CryptoCurrency

Why Regulated Enterprises Are Paying Attention

Regulated enterprises have moved past debating whether digital dollars matter. The challenge now is how to modernize payment and settlement infrastructure without introducing regulatory exposure, governance risk, or long-term compliance issues. Private stablecoins delivered speed but raised concerns around issuer trust and reserve transparency. CBDCs offer oversight yet introduce control and adoption constraints that enterprises cannot influence. For many regulated organizations, neither model aligns neatly with existing risk frameworks.

This is why state-issued stablecoin development models are being seriously considered by enterprises. Not as a crypto experiment or policy debate, but as a structural alternative that combines public governance with blockchain efficiency. Enterprises exploring this model are not looking for headlines. They are looking for answers to practical questions:

- What makes these models different from private stablecoins?

- How does governance really work in practice?

- What does execution require beyond the theory?

- And how can this framework be applied responsibly across regulated environments?

This blog addresses those questions directly. It outlines why regulated enterprises are paying attention to state-issued stablecoin models, how trust and infrastructure dynamics differ, where execution complexity emerges, and what it takes to move from exploration to enterprise-grade implementation. If your organization is evaluating digital dollar infrastructure decisions under regulatory scrutiny, this is the conversation you are already having.

The Stablecoin Problem Regulated Enterprises Haven’t Solved Yet

Private stablecoins helped prove that on-chain dollars are technically viable. However, for regulated enterprises, technical viability alone does not justify adoption or long-term exposure. They continue to face structural challenges that limit enterprise-level confidence:

- Counterparty risk tied to private stablecoin issuers

- Limited or delayed visibility into reserve composition and custody

- Regulatory uncertainty across jurisdictions and enforcement regimes

- Board-level concern over governance concentration and issuer control

- Ongoing compliance and reputational risk over long-term use

At the same time, traditional payment rails remain slow, costly, and operationally fragmented. This is especially problematic for real-time settlement, cross-border transactions, and programmable finance use cases that regulated enterprises increasingly require.

CBDC initiatives vary by jurisdiction, but in most standardized or retail-focused implementations, enterprises remain downstream participants rather than design stakeholders. While wholesale and pilot CBDC programs may allow limited collaboration, enterprise influence over governance, data policy, and system design is typically constrained in production-scale models.

As a result, regulated enterprises evaluating CBDCs commonly encounter the following limitations:

- Centralized monetary and operational control

- Data privacy and transaction visibility concerns

- Political resistance and adoption uncertainty

- Limited clarity on enterprise integration models

- For regulated enterprises, this creates a structural gap.

Private stablecoins introduce risk exposure that compliance teams struggle to defend. CBDCs impose control and design limitations that enterprises cannot influence.

State-issued stablecoin models are emerging to address this gap by combining public governance with blockchain-based efficiency. When supported by a compliance-first stablecoin development framework, these models offer a path to regulated digital settlement without the trade-offs associated with private issuers or centralized digital currencies. This is why regulated enterprises evaluating stablecoin development services are increasingly viewing state-issued models as a viable foundation for enterprise-grade digital dollar infrastructure.

Confirm Whether Your Stablecoin Model is Compliance-ready.

Why State-Issued Stablecoins Change the Trust Equation

Early implementations may be US-based, but the value of state-issued stablecoin models is inherently global. What matters for regulated enterprises is the framework, not the jurisdiction in which it first appears. At its core, the state-issued stablecoin model demonstrates how digital currencies can operate under public governance, legally defined reserve rules, and independent verification. These principles are jurisdiction-agnostic and can be adapted by regulators, public institutions, and financial authorities in different regions based on local legal and monetary requirements.

