Crypto World

WLFI price outlook as bulls target key resistance at $0.14

- World Liberty Financial’s price traded to highs of $0.1145 in the early hours on Monday.

- The WLFI token could break to $0.14 or higher if bulls hold.

- Broader market conditions may derail the momentum.

WLFI, the native token of the World Liberty Financial project, posted double-digit gains early on Monday, rebounding from losses that saw prices slide to lows near $0.09 on Friday.

Data from CoinMarketCap showed WLFI climbing more than 12% to intraday highs of $0.1145, placing it among the day’s top performers alongside Axie Infinity.

The rally was supported by a sharp rise in trading activity, with 24-hour volume surging 98% to more than $228 million.

The move also coincided with Bitcoin and Ethereum hovering near $70,000 and $2,000, respectively.

The rebound suggests the token is attempting to recover quickly from the lows recorded during last week’s broader market sell-off.

WLFI price jumps to near $0.12

WLFI’s upward momentum propelled the token close to $0.12, with likely bullish drivers being a confluence of whale accumulation and an upcoming high-profile event.

Blockchain analytics firm Lookonchain reported that a new wallet had deployed $10 million in USDC to acquire 47.6 million WLFI tokens.

The large purchase was at an average price of $0.109, and data showed the whale still held more than $4.8 million of dry powder ready for fresh buying.

Adding to the bullish sentiment is the anticipation surrounding the World Liberty Forum.

The event is slated for February 18 at Mar-a-Lago, and could feature investment heavyweights from Goldman Sachs, Franklin Templeton, and FIFA.

These developments come despite the latest spotlight on World Liberty Financial from Democrats, largely around the $500 million investment into the project by the UAE.

Investors defying the negative sentiment from this development look to have added to the buying pressure that pushed WLFI toward the $0.12 supply wall.

World Liberty Financial price prediction

Technical indicators on WLFI’s four-hour chart point to a strengthening near-term outlook, with prices trading above the midline of a descending channel.

Further upside could see the token test the upper boundary of the channel.

From a technical perspective, this setup suggests the potential for a breakout, with a key supply zone located around $0.14.

Momentum indicators are also supportive. The Moving Average Convergence Divergence (MACD) has registered a bullish crossover, while the Relative Strength Index (RSI) is hovering near 47, indicating neutral-to-bullish conditions as the market recovers from earlier overbought levels.

Traders are now focused on $0.14 as the main resistance level.

A sustained move above this zone could open the way toward $0.16, where the upper Bollinger Band and previous support levels converge.

On the downside, a failure to hold support near $0.13 could trigger a pullback toward the lower end of the channel, around $0.10, underscoring the importance of strong volume confirmation for any further upside move.

Crypto World

They Must Evolve, Says Aave Founder

Stani Kulechov, the founder of decentralized lending platform Aave (CRYPTO: AAVE), argues that the very premise of decentralized autonomous organizations (DAOs) needs rethinking. In the wake of ongoing governance disputes surrounding the future direction of the protocol, Kulechov contends that tokenholder voting should not be the sole mechanism for steering a project, especially when daily operations require decisive leadership. His reflections come as Aave and the broader DAO landscape grapple with how to balance on-chain transparency and accountable decision-making with the friction inherent in collective governance.

Key takeaways

- DAO participation typically runs in the 15%–25% range, raising concerns about power concentration and governance deadlock.

- Kulechov advocates preserving code-based rules and on-chain accountability while ensuring token holders retain influence on major strategic decisions.

- The Aave community has seen governance tensions, including the March 1 temperature check for the “Aave Will Win Framework” proposal and the Aave Chan Initiative’s exit from DAO governance oversight.

- Leaders and dedicated teams are necessary for day-to-day protocol management, with accountability tracked on-chain to avoid the pitfalls of traditional corporate bureaucracy.

- The ongoing debates reflect a broader push to refine DAO structures without sacrificing decentralization’s core benefits.

Tickers mentioned: $BTC, $ETH, $COIN, $AAVE

Sentiment: Neutral

Market context: The episode underscores a broader trend in crypto governance where communities seek to formalize decision-making processes without sidelining accountability. As DAOs experiment with different models, governance votes, temperature checks, and delegated authority remain central to evaluating how decentralized networks can scale while maintaining trust among participants.

Why it matters

The discussion around Aave’s governance highlights a tension at the heart of decentralized networks: how to reconcile broad participation with effective, timely decision-making. In a model where rules, treasury visibility, and major policy shifts are encoded on a blockchain, the risk of paralysis or capture by the most vocal factions looms large. Kulechov’s critique focuses on the symptoms—lengthy forum threads, multi-stage voting processes, and the politicization of proposals—and points toward a middle path where decentralization does not mean abdication of accountability.

What makes this debate consequential is its potential impact on how future DAOs design their voting systems and governance workflows. If token holders are empowered to influence only high-stakes, long-term decisions, while professional teams handle day-to-day operations, the governance model could become more sustainable and less susceptible to factional infighting. The emphasis on keeping core rules in code, preserving treasury openness, and maintaining on-chain accountability could set a template for other protocols wrestling with similar governance frictions.

