CryptoCurrency

Who Leads DeFi Staking in 2026?

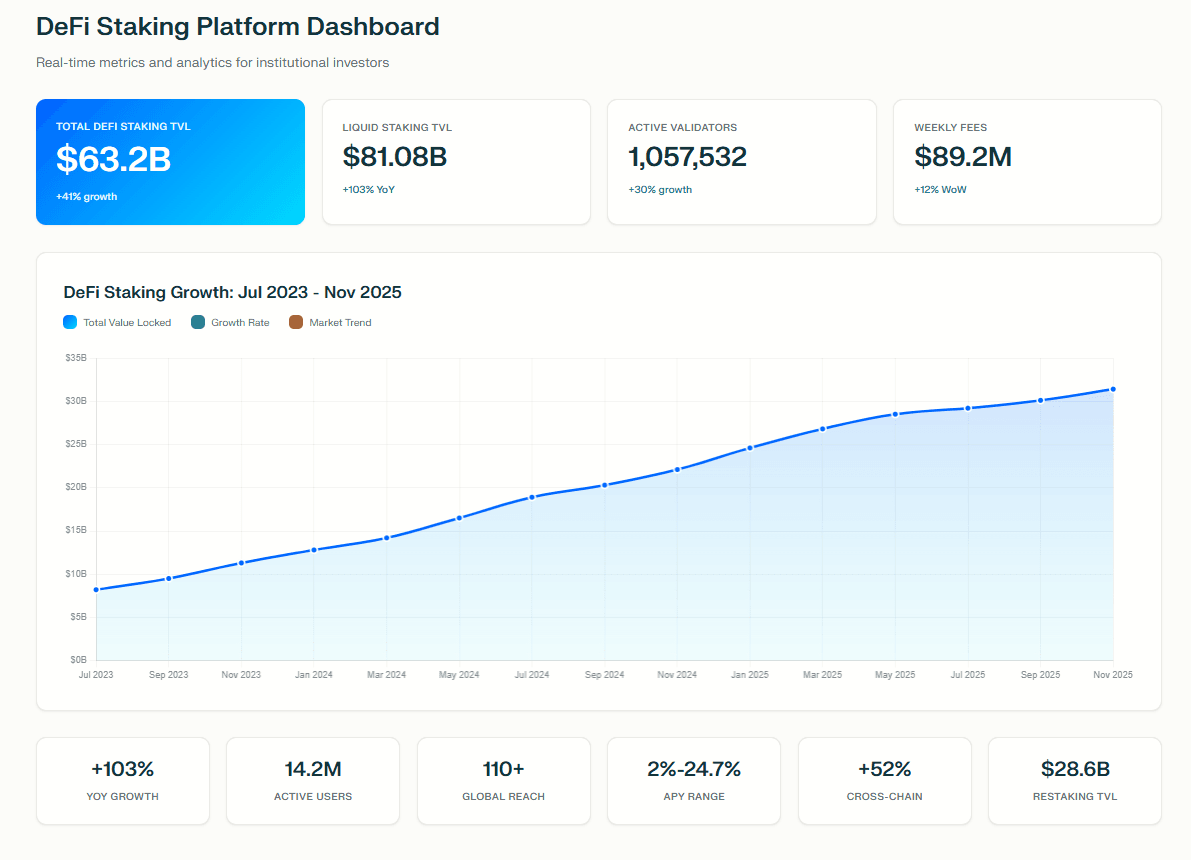

Staking has quickly become the core of decentralized finance, securing $63.2 billion in locked value with a 103 percent annual growth rate. As DeFi matures, founders need secure, scalable systems that attract liquidity, retain users, and strengthen token value. This rising demand continues to push projects toward professional DeFi staking development rather than basic, limited staking contracts.

Global activity confirms the momentum. More than 14.2 million users across 110 countries process $48 billion in weekly transactions, while cross-chain staking has grown 52 percent. Restaking has surged to $28.6 billion in TVL, a 134% increase since Q2 2025, making it one of the fastest-growing sectors in the ecosystem.

With more than 150 protocols battling for liquidity, the quality of your staking platform directly affects APY performance, security, and multi-chain expansion. Projects investing in advanced infrastructure now are positioned to lead the projected $162 billion DeFi market by 2032, especially as demand for expert-led DeFi staking platform development continues to accelerate.

Before we break down the ten companies dominating the staking landscape in 2025, let’s first look at the core features every founder should demand to build a scalable and future-ready staking ecosystem.

