Crypto World

WLFI Price Eyes Another Rally? 3 Distribution Risks Loom

World Liberty Financial price, or the WLFI price, surged nearly 20% over the past 24 hours, triggering optimism across holders. But three separate metrics now reveal hidden risks beneath the surface strength.

Distribution happening across whale cohorts and mid-term holders preparing exits create consolidation pressure that could derail the pattern entirely. Or, is the WLFI price action planning a plot twist here?

Cup Pattern Needs Controlled Consolidation Above $0.105

The 8-hour chart shows a rounded bottom structure resembling a cup. The cup itself has already completed, given the recent price recovery. Now WLFI needs to form the handle through controlled consolidation before attempting the next breakout.

Sponsored

Sponsored

The key detail is the upsloping neckline connecting the rim of the cup on both sides. The left rim formed at an earlier high while the right rim sits at a higher level. This upward slope indicates that buyers are willing to pay higher prices over time, creating structural strength. The neckline must be broken upward to complete the pattern and trigger the measured 17% move.

Between February 4 and February 18, a hidden bearish divergence formed on the 8-hour timeframe. WLFI price made a lower high after peaking at $0.119. During that same period, the Relative Strength Index made a higher high. RSI measures momentum strength by comparing the magnitude of recent gains to recent losses.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

When price makes lower highs, but RSI makes higher highs, it signals that a pullback could be coming.

The divergence could actually be constructive for the pattern. Cup formations require a handle to complete properly. The handle forms through sideways or slight downward price movement that shakes out weak hands before the next explosive move.

The critical level is $0.105. As long as WLFI consolidates without breaking below this support, the pattern and breakout possibility remain intact. A measured move from the cup’s low to the neckline projects a breakout target of $0.142, representing approximately 17% additional upside from the possible breakout point.

Sponsored

Sponsored

Mega-Whales Sold 1.1 Billion Tokens as Long Positions Diverged

While new whale cohorts accumulated approximately 25 million WLFI tokens during the past 24 hours, the largest holders moved in the opposite direction.

Mega-whale addresses holding more than 1 billion tokens have been steadily reducing their positions since February 6. On February 17, during the price rally, they dropped holdings dramatically from 9.45 billion to 8.35 billion WLFI. That represents 1.1 billion tokens sold directly into the strength.

The price did not crash because smaller whales and leveraged long positions absorbed the selling.

But the distribution creates overhead pressure.

Data from Hyperliquid derivatives exchange shows diverging behavior across different WLFI trader cohorts over the past 24 hours. General whale addresses increased their long positions by 68%, showing continued optimism.

Sponsored

Sponsored

But the top 100 addresses (mega whales) by trading volume reduced long positions significantly.

Smart Money, which tracks positioning by experienced traders, shows a net short position over the past 24 hours, hinting at caution.

This creates a dangerous setup where smaller participants are buying and adding leverage while the largest and most sophisticated players distribute and position defensively.

The rally relied on smaller whale buying and leverage rather than conviction from mega-whales. If consolidation turns into a long squeeze where leveraged longs get forced to sell, the pullback could accelerate beyond the healthy handle formation needed for pattern completion.

Sponsored

Sponsored

Mid-Term Holders Activate 500 Million Tokens for Exit, Could This Impact the WLFI Price?

The third warning comes from on-chain activity metrics. Spent Coins Age Band tracks coin movement from specific holder cohorts based on how long they held the tokens. The 90-day to 180-day age band represents mid-term holders who acquired WLFI between three and six months ago.

Before February 17, this cohort showed activity of approximately 949,000 tokens moving. Between February 17 and 18, that number exploded to over 500 million tokens.

This represents a 500-times increase in coin activity from mid-term WLFI holders. When holders who sat through months of price action suddenly activate coins en masse, it typically means preparation for exit. They see the 20% rally as their opportunity to take profits after months of waiting. The 500 million tokens moving creates significant potential selling pressure on top of the 1.1 billion already sold by mega-whales and the cautious positioning by Smart Money.

All three risks point toward consolidation. The 8-hour chart RSI divergence predicts it. Mega-whales selling 1.1 billion confirms it. Mid-term holders activating 500 million validates it. The consolidation is healthy and necessary for handle formation if it stays controlled above $0.105 and respects the upsloping neckline. But the market remains weak broadly.