Observers note that the most successful experiments may blend on-chain transparency with structured, accountable leadership. In Kulechov’s view, the ultimate objective is to keep what works—transparent decision logs, automatic enforcement of rules via smart contracts, and a mechanism to hold teams to account—while trimming the parts of DAOs that resemble obsolete corporate bureaucracy. The aim is not to abandon decentralization, but to refine it so that it remains responsive, verifiable, and resistant to capture by the loudest voices alone.

“DAOs also become politicized very quickly and it’s easy for voting to become about attention. Participants take sides, lean toward the loudest voices, and form political alliances to get their own proposals passed later,”

The quote captures a core concern: without a balanced governance design, DAOs can devolve into popularity contests rather than strategic, outcomes-focused organizations. Yet the same on-chain transparency that enables coordination also provides a tool for real accountability. “The difference is that their decisions and performance are all on-chain and transparent, and token holders can fire the team when objectives are not met. Accountability is verifiable, and that is what separates this from a traditional company. There is no vendor lock-in,”

Aave governance in the spotlight

Kulechov’s remarks come amid active governance experiments within Aave. The protocol recently tested a framework called the “Aave Will Win Framework,” which passed a temperature check on March 1, signaling continued experimentation with how votes should be structured and how much weight should be given to different stakeholders. The move followed a chain of governance events, including the departure of a prominent governance delegate, the Aave Chan Initiative (ACI), which announced it would wind down its involvement with the Aave DAO over concerns with governance standards and voting dynamics during the proposal process.

Earlier in the year, another notable governance episode involved a proposal intended to transfer control of Aave’s brand assets and intellectual property to the DAO, a move that ultimately failed. Those debates have rekindled discussions about the protocol’s long-term direction and the governance architecture needed to sustain a large, active ecosystem. The tension reflects a broader pattern across the space: communities seek to preserve decentralization’s core advantages while layering on governance mechanisms that can enforce accountability and clarity around decision-making.

For context, the conversation is not happening in a vacuum. It aligns with a growing set of discussions around AI-assisted governance, executive oversight in decentralized structures, and how best to translate the benefits of on-chain governance into practical outcomes. In related discourse, Vitalik Buterin has explored potential AI-assisted governance approaches, underscoring that the field is actively seeking tools to augment human decision-making in DAOs. The debate has extended to how, if at all, AI could help moderate proposals, synthesize inputs, and highlight trade-offs in complex governance processes.

In parallel, this ongoing discourse continues to influence how creators, developers, and investors view DAO-based ecosystems. While critics worry about dilution of accountability when projects become too automated or too diffuse, proponents argue that the on-chain record and the ability to replace or rematch participants creates a form of governance that is fundamentally different from traditional centralized leadership—and potentially more resilient in the long term.

What to watch next

- March–April: Follow the outcome of subsequent votes and any formal revisions to the Aave governance framework, including how proposals are scoped and how powers are delegated.

- Regulatory and legal developments that may influence DAO structures and on-chain governance transparency.

- New proposals addressing treasury management, asset diversification, and branding/IP control within Aave’s ecosystem.

- Updates to AI-assisted governance experiments and any public pilots or white papers from related projects.

Sources & verification

- Aave Will Win Framework temperature check and governance votes: https://cointelegraph.com/news/aave-temp-check-split-vote-arfc-governance

- Aave Chan Initiative exit from DAO governance: https://cointelegraph.com/news/aave-aci-exit-dao-governance-vote

- Aave governance and branding/IP transfer discussions: https://cointelegraph.com/news/aave-founder-strategy-after-governance-vote

- AI-assisted DAO governance discussions with Vitalik Buterin: https://cointelegraph.com/news/ai-assisted-dao-governance-vitalik-buterin

DAO governance in focus: Aave’s push for accountable decentralization

Stani Kulechov, the founder of decentralized lending platform Aave (CRYPTO: AAVE), has emerged as a prominent voice in the evolving debate over how DAOs should function. In remarks and on-chain discourse, he emphasizes that the current model—where tokenholders vote on a labyrinth of issues—often yields suboptimal outcomes due to slow processes, internal schisms, and the tendency for controversy to eclipse substance. He notes that DAOs, by design, eschew traditional corporate leadership, but the practical reality increasingly mirrors bureaucratic challenges when proposals require extended discussion, a cascade of polls, and multiple rounds of voting. The central question is whether tokenholder input should be scaled down for day-to-day operations while preserving it for high-impact decisions.

In his view, the solution lies in a hybrid approach that preserves what DAOs do well—on-chain rules, transparent treasury management, and public accountability—while ensuring that the leadership layer has the capacity to act swiftly when necessary. “Rules should stay in the code, DAOs typically resolve decisions through smart contracts on a blockchain, the treasury should stay visible to everyone, and token holders should still have input on major decisions,” he argues. Acknowledging that governance will never be perfect, he suggests designing mechanisms to reduce the risk of capture by the most vocal participants while maintaining a high degree of transparency that distinguishes crypto governance from conventional corporate governance.

