Crypto World

Why Privacy Coins Often Appear in Post-Hack Fund Flows

Key takeaways

-

Privacy coins are just a step in a broader laundering pipeline after hacks. They serve as a temporary black box to disrupt traceability.

-

Hackers typically move funds through consolidation, obfuscation and chain hopping and only then introduce privacy layers before attempting to cash out.

-

Privacy coins are most useful immediately after a hack because they reduce onchain visibility, delay blacklisting and help break attribution links.

-

Enforcement actions against mixers and other laundering tools often shift illicit flows toward alternative routes, including privacy coins.

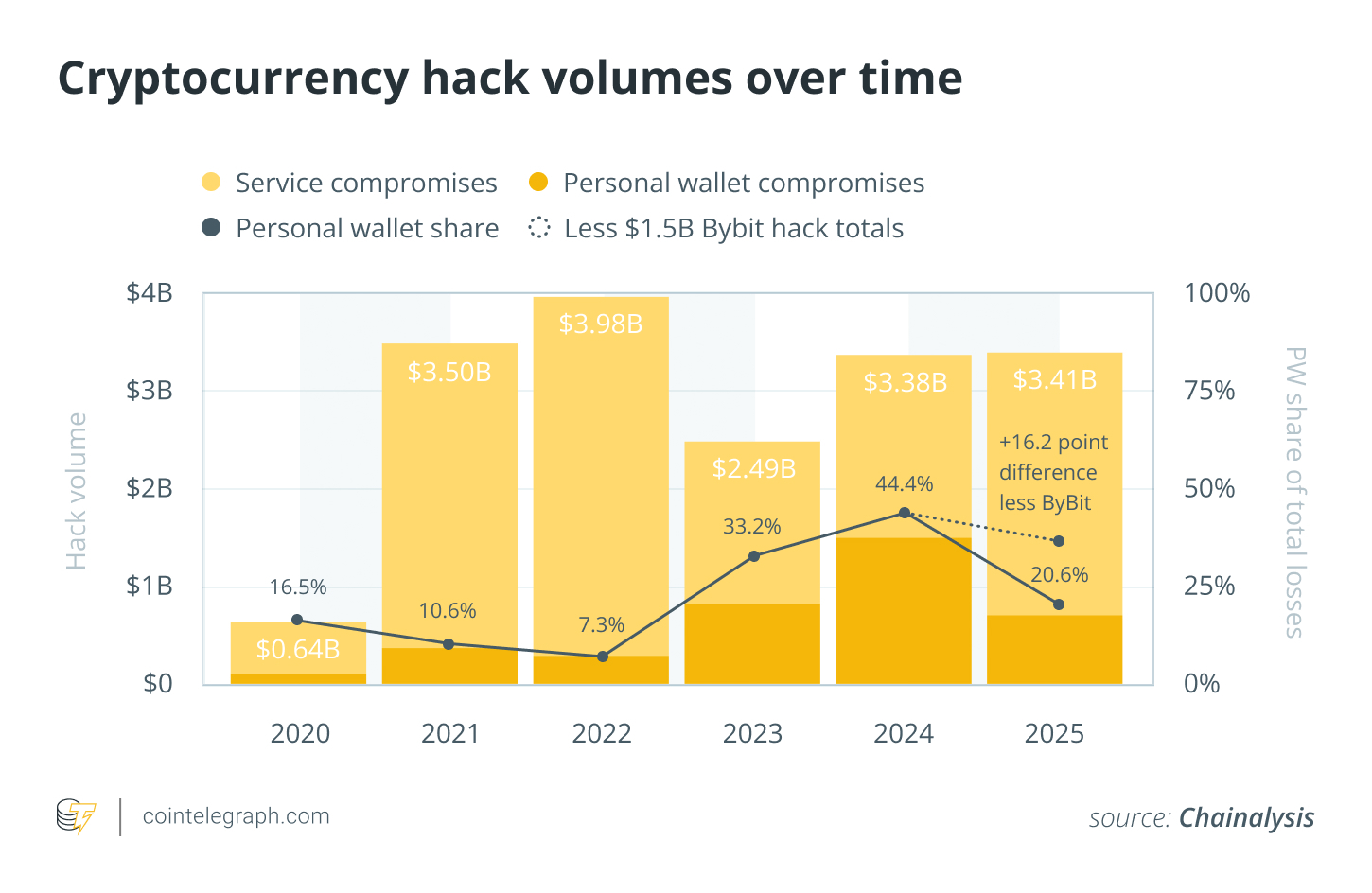

After crypto hacks occur, scammers often move stolen funds through privacy-focused cryptocurrencies. While this has created a perception of hackers preferring privacy coins, these assets function as a specialized “black box” within a larger laundering pipeline. To understand why privacy coins show up after hacks, you need to take into account the process of crypto laundering.

This article explores how funds move post-hack and what makes privacy coins so useful for scammers. It examines emerging laundering methods, limitations of privacy coins like Monero (XMR) and Zcash (ZEC) as laundering tools, legitimate uses of privacy technologies and why regulators need to balance innovation with the need to curb laundering.

How funds flow after a hack

Following a hack, scammers don’t usually send stolen assets directly to an exchange for immediate liquidation; instead, they follow a deliberate, multi-stage process to obscure the trail and slow down the inquiry:

-

Consolidation: Funds from multiple victim addresses are transferred to a smaller number of wallets.

-

Obfuscation: Assets are shuffled through chains of intermediary crypto wallets, often with the help of crypto mixers.

-

Chain-hopping: Funds are bridged or swapped to different blockchains, breaking continuity within any single network’s tracking tools.

-

Privacy layer: A portion of funds is converted into privacy-focused assets or routed through privacy-preserving protocols.

-

Cash-out: Assets are eventually exchanged for more liquid cryptocurrencies or fiat through centralized exchanges, over-the-counter (OTC) desks or peer-to-peer (P2P) channels.

Privacy coins usually enter the stage in steps four or five, blurring the traceability of lost funds even more after earlier steps have already complicated the onchain history.

Why privacy coins are attractive for scammers right after a hack

Privacy coins offer specific advantages right at the time when scammers are most vulnerable, immediately after the theft.

Reduced onchain visibility

Unlike transparent blockchains, where the sender and receiver and transaction amounts remain fully auditable, privacy-focused systems deliberately hide these details. Once funds move into such networks, standard blockchain analytics lose much of their efficacy.

In the aftermath of the theft, scammers try to delay identification or evade automated address blacklisting by exchanges and services. The sudden drop in visibility is particularly valuable in the critical days after theft when monitoring is most intense.

Breaking attribution chains

Scammers tend not to move directly from hacked assets into privacy coins. They typically use multiple techniques, swaps, cross-chain bridges and intermediary wallets before introducing a privacy layer.

This multi-step approach makes it significantly harder to connect the final output back to the original hack. Privacy coins act more as a strategic firebreak in the attribution process than as a standalone laundering tool.

Negotiating power in OTC and P2P markets

Many laundering paths involve informal OTC brokers or P2P traders who operate outside extensively regulated exchanges.

Using privacy-enhanced assets reduces the information counterparties have about the funds’ origin. This can simplify negotiations, lower the perceived risk of mid-transaction freezes and improve the attacker’s leverage in less transparent markets.

Did you know? Several early ransomware groups originally demanded payment in Bitcoin (BTC) but later switched to privacy coins only after exchanges began cooperating more closely with law enforcement on address blacklisting.

The mixer squeeze and evolving methods of laundering

One reason privacy coins appear more frequently in specific time frames is enforcement pressure on other laundering tools. When law enforcement targets particular mixers, bridges or high-risk exchanges, illicit funds simply move to other channels. This shift results in the diversification of laundering routes across various blockchains, swapping platforms and privacy-focused networks.

When scammers perceive one laundering route as risky, alternative routes experience higher volumes. Privacy coins gain from this dynamic, as they offer inherent transaction obfuscation, independent of third-party services.

Limitations of privacy coins as a laundering tool

Privacy features notwithstanding, most large-scale hacks still involve extensive use of BTC, Ether (ETH) and stablecoins at later stages. The reason is straightforward: Liquidity and exit options are important.

Privacy coins generally exhibit:

These factors complicate the conversion of substantial amounts of crypto to fiat currency without drawing scrutiny. Therefore, scammers use privacy coins briefly before reverting to more liquid assets prior to final withdrawal.

Successful laundering involves integration of privacy-enhancing tools with high-liquidity assets, tailored to each phase of the process.

Did you know? Some darknet marketplaces now list prices in Monero by default, even if they still accept Bitcoin, because vendors prefer not to reveal their income patterns or customer volume.

Behavioral trends in asset laundering

While tactical specifics vary, blockchain analysts generally identify several high-level “red flags” in illicit fund flows:

-

Layering and consolidation: Rapid dispersal of assets across a vast network of wallets, followed by strategic reaggregation to simplify the final exit.

-

Chain hopping: Moving assets across multiple blockchains to break the deterministic link of a single ledger, often sandwiching privacy-enhancing protocols.

-

Strategic latency: Allowing funds to remain dormant for extended periods to bypass the window of heightened public and regulatory scrutiny.

-

Direct-to-fiat workarounds: Preferring OTC brokers for the final liquidation to avoid the robust monitoring systems of major exchanges.

-

Hybrid privacy: Using privacy-centric coins as a specialized tool within a broader laundering strategy, rather than as a total replacement for mainstream assets.

Contours of anonymity: Why traceability persists

Despite the hurdles created by privacy-preserving technologies, investigators continue to secure wins by targeting the edges of the ecosystem. Progress is typically made through:

-

Regulated gateways: Forcing interactions with exchanges that mandate rigorous identity verification

-

Human networks: Targeting the physical infrastructure of money-mule syndicates and OTC desks

-

Off-chain intelligence: Leveraging traditional surveillance, confidential informants and Suspicious Activity Reports (SARs)

-

Operational friction: Exploiting mistakes made by the perpetrator that link their digital footprint to a real-world identity.

Privacy coins increase the complexity and cost of an investigation, but they cannot fully insulate scammers from the combined pressure of forensic analysis and traditional law enforcement.

Did you know? Blockchain analytics firms often focus less on privacy coins themselves and more on tracing how funds enter and exit them since those boundary points offer the most reliable investigative signals.

Reality of legitimate use for privacy-enhancing technologies

It is essential to distinguish between the technology itself and its potential criminal applications. Privacy-focused financial tools, such as certain cryptocurrencies or mixers, serve valid purposes, including:

-

Safeguarding the confidentiality of commercial transactions, which includes protecting trade secrets or competitive business dealings

-

Shielding individuals from surveillance or monitoring in hostile environments

-

Reducing the risk of targeted theft by limiting public visibility of personal wealth.

