Crypto World

Why DOGE and XRP Holders Are Excited

As part of the strategy to turn X (formerly Twitter) into a “super app” or Everything App, a key missing piece, X Money, is beginning to take shape.

X aims to be more than a social media platform. Elon Musk wants to transform it into a personal finance game-changer. Users could handle messaging, shopping, and full personal asset management in one place.

Why Are Crypto Investors Excited About X Money?

During an xAI “All Hands” presentation in February 2026, Elon Musk revealed that X Money is already running in internal testing among X employees. A limited rollout to users is expected within the next one to two months.

Sponsored

Sponsored

X Money has secured money transmitter licenses in more than 40 US states. It also established strategic partnerships with major payment giants such as Visa last year.

“For X Money, we actually had X Money live in closed beta within the company, and we expect in the next month or two to go to a limited external beta and then to go worldwide to all X users. And this is really intended to be the place where all the money is, the central source of all monetary transactions. So it’s really going to be a game-changer,” Elon Musk said.

Musk aims to push monthly active users past 600 million and ultimately reach 1 billion. Analysts compare this ambition to building an everything app similar to China’s WeChat.

As a result, X Money represents a major opportunity for any crypto project that accepts it as a payment method or is indirectly connected to the platform.

However, X Money has never confirmed that crypto will be used as a payment option. Investors, meanwhile, continue to build their own narratives.

The first speculation centers on Dogecoin (DOGE). This meme coin closely aligns with Elon Musk’s personal brand. The theory stems from Musk’s past comments suggesting DOGE could be suitable for micropayments.

The second speculation involves XRP. This hypothesis is linked to Cross River Bank, a financial partner working with X to process payment flows. Since 2014, Cross River Bank has integrated Ripple’s protocol to enable real-time cross-border payments between the US and Western Europe.

Despite these narratives, DOGE and XRP prices showed no significant reaction to news of X Money’s upcoming launch.

In the coming months, once X Money officially goes live as planned, its impact on crypto markets and the global financial system may become clearer.

Crypto World

Google’s Gemini AI Predicts the Price of XRP, Solana and Cardano by The End of 2026

Global headlines may be rattling investors, but when fed with a carefully calibrated prompt, Gemini AI unlocks surprising medium-and long-term outlook for XRP, Solana, and Cardano.

According to Gemini AI, the next ten months will bring a lot of new capital into crypto thanks to a combination of technical indicators, news developments and a maturing regulatory environment.

So, here’s why Gemini just might be right.

XRP (XRP): Gemini AI Sees 10x Potential Within 10 Months

In a recent statement, Ripple emphasized that XRP ($XRP) remains central to its strategy of turning the XRP Ledger (XRPL) into a global, enterprise-level payments infrastructure.

The company designed XRPL for fast low-cost transaction settlement, while giving it an early lead in two of crypto’s biggest use cases: stablecoins and tokenized real-world assets.

XRP is currently trading near $1.42, and Gemini’s projections indicate the asset could climb toward $15 before the end of the year, representing a more-than-tenfold increase.

Technical indicators also point toward improving momentum. XRP’s recent support and resistane lines form a bullish flag that often foreshadows a breakout.

Several price drivers to watch include sustained institutional investment via the recently launched US XRP ETFs, Ripple’s growing list of international partnerships, and the possibility of the CLARITY Act passing Congress this year.

Solana (SOL): Could Solana Double Its Previous Record in 2026?

Solana ($SOL) currently hosts $6.7 billion in total value locked and capitalizes $50 billion.

Institutional adoption accelerated after asset managers Bitwise and Grayscale launched Solana spot ETFs in the US.

SOL experienced a steep downturn toward the end of 2025 and spent much of this February trading below $100.

Gemini’s most optimistic scenario sees Solana surging from $88 to as high as $600 by Christmas, a gain of 7x that would double SOL’s January 2025 ATH of $293.

Supporting the long-term thesis, major financial institutions including Franklin Templeton and BlackRock have begun deploying tokenized financial products on Solana, highlighting its early advantage in a potentially ubiquitous future crypto use case.

Cardano (ADA): Gemini AI Suggests Potential Gains of Up to 1,000%

Developed by Ethereum co-founder Charles Hoskinson, Cardano ($ADA) takes a a research-driven approach to development that prioritizes academic rigor, security, scalability, and sustainability.

With a market capitalization exceeding $10 billion and more than $140 million in TVL, Cardano’s ecosystem continues growing in step with its rivals.

Gemini’s forecast suggests ADA could rise by 826%, from roughly $0.27 today to around $2.50 by Christmas. Such a move would allow the token just below its record of $3.09 reached in 2021.

Like with all altcoins targeting institutional capital, comprehensive cryptocurrency legislation in the United States would massively expand ADA’s price prospects. Clear regulatory could also enable leading altcoins to move more independently from Bitcoin’s price cycles.

Maxi Doge: Early-Stage Meme Coin Aims for Major Breakout

If a bull run or altseason arrives, the momentum could drive the price of meme coins sky high, as they notoriously exaggerate the price movements of the wider market

One new meme coin tipped to explode tis Maxi Doge ($MAXI). The token has already raised $4.7 million through its ongoing presale as traders bet it could unseat stalwarts like BONK or Floki.

Maxi Doge is Dogecoin’s loud, proud hard-pumping, risk-loving distant cousin, recapturing the viral degen comic culture that ignited the 2021 meme coin boom.

The is an ERC-20 asset on Ethereum’s proof-of-stake network, giving it a smaller environmental footprint than Dogecoin’s proof-of-work architecture.

Presale investors can currently stake MAXI tokens for rewards reaching as high as 67% APY, although yields gradually decrease as more tokens enter the staking pool.

