Crypto World

Will Crypto Markets React to $2B Bitcoin Options Expiring Today?

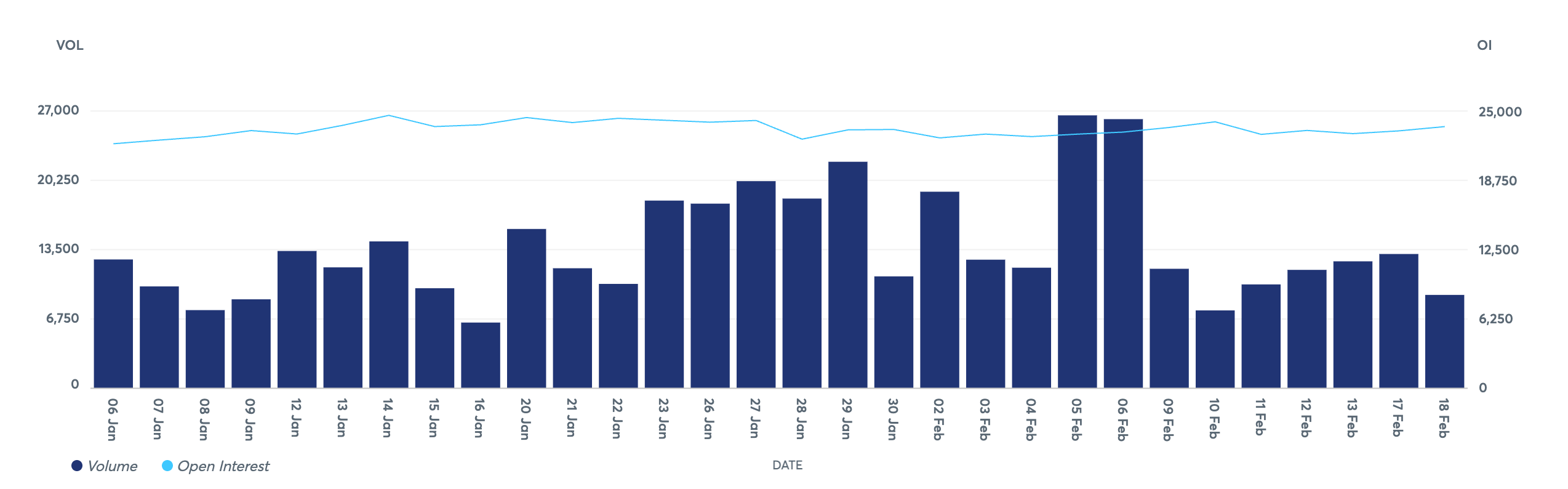

Another week has ended, and Friday has arrived, which means another batch of Bitcoin options contracts is expiring while spot markets remain sideways.

Around 30,600 Bitcoin options contracts will expire on Friday, Feb. 20, with a notional value of roughly $2 billion. This event is a little smaller than last week’s expiry, so there is unlikely to be any impact on spot markets.

Crypto markets are in bear market territory, but have remained flat over the past week as volume and volatility dry up.

Bitcoin Options Expiry

This week’s batch of Bitcoin options contracts has a put/call ratio of 0.59, meaning that there are more expiring calls (longs) than puts (shorts). Max pain is around $70,000, according to Coinglass, which is above current spot prices, so many will be out of the money on expiry.

Open interest (OI), or the value or number of Bitcoin options contracts yet to expire, remains highest at $60,000 with $1.2 billion and $1 billion at $50,000 strike prices on Deribit as bearish bets increase. Total BTC options OI across all exchanges has been climbing this month and is at $36.5 billion.

“Positioning skews call heavy across both assets, with BTC showing the stronger upside skew,” said Deribit.

Meanwhile, derivatives analyst Laevitas observed that “downside protection remains in demand,” noting 2,140 BTC worth of puts at $58,000 recently bought.

🚨 Options Expiry Alert 🚨

At 08:00 UTC tomorrow, over $2.4B in crypto options are set to expire on Deribit.$BTC: ~$2.0B notional | Put/Call: 0.59 | Max Pain: $70K$ETH: ~$404M notional | Put/Call: 0.75 | Max Pain: $2,050

Positioning skews call heavy across both assets, with… pic.twitter.com/pgl2z4ZGJ6

— Deribit (@DeribitOfficial) February 19, 2026

You may also like:

In addition to today’s batch of Bitcoin options, around 212,000 Ethereum contracts are also expiring, with a notional value of $404 million, max pain at $2,050, and a put/call ratio of 0.75. Total ETH options OI across all exchanges is around $6.8 billion.

This brings the total notional value of crypto options expiries to around $2.4 billion.

Spot Market Outlook

Total market capitalization has been flat for the past 24 hours and since the beginning of the week, hovering around $2.37 trillion, down 46% from its peak. Bitcoin has slowly eroded since Monday, hitting a weekly low of $65,700 in late trading on Thursday before recovering to $67,290 at the time of writing on Friday morning in Asia.

Resistance is forming at $70,000, with support still just above $60,000, and this seems to be the closest target. There has been no movement in Ether prices, which have started to consolidate around $1,950. The rest of the altcoins remain flat at bear market bottoms.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

What Is the PUNCH Meme Coin and Why Is It Surging?

PUNCH, a Solana-based meme coin, has surged more than 80,000% since its launch earlier this month, capturing traders’ attention across the ecosystem.

As its market cap expands and accumulation intensifies, concerns are also mounting. Amid the token’s explosive rally, analysts are highlighting red flags surrounding this new market entrant.

What Is PUNCH Token?

PUNCH is a token inspired by the story of a baby Japanese macaque named Punch and his inseparable plush companion. The token positions itself as a community-driven cryptocurrency built around emotion, comfort, and companionship.

According to details provided on the website, the token has a fixed total supply of 1 billion. The project states that its liquidity has been locked and burned.

It also claims that ownership has been renounced. In addition, the token operates with a 0% tax.

“PUNCH is gearing up to be the MOODENG of 2026,” an analyst wrote.

Solana Meme Coin PUNCH Skyrockets to $30 Million Market Cap

Data from GeckoTerminal showed that the token began trading earlier this month. Momentum accelerated as the story of the baby macaque gained traction across media outlets and social platforms. Over the past week alone, the meme coin has surged 22,290.8%.

During early Asian trading hours today, PUNCH hit an all-time high, with its market cap climbing above $30 million. On CoinGecko, the token emerged as the top daily gainer, posting a 260% increase. It also ranks third among the platform’s top trending cryptocurrencies.

The rally has attracted substantial investor interest. Blockchain tracker Stalkchain highlighted one wallet that accumulated approximately $226,000 worth of PUNCH.

Data from Nansen also revealed that over the past seven days, public figure holdings in PUNCH surged 89.69%. However, smart money and whale holdings have declined.