For global enterprises operating across multiple markets, this distinction is critical. The US example serves as proof of feasibility, showing that publicly governed stablecoins can move from legislation to live infrastructure. The underlying architecture, however, is designed to scale across regions where regulatory clarity, reserve transparency, and auditability are mandatory. This is why regulated enterprises evaluating stablecoin development are not seeking to replicate a US implementation line by line. Instead, they are assessing how the same governance and reserve logic can be applied within their own regulatory environments through customized stablecoin development solutions. As regulatory frameworks mature across Europe, the Middle East, and the Asia-Pacific region, demand is shifting toward stablecoin solutions that can translate this model into locally compliant, enterprise-grade digital settlement infrastructure. The opportunity is not limited to one country. It lies in applying a proven public-sector stablecoin framework wherever regulated digital money is required.

The Infrastructure Case for State-Issued Stablecoin Development Models

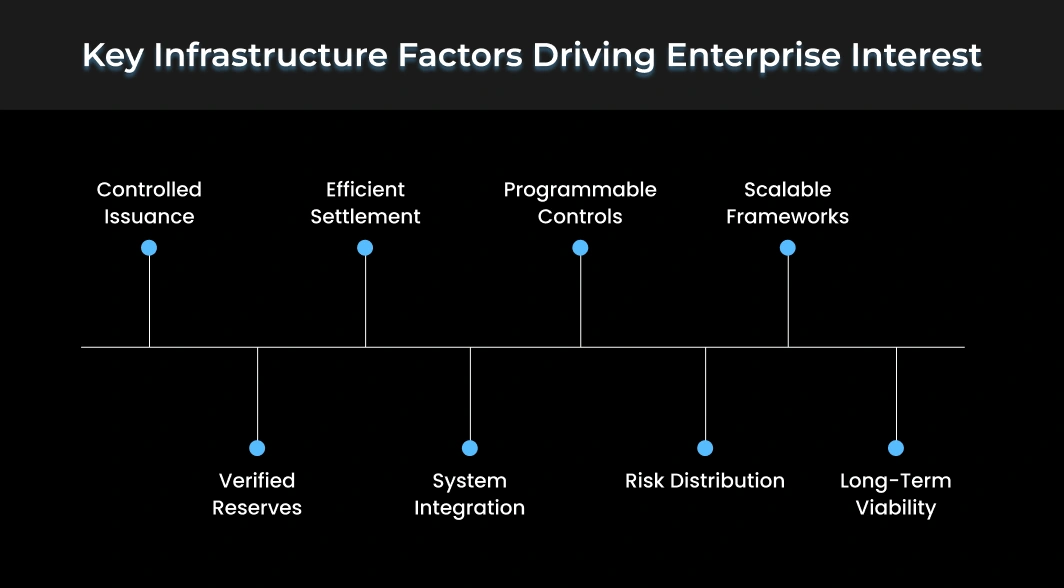

Regulated enterprises evaluate state-issued stablecoin models as financial infrastructure decisions, not technology upgrades. The interest is driven by how these models resolve long-standing constraints around governance, settlement reliability, and regulatory defensibility.

- Controlled Issuance: State-issued models introduce deterministic issuance and redemption logic governed by statutory frameworks. For regulated enterprises, this removes issuer discretion and enables internal alignment with compliance, treasury, and risk oversight requirements.

- Verified Reserves: Reserve structures are designed for continuous audit visibility and legally defined custody standards. This materially reduces internal approval friction and simplifies regulator and auditor engagement compared to privately issued stablecoins.

- Efficient Settlement: Blockchain-native settlement delivers real-time finality and cost efficiency without exiting recognized monetary frameworks. Enterprises view this as a direct replacement layer for slow and fragmented legacy payment rails.

- System Integration: State-issued stablecoins are assessed on their ability to integrate with existing treasury, accounting, and reconciliation systems. Any Stablecoin Development effort that does not prioritize enterprise interoperability fails early in evaluation cycles.

- Programmable Controls: Enterprises gain access to programmable payment logic while retaining rule-based governance. Mature Stablecoin Development Services focus on enforceable controls, not unrestricted smart contract execution.

- Risk Distribution: Public governance reduces counterparty concentration risk inherent in private issuer models. This redistribution of trust is a primary driver for compliance and legal teams reassessing stablecoin exposure.