The token is $0.0002808 during the current round, with nominal price increases scheduled at each new funding round.

Interested investors can visit the official website and connect a supported wallet such as Best Wallet.

Purchases can also be completed using a bank card.

Visit the Official Website Here

The post Google’s Gemini AI Predicts the Price of XRP, Solana and Cardano by The End of 2026 appeared first on Cryptonews.

Crypto World

DeepSnitch AI Best AI Crypto of 2026? That’s What People Rushing for the Presale Final Days Think, Though KITE & NEAR Are Good Contenders

Is DeepSnitch AI the best AI crypto of 2026? Judging by how its presale is performing, that’s what many investors are thinking right now. The upcoming crypto is by far the most sophisticated AI implementation in the industry; one that will likely turn into a 100x crypto explosion sooner than later.

And as the last days of DeepSnitch AI’s presale are ongoing, people are rushing to take advantage of this unique opportunity before the final countdown comes to an end.

DeepSnitch AI’s launch comes amid likely rotation towards AI coins

Part of the reason why so many people are asking themselves whether DeepSnitch AI is the best AI crypto of 2026 has to do with the AI segment itself. There are numerous analyses showing that AI coins are the future; the most promising sector in crypto.

Recently, Rick Rieder, BlackRock’s Chief Investment Officer of Global Fixed Income, made the case for an upcoming AI rotation that would affect Bitcoin, even though US growth should stay resilient.

Rick Rieder from BlackRock sees significant AI rotation coming ahead.

Rick Rieder from BlackRock sees significant AI rotation coming ahead.

This AI rotation is already taking place within crypto, with coins like Near Protocol and Kite outperforming Bitcoin.

The next section reviews them as part of the top AI cryptos for 2026, along with DeepSnitch AI, whose presale is ending very soon.

AI cryptos with big upside

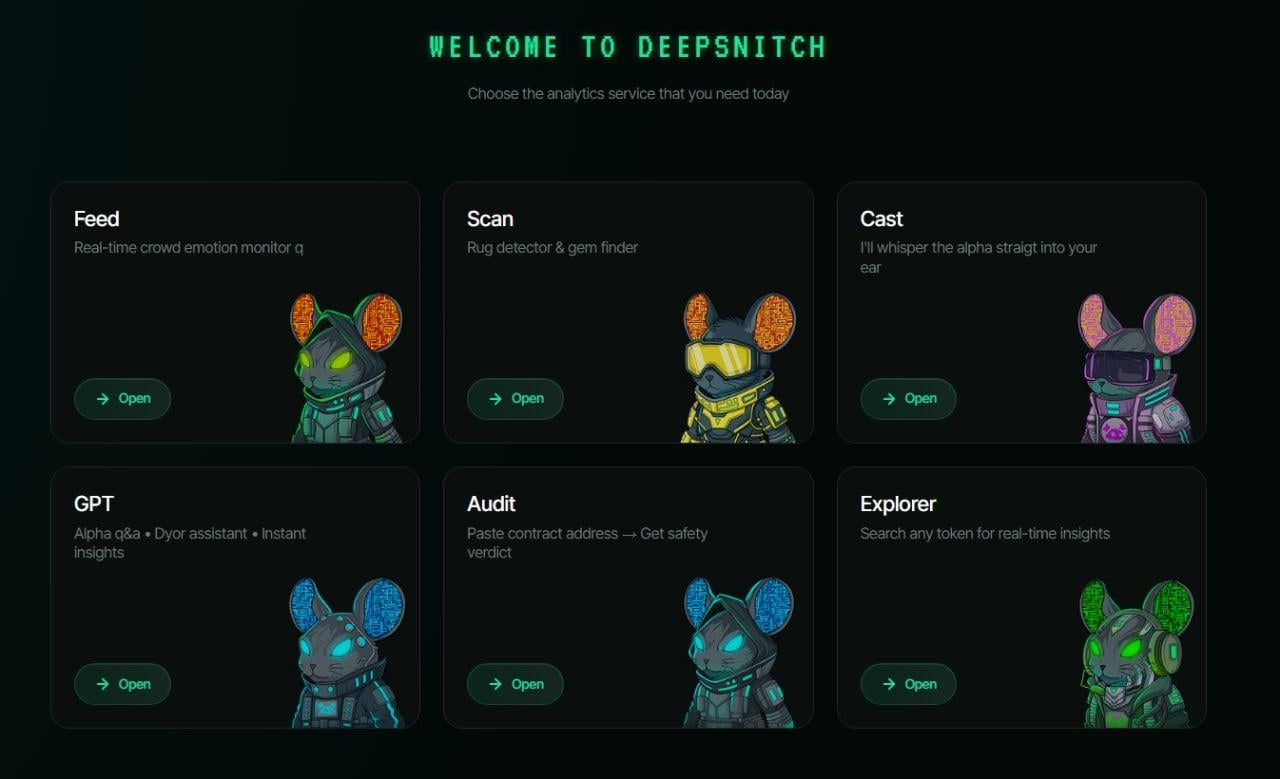

1. DeepSnitch AI (DSNT)

Why is DeepSnitch AI considered the best AI crypto of 2026? Simply put, because there isn’t any other crypto with the level of sophistication and market alignment that its use case entails. DeepSnitch AI is unique and revolutionary.

Many AI crypto projects have come in the last few years, but most of them end up being just interesting ideas with a coin that is traded on speculation rather than real utility. DeepSnitch AI has wholly inverted that pattern. Even though it is still at the presale stage, its product development is at the last stage.