Fibonacci extension to the downside projects $0.090 or lower if the pattern breaks, invalidating the entire setup.

On the upside, breaking above $0.119 reactivates bullish momentum with first resistance at $0.132 before the main pattern target of $0.142. The $0.105 level decides everything. Controlled consolidation above it allows the cup to complete its handle. Breakdown below it turns the distribution into a cascade.

Crypto World

Brevan Howard’s crypto fund lost 30% in 2025 in worst year since inception: FT

Investment manager Brevan Howard’s cryptocurrency fund fell almost 30% last year as the bitcoin bull run faltered, the Financial Times (FT) reported on Wednesday.

The BH Digital Asset fund lost 29.5% of its value, its worst performance in a calendar year since its inception in 2021, according to the report, which cited people familiar with the fund’s performance. The fund underperformed bitcoin, which lost 6% in the period.

BH Digital Asset, which invests in crypto tokens and digital asset-related companies, enjoyed gains of 43% and 52% in 2023 and 2024, respectively, as the crypto market recovered from the lows of 2022 and the bitcoin price eclipsed $100,000 in December 2024.

“There are a lot of private equity and venture capital type instruments [in BH Digital Asset],” said one hedge fund investor, according to the FT’s report. “They have underperformed bitcoin but to give them credit, last year was terrible for crypto.”

Brevan Howard did not immediately respond to CoinDesk’s request for further comment.

Crypto World

Moonwell’s ‘vibe-coded’ oracle in $1.8M blowup

It was only a matter of time before “vibe-coded” smart contracts led to a significant loss of funds and on Sunday, an oracle misconfiguration led to users of DeFi lending platform Moonwell being liquidated for a total of 1,096 Coinbase Wrapped Staked Ether (cbETH).

The protocol was also saddled with $1.8 million worth of bad debt as a result.

The error was introduced in pull request 578, submitted by Moonwell core contributor “anajuliabit” and co-authored by Claude Opus 4.6.

Including this incident, Moonwell has suffered three oracle malfunctions in the past six months, leading to over $7 million in bad debt.

Read more: Claude AI plugins can now vibe code smart contracts

cbETH = $1.12

Moonwell’s post-mortem report states that, this time, the issue lies in calculating the dollar price of cbETH.

“The oracle used only the raw cbETH/ETH exchange rate. This misconfiguration caused the oracle to report cbETH’s price as approximately $1.12 (reflecting the cbETH/ETH ratio of ~1.12) rather than the intended market value of roughly $2,200,” the report explains.

As a result, the error “wiped out most or all of the cbETH collateral for many borrowers.”

A total of 1,096 cbETH was liquidated. In turn, $1.78 million worth of bad debt was generated for the protocol.

Monitoring systems picked up the discrepancy and strict borrow and supply caps were set to prevent further interaction.

Despite this, liquidation of existing positions continued. Any oracle correction requires “a five-day governance voting and timelock period, which could not be bypassed.”

Trading Strategy’s Mikko Ohtamaa pointed out that “regardless of whether the code is written by an AI or by a human, these kinds of errors are caught in an automated integration test suite.”

He highlights that Claude can even write these tests itself, but that in this case “there was no test case for price sanity.”

Others highlighted the contributor’s GitHub profile which shows an extremely high workrate, over 1,000 commits in the past week.

Read more: Clawdbot creator Peter Steinberger: ‘Crypto folks, stop harassing me’

The dark side of the moon

Moonwell is a lending protocol active on the Base, Optimism, and Moonbeam networks. It holds around $90 million in total value locked (TVL), according to DeFiLlama data, down from a peak of $380 million in August last year.

Since then, the project has suffered a number of hiccups.

DeFi commentary account “Yieldsandmore” details two further incidents in recent months. The first came during last year’s infamous October 10 crash, when a pricing discrepancy between Chainlink feeds and decentralized exchanges on Base led to $12 million in liquidations and $1.7 million of bad debt.

The second came less than a month later, on November 4, when the $129 million Balancer hack had a knock on effect on Moonwell’s market-based wrsETH/ETH oracle, leading to $3.7 million of bad debt.

The two incidents were apparently exploited by the same attacker, who is “clearly constantly scanning Moonwell for extractable value.”

