Crypto World

We Asked 4 AIs How Low XRP Could Fall This Bear Cycle

Some of the answers predict another massive leg down for XRP’s price soon.

Although most cryptocurrencies tumbled hard in the past few weeks, XRP became the worst performer during the Thursday crash, dropping to just over $1.10 for the first time in well over a year.

This meant that the asset had shed more than 50% of its value in just a month as it peaked at $2.40 on January 6. The question now is whether this is a full-on bear market, and if it is, how low can XRP go as the correction deepens? We asked ChatGPT, Perplexity, Grok, and Gemini about their view on the matter.

How Low, XRP?

ChatGPT admitted that plummeting from $2.40 to $1.10 in the span of just a month means it’s not just a “healthy correction” any longer – it’s a clear shift in market structure. The rejection at $2.40 marked a decisive local top, while the subsequent breakdown below $1.50 and $1.30 erased multiple layers of support. The current weak rebound suggests that buyers remain cautious and any upside attempts are likely to face heavy selling pressure, it added.

If this bearish behavior continues in the following weeks or months, the AI solution from OpenAI noted that XRP could plunge to somewhere between $0.85-$0.95. Interestingly, Perplexity sort of agreed with that target:

“This range represents a realistic bear-cycle low target if broader capitulation unfolds. A move here would align with historical behavior seen across larger-cap altcoins during prolonged downturns,” Perplexity added.

Gemini outlined the significance of the psychological $1.00 support. If it falls, XRP’s situation could worsen exponentially as investors will likely flock once that floor gives in. Consequently, it warned that the asset’s crash might take it even further south, to a low of somewhere around $0.60. Interestingly, that would result in completing a full circle since the US presidential elections in 2024, as XRP started its ascent from those levels.

Chances for a Rebound?

All AIs noted that it’s difficult to be optimistic in the current market environment. However, Grok outlined a possible bounce-off scenario in case XRP has already bottomed at $1.10.

The AI integrated into X said the cross-border token can remain sideways between $1.10 and $1.45 for the next few weeks and possibly look ahead for a more decisive rebound to over $1.60 if it manages to take down the $1.50 resistance. This would be the so-called ‘bull case’ in which XRP doesn’t break down beneath $1.00 soon. If it does, all bets are off, Grok added, and warned of further declines to under $0.90.

You may also like:

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Bitcoin Is Offering ‘New Crack Of The Apple’ To Institutions: Bitwise CEO

Bitcoin’s drop below $70,000 is being seen very differently by long-time holders and institutional investors, according to Bitwise CEO Hunter Horsley.

“I think long-time holders are feeling unsure, and I think the new investor set, institutions are sort of getting a new crack at the apple,” Horsley said during an interview with CNBC on Friday. Horsley said that institutional buyers are “seeing prices they thought that they’d forever missed.”

It was only in October that Standard Chartered’s head of digital asset research, Geoff Kendrick, said he doesn’t expect Bitcoin to fall below $100,000 again.

Bitcoin “getting swept up” with the rest of macro

Horsley acknowledged that Bitcoin’s (BTC) recent plunge comes at an unusual time, given the ramp-up in efforts toward regulatory clarity and growing institutional interest. Bitcoin is down 22.60% over the past 30 days, trading at $69,635 at the time of publication, according to CoinMarketCap.

Horsley said that Bitcoin is in a bear market and is “getting swept up” with the rest of the macroassets as investors are “selling everything that is liquid.”

“In the present moment, it is mostly trading with other liquid assets,” he said.

Gold has since fallen 11.43% from its all-time high of $5,609 on Jan. 28, trading at $4,968 at the time of publication, according to Trading Economics.

Meanwhile, Silver has fallen 35.95% from its all-time high of $121.67 on Jan. 29, trading at $77.98 at the time of publication.

Horsley points to strong inflows from institutions

Horsley said demand for Bitcoin remains strong, particularly from institutional investors.

He said that Bitwise manages over $15 billion in institutional funds and saw more than $100 million in inflows on Monday alone, when Bitcoin was trading around $77,000.

Related: Bitcoin difficulty drops by over 11%, sharpest drop since 2021 China ban

“There’s a lot of volume, and there are sellers and buyers,” Horsley said.

Curiosity among retail investors has also spiked. Google Trends data shows worldwide searches for “Bitcoin” reached a score of 100 for the week starting Feb. 1, the highest level in the past 12 months, as the price fell to $60,000 on Tuesday, a level not seen since October 2024.

Meanwhile, BlackRock’s spot Bitcoin exchange-traded fund (ETF) saw $231.6 million in inflows on Friday, following two days of heavy outflows during the turbulent week for the asset.