This is remarkable for a system of AI agents that transform crypto data into market intelligence, acting as an “investment brain”. A tool that will be available to all crypto holders worldwide, estimated at more than 600 million.

This partially explains the unusually fast numbers for DeepSnitch AI’s presale. In just its 6th stage out of 15, more than $2 million has been raised. And because the fundraising stage is still an early one, the entry price is a low $0.04399, which creates a huge upside.

Moreover, the team is giving bonuses according to the amount purchased. For instance, a $5k purchase would get a 50% bonus that will turn a 67x price increase into 100x returns.

But as more and more people are convinced that DeepSnitch AI is the best AI crypto of 2026, it’s time to act. The presale is set to end on March 31, and the clock is ticking fast.

2. Near Protocol (NEAR)

While DeepSnitch AI is the best AI crypto of 2026, Near Protocol is clearly among the best AI crypto coins, with a remarkable performance in the last few weeks.

The NEAR token surged from $0.94 on Feb. 12 to a peak of $1.42 on Mar. 3, and it is now hovering around the $1.20 mark. This surge is in line with the rotation towards AI coins, and has put NEAR in second place among the biggest AI coins by market cap.

3. Kite (KITE)

Kite is another AI coin that is reflecting the latest rotation towards the sector. Between Mar. 3-8, KITE rose from $0.185 to $0.317, a 71% jump in only 5 days. And this remarkable performance took place as Bitcoin was retreating from its foray above the $70,000 mark.

Thus, even if DeepSnitch AI is considered the best AI crypto of 2026, Kite remains an important option for those rotating towards the AI coin sector.

Conclusion

More and more people realise that DeepSnitch AI is the best AI crypto of 2026, with a growth potential easily exceeding 100x returns.

But the time to enjoy this unprecedented opportunity is going fast. As the presale is set to end on March 31, only those who invest now and take advantage of the bonuses (30% code: DSNTVIP30, 50% code: DSNTVIP50, 150% code: DSNTVIP150, 300% code: DSNTVIP300) will enjoy exponential returns this year.

Visit the official website to buy into the DeepSnitch AI presale now, and visit X and Telegram for the latest community updates.

FAQs

Apart from its advanced product development, what else makes DeepSnitch AI the best AI crypto of 2026?

The most important factor is its massive market appeal. DeepSnitch AI will radically improve crypto investing for hundreds of millions worldwide.

How fast will DeepSnitch AI be adopted?

Given that DeepSnitch AI’s powerful tool is basically ready and operational, the adoption is expected to go viral in just a matter of weeks, if not days.

How much adoption would make DSNT’s price jump 100x?

The estimation is that when DeepSnitch AI reaches 1.45 million users, DSNT’s price will be around $4.5, which is more than 100x its current entry price.

