CryptoCurrency

What Are Supply and Demand Trading Zones?

Supply and demand zones are a way of looking at price that focuses on where momentum started, not where it paused. Traders use these zones to frame structure, reactions, and context across different market conditions. Rather than treating levels as static lines, the approach looks at behaviour and participation around key areas.

This article examines how supply and demand zones are identified, how common patterns form, and how they are applied in trading analysis.

Key Takeaways

- Supply and demand zones are price areas where strong buying or selling previously drove decisive moves, often linked to liquidity shifts and institutional positioning rather than repeated price reactions.

- Four core patterns appear around these zones: Rally-Base-Rally, Drop-Base-Drop, Rally-Base-Drop, and Drop-Base-Rally, each reflecting continuation or reversal behaviour.

- Continuation strategies focus on breakouts from a base following strong momentum away from a zone through Rally-Base-Rally or Drop-Base-Drop patterns.

- Reversal strategies analyse price returning into a zone and reacting through Rally-Base-Drop or Drop-Base-Rally structures.

What Are Supply and Demand Zones?

Supply and demand zones are specific areas on a chart that indicate where the price of an asset has historically made significant moves, either upwards (demand zone) or downwards (supply zone).

- A demand zone is typically found where the market has stopped falling and then shot upwards. This area represents a level where buyers found the price attractive enough to enter the market in large numbers, driving it up.

- A supply zone represents a level at which selling interest overcomes buying pressure, causing the price to fall sharply. This is typically where sellers find the asset overvalued and decide to exit their positions or open new positions to sell.

Trading supply and demand zones involves understanding their potential role as areas of support (demand) or resistance (supply). In an established trend, these zones are formed from bases—periods of consolidation—that, once the price breaks out and moves in a consistent direction, are likely to act as areas of support or resistance in return.

Characteristics of Strong Zones

- Clean departure: Strong zones show fast, directional moves away from the base, pointing to clear imbalance rather than gradual drift.

- Compact bases: Short consolidations with fewer candles often carry more informational weight than wide ranges.

- Fresh levels: Zones that have not been revisited tend to attract more interest than heavily tested areas.

- Markets and timeframes: These zones appear across forex, indices, commodities, and equities, from intraday to weekly timeframes.

Supply and Demand vs Support and Resistance

How Traders Spot Supply and Demand Zones

Traders spot supply and demand zones by studying how price behaved before sharp expansions or breakdowns. The emphasis is on context and sequencing rather than drawing levels after the fact. What matters is how price leaves an area, not how long it sits there.

- Identifying impulsive moves: Attention goes to areas where price accelerates strongly, leaving little overlap between candles.

- Locating the base: The focus then shifts to the short consolidation or pause that formed just before that move began.

- Evaluating candle structure: Narrow ranges, small wicks, and compressed price action often point to balance before imbalance.

- Assessing directionality: Whether price exited upward or downward frames the zone as demand or supply.

- Checking reaction quality: How price behaves when returning towards the area often provides more information than the initial move itself.

- Using multiple timeframes: Higher-timeframe zones often define context, while lower timeframes offer detail and precision.

- Filtering by environment: Zones forming near key highs, lows, or structural shifts often carry more relevance than those forming mid-range.