Crypto Watchers Raise Red Flags Over PUNCH

Several market watchers have raised concerns about the token. Crypto analyst StarPlatinum has alleged that the token shows “multiple signs of coordinated insider control.”

In a post on X, the analyst claimed that the creator wallet, identified as A8Z1ejQGk45EJibBPJviWnM3UvwKSuYun53nSCkWKM52, distributed approximately 100 billion PUNCH tokens, equivalent to 10% of the total supply, soon after the token went live.

According to the analysis, the wallet (A8Z1e) sent 48.2 billion tokens directly to another wallet, CgR8tggfcM8Re5agDY5fsT4pKmqQTzF8vQ7jQknM6iBj. This entity allegedly acted as an intermediary between the creator and several large holders.

Blockchain traces shared in the thread suggest a flow pattern from the creator wallet to the intermediary address, then to large wallets. Among the top linked holders identified:

- Wallet Hbx5PturLVp9F7YYG18jZZSWFTNp9TTSXEJepq6pvSi3 reportedly holds 35 billion PUNCH, or 3.5% of the total supply, and was funded from the intermediary wallet.

- Wallet H8GLvJ89DwoeBTY3YhepLTf3VmKR44qVnskNdEZHQVDPK holds 25.1 billion tokens, representing 2.5% of supply, and was allegedly funded by the largest holder.

- Wallet DXU65912VjiPUhKR37TLiHCrbp4uNHVNNZiBdLv1uAx1 controls 17.5 billion tokens, or 1.75% of supply, and is said to be connected within the same funding cluster.

Combined, these three wallets account for approximately 7.75% of the total supply, with all allocations allegedly traceable back to the initial creator distribution, according to the claims.

“This is how controlled memecoins are structured. Stay careful,” StarPlatinum wrote.

Here, it’s worth noting that the website specifies that PUNCH’s total supply stands at 1 billion. Meanwhile, the White Whale also identified two “red flags” related to the PUNCH token.

“1. Bubble maps is too perfect. Too clean. Real life is messy. 2. Liquidity does NOT look like this. In fact it simply cannot look like this due to how distribution takes place on the idiotic constant product pools,” he noted. “Almost 6x “support” in equal distance below than resistance above? It’s fake, guys. No coin gets that much support organically with liquidity just sitting around on the books in case of a dip. It’s all done through Meteora.”

However, the White Whale clarified that he is not directly accusing the project team or developers of orchestrating the activity. He stated that the project itself “may or may not be good.”

“I didn’t warn people when I saw the warning signs on Penguin because I didn’t want to be accused of having a conflict of interest. Those same warning signs are now presenting themselves on Punch. Trade carefully. We never know when the cabal is going to pull the rug,” he wrote in another post.

Thus, while PUNCH’s rally has attracted significant interest, analysts’ concerns raise questions about the sustainability of its momentum. As with many sharply appreciating meme coins, heightened volatility and structural risks remain key factors for traders to monitor.

Crypto World

Crypto Liquidations Steal The Show With Bitcoin Stuck Below $70,000

Bitcoin fed into “extreme bearish sentiment” as a tight BTC price range fueled daily crypto liquidations of over $200 million.

Bitcoin (BTC) faced fresh downside predictions on Thursday as BTC price action kept long liquidations high.

Key points:

-

Bitcoin price analysis sees lower levels coming amid a lack of a “strong bounce.”

-

High liquidations contrast with the tightly rangebound BTC price behavior.

-

Crypto funds seal a fourth week of net outflows amid “extreme” bearish sentiment.

Analyst expects Bitcoin to “test lower”

Data from TradingView showed BTC/USD acting within an increasingly narrow range, with the day’s lows at $65,620.

A modest improvement in US jobless claims prior to the Wall Street open had little impact on the mood, and market participants expected lower levels to come into focus next.

“This looks to me as if we’re going to test lower on the markets to see whether there’s some support on Bitcoin,” crypto trader, analyst and entrepreneur Michaël van de Poppe said about the four-hour chart in a post on X.

“Not a strong bounce, and constant lower highs.”

CryptoReviewing, the pseudonymous cofounder of trading community Wealth Capital, drew attention to ongoing large liquidation numbers despite the relative lack of BTC price volatility.

“Now, below us at $64,000 – $66,000 we still have a sizable amount of liquidity,” he told X followers alongside data from CoinGlass.

“However, $68,000 – $71,000 has around 3x more liquidations built up ready to be taken, making this a higher probability zone to visit in the next days. Bulls really need to respond soon.”

CoinGlass put 24-hour cross-crypto liquidations at $210 million at the time of writing.

Trader Daan Crypto Trades nonetheless described nearby liquidity as “nothing major.”

“This current ~$66K area has held as support for the past 2 weeks with ~$71K capping price. Will see if we get a decisive break by the end of the week because as of now there’s not much action going on,” he wrote.

Institutions underscore ”extreme bearish levels”

Institutional investor flight from crypto instruments, meanwhile, caught the attention of mainstream commentator The Kobeissi Letter.

Related: Bitcoin 2024 buyers steady BTC price as trader sees $52K ‘next week or so’

In an X post on the day, Kobeissi flagged last week’s outflows of $173 million from crypto funds, their fourth consecutive negative weekly performance.

“This brings 4-week cumulative outflows to -$3.74 billion. Bitcoin led the selling with -$133 million in outflows last week, while Ethereum saw -$85 million. Crypto funds have now seen withdrawals in 11 out of the last 16 weeks,” it continued.

As Cointelegraph reported, the US spot Bitcoin exchange-traded funds (ETFs) form one part of the institutional sector experiencing long-term pressure under current conditions.

Kobeissi described sentiment as “reaching extreme bearish levels.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

CME Group Announces Upcoming 24/7 Crypto Futures and Options Trading

CME Group, the world’s largest derivatives exchange, said on Thursday that crypto options and futures contracts will begin trading 24 hours a day, seven days a week on May 29, pending regulatory approval.

“CME Group Cryptocurrency futures and options will trade continuously on CME Globex with at least a two-hour weekly maintenance period over the weekend,” according to the parent of The Chicago Mercantile Exchange’s announcement.

All trading activity on market holidays and weekends will be cleared, settled and posted the following business day, with regulatory reporting also filed on the following day, CME Group said.

The exchange’s average daily volume for crypto futures and options in 2026 is up 46% year on year, according to CME.

The announcement follows a joint statement in September from the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) concerning the potential shift to 24/7 capital markets in the United States.

Related: CME CEO Duffy says exchange is exploring issuing its own token

US regulators explore always-on markets, while exchanges expand hours

“Certain markets, including foreign exchange, gold, and crypto assets, already trade continuously. Further expanding trading hours could better align US markets with the evolving reality of a global, always-on economy,” the regulators’ statement said.

