Crypto World

What Happens to XRP if the $1.30 Demand Zone Breaks?

Ripple’s XRP remains under sustained bearish pressure, with the price continuing to print lower lows and failing to reclaim key supply zones. The broader structure still reflects a dominant downtrend, and the recent price action suggests sellers remain in control as the market approaches a critical demand area that could define the next directional move.

Ripple Price Analysis: The Daily Chart

On the daily timeframe, XRP is trading deep within a bearish market structure, having lost multiple former support levels that have now flipped into resistance. The price is currently pressing into a well-defined demand zone at the $1.3 range highlighted on the chart, an area that previously acted as a base before the last impulsive upside move. This zone represents the first meaningful area where buyers may attempt to slow the decline.

However, the broader daily trend remains decisively bearish. Each corrective bounce over the past months has been capped by lower supply zones, and the asset has consistently respected these areas before continuing lower. As long as XRP remains below the channel’s mid-trendline of $1.6, any bounce from the current demand should be treated as corrective rather than trend-reversing.

Nevertheless, a failure to hold this demand zone would significantly weaken the structure and open the door for a deeper continuation toward lower, untested liquidity levels. Conversely, a strong daily reaction from this area would be required to signal short-term relief, but not yet a confirmed trend shift.

XRP/USDT 4-Hour Chart

The 4-hour chart provides additional clarity on the internal structure of the downtrend. Recent price action shows a sharp rejection from successive supply zones, confirming that sellers are aggressively defending these levels.

Following the latest rejection, the asset accelerated lower and is now approaching the $1.3 critical support, which also aligns with the broader demand zone visible on the daily timeframe. This confluence increases the probability of at least a short-term reaction, as short sellers may begin to take profits and reactive buyers step in.

That said, the presence of multiple stacked supply zones above the current price at $1.6 and $2 significantly limits upside potential in the near term. Any rebound toward these levels would likely face renewed selling pressure, unless accompanied by a clear break in structure and acceptance above the channel. Until such confirmation appears, the 4-hour trend remains firmly bearish, with rallies best viewed as pullbacks within a broader downtrend.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Shareholders revolt over Bitcoin treasury

Bitcoin (CRYPTO: BTC) treasuries have become a flashpoint for investors weighing the merits and risks of corporate crypto bets, as activists push for governance changes and potential sales. After a multi-quarter stretch of price softness across the sector, several high-profile treasury strategies are facing renewed scrutiny, underscoring a broader debate about the long-term viability of treating digital assets as corporate balance-sheet anchors. On the other side of the ledger, stablecoins continue to provide on-chain liquidity ballast, even as the sector evolves under regulatory and market pressure. Empery Digital, a company that converted its business into a Bitcoin treasury holder, sits at the center of activist scrutiny, underscoring how a single treasury policy can become a flashpoint for shareholders. Empery Digital has accumulated 4,081 BTC, placing it among the top 25 public holders. The broader market is watching how such large holdings influence liquidity, capital allocation, and corporate governance during crypto’s latest cycle of volatility and recalibration. Circle, a stalwart in the stablecoin space, reported a stronger-than-expected fourth quarter, reinforcing the staying power of dollar-backed liquidity despite a broader downturn in crypto prices. In parallel, PayPal is navigating a different form of pressure, as the company’s crypto ambitions collide with investor sentiment and potential consolidation activity in the payments space. The week’s Crypto Biz survey tracks the tension around Bitcoin treasuries, the durability of stablecoins, and the headwinds facing legacy payments players embedded in crypto’s next phase.

Key takeaways

- Activist investor pressure intensifies around Empery Digital’s Bitcoin treasury, with calls for leadership changes and a potential sale of roughly 4,000 BTC, highlighting investor divergence on capital allocation.

- Empery Digital holds 4,081 BTC, reinforcing its position as one of the 25 largest public holders of the asset.

- Circle delivers a robust Q4, with revenue of $770 million (up 77% year over year) and USDC growth, as supply expands 72% to $75.3 billion by year-end, signaling sustained demand for on-chain dollar liquidity.

- Circle’s full-year results show a $2.7 billion revenue stream but a net loss of $70 million, largely due to stock-based compensation tied to its IPO, while shares reacted positively to the quarterly performance.

- PayPal draws takeover chatter after a prolonged stock decline, with discussions reportedly exploring a full acquisition or targeted asset splits, including involvement from Stripe among potential bidders.

- Tokenized real-world assets gain traction as Better and Framework Ventures launch a $500 million stablecoin-backed mortgage initiative, aiming to bridge DeFi liquidity with traditional housing finance.

Tickers mentioned: $BTC, $USDC, $PYPL

Sentiment: Neutral

Price impact: Positive. The mixed earnings signals and ongoing stablecoin expansion contributed to an overarching sense of cautious optimism in related equities and liquidity metrics.

Trading idea (Not Financial Advice): Hold. While activist actions and strategic reorganizations unfold, the mix of treasury risk and stablecoin demand suggests a wait-and-see approach until governance outcomes and asset flows clarify the near-term trajectory.

Market context: The period highlights how liquidity anchors like stablecoins are shaping on-chain activity even as traditional equities linked to crypto face volatility and scrutiny from investors, regulators, and market participants. The interplay between corporate treasuries, real-world asset tokenization, and ongoing payments industry consolidation reflects a sector-wide shift toward more nuanced risk, governance, and valuation frameworks.

