Crypto World

What’s Next for SUI? $0.95 Weekly Oversold RSI Triggers Setup Phase

TLDR:

- SUI is trading near $0.95, sitting just below Weekly Hypertrend resistance positioned around the $1.00 level.

- The weekly RSI has entered oversold territory, with approximately 50% of the October 10 liquidation wick now filled.

- Past weekly oversold signals for SUI led to expansions of 503% in October 2023 and 837% in August 2024 respectively.

- The Genesis AVWAP near $2.00 defines long-term macro positioning, while reclaim and volume confirmation remain the key requirements.

SUI is drawing renewed attention from analysts as the asset trades near $0.95. The token sits just below a key Weekly Hypertrend level around $1.00.

Market observers note that the RSI has entered oversold territory on the weekly chart. Early momentum divergence signals are beginning to appear.

The broader macro structure remains upward sloping since genesis. Traders are now watching for confirmation before positioning.

Technical Levels Point to a Compressed Setup

SUI is currently trading just below the Weekly Hypertrend resistance near $1.00. This level has acted as a structural ceiling in recent price action.

The RSI entering oversold territory on the weekly timeframe adds weight to the current setup. Analysts are watching whether momentum divergence will develop into a confirmed reversal signal.

According to market commentary from eye zen hour, approximately 50% of the October 10 liquidation wick has now been filled. This kind of wick fill often reflects a controlled recovery in price structure.

On-balance volume, or OBV, remains a key indicator to monitor at this stage. A curl back above its moving average could support the case for trend continuation.

The Genesis AVWAP sits near the $2.00 level and continues to define long-term positioning for SUI. This anchored volume-weighted average price from genesis serves as a macro reference point.

Price remains well below that level, meaning there is room for expansion if structure confirms. Traders are treating the $2.00 area as a longer-term target, not an immediate one.

Eye zen hour noted in a recent post that the current phase is “setup phase, not breakout phase.” That framing keeps expectations grounded without dismissing the structure building beneath price.

Until a Weekly Hypertrend reclaim occurs with participation, the setup remains unconfirmed. This distinction is important for risk management at current levels.

Historical Oversold Signals Offer Raw Data for Context

SUI has produced weekly oversold readings before, and the outcomes were notable both times. The October 2023 oversold signal was followed by a price expansion of 503%.

The August 2024 signal led to an 837% move higher from the oversold condition. These figures are cited as raw historical data, not as forward projections.

Eye zen hour was clear in stating these are “not predictions, just raw data.” That framing separates observation from speculation, which matters in volatile markets.

Still, the historical context gives traders a framework for understanding how the asset has behaved. Pattern recognition remains one tool among many in technical analysis.

The macro structure for SUI since genesis continues to slope upward, according to the analysis. Momentum is currently stretched to the downside, and structure appears compressed.

These two conditions together often precede volatility expansion in either direction. Confirmation through reclaim and volume participation remains the key requirement before any directional bias is established.

Crypto World

Kraken parent acquires token management company ahead of planned IPO push

Crypto exchange Kraken has extended its acquisition streak by buying token management platform Magna as the company gears up for an expected public market debut.

The deal, announced Wednesday by Kraken’s parent company Payward, brings in a platform used by crypto teams to manage token vesting, claims and distributions. It currently serves over 160 clients and reported a peak total value locked (TVL) of $60 billion in 2025, according to the press release.

Terms of the deal were not disclosed.

The deal highlights Kraken’s push to become more than just a crypto exchange, expanding its offerings ahead as the firm is widely expected to go public.

Last year, it bought U.S. futures platform NinjaTrader for $1.5 billion, U.S.-licensed derivatives trading venue Small Exchange for $100 million. It also acquired proprietary trading firm Breakout and tokenized stock specialist Backed Finance, the issuer behind xStocks.

Kraken raised $800 million in November, a round that included Citadel Securities, valuing the firm at $20 billion.

Magna will continue to operate as a standalone platform, but its tools will be integrated into Kraken’s institutional-facing product suite.

Read more: Crypto exchange Kraken fires chief financial officer ahead of long-awaited IPO

Crypto World

Banking trade groups responsible for impasse on market structure bill, Brian Armstrong says

PALM BEACH, Fla. — Banking trade groups, rather than individual banks, are chiefly responsible for stalled negotiations on crypto market structure legislation, Coinbase CEO Brian Armstrong said.

Banks themselves are looking at crypto as an opportunity, he said Wednesday at the World Liberty Forum hosted at Mar-a-Lago.

“For whatever reason, sometimes incumbent industries have trade groups, and they view the world with a zero-sum mindset [where they believe] for the banks to win, crypto has to lose,” he said. “They’re not viewing this as a positive [step].”

Banking trade groups have represented the industry in meetings with the crypto industry hosted by the White House since the Senate Banking Committee’s push to advance market structure legislation last month fell apart. The latest such meeting, which took place last week, saw the banking industry holding the line on its demands that the bill block stablecoin rewards.