Previously, 2022’s $190 million Nomad Bridge hack devastated the protocol’s Moonbeam deployment, its sole instance at the time.

The incident saw TVL drop 80%, from over $100 million to just $21 million.

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Sai Launches Perps Platform Combining CEX Speed with Onchain Settlement

[PRESS RELEASE – Panama City, Republic of Panama, February 18th, 2026]

Sai today launched Sai Perps, a perpetuals trading platform built to be as fast and intuitive as a centralized exchange with the transparency and self-custody of on-chain settlement. The platform features gasless transactions, removing friction for traders while maintaining full on-chain security.

Sai also unveiled Let’s Go Saicho, a one-month on-chain trading competition running from February 18 through March 19, 2026, with $25,000 in total prizes. The campaign is structured in two phases designed to reward both performance and participation: a PNL competition for profitable traders, followed by a first-come, first-serve “Be Early” phase for traders who engage early and hit a minimum volume threshold.

“On-chain markets shouldn’t require traders to compromise between speed and self-custody,” said Matthias Darblade, a Sai contributor. “Sai Perps is designed for active traders who want a clean, CEX-like experience, while still getting the transparency and settlement guarantees that only on-chain infrastructure can provide.”

Why Sai vs. Other Perps DEXs

Sai Perps is built around the premise: trading should be accessible without the usual friction of on-chain perps. Compared to existing perpDEXs, Sai stands out in many ways:

- CEX-like UX, on-chain settlement: A streamlined trading experience designed to be fast and familiar, with trades settling on-chain for transparency and verifiability.

- Infrastructure built for deep, smooth markets: Sai has focused heavily on liquidity, risk systems, and oracle design to support more consistent execution and robust market integrity.

- Accessible to both new and experienced traders: A platform experience optimized for speed and clarity, without sacrificing advanced trading capability.

- Roadmap beyond crypto perps: Sai’s planned expansion includes stocks, commodities, and FX markets, plus user-focused capital efficiency features like Sai Savings (yield on deposits), and cross-chain deposits.

Let’s Go Saicho: $25,000 Trading Competition (Feb 18 – Mar 19, 2026)

Let’s Go Saicho is a one-month competition rewarding trading on Sai across two two-week phases:

- Phase 1 (Feb 18 – Mar 4): PNL Competition | $20,000 prize pool, 50 winners

- Phase 2 (Mar 5 – Mar 19): Be Early (First Come First Serve) | $5,000 prize pool, 50 winners

All markets listed on Sai are eligible in both phases. Traders may go long or short on any listed pair using supported collateral (e.g., USDC and other supported assets such as stNIBI, as available on Sai). For more details on Sai’s Trading Competition, visit here.

About Sai

Sai is a new perpetuals trading platform designed to feel as easy and fast as a centralized exchange, while still settling fully on-chain. Sai’s mission is to make advanced trading accessible without sacrificing transparency or self-custody.

Sai is focused on finalizing its core trading infrastructure and user experience, building liquidity and risk systems for smoother execution, and laying the groundwork for yield features that help users earn on idle collateral. Next on the roadmap: expanded markets (stocks, commodities, FX), Sai Savings, cross-chain deposits, and smart accounts for gasless trading.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

ECB To Launch Payment Provider Selection For Digital Euro

The European Central Bank (ECB) is moving closer to a pilot for a digital euro, with Executive Board Member Piero Cipollone outlining plans to begin selecting payment service providers (PSPs) in early 2026, ahead of a 12-month test scheduled for the second half of 2027.

Cipollone on Wednesday held an executive committee meeting of the Italian Banking Association. He said the pilot would involve a limited number of payment service providers, merchants and Eurosystem staff. Selection of participating providers is expected to start in the first quarter of 2026.

Cipollone said the digital euro will be designed to ensure it protects European card schemes and keeps banks at the core of the Eurozone payments system, according to Reuters.

Pilot could give PSPs an early start

European Union-licensed PSPs will be at the core of digital euro distribution, Cipollone said. For participating PSPs, the pilot offers an early-readiness advantage ahead of a potential broader rollout, including hands-on experience with onboarding, settlement and liquidity management.