The Role of Accumulations and Distributions

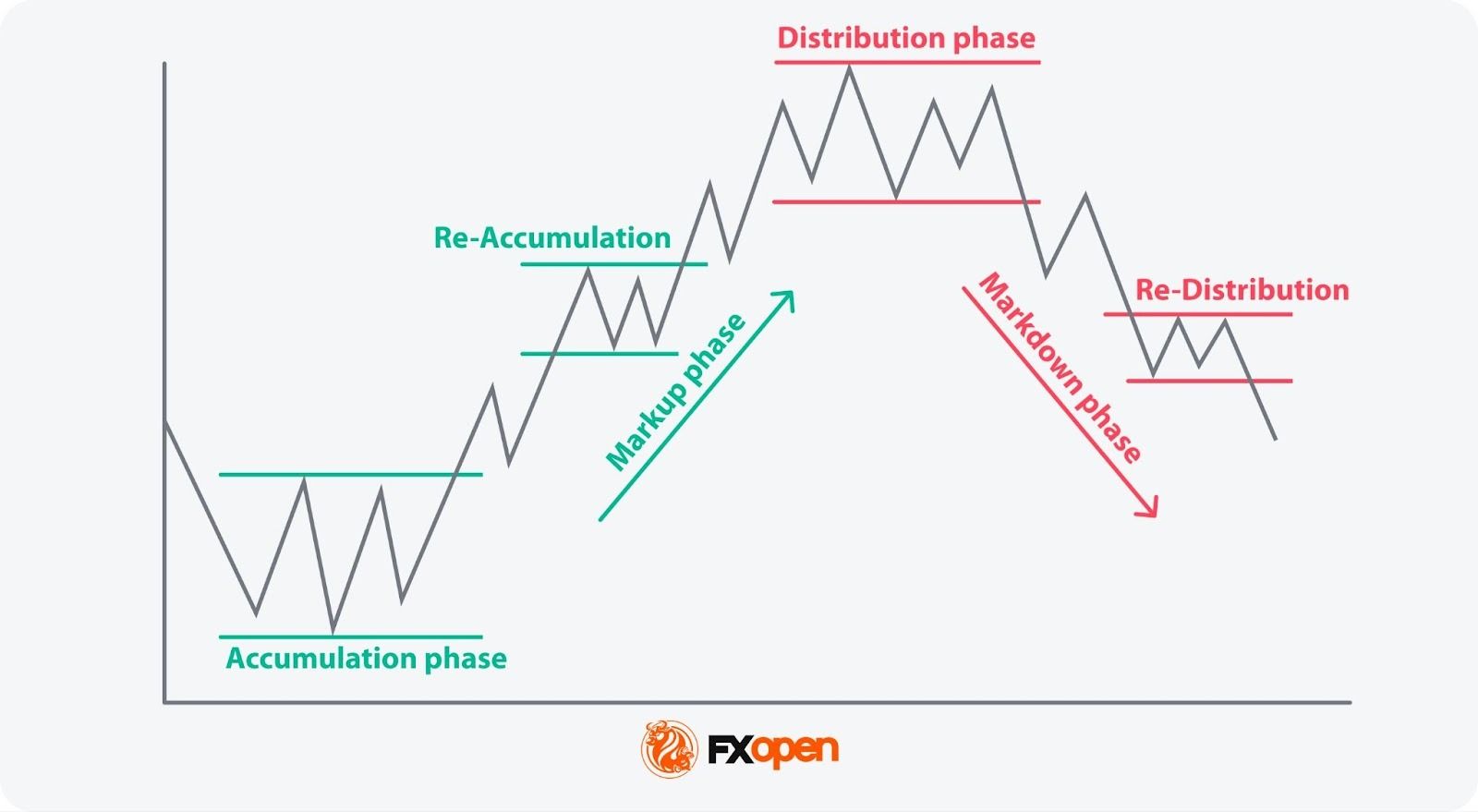

Accumulation and distribution are critical in understanding how supply and demand zones form and behave in financial markets. These terms describe the actions taken by influential market players—often large institutional investors or “smart money“—as they prepare for a potential price movement. They form a key component of Wyckoff trading.

Accumulation occurs when these entities begin to buy or “accumulate” a long position over a period, typically at lower levels. This phase is generally not accompanied by a notable price increase, as the buying is done gradually to avoid significant movements that could attract attention. The end of an accumulation phase is often marked by a reaccumulation, where buying resumes after a brief rally and pullback/consolidation, further establishing a demand zone.

Distribution reflects the opposite scenario, where large holders begin to sell their holdings, usually after a rise. This selling does not immediately lead to a drop; it happens subtly to prevent a drastic decrease in price. Following a distribution phase, a redistribution might occur where selling continues after a minor rally or consolidation—this process may help solidify a supply zone.

Four Patterns of Supply and Demand in Trading

Recognising specific patterns in supply and demand zones can assist traders in determining potential market movements. These patterns, derived from price action and the behaviour of market participants, provide visual cues on charts that suggest future trajectories. Here are four important patterns, which are explained in Frank Miller’s Supply & Demand Trading: How to Master the Trading Zones.

1. Rally-Base-Rally (RBR)

This pattern is a bullish indicator and occurs as the price leaves an accumulation/demand zone. The sequence starts with a rally, where there is a noticeable upward movement. This is followed by a base, a period where prices consolidate within a relatively narrow range, indicating a balance between buyers and sellers. The pattern completes with another rally, suggesting that demand has overwhelmed supply, pushing prices higher.

Recognising the Rally-Base-Rally pattern can signal traders to consider a long position as the market sentiment will likely continue upward.

2. Drop-Base-Drop (DBD)

Mirroring the RBR, the Drop-Base-Drop pattern is a bearish formation found after an effective distribution from a supply zone. It begins with a drop, indicating strong selling pressure. The base phase occurs next, where the price moves sideways briefly, showing uncertainty or equal force from buyers and sellers. A subsequent drop follows, demonstrating renewed selling pressure and an overpowering supply.

As the price leaves the base, traders may consider it as an entry for a short position.

3. Rally-Base-Drop (RBD)

The Rally-Base-Drop pattern typically signals the formation of a supply zone and is indicative of a bearish reversal. It starts with a rally, where buyers temporarily gain control. However, this rally is short-lived and leads into a base phase—a period of consolidation. The critical phase is the subsequent drop, where sellers dominate, reversing the initial upward trend.