Magazine: Bitcoin’s ‘biggest bull catalyst’ would be Saylor’s liquidation: Santiment founder

Crypto World

Bithumb Recovers Overpaid Bitcoin, Covers 1,788 BTC Shortfall

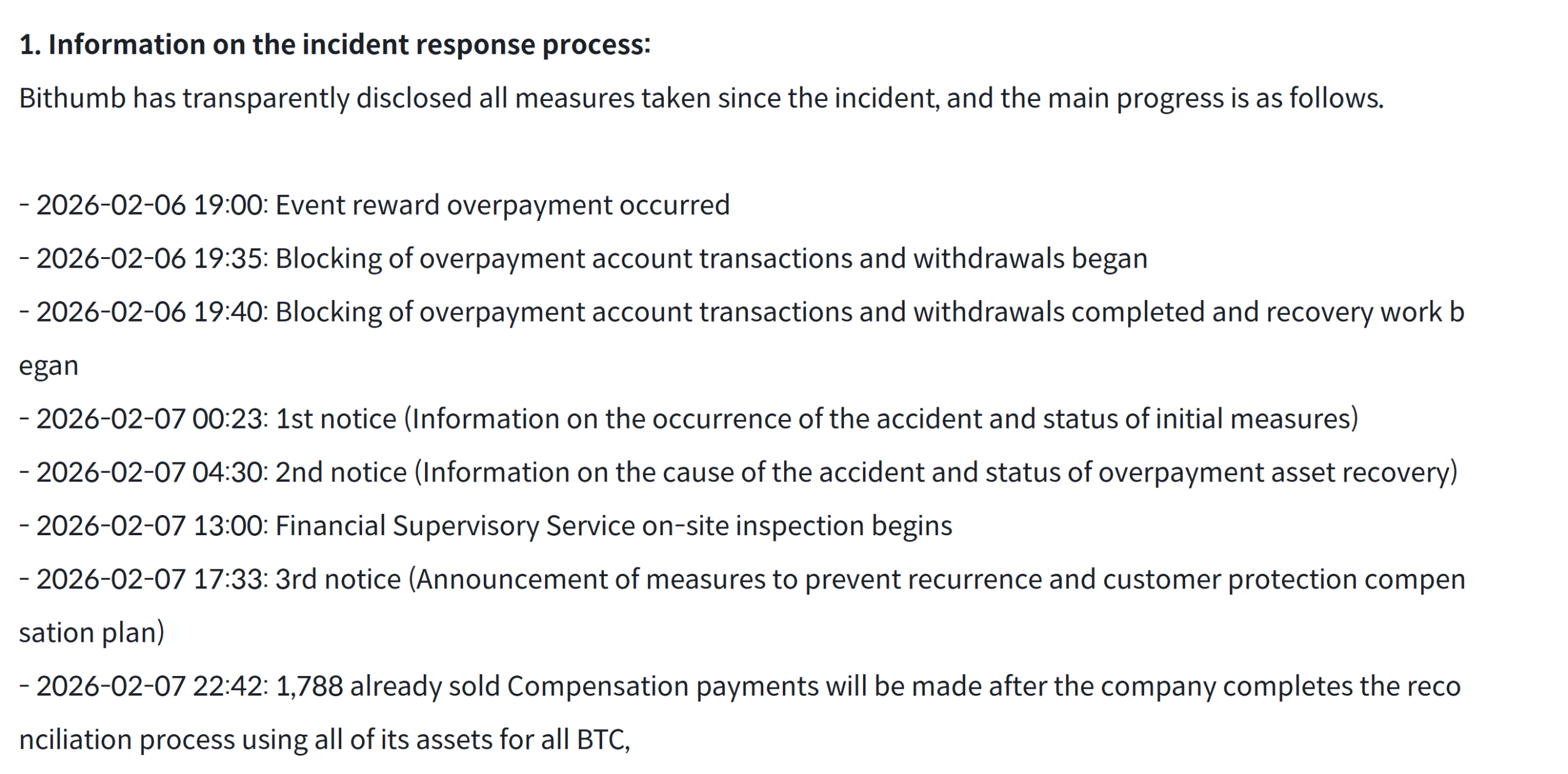

South Korean cryptocurrency exchange Bithumb says it has resolved an incident in which a promotional reward error credited certain user accounts with excess Bitcoin.

In a Sunday statement, the exchange confirmed it recovered 99.7% of the overpaid Bitcoin (BTC) on the same day the incident occurred. The remaining 0.3%, totaling 1,788 Bitcoin that had already been sold, was covered using company funds to ensure customer balances remained fully matched.

“Bithumb’s holdings of all virtual assets, including Bitcoin (BTC), are 100% equivalent to or exceeding user deposits,” the exchange wrote.

According to Bithumb, most of the excess Bitcoin was retrieved directly from accounts, while the portion already liquidated in the market required reimbursement from corporate reserves.

Related: Bithumb flags $200M in dormant crypto assets across 2.6M inactive accounts

Bithumb rolls out compensation plan

The exchange also announced some compensation measures. Users connected to the platform at the time of the incident will receive 20,000 Korean won ($15) each. Traders who sold Bitcoin at unfavorable prices during the disruption will receive full reimbursement of their sale value plus an additional 10% payment. The platform will also waive trading fees for all markets for seven days starting Monday.

The incident began on Friday when a system issue during a promotional event credited some users with an unusually large amount of Bitcoin, briefly causing sharp price swings on the exchange when recipients began selling the funds. The platform quickly restricted affected accounts and stabilized trading within minutes, preventing broader liquidations.