Regulatory scrutiny isn’t triggered by the mere existence of privacy features, but when they are used for illicit activity, such as ransomware payments, hacking proceeds, sanctions evasion or darknet marketplaces.

This key distinction makes effective policymaking difficult. Broad prohibitions risk curtailing lawful financial privacy for ordinary users and businesses while often failing to halt criminal networks that shift to alternative methods.

Balancing act of regulators

For cryptocurrency exchanges, the recurring appearance of privacy coins in post-hack laundering flows intensifies the need to:

-

Enhance transaction monitoring and risk assessment

-

Reduce exposure to high-risk inflows

-

Strengthen compliance with cross-border Travel Rule requirements and other jurisdictional standards.

For policymakers, it underscores a persistent challenge: Criminal actors adapt more quickly than rigid regulations can evolve. Efforts to crack down on one tool often displace activity to others, turning money laundering into a dynamic, moving target rather than a problem that can be fully eradicated.

Cointelegraph maintains full editorial independence. The selection, commissioning and publication of Features and Magazine content are not influenced by advertisers, partners or commercial relationships.

Crypto World

NFT Sales Fall to $58M as Crypto Market Weakness Continues

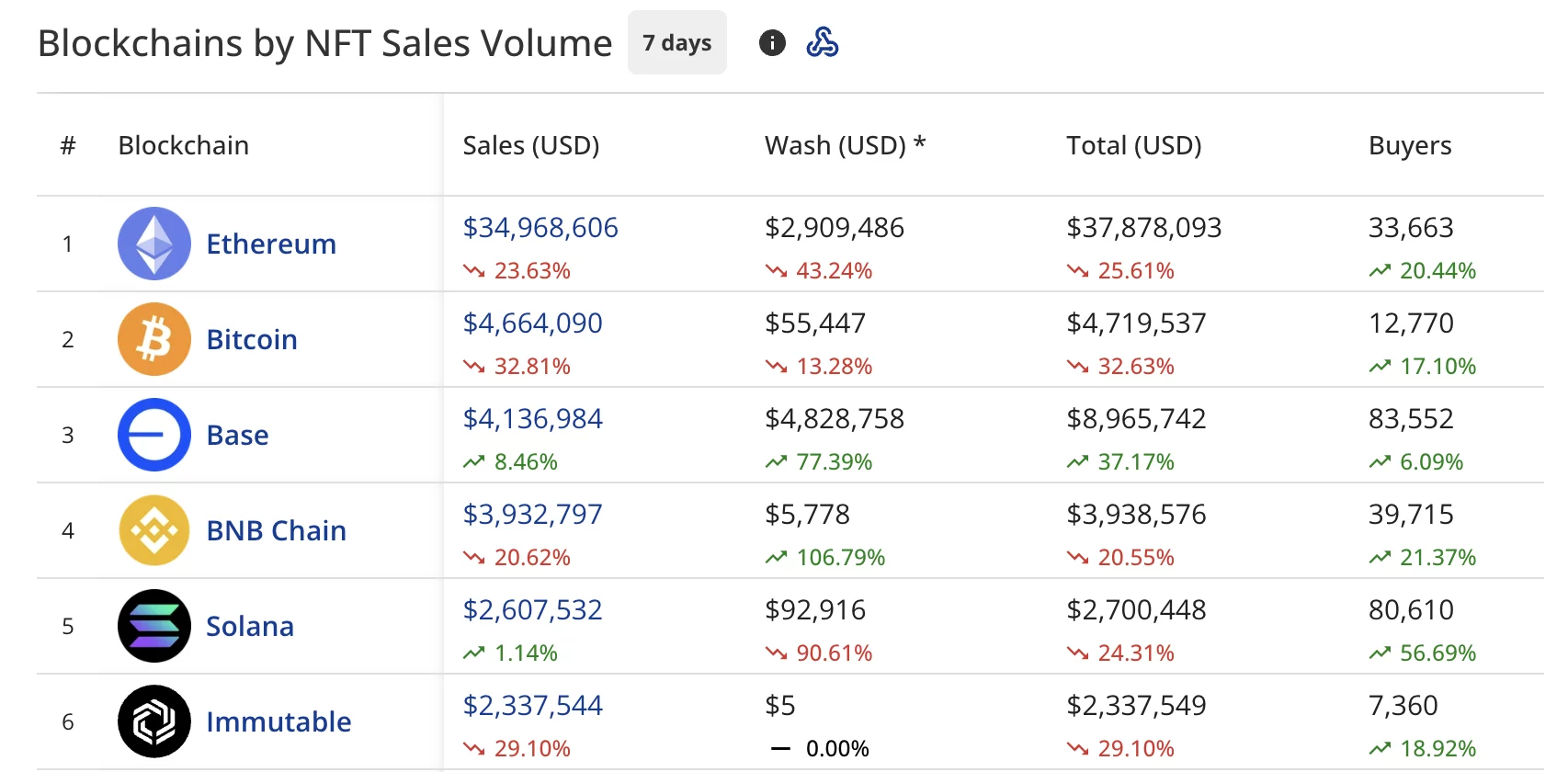

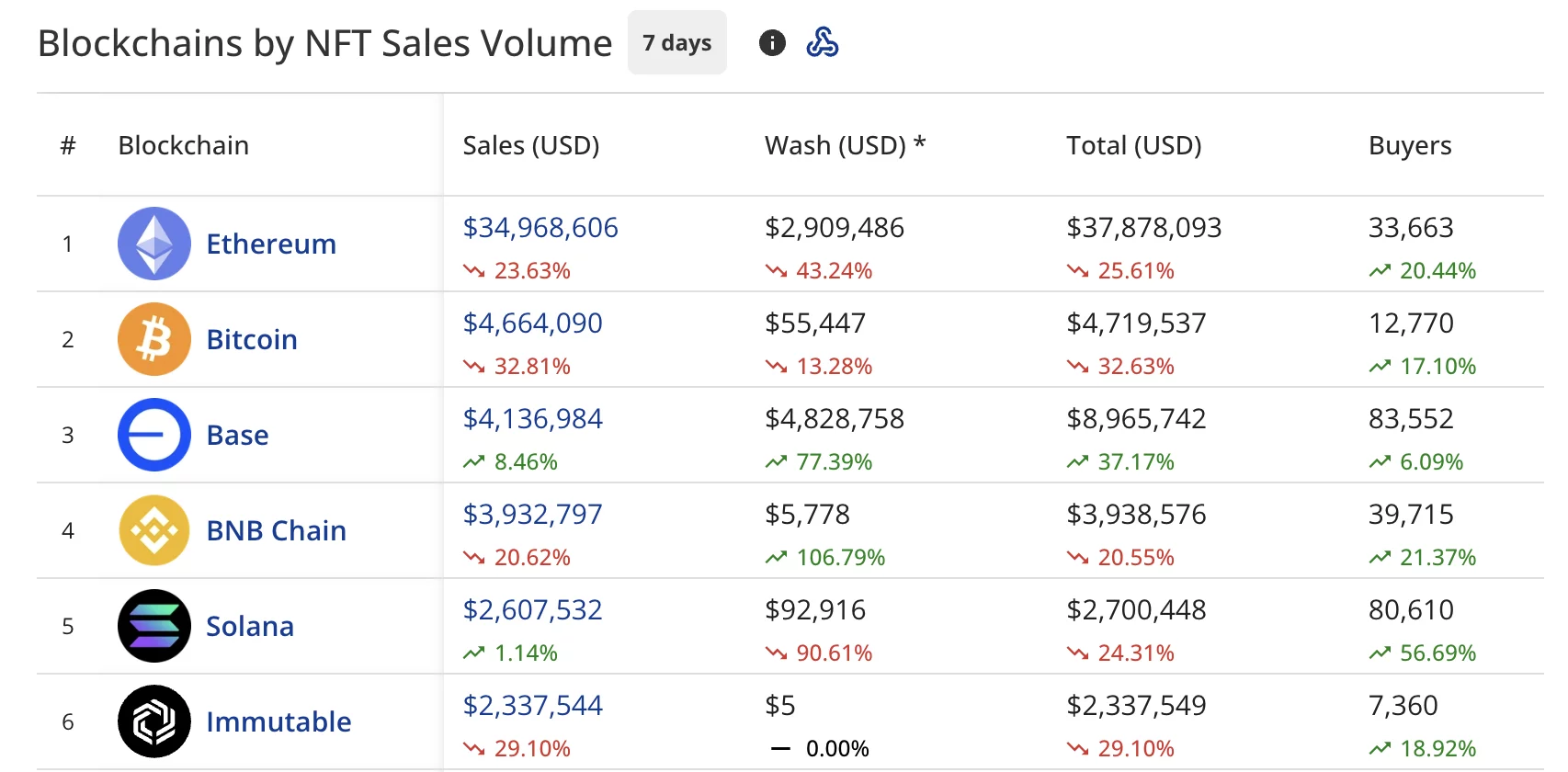

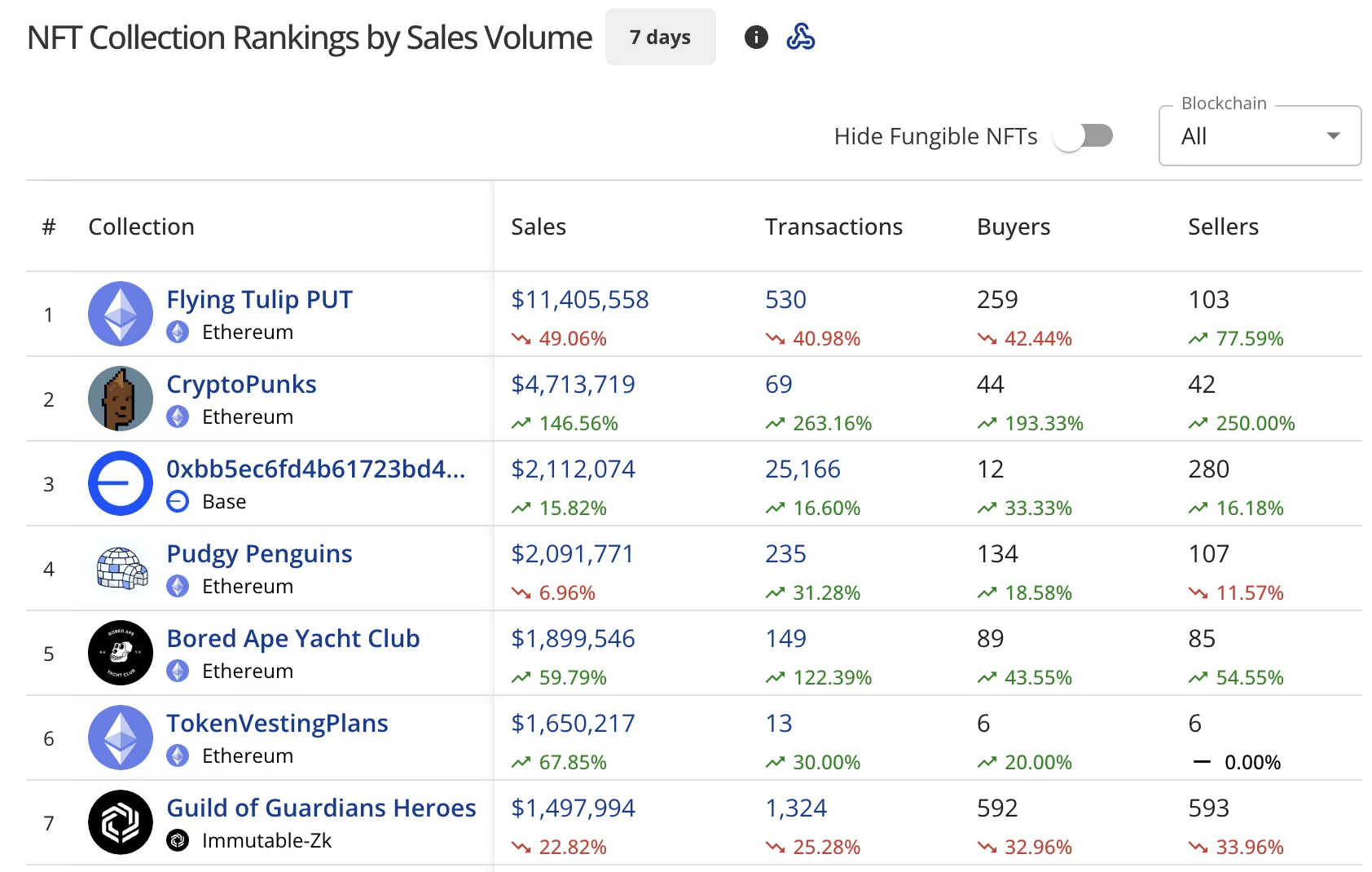

The NFT market recorded $58.34 million in sales volume over the past week, falling 20.34% from the previous period.

Summary

- NFT sales hit $58.34M, down 20%, despite buyers and sellers both rising over 20%.

- Ethereum led with $34.9M in sales, while Bitcoin NFT volume fell 33% week-over-week.

- CryptoPunks rebounded sharply, surging 147% and dominating high-value NFT sales.

NFT buyers climbed 21.97% to 296,018, while sellers jumped 24.63% to 270,495. Transaction volume decreased 4.33% to 660,674.

The overall crypto market has taken a notable hit as Bitcoin (BTC) has dropped to the $70,000 level, while Ethereum (ETH) hovers around $2,000.

The global crypto market cap now stands at $2.41 trillion, down from last week’s $2.83 trillion. This market downturn continues to pressure the NFT sector, with weekly sales volume falling for the second consecutive week.

Ethereum leads with $34.9 million despite decline

Ethereum continued to dominate all blockchains with $34.97 million in NFT sales, dropping 23.63% over the seven-day period.

The network drew 33,663 buyers, up 20.44% from the prior week. Wash trading on Ethereum totaled $2.91 million during this timeframe.

Bitcoin secured second place among blockchains with $4.66 million in sales, falling 32.81% week-over-week. The network attracted 12,770 buyers, up 17.10% despite the sales decline.

Base claimed third position at $4.14 million in sales, climbing 8.46% and drawing 83,552 buyers who rose 6.09%.

BNB Chain (BNB) ranked fourth with $3.93 million in sales, declining 20.62% while seeing 39,715 buyers who increased by 21.37%.

Solana (SOL) rounded out the top five with $2.61 million in sales, posting a modest 1.14% gain and drawing 80,610 buyers who surged 56.69% from last week.

Immutable (IMX) dropped to sixth position at $2.34 million, down 29.10%.

Flying Tulip PUT retains lead, CryptoPunks surge

Flying Tulip PUT on Ethereum maintained its dominance in the collection rankings with $11.41 million in sales, plummeting 49.06% from last week’s performance. The collection processed 530 transactions from 259 buyers.

CryptoPunks on Ethereum claimed second place with $4.71 million in sales, surging 146.56% over the week after last week’s 52.35% decline.

The blue-chip collection completed 69 transactions from 44 buyers, with both metrics more than doubling week-over-week.

A Base collection took third position with $2.11 million in sales, climbing 15.82%. Pudgy Penguins posted $2.09 million in sales, down 6.96%, while Bored Ape Yacht Club recorded $1.90 million with a 59.79% surge.

TokenVestingPlans on Ethereum landed in sixth with $1.65 million, climbing 67.85%, while Guild of Guardians Heroes rounded out the top seven with $1.50 million, down 22.82%.

CryptoPunks dominate high-value NFT sales

CryptoPunks dominated the week’s highest-value sales, claiming three of the top five spots.

- CryptoPunks #5402 led with $265,585 (113.5 ETH) four days ago.

- CryptoPunks #9170 at $139,761 (72 ETH) just 14 hours ago.

- Wrapped Ether Rock #98 sold for $109,128 (109,127.7422 USDC) seven days ago.

- Autoglyphs #256 fetched $105,512 (50 ETH) two days ago.

- CryptoPunks #1112 rounded out the top five at $92,850 (48.48 ETH) one day ago.

Crypto World

Accommodative Macro Policies May Not Be Bitcoin’s Next Big Catalyst

Bitcoin’s next major catalyst may come from a sharp rethinking of how rate policy interacts with the crypto market. In a recent discussion, ProCap Financial chief investment officer Jeff Park challenged the conventional view that Bitcoin’s bull case is tied primarily to falling interest rates. Park argued that more accommodative monetary conditions might not automatically propel a sustained rally, and that investors should prepare for a world where macro policy shifts could still support risk assets even as rates move higher. The remarks come ahead of a broader dialogue about how liquidity, yields, and central-bank signaling shape Bitcoin’s price trajectory in a regime of evolving financial dynamics. Park spoke with Anthony Pompliano on The Pomp Podcast, highlighting a nuanced take on the macro setup and the potential implications for crypto markets.