Proponents of the status quo point to the counter-argument: a fully centralized team could undermine decentralization. The challenge is to strike a balance that preserves broad participation without allowing endless politicking to derail execution. A pivotal part of the conversation is about accountability. If the decisions, performance, and outcomes are recorded on-chain, token holders can evaluate results and potentially replace leadership that underdelivers. The on-chain trail offers a form of verifiability that is not easily replicable in traditional company structures, even as it requires careful governance engineering to prevent fragmentation.

As this debate unfolds, the Aave governance experiments, including the temperature checks and the strategic assessments around IP and branding, will likely influence other DAOs exploring efficient governance models. The dialogue underscores a broader industry trend: builders and communities are actively seeking to reshape governance to be both more accountable and more scalable, without sacrificing the decentralized ethos that attracted many participants to Web3 in the first place. The path forward, as Kulechov and others suggest, may lie in blending codified rules with pragmatic leadership, all while maintaining the transparency that crypto enthusiasts regard as its defining strength.

Crypto World

Major Ripple (XRP) Announcement for Australian Users

Ripple is on its way to obtain an Australian financial license, further expanding its international presence.

Ripple – the firm behind one of the world’s leading cryptocurrencies, XRP, announced plans to secure an Australian Financial Services License.

The move aims to further enable the company to expand its payments offering in the country, allowing financial institutions, fintech businesses, and enterprises to move value more efficiently and quickly across borders while working within established regulatory frameworks.

Speaking on the matter was Fiona Murray, Managing Director at Ripple for the Asia Pacific region, who said:

“Licensing is fundamental to Ripple’s strategy, ensuring we can deliver secure, compliant solutions to customers worldwide. […] Australia is a key market for Ripple, and an AFSL strengthens our ability to scale Ripple Payments across the region. By leveraging blockchain technology and digital assets, we enable customers to move value globally with greater speed, transparency, and reliability. We remain focused on working closely with regulators to support the next phase of growth for digital asset infrastructure.”

Ripple’s Plan Regarding the AFSL

The goal is to obtain the license by acquiring BC Payments Australia Pty Ltd., subject to finalizing the standard completion process. The move will supposedly strengthen Ripple’s capabilities to offer a licensed platform for moving funds across the globe.

Once obtained, the license will allow the company to manage the full lifecycle of a transaction – from onboarding and compliance through funding, forex, liquidity management, as well as the final payout.

Additionally, Ripple will be able to directly oversee settlement, connect customers to local payout partners, and optimize transaction routing, resulting in quicker settlement, more transparency, and reduced counterparty risk, according to the official blog post.

International Licensing Underway

Obtaining the Australian Financial Services License will be just the last in a series of similar moves for Ripple, which is evidently seeking international licensing. As CryptoPotato reported earlier this year, the firm secured a preliminary electronic money institution license in Luxembourg, which allows it to issue digital cash and provide digital payment services within jurisdictions regulated by the CSSF (Commission de Surveillance du Secteur Financier in Luxembourg).

You may also like:

With that, the US-based firm now holds licenses in several jurisdictions, including but not limited to the United Arab Emirates, Singapore, Ireland, New York, Japan, and more.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Bitcoin Could Hit $1M if it Tracks Gold

Bitcoin needs to make up just one-sixth of the global “store of value” market, currently dominated by gold, to reach $1 million per coin, argues Bitwise chief investment officer Matt Hougan.

In a blog post on Tuesday, Hougan said that most dismiss the lofty forecast for Bitcoin, as it would require Bitcoin to muscle into 50% of gold’s current market value.

However, Hougan said the “mistake” most people are making is ignoring the growth of gold and the broader “store of value” market.

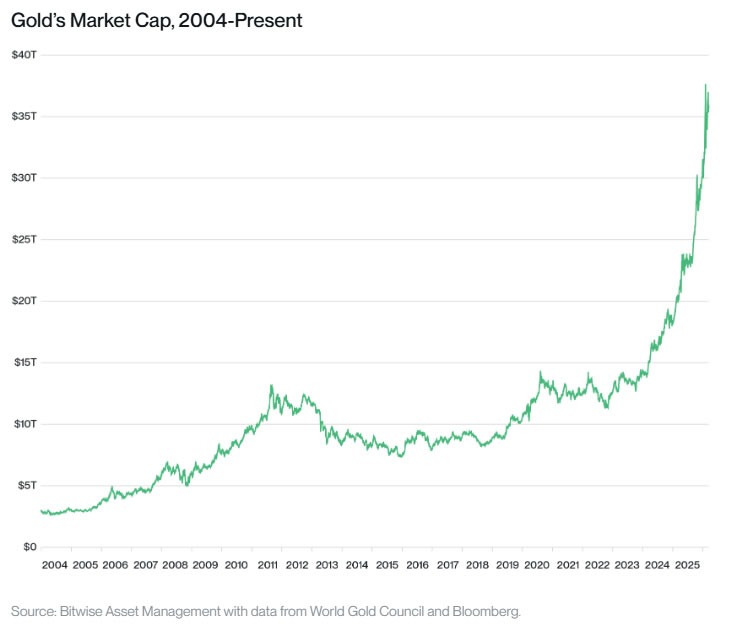

Gold’s market cap has grown at around 13% annually since 2004, from $2.5 trillion to around $38 trillion, driven by “rising concerns about government debt, geopolitical uncertainty, easy monetary policy, and other factors.”

