocurrency prices may not continue for long, according to the firm’s assessment.

Crypto World

Specialized AI detects 92% of real-world DeFi exploits

A purpose-built AI security agent detected vulnerabilities in 92% of exploited DeFi smart contracts in a new open-source benchmark.

The study, released Thursday by AI security firm Cecuro, evaluated 90 real-world smart contracts exploited between October 2024 and early 2026, representing $228 million in verified losses. The specialized system flagged vulnerabilities tied to $96.8 million in exploit value, compared with just 34% detection and $7.5 million in coverage from a baseline GPT-5.1-based coding agent.

Both systems ran on the same frontier model. The difference, according to the report, was the application layer: domain-specific methodology, structured review phases and DeFi-focused security heuristics layered on top of the model.

The findings arrive amid growing concern that AI is accelerating crypto crime. Separate research from Anthropic and OpenAI has shown that AI agents can now execute end-to-end exploits on most known vulnerable smart contracts, with exploit capability reportedly doubling roughly every 1.3 months. The average cost of an AI-powered exploit attempt is about $1.22 per contract, sharply lowering the barrier to large-scale scanning.

Previous CoinDesk coverage outlined how bad actors such as North Korea have begun using AI to scale hacking operations and automate parts of the exploit process, underscoring the widening gap between offensive and defensive capabilities.

Cecuro argues that many teams rely on general-purpose AI tools or one-off audits for security, an approach the benchmark suggests may miss high-value, complex vulnerabilities. Several contracts in the dataset had previously undergone professional audits before being exploited.

The benchmark dataset, evaluation framework and baseline agent have been open-sourced on GitHub. The company said it has not released its full security agent due to concerns that similar tooling could be repurposed for offensive use.

Crypto World

Fusaka Upgrade Fuels Record Address Poisoning on Ethereum

Lower gas costs have turned Ethereum into a playground for mass address poisoning, with scammers hitting thousands of wallets daily.

Ethereum has spent years trying to fix high fees, and recent upgrades finally made transactions cheaper. But while they solved one problem, they may have opened the door to another.

Leon Waidmann, head of research at Lisk, noted in an X post on Wednesday, Feb. 18, that network activity is booming, with stablecoin volume hitting $7.5 trillion in a single quarter while transaction fees stayed under a dollar.

“Record usage. Record cheap. At the same time. The biggest divergence between fundamentals and price in all of crypto right now,” he noted.