Why it matters

The debate over corporate Bitcoin treasuries matters because it tests how much value companies can extract from crypto holdings when faced with activist investor demands and evolving regulatory expectations. Empery Digital’s situation underscores a broader question: can a Bitcoin-heavy treasury deliver durable shareholder returns, or does it anchor capital in an asset class characterized by macro-driven volatility? As Empery’s 4,081 BTC stake sits among the top 25 public holders, the outcome of investor pressure could influence how other companies deploy crypto in their balance sheets. The narrative around treasuries is not just about price swings; it’s about governance, capital return policies, and the signaling effect that large crypto positions convey to the market about a company’s strategic risk tolerance.

Meanwhile, Circle’s quarterly performance reinforces the enduring appeal of stablecoins as a liquidity mechanism. The company’s results show that demand for dollar-denominated liquidity remains robust even when sentiment toward broader crypto is mixed. The rapid growth in USDC supply—an expansion to $75.3 billion by year-end—emphasizes the role of on-chain dollars in enabling borrowing, lending, and cross-border payments within decentralized ecosystems. This trend matters not only for traders and liquidity providers but for developers building on-chain financial rails who rely on dependable stablecoin rails to anchor pricing and risk management. The stability-centric narrative also intersects with regulatory scrutiny around stablecoins, reserve composition, and transparency, shaping how these digital dollars are perceived by auditors, investors, and policymakers alike.

The PayPal development adds another layer to the ongoing transformation of the digital payments landscape. As the company explores consolidation options and deepens its digital asset ambitions, investors are weighing how such moves could recalibrate competition, product strategy, and the integration of crypto services with mainstream finance. The discussions surrounding a potential full acquisition or asset-focused deals demonstrate that traditional payments players remain in the crosshairs of market restructuring opportunities, which could accelerate vertical integration and open new channels for crypto-enabled commerce. The involvement of players such as Stripe in takeover chatter signals a possible shift in how the payments ecosystem could consolidate, a dynamic that could influence funding, regulatory attention, and consumer access to crypto-enabled payments in the near term.

Finally, the collaboration between Better and Framework Ventures on a $500 million stablecoin mortgage initiative signals that tokenized real-world assets are inching closer to scale. If successful, the program could demonstrate a viable model for channeling stablecoin liquidity into the housing sector, potentially reducing funding frictions and expanding the reach of mortgage products to crypto-native capital. While the project remains in its early stages, it highlights a broader trend: the search for practical, de-risked uses of crypto-enabled liquidity beyond trading and speculation, with implications for liquidity provisioning, risk management, and the integration of decentralized finance with everyday financial services.

What to watch next

- Empery Digital’s governance moves and any announced leadership changes or strategic reviews following activist pressure.

- Circle’s ongoing earnings trajectory and any shifts in USDC reserve management, auditing, or regulatory disclosures in 2025.

- PayPal’s strategic review outcomes and any concrete steps toward deeper crypto integration or potential consolidation in the payments space.

- Progress and scaling milestones for the Better–Framework mortgage initiative, including regulatory approvals and pilot results.

- Regulatory signals around stablecoins and corporate crypto treasuries that could influence capital allocation and asset-liquidity policies across the sector.

Sources & verification

- Empery Digital’s Bitcoin holdings and shareholder revolt details as listed on BitcoinTreasuries.NET and cited by Empery-related coverage: https://bitcointreasuries.net/public-companies/volcon-inc.

- Empery Digital shareholder-demands article detailing calls for sale of Bitcoin holdings and leadership changes: https://cointelegraph.com/news/empery-digital-shareholder-demands-bitcoin-sale-ceo-resignation.

- Circle Q4 earnings and USDC growth, including revenue, net income, and USDC supply data: https://cointelegraph.com/news/circle-q4-earnings-usdc-75b-revenue-2025-shares-surge.

- PayPal takeover interest reporting, including Bloomberg references and related coverage: https://cointelegraph.com/news/paypal-buyout-approaches-share-decline-report.

- Stablecoin mortgage initiative between Better and Framework Ventures and its funding implications: https://cointelegraph.com/news/better-500m-stablecoin-mortgage-defi-deal.

Bitcoin treasuries, stablecoins and payments in crypto’s next phase

The evolving story of corporate crypto treasuries, stabilizing on-chain dollars, and traditional payments incumbents reshaping strategy highlights a sector transitioning from narrative to implementation. As activist investors scrutinize treasury strategies, the market is increasingly demand-aware and governance-conscious. Stablecoins’ on-chain footprint continues to expand, reinforcing the critical role of liquidity and price stability in enabling broader DeFi and real-world asset use cases. Meanwhile, the potential for consolidation in the payments space and the prospect of tokenized real-world assets moving from concept to scale suggest a crypto-adjacent ecosystem maturing toward more integrated financial services.

Crypto World

World Liberty Financial Introduces Tiered Node System for Governance Staking

Unstaked WLFI cannot vote; stakers earn rewards, Node privileges, and Super Node partnership opportunities.

World Liberty Financial has proposed a new staking-focused governance system for WLFI holders – the WLFI Governance Staking System. It makes WLFI tokens the primary tool for community governance, and allows holders to influence the ecosystem while promoting long-term participation.

The proposal’s main goals are to encourage active governance, require staking for voting with unlocked tokens, reward participation, create a tiered node system for committed holders, and prioritize partnerships with supportive projects.

Tiered Governance

According to the official announcement, the initiative aims to redirect value from intermediaries and market makers, who captured millions in arbitrage profits during the USD1 expansion phases, to long-term participants, while also applying structural pressure on competing stablecoins.