The next meeting is set to take place Thursday morning, individuals familiar with the plan told CoinDesk.

Read more: Crypto’s banker adversaries didn’t want to deal in latest White House meeting on bill

Armstrong said he did expect some sort of compromise where banks would have new benefits under a fresh draft market structure bill, though he did not elaborate. When the Digital Asset Market Clarity Act stalled the night before a Senate Banking Committee hearing, it was after Armstrong publicly withdrew his company’s support.

In the current talks, the Coinbase co-founder argued that individual small and medium-sized banks did not really fear deposit flight to stablecoin issuers, but rather said their more urgent concerns were with deposit flight to larger banks.

Major banks are leaning into crypto as well, he said, adding that Coinbase is supporting crypto infrastructure for “five of the largest banks in the world.”

Other banks are hiring for blockchain or crypto-focused employees on LinkedIn.

“We now live in this world where we have regulated U.S. stablecoins with rewards,” he said. “You have to accept that as a reality and decide if you want to treat that as an opportunity or as a threat.”

Crypto World

Real estate mogul Barry Sternlicht says his firm is ready to tokenize assets, but U.S. regulation blocks it

Billionaire real estate mogul Barry Sternlicht said his firm, Starwood Capital Group, which manages over $125 billion in assets, is ready to begin tokenizing real-world assets but can’t move forward due to regulatory barriers in the United States.

“We want to do it right now and we’re ready,” Sternlicht said Wednesday at the World Liberty Forum in Palm Beach. “It’s ridiculous that our clients can’t do it in token,” he said, referring to transacting real-world assets — like real estate — using blockchain-based tokens.

Tokenization refers to converting ownership of physical assets, like real estate or art, into blockchain-based tokens that can be traded. For firms like Starwood, it could offer a new way to raise capital or give investors access to previously illiquid markets.

Putting real estate on the blockchain isn’t a new idea, and some other firms are already moving forward on a small scale to make the massive market, which still relies heavily on manual processes, more efficient.

One such firm is Propy, which laid out its plans last year for $100 million expansion to acquire mid-size property title firms across the U.S., aiming to streamline the industry processes.