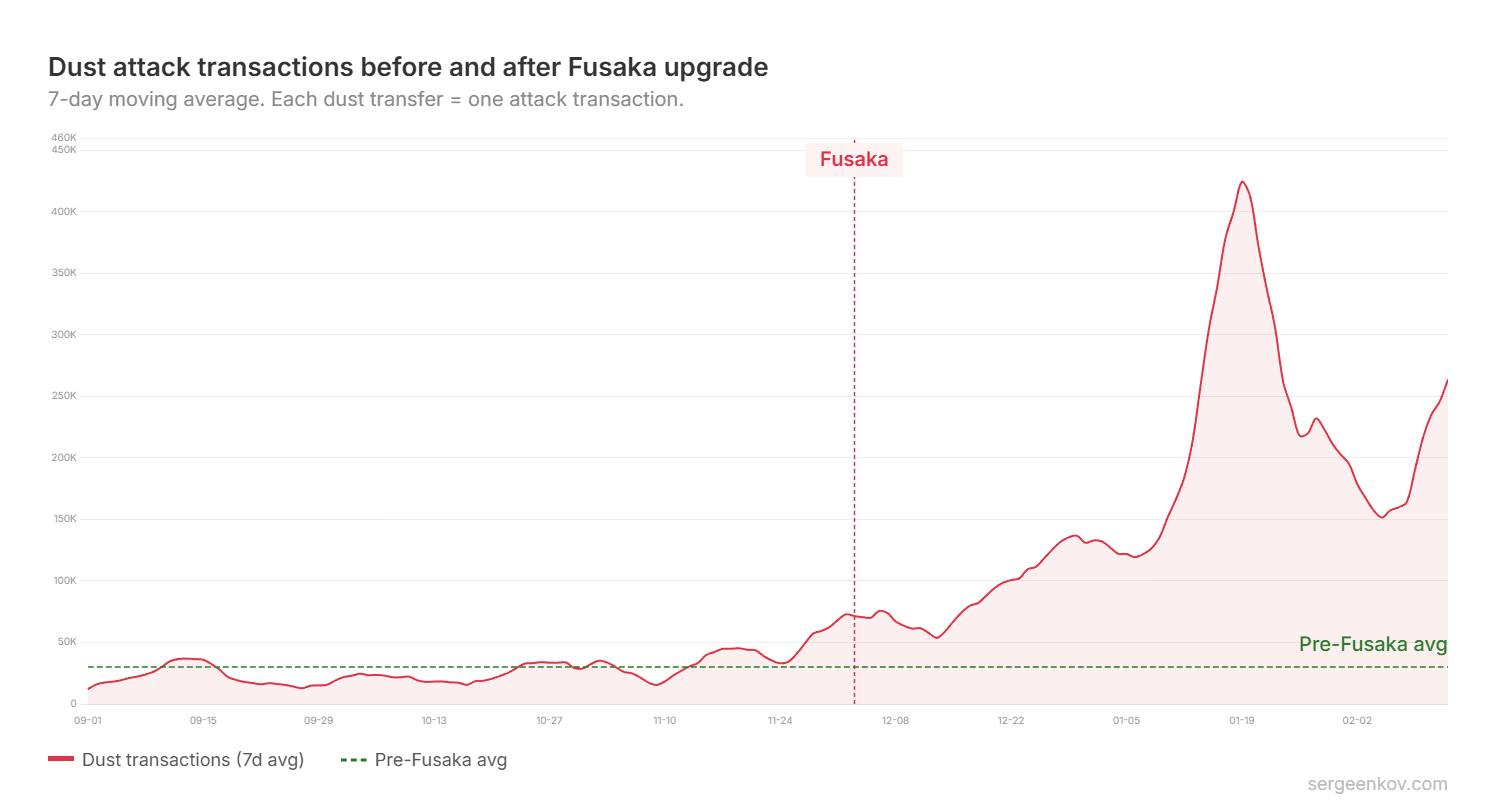

But the growth may hide a more alarming reality. A recent study by blockchain researcher Andrey Sergeenkov finds address poisoning attacks surged significantly after the December Fusaka upgrade, which cut gas fees sixfold and made spam attacks cheap enough to scale.

Address poisoning works by sending tiny transfers from addresses that look like the victim’s real contacts. If the victim copies the wrong address from their history, funds get stolen. Sergeenkov says attackers treat this like a lottery, sending millions of cheap transactions in the hope of a few big payoffs.

Unintended Consequences

Before Fusaka, attackers were sending roughly 30,000 dust transactions per day, according to Sergeenkov’s analysis of 101 tokens between Sept. 1, 2025, and Feb. 13 this year.

But after the upgrade, lower fees made mass poisoning viable in a way that wasn’t possible before, and daily dust transactions jumped to 167,000, peaking at about 510,000 in one day in January.

In just over two months after Fusaka, victims lost more than $63 million, 13 times the $4.9 million lost in a comparable prior period, the data shows.

“There is nothing wrong with lowering fees, but the security problems that cheap transactions amplify should have been addressed before the upgrade. When the Ethereum Foundation claims it is building trillion-dollar security, user safety must be the strictest priority over growth metrics,” Sergeenkov writes.

Sergeenkov noted that a single transfer accounted for a large share of the post-Fusaka losses, when attackers stole $50 million in USDT on Dec. 19, 2025. Even leaving that out, total losses still came to $13.3 million, 2.7 times higher than the pre-Fusaka period, he concluded.

Crypto World

Dutch Authorities Call on Polymarket Arm to Cease Activities

The prediction market’s Dutch arm, Adventure One, allegedly offered illegal bets, including on elections in the Netherlands.

The Netherlands Gambling Authority said it imposed a penalty on prediction markets platform Polymarket’s Dutch arm, Adventure One, for offering gambling to residents without a license.

In a Tuesday notice, Dutch authorities ordered the Polymarket company to “cease its activities immediately,” or face up to $990,000 in fines. According to authorities, Adventure One was in violation of Dutch law for offering illegal bets, including those on local elections, and the company had not responded to requests to address these activities.

”Prediction markets are on the rise, including in the Netherlands,” said the Netherlands Gambling Authority’s director of licensing and supervision, Ella Seijsener. “These types of companies offer bets that are not permitted in our market under any circumstances, not even by license holders.”