He added that it also provides clearer visibility on future infrastructure, compliance and staffing costs, helping companies plan investments more accurately.

With direct Eurosystem support and the ability to feed into the design process, participants should gain both operational insight and influence over how the digital euro ultimately takes shape.

Stablecoins are not the only threat to banks, says Cipollone

The digital euro pilot is also intended to protect domestic European payment projects, such as Italy’s Bancomat card network and Spain’s Bizum peer-to-peer system.

“Banks could lose their role in payments not just because of stablecoins but also due to other private solutions,” Cipollone said, pointing to Europe’s heavy reliance on international card networks like Visa and Mastercard.

He added that the digital euro would be structured to preserve the competitiveness of local systems.

“The cap on the fee that merchants will pay on the digital euro network will be lower than what the international payments network, normally the costlier, charge, but higher than what domestic payments scheme, normally the cheapest, charge,” Cipollone said.

Cointelegraph contacted the ECB for comment on the PSP selection but had not received a response by publication.

Related: Lagarde early exit report puts ECB succession and digital euro in focus

The news marks a milestone in the digital euro pilot after the ECB officially moved to the next phase of the project in October 2025, targeting a launch in 2029.

The central bank then projected that a pilot exercise could start in 2027 if legislation is put in place during the course of 2026.

Magazine: Is China hoarding gold so yuan becomes global reserve instead of USD?