Under the system, holders of unlocked WLFI tokens must stake to participate in governance. The minimum lock-up period is 180 days. Voting power depends on both the staked amount and the remaining lock-up period. Governance rights adjust dynamically as the lock-up period decreases. Stakers must vote at least twice during the lock-up period to receive staking rewards, which target an annual percentage yield of around 2%. This will be paid from the WLFI treasury.

The proposal introduces a Node tier for participants staking 10 million WLFI (about $1 million). Nodes gain access to over-the-counter USD1 conversion through licensed market makers, receive team-building rights, and earn rewards based on USD1 conversion volume. WLFI subsidizes market makers to maintain 1:1 parity and redirects arbitrage benefits to long-term participants.

Super Nodes are holders staking 50 million WLFI (approximately $5 million). They receive all Node privileges, guaranteed access to the WLFI team for partnership discussions, and potential eligibility for economic incentives on approved integrations. Super Node status does not guarantee a partnership with WLFI.

Implementation is planned in three phases. First is the governance staking for unlocked tokens with rewards and USD1 incentives. Second, includes node tier activation with KYC onboarding and OTC conversion rights. Third, Super Node tier activation with partnership access and revenue-sharing frameworks.

You may also like:

Timelines for each phase will be shared by the WLFI team after voting concludes.

Pakistan Explores USD1 Stablecoin

The latest proposal comes a month after Pakistan signed a memorandum of understanding (MoU) with SC Financial Technologies, an entity affiliated with World Liberty Financial, to explore the use of its USD1 stablecoin. The agreement aims to support technical dialogue and understanding around digital payment systems.

SC Financial Technologies will work with Pakistan’s central bank to integrate USD1 into regulated digital payments, allowing it to operate alongside the country’s digital currency infrastructure.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

UAE Capital Market Authority Orders Exchange Closures as Missile Strikes Threaten Gulf Financial Stability

TLDR:

- UAE regulators shut both exchanges for two days to prevent panic selling after missile and drone strikes.

- The Abu Dhabi Securities Exchange holds roughly $700 billion in market cap, putting billions at risk of loss.

- Polymarket puts the probability of a Strait of Hormuz closure at 48.5%, threatening global oil and LNG supply.

- War-risk insurance has jumped 50% and Hapag-Lloyd suspended strait transit, signaling rising market concern.

UAE markets have been ordered closed for Monday and Tuesday following a large-scale missile and drone attack on the country.

The UAE Capital Market Authority directed both the Abu Dhabi Securities Exchange and the Dubai Financial Market to suspend trading.

This move came after 165 ballistic missiles, 541 drones, and two cruise missiles struck the UAE over 48 hours. Three people died, and 58 others sustained injuries. Fires broke out at the Port of Jebel Ali, and debris hit the Burj Al Arab hotel.

Exchange Closure Signals a Confidence Crisis

The regulator’s decision to halt trading was not due to a holiday or technical failure. It was a direct response to the threat of panic selling on the exchange floor.

The Abu Dhabi Securities Exchange alone carries roughly $700 billion in market capitalization. A single session of fear-driven selling could have erased billions in value within hours.

Analyst Shanaka Anslem Perera noted on X that this marks the first time the Dubai Financial Market has gone dark outside of a pandemic.

He wrote that “financial markets do not operate by military standards,” adding that they run on confidence instead. That confidence took a visible hit when shrapnel killed a civilian and debris landed on a Palm Jumeirah hotel.

Saudi Arabia’s Tadawul index dropped more than 4% on Sunday, while Egyptian markets fell over 5%. UAE regulators chose to avoid a similar outcome by keeping screens off entirely. The move bought time, but the deeper question about investor confidence remains unanswered.

Regional markets had long relied on Gulf stability to attract global capital. That stability is now under direct pressure from ongoing military activity.

Strait of Hormuz Risk Adds to Financial Pressure

Beyond the exchange closures, broader energy market risks are now in focus. Polymarket currently prices the probability of a Strait of Hormuz closure by March 31 at 48.5%.

War-risk insurance has reportedly climbed 50%, and Hapag-Lloyd has suspended vessel transit through the strait. Around 20 million barrels of oil and nearly 20% of global LNG exports move through this narrow waterway daily.

A closure of the strait would push oil prices past $100 per barrel almost immediately. That would drive US consumer price inflation toward 5%, contradicting stated US policy goals on energy costs. The financial ripple effects would extend well beyond the Gulf region.

Iran reportedly targeted the UAE not over a bilateral dispute, but because the country hosts Al Dhafra Air Base. The US security umbrella, long seen as a shield for Gulf commerce, became a target instead. That shift changes how global allocators view risk in the region.

UAE markets are expected to reopen by Wednesday. Whether institutional capital returns at the same pace remains the central question facing Gulf financial centers.

Crypto World

Crypto Market Structure Bill Approval by Mid-Year Could Spark Second-Half Rally, JPMorgan Says

TLDR:

- JPMorgan analysts say the CLARITY Act could be approved by mid-year and lift crypto markets in H2 2026.

- The bill would classify tokens under CFTC or SEC oversight, easing compliance for assets like XRP and Solana.

- New crypto projects could raise up to $75 million annually without full SEC registration under a grace period rule.

- JPMorgan warns the bill may shift institutional focus from stablecoins toward tokenized deposits if enacted into law.

The crypto market structure bill may receive U.S. approval by mid-year, according to JPMorgan analysts. Their report suggests the legislation could serve as a positive catalyst for crypto markets later in 2026.

Despite weak sentiment across digital assets, analysts remain constructive on the sector’s outlook for the year ahead.

Crypto Market Structure Bill: What the Legislation Covers

The proposed legislation, widely known as the CLARITY Act, aims to build a comprehensive regulatory framework for digital assets.