- Scalable Frameworks: State-issued models provide a replicable structure that can be extended across jurisdictions, subsidiaries, and use cases. Well-architected Stablecoin Development Solutions are built to absorb regulatory variation without redesign.

- Long-Term Viability: Regulated enterprises prioritize infrastructure that remains defensible under regulatory change, policy scrutiny, and market stress. State-issued stablecoin models are evaluated for durability, not innovation signaling.

See a Compliance-First Stablecoin Model in Action

What Regulated Enterprises Actually Need to Build This Right

Interest in state-issued and compliant stablecoin models rises quickly once regulated enterprises recognize the trust and governance advantages. Execution, however, is where most initiatives slow down. These models are not plug-and-play and require enterprise-grade stablecoin development to address architectural and regulatory dependencies. Successful implementation demands coordinated decision-making across legal, financial, and technical teams.

What does execution actually involve?

Successful deployment depends on aligning multiple layers simultaneously:

- Legal and regulatory interpretation across applicable jurisdictions

- Reserve architecture, custody arrangements, and asset eligibility rules

- Issuance, minting, and redemption governance

- Blockchain network selection based on compliance and scalability needs

- Auditability, reporting cadence, and disclosure logic

- Integration with existing payment, treasury, and accounting systems

Each of these decisions influences the others. Treating them in isolation is where many enterprise initiatives stall.

Where internal reviews begin to break down?

Complexity becomes visible as soon as proposals reach compliance, risk, or board review. Common questions surface quickly:

- Who has authority over issuance and burn controls?

- How are reserve assets governed, verified, and reported?

- How are regulatory changes handled without system redesign?

- How is compliance maintained across regions over time?

Without clear architectural answers, projects pause or reset.

Why serious enterprises start with architecture, not tooling

Regulated enterprises that progress beyond exploration take a different approach. They do not begin with wallets, blockchains, or token mechanics. They begin with architecture and advisory.

A mature stablecoin development company focuses on designing compliance-first monetary infrastructure, not just issuing digital tokens. This includes aligning governance models, reserve frameworks, audit requirements, and system integration with enterprise risk and regulatory expectations from day one.

Why This Matters Now

State-issued stablecoin models are no longer theoretical. They represent a structural shift in how digital dollars can operate with public oversight, reduced issuer risk, and enterprise-grade governance. For regulated enterprises, the window now is about readiness. Teams that understand the architecture early will influence standards, partnerships, and regulatory alignment. Those who wait will inherit frameworks built by others. This is why stablecoin development discussions are moving into executive and board-level strategy, where long-term infrastructure decisions are made.

Final Thought

State-issued stablecoins are not an innovative trend. They are a response to unresolved trust, compliance, and infrastructure challenges in digital finance. For regulated enterprises, the decision is no longer whether this model matters, but how it will be implemented responsibly. That decision comes down to choosing a stablecoin development company that understands regulation and blockchain at an infrastructure level. Antier develops compliance-first stablecoin infrastructure that enables regulated enterprises to move from strategy to production with confidence. Connect with Antier to assess your stablecoin strategy and execution roadmap.

Frequently Asked Questions

01. What are the main concerns regulated enterprises have with private stablecoins?

Regulated enterprises are concerned about counterparty risk tied to private stablecoin issuers, limited visibility into reserve composition, regulatory uncertainty, governance concentration, and ongoing compliance and reputational risks.

02. Why are state-issued stablecoin development models being considered by enterprises?

State-issued stablecoin models are being considered as they combine public governance with blockchain efficiency, addressing the structural challenges and risks associated with private stablecoins while offering a more reliable framework for regulated environments.

03. What practical questions are enterprises exploring regarding state-issued stablecoins?

Enterprises are exploring questions about how state-issued stablecoins differ from private stablecoins, the practical aspects of governance, execution requirements, and how to apply this framework responsibly in regulated environments.