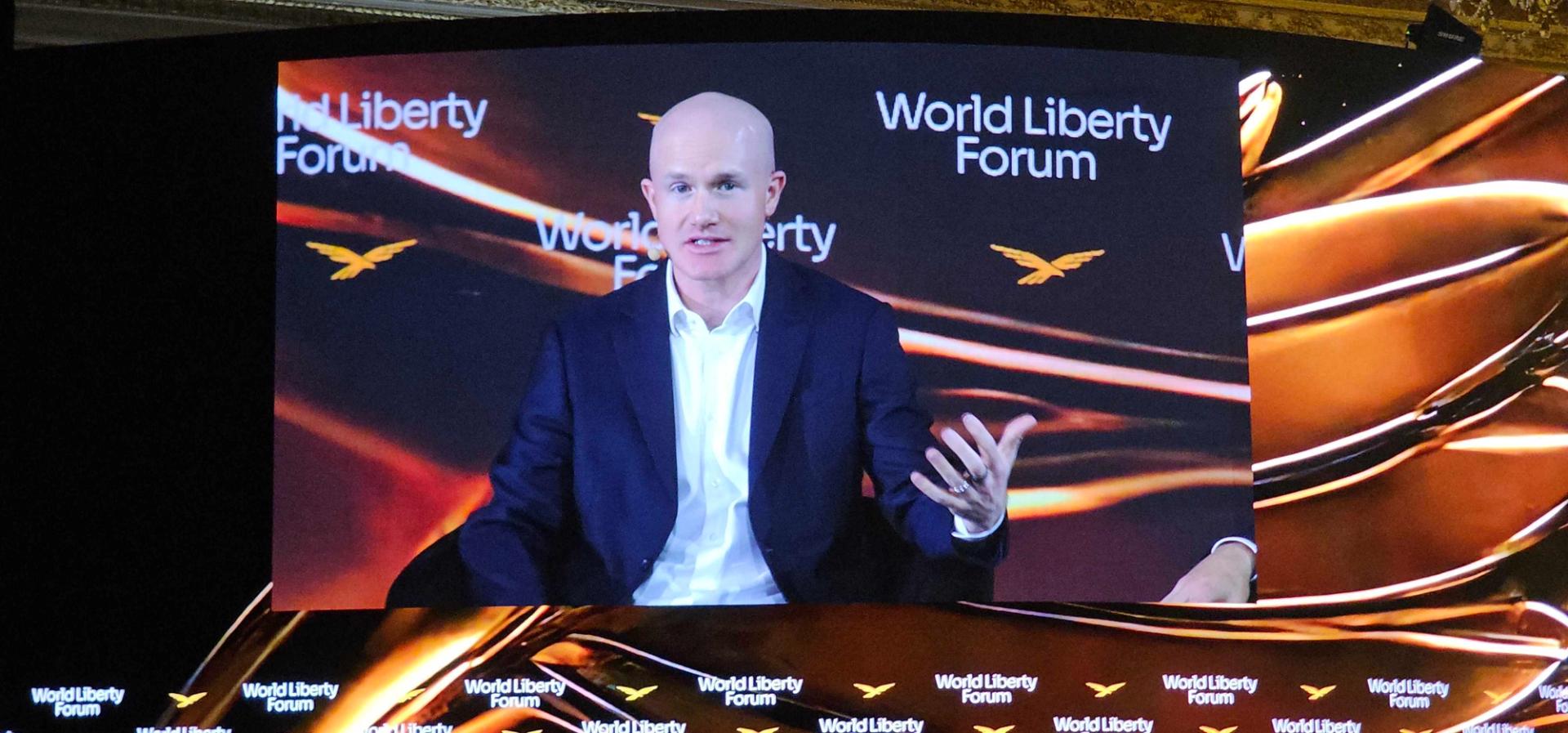

In fact, consulting giant Deloitte said in a report last year that $4 trillion of real estate will be tokenized by 2035, increasing from less than US$0.3 trillion in 2024. If that becomes reality, that’s a 27% CAGR for tokenized real estate.

“Tokenized real estate could not only pave the way for new markets and products, but also give real estate organizations an opportunity to overcome challenges related to operational inefficiency, high administrative costs charged to investors, and limited retail participation,” Deloitte said.

‘It’s a fantastic thing’

Sternlicht also seems to share the vision that tokenization can revolutionize the industry by praising the massive potential of the underlying technology.

“The technology is superior,” he said. “This is the future.

He went so far as to compare the current state of tokenization to artificial intelligence, saying it is far behind where AI is today.

“This is even earlier in the physical world than AI is.” Sternlicht called tokenization “exciting as can be,” saying, “It’s a fantastic thing for the world, the world just has to catch up with it.”

Crypto World

Coin Center presses Senate to keep dev protections in BRCA bill

Crypto dev liability fears surge after 2025 cases, as Coin Center defends BRCA protections.

Summary

- Coin Center urged the Senate Banking Committee to advance the Blockchain Regulatory Certainty Act, warning that diluting it would chill U.S. blockchain innovation.

- The Lummis–Wyden bill clarifies that non-custodial developers and infrastructure providers are not money transmitters under federal law if they never control user assets.

- Recent convictions of Tornado Cash’s Roman Storm and Samourai Wallet’s founders for unlicensed money transmission highlight how unclear rules can expose open-source devs to prison.

Coin Center has called on the U.S. Senate Banking Committee to advance legislation that would shield cryptocurrency developers from prosecution when they do not control user funds, according to a letter sent by the advocacy group.

The organization warned that removing protections from the Blockchain Regulatory Certainty Act could discourage blockchain innovation in the United States, the letter stated.

Representative Tom Emmer first introduced the Blockchain Regulatory Certainty Act in 2018. Senators Cynthia Lummis and Ron Wyden introduced a revised version last month to clarify federal money transmitter rules, according to congressional records.

The updated bill seeks to confirm that software developers and blockchain infrastructure providers are not money transmitters if they do not take custody of customer assets. The draft has not yet been marked up or voted on by the Senate Banking Committee, according to lawmakers.

In the letter, Coin Center policy director Jason Somensatto compared blockchain developers to internet service providers and cloud hosting companies. Somensatto stated that authorities do not threaten those actors with prison when criminals misuse their systems and argued the same legal standard should apply to blockchain developers who publish code but do not manage user funds.

“This is the same type of activity conducted every day by internet service providers, cloud hosting services, router manufacturers, browser developers, and email providers,” Somensatto wrote in the letter.

The debate follows several criminal convictions of cryptocurrency developers in the United States in 2025. Courts convicted Tornado Cash developer Roman Storm and Samourai Wallet founders Keonne Rodriguez and Will Lonergan Hill of conspiring to operate an unlicensed money-transmitting business. Judges sentenced Rodriguez to five years in prison and Lonergan Hill to four years, according to court records. Storm is awaiting sentencing.

Coin Center stated that weakening the legislation could increase uncertainty for developers working in open-source software. The organization warned that some developers may choose to leave the United States if clear protections are not enacted.

Lawmakers continue to review the bill as discussions over digital asset regulation progress in Congress.

Crypto World

Pepe Coin price rare pattern points to a 150% jump as key metric rises

Pepe Coin price retreated this week, moving from the weekend high of $0.000005030 to the current $0.000004325.

Summary

- Pepe Coin price has formed a giant double-bottom pattern on the daily chart.

- This pattern points to a 150% surge to $0.00001080.

- Pepe’s futures open interest and volume have held steady this week.

The Pepe (PEPE) token remains well above its year-to-date low of $0.0000031, giving it a market capitalization of over $1.78 billion.

The ongoing consolidation is due to the crypto market’s price action, with Bitcoin and most altcoins remaining in a tight range.