In March 2025, Nasdaq, a technology-focused stock exchange, announced it would expand its trading hours to offer 24-hour markets, five days a week.

The exchange expects to roll out the expanded trading hours in the second half of 2026, according to an announcement from Nasdaq president Tal Cohen.

The New York Stock Exchange (NYSE) said last month that it is developing a platform for trading tokenized stock and exchange-traded funds (ETFs).

NYSE’s upcoming platform will feature 24/7 trading hours and will be able to interface with blockchain-based systems, including support for multichain settlement and custody, according to NYSE’s announcement.

The launch of the platform is part of a broader digital strategy and will be a testing ground for potentially integrating tokenized collateral on the NYSE, according to the company.

Magazine: Will Robinhood’s tokenized stocks REALLY take over the world? Pros and cons

Crypto World

BTC logs worst ever start to a year through first 50 days

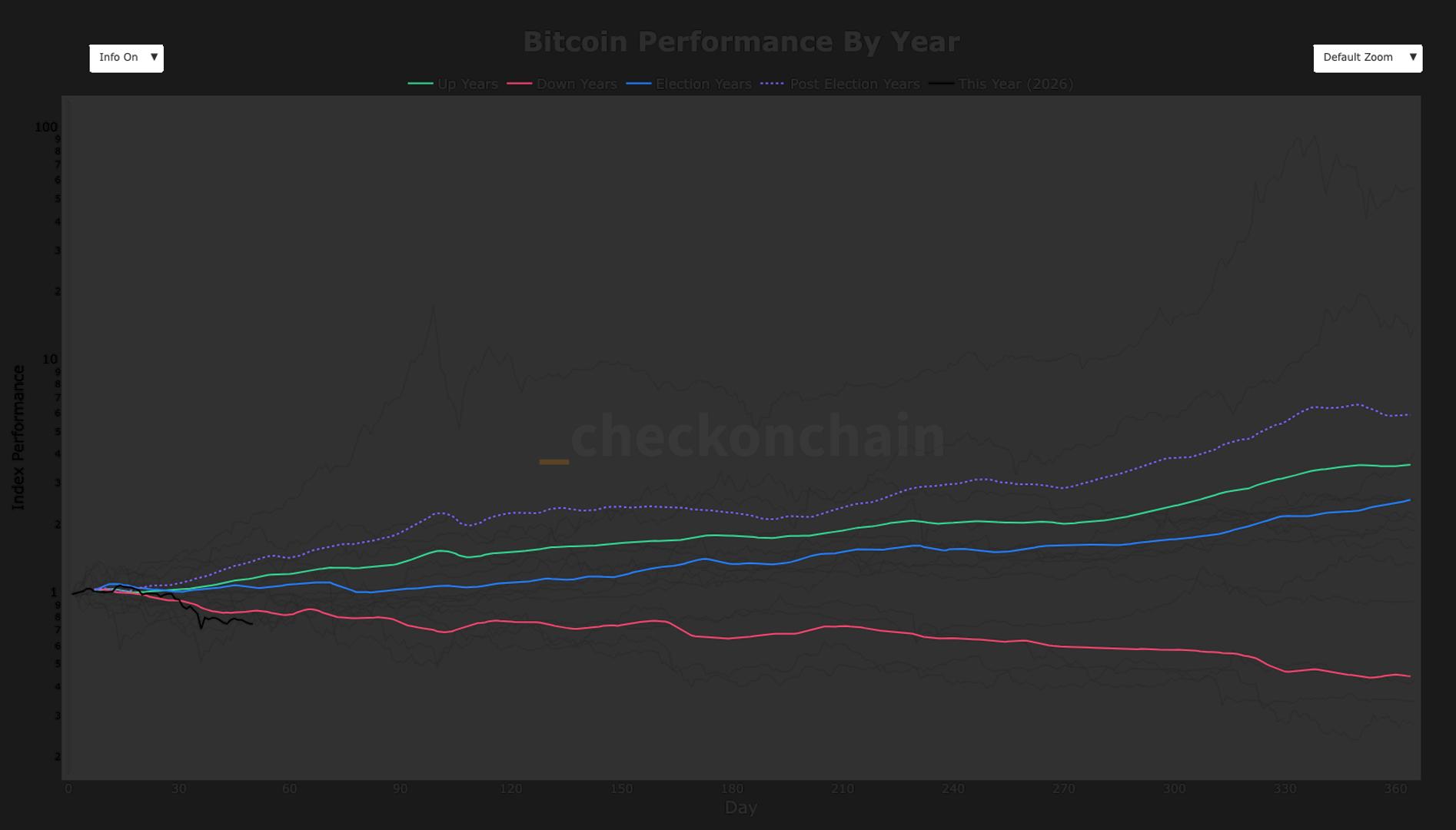

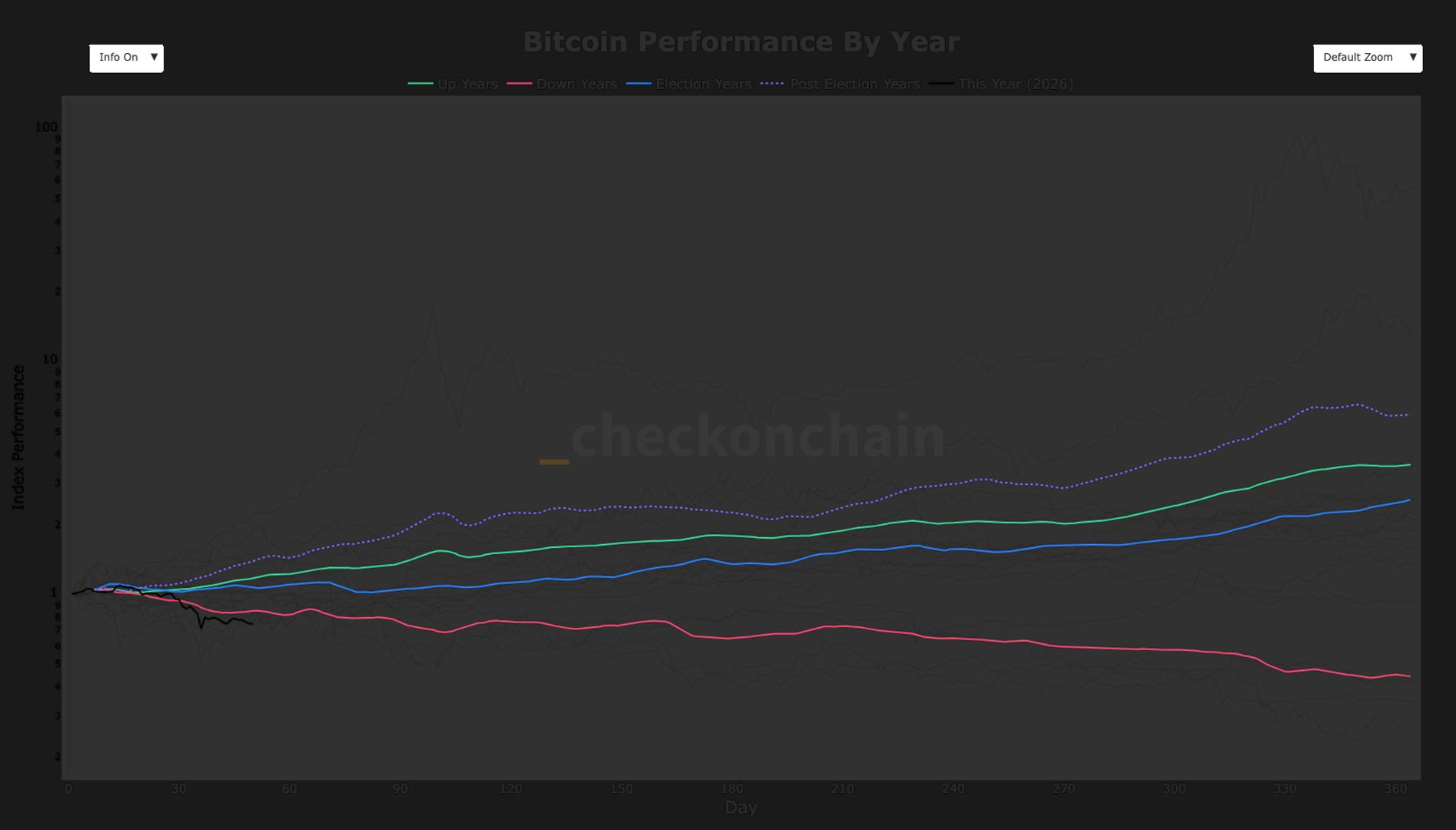

Fifty days into 2026, bitcoin is off to its worst start to a financial year on record, according to Checkonchain data. The asset is down 23% year to date, having fallen 10% in January and a further 15% in February.

Bitcoin has never previously recorded back-to-back declines in January and February, according to Coinglass data. While there have been double digit drops in January in years such as 2015, 2016 and 2018, each of those was followed by a positive February. If losses hold, bitcoin is also on track for its weakest consecutive monthly performance since 2022.

Checkonchain data shows that in a typical down year, the average index reading is 0.84, 50 days in, a benchmark that traders often use to gauge cyclical drawdowns. While bitcoin is currently at 0.77, underscoring the scale of the drawdown.

The weakness follows a 17% decline in 2025, a post election year. Historically, post election years have tended to outperform election years and have outperformed up years on aggregate, making the recent underperformance stand out further.

Crypto World

Brad Garlinghouse says CLARITY bill has ‘90% chance’ of passing by April

Ripple CEO Brad Garlinghouse said he now sees a 90% chance that the long-debated Clarity Act will pass by the end of April, signaling growing confidence inside the crypto industry that U.S. lawmakers may finally deliver long-sought regulatory certainty.

Speaking on Fox Business, Garlinghouse said momentum has accelerated following renewed engagement from lawmakers and the White House. He described recent meetings in Washington that included leaders from both crypto and traditional banking, suggesting political appetite to move legislation forward has strengthened after months of delays.

The Clarity Act is designed to define which digital assets fall under securities laws and which would be overseen by the Commodity Futures Trading Commission. The bill has faced friction over stablecoin reward provisions and whether crypto platforms should be allowed to offer yield-like incentives to customers. The White House has reportedly set a March 1 target to push negotiations forward.

Garlinghouse framed the bill as imperfect but necessary. Ripple, he noted, secured a federal court ruling that XRP is not a security, giving the company clarity that much of the industry still lacks.

“The industry can’t live in limbo,” he said, arguing that regulatory uncertainty has weighed on innovation and market sentiment.