The exchange said the incident was not related to hacking and that no customer assets were lost, with deposits and withdrawals continuing as normal. While the company did not disclose the total amount involved, some users claimed roughly 2,000 BTC had been credited.

Related: South Korean lawmaker faces scrutiny over family ties to crypto exchange: Report

Centralized crypto exchanges face operational issues

Centralized cryptocurrency exchanges have continued to encounter operational problems. In June, Coinbase said account restrictions had been a major issue and reported reducing unnecessary freezes by 82% after upgrading its machine-learning systems and internal infrastructure, following years of complaints from users locked out of accounts for months without any security breach.

Similar concerns emerged during the Oct. 10 market sell-off, when Binance users reported technical difficulties that prevented some traders from closing positions at peak volatility. While the exchange said its core trading system remained operational and blamed broader market conditions for most liquidations, it later distributed about $728 million in compensation to affected users.

Magazine: Bitget’s Gracy Chen is looking for ‘entrepreneurs, not wantrepreneurs’

Crypto World

Trump disclaims UAE World Liberty stake knowledge, Gemini exits, China bans yuan stablecoins | Weekly Recap

In this week’s edition of the weekly recap, President Donald Trump denied awareness of reported UAE investment in World Liberty Financial, and China’s central bank joined nine agencies in banning unapproved yuan-linked stablecoins. Trump distances himself from World Liberty investment…

Crypto World

Forward Industries Maintains $600M Solana Position Despite $1B Unrealized Loss

TLDR:

- Forward Industries holds nearly 7 million SOL tokens, more than its next three competitors combined.

- FWDI’s average SOL acquisition cost of $232 creates $1 billion unrealized loss at current $85 price.

- The company’s debt-free balance sheet enables offensive consolidation while rivals face selling pressure.

- Forward raised $1.65 billion in 2025 from Galaxy Digital, Jump Crypto, and Multicoin Capital backing.

Forward Industries controls nearly 7 million SOL tokens as the largest publicly traded Solana treasury company. The firm’s holdings face substantial unrealized losses amid current market conditions.

Unlevered Balance Sheet Provides Strategic Advantage

FWDI purchased its SOL holdings at an average price of $232 per token. Current valuations place SOL near $85, creating a paper loss approaching $1 billion. The company’s share price has declined from $40 to approximately $5.

Chief Investment Officer Ryan Navi maintains the firm can consolidate weaker competitors during this downturn. “Scale plus an unlevered balance sheet is a real advantage in this market,” Navi told CoinDesk. “We can play offense when others are playing defense,” he added.

Forward Industries operates without corporate debt or leverage on its balance sheet. “Forward Industries has strategically avoided leverage and debt by design,” Navi explained. This structure provides flexibility to deploy capital when market opportunities emerge.

The firm raised $1.65 billion through a private investment in public equity during 2025. Galaxy Digital, Jump Crypto and Multicoin Capital led the funding round. Forward Industries now holds more SOL than its next three public competitors combined.

Staking Strategy and Permanent Capital Model

Forward Industries stakes its SOL holdings to generate yields between 6% and 7%. The staking rate will decrease over time as Solana’s programmed issuance declines. This creates an increasingly disinflationary supply environment for the network.

The company partnered with Sanctum to launch fwdSOL, a liquid staking token. This instrument earns staking rewards while functioning as collateral in decentralized finance protocols. Forward can borrow against this collateral at rates below the staking yield on platforms like Kamino.

Navi positions Forward Industries as a permanent capital vehicle rather than a short-term trading operation. “We’re not running a trading book, we’re building a long-term Solana treasury,” Navi stated. The company plans to underwrite real-world assets and tokenized royalties that exceed its cost of capital.

Kyle Samani announced his departure as managing director of Multicoin Capital on Wednesday. He retains his position as chairman of Forward Industries. Samani is receiving his exit from the Multicoin Master Fund in FWDI shares and warrants instead of cash redemption.

“What differentiates Forward is discipline: no leverage, no debt,” Navi said. The firm maintains a long-term view on Solana as strategic infrastructure rather than a speculative bet. Management believes its debt-free structure positions it to lead sector consolidation during this challenging period.

Crypto World

El Salvador’s Bukele Approval Hits Record 91.9% Despite Tepid Bitcoin Adoption

El Salvador President Nayib Bukele continues to command overwhelming public support, even as the country’s landmark Bitcoin policy shows limited traction among citizens.

Key Takeaways:

- Bukele holds a 91.9% approval rating, driven mainly by improved security and falling crime.

- Bitcoin adoption among citizens remains limited despite its legal tender status.

- El Salvador continues accumulating Bitcoin even while negotiating with the IMF.

A new survey published by Salvadoran newspaper La Prensa Gráfica found that 91.9% of respondents approve of Bukele’s performance in office.

Of the 1,200 people polled, 62.8% said they strongly approve of the president, while only 1.8% expressed strong disapproval. Bukele reacted sarcastically to the figures on X, writing, “So now they’re 1.8%?”

Crime Reduction Fuels Bukele Support Despite Bitcoin Experiment

The results suggest that the administration’s popularity is being driven largely by domestic policy rather than cryptocurrency.