Polymarket and other platforms offering event contracts on prediction market platforms face similar scrutiny in the United States, where many individual state authorities have filed lawsuits over sports gambling. However, the chair of one of the federal financial regulators, the Commodity Futures Trading Commission, said on Tuesday that he would defend the agency’s “exclusive jurisdiction” over prediction markets, criticizing state-level action.

Related: Polymarket’s lawsuit could decide who regulates US prediction markets

Cointelegraph reached out to Polymarket for comment, but had not received a response at the time of publication. The company’s chief legal officer, Neal Kumar, said on Feb. 9 that Polymarket “welcome[s] dialogue with other states while the federal courts” consider the issue of jurisdiction in the US.

Dutch tax on crypto passes House of Representatives

The Polymarket crackdown in the Netherlands came within a week of the country’s House of Representatives advancing a proposal to introduce a 36% capital gains tax on investments that would likely include cryptocurrencies. If passed by the Dutch Senate and signed into law, it could take effect as early as 2028.

Magazine: Big questions: Should you sell your Bitcoin for nickels for a 43% profit?

Crypto World

Bitcoin Rally To $70K Possible As Bears At Risk Of $600M Liquidation

Key takeaways:

-

A minor 4.3% Bitcoin price increase to $69,600 could trigger over $600 million in forced liquidations for bearish traders.

-

Rising network hashrate and the BIP-360 quantum security proposal are helping to diminish long-term technical concerns.

Bitcoin (BTC) has remained confined within a relatively tight range of $65,900 to $70,500 over the past week. This stagnation has encouraged bearish traders, particularly as other major asset classes displayed resilience. However, even if Bitcoin requires months to reclaim the $90,000 level, excessive bearish confidence could trigger a wave of forced liquidations in futures positions, rapidly shifting momentum back to the bulls.

According to CoinGlass estimates, a price rally to $69,600 would force the liquidation of over $600 million in short BTC futures. For context, when Bitcoin climbed from $60,200 to $70,560 on Feb. 6, short liquidations totaled $385 million. Currently, a mere 4.3% move upward from the $66,700 level could deliver an even more significant blow to those betting on further declines.

Bulls may also find a catalyst in weakening macroeconomic data. The US reported sluggish gross domestic product growth for the fourth quarter of 2025, with an annualized rate of 1.4% falling short of the 2.9% analysts expected, per Yahoo Finance. This slower economic activity negatively impacts corporate earnings outlooks, typically reducing investor appetite for stock market exposure.

Meanwhile, underlying US inflation rose more than anticipated in December, dampening hopes for near-term interest rate cuts. The US personal consumption expenditures price index, excluding food and energy, increased by 0.4% month over month. As the S&P 500 loses bullish steam, investors may be forced out of their comfort zones to seek higher returns in onchain markets.

Escalating Middle East tensions may prompt investors to seek alternative hedges, particularly after gold prices rallied 25% in just three months. Gold’s market capitalization has climbed to a staggering $35.2 trillion—nearly eight times larger than Nvidia (NVDA US), which sits at $4.6 trillion.

As Bitcoin trades approximately 47% below its all-time high, the risk-reward profile for the cryptocurrency may become increasingly attractive to macro traders. For now, Bitcoin bears retain control, as evidenced by the lack of demand for long positions in the futures market.

The BTC perpetual futures funding rate has failed to stay above the 6% neutral threshold over the last two weeks. More telling is the recent stretch of negative funding rate, suggesting that bears are committed to their positions even as Bitcoin retests the $66,000 support level. Regaining conviction remains a hurdle for the bulls, who witnessed $1.6 billion in liquidations during the three-day crash that started on Feb. 6.

Related: Bitcoin ETFs shed $166M as BTC heads for worst start in years

Recovering hashrate and BIP-360 progress strengthen Bitcoin network security

While some of Bitcoin’s recent weakness was attributed to network security concerns, those risks are now dissipating.

The seven-day average hashrate has recovered to 1,100 exahashes per second, matching levels from late January. Earlier fears that miners were abandoning the network to pivot toward the artificial intelligence sector have proven premature, as the industry shows remarkable resilience.

Furthermore, the introduction of BIP-360 has addressed much of the uncertainty surrounding quantum computing threats. This proposal outlines a framework for post-quantum protection through a backwards-compatible soft fork. By removing the vulnerable key-path spend found in Taproot, the proposal hides public keys onchain until the moment of spending.