The House has already advanced the bill, while Senate discussions remain ongoing. Two key sticking points continue to slow progress on the final version.

One concern involves stablecoin yield. Crypto firms want to reward users who hold stablecoins, but banks warn this could draw deposits away from traditional institutions.

The other issue centers on conflict-of-interest rules, with Democrats pushing to bar senior government officials and their families from certain crypto financial activities.

JPMorgan analysts led by Nikolaos Panigirtzoglou stated, “While sentiment remains negative in crypto markets, we continue to believe that a potential approval of the market structure legislation most likely by mid year could serve as a positive catalyst for crypto markets into the second half of the year.” The team remains broadly constructive on crypto for 2026 despite current headwinds.

The White House has held multiple closed-door meetings between crypto firms and banking groups. A compromise remains possible, though no final agreement has been reached yet.

Eight Catalysts That Could Follow a Crypto Bill Passage

JPMorgan outlined eight potential positive outcomes if the bill becomes law. The analysts wrote that passage would fundamentally reshape the digital asset space, stating: “If passed it will reshape market structure by providing regulatory clarity, ending ‘regulation by enforcement,’ promoting tokenization, and facilitating greater institutional participation.”

The legislation would classify tokens under either CFTC or SEC oversight, easing compliance for major digital assets. A grandfather clause could place tokens like XRP, Solana, and Dogecoin under the lighter CFTC framework.

New projects would receive a grace period allowing up to $75 million in annual fundraising without full SEC registration.

This could support venture activity within U.S. borders rather than pushing it offshore. A pathway also exists for tokens to transition from securities to commodity status once sufficiently decentralized.

Clearer custody rules could allow institutions like BNY Mellon and State Street to directly hold digital assets. On stablecoins, the analysts noted that enacted provisions “could weigh on U.S. stablecoins by recasting them more as digital cash instruments rather than investment deposits,” potentially shifting attention toward tokenized deposits or offshore alternatives like Ethena’s USDe.

Small-transaction tax exemptions for everyday crypto payments are also included in the proposal. Miners, validators, and developers would be exempt from broker reporting requirements during development phases.

JPMorgan’s long-term bitcoin price target remains at $266,000, based on a volatility-adjusted comparison to gold.

Crypto World

Strategy Raises STRC Dividend to 11.50% Amid Bitcoin Losses and Mounting Pressure on MSTR

TLDR:

- Strategy raised its STRC preferred stock dividend by 25 basis points, bringing the annual rate to 11.50%.

- MSTR fell 14% in February, marking eight straight months of losses as Bitcoin dropped nearly 20% that month.

- Strategy now holds 717,722 BTC at an average cost of $76,020, carrying an unrealized loss of around $6.5 billion.

- Saylor posted “The Turn of the Century” on X, signaling a potential new Bitcoin purchase may be disclosed soon.

Strategy has lifted the dividend rate on its preferred stock, STRC, by 25 basis points to 11.50%. Executive Chairman Michael Saylor led the decision amid continued pressure on the company’s common stock, MSTR.

The move marks the seventh dividend increase since STRC began trading in July 2025. Bitcoin’s sharp decline in February added urgency to the adjustment.

Seventh Dividend Hike Targets Price Stability

Strategy raised the annualized payout on its perpetual preferred stock, STRC, to 11.50%. The 25 basis point increase keeps the shares trading close to their $100 par value. STRC closed at $100 on Friday after dipping below that level during February.

The company positions STRC as a short-duration, high-yield savings instrument. Monthly cash distributions are adjusted regularly to reduce price swings. This structure has largely worked, keeping STRC in a tight range since its launch.

The dividend rate is reviewed each month based on market conditions. When STRC trades below par, Strategy typically boosts the payout to attract buyers. This latest adjustment follows the same pattern seen in prior months.

MSTR Posts Eighth Straight Monthly Decline

Strategy’s common stock, MSTR, fell 14% in February, extending a losing streak to eight consecutive months. Bitcoin dropped nearly 20% during the same period, pulling MSTR lower alongside it. The correlation between the two remains strong, as Bitcoin makes up the bulk of Strategy’s balance sheet.

The company holds 717,722 BTC as of mid-February, after purchasing 592 BTC at an average price of $67,286. This purchase marked the firm’s 100th recorded Bitcoin acquisition. The average entry price across all holdings now stands at $76,020 per coin.

With Bitcoin currently trading well below that cost basis, Strategy is sitting on an unrealized loss of around $6.5 billion.

Saylor shared a tracker showing the treasury valued at approximately $48 billion. The gap between cost and current value has grown as the market retreat continues.

Saylor Signals More Bitcoin Buying Ahead

On March 1, Saylor posted “The Turn of the Century” on X, a phrase that has drawn attention from market watchers.

Based on past patterns, Strategy typically discloses a new Bitcoin purchase the day after such posts. Traders and analysts closely follow these signals ahead of official filings.

Despite the losses, Saylor suggested another weekly purchase could be coming. The firm has maintained a long-term approach to its Bitcoin treasury program, even under market stress. Strategy stated it could sustain operations even if Bitcoin dropped to $8,000.

The company has also shifted its funding strategy in recent months. Rather than issuing common stock to finance Bitcoin purchases, Strategy has leaned more heavily on preferred capital.

Executives noted this structure may take on an even larger role throughout the year as volatility continues.

Crypto World

Hyperliquid (HYPE) Price’s Golden Cross Hangs On This Condition

Hyperliquid price has attempted a steady recovery in recent sessions, regaining part of its prior losses. HYPE has not completely lost bullish momentum. However, futures market positioning suggests resistance remains strong, keeping the altcoin vulnerable to sudden volatility.