According to the poll, improved security conditions ranked as the main reason for public support.

Since taking office in 2019, Bukele has launched an aggressive crackdown on gangs and opened the Terrorism Confinement Center (CECOT), a large-scale prison designed to hold suspected gang members.

Homicide rates have fallen sharply compared with previous years, a change widely cited by residents as the government’s biggest achievement.

By contrast, the president’s Bitcoin initiative appears to carry little weight in public opinion. Only 2.2% of respondents described Bitcoin as the biggest failure of Bukele’s six-year presidency, and the cryptocurrency was otherwise barely mentioned in the survey.

The muted reaction reflects a broader pattern: while the country made history in 2021 by adopting Bitcoin as legal tender and requiring businesses to accept it where possible, everyday usage has remained limited.

Bukele himself acknowledged the gap in a 2024 interview with TIME, saying the project did not achieve the widespread adoption authorities initially expected.

The policy also drew criticism from international lenders, particularly the International Monetary Fund, which repeatedly warned about fiscal and financial stability risks.

Despite those concerns, El Salvador has not stepped away from accumulating Bitcoin.

Government officials say the country has continued buying one Bitcoin per day since 2022, a strategy Bukele has publicly pledged to maintain. Online trackers linked to the government’s Bitcoin office indicate the national reserves are still growing.

San Salvador recently reached a financing agreement with the IMF that included scaling back certain crypto-related initiatives, but the administration has signaled that purchases for state reserves will continue.

IMF Presses El Salvador as Chivo Wallet Sale Looms

In December last year, the IMF said its ongoing talks with El Salvador over Bitcoin policy are focused on improving transparency, protecting public funds and reducing financial risks.

As part of the discussions, authorities are negotiating the potential sale or shutdown of the government-run Chivo wallet, which has faced complaints about fraud, identity theft and technical problems since launch.

Officials had previously signaled the app could be wound down while private crypto wallets continue operating in the country.

El Salvador secured a $1.4 billion IMF loan in 2024 after tensions linked to its Bitcoin adoption. The IMF’s latest review noted stronger-than-expected economic performance, projecting real GDP growth of about 4% this year with positive prospects for the next.

The post El Salvador’s Bukele Approval Hits Record 91.9% Despite Tepid Bitcoin Adoption appeared first on Cryptonews.

Crypto World

Polygon price double bottoms as Tazapay, Revolut, Paxos, and Moonpay payments rise

Polygon price crashed and erased all the gains it made earlier this year despite its strong fundamentals, including its growing market share in the payment industry and its growing burn rate.

Summary

- Polygon price has crashed and erased most of the gains it made earlier this year.

- Data shows that its payment transaction volume has soared in the past few months.

- Technical analysis suggests that the token will rebound in the coming weeks as it has formed a double-bottom pattern.

Polygon (POL), whose ticker was previously known as MATIC, was trading at $0.095, down sharply from the year-to-date high of $0.1853. It remains much lower than its all-time high.

POL price crash coincided with the ongoing crypto market dip that has affected Bitcoin and most altcoins. It also happened as Vitalik Buterin criticized layer-2 network. He believes that these networks will likely struggle in the future as Ethereum has largely solved some of the scaling challenges it had in the past.

Ethereum is now substantially faster than it was a few years and its upcoming upgrades will make it faster. Also, its transaction costs have continued falling in the past few years.

Buterin believes that layer-2 networks that will survive are those that will solve key challenges and focus on key niches. Polygon has largely succeeded in this by focusing on the payment industry.

For example, data shows that it has the second-highest monthly USDC addresses after Solana. Its stablecoin P2P transfer volume has jumped to over $39 billion. The top players using its chain are Tazapay, which handled over $687 million in January.

Revolut handled over $50 million, while Stripe, Paxos, Moonpay, and Avenia Pay handled millions of dollars in volume. These networks will likely continue experiencing more volume in the near term, benefiting Polygon.

The rising growth, together with its strong market share in the predictions market, has led to a surge in network fees. Data compiled by Nansen shows that its network fees jumped by double digits, while the burn rate has soared in the past few months.

Polygon price technical analysis

The daily timeframe chart shows that the POL price has retreated sharply in the past few weeks, moving from a high of $0.1853 in January to a low of $0.0841 last week. This drop coincided with the broader crypto market crash.

POL price has formed a double-bottom pattern, whose neckline is at $0.1853. A double-bottom is one of the most common bullish reversal signs in technical analysis.

Therefore, the most likely POL price prediction is bullish, with the initial target being at $0.1500, which is about 57% above the current level. A drop below the key support level at $0.0845 will invalidate the bullish outlook and point to more downside.