Key Features You Should Demand in a Modern Staking Platform

Projects planning long-term scalability now place a high value on simplicity, automation, and liquidity efficiency. This evolution has prompted founders to explore the most efficient models for DeFi staking development as they seek to outperform competitors and maximize token participation across diverse chains and wallets.

- Liquid Staking: Liquid staking is now the most demanded feature in 2026. Users no longer want to sacrifice liquidity while staking, making liquid staking derivatives essential for flexible participation.

- Multi Chain Staking: Cross-chain functionality boosts accessibility by allowing users to stake on multiple chains, such as Base, Polygon, Solana, BNB Chain, and Sui. Multi-chain support is key to unlocking new liquidity channels.

- Modular Reward Engines: Reward engines must be fully programmable. Founders now prioritize auto-compounding, dynamic APY curves, and custom incentive models to align staking with token economics.

- Real Time Analytics: Live dashboards showing TVL, pool performance, APY trends, and user activity increase trust and improve user experience. Transparency drives staking adoption.

- Smart Wallet Integration: Account abstraction, gasless staking, and smart wallet support simplify onboarding and make staking accessible to non-technical audiences.

- DAO-Based Governance: Modern staking platforms integrate governance features that allow users to vote on lockup cycles, APY shifts, and reward structures.

- Automated Restaking: Restaking is one of the fastest-growing trends in 2026. Automated restaking helps users maximize returns while increasing liquidity stability in the ecosystem. These new capabilities highlight why more founders are now choosing advanced Defi staking platform development solutions to future-proof their staking infrastructure.

Top 10 DeFi Lending Platform Development Companies

1.Antier

Overview

Antier is recognized globally as a premium DeFi staking platform development company with deep specialization in DeFi staking ecosystems. Their team delivers highly scalable and security-driven infrastructures tailored for enterprise-grade adoption. Antier operates with strong R&D capabilities, constantly enhancing staking models to meet the evolving needs of global protocols.

Core Expertise

- High-performance staking platform architecture

- Multi-token and multi-chain reward engines

- Institutional-grade smart contract development

- White label staking modules with fast customization

Why It Stands Out

Antier’s staking platforms are engineered for seamless scalability, operational security, and flexible multi-chain deployment. Their ability to implement validator logic and complex reward mechanisms makes them a preferred Defi staking development partner for institutions and high-growth Web3 companies. Their consulting-first approach ensures founders build staking ecosystems that withstand long-term market demands.

2. Unicsoft

Overview

Unicsoft stands out for its secure, modular, and audit-ready staking platform engineering. Their focus on system robustness and tokenomics-aligned infrastructure makes them ideal for projects that value technical accuracy and financial design. They merge blockchain expertise with data-driven decision-making to support sustainable staking economies.

Core Expertise

- Cross-chain staking integration

- Automated reward issuance

- APY modeling and dynamic reward logic

- Smart contract audits and architecture

Why It Stands Out

Unicsoft is known for its precise engineering standards and strong security framework. Their staking systems are built to scale with user growth while maintaining predictable reward distribution. This makes them a reliable choice for founders needing dependable infrastructure backed by deep technical knowledge and transparent DeFi development processes.

3. Debut Infotech

Overview

Debut Infotech delivers full-cycle staking platform development using a product-centric approach that blends functionality with exceptional UX. They specialize in token-focused ecosystems where staking acts as the primary driver of liquidity and community engagement.

Core Expertise

- Staking pool architecture

- Governance and token lockup systems

- Liquidity integration

- Reward distribution automation

Why It Stands Out

Debut Infotech’s strength lies in building smart, visually polished, and highly reliable staking platforms. Their focus on code quality and high UI standards makes them a standout partner for founders looking to deliver professional-grade user experiences.

4. BlockchainX

Overview

BlockchainX is known for rapid execution and high levels of customization, making it a practical choice for early-stage Web3 teams. Their staking platforms are lightweight, feature-rich, and designed to support flexible token models. They emphasize high maintainability and smooth user flows that simplify staking participation.

Core Expertise

- Liquidity staking

- Fixed and flexible APY models

- Cross-chain participation

- Lightweight staking interfaces

Why It Stands Out

BlockchainX offers a balanced mix of speed, affordability, and technical quality, making it a strong choice for projects exploring advanced Defi staking platform development for their tokens.