His comments come amid a broader crypto pullback and renewed volatility across digital assets. While bitcoin and other tokens have struggled in recent weeks, Garlinghouse said Ripple continues to see growing interest from corporate treasurers and financial institutions exploring stablecoins, liquidity management, and cross-border payments.

Ripple has spent nearly $3 billion on acquisitions since 2023, expanding into custody, prime brokerage, and treasury management. Garlinghouse said the company will pause on major deals in the near term to focus on integration.

Beyond crypto-native firms, he noted that traditional financial players increasingly want clearer rules to compete on equal footing. That shift, he suggested, reflects the dramatic change in attitudes toward digital assets over the past few years.

If the Clarity Act advances, it could mark one of the most significant legislative milestones for the U.S. crypto sector to date.

Polymarket bettors are giving the bill an 82% chance of passing by the end of the year.

Crypto World

New Draft Text Narrows Stablecoin Yield Debate in Washington

TLDR:

- White House draft language shifted the stablecoin meeting from broad bans toward narrow rules on rewards.

- Banks now cite competition risks over deposit flight as their main concern in stablecoin policy talks.

- Regulators would gain authority to fine firms $500,000 daily for illegal yield on idle balances.

- Trade groups aim to reach compromise on stablecoin rewards before an end-of-month deadline.

Bitcoin and stablecoin policy talks in Washington entered a new phase as the White House assumed direct control of discussions. The latest stablecoin meeting brought together fewer participants but sharper policy direction.

Officials circulated draft language that reframed disputes over rewards and yield. The talks now center on narrow limits instead of broad industry bans.

Stablecoin meeting steered by White House draft language

The stablecoin meeting included representatives from Coinbase, Ripple, and Andreessen Horowitz. Trade groups such as Blockchain Association and Crypto Council for Innovation also attended.

No individual banks sent executives to the room. Instead, banking voices came through American Bankers Association, Bank Policy Institute, and Independent Community Bankers of America.

According to reporting by Eleanor Terrett, the White House set the agenda rather than letting industry groups lead. White House Crypto Council Executive Director Patrick J. Witt presented draft text that guided the entire discussion.

The language acknowledged bank objections raised in a prior document on yield and interest limits. It also clarified that any future restrictions on rewards would remain narrowly defined.

Stablecoin rewards debate narrows to specific activities

Participants said earning yield on idle stablecoin balances now appears excluded from negotiations. The remaining debate focuses on whether rewards tied to certain activities can continue.

A crypto-side attendee said banks now frame their concerns around competition rather than deposit flight. Earlier discussions had emphasized risks to bank deposits from payment stablecoins.

Bank representatives continue to push for a formal study on deposit outflows. The proposal would examine how stablecoin payment growth could affect traditional banking balances.

Draft language also introduced anti-evasion enforcement measures. These provisions would grant the Securities and Exchange Commission, the United States Department of the Treasury, and the Commodity Futures Trading Commission authority to police violations.