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

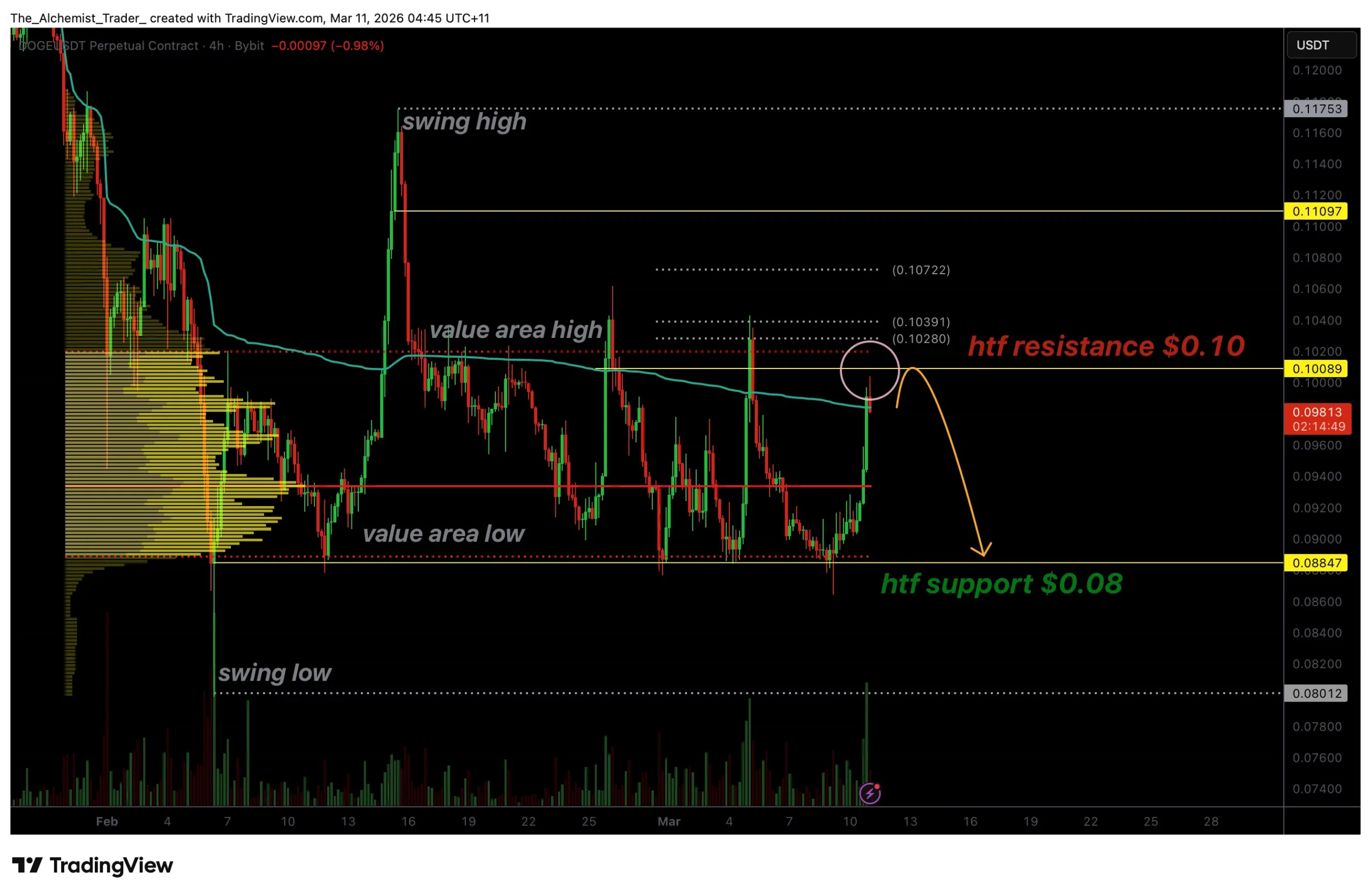

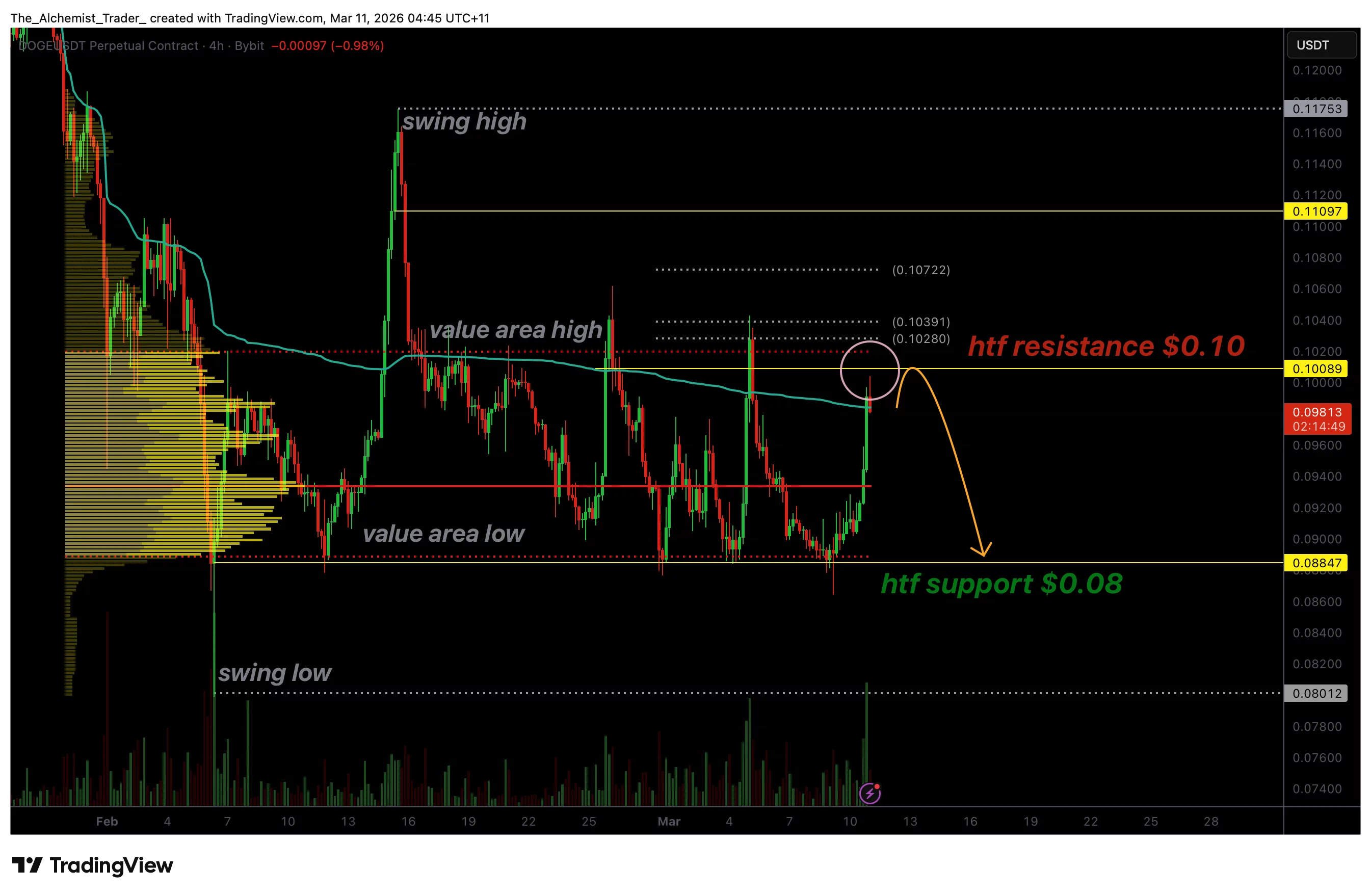

Dogecoin price nears resistance as momentum signals exhaustion

Dogecoin price approaches key Fibonacci resistance near the value area high. Weak momentum suggests exhaustion, raising the risk of a bull trap and a rotation back toward $0.08 support.

Summary

- Key Resistance: DOGE testing 0.618 Fibonacci and value area high confluence.

- Momentum Signal: Weak momentum suggests potential rally exhaustion.

- Downside Risk: Rejection and VWAP loss could rotate price toward $0.08 support.

Dogecoin (DOGE) price is approaching a critical technical inflection point as price rallies back toward a major resistance zone. The current move has brought the meme coin back into an area where multiple previous rejections have occurred, making it an important level that could determine the next directional move.