This pattern is particularly valuable for traders looking to capture the shift from a bullish to a bearish market.

4. Drop-Base-Rally (DBR)

Contrary to RBD, the Drop-Base-Rally pattern indicates a bullish reversal and creates a demand zone. It starts with an initial drop, reflecting strong selling. This phase is followed by a base, where the market finds equilibrium and the selling pressure begins to wane. The final phase is a rally, suggesting that buyers have regained control and are likely to push prices higher.

This pattern aids traders in spotting potential entry points for long positions as the market sentiment shifts from bearish to bullish.

To try spotting these patterns for yourself, you can consider heading over to FXOpen’s TickTrader platform to access real-time charts with over 1,200 analysis tools.

Supply and Demand Zones: Trading Strategies

Trading strategies based on supply and demand zones are centred around the identification and reaction to key levels that indicate underlying shifts in market sentiment. Traders often focus on how price exits these zones to gauge potential continuation or reversal of trends.

Strategy for Rally-Base-Rally (RBR) and Drop-Base-Drop (DBD)

This Drop-Base-Drop/Rally-Base-Rally strategy capitalises on the formation of a base after a distinct move that often breaks an established trend, i.e. moving sharply above a lower high in a downtrend or higher low in an uptrend.

Traders look to this pattern as it leverages the momentum generated from a strong initial move (rally or drop) followed by a stabilisation period (base) that offers a clear breakout point, indicating a potential trend continuation.

Entry

- Traders typically monitor the price as it rallies or drops, forming a base.

- A breakout from the consolidation zone is awaited, where the price moves above the high in RBR or below the low in DBD.

- Entry might be made via a stop order at the breakout point to capture the movement as it happens.

Stop Loss

- It might be placed just outside the opposite side of the base range to protect against false breakouts.

Take Profit

- It might be set at previously identified supply or demand zones where price may potentially react and reverse.

Strategy for Rally-Base-Drop (RBD) and Drop-Base-Rally (DBR)

This approach focuses on reversal patterns forming in established supply or demand zones, offering insights into potential trend shifts. It utilises the inherent strength of existing supply or demand zones, coupled with a clear reversal pattern, to identify high-probability trades in line with the trend’s direction.

Entry

- Traders observe an established supply or demand zone and look inside it for an RBD or DBR pattern formation, respectively.

- A break of a significant high (in downtrends) or low (in uptrends) within these zones signals the strength of the pattern.

- Following the break, traders wait for a retracement back to the zone, placing a limit order at the edge of the zone.

Stop Loss

- It might be positioned just beyond the opposite side of the zone.

Take Profit

- It might be targeted at the next significant supply or demand zone that could oppose the current movement.

Advantages and Limitations

Supply and demand analysis offers a structured way of reading price, but it is not without trade-offs. Understanding where it adds clarity, and where it can mislead, keeps expectations grounded.

Advantages

- Provides a framework for analysing price in context rather than reacting to single candles or indicators.

- Encourages focus on participation and order flow clues instead of isolated price levels.

- Works across forex, indices, commodities, and equities, and scales from intraday to higher timeframes.

- Supports trade planning by defining areas where reactions, continuation, or failure may occur.

Limitations

- Zone identification is subjective, and different traders may mark the same chart differently.

- Not every zone leads to a reaction; price can pass through without pause.

- Requires patience, as clean setups may not appear frequently.

- Loses clarity in choppy or news-driven conditions where structure becomes compressed.

The Bottom Line

Supply and demand zones and their related patterns can support market analysis across various asset types, including forex, stocks, commodities, and cryptocurrencies*. In practice, this approach centres on reading context, timing reactions, and managing invalidation rather than searching for certainty. Over time, repeated exposure to these zones may support a more consistent way of framing price behaviour across markets.

If you’d like to put theory into practice, you can consider opening an FXOpen account to access a wide range of instruments at competitive trading conditions.

FAQs

What Is a Supply and Demand Zone in Trading?

Supply and demand zones are specific areas on a trading chart where significant buying (demand zones) or selling (supply zones) activity has occurred, causing the price to move dramatically. These zones are used to identify potential areas where the price might either stall or reverse based on past trading activity.

What Is the Difference Between Supply & Demand Zones and Support & Resistance Zones?

While both supply and demand zones and support and resistance zones identify important levels, supply and demand zones are identified by areas that cause substantial price movements, whereas support and resistance are defined by frequent price reversals at certain price levels.

What Are the 4 Stages of the Market Cycle?

The four stages of the market cycle include Accumulation, Markup, Distribution, and Markdown. These stages describe the systematic process of price movement in markets, from periods where smart money accumulates positions to phases where these positions are distributed, leading to price declines.

*Important: At FXOpen UK, Cryptocurrency trading via CFDs is only available to our Professional clients. They are not available for trading by Retail clients. To find out more information about how this may affect you, please get in touch with our team.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.