However, on the positive side, there are signs that Pepe may be on the cusp of a strong bullish breakout, potentially to the year-to-date high of $0.000072.

Data compiled by CoinGlass show that futures open interest has continued to rise over the past few days, a sign of increased demand among traders betting on a potential rebound.

The futures open interest rose to $262 million, well above the year-to-date low of $200 million. Similarly, Pepe’s daily volume has bounced back from its lowest level this month. It stood at $435 million on Wednesday, much higher than the year-to-date low of $436 million.

Pepe’s volume was much higher than that of other top meme coins. For example, Shiba Inu had a daily volume of $114 million, while Official Trump had $152 million. The elevated volume is also a sign of demand among whale investors.

Pepe Coin price has formed a double-bottom pattern

The daily chart shows that Pepe has been in a strong downward trend since 2025 as demand for meme coins waned and most altcoins tumbled.

On the positive side, it has formed a large double-bottom pattern at $0.0000036, its lowest level in December last year and this month.

A double-bottom pattern consists of two low swings and a neckline, which in this case is at $0.0000072. The profit target is determined by first measuring the distance between the neckline and the lower side.

After that, one measures the same distance from the neckline. In this case, Pepe will likely rally to $0.000p1082, up 150% from the current level.

The bullish Pepe Coin price forecast will become invalid if it drops below the double-bottom level at $0.0000036.

Crypto World

Are Traders Moving to Bitcoin?

Altcoins have endured a pronounced stretch of selling pressure, with net selling totaling about $209 billion since January 2025, underscoring one of the steepest declines in speculative demand this cycle. On major exchanges, activity in the altcoin space has cooled markedly; data indicates a roughly 50% drop in altcoin trading volumes on Binance since late 2025, even as Bitcoin’s presence in the order book has grown. In this environment, market participants appear to be prioritizing the flagship asset, with capital gravitating toward Bitcoin during a sustained downtrend. The shift aligns with broader trends in the crypto market, including rising reliance on dollar-denominated assets as macro headwinds persist.

Key takeaways

- Altcoin net demand, excluding the leading crypto assets, shows a cumulative delta of -$209 billion since January 2025, signaling a persistent withdrawal of spot buyers and highlighting that this metric, while informative about demand balance, does not by itself mark a market bottom.

- On Binance, altcoin spot volumes have collapsed by about 50% since November 2025, while Bitcoin’s share of total exchange volume rose to 36.8% on February 7, with altcoins slipping to 33.6% by mid-February from a peak of 59.2% in November.

- Analysts point to repeated rotations into Bitcoin during corrective phases, with Darkfost noting similar patterns in April 2025, August 2024, and October 2022, when investor capital consolidated into BTC amid drawdowns for risk assets.

- Tether dominance has climbed to an all-time-like level on a weekly basis, hovering near 8% (USDT), a condition historically associated with capital shifting into dollar-pegged assets rather than tokens like BTC or ETH. Prior cycles show that declines in this metric have sometimes preceded renewed upside for Bitcoin.

- The combination of waning altcoin demand and rising stablecoin dominance suggests a risk-off environment where traders favor BTC and stablecoins as macro uncertainties persist and the market absorbs potential regulatory and macro signals.

Tickers mentioned: $BTC, $ETH, $USDT

Sentiment: Bearish

Market context: The current environment shows a clear preference for liquidity and safety over speculative bets on altcoins. With altcoin demand contracting and stablecoin dominance rising, the market signals a reduction in risk appetite as Bitcoin consolidates amid macro headwinds and evolving regulatory considerations. The shift mirrors past cycles where capital moved toward the flagship cryptocurrency as risk-off conditions intensified.

Why it matters

The observed rotation away from altcoins toward Bitcoin and stablecoins has meaningful implications for investors, developers, and market structure. For traders, the data underscores the importance of monitoring liquidity flows and the relative strength of Bitcoin during downturns, rather than simply chasing uncorrelated altcoin narratives. For ecosystem builders, sustained declines in altcoin demand could influence funding dynamics, token performance, and the pace of new project launches, as capital allocations recalibrate in a more risk-off posture. For the broader market, a prolonged shift toward BTC and dollar-pegged assets may affect liquidity distribution, derivatives pricing, and the timing of potential recoveries, making risk controls and diversification more critical in volatile environments.

The trend also emphasizes the value of watching market signals rather than price action alone. While Bitcoin’s price movements remain central to risk sentiment, the degree to which altcoins capitulate or stabilize can shape the pace and breadth of any eventual recovery. In this context, market participants are paying close attention to on-chain and exchange-level indicators, seeking any early signs that a shift in appetite could re-emerge as macro conditions evolve.

What to watch next

- Monitor the pace of altcoin net selling versus BTC-driven inflows to determine whether the current distribution begins to reverse or persists through the next leg of the cycle.

- Track USDT dominance around the 8% level and any moves away from this regime, as shifts could foreshadow changes in risk sentiment and liquidity allocation.