Get your staking platform blueprint from Antier.

5. Innowise Group

Overview

Innowise Group provides world-class DeFi engineering supported by large global delivery teams and strong technical governance. Their staking solutions emphasize operational reliability, making them ideal for large-scale token ecosystems that expect sustained user participation.

Core Expertise

- Advanced staking smart contracts

- Liquidity and yield management

- Multi-chain validator deployment

- Scalable staking infrastructure design

Why It Stands Out

Innowise combines strong engineering precision with the ability to support complex multi-layer DeFi ecosystems, making them a valuable partner for projects exploring high-quality DeFi staking platform development solutions.

6. ScienceSoft

Overview

ScienceSoft brings decades of software engineering excellence into blockchain and DeFi staking development. Their solutions are tailored for enterprises, institutions, and large platforms that demand strict security and absolute operational reliability.

Core Expertise

- Custom staking architecture

- Wallet and validator integration

- Secure reward distribution

- Smart contract engineering

Why It Stands Out

Their engineering maturity and structured development methodology position them as a trusted partner for enterprise-grade staking initiatives.

7. 4IRE Systems

Overview

4IRE Systems combines fintech expertise with advanced blockchain engineering to deliver sophisticated staking ecosystems. Their platforms focus on automation, efficiency, and robust financial logic. They also prioritize designing user-friendly interfaces that simplify staking participation for both retail and institutional audiences.

Core Expertise

- Automated claiming and reward throttling

- Smart vesting rules

- Advanced platform UI/UX

Why It Stands Out

Their strength lies in merging premium user experience design with powerful backend architecture. This makes 4IRE Systems ideal for teams that require polished, high-performance DeFi staking platforms with seamless user engagement and strong token retention capabilities.

8. SoluLab

Overview

SoluLab provides ready-to-launch white label staking platforms designed for rapid deployment and multi-chain flexibility. Their approach focuses on speed, modularity, and data-driven optimization.

Core Expertise

- Liquid staking and re-staking systems

- Multi-chain support

- Real-time analytics dashboards

Why It Stands Out

Their white label framework offers a strong starting point for any staking ecosystem, enabling projects to deploy quickly without sacrificing quality.

9. Hivelance

Overview

Hivelance provides fast, budget-friendly staking platform development tailored to early-stage and community-driven Web3 projects. Their solutions are simple, scalable, and optimized for straightforward deployment. They are especially popular among meme coins, utility tokens, and emerging DeFi protocols.

Core Expertise

- Fixed and flexible staking

- Automated compounding modules

- Multi-chain pool creation

- DAO-driven governance integration

Why It Stands Out

Hivelance balances affordability with functionality, allowing small to mid-size projects to build robust staking platforms without overshooting their budgets. Their flexible architecture supports future scaling, making them a strategic pick for fast-growing tokens.

10. Nadcab Labs

Overview

Nadcab Labs focuses on crafting reliable staking ecosystems with a strong emphasis on security, automation, and modular deployment. Their approach ensures that token issuers, enterprises, and Web3 startups can implement staking utilities that support long-term token value and community participation.

Core Expertise

- Validator module implementation

- Automated reward logic

- Lockup and vesting mechanisms

- Multi-chain compatibility

Why It Stands Out

Their platforms are built for stability and cost efficiency, making Nadcab Labs an appealing option for projects entering the DeFi staking market. They specialize in creating systems that enhance user retention through predictable rewards and secure staking flows.

Pick the Staking Partner That Positions You Ahead of 2026 Trends

The staking market is evolving fast, and only the projects that upgrade now will stay ahead. With liquid staking, multi-chain expansion, and restaking gaining momentum, generic setups will not be enough to compete. Your ability to attract liquidity and deliver strong APYs depends on choosing a partner with proven engineering strength. The founders investing in advanced infrastructure today will lead the next cycle. If you want a partner already shaping the future of DeFi staking, Antier remains the top choice.

Frequently Asked Questions

01. What is the current value locked in DeFi staking and its growth rate?

The current value locked in DeFi staking is $63.2 billion, with a growth rate of 103 percent annually.

02. What are the key features that modern staking platforms should include?

Modern staking platforms should include liquid staking, multi-chain staking, modular reward engines, and real-time analytics for optimal performance and user experience.

03. How has restaking activity changed recently in the DeFi ecosystem?

Restaking has surged to $28.6 billion in total value locked (TVL), representing a 134% increase since Q2 2025.