Crypto World

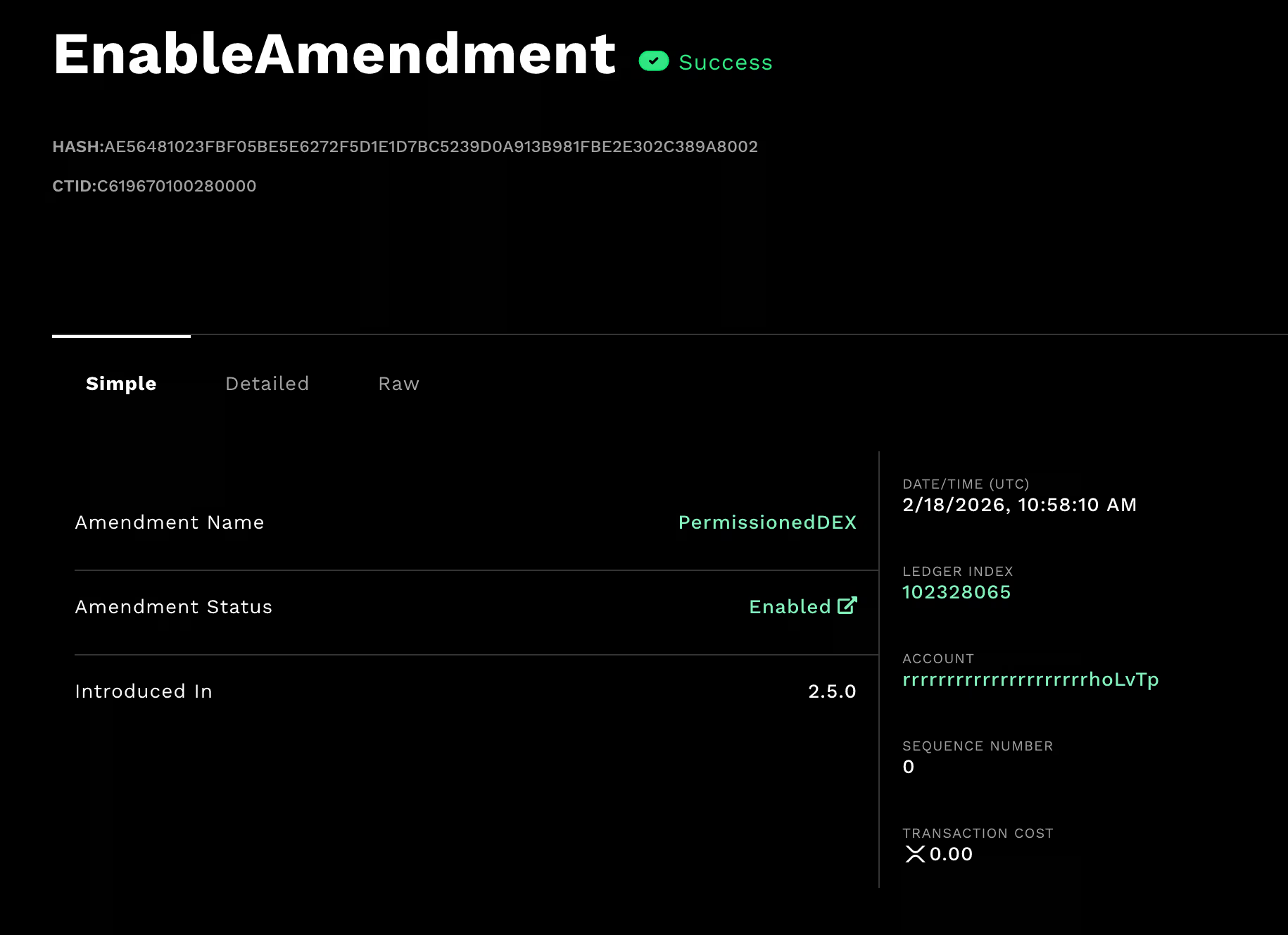

XRP Ledger rolls out members-only DEX for regulated institutions

The XRP Ledger has activated a new “Permissioned DEX” amendment, a technical upgrade designed to let regulated institutions trade on XRPL without opening markets to everyone.

The change, known as XLS-81, allows the creation of permissioned decentralized exchanges that work like XRPL’s existing built-in DEX, but with a key difference.

A permissioned domain can restrict who is allowed to place offers and who is allowed to accept them, creating a gated trading venue where participation can be tied to compliance requirements such as KYC and AML checks.

Think of it as a ‘members only’ marketplace, while still keeping the trading mechanics native to the ledger.

The feature is aimed at banks, brokers and other firms that may want onchain settlement and liquidity but cannot interact with fully open DeFi markets. For these players, the ability to control access is not optional but forms the minimum requirement.

The activation also adds to a growing set of “institutional DeFi” primitives XRPL has been rolling out this month. Token Escrow, or XLS-85, went live last week, extending XRPL’s native escrow system beyond XRP to all trustline-based tokens and Multi-Purpose Tokens, including stablecoins such as RLUSD and tokenized real-world assets.

Together, the two upgrades create a more complete toolkit for regulated finance on XRPL. Token escrow allows conditional settlement for assets issued on the network, while the permissioned DEX provides a controlled venue for trading them.

That combination is central to use cases like tokenized funds, stablecoin FX rails, and regulated secondary markets for tokenized assets.

While the changes are unlikely to matter to most retail traders day to day, they signal XRPL’s direction. It is building infrastructure for institutions first, even if that means leaning into gated markets rather than the fully open DeFi model that defined the last cycle.

Crypto World

Aptos (APT) declines 3%, leading index lower

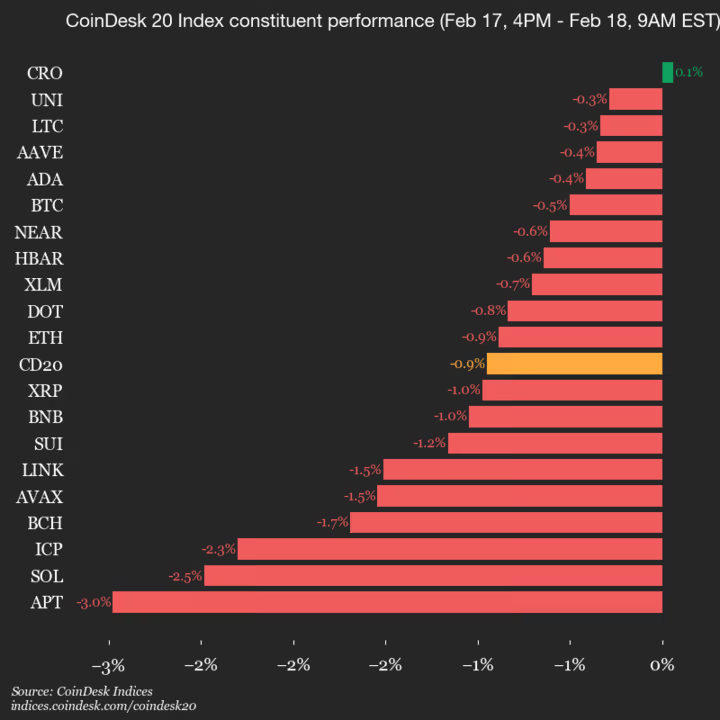

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index.

