CryptoCurrency

Why Are Businesses Switching to AI Crypto Wallets in 2026?

The transition occurred more quickly than most forecasters had anticipated. Only 2 years ago, a crypto wallet was treated as a mere storage facility—silent, inactive, and entirely dependent upon human input. If your treasury operator made an error, there would be almost no realistic chance of recovering those funds. If an attack occurred and a contract was not audited correctly, then the treasury could even be wiped out.

As we reach January of 2026, this manually gated approach has become competitively insufficient. If you are building a crypto wallet product for launch in 2026, you can’t just satisfy customers anymore by offering mere “custody-only solutions”; rather, you need to offer wallets that act as bankers for end-users. That means more intelligent offerings – AI crypto wallets that process user transactions, detect fraud automatically, optimize routing, and protect assets without requiring continuous human oversight.

In 2025, incidents of crypto theft rose sharply to $3.4 billion [Chainalysis 2026 Crypto Crime Report], reminding us that relying solely on human intervention & static approval workflows to protect institutional capital is inadequate. In order to survive in this environment, your wallet must incorporate dynamic (automated) capabilities from day one.

“But – Wait”

What Are The Shortcomings In Traditional Wallets For 2026 Launches?

Before we discuss the various reasons why AI crypto wallet development is trending among the enterprise circles this year, it is important to know what is actually being replaced. Why will your future customers find legacy wallets to be outdated?

“The Four Main Problems With The Existing Model”

1. Static Security Models

Legacy wallets utilize a ‘set and forget’ model for their private key storage. Once your users’ private key is stolen, all assets in that wallet are at risk. There is no mechanism to continually update security models, learn from attack patterns, or provide new levels of protection to users.

2. Human Bottlenecks

The traditional wallet model requires customers to approve all transactions. If it is 3 o’clock in the morning during a market crash and your user is not available to approve their transactions, their reserves will become vulnerable.

3. Blind Signing Risks

Customers see hex data and must sign contracts that they don’t fully comprehend. The average phishing and blind-signing-style scams in 2025 were approximately 83 million dollars. This indicates a larger problem for your audience: they need multiple levels of protection against unauthorized transaction approvals, lost private keys, and delayed settlements.

4. Limited Integration of Threat Intelligence

Traditionally, all crypto wallet businesses have operated within their own security ‘silos,’ meaning that they have not had the ability to share threat intelligence with other networks in real-time. Without built-in threat detection and automated signal sharing, you risk exposing your users to preventable attacks and eroding competitive positioning.

AI Wallets Answer The Toughest Questions Crypto Businesses Face Today

“Exactly The Reason Why They Have Become So Coveted In 2026”

-

Question No.1 – “Why are our end-user funds remain vulnerable despite ‘bank-grade’ security?” – Welcome to the new era of active defense

This is the question that keeps CISOs awake at night. According to estimates from Chainanalysis, TRM Labs, and De.Fi, a whopping amount of $2.7 billion of cryptocurrency—was stolen from DeFi projects and exchanges this year. Even with professional security staff, your wallet may still remain vulnerable to sophisticated attacks.

Now this explains the first “critical reason” that is making crypto businesses switch to AI crypto wallet development – “The Call For Active Immunity.”

Traditional wallets can be likened to smoke detectors—they alert after damage spreads. Wallets powered by AI are like security guards checking IDs at the door; they scan behavior, device history, and transaction patterns to flag risks before your users sign. This is made possible through real-time transaction simulation: before a transaction is sent to the blockchain, the AI executes it in a secure sandbox environment, showing exactly what will happen.

If the smart contract executes similarly to a well-known draining pattern or attempts to modify critical permissions, AI will notify this immediately – protecting your users from potential scams or frauds while upholding your business’s integrity. This is how, in 2026, security shifts from password strength alone to AI-enhanced anomaly detection.

-

Question No. 2 – Why does our UX appear slow and riddled with errors? –The intent revolution

Truth be told, operational friction within Web3 presents as an impenetrable barrier to a larger scale of adoption. For your users, working directly via an unaltered DeFi protocol (as in most 2024-era traditional wallet models) – with no major feature to create an easier UX- is quite challenging.