“If this growth rate continues, the global ‘store of value’ market will be [around] $121 trillion in 10 years. At that level, Bitcoin only needs to take 17% of the market to be worth $1 million a coin.”

Related: Bitcoin undervalued relative to gold signals potential rally: Analyst

Hougan cited the growth of institutional investment, such as exchange-traded funds, sovereign wealth funds, and increasing portfolio allocations as potential catalysts.

“There are still miles to go, but with these undercurrents, capturing one-sixth of the store-of-value market in 10 years doesn’t seem extreme,” he said, adding:

“As I see it, the base case — that the store-of-value market will continue to grow as it has, and Bitcoin will continue to gain market share as it has — leads you to much, much higher prices than we have today.”

Bitcoin and gold divergence deepens

Hougan’s million-dollar Bitcoin (BTC) thesis depends on the asset continuing to converge with gold; however, the last several months have shown that Bitcoin hasn’t been moving in lockstep with gold.

The price of gold hit an all-time high of $5,327 per ounce in late January, and it is just 2.2% away from that today, whereas Bitcoin is currently trading down 44% from its October peak.

Billionaire investor Ray Dalio cautioned against Bitcoin as a long-term store-of-value and safe-haven asset in early March, stating that gold was much better.

He argued that central banks are not buying BTC, which he said behaves more like a tech stock.

Greg Cipolaro, global head of research at NYDIG, said on March 6 that it appears Bitcoin is “not currently being priced as a macro hedge, a sovereign risk hedge, or a real-rate or inflation trade.”

“That dynamic helps explain the ongoing frustration around Bitcoin’s failure to ‘act like gold’ despite the digital gold label.”

Magazine: China’s ‘50x’ blockchain boost, Alibaba-linked AI mines Bitcoin: Asia Express

Crypto World

Months More Bitcoin Consolidation Expected as Long-term Holder Activity Decreases

Bitcoin prices could continue to consolidate for a while yet, as network activity indicates decreasing momentum amid reduced selling pressure.

Bitcoin didn’t remain above $70,000 for long and has fallen back below it in early trading on Wednesday morning. Resistance was too strong, and it has returned to the middle of its five-week range-bound channel.

Long-term holder activity has decreased significantly, declining to levels typically seen during bear markets, according to CryptoQuant analyst ‘Darkfost’ on X on Wednesday.

They added that this decline in activity “reflects a reduction in selling pressure, which likely helps Bitcoin continue consolidating.”

📉 LTH activity has decreased significantly, to the point where it has returned to levels typically seen during bear markets.

This chart shows the monthly total of BTC spent by LTHs.

⁰Be careful when interpreting the spike in November, as it corresponds to the period when… pic.twitter.com/kXIRnpukdy— Darkfost (@Darkfost_Coc) March 10, 2026

Months of Boring Sideways Markets

Analyst ‘Daan Crypto Trades’ observed that it has been another week where BTC’s price closed below the 200-week exponential moving average, a very long-term trend indicator. He added that it tried to get back above it on this push early in the week, but failed, falling back below $70,000.

Meanwhile, the bull market support band is “moving down rapidly and will meet the price relatively quickly, as long as it keeps hovering around here,” he added. This could result in months of consolidation and sideways markets.

“My base case is still that we will spend quite a while in this larger, let’s say ~$60K-$80K region. Could easily take several months before we see a decisive move again, I think.”

“Back and forth. Back and forth. That’s the current rhythm of Bitcoin,” commented MN Fund founder Michaël van de Poppe on Tuesday. “No breakout, but the longer it stays in here, the stronger the move will be,” he added.

You may also like:

Meanwhile, ‘RedHotTrade’ said Bitcoin is “compressing between $60,000 and $70,000 and “multiple technical patterns are forming at once.”

“When several patterns point to the same breakout level, the move that follows is often explosive.”

Analyst Matt Hughes observed that BTC price keeps getting rejected just above $71,000, “so we can’t celebrate a real breakout until weekly candles close above this level.”

Crypto Market Outlook

Crypto markets are flat on the day with total capitalization remaining at $2.45 trillion, close to where it has been since early February.

Bitcoin was rejected at $71,600 on Tuesday and had fallen back to $69,600 at the time of writing. Meanwhile, Ether prices remained tightly coiled just above $2,000, slowly eroding previous minor gains.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Aave Founder Says DAOs Must Evolve

Stani Kulechov, the founder of decentralized lending platform Aave, says decentralized autonomous organizations (DAOs) need a rethink, namely, how much tokenholders vote on as opposed to input from leaders.

His comments came in the wake of governance disputes about the future of the protocol.

Kulechov said in an X post on Tuesday that DAOs, in their current form, are “extraordinarily difficult” to operate because of internal conflicts and proposals that can take weeks of forum posts, temperature checks and multiple votes to pass.

DAOs are intended to operate without core leadership, with all decisions made through community consensus; however, average participation rates in DAOs are estimated at 15% to 25%, which can lead to issues such as power centralization and ineffective decision-making.