- Observe Bitcoin’s price and volume dynamics for signs of renewed strength or further consolidation near bear-market levels, particularly in relation to market-wide risk-off moves.

- Watch Binance and other major exchanges for changes in altcoin and BTC share of total volume, which can reveal evolving trader preferences during downturns.

- Stay alert for macro or regulatory catalysts that could alter the flow of capital between BTC, ETH, and dollar-pegged assets, potentially reshaping the near-term trajectory for altcoins.

Sources & verification

- CryptoQuant, Altcoin sell-pressure just hit a 5-year extreme — https://cryptoquant.com/insights/quicktake/6994dc07312550148f4ebe22-Altcoin-sell-pressure-just-hit-a-5-year-extreme

- CryptoQuant, Altcoin volumes shrink by 50% as capital rotates back to Bitcoin — https://cryptoquant.com/insights/quicktake/69958a88c876a02133a047bb-Altcoin-volumes-shrink-by-50-as-capital-rotates-back-to-Bitcoin

- TradingView, USDT.D chart data — https://in.tradingview.com/symbols/USDT.D/

- Cointelegraph, New Bitcoin whales are trapped underwater, but for how long? — https://cointelegraph.com/news/new-bitcoin-whales-are-trapped-underwater-but-for-how-long

- Cointelegraph, Wells Fargo tax refunds YOLO trade driving Bitcoin and risk assets — https://cointelegraph.com/news/wells-fargo-tax-refunds-yolo-trade-bitcoin-stocks-150b

Altcoin demand wanes as capital rotates back to Bitcoin and stablecoins rise

Bitcoin (CRYPTO: BTC) activity began to draw a larger slice of total exchange volume as altcoins retrenched, a trend reinforced by the wider market’s risk-off posture. While the market previously witnessed heightened attention to altcoins during bullish phases, the latest data show a clear tilt away from the broader altcoin complex toward the flagship asset. The shifts in volume and demand are not only a reflection of price moves but a signal of how market participants are prioritizing liquidity and safety in uncertain times.

Ether (CRYPTO: ETH) and other altcoins have experienced a decline in both trading interest and net demand, with the combined effect being a tight supply of buyers in the spot market. This is not a simple bottom indicator; rather, it reflects a fundamental reallocation of capital, where risk-on bets in lesser-known tokens give way to a more conservative stance. The data from centralized exchanges shows a persistent exodus from altcoin markets over the past year, with the most pronounced outflows occurring in the current downcycle, as traders reassess risk and position for potential macro triggers.

At the same time, the dominance of dollar-pegged assets remains elevated. USDT, a primary stablecoin, has reached levels reminiscent of prior multi-month highs, a condition that typically accompanies a preference for liquidity and ready-to-deploy capital in times of uncertainty. The dynamic has historically been associated with a cautious stance among traders, as they seek to preserve value while awaiting clearer directional cues from macro data, regulatory updates, or shifts in market sentiment.

In this context, the market has shown a pattern of capital rotations: investors move money into Bitcoin amid broad market weakness, then re-evaluate altcoin exposure as conditions stabilize. While such rotations do not guarantee a resumption of altcoin strength, they set the stage for potential re-entry if liquidity returns and risk appetite improves. The ongoing narrative emphasizes the intertwined nature of liquidity, risk sentiment, and asset selection within the crypto market, with Bitcoin acting as a focal point for funding during downturns and stablecoins serving as a practical store of value and liquidity during periods of uncertainty.

Crypto World

How Aave Could Help End Crypto Winter, According to Bitwise

Bitwise exec said that Aave’s governance proposal stands out as a positive development for DeFi during the crypto downturn.

Even after four months since the massive slump from a record price above $126,000, sentiment surrounding Bitcoin remains fragile. Its failure to bounce back has intensified fears about another crypto winter.

But Matt Hougan, Chief Investment Officer at Bitwise, believes that decentralized finance could play a central role in leading the market out of the current bear phase, as investors increasingly focus on fundamentals such as real users, revenues, and sustainable value.

Aave at the Center

In a recent post, Hougan spoke about a governance proposal published by Aave Labs, the team behind the Aave lending protocol, titled “Aave Will Win,” as an example of why DeFi may be entering a new phase. According to Hougan, DeFi protocols like Uniswap and Aave already function as serious businesses. Uniswap, at times, handles more spot trading volume than Coinbase, while Aave generates more than $100 million annually in revenue.

Despite this, DeFi-related tokens have underperformed, largely because most were designed as governance tokens that offer voting rights but no direct claim on protocol revenues. Hougan explained that this structure emerged as a defensive response to regulatory pressure, particularly from the US Securities and Exchange Commission (SEC), which used the Howey test to assess whether tokens could be classified as securities.

The Bitwise exec noted that Aave attempted to address this issue through its “Aavenomics” upgrades in 2024 and 2025, which introduced token buybacks funded by protocol fees. But tensions continued because Aave Labs could still direct some revenues to itself, a point that drew attention in December 2025 when it allocated $10 million in swap fees to the company.