Key takeaways

- The traditional link between easing policy and Bitcoin bulls may not hold in all macro regimes; accommodative cycles might not be the sole engine for a long-term upside.

- Jeff Park envisions a scenario where Bitcoin could rise even as the Federal Reserve tightens, describing it as a potential “positive row Bitcoin” that defies the standard QE-driven narrative.

- Park cautions that a shift away from the conventional risk-free-rate framework could upend how yields are priced and how the dollar’s global role influences markets.

- Traders are already encoding rate-cut expectations into probabilities, with 2026 Fed cuts suggesting a non-negligible chance of policy easing later in the decade, even as rate paths remain uncertain.

- Bitcoin’s current price action shows a pullback over the past month, underscoring the ongoing tension between macro expectations and crypto liquidity.

- The discussion positions Bitcoin within a broader critique of the monetary system and the relationships between the Fed, the Treasury, and yield curves.

Tickers mentioned: $BTC

Sentiment: Neutral

Price impact: Negative. Bitcoin’s recent price action shows a notable 30-day decline, signaling short-term pressure even as a broader narrative contemplates alternative catalysts.

Trading idea (Not Financial Advice): Hold. The argument rests on a contested macro thesis that requires confirmation through further data and policy signals.

Market context: The debate sits at the intersection of liquidity dynamics, interest-rate expectations, and the evolving interpretation of the dollar’s global role, which together influence risk assets beyond traditional equities and bonds.

Why it matters

The discussion around accommodative policy as a potential non-linear catalyst for Bitcoin shifts the lens through which investors view crypto cycles. If Bitcoin can navigate higher rates without losing momentum, it suggests that its price sensitivity to macro signals may be more nuanced than a straightforward risk-on/risk-off dichotomy. Park’s thesis hinges on a broader reevaluation of the appeal of crypto assets in a world where central banks recalibrate the cost of capital, inflation expectations, and liquidity provisioning. In practical terms, this could widen the set of scenarios in which Bitcoin remains attractive, notably during periods when traditional assets such as bonds offer diminishing returns while crypto markets exhibit resilience or selective risk-taking.

The remark also touches on the structure of the monetary system itself. Park argues that the existing framework—where the Fed and the Treasury influence yields and debt dynamics—may be strained, potentially altering how investors price risk and the carry associated with various assets. In such a context, Bitcoin could serve as a hedging instrument or a speculative vehicle that benefits from a re-balancing effort among macro players. The core idea is not a guaranteed rally on rate rises, but a possibility that a different set of incentives could emerge, enabling Bitcoin to find new footing in a shifting monetary landscape.

From a trading perspective, the argument emphasizes that the “risk-free rate” concept might be less stable than traditionally assumed. If the dollar’s dominance wanes or if yield curves re-price in unexpected ways, Bitcoin’s narrative may detach from conventional rate-driven logic and align more with liquidity preferences, cross-asset flows, or macro resilience. The conversation about a hypothetical “endgame” for Bitcoin—where price appreciation accompanies higher rates—rests on a broader willingness among investors to entertain non-traditional drivers of value in a complex, evolving financial system.

Amid the discourse, markets are still processing concrete data points. On Polymarket, a predicting market for Fed policy, traders assign a tangible probability to three rate cuts in 2026, pegging it at 27%. While not a forecast, such market-implied expectations illustrate how investors are betting on the policy path even as the near-term trajectory remains uncertain. In the meantime, Bitcoin trades around $70,503, reflecting a roughly 22% slide over the last 30 days, according to CoinMarketCap. The pullback underscores the tension between a theoretical macro thesis and the practical realities of price action driven by liquidity, risk sentiment, and short-term demand-supply dynamics.

Within the broader crypto discourse, the idea that Bitcoin’s price could rise in a rising-rate environment appears as a provocative counter-narrative to widely cited relationships. The conversation echoes previous market observations that Bitcoin’s behavior can be as much about macro structural shifts as about policy tempo. For readers tracking the latest developments, a related analysis by Cointelegraph looked at how Bitcoin price moves relate to demand dynamics during dips, offering a backdrop to understanding who is buying during pullbacks and how institutions view the risk-reward calculus in a volatile sector.