While spot traders show cautious optimism, derivatives data highlights persistent bearish pressure.

Hyperliquid Traders Must Watch This Level

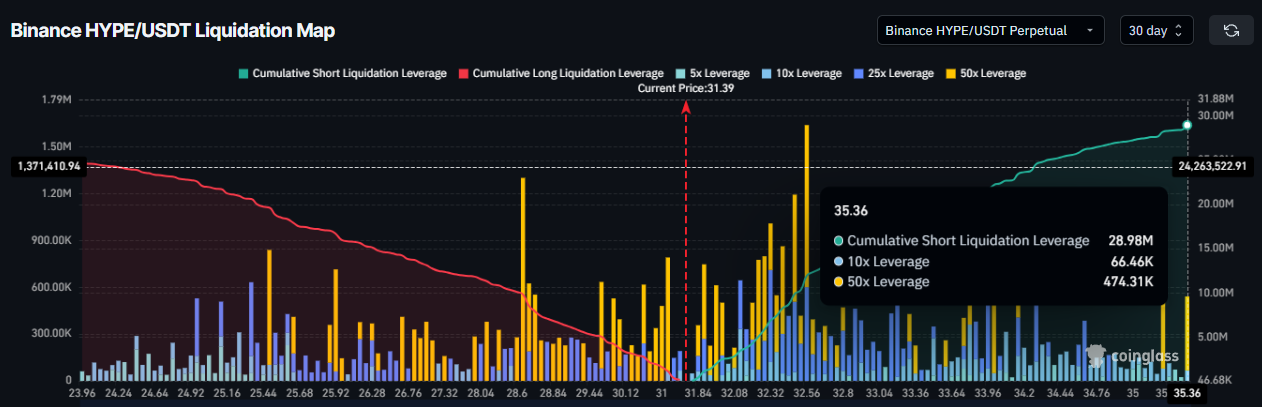

The liquidation map shows that Hyperliquid contracts are currently skewed toward bearish exposure. A cluster of $28.9 million in short liquidations sits above the $35 price level. This concentration reflects significant short positioning among futures traders.

Dominant short exposure indicates that many traders expect downside continuation. However, heavy short interest also creates squeeze potential. If HYPE crosses $35 decisively, forced short liquidations could amplify upside volatility and quickly shift market sentiment.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Technical indicators offer a more constructive short-term outlook. The Moving Average Convergence Divergence indicator registered a bullish crossover on Sunday. This signal often marks strengthening upside momentum.

MACD’s upward shift suggests buying pressure may build gradually. Momentum oscillators reflect improving trend conditions despite futures skepticism. If spot demand aligns with technical signals, HYPE could regain upward traction in the near term.

HYPE Price May Face Resistance

Hyperliquid price is currently facing mixed signals, leaving direction dependent on broader crypto market conditions. Geopolitical tensions and macro uncertainty could limit investor risk appetite. If external sentiment weakens, HYPE may struggle to sustain upward momentum.

Should the market avoid a severe bearish reaction, HYPE could push above $34 resistance. A breakout toward $36 would place the price near the $35 liquidation cluster. Triggering approximately $28.9 million in short liquidations could accelerate gains toward $38. Such a move may also bring the 50-day and 200-day exponential moving averages closer together, setting up a potential Golden Cross formation, which would be achieved following the short liquidations.

Conversely, renewed bearish conditions would undermine this outlook. A breakdown below $30 support could shift sentiment decisively negative. Loss of this level would expose $26 as the next major support for HYPE price. Such a move would invalidate the bullish thesis and disrupt the month-and-a-half uptrend structure currently in place.

Crypto World

AI may accelerate Ethereum roadmap and security

Ethereum co-founder Vitalik Buterin said artificial intelligence could ramp up the network’s development roadmap while improving security standards.

Summary

- Vitalik says AI could speed up Ethereum’s roadmap and delivery timelines.

- Half of AI gains should go toward stronger testing and formal verification.

- AI may help make near bug-free crypto code a realistic expectation.

Responding to an experiment where someone “vibe-coded” Ethereum’s entire 2030 roadmap within weeks, Buterin wrote that “six months ago, even this was far outside the realm of possibility, and what matters is where the trend is going.”

Buterin personally tested AI coding by building an equivalent of his blog software within an hour using his laptop.

The Ethereum founder suggested taking half the speed gains from AI and applying them to security through more test cases, formal verification, and multiple implementations.

“People should be open to the possibility (not certainty! possibility) that the Ethereum roadmap will finish much faster than people expect, at a much higher standard of security than people expect.”

AI enables formal verification of complex cryptographic proofs

A collaborator of the Lean Ethereum project managed to AI-code a machine-verifiable proof of one of the most complex theorems that STARKs rely on for security.

The Lean Ethereum initiative aims to formally verify all components, with AI improving the ability to achieve that goal.

Buterin noted that simply generating a much larger body of test cases matters beyond formal verification.

The two-week roadmap experiment contained “massive caveats: almost certainly lots of critical bugs, and probably in some cases ‘stub’ versions of a thing where the AI did not even try making the full version.”

The right approach splits AI gains between speed and security improvements. “Do not assume that you’ll be able to put in a single prompt and get a highly-secure version out anytime soon; there WILL be lots of wrestling with bugs and inconsistencies between implementations,” Buterin warned.

Bug-free code could shift from idealistic delusion to basic expectation

Buterin expressed excitement about the possibility that bug-free code, “long considered an idealistic delusion, will finally become first possible and then a basic expectation.” He framed this as necessary for trustlessness in crypto systems.