The new “Aave Will Win” proposal seeks to resolve this by committing Aave Labs to route 100% of revenue from all Aave-branded products, including its website, mobile app, card, and institutional services, directly to the DAO treasury controlled by token holders. In return, Aave Labs would receive a funding package of stablecoins, Aave tokens, and milestone-based grants of around $50 million to cover development of Aave V4 and the transfer of intellectual property to the community, while a new foundation would hold the Aave brand and trademarks.

This would effectively transform the Aave token from a governance-only role toward an asset with a direct claim on revenues, while positioning the founding team as a service provider accountable to token holders, Hougan said.

You may also like:

Pushback

The proposal has drawn criticism from some community members who view the funding request as excessive or argue that certain elements are bundled together. Others also point to unresolved questions around how revenue will be defined and controlled.

While deeming those concerns “legitimate,” Hougan said that Aave’s move may result in other assets following suit.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Solana price risks a drop below $80 as bearish engulfing candles indicate weakness

Solana’s price is showing renewed downside risk after bearish engulfing candles rejected key resistance, with weakening market structure increasing the likelihood of testing sub-$80 support levels.

Summary

- Bearish engulfing candles confirm rejection at the key $90 resistance

- Loss of the point of control signals weakness, favoring further downside

- $78–$80 support is the critical zone, with Fibonacci and liquidity confluence

Solana (SOL) price action has shifted back into a vulnerable technical position after a failed attempt to reclaim higher resistance. What initially looked like a potential stabilization has now turned into renewed weakness, as sellers regain control after a rejection at a key resistance zone. The broader structure remains corrective, and recent candlestick behavior suggests that downside continuation is becoming increasingly likely.

As price trades back below important value levels, attention is now turning to high-timeframe support zones that could come into play in the near term. Whether these levels hold or fail will determine if Solana can stage a meaningful bounce or if the correction deepens further.

Solana price key technical points

- Bearish engulfing candles rejected $90 resistance, reinforcing seller control

- Loss of the point of control signals weakness, favoring rotation lower

- $78–$80 support zone aligns with Fibonacci confluence, acting as a key downside target

Solana recently attempted to push above the $90 resistance level, but the move failed to gain traction. Price quickly closed back below resistance, forming bearish engulfing candles that invalidated the breakout attempt. These engulfing structures are significant because they often reflect aggressive selling pressure entering the market when buyers lose control.

The rejection from resistance is further reinforced by Solana’s inability to hold above the point of control (POC). Multiple counter-trend closes below this level indicate that the market has shifted away from balance and back into bearish momentum. When price loses the POC after a failed breakout, it often signals the start of a deeper corrective rotation.

Loss of value opens path toward $78 support

With price now trading below the point of control, the next logical downside magnet is the value area low. This level defines the lower boundary of fair value within the current range and frequently acts as a target during corrective phases.

Below the value area low sits high-timeframe support around $78, which also marks the lower edge of the broader trading structure. A move into this region would place Solana below the $80 psychological level, increasing volatility as traders reassess risk.

From a technical perspective, the $78 area carries additional significance due to its alignment with the 0.618 Fibonacci retracement. Fibonacci confluence often attracts price during corrective moves, particularly when paired with visible resting liquidity.

Liquidity sweep or deeper breakdown?

The swing low near $78 indicates an area with likely resting liquidity. Markets often dip into such zones to trigger stop-loss orders before deciding on the next directional move. If Solana quickly trades into this region and then reclaims it with strong buying interest, the move could resemble a liquidity sweep, setting the stage for a reactive bounce.

However, timing and structure will be critical. A slow grind lower, or prolonged acceptance below $78, would weaken the bounce thesis and suggest that a deeper corrective phase is unfolding. In that scenario, the market would be signaling that buyers are not yet ready to defend key support.

Broader market structure remains corrective

From a market structure standpoint, Solana has not yet invalidated its bearish bias. Lower highs remain intact, and recent attempts to reclaim resistance have failed. Without a decisive reclaim of value and strong bullish volume, rallies should continue to be treated as corrective rather than trend-changing.

The presence of bearish engulfing candles at resistance adds further weight to this view, as such patterns often precede continuation lower rather than immediate reversal.

What to expect in the coming price action

From a technical, price-action, and market-structure perspective, Solana is likely to continue rotating lower in the short term. As long as the price remains below the resistance and the point of control, the probability favors a move toward the value area, low and high-timeframe support near $78.

Traders should closely monitor price behavior around this zone. A sharp reaction and reclaim could trigger a short-term relief bounce, while sustained trading below $80 would increase the risk of a deeper correction.

Until bullish acceptance returns above key value levels, downside risks remain elevated, and Solana’s next meaningful move is likely to be defined by how the price reacts at sub-$80 support.

Crypto World

Bitcoin Still Being Bought, Just Much More Cautiously: Report

Short-term Bitcoin buyers are becoming cautious, and accumulation is slowing even as net positions stay positive.