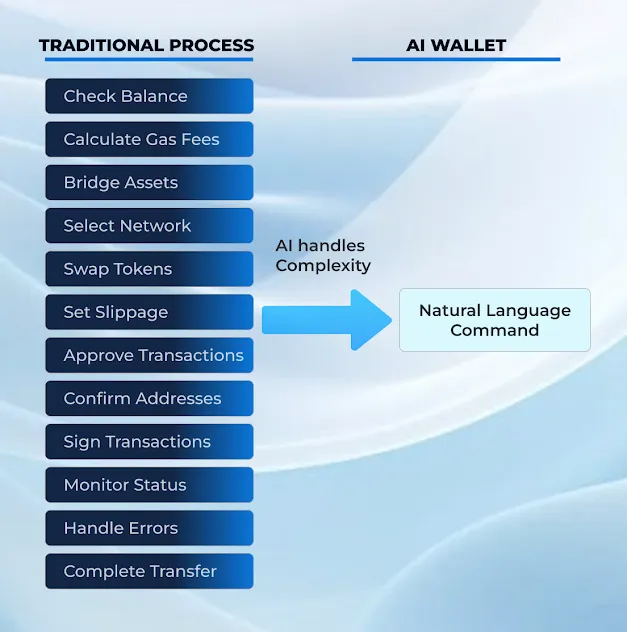

They have to encounter a whole lot of hexadecimal addresses, gas limits, and the constant, paralyzing fear of a “fat finger” error. This systemic drag ultimately dampens markets’ trust in traditional crypto wallets. The good news is that AI wallets, through Natural Language Intent, alleviate these problems effectively.

Take, for example, your customers’ need to rebalance a portfolio. That would take multiple manual processes; however, in 2026, all they are obliged to do is – simply add text—like ‘Please move our high-risk treasury assets into USDC when/if Ethereum drops under 2,500 USD.’

Based on the instructions, the AI plans a route and then executes the complex chain of transactions within each required layer. CoinMarketCap’s forecasts for 2026 indicate an increase in usage of “Intent-Based Execution” as the normal practice for DeFi. By eliminating technical complexity, you are not only increasing efficiency; you are also democratizing access- empowering customers to use & manage their crypto confidently and safely.

-

Question No.3 – How do we prevent user churn due to gas fee shock? – Predictive Gas Intelligence To The Rescue

“Gas fee shock” is a serious issue and continues to negatively impact user adoption in new wallets.

When retail users see – transaction failed message as they spend $50 to complete a trade – owing to insufficient gas, they feel agitated. High gas fees for such trivial transactions make them unwilling to use your wallet in future. Institutional users too abandon when they have to spend countless hours just searching for lower gas fees on alternative routes, thus losing precious time while the market fluctuates. AI Wallets solve this problem with – Smart Cost Prediction. For example, if a customer typed “Swap my ETH for USDC,” the AI model would return:

Mainnet Gas: $28. Arbitrum gas $1.20 : Would you like to switch?

And when corporate participants – type “Rebalance treasury to stable coins,” the AI would respond with:

Optimal path savings 23% vs. the current route. Would you like to execute?

Smart Cost Prediction operates as follows:

1. Pre-calculates the estimated cost of the transaction on 20+ blockchains.

2. Suggess the cheaper route via the artificial intelligence model

3. Pre-funds the gas cost from the yield account

This way, your business achieves many benefits, such as

— Reduce rage quits from gas shock

— Save hours on route optimization for users

— Eliminate help desk tickets like “Why so expensive?”

- Question No. 4 – How do we ensure compliance audits do not become deal breakers? – Here comes the era of audit-ready transparency

Compliance audits are where the successful launch of many wallets stops. Regulators require proof: Which transactions were inspected, and what were the reasons for any transaction to be approved/rejected?

In the pre-AI wallet systems, there is opacity beyond the limited raw on-chain data. All you have is a private key and the corresponding signed transaction data, but you have no detailed audit trail or contextual transparency.

AI-infused crypto wallet development addresses this issue with compliance provenance.

What AI brings for cryptocurrency wallets:

- Immutable audit logs – Decision made for every transaction is documented: risk score, screening result, whether given approval or rejected, and timestamp

- Real-time transaction metadata – attaches device fingerprint (idenitfying the device from which the transaction occurred), behavioral signals, and screening results related to each transaction

- Regulaotry reporting – Auto generates summaries for MICA, FinCEN, or local regulators) without necessitating any manual work.

Business wins :

- Compliance audits will be completed on first submission, not second or third

- Preparation time for the audit reduces from weeks to days

- You gain the confidence of the investor. Transparent compliance = lower risk premium

You get a wallet that is audit-proof from day one.

- Question No. 5 – What R&D cost containment strategy can we use in 2026? – The White-labeling flex

Many fintech firms and neo-banks experience ‘wake-up’ calls with their journeys; they realize that developing their proprietary artificial intelligence wallet from the ground up is a considerable drain on their resources.

The algorithms for advanced techniques, e.g., live threat interception, require access to vast amounts of data, which you may not have as a startup.