Total security remains impossible as it would require exact correspondence between lines of code and contents of the mind, which Buterin estimated at many terabytes of information.

Specific security claims can be made and verified in particular cases, cutting out over 99% of negative consequences from broken code.

The statement shows AI as a tool for both ramping up development timelines and raising security bars simultaneously.

Buterin’s framework suggests AI could remove that tradeoff by enabling thorough security verification at development speeds previously impossible.

Crypto World

Buterin Targets Ethereum’s Core Bottlenecks with Bold Overhaul

Vitalik Buterin is shifting the Ethereum scaling conversation away from Layer 2 (L2) and back to the protocol’s core.

The Russo-Canadian innovator argues that Ethereum’s biggest long-term constraints are not rollups or blob capacity, but deeper architectural bottlenecks inside the network’s state tree and virtual machine.

Vitalik Buterin Proposes Deep Ethereum Overhaul Targeting State Tree and Virtual Machine Bottlenecks

According to Buterin, two components — the network’s state tree and virtual machine — account for more than 80% of the proving costs. This, he says, is a critical issue as zero-knowledge (ZK) technology becomes central to Ethereum’s roadmap.

“Today I’ll focus on two big things: state tree changes, and VM changes,” Buterin wrote, adding that both are “the big bottlenecks that we have to address if we want efficient proving.”

A Binary Tree Overhaul

At the heart of the proposal is EIP-7864, which would replace Ethereum’s current hexary Merkle Patricia tree with a binary tree design.

The change may sound subtle, but its implications are significant. Binary trees would produce Merkle proofs roughly 4 times shorter than the current structure, dramatically reducing verification bandwidth requirements.

That makes lightweight clients and privacy-preserving applications cheaper and more viable.

The new structure would also group storage slots into “pages,” allowing applications that load related data to do so more efficiently.

Many decentralized applications (dApps) repeatedly access adjacent storage slots. This means the upgrade could save more than 10,000 gas per transaction in some cases.

Buterin also suggested pairing the tree change with more efficient hash functions, potentially delivering further gains in proof generation speed.

More importantly, the redesign would make Ethereum’s base layer more “prover-friendly,” allowing ZK applications to integrate directly with Ethereum’s state instead of building parallel systems.

Zooming out, the binary tree proposal aims to consolidate a decade of lessons on state management into a cleaner, future-proof structure.

A Future Beyond the EVM?

Even more ambitious is Buterin’s long-term vision for Ethereum’s execution engine. He floated the idea of eventually moving beyond the Ethereum Virtual Machine (EVM) toward a RISC-V–based architecture.

RISC-V is a widely used open instruction set that could offer greater efficiency and simplicity.

Buterin argued that Ethereum’s increasing reliance on special-case precompiles reflects a deeper discomfort with the EVM itself.

If Ethereum’s core promise is general-purpose programmability, he suggested, then the VM should fully support that vision without excessive workarounds. A RISC-V-based VM could:

- Reduce complexity

- Improve raw execution efficiency, and

- Better align with modern zero-knowledge proving systems, many of which already use RISC-V environments internally.

In the near term, Buterin proposed a “vectorized math precompile,” described as a “GPU for the EVM.” This could significantly accelerate cryptographic operations.

Longer term, he outlined a phased transition in which RISC-V would first power precompiles, then support user-deployed contracts, and eventually absorb the EVM itself as a compatibility layer.

Debate Over Complexity

However, not everyone is convinced Ethereum needs more deep-layer changes. Analyst DBCrypto criticized what he described as growing abstraction across the Ethereum roadmap, including new frameworks aimed at addressing rollup fragmentation.

Each additional layer, he argued, increases complexity, introduces trust assumptions, and creates additional potential attack surfaces.

The tension reflects a broader debate over whether Ethereum should continue layering solutions on top of its existing design or rework its foundation.

However, according to Vitalik Buterin, Ethereum’s architecture must evolve and adapt as zero-knowledge proofs move from a niche to a necessity.

The next phase of scaling, he suggests, may not occur on Layer 2 but rather deep within Ethereum’s core.

Crypto World

Altcoin Season Index Is Rising While Bitcoin Remains Under Pressure: Here is Why

TLDR:

- The Altcoin Season Index shows 24 out of 55 altcoins outperforming Bitcoin on a rolling 60-day basis.

- Altcoin bear markets historically last 7 to 11 months, while Bitcoin bear markets typically run closer to 12 months.

- Many altcoins have already dropped 80% to 90% from cycle highs, leaving less room to set new lows.

- The index measures relative performance, meaning altcoins are falling less than Bitcoin, not necessarily recovering yet.

The Altcoin Season Index is rising, and the numbers behind it tell a specific story. At 24 out of 55 altcoins outperforming Bitcoin over a rolling 60-day period, the index sits just below the midpoint between Bitcoin season and altcoin season.

The direction from its recent low is upward. Understanding what the index actually measures helps explain why this reading matters in the current market environment.

What the Index Measures and Why the Current Reading Stands Out

The Altcoin Season Index tracks relative performance, not absolute price movement. When more altcoins outperform Bitcoin over a 60-day window, the index rises.

That does not mean altcoins are going up in price. It means they are falling less than Bitcoin during the same period.

This distinction is critical for reading the current data correctly. Crypto markets remain under broad pressure, with fear at historically high levels. Yet the index has been climbing from its recent trough.

That combination points to altcoins holding ground better than Bitcoin, not staging independent recoveries.