The CoinDesk 20 is currently trading at 1962.18, down 0.9% (-18.81) since 4 p.m. ET on Tuesday.

One of the 20 assets is trading higher.

Leaders: CRO (+0.1%) and UNI (-0.3%).

Laggards: APT (-3.0%) and SOL (-2.5%).

The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally.

Crypto World

MYX closes strategic funding round led by Consensys

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

MYX has completed and closed a strategic funding round led by Consensys ahead of its V2 launch.

Onchain derivatives protocol MYX has completed a strategic funding round led by Consensys, with participation from Consensys Mesh and Systemic Ventures, ahead of the MYX V2 launch. With the closing of this round, Consensys has officially become the largest investor in MYX. The raise supports the rollout of MYX’s Modular Derivative Settlement Engine, marking the platform’s transition into core infrastructure for omnichain derivatives.

MYX V2 represents a structural shift in how onchain derivatives are built and settled. Rather than operating as a vertically integrated dapp, MYX now serves as a modular settlement layer that other products and platforms can build upon.

At the protocol level, MYX V2 integrates account abstraction via EIP-4337 and EIP-7702 alongside Chainlink’s latest permissionless oracle stack. Together, these components are designed to remove long-standing frictions in onchain trading including slow listings for long-tail assets as well as inefficient use of capital and complex transaction flows.

MYX V2 enables gasless, one-click trading while preserving non-custodial control and introduces a Dynamic Margin system that supports up to 50x leverage without relying on traditional order book depth. This architecture allows MYX to offer oracle-anchored pricing that eliminates slippage for large orders, significantly reducing execution risk for professional traders.

By decoupling liquidity depth from execution quality, MYX aims to eliminate the trade-off between access and execution that onchain perps traders deal with every day. MYX states that with this approach, traders no longer need to wait for deep order books, ladder into positions, or eat slippage when trading size, especially in new or volatile markets. Pricing is anchored directly to oracles rather than transient market depth, allowing positions to be opened and closed at predictable prices regardless of local liquidity conditions.

According to the team, the result is materially lower effective trading costs than underlying spot markets, immediate access to newly emerging assets, and consistent execution even during periods of market stress. These mechanics are not discretionary or market-maker dependent; they are enforced by deterministic economic models, robust margin systems, and conservative security assumptions designed to perform under real trading conditions.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

Bitcoin stays volatile while MUFG says stables work better as money

Bitcoin slips ~2% in 7d as MUFG touts stablecoins’ price-stable payments.

Summary

- TC trades near $68k, with a 7d move of about -2.25%, and a 24h range around $66.7k–$69.1k.

- MUFG’s Hardman says stablecoins better meet money’s role via price stability, fast settlement, and low-cost transfers versus BTC’s higher volatility.

- Stablecoins, often fiat-pegged, are gaining attention as digital cash and could see higher adoption in payments while BTC remains mainly a store-of-value asset.

An analyst at Mitsubishi UFJ Financial Group has stated that stablecoins represent a more suitable currency option than Bitcoin for payment purposes, according to recent commentary from the Japanese financial institution.

Lee Hardman, an analyst at MUFG, one of Japan’s three largest banks, said stablecoins have attracted increased attention compared to other digital assets due to their function as digital cash.

Hardman stated that stablecoins better fulfill the requirements of money by offering price stability and fast, low-cost payment services, according to the analyst’s assessment. The analyst noted that Bitcoin’s high price volatility limits its use as a daily payment method.

Stablecoins are pegged to fiat currencies and maintain stable value, making them more likely to be used as a medium of exchange and payment, Hardman said.

The comments come as interest in Bitcoin and cryptocurrencies continues to expand globally, with financial institutions increasingly evaluating various digital asset classes for potential use cases.

Crypto World

What Happens to ETH if $2K Support Is Decisively Lost?

After the aggressive sell-off toward the $1.8K region, the market has transitioned into choppy consolidation, while lower timeframes are now approaching a decisive breakout point. The key question is whether this compression resolves to the upside or results in continuation within the dominant downtrend structure.