Civil monetary penalties would reach $500,000 per violation per day. Officials framed this as a deterrent against indirect yield payments.

Bank trade groups will now brief their members and test whether compromise remains possible. The focus rests on limited rewards rather than full prohibition.

Sources close to the talks said the timeline has tightened. Negotiators now view an end-of-month target as achievable as discussions continue over the coming days.

Crypto World

Explore the most cutting-edge non-custodial crypto wallets of 2026

“In 2026 and thereafter, Non-Custodial Wallets Will Be Critical to Your Strategy.”

Think of two users:

User A stores all of their cryptocurrency on the exchange and third-party services.

User B has complete control of their private keys, can automate DeFi strategies, and connects directly to Web3-native solutions.

This elucidates the reason why non-custodial crypto wallets are becoming so important to the infrastructure market –

“Retail as well as large-scale crypto users are demanding it because of its expected benefits.”

They are no longer a fringe technology; they are now becoming part of the foundational structure—as significant as your identity access management, treasury systems, and security keys.

According to industry research studies, the non-custodial wallet industry will be approximately $1.5-2.5 billion by the year 2026, and the anticipated growth rate over the next decade is expected to be very high as well, often exceeding 20-25% compound annual growth rate (CAGR), varying by report methodology.

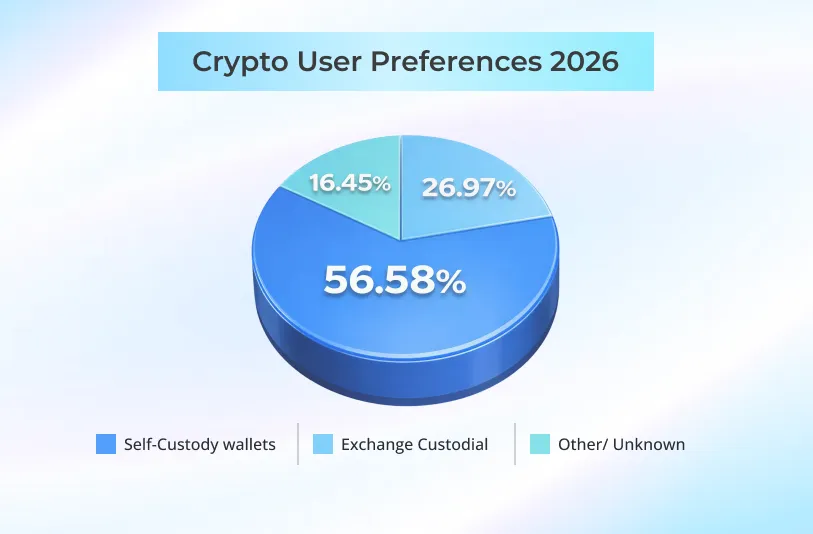

Various recent studies show that the bulk of all cryptocurrency wallets being used today are self-custodial, indicating a growing trend toward individual control over assets and financial transactions as a whole.

Source: https://coinlaw.io/self-custody-wallet-statistics/

For enterprise leaders currently planning to roll out their own Web3 crypto wallet, the extreme diversity of self-custodial wallet options — from hardware air-gapped wallets to smart contract-based wallets — presents an important question:

- What trends and tactics should your enterprise’s wallet strategy look at moving forward?

Now that we have defined an overall strategic environment, let’s look at the wallets that you came to evaluate.

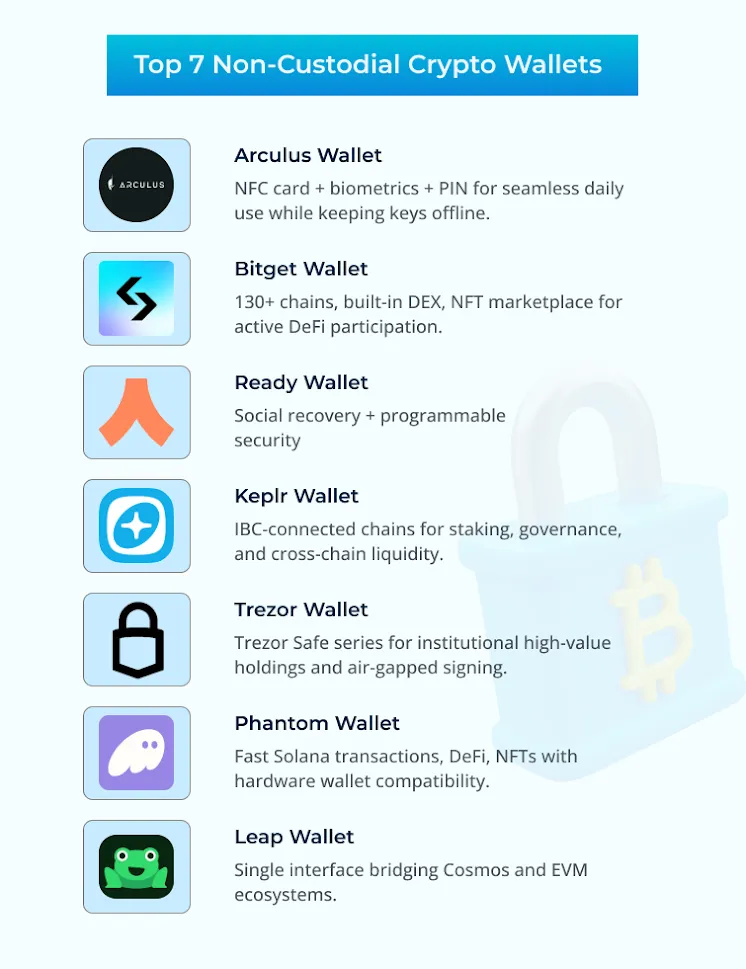

A Look at Today’s Peak Value Non-Custodial Crypto Wallets

Here, we will analyze the top self-custodial wallets of 2026, not just simply by looking at a list of ‘features,’ but instead from an enterprise perspective: how relevant is each wallet’s use case for you? What security models do they utilize? How do they compare in the overall ecosystem, and how can developing similar wallets give you a competitive advantage?

1. Arculus Wallet

The Arculus wallet offers a unique solution for securing digital assets.

The Arculus card, using NFC technology, connects to the user’s smartphone through an app. The private keys are stored offline on the card.

As a result, consumers are able to use the wallet daily without handling private keys or seed phrases frequently (though a one-time recovery phrase is generated at setup).

To use crypto in day-to-day use, the users will be required to first unlock the app using biometrics, enter their 6-digit PIN when prompted, and then tap their NFC-enabled Arculus card against the back of their phone.

For enterprise teams, launching an Arculus-like wallet will provide the following merits:

- When a user’s interaction with their wallet is limited to their hardware card or application, the user’s exposure to their written seed phrases (physically/electronically stored) or chances of losing possession of the seed phrase during routine usage (such as for migrating devices or support issues) are greatly reduced.