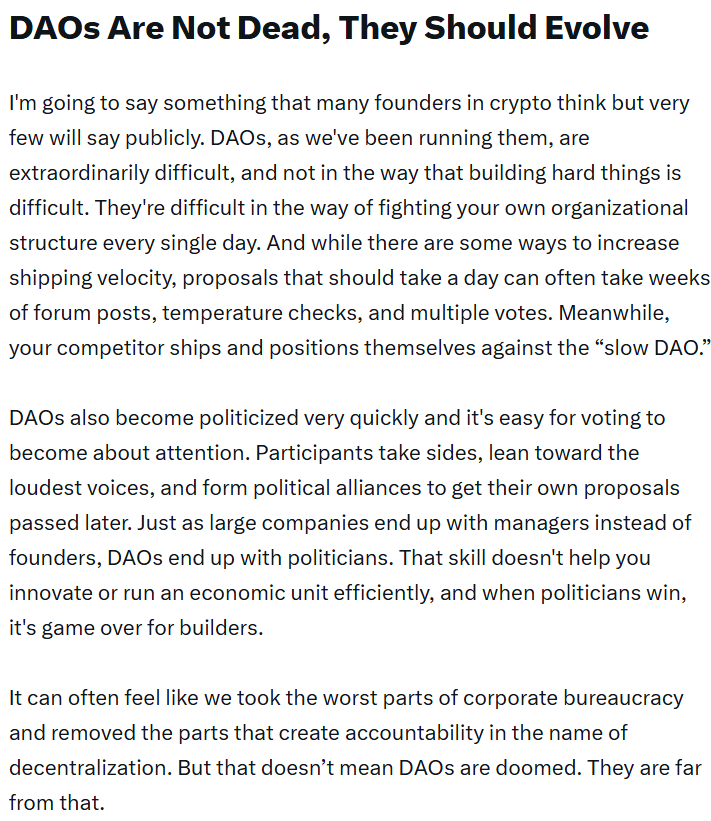

“DAOs also become politicized very quickly and it’s easy for voting to become about attention. Participants take sides, lean toward the loudest voices, and form political alliances to get their own proposals passed later,” Kulechov said.

“It can often feel like we took the worst parts of corporate bureaucracy and removed the parts that create accountability in the name of decentralization. But that doesn’t mean DAOs are doomed. They are far from that,” he added.

DAOs should keep what works, leave the rest

Kulechov said the path forward needs to involve DAOs keeping what they “got right” and fixing “what they got wrong.”

He proposes that rules should stay in the code, DAOs typically resolve decisions through smart contracts on a blockchain, the treasury should stay visible to everyone, and token holders should still have input on major decisions.

Related: Vitalik Buterin proposes using AI to strengthen DAO governance

However, Kulechov argues that going forward, token holders shouldn’t vote on everything, because running the protocol day-to-day requires teams and leaders, not thousands of voters.

“Someone needs to wake up every morning with the full context in their head and make hard calls,” he said.

“The difference is that their decisions and performance are all on-chain and transparent, and token holders can fire the team when objectives are not met. Accountability is verifiable, and that is what separates this from a traditional company. There is no vendor lock-in.”

Aave governance proposals spark exit

Kulechov’s comments come amid a proposal, the “Aave Will Win Framework,” which passed a temperature check on March 1.

Soon after, a major governance delegate, the Aave Chan Initiative, announced it would wind down its involvement with the Aave DAO over concerns with the governance standards and voting dynamics during the proposal process.

In January, another proposal to transfer control of Aave’s brand assets and intellectual property to its DAO failed, prompting renewed debate within the Aave community over the protocol’s long-term direction and governance structure.

Magazine: The debate over Bitcoin’s four-year cycle is over: Benjamin Cowen

Crypto World

Bitcoin to $1 million? Bitwise CIO says it could happen under these conditions

Bitcoin could reach $1 million per coin if it captures a meaningful share of the global store-of-value market, according to a new memo from Matt Hougan, chief investment officer at Bitwise Asset Management.

Summary

- Bitwise CIO Matt Hougan says Bitcoin could reach $1 million if it captures about 17% of the global store-of-value market.

- The analysis frames Bitcoin as a competitor to gold, which currently dominates the store-of-value sector.

- Increasing adoption through spot Bitcoin ETFs and institutional investment could help drive Bitcoin’s market share higher.

Bitcoin’s path to $1M runs through gold’s market: Bitwise CIO

In the memo titled “How Bitcoin Gets to $1 Million,” Hougan argues that Bitcoin’s (BTC) long-term valuation depends largely on its ability to compete with traditional store-of-value assets such as gold and government bonds.

Hougan estimates the global store-of-value market at roughly $38 trillion, with Bitcoin currently accounting for only a small portion of that total.

The largest share is held by gold, which he describes as Bitcoin’s most direct competitor.

According to the analysis, if the store-of-value market grows to around $120 trillion over the next decade and Bitcoin captures roughly 17% of that market, the cryptocurrency could reach a valuation close to $1 million per coin.

Hougan argues that such a scenario is not as far-fetched as it once seemed, citing the rapid institutional adoption of Bitcoin in recent years.