Crypto World

Crypto Industry Headed for Massive Consolidation, Says Bullish CEO

The crypto sector is bracing for a wave of consolidation as larger players gear up to absorb smaller projects, a shift that could reshape the landscape over the coming months. In an appearance on CNBC, Tom Farley, the former NYSE president and current CEO of Bullish, argued that the industry is entering a phase reminiscent of traditional financial markets where fragmentation gives way to scale through acquisitions. He pointed to a marked downturn in crypto prices, noting that Bitcoin (CRYPTO: BTC) has fallen roughly 45% from its October peak of $126,100 and was hovering near $69,405 at the time of reporting, according to CoinMarketCap. Farley framed the pullback as a catalyst for consolidation rather than a mere cycle. He stressed that consolidation should have happened earlier, but inflated valuations helped sustain a veneer of optimism. “It should have happened a year or two ago,” he told CNBC, underscoring that the sector’s fortunes are likely to hinge on the ability of firms to merge, scale, and operationalize.

Key takeaways

- Major crypto firms are expected to accelerate acquisitions to achieve scale, reducing sector fragmentation in the coming quarters.

- The current price downturn is described as a catalyst for consolidation, not a sign of systemic weakness.

- Valuations from the late-stage hype era are receding; buyers will prioritise revenue generation and long-term viability over speculative promise.

- Venture capital has grown more selective, with investors favoring mature, revenue-oriented projects and tighter due diligence.

- Consolidation could bring redundancies and organizational disruption as portfolios merge and strategic priorities reshuffle.

Tickers mentioned: $BTC

Market context: The pullback in crypto prices coincides with a maturation of the market, a period in which capital begins to reward scalable, revenue-backed business models. Investors and strategists alike are watching whether consolidation will unlock synergies, reduce duplication, and create more defensible platforms amid a challenging macro backdrop and evolving regulatory considerations.

Why it matters

For investors, the shift toward consolidation could recalibrate risk and reward in the sector. Entities that survive the purge—those with clear paths to profitability, diversified products, and integrated operations—stand to gain greater market share and pricing power as competition contracts. This is not merely about absorbing idle projects; it is about creating platforms capable of attracting institutional-grade capital and sustaining longer-term growth even as market cycles ebb and flow.

From a builder’s perspective, the emphasis on scale and sustainability will push teams to prioritize product integration, interoperability, and go-to-market execution. Rather than chasing a flashy new product with limited traction, startups and incumbents alike may seek partnerships, platform consolidations, and joint ventures that accelerate product roadmaps and user acquisition. That strategic shift could reshape funding dynamics, with investors favoring businesses that demonstrate measurable user adoption, revenue growth, and a clear path to profitability.

Analysts point to the broader maturation of crypto finance, where competitive advantages increasingly accrue to firms that can operate at scale, manage risk effectively, and offer diversified ecosystems. The trajectory mirrors patterns seen in other tech sectors, where consolidation follows cycles of hype and valuation inflation. The ongoing discussion about venture capital discipline—highlighted by Ajna Capital’s chief investment officer, Eva Oberholzer, who described a tightening in crypto-dedicated funding—underscores a measured, quality-focused approach to new investments (via the linked coverage). Investors are increasingly skeptical of entities with only a spark of potential and no robust business model to translate that potential into durable revenues. A comprehensive view from market watchers and researchers, including analyses that discuss how retail investors interpret downturns, further reinforces the idea that the market is shifting toward more disciplined, evidence-based evaluation of projects and teams (Santiment).

Against this backdrop, observers caution that consolidation can be a double-edged sword. While it may eliminate redundant offerings and sharpen competitive dynamics, it can also precipitate layoffs and internal disruption as merged entities realign priorities and streamline operations. The risk is especially pronounced for smaller teams whose business models hinge on niche deployments or speculative demand. Yet proponents argue that a more consolidated landscape could enhance resilience, improve risk management, and foster stronger governance across a sector that has, at times, struggled with fragmentation and fragmentation-related inefficiencies.

As Farley noted in his CNBC remarks, the market’s current volatility creates a window for consolidation to take hold while the sector adjusts to a more sober valuation regime. The broader crypto community continues to weigh the pace and breadth of consolidation, balancing the potential benefits of scale against the human and organizational costs of large-scale mergers. The conversation also intersects with ongoing analyses from researchers and commentators who monitor how sentiment, regulatory changes, and macro liquidity influence consolidation activity and the pace of innovation within crypto ecosystems.

What to watch next

- Announcements of mergers or strategic partnerships among major crypto exchanges, wallets, or infrastructure providers in the coming quarters.

- Shifts in venture capital patterns toward mature, revenue-positive crypto initiatives and away from speculative, early-stage bets.

- Regulatory developments that clarify how competition and consolidation should be managed in crypto markets.

- Reorganizations or workforce changes within consolidating firms as strategies are realigned to capitalize on scale.

Sources & verification

- CNBC interview with Tom Farley discussing consolidation in crypto and the role of price pressures in catalyzing deals (YouTube: https://www.youtube.com/watch?v=-OPn8-Juhyo).

- Bitcoin price reference and market data (CoinMarketCap): https://coinmarketcap.com/.

- Ajna Capital commentary on venture capital discipline and market maturation (Cointelegraph).

- Santiment analysis piece on crypto market behavior during the downturn (Cointelegraph).