This technological roadmap provides a clear path for bulls to regain the narrative, potentially forcing a short squeeze that could propel Bitcoin back above $70,000.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Will XRP Drop Back to $1.20? Key Support Levels Tested Amid Bearish Pressure

XRP remains under sustained bearish pressure across both its USDT and BTC pairs, with the price structure continuing to print lower highs and lower lows. Despite short-term bounces from support levels, the broader trend favors sellers as the price trades below key moving averages and within a descending structure.

Ripple Price Analysis: The USDT Pair

On the XRP/USDT chart, the price is trading inside a well-defined descending channel, consistently rejecting dynamic resistance from the midline of the channel, the upper trendline, and the 100-day and 200-day moving averages. The recent bounce from the $1.20 demand zone failed to reclaim the $1.80 supply area, reinforcing the bearish structure and confirming that rallies are still corrective in nature.

The RSI also remains below the neutral 50 level and continues to trend weakly, signaling a lack of bullish momentum. As long as XRP stays below the mid-channel resistance and the 100-day and 200-day moving averages, located near $1.90 and $2.30 levels, respectively, the downside risk toward the lower channel boundary remains elevated, with the $1.20 zone acting as critical structural support.

The BTC Pair

Against Bitcoin, XRP is also showing relative weakness, trading below both the 100-day and 200-day moving averages, which are both located above the 2,200 sats area, after failing to hold prior breakout gains. The rejection from the 2,200-2,400 sats resistance zone confirms that sellers are defending higher levels, while the price compresses near a key horizontal support band at 2,000 sats.

Momentum on the XRP/BTC pair is neutral-to-bearish, with the RSI struggling to establish sustained strength above 50. A breakdown below the current support region could open the door for further relative underperformance, while reclaiming the moving average cluster would be the first signal that XRP is beginning to regain strength versus BTC.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Trump Fires Back After SCOTUS Ruling, Announces 10% Global Tariff

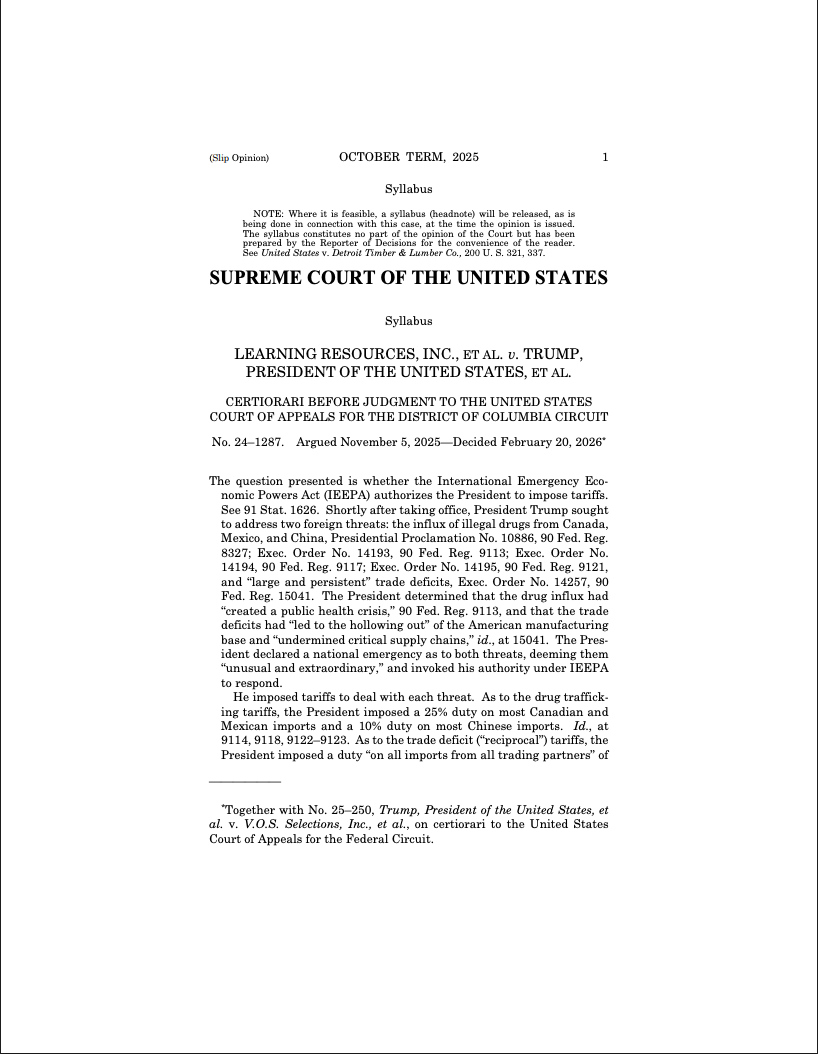

The United States Supreme Court ruled on Friday that President Donald Trump could not use national emergency powers to levy tariffs during peacetime.