Ethereum Price Analysis: The Daily Chart

On the daily timeframe, Ethereum is exhibiting clear consolidation behaviour following its sharp decline. The price action has become increasingly choppy, reflecting equilibrium between buyers and sellers. Instead of impulsive continuation, the market is printing overlapping candles with limited directional commitment.

This consolidation is confined between the $1.8K static support base and the channel’s midline acting as dynamic resistance. The mid-boundary of the descending channel continues to cap bullish attempts, preventing a structural trend reversal. Meanwhile, the $1.8K zone remains a strong demand area that has repeatedly absorbed selling pressure.

As long as the price remains trapped between these two boundaries, the primary scenario is range-bound fluctuation. A confirmed breakout above the channel’s midline would open the path toward higher resistance zones, while a breakdown below $1.8K would invalidate the equilibrium and likely trigger another impulsive leg lower.

ETH/USDT 4-Hour Chart

Zooming into the 4-hour timeframe, the market structure becomes more compressed. Ethereum has formed a clear triangle pattern, with descending resistance and rising support squeezing the price into a narrow apex. This pattern reflects volatility contraction and typically precedes an expansion phase.

The asset is now approaching the final portion of the triangle, suggesting that a breakout is imminent. Given the recent higher lows inside the pattern and the improving short-term structure, the probability of an upside breakout is increasing. The targets are clearly defined on the chart, with the first resistance zone aligned with the previously marked supply region above the pattern at the $2.4K area.

However, failure to break upward and a decisive breakdown below the ascending support would shift momentum back in favour of sellers.

Sentiment Analysis

The Binance ETH/USDT liquidation heatmap reveals significant liquidity dynamics around the current range. A dense liquidity cluster is positioned above the current price, indicating a concentration of short liquidation levels. Such clusters often act as magnets, drawing the price upward to trigger liquidations before a potential reaction.

At the same time, a developing liquidity concentration below the market reflects the accumulation of long positions. This suggests that traders are increasingly positioning for upside continuation, building long exposure near the consolidation zone.

The interaction between these liquidity pools increases the likelihood of a volatility expansion. A breakout to the upside could trigger short liquidations above the price, accelerating the move. Conversely, a downside sweep could target the long liquidity cluster before a potential rebound.

Overall, Ethereum is in a compression phase. The daily chart reflects equilibrium within a broader downtrend, the 4-hour chart shows a triangle nearing resolution, and liquidity positioning suggests that a decisive breakout move is approaching.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

