CryptoCurrency

What’s Going On With BTC?

Bitcoin tied to the defunct Silk Road marketplace moved again after more than a decade of silence, raising new questions about who controls the coins and what the latest activity means for the market.

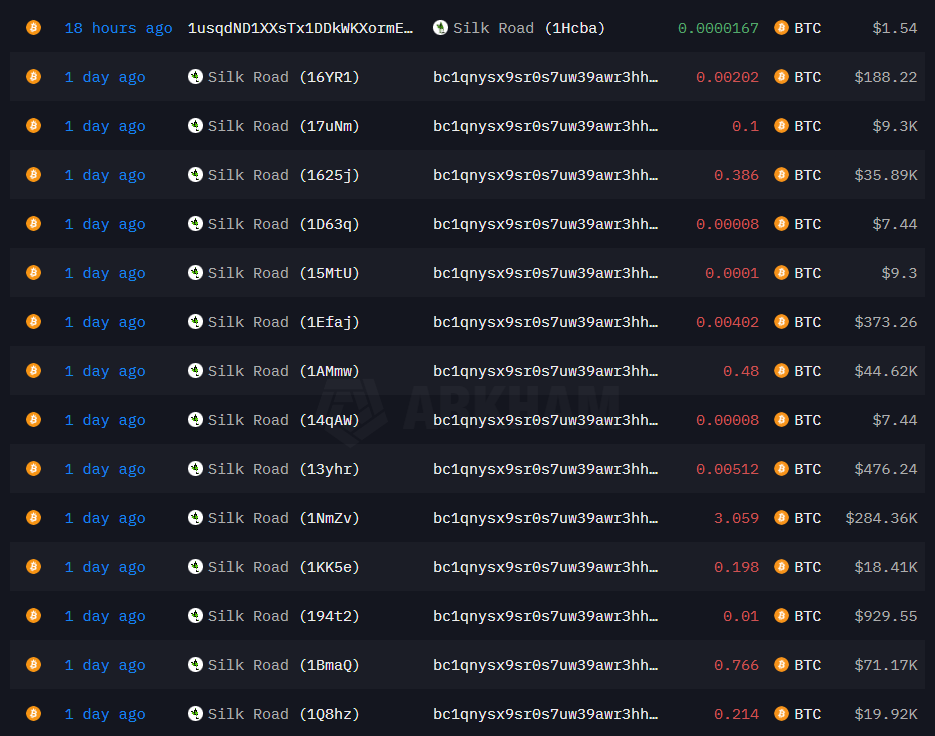

Blockchain data shows that 176 transfers were executed in the past 24 hours from a cluster of long-dormant Silk Road–linked wallets, moving a total of around $3.14 million into a small set of fresh addresses.

Sponsored

Sponsored

A Consolidation Pattern, Not a Market Dump

The pattern immediately drew attention because these wallets rarely show activity, and dormant Bitcoin tied to early dark web markets often sparks concern among traders.

However, the movement’s structure suggests a more controlled and deliberate reorganization rather than a rush to sell.

On-chain data shows the funds were sent in small, evenly structured batches, a pattern analysts typically associate with wallet consolidation. The coins did not move toward exchange deposits or known mixing infrastructure, which would indicate liquidation or laundering.

Instead, the funds appear to be reconsolidating into new wallets, a process often used to clean up outdated UTXOs, reorganize custody, or prepare for later actions.

This mirrors past movements from both private holders and law-enforcement–controlled addresses.

Possible Motives Behind the Dark Web Bitcoin Transfers

The activity could reflect several scenarios. The most likely is that an entity controlling the coins — whether a private early Silk Road participant or a government agency — is updating its wallet structure.

Sponsored

Sponsored

The US government has previously consolidated large Silk Road seizures before liquidation events, and the courts earlier this year approved the sale of more than 69,000 BTC tied to Silk Road seizures.

Another possibility is that a private holder regained access to old keys for the first time in years. Dormant BTC from the 2011–2013 period occasionally resurfaces when early users recover wallets or transfer ownership through estates.

These reactivations often follow slow, patterned transaction sequences similar to what is now visible on-chain.

Less likely is the theory that the coins are being laundered or prepared for immediate sale. Typical laundering flows involve thousands of micro-transactions, peel chains, or direct movement to mixers — none of which has appeared so far.

What It Means for Bitcoin

The market impact remains limited. Until the funds move toward exchanges, there is no direct selling pressure.

Analysts will continue monitoring whether the new addresses eventually forward coins to centralized trading platforms or OTC desks.

However, movements from legacy darknet-linked wallets carry symbolic weight. They highlight how early Bitcoin remains traceable and how activity from more than a decade ago can resurface unexpectedly.

Also, the transfers illustrate the heightened sensitivity around supply movements during a period when institutional flows, ETF activity, and macro conditions already drive volatility.