A key factor driving that adoption has been the launch of spot Bitcoin exchange-traded funds in the United States, which have opened the asset class to pension funds, financial advisors and other institutional investors that previously had limited access to crypto markets.

Hougan said these developments have helped position Bitcoin as a legitimate macro asset alongside traditional stores of value. As institutional allocations increase and global demand for non-sovereign assets grows, Bitcoin could gradually gain market share within the broader store-of-value ecosystem.

“As I see it, the base case—that the store-of-value market will continue to grow as it has, and bitcoin will continue to gain market share as it has—leads you to much, much higher prices than we have today,” Hougan wrote.

The memo stops short of predicting an exact timeline for the $1 million milestone, but suggests the target could be achievable within roughly a decade if Bitcoin adoption continues to expand and the broader market for store-of-value assets grows.

Crypto World

Crypto Bill Can Advance, but Lobbyists Will Be Unhappy: Senator

A US Senate Democrat says crypto and banking lobbies will both have to accept compromises amid a new proposal to move the crypto market structure bill forward.

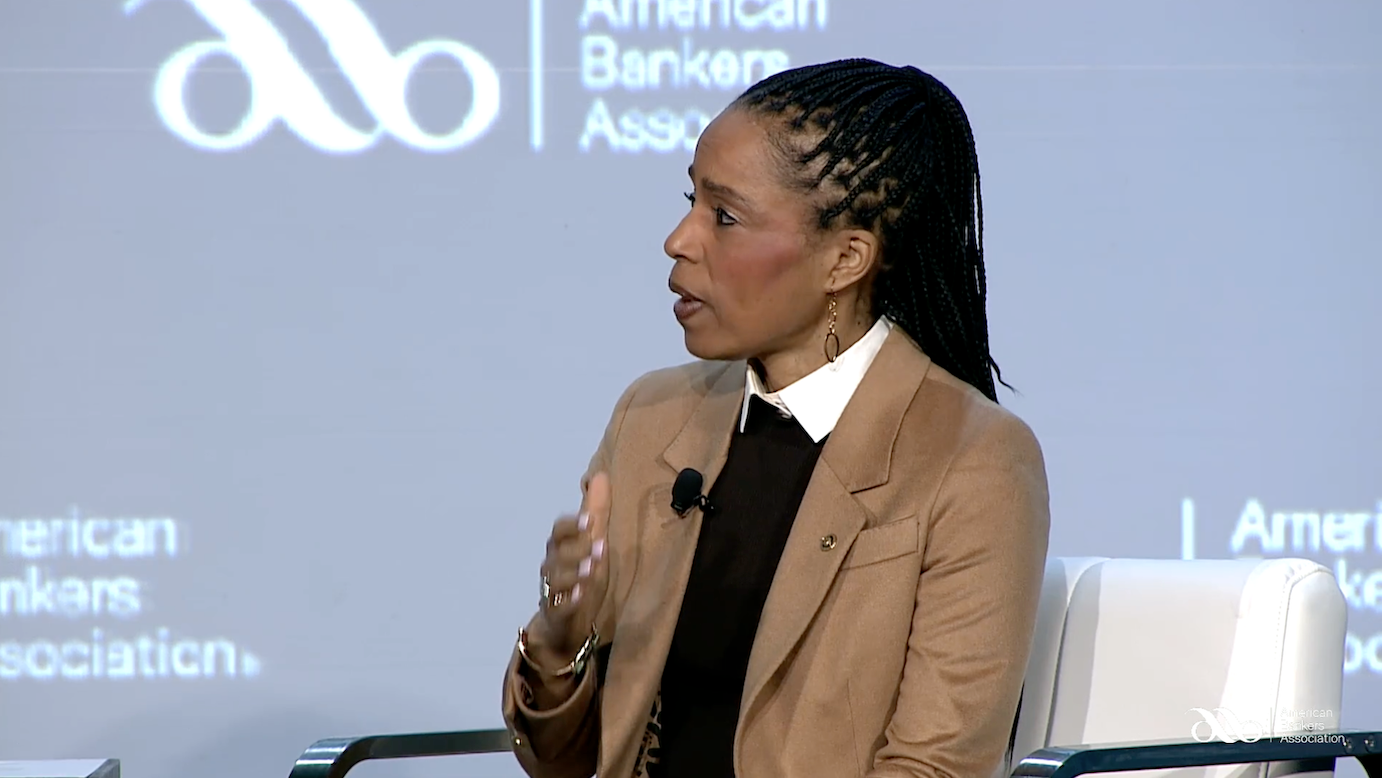

Senator Angela Alsobrooks, a key Democrat on the Senate Banking Committee, said at an American Bankers Association event on Tuesday that she and Republican Senator Thom Tillis are working on a compromise proposal, but crypto and banking interests can’t let “perfect be the enemy of good.”

“All of us will probably walk away just a little bit unhappy,” she said. “What we don’t want is to have an unregulated system — to have crypto not regulated at all — and not to have the guardrails to allow a situation where we will have deposit flight.”

Banking groups, including the American Bankers Association, have pushed for the Senate to include a ban on third-party stablecoin yield payments in crypto market structure legislation pending in the Senate.