US President Donald Trump announced a 10% global tariff on Friday following the Supreme Court’s ruling striking down his authority to levy tariffs under the International Emergency Economic Powers Act (IEEPA).

Trump was critical of the Supreme Court’s decision, calling the decision “ridiculous” at Friday’s press conference, and said that he will levy the tariffs under different legal methods, including the Trade Expansion Act of 1962 and the Trade Act of 1974. Trump said:

“Effective immediately. All national security tariffs under Section 232 and Section 301 tariffs remain fully in place. And in full force and effect. Today, I will sign an order to impose a 10% Global tariff under Section 122 over and above our normal tariffs already being charged.”

Trump’s tariffs have repeatedly caused severe downturns in markets considered high risk, including crypto and equities, as the threat of tariffs fuels uncertainty and shakes investor confidence.

Related: Bitcoin ignores US Supreme Court Trump tariff strike amid talk of $150B refund

The Supreme Court strikes down Trump’s authority to levy tariffs under emergency powers

Trump levied a 25% tariff on most goods coming in from Canada and Mexico, and a 10% tariff on goods coming in from China under the IEEPA, framing both tariffs as a response to national security threats.

An influx of drugs from foreign countries created a “public health crisis,” according to Trump, while trade deficits with China threatened the industrial manufacturing base in the US, he alleged.

However, the Supreme Court rejected both premises as national security threats under the IEEPA and said that the Executive Branch does not have the authority to levy tariffs under the IEEPA during peacetime.

“In IEEPA’s half-century of existence, no president has invoked the statute to impose any tariffs, let alone tariffs of this magnitude and scope,” the ruling said.

“Article I, Section 8, of the Constitution specifies that ‘The Congress shall have Power To lay and collect Taxes, Duties, Imposts and Excises.’ The Framers recognized the unique importance of this taxing power,” the Supreme Court ruled on Friday.

Magazine: Is China hoarding gold so yuan becomes global reserve instead of USD?

Crypto World

Only 1 in 10 Weak Token Launches Recovered in 2025: Arrakis

Data from more than 120 token launches shows that early sell pressure, not market timing, largely determined whether new tokens thrived in 2025.

New tokens struggled to find a floor in 2025, with early trading dynamics often setting a trajectory that proved hard to reverse as the year wore on, data shows.