Bitcoin climbed above $126,000 in early October and recently crashed to $60,000 before a modest recovery near $68,000. Despite the brutal swing, many entities are still buying the asset, betting on a much-anticipated price appreciation.

But a certain cohort of BTC holders has reduced this pace.

Demand Deceleration

Data shared by Alphractal revealed that the Short-Term Holder Net Position Change over 90 days is declining, despite remaining in positive territory. This means that while short-term holders are still accumulating Bitcoin, the pace of accumulation has slowed sharply in recent days.

According to the analytics platform, this deceleration points to weakening short-term demand momentum and has historically preceded periods of market consolidation, increased volatility, or broader regime transitions.

Against this backdrop, Alphractal founder Joao Wedson said that recent institutional buying has not translated into stronger short-term holder demand.

“Even with the news of Strategy accumulating and other institutional entities increasing their positions, Short-Term Holders are not accumulating at the same pace as they were 90 days ago. Analyzing a few isolated entities is not enough. The correct approach is to evaluate the entire Bitcoin blockchain to understand the true underlying demand”

Whale Holdings Differ

Separate analysis from CryptoQuant points to a contrasting trend among large Bitcoin holders. It found that whale accumulation has increased by more than 200,000 BTC.

Although whale inflows to exchanges have risen recently, which is often associated with short-term selling activity, their overall holdings have continued to grow. To capture a more medium-term perspective, the analysis tracks whale-held supply using monthly averages rather than short-term flows. After this metric fell sharply to nearly -7% on December 15, whale behavior appears to have changed over the past month, as evidenced by holdings increasing by 3.4%.

You may also like:

During this period, the amount of Bitcoin held by whales rose from around 2.9 million BTC to over 3.1 million BTC. The last time an accumulation of this scale occurred was during the April 2025 market correction, when whale buying helped absorb selling pressure and Bitcoin’s advance from $76,000 to $126,000. CryptoQuant explained that the crypto asset is currently consolidating almost 46% below its most recent all-time high. Hence, some whales may be taking advantage of this opportunity.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

HBAR Bears Face $4.9 Million Squeeze as Price Direction Shifts

Hedera has posted a muted recovery in recent sessions. HBAR price remains constrained by cautious sentiment across the broader cryptocurrency market. Uncertainty in Bitcoin and macro conditions continues to cap upside attempts.

However, bearish traders may need to monitor changing signals. Derivatives positioning and capital flow indicators suggest the current balance could shift.