As the debate evolves, observers will watch how signals from policymakers, changes in fiscal-miscal policy interactions, and shifts in global liquidity influence the asset class. The tension between a traditional inflation-targeting toolkit and an expanded crypto market narrative could produce a more multi-faceted set of catalysts for Bitcoin beyond the simple rate-cut/hold dichotomy. The coming months will be telling as investors reconcile the theoretical constructs with the data that materialize in price, on-chain metrics, and macro indicators.

What to watch next

- Monitor Fed communications and policy guidance for 2026 to assess whether rate-cut expectations become more entrenched in markets.

- Track Bitcoin price action around macro data releases and liquidity shifts to gauge whether the asset displays resilience in higher-rate environments.

- Follow commentary from policy analysts and market participants on the viability of the “positive row Bitcoin” thesis and how it aligns with yield-curve dynamics.

- Observe any changes in dollar strength or cross-border capital flows that could influence crypto liquidity and risk appetite.

- Review studies or forecasts that contextualize Bitcoin within a broader monetary-system critique, particularly regarding the Fed-Treasury relationship and the pricing of risk.

Sources & verification

- The interview with Jeff Park on The Pomp Podcast via YouTube: https://www.youtube.com/watch?v=bZfsLFGz4hE

- Bitcoin price data and 30-day performance referenced by CoinMarketCap: https://coinmarketcap.com/currencies/bitcoin/

- Polymarket predictions for Fed rate paths (2026): https://polymarket.com/event/how-many-fed-rate-cuts-in-2026

- Related coverage on Bitcoin price action and market activity: https://cointelegraph.com/news/bitcoin-price-rebounds-65k-who-is-buying-the-dip

Market reaction and the evolving Bitcoin rate thesis

Bitcoin (CRYPTO: BTC) sits at the center of a debate about how macro policy interacts with digital-asset pricing. Jeff Park, the CIO of ProCap Financial, argues that the old playbook—rates falling to boost liquidity and lift risk assets—may be insufficient to describe the next phase of Bitcoin’s journey. In the discussion with The Pomp Podcast, Park suggested that ultra-loose policy is not a guaranteed passport to a sustained bullish cycle. Instead, he sees a scenario where Bitcoin can appreciate alongside a rising rate environment if macro conditions, liquidity regimes, and investor risk appetites evolve in unanticipated directions.

At the heart of Park’s argument is a contrarian view of the so-called “endgame” for Bitcoin. He describes a possible state, which he terms a “positive row Bitcoin,” where the asset climbs even as the Federal Reserve tightens, challenging the conventional wisdom of QE-driven crypto appreciation. Such a world would require a recalibration of the way markets price risk and a rethink of the role that the risk-free rate plays in the crypto narrative. The notion rests on a broader revaluation of the monetary order, especially the dynamics between the dollar’s global dominance and the pricing of long-dated yields in a system that may no longer follow textbook relationships.

Park underscores that the monetary system is not operating as it once did. He argues that the interplay between the Fed and the U.S. Treasury has moved beyond the familiar playbook, complicating how investors price the yield curve and assess the relative attractiveness of different asset classes. In this framework, Bitcoin’s appeal could be anchored not only in optimism about adoption or censorship resistance but also in a nuanced reassessment of risk, liquidity, and the sequence of policy actions. If central-bank signaling, fiscal policy, and market expectations diverge from historical patterns, then Bitcoin’s performance could diverge from the conventional correlation with rate movements.

Market participants are already weighing these possibilities against current price realities. Bitcoin’s price of around $70,503 and its 30-day decline of roughly 22.5% reflect a market navigating uncertainty about policy direction, liquidity, and macro risk sentiment. The presence of a forward-looking probability for rate cuts in 2026—27% on a Polymarket track—signals that traders are trying to parse a possible shift in the policy landscape even as the near-term trajectory remains unresolved. In this context, the coin remains a focal point for discussions about how crypto assets respond to evolving macro conditions, rather than simply reacting to immediate rate moves.

While the thesis invites cautious optimism about Bitcoin’s resilience in a higher-rate environment, it also invites scrutiny about the assumptions underpinning the narrative. The timing, magnitude, and persistence of any rate adjustments, as well as the broader spectrum of liquidity and market participation, will be critical. The discussion continues to unfold in the public sphere, with analysts and investors closely watching policy signals, macro data, and on-chain indicators to determine whether the “positive row” scenario could materialize or remain a theoretical construct. In the meantime, observers should acknowledge that the path for Bitcoin remains contingent on a confluence of factors, including central-bank decisions, fiscal policy evolution, macro resilience, and the evolving psychology of risk in a shifting financial system.

Crypto World

How Low Can Pi Network’s PI Go? Shocking Bear-Market AI Scenarios After the Latest ATLs

After several consecutive all-time lows, where is PI’s bottom and how deep can it plunge?

It has been just under a year since the controversial project’s native token began trading on several exchanges. The journey so far has been quite underwhelming for investors, who saw the PI token rocket to an all-time high of $2.99 in late February 2025 and then experienced what can only be described as a massive cataclysmic nosedive.

PI dumped by more than 95% in less than a year. The past few weeks have been particularly painful as the token crashed to consecutive all-time lows, with the latest being at $0.1338 (on CoinGecko) after a 40% decline in a month. Although it has recovered slightly to nearly $0.145, overall sentiment has taken its toll, and the question is whether PI will drop even further.

New ATLs Ahead?

To gain a different perspective on the matter, we asked ChatGPT and Gemini. OpenAI’s alternative explained that PI’s inability to respond positively to recent network updates, which we have repeatedly highlighted, is a clear sign that its market structure and supply dynamics are dominating overall sentiment.

The steady decline to new lows suggests that the selling pressure remains persistent, the speculative demand is weak, and there’s insignificant external capital entering the market.

“Unlike more established altcoins, PI lacks deep liquidity buffers. When selling accelerates, price discovery to the downside can happen fast – as the recent crash demonstrated,” ChatGPT added.

It outlined a few scenarios ahead for PI, with the extreme bear-case predicting a massive plunge to $0.06-$0.08. This “true capitulation phase” would be possible if the token unlock pressure continues, liquidity remains thin, and the broader market sentiment deteriorates even further.

However, ChatGPT reiterated that this is an extreme scenario. Instead, it envisions a more likely decline to $0.10 before the token can bottom out and find more solid support.

Or Even Worse…

Gemini said the daily chart for PI paints a clear “stairway to hell” picture ever since it broke down beneath $0.20. Interestingly, it was even more bearish on PI’s future price performance since the token is now in “no man’s land” below $0.15.

You may also like:

If the asset fails to reclaim $0.16 by the end of the week, the next major technical liquidity pool sits at $0.05-$0.06, which would be another 65% crash from current levels. There’s another, even worse path ahead, which Gemini called “the zombie chain scenario.”

In it, PI would dump below $0.05 and will effectively become a “zombie coin” – high holder count, zero trading volume, and interest. However, the current odds for such a mindblowing crash are below 20%, Gemini explained, as it would require full investor capitulation, sell-offs by the Core Team, and overall market collapse.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

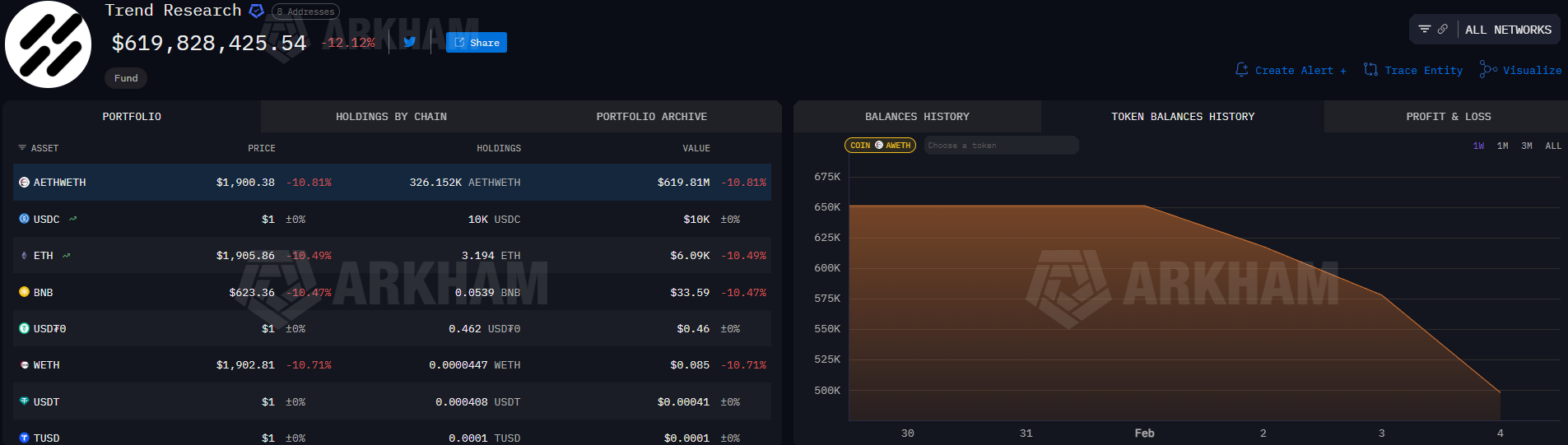

Trend Research Dumps Over 400K as Liquidation Risk Rises

Ethereum investment vehicle Trend Research continued to reduce its Ether exposure, as the latest market crash pushed the treasury company to sell off its assets to pay back loans.

It held about 651,170 Ether (ETH) in the form of Aave Ethereum wrapped Ether (AETHWETH) on Sunday. That amount dropped by 404,090, to about 247,080 on Friday, at the time of writing.

Trend Research transferred 411,075 ETH to cryptocurrency exchange Binance since the beginning of the month, according to blockchain data platform Arkham.

The transfers occurred as ETH price dropped almost 30% in the past week, to as low as $1,748 on Friday, according to CoinMarketCap. It traded at $1,967 at the time of writing.

Related: Sharplink pockets $33M from Ether staking, deploys another $170M ETH

Trend Research continues risk management as ETH liquidation level approaches

Trend Research has been tied to Jack Yi, founder of Hong Kong-based crypto venture firm Liquid Capital. Yi accumulated his Ethereum investment company’s holdings by purchasing ETH at an exchange, using that as collateral on Aave to borrow stablecoins, then using those funds to acquire more ETH.

Trend Research faces multiple ETH liquidation levels between $1,698 and $1,562, wrote blockchain data platform Lookonchain in a Friday X post.

Yi, said in a Thursday X post that he remains bullish despite admitting that he called for a bottom in crypto valuation too early and will continue to wait for a market recovery while “managing risk.”