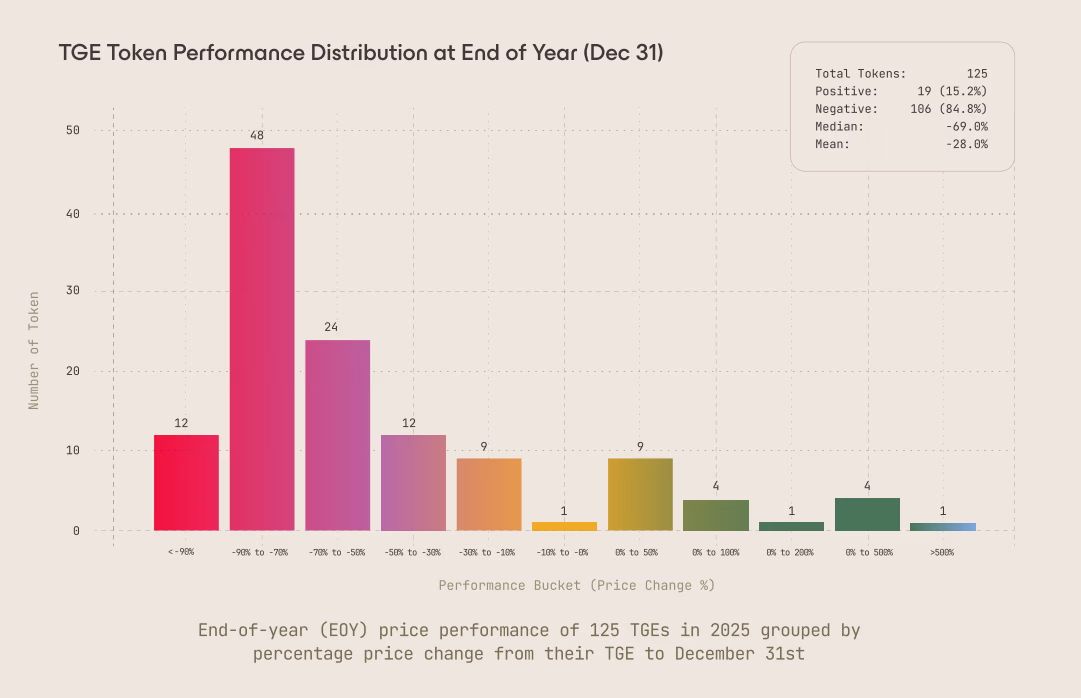

An 80-page analysis by Arrakis Finance found that about 85% of tokens launched last year finished below their initial price, after reviewing 125 token generation events (TGE) and surveying more than 25 founding teams.

The data also shows that nearly two-thirds of tokens were already down within the first seven days, and only 9.4% of tokens that declined in the first week after TGE ever recovered to their launch price at any point later in the year. In most cases, early drawdowns deepened rather than reversed.

Airdrops were one of the strongest sources of immediate selling. Across multiple launches, Arrakis observed that up to 80% of airdrop recipients sold their positions on the very first day of TGE, creating concentrated sell pressure.

“The baseline assumption should be that most of an airdrop will be sold; recipients have zero cost basis and expect prices to decline, making immediate selling rational,” the report states.

Market-making structures also mattered. Arrakis says liquidity was often mispriced, prompting traders to take quick exits.

“Liquidity depth is your buyer against sell pressure. Depth needs to absorb selling from airdrops, exchange allocations, and market maker loans without catastrophic price impact,” the report notes.

Arrakis concludes that token outcomes in 2025 were largely decided by launch mechanics rather than market cycles. Early supply shocks, not macro conditions, determined whether tokens stabilized or slid, and once early confidence was lost, recovery was statistically rare.

That finding broadly aligns with separate research from Dragonfly Capital, which recently found little difference in long-term performance between tokens launched in bull versus bear markets.

As Dragonfly Capital managing partner Haseeb Qureshi explained, regardless of the timing, most tokens don’t perform well over time. Bull market launches recorded a median annualized return of about 1.3%, while bear-market launches came in at -1.3%.

Crypto World

Supreme Court Rules Against Trump Tariffs Under IEEPA Law

The Supreme Court of the United States (SCOTUS) issued a ruling on Friday striking down most of US President Donald Trump’s tariffs, with six of the nine Supreme Court justices ruling that the Executive Branch lacks authority to levy tariffs under the International Emergency Economic Powers Act (IEEPA).

“IEEPA does not authorize the President to impose tariffs,” Friday’s ruling said, adding that the president has “no inherent authority” to impose tariffs during peacetime using the statutes in the IEEPA. The ruling read:

“In IEEPA’s half-century of existence, no president has invoked the statute to impose any tariffs, let alone tariffs of this magnitude and scope. That ‘lack of historical precedent,’ coupled with the breadth of authority that the President now claims, suggests that the tariffs extend beyond the President’s ‘legitimate reach.’”

Trump claimed that the purported inflow of drugs from Canada, China and Mexico, as well as the “hollowing out” of the US industrial base, constituted a national emergency under IEEPA that justified the tariffs, which the court rejected.

Trump criticizes court, says he’ll get tariffs reinstated

In a press briefing following the decision, Trump lashed out at the justices who voted to strike down the tariffs and vowed to get them reinstated, Politico reported.

“The Supreme Court’s ruling on tariffs is deeply disappointing, and I’m ashamed of certain members of the court, absolutely ashamed, for not having the courage to do what’s right for our country,” Politico cited him as saying.

He said he would reinstate the tariffs by using “other alternatives.”

Trump’s tariffs sent shockwaves through asset markets in 2025, causing severe downturns in crypto and equities when a new round of tariffs was announced or even threatened, fueling macroeconomic uncertainty.

Related: US stocks, crypto rise after Trump pauses planned European tariffs

Trump claims tariffs could replace income tax, but crypto markets are paying the price

In October 2024, while on the campaign trail, Trump floated the idea of replacing the federal income tax with revenue generated from tariffs. Trump said the tariffs would dramatically lower the US budget deficit.