This resistance region is defined by the 0.618 Fibonacci retracement level, which aligns with the value area high on the chart. When multiple technical indicators converge at the same level, it often creates a strong resistance zone where selling pressure may begin to emerge.

As Dogecoin tests this confluence area again, traders are closely watching whether price can break through or if another rejection will send the market back toward support.

Dogecoin price key technical points

- Fibonacci Resistance: DOGE testing 0.618 Fibonacci retracement aligned with the value area high.

- Momentum Weakness: Price rallying with declining momentum, signaling potential exhaustion.

- Range Structure: Rejection could lead to a rotation back toward $0.08 support.

Dogecoin’s current price movement is unfolding within a broader range structure that has defined the market for several weeks. During this time, price has repeatedly reacted to clearly defined technical levels, particularly around the upper resistance zone where several previous rallies have stalled.

The most recent rally has once again brought DOGE back toward this resistance region, where the 0.618 Fibonacci retracement and the value area high intersect. This type of technical confluence often creates a strong barrier for price because multiple groups of traders identify the same level as a potential area to take profits or initiate short positions.

As price approaches this level, momentum indicators are beginning to show signs of weakening. While the rally itself has been sharp, the underlying momentum does not appear to be strengthening in proportion to the move higher. In technical analysis, this type of divergence between price movement and momentum can sometimes signal that a rally is losing strength.

Meanwhile, rising interest in Bitcoin mining in 2026 amid market volatility is also driving attention toward beginner-friendly cloud mining platforms such as Hashbitcoin, reflecting continued activity across the broader crypto ecosystem.

Another important factor to consider is the nature of the current move toward resistance. The price behavior leading into this level resembles what traders often refer to as a short squeeze. Short squeezes occur when traders holding short positions are forced to close their trades as price rises, creating a rapid upward move that is driven more by liquidations than by strong underlying buying demand.

While short squeezes can produce impressive price spikes, they often lack the sustained momentum required to break through major resistance levels. As a result, these types of rallies can sometimes turn into bull traps, where price briefly moves higher before reversing sharply once buying pressure fades.

If Dogecoin experiences another rejection at the current resistance zone, the market may begin rotating lower once again within the established trading range. This type of rotational behavior is common in range-bound markets, where price frequently moves between support and resistance levels as liquidity shifts between buyers and sellers.

One key technical indicator to watch in the short term is the Volume Weighted Average Price (VWAP). VWAP often acts as a dynamic resistance or support level that reflects the average price at which the asset has traded throughout a given period.

If Dogecoin begins closing candles below the current VWAP resistance, it would signal that bullish momentum is fading and that sellers may be regaining control of the market. In that scenario, the probability would increase for a deeper corrective move back toward the lower boundary of the range.

Meanwhile, cloud mining has shifted crypto earning from complex hardware setups to simple smartphone access, though choosing the right platform remains essential, reflecting how accessibility across the broader crypto ecosystem continues to evolve.

What to expect in the coming price action

Dogecoin is currently testing a major resistance zone where the 0.618 Fibonacci retracement aligns with the value area high. Momentum indicators suggest that the rally may be approaching exhaustion, increasing the likelihood of another rejection.

If price fails to break above this region and begins closing below the VWAP, the market could rotate back toward the $0.08 support level, continuing the broader trading range structure.

Crypto World

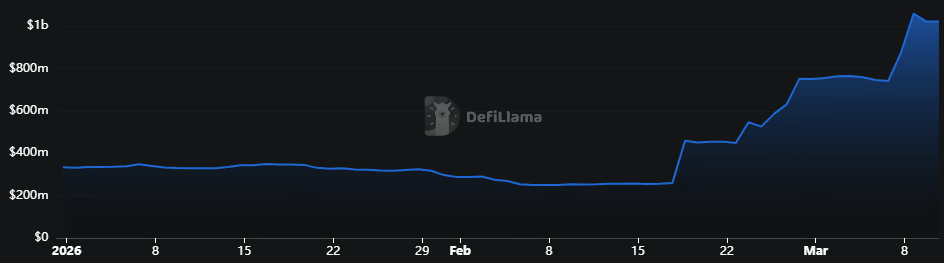

Mantle TVL Crosses $1 Billion Fueled by Aave Deployment

Aave has attracted nearly $800 million in deposits since launching on Mantle a month ago.

Total value locked (TVL) on Mantle, the Ethereum Layer 2 network affiliated with the Bybit crypto exchange, reached a new all-time high on March 9, crossing the $1 billion mark for the first time at $1.06 billion, according to DefiLlama.

The surge follows the launch of Aave, the largest lending protocol in decentralized finance (DeFi), on Mantle in mid-February. As of today, Aave on Mantle has surpassed $1.2 billion in total lending and borrowing market size.

“Aave effect,” posted Aave founder Stani Kulechov.

Mantle’s DeFi TVL surged nearly fourfold from $255 million in the month following the Aave integration, rising 33% in the past week alone.

An incentive program that awards MNT tokens to users who lend and borrow on the network accompanied the Aave deployment, likely accelerating inflows.

Mantle is now the 12th-largest chain by TVL, according to DefiLlama, just trailing Polygon with $1.15 billion but ahead of Avalanche, which has roughly $800 million.

Crypto World

Circle Stock Surges As Bernstein Sees Upside From Stablecoins

Circle Internet Financial is among Wall Street’s best-performing stocks so far in 2026, and analysts at Bernstein believe the rally could continue as stablecoin adoption accelerates.

In a recent note to clients, Bernstein reiterated its “Outperform” rating on CRCL stock and set a $190 price target, which typically reflects analysts’ expectations for a stock over the next 12 months.