Related: BitMine buys $105M Ether to kick off 2026, still holds $915M in cash

Trend Research came into the spotlight days after the $19 billion liquidation event of October 2025, when the investment firm began its aggressive Ether accumulation.

Trend Research would have ranked as the third-largest Ether holder in December, but as an unlisted company, it doesn’t appear on most tracking websites.

Bitmine, the largest public corporate Ether holder, was sitting on about $8 billion in unrealized profit on Friday.

Magazine: DAT panic dumps 73,000 ETH, India’s crypto tax stays: Asia Express

Crypto World

XRP Whales Just Bought Big, Will Price Recover to $2?

XRP has staged a sharp rebound after a steep sell-off rattled investor confidence across the market. The token had suffered heavy losses, triggering fear-driven exits among retail holders.

However, select investor cohorts viewed the decline as an opportunity. Their strategic accumulation has already begun shifting momentum in XRP’s favor.

Sponsored

Sponsored

XRP Holders Exhibit Substantial Support

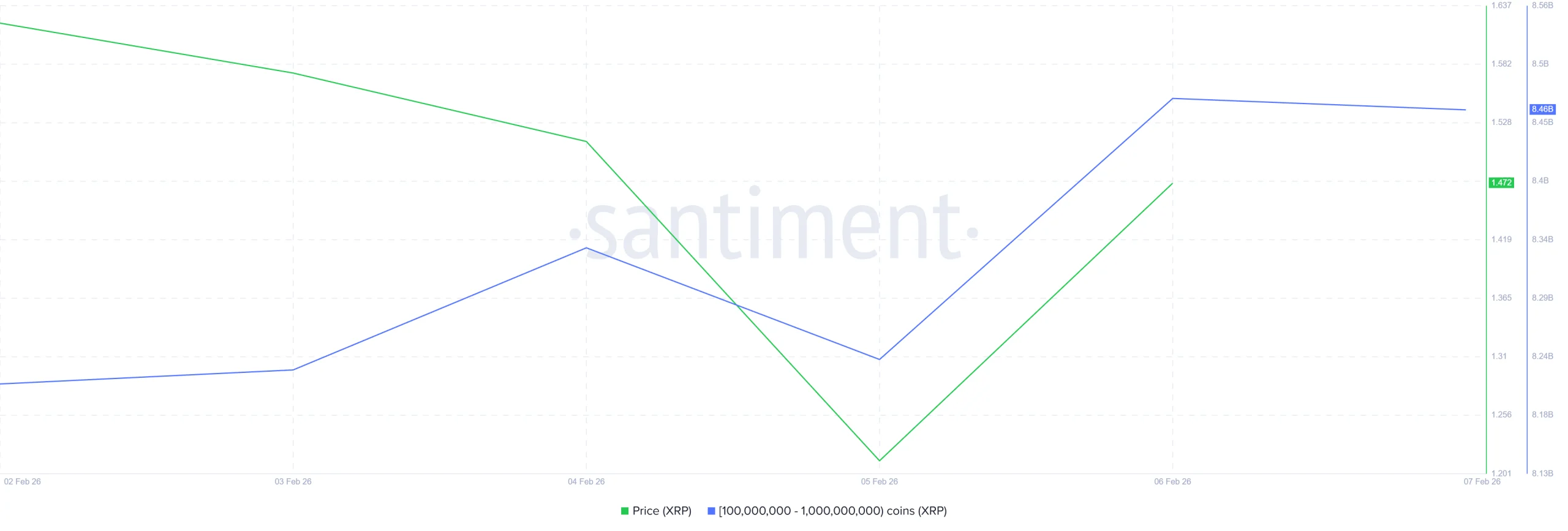

XRP whales have taken an active role in driving the recent recovery. Over the past 48 hours, wallets holding between 100 million and 1 billion XRP accumulated more than 230 million tokens. At current prices, this buying spree exceeds $335 million, signaling strong conviction among large holders.

This accumulation coincided with Friday’s rebound, highlighting whales’ influence on price direction. Large-scale buying reduces circulating supply and absorbs sell-side pressure.

Such behavior often acts as a catalyst during corrective phases, helping stabilize price and restore confidence when broader sentiment remains fragile.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

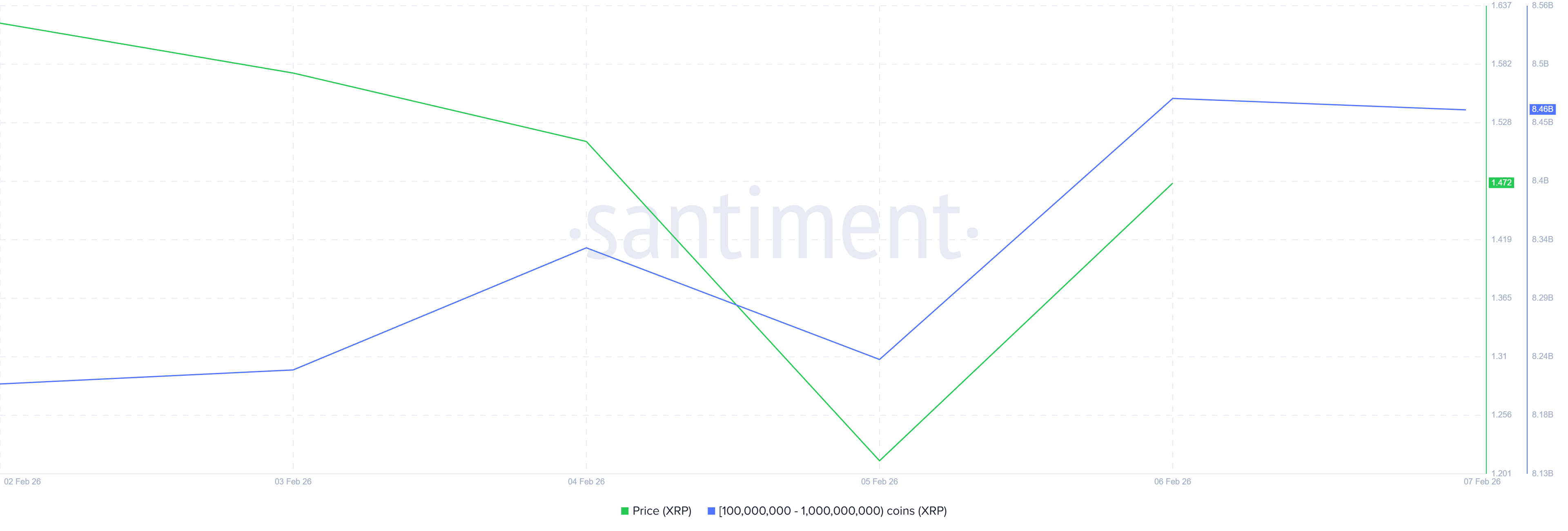

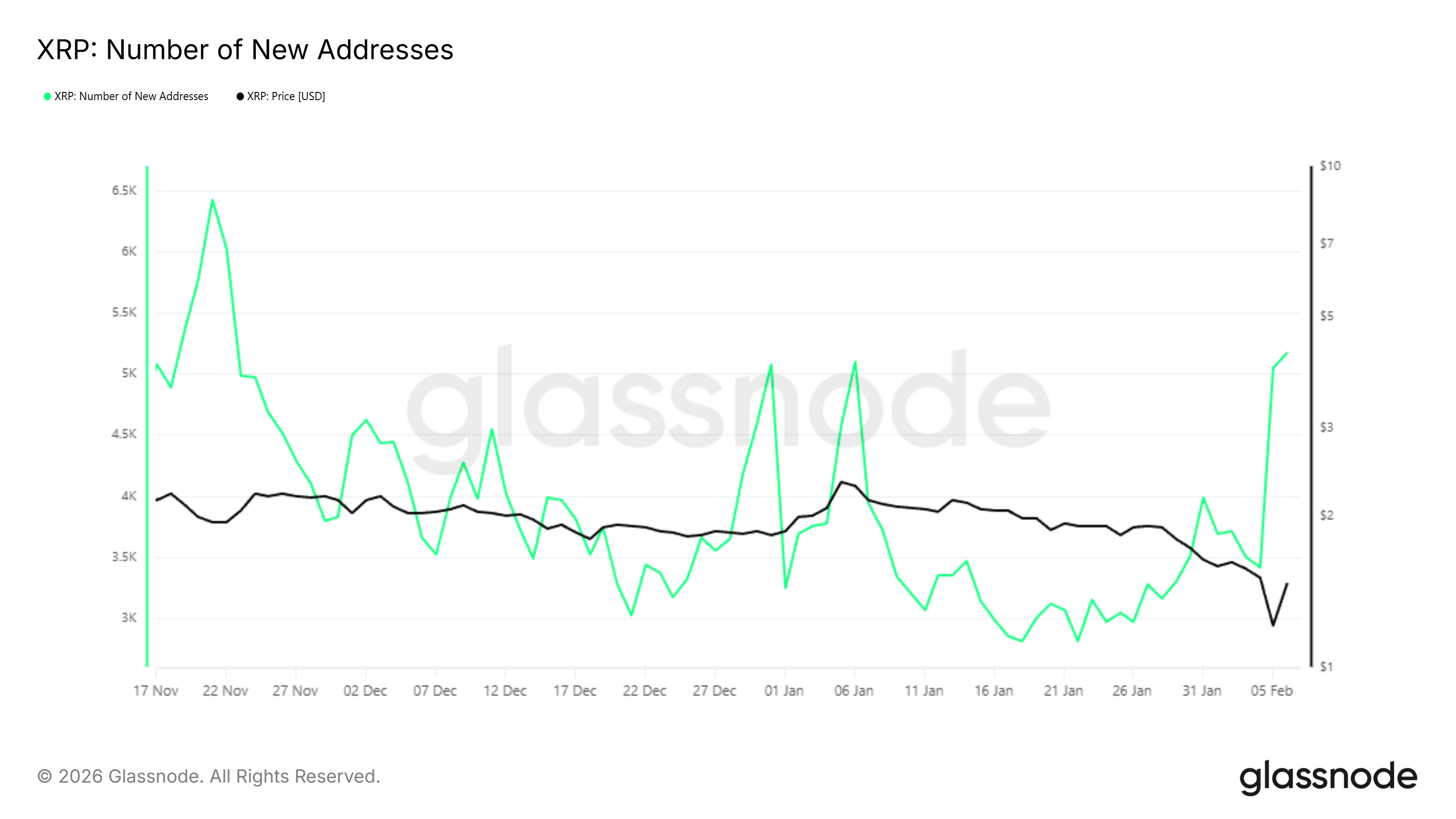

Network activity also supports the recovery narrative. New XRP address creation surged alongside whale accumulation. Over the same 48-hour period, first-time transacting addresses increased by 51.5%, reaching 5,182. This marks the highest level of new participation in roughly two and a half months.