The groups argue that the payments are a deposit flight risk for bank accounts that could destabilize the banking system and that the ban would close a perceived loophole in the GENIUS Act, which banned stablecoin issuers from offering yield on their tokens.

Stablecoin yield payments are a popular way for crypto exchanges to entice customers, and crypto lobby groups have fought against the proposal to ban them.

The fight has stalled the crypto bill from moving forward, which outlines how market regulators would police crypto.

Senator Alsobrooks said that in negotiations for the GENIUS Act, lawmakers knew they’d have to “revisit the issue around interest and yield,” adding that crypto market structure legislation must address the issue of stablecoin yields so they don’t end up undermining the banking sector.

Related: Donald Trump takes swipe at banks over stalled crypto bill

“If it quacks like a duck and looks like a duck, it is a duck,” she said. “Making sure that we are not allowing bank-like products without bank-like protections — this is what we know is really important.”

Americans want stablecoin yield limits if banks at risk

Alsobrooks’ comments come as the American Bankers Association shared a survey finding that 42% of respondents agreed that Congress should ban stablecoin yields if there is any risk that it could reduce the amount of money available to banks.

The survey, conducted by Morning Consult on behalf of the lobby group and polling a national sample of 4,456 adults, also found that 84% agreed that a business providing bank-like services, like a savings product, should be “held to the same standards for consumer protection that banks are.”

Magazine: How crypto laws changed in 2025 — and how they’ll change in 2026

Crypto World

XRP price rises as Brad Garlinghouse highlights priorities for 2026

XRP price turned on Tuesday as the crypto market rallied, and after Brand Garlinghouse highlighted Ripple’s priorities for the year.

Summary

- XRP price has moved sideways in the past few weeks.

- Brad Garlinghouse highlighted the key priority areas for the company this year.

- The coin has formed a bullish divergence pattern, pointing to a rebound.

Ripple (XRP) token rose to $1.3895 from this week’s low of $1.3365. It has remained in this range in the past few weeks.

In an X post, Garlinghouse, Ripple Labs CEO, highlighted some of the top priorities the company is focusing on this year. He made the comment after traveling to three continents in five days, together with Monica Long, the president.

He expects the company to continue focusing on key areas like payments, custody, liquidity, and treasury management.

The company has already made some major announcements on this recently. For example, it launched Ripple Payments, a solution tailored to corporations, providing them with solutions like managed custody, unified collections, and advanced liquidity.

These solutions will be at the intersection of fiat and stablecoins, helping companies to save money and accelerate the speed of cash management.

Ripple Labs has also intensified its RLUSD growth recently. Data shows that the RLUSD stablecoin has accumulated over $1.6 billion in assets across Ethereum and XRP Ledger network. It will then roll out the coin to other chains, including Base and Polygon, through Wormhole.

Additionally, the developers launched the Permissioned DEX platform, which allows companies to take part in decentralized finance through a regulated platform. Its use case will be in areas like cross-border payments, fiat and stablecoin swaps, payroll management, and international payments.

XRP price prediction: Technical analysis

The three-day chart shows that the XRP price has drifted sideways in the past month as demand has remained thin. Indeed, spot XRP ETF inflows have been highly limited in this period, a sign that investors are remaining in the sidelines.

On the positive side, the Stochastic RSI has reversed and moved to the highest point in weeks. The Percentage Price Oscillator has formed a bullish crossover pattern.

Therefore, while the coin remains below all moving averages and the Ichimoku cloud, there is a possibility that it will rebound in the near term. If this happens, the next key target to watch will be at $1.6700, its highest point in February.

The bullish XRP price forecast will become invalid if it drops below the key support level at $1.3363.

Crypto World

Crypto wrench attacks rise as French couple robbed of $1M in Bitcoin at knifepoint

A couple in western Paris was held hostage and forced to transfer roughly €900,000 ($980,000) in Bitcoin after three criminals posing as police officers broke into their home in what appears to be the latest crypto “wrench attack.”

Summary

- Three attackers posing as police forced their way into a home in Yvelines, threatening the victims with a knife and demanding a crypto transfer.

- The husband transferred roughly €900,000 in Bitcoin under duress before the suspects tied him up and fled.

- The attack adds to a surge of crypto-related kidnappings and extortion attempts in France, where criminals increasingly target digital asset holders.

The attack took place Monday morning in Le Chesnay-Rocquencourt in the Yvelines department, where the suspects rang the doorbell and claimed to be police officers.

When the woman opened the door, the men forced their way inside and threatened her with a knife, demanding that her partner transfer the cryptocurrency to a wallet under their control.

Under duress, the husband complied and transferred the equivalent of €900,000 in Bitcoin (BTC). The attackers then tied him up while the woman suffered minor injuries before the group fled the scene in a white van.

The woman later managed to free her husband and alert neighbors, ending the ordeal shortly after.

The Versailles prosecutor’s office has opened an investigation into charges including organized armed robbery, kidnapping and criminal conspiracy. The case is being handled by France’s Brigade for the Repression of Banditry (BRB), and no arrests had been reported so far.