It is at this point that white-labeled AI solutions enter the scene. You can spend 18 months and millions of dollars building and training a model, or you can implement a widely used, tested AI-based infrastructure in a matter of weeks!

Investors want proven venture performance, not that ‘reinventing the wheel’ approach.

By opting AI-led white-label crypto wallet products, you get the freedom to direct your attention towards your individualized value proposition – it may be a specific remittance corridor, loyalty program, or institutional treasury management—while the white-labeled backbone takes care of the security and the performance of the wallet.

Next On The Shelf: The Best 11 Agentic-AI-Powered Crypto Wallet Development Companies Of 2026

Direct Comparison: Traditional vs AI Crypto Wallets

| Feature | Traditional Wallets (2023-2024 model) | AI-Enhanced Crypto Wallets (2026) |

|---|---|---|

| Security Model | Static keys: the user signs transactions without contextual risk analysis. | Adds pre-signing simulation and risk checks on transactions before the user signs, using on-chain data and heuristics. |

| Threat Detection | Relies mainly on blacklists, basic device checks, and user vigilance. | Integrates behavioral and device intelligence (IP, device fingerprint, interaction patterns) to flag account takeover and suspicious activity in real time. |

| User Experience | Users interpret hex data or technical transaction details; complex multi-step operations are manual. | Supports intent-based or simplified flows where users express goals (e.g., conditional orders, auto-yield moves) and the wallet orchestrates multi-step execution with user confirmation. |

| Automation Scope | Little to no native automation; recurring actions require manual approval each time. | Allows rule-based or AI-driven automation (price triggers, periodic portfolio actions) within user-defined limits. |

| Compliance Readiness | Built primarily around KYC/KYT for human users and standard transaction monitoring. | Designed to attach richer metadata (device, behavioral signals, policy context) to events and to support emerging expectations around agent accountability (KYA-style frameworks). |

What are the in-demand capabilities that AI crypto wallets must include in 2026?

-

Behavioral Biometrics & Continuous Authentication

Analyze user keystroke rhythm, device fingerprinting information, and interaction patterns to determine when suspicious activity occurs so that you can respond in real time. This enables you to identify instances of account takeover before the attacker can drain and steal your users’ funds.

-

Zero-Trust Execution With Predictive Threat Scoring

ML models will enable you to assess the exploit risk of a transaction before it occurs. All high-risk transactions should be routed through additional forms of verification without any disruption to the user experience.

-

Utilizing Natural Language Intent for End Users

End users should be able to express their intent in natural language through conditions such as “Automatically move my stablecoins to L2 for the highest yield.” Your wallet’s advanced intelligence should monitor these conditions so that when they occur, multi-step transactions (swaps, bridges, yield deposits) will be executed without needing the end user to sign the transaction at each step.

-

Embedded Compliance Framework for AI Transactions

Regulators are signaling that KYC (Know Your Agent) frameworks may become mandatory by H2 2026. Each transaction executed by an AI agent should contain:

- The agent’s identity metadata : agent ID, version, and publisher.

- Audit-ready logs : On-chain receipts providing answers to the following – “Who authorized this?” “Under what restrictions?” and “What occurred?”

Conclusion: Who can be the brain behind these wallets? – Antier

You have already seen how and where the problem areas exist and how AI spectacularly gives you the “power” to tackle them. If you too want to join the league of businesses making this logical switch, your next question will be- ‘Who has the experience to guide us?’

An agentic wallet is more than program code that has been pieced together; that’s why AI-smart crypto wallet development requires a crystal-clear vision. That is the principle on which Antier crafts its crypto wallet offerings.

We are here to provide transformation technology to the companies we serve, not just extract value from trends.” It is this philosophy that sets us apart. When you partner with us, you are not purchasing software; you are forming a partnership with architects who see wallets as they will be in 2026 – not only a pocket but also a shield, banker, and diplomat for the machine economy.

Frequently Asked Questions

01. What are the main shortcomings of traditional crypto wallets for 2026 launches?

Traditional crypto wallets face four main shortcomings: static security models that don’t adapt to threats, human bottlenecks requiring user approval for transactions, blind signing risks where users may not understand what they are signing, and inadequate protection against theft.

02. Why is there a need for AI crypto wallets in 2026?

AI crypto wallets are needed in 2026 because they can automate transaction processing, detect fraud, optimize routing, and enhance asset protection without relying on continuous human oversight, addressing the inadequacies of traditional wallet models.

03. How much did crypto theft incidents rise to in 2025?

In 2025, incidents of crypto theft rose sharply to $3.4 billion, highlighting the need for more secure and dynamic wallet solutions.