Market reaction and consolidation in a maturing crypto landscape

The discussion surrounding consolidation centers on a simple premise: scale matters more than ever in a sector attempting to transition from a volatile early-stage market to a more mature, revenue-centric industry. As Farley argued on CNBC, the downturn has exposed the inefficiencies that plagued a number of crypto ventures, where inflated expectations outpaced actual business traction. The reality, he suggested, is that many entities do not possess independent, durable business models and will need to merge with larger players to survive and thrive. This echoed sentiment from industry observers who have long argued that valuation bubbles and revenue misalignment fuel unsustainable growth trajectories, and it is now driving a pragmatic approach to dealmaking across the sector.

Bitcoin (CRYPTO: BTC) has been emblematic of the cycle, retreating from its October peak near $126,100 to the vicinity of $69,405, illustrating how market-wide valuations influence corporate strategy as much as they do investor sentiment. The decline has not only re-priced risk but also intensified the focus on cash flow, customer acquisition, and the ability to convert users into recurring revenue streams. In this environment, consolidation could unlock efficiencies—such as shared technology stacks, consolidated compliance frameworks, and integrated go-to-market motions—that help firms weather volatility and pursue longer-term objectives. Yet the path to consolidation is not guaranteed to be smooth; it may trigger redundancies, realign product portfolios, and set off internal restructuring as newly merged entities consolidate operations and governance.

Industry observers also highlight a broader trend: investors are recalibrating expectations. The crypto market’s maturation is accompanied by a shift in venture capital discipline. Eva Oberholzer, chief investment officer at Ajna Capital, told Cointelegraph that the market has reached a stage where risk appetite is tempered by a preference for measurable progress and sustainable growth. This shift aligns with a more cautious but potentially more durable investment climate, where teams must demonstrate traction and a clear path to profitability to attract sustained funding. Meanwhile, industry analyses have emphasized the importance of understanding market dynamics during downturns, with researchers and commentators tracking how retail and institutional participants interpret price movements and project fundamentals during cyclical declines. The synthesis of these perspectives suggests a sector increasingly governed by fundamentals, governance, and scalable business models rather than aspirational narratives alone.

Looking ahead, the landscape may continue to evolve as consolidation takes hold, testing the resilience of teams, products, and platforms. The potential benefits—reduced duplication, stronger balance sheets, and enhanced platform capabilities—must be weighed against the practical challenges of combining cultures, harmonizing technology, and preserving employee morale. As the next wave of deals unfolds, market participants, builders, and regulators will closely monitor how mergers reshape competition, liquidity, and consumer trust within the crypto economy. The ultimate measure will be whether the sector can sustain innovation while delivering durable value to users and investors alike.

Sources & verification items to verify include the CNBC interview with Tom Farley, BTC price data from CoinMarketCap, Ajna Capital’s commentary on market maturation, and Santiment’s analyses cited in industry coverage.

Crypto World

Tether Assists Turkey in $544 Million Crypto Seizure, Reveals $3.4B Global Enforcement Record

TLDR:

- Tether assisted Turkish authorities in freezing $544 million in crypto linked to betting schemes.

- Stablecoin issuer has supported over 1,800 law enforcement cases across 62 countries worldwide.

- Tether has frozen a total of $3.4 billion in illicit USDT through global cooperation efforts.

- Turkish probe targets Darkex platform owner accused of providing crypto infrastructure for betting.

Tether assisted Turkish authorities in freezing approximately $544 million in cryptocurrency assets tied to illegal betting operati

The stablecoin issuer acted on requests from law enforcement investigating money laundering schemes.

The frozen funds represent one of Turkey’s largest crypto-related seizures to date. Tether simultaneously disclosed its involvement in over 1,800 cases across 62 countries.

The company has frozen a total of $3.4 billion in illicit USDT through global law enforcement collaborations.

Tether’s Expanding Role in Global Law Enforcement

Tether’s cooperation with Turkish officials highlights the company’s growing partnership with international authorities.

The stablecoin issuer provided technical assistance to freeze wallets connected to unauthorized betting platforms.

This intervention prevented suspects from moving potentially laundered cryptocurrency to other addresses.

The action demonstrates how blockchain transparency enables rapid response to criminal investigations.

The $544 million seizure in Turkey forms part of a broader enforcement pattern. Tether has developed protocols for responding to legitimate law enforcement requests worldwide.

These procedures allow authorities to immobilize USDT holdings linked to suspected criminal activity. The company maintains compliance teams dedicated to processing such requests efficiently.

Across 62 countries, Tether has supported more than 1,800 criminal investigations. The cases span various categories including fraud, money laundering, and illicit marketplace operations.

The $3.4 billion in frozen USDT reflects the scale of detected criminal activity. This figure represents cumulative freezes executed over multiple years of cooperation.

The stablecoin issuer’s transparency measures contrast with criticisms often directed at cryptocurrency platforms.

By maintaining the ability to freeze addresses, Tether provides law enforcement with tools unavailable in truly decentralized systems.

This capability has made USDT a cooperative asset in criminal investigations. Authorities can trace and halt illicit fund movements more effectively than with privacy-focused cryptocurrencies.

Turkish Investigation Targets Crypto-Enabled Betting Networks

The Istanbul Chief Public Prosecutor’s Office identified the frozen assets as belonging to illegal betting operations. Authorities targeted Seref Yazici, owner of the Dubai-based Darkex cryptocurrency platform.