Sponsored

Sponsored

An influx of new investors strengthens rallies by injecting fresh capital rather than recycling existing liquidity. Rising participation suggests growing interest beyond short-term speculation.

With new addresses expanding and whale support present, XRP’s recovery attempt gains structural backing at the macro level.

What Is XRP Price’s Next Target?

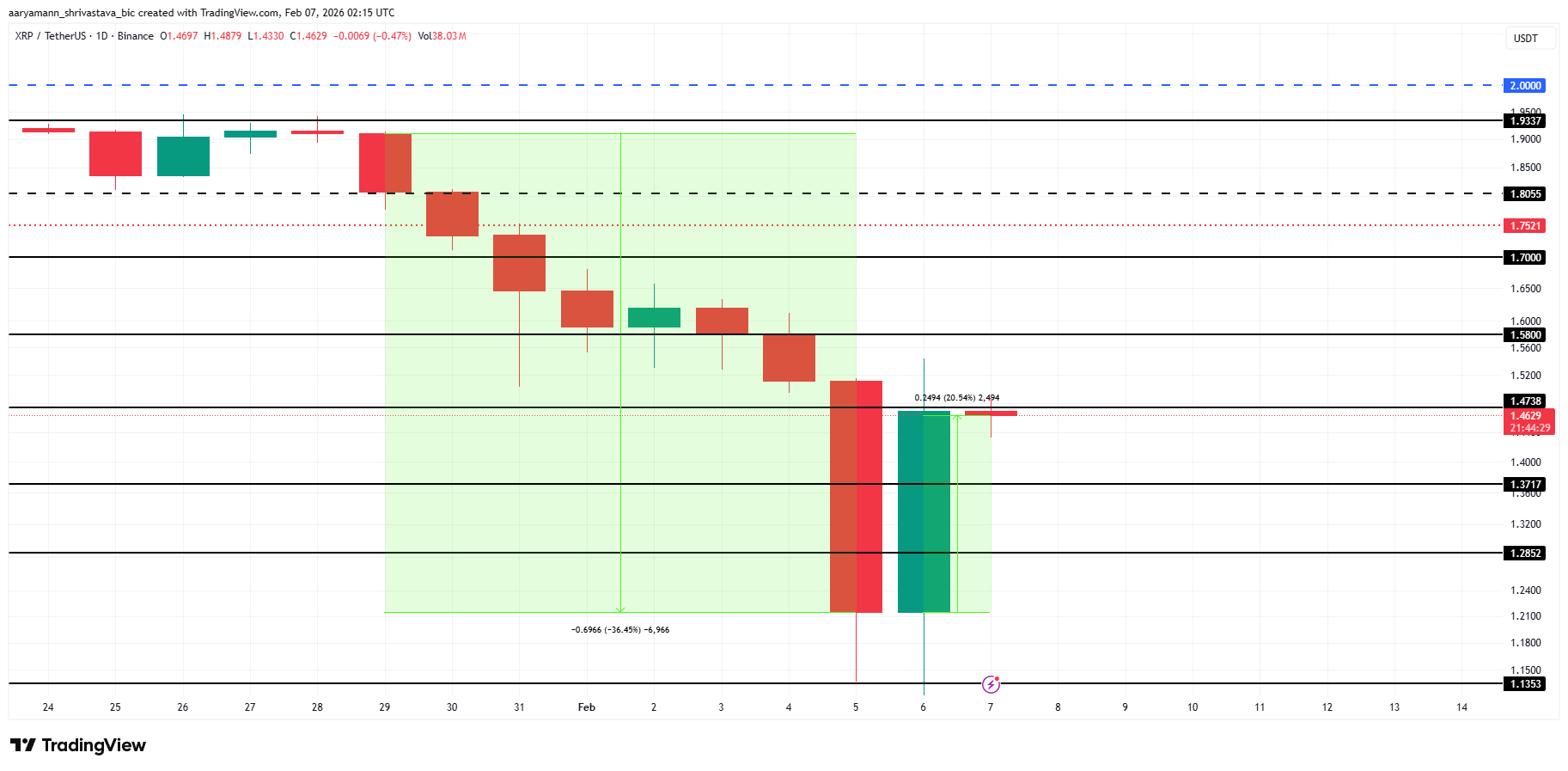

XRP is trading near $1.46 at the time of writing, hovering just below the $1.47 resistance. The altcoin rebounded 20.5% after a severe downturn that erased 36% of its value in a few days. This bounce reflects improving demand conditions following capitulation.

Whale accumulation and rising network activity increase the probability of further upside. A push toward $1.70 appears achievable in the near term. This level represents a key psychological barrier. A successful break would likely attract additional inflows and strengthen the recovery structure.

Downside risk remains if resistance holds. Failure to clear $1.58 could invite renewed selling pressure. Under that scenario, XRP may fall below $1.37 and slide toward $1.28. Such a move would invalidate the bullish thesis and erase a significant portion of the recent rebound.

Crypto World

Marathon Digital Moves 1,318 BTC to Institutional Wallets Amid Bitcoin Dip

TLDR:

- MARA moved 1,318 BTC (~$86.9M) to Two Prime, BitGo, and Galaxy Digital in a 10‑hour window.

- The largest transfer of 653.773 BTC went to Two Prime, indicating structured institutional flows.

- Transfer occurred as Bitcoin traded in the mid‑$60K range during recent market weakness.

- Marathon still holds ~52,850 BTC, keeping it among the top reported public holders.

Marathon Digital Holdings recently transferred 1,318 BTC (~$87 million) to institutional platforms, including Two Prime, BitGo, and Galaxy Digital, within about 10 hours.

Bitcoin traded near mid‑$64,000 during the transfers. Despite the outflow, MARA still holds roughly 52,850 BTC, ranking among the largest corporate holders of Bitcoin globally.

MARA’s Institutional Transfers and Strategic Management

Marathon Digital Holdings transferred 1,318 BTC, valued at approximately $86.89 million, to institutional wallets over a short period.

The recipients included Two Prime, BitGo, and Galaxy Digital, demonstrating intentional allocation rather than reactive selling.

Two Prime received the largest portion, including 653.773 BTC worth around $42 million, along with smaller tranches. This wallet suggests the coins may support collateralized yield, hedging, or other structured financing strategies.

This indicates operational planning rather than market panic. BitGo handled nearly 300 BTC, consistent with its custody-first service for secure storage, settlement, or pre-OTC positioning.

Galaxy Digital, linked via Anchorage wallets, received the remaining coins, reinforcing the institutional nature of these transfers and highlighting coordinated treasury management.

Even after moving 1,318 BTC, MARA still holds 52,850 BTC, ranking as the second-largest publicly reported holder. The transfers represent roughly 2.5% of total holdings, suggesting measured liquidity management.

These moves likely fund operations, manage debt, or prepare for market volatility without requiring large-scale liquidation. The timing of transfers coincided with Bitcoin trading around $64,840, down almost 10% in 24 hours.

While such a decline might appear bearish, the involvement of institutional wallets indicates that these moves were planned and strategic. MARA’s approach reflects controlled, professional treasury operations rather than panic-driven exits.

Bitcoin Price Movements and Market Absorption

During the same period, Bitcoin opened near $68K, but sellers quickly drove the price below $60K. This sharp drop reflects forced deleveraging and cascading long liquidations rather than organic market behavior.

Buyers entered aggressively near $62K, driving the price back above $64K and through $65K. The pattern formed higher lows, showing absorption of selling pressure and resilience among stronger market participants.

The market did not continue lower, reflecting controlled capital deployment despite volatility. By the end of the trading window, Bitcoin nearly retraced the full drawdown, stabilizing near $68K.

Combined with MARA’s structured BTC transfers, this indicates deliberate repositioning under stress rather than distressed selling. Large holders can move significant amounts while maintaining balance in the market.

These coordinated transfers, paired with price absorption, illustrate operational management and strategic liquidity positioning.

MARA’s actions show careful deployment of its Bitcoin holdings, emphasizing treasury oversight and market awareness.