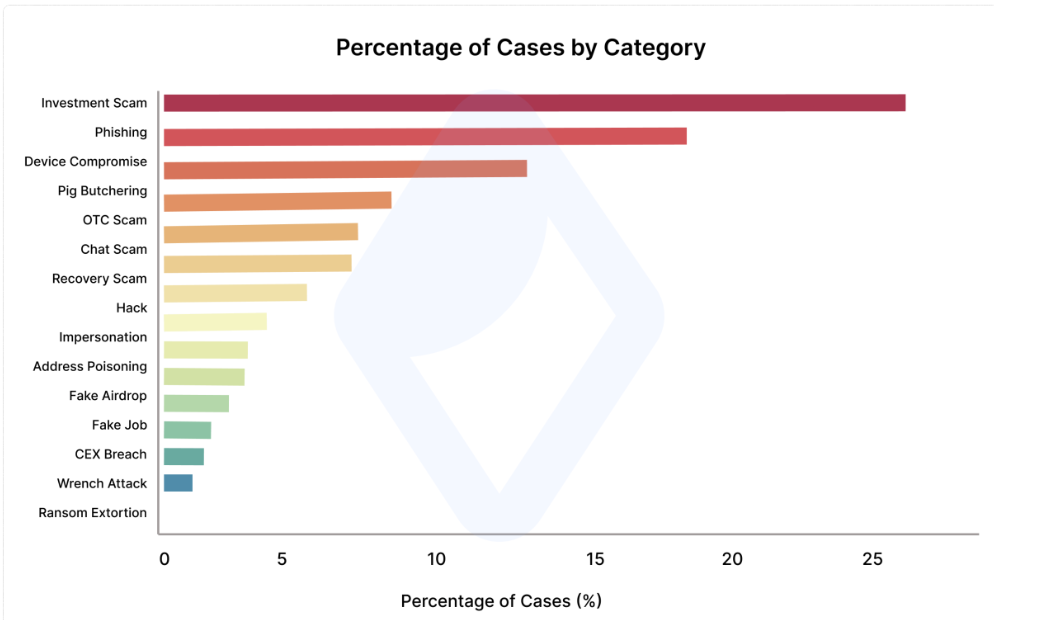

AMLBot Says Social Engineering Drove 65% of Crypto Incidents in 2025

About two-thirds of crypto incidents investigated by blockchain analytics company AMLBot in 2025 were driven by social engineering rather than technical exploits, according to a report based on the company’s internal casework.

AMLBot said 65% of the incidents it reviewed last year involved access and response failures, such as compromised devices, weak verification and delayed detection, instead of vulnerabilities in blockchains or smart contracts.

The company said its analysis drew on about 2,500 internal investigations and should not be read as an industry-wide measure of crypto crime, according to a Wednesday report shared with Cointelegraph.

Primary attack vectors included device compromises via chat scams, impersonation scams, and other investment and phishing scams involving social manipulation.

Crypto phishing attacks are social engineering schemes that don’t require hacking code. Instead, attackers share fraudulent links to steal victims’ sensitive information, such as the private keys to crypto wallets.

The findings suggest that security improvements at the protocol level may not be enough to protect users if scammers can bypass safeguards by targeting people directly.

Investment scams and phishing lead by case count

Investment scams accounted for the largest share of cases (25%), followed by phishing attacks (18%) and device compromises (13%), as the most damaging categories in terms of case frequency.

Related: 22 Bitcoin worth $1.5M vanish from Seoul police custody

Pig-butchering scams accounted for 8%, over-the-counter (OTC) fraud for 8%, and chat-based impersonation represented 7%, collectively making up the second tier of the most frequent attacks.

Impersonation linked to $9 million in recent losses

AMLBot traced at least $9 million in stolen digital assets to impersonation-related attacks over the past three months.

Impersonation is the most damaging attack vector in terms of social engineering scams, Slava Demchuk, CEO of AMLBot, told Cointelegraph. “Attackers continue to exploit and trick victims with a ruthless game of charades, posing as trusted entities,” he said. “Sometimes they’re exchange support teams, investment partners, project managers or reps.”

Demchuk urged users not to share private keys or recovery phrases and to be wary of urgent requests involving fund transfers or wallet access, which he said are common entry points for social engineering scams.

Related: Binance confirms employee targeted as three arrested in France break-in

To protect against impersonation attacks, Demchuk urged crypto investors not to share their private keys and recovery phrases.

He also advised investors to ignore “urgent requests involving fund transfers of wallet access,” which are usually the first point of contact for social engineering scams.

CertiK reports January spike in crypto losses

Crypto scams saw an uptick in January, when scammers stole $370 million, the highest monthly figure in 11 months, according to crypto security company CertiK.

$311 million of the total value was attributed to phishing scams, with a particularly damaging social engineering scam costing one victim around $284 million.

Magazine: Meet the onchain crypto detectives fighting crime better than the cops

-

Sports7 days ago

Sports7 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Video2 days ago

Video2 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech3 days ago

Tech3 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video5 days ago

Video5 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech1 day ago

Tech1 day agoThe Music Industry Enters Its Less-Is-More Era

-

Sports1 day ago

Sports1 day agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Crypto World1 day ago

Crypto World1 day agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Business15 hours ago

Business15 hours agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Video1 day ago

Video1 day agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech6 hours ago

Tech6 hours agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World5 days ago

Crypto World5 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World7 days ago

Crypto World7 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video6 days ago

Video6 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

NewsBeat3 days ago

NewsBeat3 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business6 days ago

Business6 days agoBarbeques Galore Enters Voluntary Administration

-

Business7 hours ago

Business7 hours agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Crypto World6 days ago

Crypto World6 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat3 days ago

NewsBeat3 days agoMan dies after entering floodwater during police pursuit

-

Crypto World5 days ago

Crypto World5 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

NewsBeat4 days ago

NewsBeat4 days agoUK construction company enters administration, records show