Federal taxes would be “substantially reduced” for individuals and households making less than $200,000 per year once tariff revenue started rolling in, Trump said in April 2025.

Trump announced 100% tariffs on China on Oct. 10, 2025. Within minutes, crypto markets plummeted, and the price of Bitcoin (BTC) dropped from a high of about $122,000 to about $107,000 the same day the tariffs were announced.

Analysts cited several reasons for the crash, including excessive leverage. However, traders overwhelmingly saw the 100% China tariffs as the catalyst for the crypto crash, according to market sentiment platform Santiment.

Crypto prices have yet to recover from October’s crash, and BTC remains nearly 50% below its all-time high of over $125,000 reached on October 6, despite Trump walking back his tariff policies.

Magazine: Bitcoiners are ‘all in’ on Trump since Bitcoin ’24, but it’s getting risky

Crypto World

Simon Gerovich Slams Critics of Metaplanet’s BTC Strategy

Metaplanet denied claims of hidden activity, and maintained that all Bitcoin purchases, wallet addresses, and capital deployment decisions were publicly disclosed in real time.

Metaplanet’s CEO Simon Gerovich said claims that the firm’s disclosures are insincere are “inflammatory and contrary to the facts.” He added that over the past six months, as volatility increased, the Japanese public company allocated more capital to its income business and sold put options and put spreads, which are actively managed as option positions.

The response follows accusations circulating online questioning Metaplanet’s disclosure practices and use of shareholder funds. The claims state that Bitcoin purchases were not disclosed promptly, including a large purchase made near the September price peak using proceeds from an overseas public offering, followed by a period without updates.

Gerovich’s Defense

In his latest post on X, Gerovich said part of these funds was used to purchase Bitcoin for long-term holding, and that these purchases were disclosed at the time they were made. The exec added that all BTC addresses are publicly available and can be viewed through a live dashboard, which allows shareholders to check holdings in real time. He went on to assert that Metaplanet is one of the most transparent listed companies in the world.

Metaplanet made four purchases during September and announced all of them promptly. While the month was a local peak, Gerovich stated that the company’s strategy is not about timing the market, maintaining that the focus is to accumulate Bitcoin long-term and systematically, and that every purchase is disclosed regardless of price.

On options trading, Gerovich noted the criticism stemmed from a misunderstanding of the financial statements. He said selling put options is not a bet on BTC’s price rising, but a way to acquire Bitcoin at a cost lower than the spot price through premium income. He explained that this strategy reduced effective acquisition costs in the fourth quarter. He revealed that Bitcoin per share, the company’s primary key performance indicator, increased by more than 500% in 2025.

Financial Statements And Borrowings

On financial results, Gerovich clarified that net profit is not an appropriate metric for evaluating a Bitcoin treasury company. He pointed to the operating profit of 6.2 billion yen, which indicates a growth of 1,694% year over year. According to the exec, the ordinary loss comes solely from unrealized valuation changes on long-term Bitcoin holdings that the company does not intend to sell.

Three disclosures related to borrowings were made – when the credit facility was established in October, and when funds were drawn down in November and December. Borrowing amounts, collateral details, interest rate structures, purposes, and terms were disclosed. The identity of the lender and specific interest rate levels were not disclosed at the counterparty’s request, despite the terms being favorable to Metaplanet.

You may also like:

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

-

Video4 days ago

Video4 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech6 days ago

Tech6 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World3 days ago

Crypto World3 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports4 days ago

Sports4 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video18 hours ago

Video18 hours agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Tech4 days ago

Tech4 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business3 days ago

Business3 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment2 days ago

Entertainment2 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video3 days ago

Video3 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech2 days ago

Tech2 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World7 days ago

Crypto World7 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Sports2 days ago

Sports2 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment2 days ago

Entertainment2 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business3 days ago

Business3 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat5 days ago

NewsBeat5 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World2 days ago

Crypto World2 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat5 days ago

NewsBeat5 days agoMan dies after entering floodwater during police pursuit

-

Crypto World23 hours ago

Crypto World23 hours ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market

-

NewsBeat6 days ago

NewsBeat6 days agoUK construction company enters administration, records show

-

Politics4 days ago

Politics4 days agoEurovision Announces UK Act For 2026 Song Contest