The exchange operated in Turkey without licensing from the Capital Markets Board. Turkish regulators blocked access to Darkex in September 2025.

MASAK, Turkey’s Financial Crimes Investigation Board, accused Yazici of facilitating unlawful betting through crypto infrastructure.

The platform allegedly processed transactions for unauthorized gambling websites operating across Turkey.

Authorities seized real estate, corporate shares, banking accounts, and cryptocurrency holdings. This comprehensive freeze aims to prevent the laundering of criminally obtained proceeds.

The case follows another major Turkish seizure announced last week. Officials confiscated $550 million in cryptocurrency linked to fugitive Veysel Sahin.

Sahin faces an Interpol Red Notice for operating illegal betting platforms and money laundering. Extradition proceedings remain ongoing.

Tether’s assistance in both Turkish cases demonstrates the company’s responsiveness to regional enforcement efforts. The combined seizures exceed $1 billion in cryptocurrency value.

Turkish authorities continue investigating additional platforms suspected of providing services to unlicensed betting operations.

The crackdown reflects stricter oversight of cryptocurrency exchanges serving Turkish users without proper authorization.

Crypto World

Wintermute CEO Dismisses Crypto Blowup Rumors As Market Seeks Clarity

TLDR:

- Wintermute CEO says no credible sources confirm circulating crypto liquidation rumors

- Modern perpetual futures markets offer transparency unlike previous cycle’s lending platforms

- Digital asset desks buying Bitcoin above $100K face mounting pressure from current prices

- Legal penalties in major jurisdictions deter false bankruptcy claims from struggling firms

Wintermute CEO Evgeny Gaevoy publicly challenged spreading rumors about major crypto firm liquidations following recent market volatility.

He expressed skepticism about immediate spillover effects despite speculation linking an Asian trading firm to Bitcoin ETF sales. The executive noted that credible industry insiders have not confirmed any blowup stories circulating on social media.

Current rumors originate from unverified accounts rather than trusted sources with direct knowledge.

Market Structure Changes Reduce Contagion Risk

Gaevoy outlined how crypto leverage shifted fundamentally since the previous cycle’s catastrophic failures.

Uncollateralized lending platforms like Genesis and Celsius facilitated opaque borrowing arrangements that collapsed spectacularly. Those entities operated without transparency and created systemic risks across the industry.

Modern leverage concentrates in perpetual futures markets with visible risk management and automated liquidation systems.

The Wintermute executive contrasted current speculation with past blowup events that followed clear patterns. Three Arrows Capital’s collapse spread through private messages within two to three days after Terra’s implosion.

FTX troubles became obvious when Binance bailout discussions leaked to the public. Major solvency crises don’t remain hidden long when real contagion exists.

Exchange risk controls improved dramatically after expensive lessons from Three Arrows Capital.

Deribit was the only exchange that lost money on that default due to special credit lines. No major platforms show appetite for similar unsecured arrangements anymore.

Auto-deleveraging mechanisms now prevent customer liquidations from damaging exchange balance sheets.

Gaevoy dismissed concerns about exchanges themselves failing through FTX-style misuse of customer funds. The practice of investing user deposits into illiquid assets appears abandoned industry-wide.

Exchanges also became better at detecting hacks even when firms attempt concealment. Legal consequences for false bankruptcy denials create real deterrents in major jurisdictions like Europe, the US, UK and Singapore.

Overleveraged Peak Buyers Still Face Reckoning

Despite short-term skepticism, Gaevoy acknowledged that market consequences from peak mania buying remain inevitable.

Digital asset trading desks purchased heavily at levels now deeply underwater. Some firms acquired Solana above $225, Ethereum above $4000 and Bitcoin above $100000. Those positions face severe pressure given current prices.

The October 10th crash damaged the altcoin market in ways still not fully understood. Smaller trading desks focused on speculative tokens likely carry even worse exposure.

Historical patterns show that reckless behavior during bull markets creates delayed problems. The executive warned that affected entities may not surface for months as positions unwind gradually.

Social media speculation linked recent volatility to an Asian firm liquidating Bitcoin through IBIT ETFs after precious metals margin calls.

Gaevoy’s comments suggest such rumors lack substance currently. However, his acknowledgment that overleveraged players will eventually face consequences indicates patience may reveal the damage

.

Crypto World

China’s Luckin Coffee opens its first high-end store

Chinese coffee giant Luckin opened its first flagship with premium drinks as the company takes on Starbucks Reserve.

Luckin Coffee

BEIJING — China’s Luckin Coffee is taking direct aim at Starbucks‘ high-end roastery chain with a new flagship store in the country’s south that sells premium drinks.

It’s Luckin’s first major departure from its original strategy of operating budget-priced coffee kiosks – a move that helped the company overtake Starbucks in terms of the number of storefronts in China.

Now, with the U.S. company selling off most of its struggling China business to a local investment firm, Luckin is proving it’s more than made a comeback from fraud allegations in 2020 that forced it to delist from the Nasdaq.