Analyst Joao Wedson addressed this pattern directly in a recent post. He noted that altcoin bear markets historically last between 7 and 11 months, while Bitcoin bear markets run closer to 12 months.

That shorter cycle duration means a portion of the altcoin market can complete its bear phase while Bitcoin is still declining. The index rising during Bitcoin weakness is consistent with that historical pattern.

The chart history of the index shows it can move from the neutral zone into altcoin season territory quickly. It can also reverse just as fast. The current reading reflects what is happening across the altcoin market right now, not what comes next.

The Floor Dynamic Behind the Data

A second factor helps explain the index behavior. Many altcoins have already declined 80% to 90% or more from their cycle highs.

Assets that have fallen that far carry less downside risk in percentage terms, even if Bitcoin drops further. That arithmetic shapes how the index moves.

Wedson noted that two thirds of altcoins may not set new lows even if Bitcoin makes fresh cycle lows. That observation is not a bullish call.

It reflects the reality that deeply discounted assets have proportionally less room to fall further. The index rising during this period is partly a result of that floor dynamic playing out across the altcoin market.

During the middle phase of Bitcoin bear markets, history shows that many altcoins rally and outperform BTC. That mid-cycle divergence is visible in the current data.

The index moving upward while Bitcoin remains under pressure aligns with how this phase has unfolded in previous cycles.

Wedson also noted that altcoins can serve as a vehicle to accumulate more Bitcoin in this environment. Rotating through discounted altcoins that outperform Bitcoin can grow BTC holdings over time.

He acknowledged the strategy carries complexity for most investors, but the data behind the index supports the broader market dynamic he describes.

Crypto World

Kalshi founder updates on Iran’s Khamenei market carveout

Prediction-market operator Kalshi voided certain contracts tied to the death of Iran’s top leader after his passing was confirmed, saying it designed safeguards to prevent profits from outcomes involving death. The death, reported by Iranian state media early Sunday after an attack by Israel and the United States, prompted traders to move into markets such as “Ali Khamenei out as Supreme Leader.” Co-founder Tarek Mansour explained on X that the platform does not list markets directly connected to death and that the rules were applied to prevent profit from such outcomes. Kalshi has since reimbursed fees for the affected market and set settlements according to the last-traded price prior to the death event.

In the platform’s own words, the policy is clear and longstanding: death-related markets are not listed, and mechanisms exist to deter profit from catastrophic events. Kalshi reiterated this stance on Saturday, stressing that the death carveout was embedded in the market’s rules. Still, the decision generated backlash online, with users arguing that the platform was curbing potential profits. The linked market for the event—“Ali Khamenei out as Supreme Leader”—remains available only under the clarified rules, and the refunds reflect Kalshi’s effort to close the episode with financial fairness for participants who were in before and after the event.

The exchange said it would reimburse all fees for participants in the death-market and would settle traders who held bets based on the last-traded price before the death. Those who opened positions after the death were also reimbursed, with the difference between the entry price and the last-traded price returned. The policy has become a focal point for debates about how prediction markets should respond to geopolitical turnarounds and sensitive events, highlighting tensions between user expectations and platform safety nets.

The broader conversation around political and geopolitical markets extended beyond Kalshi. Earlier coverage highlighted a related issue on rival platforms, where questions about insider trading and the surfacing of sensitive information prompted scrutiny. For instance, a February episode on Polymarket drew attention after six traders netted about $1 million on bets about a U.S. strike on Iran, with wallets created that month and some positions filled just hours before explosions in Tehran, according to Bloomberg. Among other threads, the narrative tied into comments from political figures who criticized information handling and raised questions about the integrity of event-driven markets.

Kalshi’s position underscores a recurring tension in prediction markets: the desire for liquidity and profitability versus safeguards that prevent exploitation of real-world events. The company’s co-founder, in his post on X, framed the approach as a principled stance to prevent profit from death, a line that some traders interpret as protective discipline and others as a restraint on market opportunities. The platform’s ongoing emphasis on rule-based conduct suggests a continued commitment to transparency around how markets are structured and settled, including how post-event price dynamics influence refunds and settlements.

In parallel coverage, a briefing about related insider-trading concerns on Polymarket signaled how geopolitical volatility can intensify debate around predictive trading. The February surge in bets around a potential strike on Iran, coupled with the rapid wallet activity observed by analysts, prompted calls for enhanced scrutiny of how information flows influence on-chain markets. While Kalshi’s policy remains explicit about death-related markets, the broader ecosystem continues to wrestle with questions about fairness, transparency, and the potential for speculative activity to intersect with real-world events in unpredictable ways. The discussions around those questions—spurred by both Kalshi’s decision and the Polymarket episode—reflect the evolving regulatory and community norms governing digital-age prediction platforms.

Key takeaways

- Kalshi voided the “Ali Khamenei out as Supreme Leader” market after confirmation of the death, applying rules designed to prevent profits tied to death-related outcomes.

- The platform reimbursed all fees for the affected market and settled positions using the last-traded price prior to the death event.

- Traders who opened positions after the death were refunded the difference between entry prices and the last-traded price, according to Kalshi’s announcements.

- The death-market policy is described as long-standing, with the rules clearly stated in the market’s framework, yet the decision drew online backlash from users who felt profits were being curtailed.

- Geopolitical event-driven markets on other platforms, such as Polymarket, have faced insider-trading scrutiny and rapid, market-driven activity around sensitive events, illustrating broader tensions in the space.

Sentiment: Neutral

Price impact: Neutral. The refunds and settlement mechanics aimed to neutralize profit opportunities tied to the event, with no evidence of material market disruption described in the sources.