- It helps facilitate an authentication consumer experience that feels similar to existing payment processes with a physical card plus phone journey.

- A physical NFC-enabled card that functions as a hardware wallet helps maintain mobile accessibility.

The Rationale Behind This Trend:

Self-custodial wallets like Arculus aim to minimize how often users must interact with their recovery phrase and front-load their access using hardware, digital PIN numbers, and biometric means.

Why This Is Important for You:

Reimagining how users store their keys and recover them can potentially lead to new user experience innovation opportunities; your goal should not be to replicate other wallet solutions; rather, you should focus on solving the challenges that users face with current wallets.

2. Bitget Wallet

The Bitget Wallet is a multi-chain wallet with a built-in DEX aggregator that offers customers access to NFT marketplaces, too, where they can buy, sell, and trade. This non-custodial crypto wallet provides multiple DeFi integrations with support for 130+ chains (Ethereum, Solana, Polygon, etc.) – hence encouraging direct user participation in the broader ecosystem.

Bitget Wallet is designed with integrative value for users, providing an aggregated view of assets and activity across EVM networks, non-EVMs’ Layer-1, and Layer-2 chains.

DEX integrations reduce time lost switching between applications.

MARK

Native NFT marketplace support is valuable for targeting users pursuing content ownership, loyalty rewards, and digital goods strategies.

Critical Insight For Web3 Wallet Businesses

Based on projections of future digital wallet usage, white label crypto wallets that combine the functions of “secure storage” and “active finance”—trading, staking, liquidity participation, and governance—will be the most successful in helping you capture long-term adoption.

3. Ready Wallet (formerly Argent)

Ready is typically characterized as an Ethereum-focused smart contract wallet, with the goal of improving user experience by incorporating concepts like social recovery, programmable security, and DeFi-compatible functionality.

Specific features that align with this are

- The use of social recovery methodologies leads to lower total cost of support due to being more streamlined than traditional recovery methods that only rely on seed phrases.

- Programmable security through policy-based controls (e.g., daily transfer limits, whitelisted addresses, and other guardrails) provides a clear, consistent, and adaptable level of protection for wallet operations.

- Native capabilities for staking on L2 systems and connection to DeFi protocol features cement the idea that the wallet is intended to serve as a facilitator of financial actions.

Enterprise Lens

Crypto wallet development with account abstraction and configurable defense will become a critical enabler of automated financial flows within Web3-based applications.

4. Keplr Wallet

Keplr is one of the major wallets used by those actively engaged with the Cosmos ecosystem. It is a self-custodial hub for IBC-connected chains.

In addition to participating in staking and governance on their native protocol, consumers can move value in a multitude of ways between other Cosmos chains as well as across the entire Cosmos ecosystem.

Web3 leaders need to take notice of what this can mean for your audience if you engineer a Keplr-grade wallet:

- A way to engage on a large scale in governance (both as validators and via delegations in DAO votes) rather than relying on ad hoc participation.

- When linking to other blockchain networks, IBC-enabled assets allow for a higher level of liquidity movement & redirection.

- This will be possible using a method that does not require customers to retain custody of their relevant assets on any one blockchain within the Cosmos universe.

A Signal To Watch

As cryptocurrency wallet development initiatives continue to create more tools and data services over diverse Cosmos blockchains, wallets that promote interactivity & interoperability among users will spur the ongoing development of both DeFi & app-specific chains.

5. Trezor Wallet

Hardware wallets are becoming an integral part of many institutions’ high-security operations, and Trezor wallets (Trezor Safe 3, Trezor Safe 5, Trezor Safe 7) are considered to be one of the best non-custodial hardware wallets available for the safe storage of numerous types of digital assets.

Trezor offers high-security, isolated keys that can be stored offline and are ideal for longer-term or treasury-type holdings.

- The ability to integrate with a desktop suite and 3rd party applications helps facilitate policy enforcement & audit workflows.

- Offline signing adds a strong security shield for high-value or high-risk transactions.

A Thought to Carry Forward

Security professionals often refer to hardware security modules, cold wallets, and air-gapped signing technology when it comes to developing treasury-based wallet systems.

Get Your Enterprise’s Crypto Wallet Launch Checklist Now

6. Phantom Wallet

Phantom is one of the premier decentralized wallets for the Solana ecosystem. It provides people with a non-custodial wallet experience with all of the key features for staking. interacting with DeFi directly within the wallet and managing NFTs while prioritizing UX.

This wallet product is compatible with hardware wallet integrations, adding extra security for end-users.

Why should you care?

- Solana wallets serve as transaction engines that empower high volume, low fees, and fast settlement.

- Enterprise use cases include gaming and loyalty programs, payroll experiments, and cross-chain financial services.

An Industry Cue

Solana-centric crypto wallet development as a whole is increasing in volume and velocity across multiple verticals; thus, the trend is towards active wallet activity instead of passive storage.

7. Leap Wallet

Leap Wallet supports both the Cosmos network and the EVM environment, enabling users to bridge the gap between these two through a single interface.

The Core Message

Wallets that reduce their operational footprint across Cosmos + EVM or other multi-technology stacks will position themselves for success when catering to corporate clients willing to adopt seamless workflows.

Decoding 2026’s Self-Custodial Wallet Success Codes – X-Factors Enterprises Can Use

| Wallet | Core Trend | Build Inspiration For You | Security Innovation |

|---|---|---|---|

| Arculus | NFC mobile payments | Card+phone UX like traditional finance | NFC card + biometrics + 6-digit PIN |

| Bitget | Multi-chain DeFi hub | DEX aggregator eliminates app switching | Unified risk control across 130+ chains |

| Ready | Account abstraction | Social recovery cuts support costs | Programmable security through policy-based controls |

| Keplr | Cosmos interoperability | IBC enables governance at scale | Security-hardened IBC cross-chain liquidity hub |

| Trezor | Institutional cold storage | Air-gapped treasury operations | Offline hardware isolation |

| Phantom | High TPS transaction engine | Solana gaming/loyalty enablement | Hardware wallet compatibility |

| Leap | Multi-stack unification | Single UI for Cosmos+EVM workflows | Fail-safe cross-ecosystem bridging |

Conclusion: The wallet is not the ultimate objective; it’s just the base level

If your organization is creating a non-custodial wallet & you are currently or will be looking for the ideal technical or product partner to help you achieve your vision for your project, make sure they help you navigate the security, compliance & UX trade-offs first.

Whether you want to create crypto wallets like the ones discussed above or want to create an AI smart crypto wallet with features like cross-chain composability, physical key storage, reg-ready governance core, or customized functionalities, Antier’s properly designed tech stack will help you craft a top-tier solution. That would grow into a durable component of your Web3 infrastructure, not just an application included in your product portfolio.