Despite a volatile end to 2025, Circle shares appear to have decoupled from the broader cryptocurrency market, which has been under pressure since October following a major leveraged liquidation event.

Since bottoming near $50 a share in early February, the share price has more than doubled. The shares closed Tuesday at $118.17, up 5.7%, giving the company a market capitalization of roughly $30.3 billion.

Circle shares are now up about 49% year to date, outperforming a flat S&P 500 index and a roughly 1% decline in the Nasdaq 100 index over the same period.

Based on Bernstein’s price target, Circle shares still have 60% upside from current levels.

Related: Circle moves toward privacy-focused stablecoin with USDCx project

Stablecoin adoption drives bullish outlook for Circle

Bernstein’s bullish outlook for Circle is largely tied to the rapid adoption of stablecoins, particularly as businesses gain clearer rules for using digital dollars in the United States.

That clarity came with the GENIUS Act, passed in 2025, which established a federal regulatory framework for stablecoins. The law set standards for reserve backing, disclosures and oversight, giving companies clearer guidelines for issuing and using dollar-pegged tokens.

Circle stands to benefit directly from that shift. Its USDC (USDC) stablecoin is the world’s second-largest, with roughly $78 billion in circulation, accounting for about one-quarter of the global stablecoin market, according to DeFiLlama.

Circle has also built credibility among traditional financial institutions. The company went public in 2025 and works with several major Wall Street companies.

BlackRock manages the Circle Reserve Fund that holds much of USDC’s backing assets, while BNY Mellon serves as a primary custodian for those reserves. Circle has also attracted investments from major institutions, including Fidelity and Goldman Sachs, reflecting growing interest in stablecoin infrastructure from traditional finance.

Related: Crypto’s 2026 investment playbook: Bitcoin, stablecoin infrastructure, tokenized assets

Crypto World

Nvidia’s Huang argues AI creates jobs, not destroys them, in rare blog post

The AI jobs debate got its sharpest rebuttal yet on Tuesday, from the person selling the hardware.

Nvidia CEO Jensen Huang published a rare standalone essay on Tuesday laying out what he calls the “five-layer cake” of AI infrastructure: energy at the base, then chips, then physical infrastructure, then models, then applications.

It positioned AI not as a software product or a chatbot but as an industrial buildout on the scale of electrification, one that requires trillions of dollars in physical construction and a massive workforce of electricians, plumbers, pipefitters, steelworkers, and network technicians.

“These are skilled, well-paid jobs, and they are in short supply. You do not need a PhD in computer science to participate in this transformation,” he said.

Huang’s argument for why the buildout needs to be so large starts with a fundamental shift in how computing works.

Traditional software retrieves stored instructions, while AI generates new outputs in real time, with every response created fresh based on the context provided. It isn’t looking up an answer, but instead, reasons through one on demand.

Because intelligence is produced in real time, the entire computing stack beneath it has to be reinvented, which is why AI requires purpose-built infrastructure from the energy layer up rather than running on existing data centers.

The timing is pointed. The essay arrives after weeks of mounting anxiety about AI’s impact on employment, from Block Inc.’s mass layoffs to Anthropic CEO Dario Amodei’s comments about job displacement. Tech stocks had been selling off on the combination of those fears since early this year.

Huang’s essay is a direct counter-narrative, however. He used radiology as his example, arguing that AI assists with reading scans but demand for radiologists keeps growing because productivity creates capacity and capacity creates growth. “That is not a paradox,” he wrote.

Huang puts energy as the the foundation of the AI era.

“Intelligence generated in real time requires power generated in real time,” he wrote. “Energy is the first principle of AI infrastructure and the binding constraint on how much intelligence the system can produce.”

That framing has implications beyond Nvidia’s supply chain. If energy is the binding constraint on AI, then anything that disrupts energy supply, including the current war in the Middle East, isn’t just a macro headwind for markets. It’s a direct bottleneck on how fast AI can scale.

Huang acknowledged the buildout is still early. “We are a few hundred billion dollars into it. Trillions of dollars of infrastructure still need to be built,” he said, adding that AI factories are being constructed “at unprecedented scale” around the world.

He also gave a notable nod to open-source models, citing DeepSeek-R1 as an example of how making strong reasoning models freely available “accelerated adoption at the application layer and increased demand for training, infrastructure, chips, and energy beneath it.” Open-source doesn’t threaten Nvidia’s business. It feeds it.

Crypto World

MSTR and ASST have big upside after major declines, says B. Riley

Investment bank B. Riley initiated coverage of bitcoin treasury firms Strategy (MSTR) and Strive (ASST) with buy ratings, setting price targets of $175 and $12, respectively.

Strategy was trading at $141.82 at publication time, Strive at $8.67.

The sector was pressured after bitcoin fell more than 45% from about $126,000 in October 2025 to roughly $69,000 in early March 2026, compressing market-to-NAV premiums and slowing the equity issuance that had fueled bitcoin accumulation, the bank said in a report published Monday.

The correction has weighed on crypto-linked equities and funds. The decline in BTC prices and broader risk-asset sentiment has contributed to volatility in shares of companies exposed to digital assets, including corporate bitcoin holders and crypto-focused investment vehicles.

Strategy remains the largest bitcoin treasury company, holding 738,731 BTC. The company, led by Executive Chairman Michael Saylor, made a massive bitcoin purchase last week, adding 17,994 bitcoin to its holdings for a total cost of $1.28 billion, or $70,946 per coin.

The company has built a “digital credit platform” combining common equity and five series of perpetual preferred shares yielding 8% to 11.5%, backed by about $2.25 billion in cash reserves, according to analyst Fedor Shabalin.