Market context: The episode sits within a broader pattern of how prediction markets respond to geopolitical shocks, balancing user demand for tradable exposure with safeguards to deter exploitation of real-world events. As regulators and platforms scrutinize on-chain and event-based markets, governance decisions like Kalshi’s illustrate how policy design shapes liquidity, risk, and user trust across the ecosystem.

Why it matters

The decision to void a death-related market and refund participants highlights a core challenge for modern prediction platforms: protecting users while maintaining transparent, rule-based operations around volatile, high-stakes events. For traders, this episode reinforces that markets anchored to real-world outcomes can trigger rapid policy shifts, especially when outcomes touch sensitive or destabilizing events. The policy keeps the platform aligned with ethical considerations that discourage profiting from human tragedy, but it also raises questions about the breadth of such rules and how they apply to future situations.

From the builders’ perspective, Kalshi’s stance demonstrates how market design can embed safeguards that reduce mispricing risk and potential manipulation. The explicit rule set—paired with a clear post-event settlement framework—provides a reproducible approach for handling similar events in the future. For users, the episode underscores the importance of understanding the platform’s rules before placing bets, particularly in markets connected to political or humanitarian events that may spiral into unforeseen consequences.

For the broader crypto and on-chain ecosystem, the episode sits at the intersection of liquidity, risk sentiment, and regulatory scrutiny. It accents the ongoing debate about how decentralized or semi-decentralized prediction markets should operate when real-world events intersect with volatile capital flows. As the market landscape evolves, stakeholders will watch for how platforms balance openness and safety, how settlements are executed in edge cases, and how governance processes respond to investor expectations during periods of geopolitical flux.

What to watch next

- Kalshi’s continued enforcement and clarification of its death-market policy, including any updates to the market’s rules or post-event settlement practices.

- Regulatory or community responses to the incident, and whether other markets adjust their own death-related or sensitive-event rules in response.

- Ongoing scrutiny of insider-trading allegations on prediction markets, particularly around geopolitical events, and what disclosures or safeguards platforms adopt.

- Developments around the specific market page for this event (kxkhameneiout) and any subsequent disclosures from Kalshi about settlements or future similar markets.

- Further analysis or reports on how price discovery and liquidity behave in event-driven markets during geopolitical shocks, including comparisons with rival platforms.

Sources & verification

Kalshi’s death-market decision and its implications

Kalshi faced a moment of policy clarity as it acted to void a market tied to the death of a major political figure and to reorganize post-event settlements. The company’s leadership underscored that markets framing fatal outcomes were never intended to function as profit channels, reinforcing a boundary around event-driven contracts that hinge on real-world violence or loss. The decision to reimburse all fees for the affected market and to settle participants using the last-traded price prior to the event reflects a deliberate approach to minimize financial risk for users while upholding a principled rule set. In parallel, the company reaffirmed the rule that markets do not list death-related outcomes, a position that has implications for how the platform will handle similar events in the future and how users should approach these markets going forward.

From a governance perspective, the episode demonstrates the importance of transparent disclosures and timely communication with users. By publicizing the policy and the settlement approach, Kalshi aims to maintain trust and deter opportunistic trading around sensitive developments. For participants, the refunds and price-based settlements provide a defined path for recourse when the market design encounters unforeseen real-world triggers. For observers and analysts, the event serves as a case study in how prediction markets navigate the delicate balance between liquidity and ethical boundaries, and how this balance shapes the broader market’s resilience amid geopolitical tension.

Looking ahead, industry watchers will be watching for how Kalshi and other platforms articulate any updates to their market rules, how they monitor for potential rule violations in edge-case scenarios, and how regulators respond to the increasing convergence of finance with geopolitics in the digital trading space. The dialogue surrounding dead-man markets, insider trading concerns, and the integrity of price discovery in crisis moments is likely to intensify as platforms refine their policies and governance practices in the months ahead.

-

Sports6 days ago

Sports6 days agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Fashion2 days ago

Fashion2 days agoWeekend Open Thread: Iris Top

-

Politics6 days ago

Politics6 days agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Business5 days ago

Business5 days agoTrue Citrus debuts functional drink mix collection

-

Politics3 days ago

Politics3 days agoITV enters Gaza with IDF amid ongoing genocide

-

Tech20 hours ago

Tech20 hours agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

Sports2 days ago

The Vikings Need a Duck

-

Crypto World6 days ago

Crypto World6 days agoXRP price enters “dead zone” as Binance leverage hits lows

-

Tech5 days ago

Tech5 days agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

NewsBeat1 day ago

NewsBeat1 day agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

NewsBeat4 days ago

NewsBeat4 days agoCuba says its forces have killed four on US-registered speedboat | World News

-

NewsBeat1 day ago

NewsBeat1 day agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat9 hours ago

NewsBeat9 hours ago‘Significant’ damage to boarded-up Horden house after fire

-

NewsBeat4 days ago

NewsBeat4 days agoManchester Central Mosque issues statement as it imposes new measures ‘with immediate effect’ after armed men enter

-

NewsBeat7 days ago

NewsBeat7 days ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

NewsBeat1 day ago

NewsBeat1 day agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

NewsBeat5 days ago

NewsBeat5 days agoPolice latest as search for missing woman enters day nine

-

Business4 days ago

Business4 days agoDiscord Pushes Implementation of Global Age Checks to Second Half of 2026

-

Sports7 days ago

2026 NFL mock draft: WRs fly off the board in first round entering combine week

-

Business3 days ago

Business3 days agoOnly 4% of women globally reside in countries that offer almost complete legal equality