Schedule a tactical meeting to architect a self-custodial wallet product with the potential to be in a league of its own.

Frequently Asked Questions

01. Why are non-custodial wallets becoming critical for cryptocurrency users?

Non-custodial wallets are essential because they provide users with complete control over their private keys, enabling automation of DeFi strategies and direct connections to Web3-native solutions, which are increasingly demanded by both retail and large-scale crypto users.

02. What is the projected market size for non-custodial wallets by 2026?

The non-custodial wallet industry is expected to reach approximately $1.5-2.5 billion by 2026, with a high anticipated growth rate often exceeding 20-25% compound annual growth rate (CAGR).

03. What factors should enterprises consider when developing their own Web3 crypto wallet strategy?

Enterprises should evaluate the diversity of self-custodial wallet options, the relevance of each wallet’s use case, the security models they utilize, and how developing similar wallets can provide a competitive advantage in the overall ecosystem.

Crypto World

Kraken’s xStocks Surpass $25B, Leading Global Tokenized Equity Markets

TLDR:

- xStocks surpass $25B in total transaction volume, reinforcing global market leadership.

- Over $3.5B in onchain activity involves 80,000 unique holders across blockchains.

- Eight of the top eleven tokenized equities by holders now use xStocks.

- xStocks support cross-chain, permissionless trading on Solana, Ethereum, and TON.

Bitcoin and crypto markets are seeing growing integration with traditional finance as xStocks reaches a major milestone. Kraken’s tokenized equities platform has surpassed $25 billion in total transaction volume across centralized and decentralized exchanges.

The milestone reflects strong adoption, with over 80,000 onchain holders and $3.5 billion in recorded onchain activity. This growth signals that tokenized equities are moving beyond experimental infrastructure toward real, scalable markets.

xStocks Sets Benchmark for Tokenized Equity Adoption

According to a blog post, xStocks now holds the largest market share in tokenized equities globally.

Eight of the top eleven tokenized equities by unique holders are xStocks, while 68% of the top twenty-five stocks also use the framework. The platform integrates across multiple blockchains, including Solana, Ethereum, and TON, with additional networks planned.

Users can access, trade, and transfer assets seamlessly through exchanges, wallets, and DeFi protocols.

Each xStock remains fully backed 1:1 by the underlying stock or ETF. Custodians hold assets in bankruptcy-remote structures, ensuring ownership security.

This model supports transparent trading and sustained liquidity across venues. The ecosystem now reports nearly $225 million in aggregate onchain assets under management.

Integration extends to both centralized exchanges like Bybit and Gate.io and decentralized platforms. This enables thousands of retail investors, professional traders, and institutions to participate globally.

xStocks are structured for cross-chain mobility and always-on markets, reinforcing interoperability standards. The framework’s expansion continues with new assets listed monthly and growing alliance participation.

Transaction volume highlights the platform’s rapid adoption. Within under eight months, xStocks surpassed $25 billion across minting, redemption, and secondary market activity.

Onchain adoption accounts for over $3.5 billion, emphasizing broad engagement across wallets and DeFi applications. Market participants now treat tokenized equities as live markets, not experimental infrastructure.

Driving Global Capital Market Interoperability

xStocks Alliance promotes open and permissionless tokenized equity standards. Members can move assets across platforms and chains without friction, fostering deeper liquidity.

The alliance’s approach encourages repeated engagement, network effects, and resilient market structures. Cross-chain integration positions xStocks as a foundation for the next generation of digital capital markets.

Adoption trends demonstrate growing confidence in fully collateralized tokenized models. Retail and institutional participation continues to expand, as more platforms integrate xStocks.

Interoperable assets reduce fragmentation and increase real-world utility. The milestone illustrates the evolving intersection between traditional U.S. capital markets and blockchain technology.

The platform’s onchain ecosystem now includes over 80,000 unique holders. Active trading across multiple blockchains highlights global demand.

xStocks combine regulatory transparency with crypto-native infrastructure. The milestone signals maturation of tokenized equities as scalable market solutions.

Crypto World

AAVE price defends $120 demand zone as RWA deposits top $1B

AAVE is holding the $120 demand zone as real-world asset deposits on Aave cross $1 billion, indicating rising institutional demand.

Summary

- Aave price is hovering near the mid of its weekly range, up 10% but still down over the past month.

- Real-world asset deposits on Aave Horizon have surpassed $1B.

- $135 remains the key resistance level for a confirmed bullish shift.

Aave (AAVE) was trading at $123 at press time, up 0.6% in the past 24 hours. The token sits near the middle of its weekly range between $110.29 and $131.29.

It has gained 10% over the past week, though it is still down 21% in the last 30 days. The larger trend has been corrective since December highs near $200.

Spot activity cooled slightly. Trading volume reached $280 million in the last 24 hours, down 21% in the last day. In derivatives markets, CoinGlass data shows futures volume down 31% to $274 million, while open interest rose 2.53% to $203 million.

Rising open interest alongside softer volume suggests traders are building positions carefully rather than chasing momentum.

RWA deposits double as institutional interest grows

On Feb. 19, Aave revealed that deposits of real-world assets on its Horizon market surpassed $1 billion. According to posts from Aave and founder Stani Kulechov, deposits have doubled since January. This makes Aave the first lending protocol to cross the $1 billion mark in tokenized real-world assets.

Aave is the first lending protocol with over $1 billion in RWAs deposited. pic.twitter.com/H9d4Nh0Aol

— Aave (@aave) February 19, 2026

Real-world assets include tokenized bonds and treasury-like products. Their rise shows that more institutional players are entering decentralized finance. For Aave, more RWA deposits can mean more borrowing and higher fees.

Revenue has grown sharply. In 2025, Aave DAO’s revenue surged to $142 million, exceeding the sum of the last three years prior. With more funds in its treasury, the DAO can invest in development, improve risk controls, and support token holders.

There is also a proposal called “Aave Will Win.” It would send all revenue from Aave-branded products to the DAO treasury. In exchange, Aave Labs would receive funding to build Aave V4 and hand over intellectual property to the community. If approved, the structure could tighten alignment between builders and token holders.

In addition, Grayscale Investments has filed to convert its Aave Trust into an exchange-traded fund listed on NYSE Arca. If approved, the move could expand access to traditional investors.

Aave also handled more than $450 million in liquidations between Jan. 31 and Feb. 5 without creating bad debt. That performance supported confidence in the protocol’s risk controls during volatile market conditions.

Aave price technical analysis

On the daily chart, AAVE is attempting to stabilize above the $115 to $120 demand zone. A recent dip toward $105 was quickly bought, forming a long lower wick. Price then reclaimed $115, which suggests buyers absorbed supply in that area.

The broader structure is still bearish. Lower highs and lower lows remain intact. A confirmed reversal would require a daily close above the $135 to $140 zone, which marks the most recent lower high.