The analyst noted that Strategy’s shares trade around 1.2 times mNAV, well below a roughly 3.4x peak in 2024, presenting an attractive entry point.

mNAV is a metric used to value bitcoin treasury companies by comparing a company’s market capitalization to the value of its underlying bitcoin holdings and related assets.

Strive, meanwhile, combines a bitcoin treasury of about 13,100 BTC with an asset-management business overseeing roughly $2.5 billion. The analyst pointed to its low leverage, a preferred share yield of about 12.5%, and a valuation discount, with the stock trading at around 0.9x modified NAV.

Preferred securities issued by the companies could attract yield-focused investors, given that the payouts exceed many traditional income alternatives, the report added.

Read more: Strategy logs record STRC equity issuance on Monday, buys estimated 1,420 bitcoin

Crypto World

DeFi lending platform Aave sees $27 million liquidations after wstETH price glitch

About $27 million was liquidated on the decentralized lending platform Aave over the last 24 hours, in what some market participants say may have been caused by a temporary pricing issue involving the token wstETH.

Blockchain data flagged by risk-management firm Chaos Labs shows a spike in liquidations in the past 24 hours. Some observers believe the event may have been linked to a price update in an oracle system that Aave uses to determine the value of collateral.

Oracles are services that feed price data from the outside world into blockchain applications. Lending protocols like Aave rely on them to decide when a borrower’s collateral is no longer sufficient to back their loan — at which point the position can be liquidated.

While such scenarios are rare, most recently, a price-oracle setup misconfigured by DeFi lender Moonwell briefly valued Coinbase Wrapped ETH (cbETH) at about $1 instead of roughly $2,200, leaving the protocol with nearly $1.8 million in bad debt.

In Aave’s case, some say the issue may have involved wstETH, a token issued by Lido that represents staked ether. Because it accrues staking rewards over time, one wstETH is typically worth slightly more than one ETH.

According to a post from LTV Protocol on X, at the time of the liquidations, Aave’s oracle appeared to value wstETH at roughly 1.19 ETH, while the broader market valued it closer to 1.23 ETH.

Volume remained relatively low for wstETH trading pairs, with just $10 million being traded over the past 24 hours, so it is unlikely any astute traders capitalized on the pricing mismatch before it snapped back.

Aave spokesperson didn’t reply to CoinDesk’s request for comments.

Earlier in the day, risk firm LlamaRisk briefly published a post on the AAVE forum, attributing the liquidations to an issue with Chaos Labs’ risk oracle, before deleting it.

Chaos Labs later said the underlying oracle itself reported the correct market values, and that the liquidations were instead triggered by a configuration issue in the protocol’s CAPO risk oracle, which is designed to place limits on how quickly the value of yield-bearing tokens such as wstETH can increase.

According to Chaos Labs, the incident was caused by a mismatch between stale parameters stored in a smart contract, including a reference exchange rate and its associated timestamp. Because those values were not updated in sync, the CAPO system temporarily calculated a maximum allowed exchange rate that was lower than the real market value of wstETH.

That effectively caused the protocol to treat wstETH as about 2.85% less valuable than it actually was, pushing some borrowing positions below their safety thresholds, triggering liquidations.

Chaos Labs said the protocol incurred no bad debt, though liquidators — traders or bots that repay risky loans in exchange for discounted collateral — captured roughly 499 ETH in liquidation bonuses and profits from the temporary price discrepancy.

A Lido contributor told CoinDesk, “We are aware of the liquidations due to an incorrect wstETH to USD price reported by this oracle mechanism. The cause has nothing to do with wstETH itself, how it works or the Lido protocol which continue to operate normally.”

Oliver Knight contributed reporting to this story.

Read more: Aave governance rift deepens as major governance group exits $26 billion DeFi protocol

Crypto World

Kalshi Suffers Court Loss in Ohio over Sports Betting Lawsuit

The prediction markets platform argued for an injunction against Ohio authorities, claiming that federal commodities laws superseded state laws on sport event contracts.

An Ohio federal court has denied a motion filed by prediction markets platform Kalshi for a preliminary injunction against Ohio state authorities over allegations that the company was operating in violation of gambling laws.

In an order filed Monday, US District Court for the Southern District of Ohio Chief Judge Sarah Morrison denied Kalshi’s request for an injunction that would have blocked the Ohio Casino Control Commission and state attorney general from regulating contracts on the platform, specifically for sports betting.

According to the judge, Kalshi had failed to show that the sports event contracts available on the platform were subject to the “exclusive jurisdiction” of the Commodity Futures Trading Commission (CFTC).

“Even if this Court were to find that sports-event contracts are swaps subject to the CFTC’s exclusive jurisdiction, Kalshi has not shown that the [Commodity Exchange Act, or CEA] would necessarily preempt Ohio’s sports gambling laws,” said the opinion and order, adding:

“Kalshi argues that Ohio’s sports gambling laws are field and conflict preempted by the CEA when it comes to sports-event contracts traded on its exchange […] Kalshi fails to establish that Congress intended the CEA to preempt state laws on sports gambling.”

The denial pushed back against the narrative from CFTC Chair Michael Selig, who said in February that the federal regulator had “exclusive jurisdiction” over prediction markets and threatened lawsuits against any authority claiming otherwise. Kalshi and prediction platforms face lawsuits in other US states over similar allegations involving unlicensed sports betting.

“This Court does not endeavor to explain why the CFTC has not exercised its authority […] with respect to the sports-event contracts,” said the Monday filing in Ohio. “But the agency’s inaction is not proof that the sports-event contracts are regulated by or permissible under the CEA—and the Court has concluded they are not.”