Sponsored

Hedera Traders Could Be In Trouble

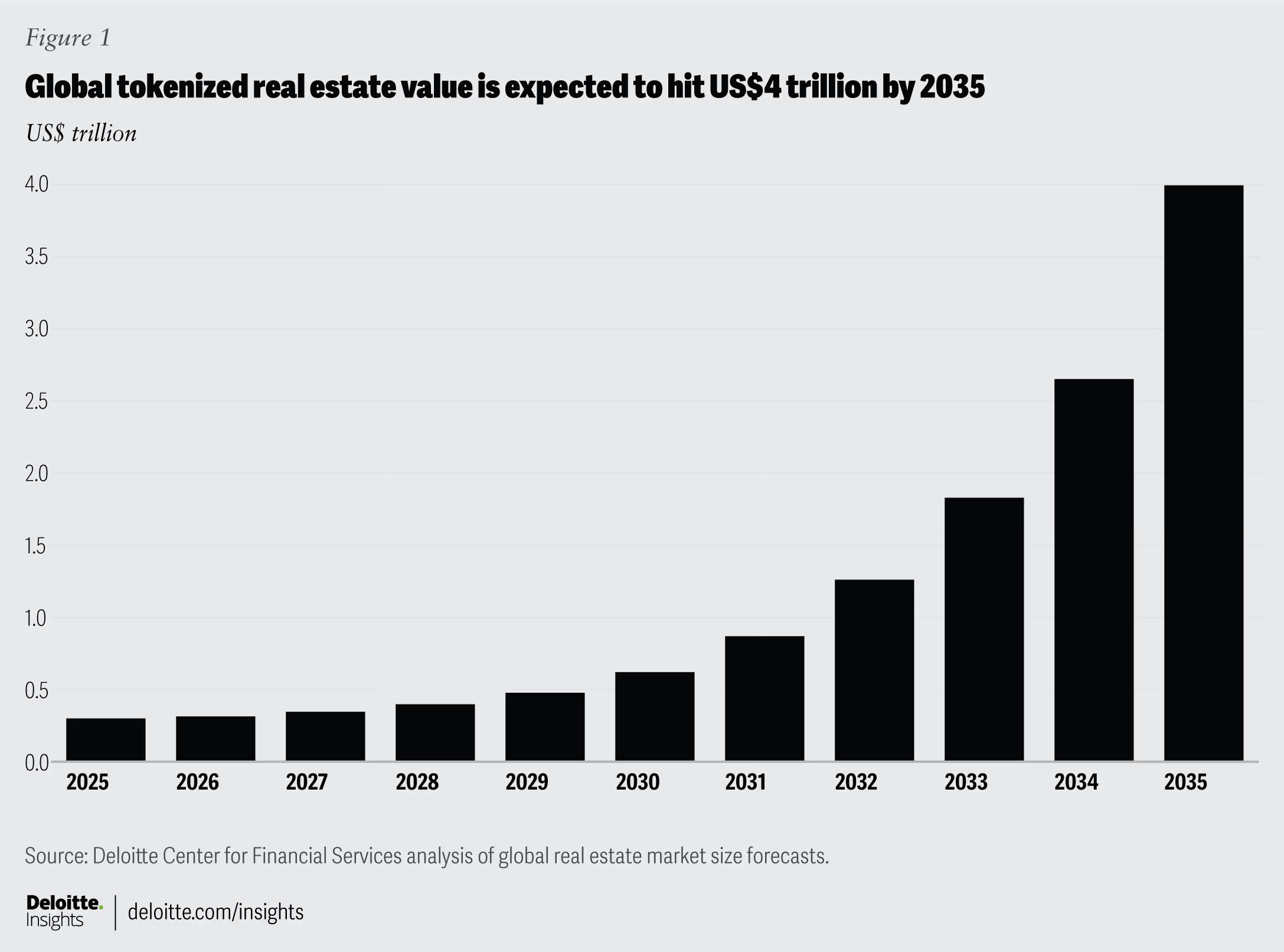

HBAR is currently experiencing strong bearish positioning in the futures market. Traders have opened a notable number of short contracts, reflecting expectations of further downside. The liquidation map highlights that positions are skewed toward bears at current levels.

Data shows that HBAR bears could face approximately $4.9 million in liquidations if the price crosses the $0.1143 mark. Such forced liquidations can trigger rapid upside volatility. When short positions unwind, buying pressure increases as traders close contracts.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

The Chaikin Money Flow indicator offers additional insight into capital movement. CMF measures inflows and outflows to assess whether buyers or sellers dominate. The indicator is currently rising, although it remains at the zero line.

Sponsored

An upward slope at zero suggests that outflows are at par with the inflows. However, the gap will likely diminish as inflows rise. Declining outflows often precede a shift toward net inflows. If this transition occurs, HBAR could gain the support needed for a short-term recovery.

Bitcoin Is Unhelpful

Correlation trends also support a potential shift. HBAR’s correlation with Bitcoin has declined in recent weeks. The current coefficient has dropped to 0.09, signaling weaker alignment with the crypto market leader, inching closer to completely dissociating with Bitcoin.

Sponsored

Reduced correlation can benefit altcoins during periods of Bitcoin uncertainty. If HBAR decouples further, price action may reflect investor-specific demand rather than broader market weakness. This flexibility could allow HBAR to chart an independent recovery path.

HBAR Price Has a Few Barriers To Breach

HBAR is trading at $0.1019 at the time of writing. The altcoin remains above the key $0.0961 support level at the 38.2% Fib line. However, it faces resistance at $0.1035, which aligns with the 50% Fibonacci retracement. This level currently caps upward momentum.

Sponsored

Flipping $0.1035 into support would mark a short-term breakthrough. Combined with declining outflows, this shift could fuel a recovery rally. HBAR would then target $0.1109 at the 61.8% Fibonacci.

This level is considered a critical support for an asset, and flipping it would likely trigger stronger buying among the investors, pushing the HBAR price higher.

This would bring HBAR past $0.1143, a level that threatens $4.9 million in shorts liquidations. Sustained strength could extend gains toward $0.1215 and $0.1349 eventually, helping recover year-to-date losses.

If bullish signals fail to materialize, consolidation may continue. Persistent outflows would limit breakout attempts. A breakdown below $0.0961support could expose HBAR to further downside near $0.0870. Such a move would invalidate the near-term bullish outlook and reinforce bearish control.

-

Sports7 days ago

Sports7 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Video2 days ago

Video2 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech4 days ago

Tech4 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Sports2 days ago

Sports2 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video5 days ago

Video5 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Crypto World2 days ago

Crypto World2 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Tech2 days ago

Tech2 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business23 hours ago

Business23 hours agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Video2 days ago

Video2 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Entertainment9 hours ago

Entertainment9 hours agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Crypto World7 days ago

Crypto World7 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World5 days ago

Crypto World5 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Tech14 hours ago

Tech14 hours agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Video7 days ago

Video7 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

NewsBeat3 days ago

NewsBeat3 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business6 days ago

Business6 days agoBarbeques Galore Enters Voluntary Administration

-

Business16 hours ago

Business16 hours agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Crypto World4 hours ago

Crypto World4 hours agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Crypto World6 days ago

Crypto World6 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

Crypto World5 days ago

Crypto World5 days agoKalshi enters $9B sports insurance market with new brokerage deal