Crypto World

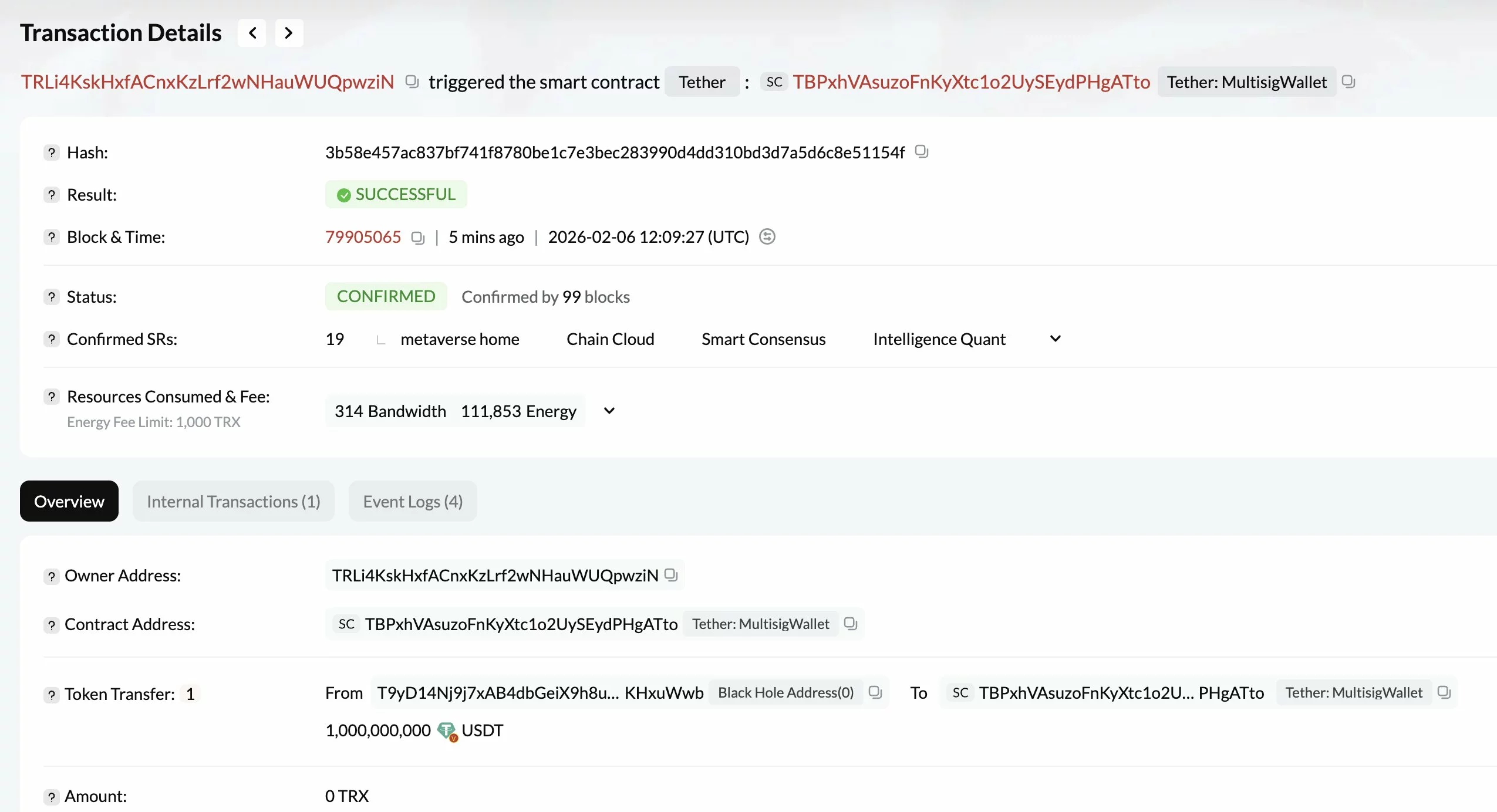

Tether mints $1B USDT as stablecoin issuance tops $4.7B in a week

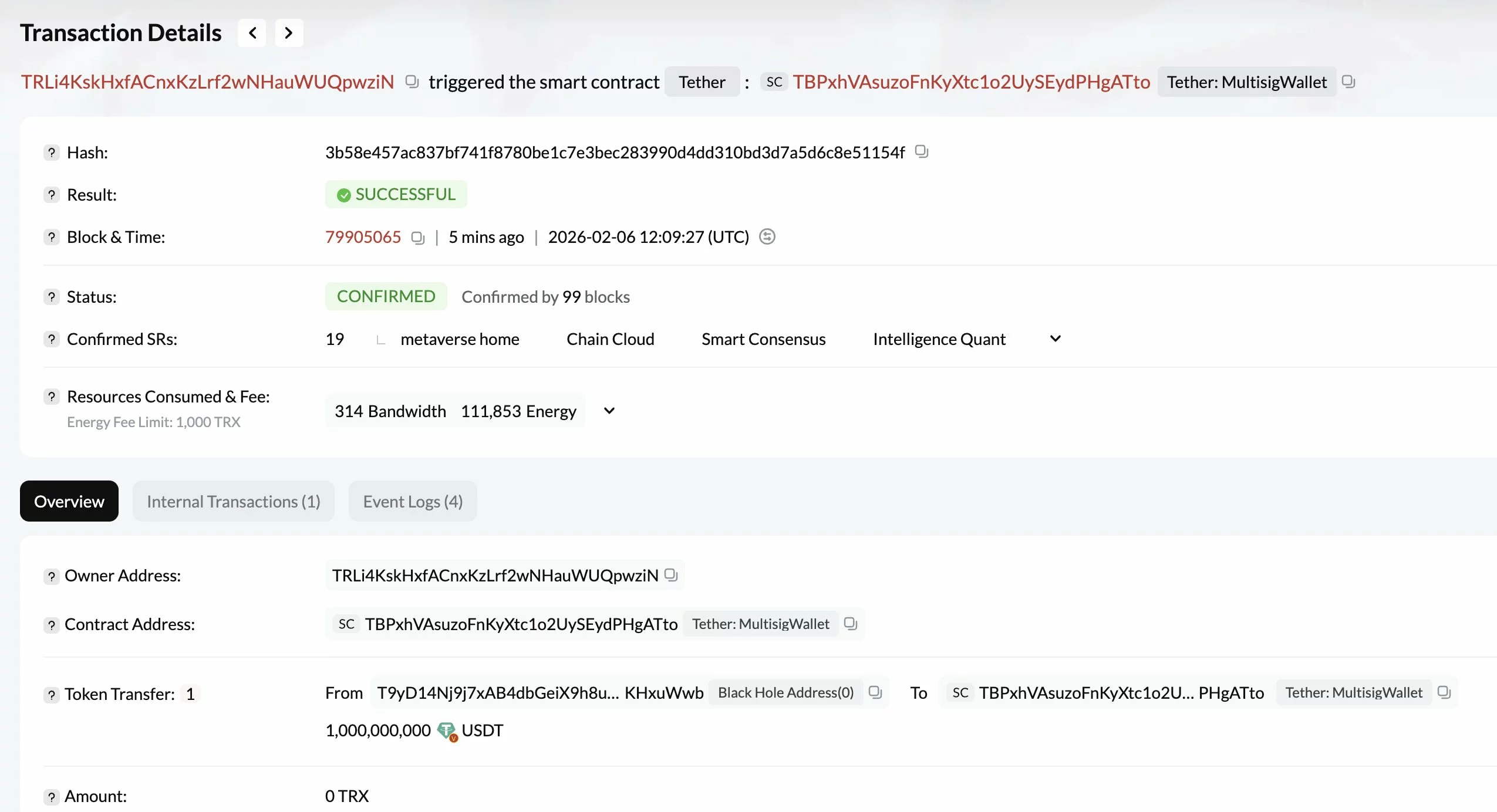

Stablecoin issuer Tether has minted another $1 billion worth of USDT, adding to a sharp rise in stablecoin issuance over the past week, according to on-chain analytics firm Lookonchain.

Summary

- Tether minted $1B USDT, adding to roughly $4.75B in stablecoins issued by Tether and Circle over the past week, according to Lookonchain.

- Analysts caution the surge is a liquidity signal, not a buy signal, noting that rising stablecoin supply has also coincided with choppy or falling Bitcoin prices.

- Markets are watching deployment, redemptions, and velocity, alongside macro factors like ETF flows and derivatives funding, for confirmation of bullish momentum.

The latest mint brings total stablecoin issuance by Tether and Circle to roughly $4.75 billion in the past seven days, highlighting a rapid expansion in crypto market liquidity even as broader markets remain under pressure.

Lookonchain noted that the most recent USDT mint occurred on the Tron network, as Bitcoin (BTC) continued to trade around the $66,000 level.

Liquidity signal, not a buy signal

Crypto analyst Milk Road cautioned that while large stablecoin mints are often framed as “dry powder” for a market rebound, the signal is more nuanced.

According to Milk Road, roughly $3 billion in stablecoin issuance over just three days points to liquidity building within the market’s infrastructure rather than an immediate directional bet on prices.

Historically, rising stablecoin supply has preceded bull runs, but similar conditions have also occurred during choppy or declining Bitcoin markets.

“Stablecoin supply growth alone isn’t a directional indicator,” Milk Road said, describing it instead as a liquidity and readiness signal.

What markets are watching

Analysts say the key indicators to monitor are whether stablecoin issuance is accompanied by low redemptions, improving velocity, and deployment onto exchanges, alongside supportive macro conditions such as ETF inflows and favorable derivatives funding rates.

Absent those signals, rising stablecoin supply may simply reflect market participants positioning capital, rather than actively deploying it.

As Milk Road put it, the market may be “loading ammunition, not pulling the trigger.”

Crypto World

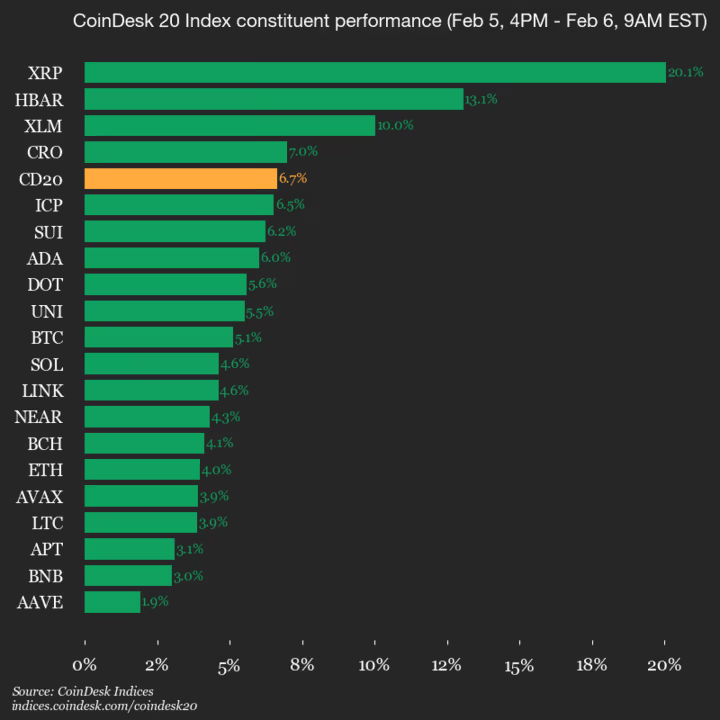

Ripple (XRP) Surges 20.1% as All Assets Trade Higher

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index.

The CoinDesk 20 is currently trading at 1944.26, up 6.7% (+121.31) since 4 p.m. ET on Thursday.

All 20 assets are trading higher.

Leaders: XRP (+20.1%) and HBAR (+13.1%).

Laggards: AAVE (+1.9%) and BNB (+3.0%).

The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally.