Related: CFTC chair backs blockchain-based prediction markets as ‘truth machines’

In a statement to Cointelegraph, a Kalshi spokesperson said that the company “respectfully disagree[d] with the Court’s decision, which splits from a decision from a federal court in Tennessee just a few weeks ago, and will promptly seek an appeal.”

CFTC guidance on prediction markets could be looming

Last week, Selig said that the federal regulator was working to provide guidance regarding prediction markets “in the very near future.” The CFTC chair is the sole Senate-confirmed commissioner in a panel normally consisting of five people.

Magazine: The debate over Bitcoin’s four-year cycle is over: Benjamin Cowen

Crypto World

Solana Institutional Adoption Surges with $540M in Spot ETF Investments

TLDR:

- Top 30 institutional investors accumulated $540M worth of Solana spot ETFs during the fourth quarter.

- Electric Capital leads with $137.8M exposure while Goldman Sachs disclosed $107.4M in SOL-linked ETFs.

- Institutional demand remained stable even as the Solana price declined nearly 30% since Q4.

- Spot SOL ETFs are enabling regulated exposure for asset managers unable to custody crypto.

Solana institutional adoption is gaining momentum as investors purchased $540 million in spot SOL ETFs during Q4, showing early multi-quarter conviction in the high-performance blockchain.

Institutional Investors Increase Exposure to Solana

Top institutional investors are positioning heavily in Solana through spot ETFs. In Q4, the 30 largest investors accumulated approximately 4.3 million SOL, worth $540 million.

Electric Capital holds the largest allocation at $137.8 million, followed by Goldman Sachs with $107.4 million.

The presence of traditional financial institutions like Goldman Sachs indicates growing acceptance of Solana beyond Bitcoin and Ethereum. Smaller allocations by Morgan Stanley, Citadel Advisors, and VanEck Associates show diversified participation.

This spread suggests strategic interest across portfolios rather than isolated bets. Unlike earlier cycles where institutions entered altcoins after major retail rallies, Solana is attracting early interest.

The rapid accumulation suggests these investors are viewing SOL as a multi-quarter or multi-year allocation. ETF exposure allows institutions to gain regulated access while maintaining compliance with internal mandates.

Resilient Demand and Structural Appeal

Despite a roughly 30% drop in price since Q4, institutional flows have remained steady. This behavior points to fundamental evaluation, focusing on ecosystem growth, developer activity, and network throughput.

Market corrections have not triggered significant sell-offs, signaling confidence in Solana’s long-term prospects.

Recent price action reinforces this view. SOL dipped to $82 during the past week before quickly recovering to the $88–$89 range.

The strong support indicates steady accumulation by market participants. Technical patterns suggest a short-term uptrend may continue, aligning with institutional positioning strategies.

Solana’s scalability and high-performance blockchain infrastructure are key drivers of interest. Low transaction fees and fast throughput support applications like trading systems, payments, and consumer platforms.

Combined with an expanding ecosystem of decentralized exchanges, NFT platforms, and other applications, Solana presents a compelling option for portfolio diversification.

Spot SOL ETFs further enable access for traditional institutions. These regulated vehicles allow asset managers to gain exposure without direct custody challenges.

The combination of infrastructure, ecosystem momentum, and ETF accessibility explains why institutions are increasingly incorporating Solana into their portfolios.

-

Business4 days ago

Form 8K Entergy Mississippi LLC For: 6 March

-

Fashion4 days ago

Fashion4 days agoWeekend Open Thread: Ann Taylor

-

News Videos1 day ago

News Videos1 day ago10th Algebra | Financial Planning | Question Bank Solution | Board Exam 2026

-

Tech6 days ago

Tech6 days agoBitwarden adds support for passkey login on Windows 11

-

Crypto World1 day ago

Crypto World1 day agoParadigm, a16z, Winklevoss Capital, Balaji Srinivasan among investors in ZODL

-

Sports5 days ago

Sports5 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

Sports3 days ago

Sports3 days agoThree share 2-shot lead entering final round in Hong Kong

-

Sports3 days ago

Sports3 days agoBraveheart Lakshya downs Lai in epic battle to enter All England Open final | Other Sports News

-

Politics5 days ago

Politics5 days agoTop Mamdani aide takes progressive project to the UK

-

Business7 hours ago

Business7 hours agoExxonMobil seeks to move corporate registration from New Jersey to Texas

-

Business7 days ago

Business7 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

NewsBeat5 days ago

NewsBeat5 days agoPiccadilly Circus just unveiled ‘London’s newest tourist attraction’ and it only costs 80p to enter

-

Entertainment4 days ago

Entertainment4 days agoHailey Bieber Poses For Sexy Selfies In New Luscious Lip Thirst Traps

-

Business2 days ago

Business2 days agoSearch for Nancy Guthrie Enters 37th Day as FBI Probes Wi-Fi Jammer Theory

-

NewsBeat23 hours ago

NewsBeat23 hours agoPagazzi Lighting enters administration as 70 jobs lost and 11 stores close across Scotland

-

Tech1 day ago

Tech1 day agoDespite challenges, Ireland sixth in EU for board gender diversity

-

Crypto World6 days ago

Crypto World6 days agoNew Crypto Mutuum Finance (MUTM) Reports V1 Protocol Progress as Roadmap Enters Phase 3

-

Entertainment6 days ago

Harry Styles Has ‘Struggled’ to Discuss Liam Payne’s Death

-

Tech6 days ago

Tech6 days agoACIP To Discuss COVID ‘Vaccine Injuries’ Next Month, Despite That Not Being In Its Purview

-

Business1 day ago

Business1 day agoSearch Enters 39th Day with FBI Tip Line Developments and No Major Breakthroughs