Bollinger Bands show price moving back toward the middle band near $119 to $120 after touching the lower band around $103 to $105. The bands are starting to tighten, often a sign that volatility may expand soon.

The relative strength index dropped to near 30 during the recent selloff, but has recovered to around 45. Momentum has improved, but RSI has not crossed above 50. That level would signal stronger buyer control.

If AAVE holds above $120 and breaks $135, the next targets sit near $150 to $175. If $120 fails, price could revisit $105, with $95 to $100 as the next support area.

Crypto World

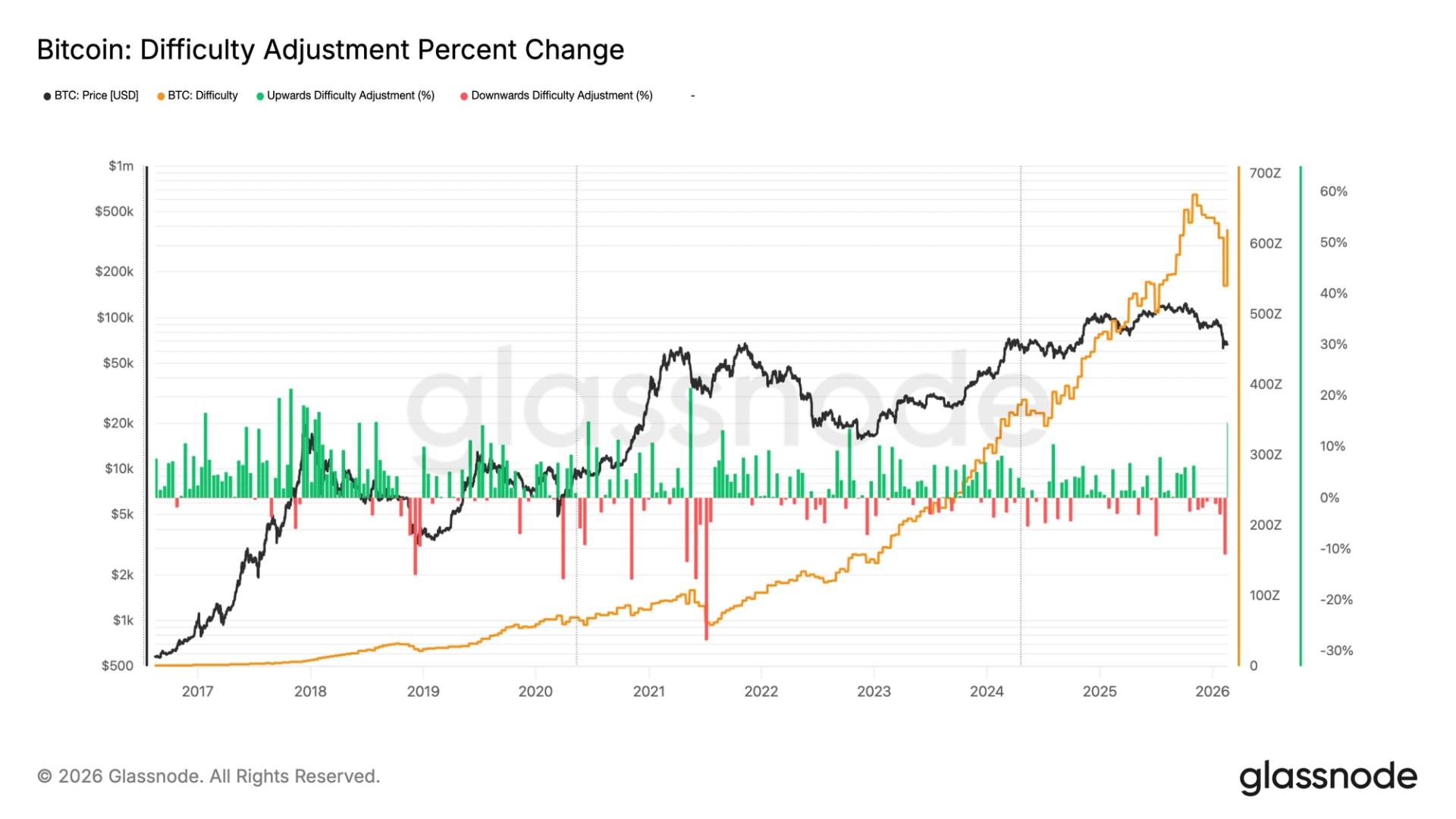

BTC difficulty jumps 15% largest increase since 2021, despite price slump

Bitcoin mining difficulty has climbed to 144.4 trillion (T), up 15%, the largest percentage increase since 2021, when the China mining ban led to a major disruption, which followed a 22% upward adjustment as the network stabilized.

Difficulty adjustments measure how hard it is to mine a new block on the network. It recalibrates every 2,016 blocks, roughly every two weeks, to ensure blocks continue to be produced about every 10 minutes, regardless of changes in the hashrate.

The adjustment follows a 12% decline in difficulty after a drop in the bitcoin hashrate, which is the total computational power securing the network. Mining activity suffered its sharpest setback since late 2021 after a severe winter storm in the United States forced several major operators to scale back operations.

In October, when bitcoin reached an all-time high of around $126,500, the hashrate also peaked at 1.1 zettahash per second (ZH/s). As prices fell to as low as $60,000 in February, the hashrate dropped to 826 exahash per second (EH/s). Since then, the hashrate has recovered to 1 ZH/s while the price has rebounded to around $67,000.

At the same time, hashprice, the estimated daily revenue miners earn per unit of hashrate, remains at multi-year lows ($23.9 PH/s), squeezing profitability.

Despite this profitability pressure, large-scale operators with access to low-cost energy continue to mine aggressively. The United Arab Emirates, for example, is sitting on roughly $344 million in unrealized profit from its mining operations.

Well-capitalized entities that can mine efficiently are helping keep the hashrate elevated and resilient, even amid subdued bitcoin prices.

-

Video4 days ago

Video4 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech5 days ago

Tech5 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World3 days ago

Crypto World3 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports3 days ago

Sports3 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video5 hours ago

Video5 hours agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Video7 days ago

Video7 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech3 days ago

Tech3 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business2 days ago

Business2 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment2 days ago

Entertainment2 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video3 days ago

Video3 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech2 days ago

Tech2 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World6 days ago

Crypto World6 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Sports1 day ago

Sports1 day agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Crypto World7 days ago

Crypto World7 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

Entertainment1 day ago

Entertainment1 day agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business2 days ago

Business2 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat5 days ago

NewsBeat5 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World2 days ago

Crypto World2 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat5 days ago

NewsBeat5 days agoMan dies after entering floodwater during police pursuit

-

Crypto World10 hours ago

Crypto World10 hours ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market