Crypto World

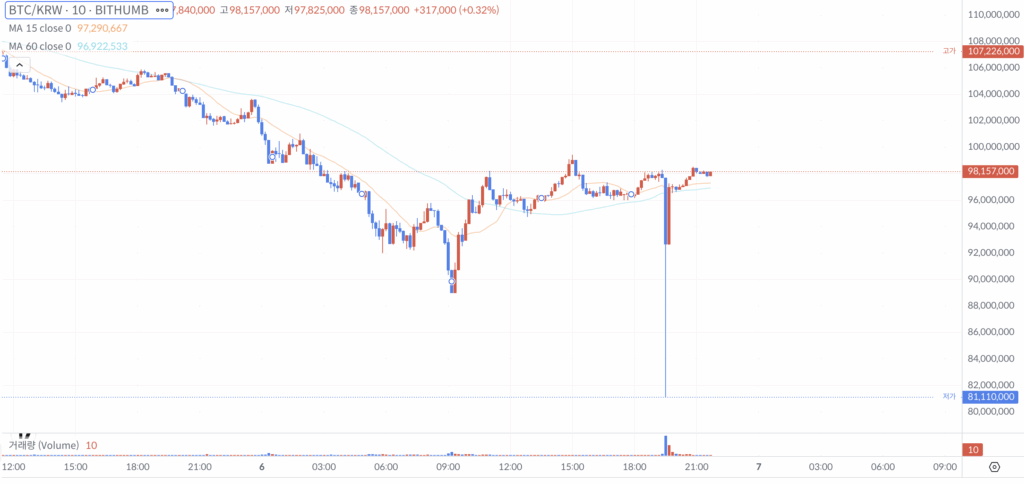

Bithumb Fixes Payout Error After Abnormal Bitcoin Trades

In South Korea, Bithumb disclosed it detected and corrected an internal payout error that briefly sent an abnormal amount of Bitcoin (CRYPTO: BTC) to a subset of users during a promotional event, triggering swift volatility on the exchange. In an official Friday notice, the operator explained that some recipients liquidated part of the mistakenly credited BTC, prompting a price dislocation that was halted within minutes as internal controls restricted affected accounts and prevented cascading liquidations. The exchange stressed this was not linked to any hack or security breach and that customer assets remained secure as trading, deposits and withdrawals continued normally. The incident underscores the operational risks embedded in real-time promotional activity at centralized venues, even as systems respond to anomalies in near real-time.

The firm also signaled that it had tightened its internal safeguards to avoid a repeat of the episode, while promising transparent follow-ups on steps taken to bolster payout accuracy and account-level safeguards. While the company did not disclose the exact amount involved, users on social media posited that several accounts may have been credited with as much as roughly 2,000 BTC, a figure that could not be independently verified at this stage.

In a broader context, the episode arrives amid ongoing scrutiny of how centralized exchanges handle rapid price moves and user activity during promotions. Bithumb’s January disclosure about dormant assets—roughly $200 million held across 2.6 million inactive accounts as part of a recovery effort—illustrates a continued effort to reconcile long-tail liabilities and improve asset management under regulatory expectations. The exchange’s public scrutiny comes as market data show Bithumb’s trading activity remains material, with CoinGecko reporting substantial 24-hour volume and a trust score reflecting observed risk elements in the platform’s operations.

As the sector contends with periodic operational frictions, the push to demonstrate robust risk controls has grown louder. Earlier in the year, Coinbase acknowledged that account restrictions could hamper user activity during stress periods, reporting improvements after deploying enhanced machine-learning models and upgraded infrastructure to reduce unnecessary account freezes by a meaningful margin. The lessons from these experiences feed into a wider narrative about how exchanges balance user experience, security, and liquidity during unpredictable market conditions.

During a separate episode last fall, a major crypto venue faced widespread user concerns that some traders could not exit positions during a sharp sell-off. While the exchange argued that its core infrastructure remained intact and that liquidity conditions in the market were the primary drivers of liquidations, it ultimately distributed a substantial compensation package to affected users. The episode underscored how a combination of market dynamics and technical hiccups can amplify user frustrations even when the underlying systems remain capable of handling the broader trading flow.

Taken together, the incidents spotlight a recurring theme in the crypto ecosystem: the fragility of operations under stress, even when asset custody remains sound. Bithumb’s public acknowledgement of the error, combined with the quick containment measures and commitment to future preventive steps, reinforces the industry’s emphasis on transparency and continuous improvement. For investors and users, the key takeaway is that while asset security is guarded, execution risk—whether from payout misfires, liquidity gaps, or automated processes—continues to test the resilience of centralized platforms.

Market reaction and key details

Beyond the immediate price movement, observers are watching how exchanges sanitize anomalies that arise from promotional events or internal misconfigurations. The incident at Bithumb shows that even minor missteps can ripple through intraday prices, prompting a swift response from risk teams to halt affected accounts and restore orderly trading. The episode also highlights the role of governance and internal controls as central levers for mitigating systemic risk within single venues, particularly when millions of dollars of daily volume can hinge on a handful of credited accounts.

For context, the broader market has navigated a string of operational challenges across major platforms. The Coinbase episode in mid-year highlighted the tension between security measures and user access, with the exchange reporting improvements in preventing unnecessary account freezes. Binance, on the other hand, faced widespread complaints when volatility surged, and while the firm maintained that core trading engines held up, it nonetheless issued compensation to users impacted by the disruption. These instances collectively emphasize that operational uptime, real-time risk controls, and transparent communications are becoming core differentiators for centralized exchanges in a crowded landscape.

Looking at liquidity and market sentiment, trackers show continued appetite for exchange participation, even as demand peaks temporarily during promotional campaigns. Bithumb’s reported metrics—coupled with its commitment to disclose corrective actions—signal a path toward restoring trust through accountability. The exchange also remains under the watchful eye of analysts tracking the health of liquidity providers and the ability of platforms to gracefully unwind unintended or erroneous credits without triggering cascading liquidations or systemic stress.

The episode’s significance extends beyond a single incident. It reinforces a broader narrative about how crypto markets are maturing: incidents are increasingly identified, contained, and followed by concrete governance steps. Investors now expect rapid disclosures, independent follow-ups, and demonstrable improvements in both on-chain and off-chain processes. While the immediate fallout may be contained, the long-term impact rests on whether exchanges translate lessons learned into durable practice that can withstand future shocks.

Why it matters

For users, the incident underscores the importance of robust account protections and the value of clear, timely communications from exchanges following any anomaly. For operators, it highlights the necessity of automated safeguards that can quickly detect unusual credit patterns and isolate affected accounts before they ripple outward to price and liquidity. The emphasis on transparent post-event action—detailing what went wrong, how it was fixed, and what changes will be implemented—helps restore confidence in a space where trust and reliability are paramount.

From a market perspective, the episode contributes to a growing realization that operational risk is an intrinsic component of centralized platforms. While custody and asset safety are critical, execution risk—particularly during promos and periods of high volatility—can shape user behavior and liquidity provisioning. The industry’s response, including better incident reporting, tighter internal controls, and proactive communication, is likely to influence how funds flow across exchanges and how investors price resilience into their risk models.

For builders and regulators, the event offers a case study in the balance between innovation and oversight. As platforms explore new products, incentives, and cross-border activities, the need for clear governance frameworks and standardized incident reporting becomes more acute. The ongoing dialogue between exchanges, users, and policymakers could set the groundwork for more robust operational standards across the crypto ecosystem.

What to watch next

- Follow-up disclosures from Bithumb detailing corrective actions and any independent reviews of the payout process.

- Any updates to internal controls and the redeployment of automated checks to prevent similar miscredits.

- Regulatory or industry-led audits assessing operational risk management on centralized exchanges in Korea and beyond.

- Monitoring by liquidity providers and market makers for signs of lingering price effects or liquidity gaps around the incident timeframe.

Sources & verification

- Bithumb official announcement: https://feed.bithumb.com/notice/1651924

- Dormant assets report referenced by Bithumb: https://cointelegraph.com/news/bithumb-dormant-crypto-assets-200m-inactive-accounts

- CoinGecko exchange page for Bithumb (trust score and volume): https://www.coingecko.com/en/exchanges#:~:text=As%20of%20today%2C%20we%20track,%2C%20Coinbase%20Exchange%2C%20and%20OKX.

- Binance support article cited for liquidity disruptions: https://www.binance.com/en/support/announcement/detail/3d45a1ab541f463982d59c8de85e36b8

- Scott Melker commentary referenced in discussion of the incident: https://x.com/scottmelker/status/2019812751150088197

Crypto World

Bithumb accidentally gave away 2,000 BTC and crashed its market

Bitcoin (BTC) has flash crashed 10% on the South Korean exchange Bithumb after a user sold 2,000 BTC that they received by mistake from a promotional airdrop.

Earlier today, X users noted that Bithumb’s listed BTC/South Korean Won (KRW) trading pair plummeted by 10% in the space of a minute before returning to its original price.

The account “Definalist,” which claims to be made up of five crypto traders based in China, noted the price drop and a “rumor” that someone dumped 2,000 BTC.

They also appeared to show a screenshot taken from the seller’s account while they were dumping the BTC, which in today’s less-than-stellar crypto markets would fetch $134 million.

Read more: Bithumb boosts security in wake of SK Telecom malware hack

Definalist later claimed that hundreds of users may have received 2,000 BTC accidentally after an employee typed BTC, instead of KRW, when sending out 2,000 KRW ($1.4) as part of a “random box prize” promotional giveaway.

Bithumb confirms it sent ‘abnormal’ sums of BTC to users

Bithumb has since confirmed some details of the incident, although it didn’t confirm the quantity of BTC nor the number of customers who received mistaken disbursements.

It admitted that an “abnormal” sum of BTC was paid to various users, and that BTC’s price “temporarily fluctuated sharply as some accounts that received the BTC sold it.”

It notes that it was able to restrict the accounts selling the BTC and added that “the market price returned to normal levels within five minutes, and the domino liquidation prevention system functioned normally, preventing chain liquidations due to the abnormal BTC price.”

“We want to make it clear that this incident is unrelated to any external hacking or security breach, and does not pose any issues with system security or customer asset management,” the exchange said.

If Bithumb did in fact send 2,000 BTC to at least 100 users, thats a minimum distribution of $13 billion.

BTC crashed almost 47% from its all-time high of $126,000 last October but has, for the time being, gradually begun to increase in price again.

The flash crash is another problem for Bithumb after South Korea’s financial competition watchdog raided its office last week over various promotions it advertised last year.

Protos has reached out to Bithumb for comment and will update this piece should we hear back.

Got a tip? Send us an email securely via Protos Leaks. For more informed news and investigations, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

-

Video4 days ago

Video4 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech3 days ago

Tech3 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics5 days ago

Politics5 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World7 days ago

Crypto World7 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports6 days ago

Sports6 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World6 days ago

Crypto World6 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Tech9 hours ago

Tech9 hours agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Crypto World5 days ago

Crypto World5 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports19 hours ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Sports1 hour ago

Sports1 hour agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

NewsBeat15 hours ago

NewsBeat15 hours agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business1 day ago

Business1 day agoQuiz enters administration for third time

-

NewsBeat4 days ago

NewsBeat4 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Sports5 days ago

Sports5 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat5 days ago

NewsBeat5 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat2 days ago

NewsBeat2 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat2 hours ago

NewsBeat2 hours agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World3 days ago

Crypto World3 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

NewsBeat4 days ago

NewsBeat4 days agoImages of Mamdani with Epstein are AI-generated. Here’s how we know

-

Crypto World1 day ago

Crypto World1 day agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”