The Chinese company on Sunday officially opened its two-floor Luckin Coffee Origin Flagship in Shenzhen on the border with Hong Kong.

In contrast to Luckin’s typical offerings priced at roughly $1 or $2 for an Americano or latte, the flagship store has nudged prices slightly higher for a range of pour-over and cold brew coffee drinks. Customers can choose beans from Brazil, Ethiopia or China’s Yunnan province, as Luckin taps into the geographical sourcing “origin” theme popular with Starbucks and other coffee companies.

The new store also sells several specialty drinks such as a “tiramisu latte” with a pastry on top, according to posts on Chinese social media platform Xiaohongshu. Users have started posting about 1 to 3 hour waits for the drinks since the store’s soft launch on Jan. 20.

The 420-square-meter (4,521 square feet) store signals how intense the competition in China has become for Starbucks. Back in 2017, the U.S.-based coffee giant chose Shanghai for its second-ever Reserve Roastery “megastore,” after launching the premium store concept in Seattle three years earlier.

But as coffee has taken off in China, traditionally a tea-drinking market, Starbucks has run into a slew of competitors from boutique cafes to chains such as Cotti Coffee and Manner — which often sell drinks at half the price as Starbucks.

Luckin reported revenue of $1.55 billion for the three months ended Sept. 30, 2025, a nearly 48% increase from a year earlier.

That’s just for the company’s self-operated stores, which account for well over half of Luckin’s China locations and most of its handful of overseas stores. The new Shenzhen location is billed as Luckin’s 30,000th store. The company reported a total of 29,214 stores worldwide as at Sept. 30.

Pictured here is the second floor of Luckin’s new flagship in Shenzhen, China, that officially opened on Feb. 8, 2026.

Luckin

In contrast, Starbucks has just over 8,000 stores in China and around 16,900 in the U.S., its biggest market.

The Seattle-based coffee giant reported a 6% year-on-year increase in China net revenue to $831.6 million for the three months ended Sept. 28. Comparable same-store sales, a standard industry metric, was just 2%, but improved to 7% for the quarter ended Dec. 28.

Starbucks did not share China net revenue for the latest quarter. The company expects to close a deal in the spring to sell 60% of its China business to Boyu Capital, while retaining a 40% stake. When the deal was announced in November, Starbucks said it values its China business at $13 billion, including future licensing fees.

Luckin, whose shares still trade over-the-counter in the U.S., had a market value of around $10.46 billion as of Thursday.

Re-listing and expansion plans

Late last year, Luckin’s CEO Jinyi Guo hinted at plans to re-list the company in the U.S. He did not specify a date. Founded in late 2017, the company achieved a $2.9 billion valuation just 18 months later and listed on the Nasdaq in May 2019. But about a year later, Luckin said it discovered much of its 2019 sales were fabricated, leading to the stock’s delisting.

The Chinese coffee company continued to operate many of its stores — and kept its name and logo.

Luckin also jumped to attract consumers through a slew of timely collaborations — with premium spirits brand Moutai, the Minions cartoon characters and the hit video game Black Myth: Wukong just days after it surged in popularity.

What sets Luckin apart has been its ability to build a robust pool of private user traffic through its smartphone ordering app, said Mingchao Xiao, founder of Zhimeng Trends Consulting. Rather than placing orders with a counter clerk, Luckin customers select and pay for drinks directly through an app.

China’s coffee market is still in a period of rapid change, Xiao said. He added that young consumers today are more willing to try different experiences, and seek emotional fulfillment, which can be met through cross-industry brand collaborations.

Like many Chinese companies, Luckin is also ramping up its global expansion.

Last summer, Luckin opened its first U.S. stores in New York City. It debuted its 10th store in the city on Feb. 6.

Luckin also has 68 stores in Singapore after it entered the market nearly three years ago, and 45 jointly operated locations in Malaysia.

-

Video5 days ago

Video5 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech4 days ago

Tech4 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics6 days ago

Politics6 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Sports1 day ago

Sports1 day agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech2 days ago

Tech2 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports19 hours ago

Former Viking Enters Hall of Fame

-

Crypto World6 days ago

Crypto World6 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports2 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

NewsBeat5 days ago

NewsBeat5 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat2 days ago

NewsBeat2 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business3 days ago

Business3 days agoQuiz enters administration for third time

-

Sports6 days ago

Sports6 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat6 days ago

NewsBeat6 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat3 days ago

NewsBeat3 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat1 day ago

NewsBeat1 day agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World4 days ago

Crypto World4 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

NewsBeat5 days ago

NewsBeat5 days agoImages of Mamdani with Epstein are AI-generated. Here’s how we know

-

Crypto World3 days ago

Crypto World3 days agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”

-

Crypto World3 days ago

Crypto World3 days agoWhy Bitcoin Analysts Say BTC Has Entered Full Capitulation

-

Fashion2 days ago

Fashion2 days agoKelly Rowland and Method Man Bring the Fashion for Relationship Goals Press Tour: Courtside in a Fringed TTSWTRS Jacket, Black and White Rowen Rose, Stella McCartney, and More!