France sees rise in crypto “wrench attacks”

The incident adds to a growing wave of so-called “wrench attacks,” where criminals use physical violence or coercion to force victims to hand over digital assets rather than attempting technical hacks.

France has emerged as a major hotspot for such crimes. Earlier reporting shows that the country has seen dozens of crypto-linked kidnappings and extortion attempts, with investors and their relatives increasingly targeted as the value of digital assets rises.

The number of verified wrench attacks worldwide jumped significantly in 2025, with France accounting for a notable share of incidents.

Recent cases include the kidnapping of relatives connected to cryptocurrency entrepreneurs and a string of violent robberies aimed at forcing victims to transfer crypto funds. Authorities have made arrests in some investigations, but the attacks continue to surface across the country.

Crypto World

Traders bet on bitcoin reclaiming $80,000

Sentiment in the bitcoin market has flipped bullish and traders are betting on a rally above $80,000, with traders positioning for a rally above $80,000.

That’s the message from decentralized exchange offering on-chain trading in crypto futures and options.

“Current options pricing shows roughly a 35% probability that BTC will reach above $80K by the end of June,” Nick Forster, founder of on-chain options platform, Derive.xyz, told CoinDesk in an email. “Combined with the recovery in skew, this activity suggests many traders expect bitcoin to recover toward the $80K level between June and September.”

Options are derivative contracts that let you bet on BTC prices moving up or down, but with a inbuilt safety net that ensures you lose only a small upfront fee, not your whole account, if the bet fails. It’s akin to buying a lottery ticket.

A call lets you bet on price rallies, while a put lets you bet on price dumps. The latter is, therefore, seen as a protective hedge.

Traders typically track options skew – that telltale pricing gap between calls and puts – to sniff out where the market’s leaning. Calls pricier than puts indicates Bullish tilt, while put premium suggests otherwise.

BTC’s skew recovers

Bitcoin’s seven day and 30-day skews have clawed back to -6% from the -25% panic lows in early February, when BTC cratered toward $25,000.

The shift signals traders dialing back on protective puts – less crash hedging, more steady nerves.

“Despite earlier fears of a catastrophic crash of the crypto markets, derivatives markets suggest those concerns may have been overstated. BTC skew – a key measure of sentiment in options markets – has rebounded sharply from around -25% (normalized by at-the-money implied volatility) to roughly +10% today, signaling a significant shift away from aggressive downside hedging,” Forster said.

Skews based on leading centralized options exchange Deribit paint a similar picture.

According to Forster, put shorting (writing) has surged across venues in recent days, a sign that traders are willing to take on downside risk in exchange for premium, which is consistent with expectations of stabilizing or rising prices.

At press time, bitcoin changed hands near $70,000, up nearly 5% for the month, according to CoinDesk data.

-

Business5 days ago

Form 8K Entergy Mississippi LLC For: 6 March

-

Tech6 days ago

Tech6 days agoBitwarden adds support for passkey login on Windows 11

-

News Videos2 days ago

News Videos2 days ago10th Algebra | Financial Planning | Question Bank Solution | Board Exam 2026

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread: Ann Taylor

-

Crypto World2 days ago

Crypto World2 days agoParadigm, a16z, Winklevoss Capital, Balaji Srinivasan among investors in ZODL

-

Sports6 days ago

Sports6 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

Sports3 days ago

Sports3 days agoThree share 2-shot lead entering final round in Hong Kong

-

Sports3 days ago

Sports3 days agoBraveheart Lakshya downs Lai in epic battle to enter All England Open final | Other Sports News

-

Business15 hours ago

Business15 hours agoExxonMobil seeks to move corporate registration from New Jersey to Texas

-

Politics5 days ago

Politics5 days agoTop Mamdani aide takes progressive project to the UK

-

NewsBeat6 days ago

NewsBeat6 days agoPiccadilly Circus just unveiled ‘London’s newest tourist attraction’ and it only costs 80p to enter

-

Entertainment4 days ago

Entertainment4 days agoHailey Bieber Poses For Sexy Selfies In New Luscious Lip Thirst Traps

-

Business3 days ago

Business3 days agoSearch for Nancy Guthrie Enters 37th Day as FBI Probes Wi-Fi Jammer Theory

-

NewsBeat1 day ago

NewsBeat1 day agoPagazzi Lighting enters administration as 70 jobs lost and 11 stores close across Scotland

-

Tech2 days ago

Tech2 days agoDespite challenges, Ireland sixth in EU for board gender diversity

-

Entertainment6 days ago

Harry Styles Has ‘Struggled’ to Discuss Liam Payne’s Death

-

Crypto World6 days ago

Crypto World6 days agoNew Crypto Mutuum Finance (MUTM) Reports V1 Protocol Progress as Roadmap Enters Phase 3

-

Tech6 days ago

Tech6 days agoACIP To Discuss COVID ‘Vaccine Injuries’ Next Month, Despite That Not Being In Its Purview

-

Business1 day ago

Business1 day agoSearch Enters 39th Day with FBI Tip Line Developments and No Major Breakthroughs

-

NewsBeat6 days ago

NewsBeat6 days agoGood Morning Britain fans delighted as Welsh presenter returns to host ITV show