Crypto World

World Liberty Financial to launch institutional RWA product

World Liberty Financial has unveiled plans to roll out an institutional-grade real-world asset product, starting with a tokenized investment linked to Trump International Hotel & Resort, Maldives.

Summary

- WLFI is partnering with Securitize and DarGlobal to tokenize loan revenue from a major Maldives resort.

- The offering targets accredited investors and will operate under strict regulatory and transfer rules.

- The project reflects WLFI’s ongoing strategy to link DeFi, traditional assets, and institutional finance.

The goal of the project, which is being developed in partnership with Securitize and DarGlobal PLC, is to tokenize loan revenue interests tied to the upscale resort.

According to WLFI’s Feb. 18 statement, the offering is designed for accredited and eligible investors, providing access to fixed yield and revenue streams within a regulated framework.

How the tokenized product is structured

The initial offering will provide investors with fixed returns and access to loan-related income generated by the resort. Revenue from interest payments will be distributed through the token structure, allowing holders to gain exposure to the asset’s performance without direct property ownership.

The company noted that the product will operate within a regulated securities framework under Regulation D and Regulation S. Tokens will not be registered for public sale in the United States and may only be offered through approved exemptions.

Eric Trump, co-founder of WLFI, said the initiative aims to bring tokenized real estate to decentralized finance in a compliant way. He described the Maldives project as a flagship example of how high-end property can move on-chain.

“We built World Liberty Financial to open up decentralized finance to the world. With today’s announcement, we are now extending that access to tokenized real estate.”

— Eric Trump, co-founder of World Liberty Financial.

Securitize chief executive officer Carlos Domingo said scalable and compliant real estate tokens could see strong global demand, while DarGlobal CEO Ziad El Chaar called the partnership a step toward improving liquidity in private real estate markets.

The announcement clarified that The Trump Organization is not directly involved in issuing or promoting the tokens, and that branding is used under a licensing agreement.

World Liberty Financial (WLFI) also noted that the tokens may later be supported on multiple public blockchains and could be used as collateral through its WLFI Markets platform, where permitted by law.

Broader expansion strategy

The real estate launch follows a series of recent efforts by WLFI to position itself in institutional digital finance. On the same day as the announcement, the company hosted the World Liberty Forum at Mar-a-Lago, bringing together executives from firms including Goldman Sachs, Nasdaq, and Franklin Templeton.

The private event focused on digital assets, stablecoins, artificial intelligence, and monetary policy, according to people familiar with the gathering.

WLFI also announced a separate partnership with Apex Group to pilot its USD1 stablecoin for settlements in tokenized fund operations. The agreement will help integrate blockchain-based payments into traditional fund administration.

Crypto World

Bitcoin Range-Bound Under Pressure as Analysts Eye $55,000

The longer Bitcoin remains rangebound, the more likely it is to fall further as the bear market deepens.

Bitcoin is “range-bound under pressure,” having broken below the “True Market Mean,” slipping into a “defensive range toward the Realized Price,” of around $55,000, reported Glassnode on Wednesday. The on-chain analytics provider remained bearish, noting that demand across spot and derivative markets was weak.

“Spot flows and ETF demand remain weak, accumulation is fragile, and options positioning shows panic hedging fading, but not renewed bullish conviction.”

Glassnode noted that historically, deeper bear market phases have found their lower structural boundary around the Realized Price. This is a measure of the average acquisition cost of all circulating coins, which now stands near $54,900.

This level is almost 18% lower than current prices and would put the fall from peak to 56.4%, which is much shallower than the last two bear markets.

Market in Controlled Consolidation

The analysts also noted that the Accumulation Trend Score sits near 0.43, well short of the 1.0 level that would signal serious large-entity buying.

Spot Cumulative Volume Delta (CVD), which tracks the difference between market buy orders and market sell orders over time, has turned firmly negative across major exchanges such as Binance and Coinbase, meaning sellers are in control.

Glassnode concluded that the market is “transitioning from reactive liquidation to controlled consolidation.”

“For a durable recovery to emerge, renewed spot demand, sustained accumulation, and improving liquidity conditions will be required.”

Range-Bound Under Pressure

Bitcoin has broken below the True Market Mean, slipping into a defensive range toward the Realized Price (~$54.9k). Spot and ETF demand remain weak, and panic hedging has eased.

Read the full Week On-Chain👇 https://t.co/XAp8OQr65i pic.twitter.com/iLuDT8o50v

— glassnode (@glassnode) February 18, 2026

You may also like:

Bitcoin network activity has also collapsed, according to Santiment, which reported on Wednesday that there have been large declines in new and unique addresses as Bitcoin’s utility declined in 2025.

“A justification for crypto beginning to see a true long-term relief rally will be when metrics like active addresses and network growth begin to rise.”

“BTC is still strengthening its bear trend,” observed analyst Willy Woo, who said that volatility is a key metric to detect trends. Bitcoin entered its bear market when volatility spiked upwards quickly, he said, before adding:

“Volatility then continues to climb, meaning the bear trend is strengthening. Then volatility finds a peak in the mid to late phase bear market… that’s when the bear trend starts to weaken.”

BTC Price Outlook

Bitcoin continues to weaken, dropping below $66,000 briefly in late trading on Wednesday. It came just shy of $67,000 during the Thursday morning Asian trading session, but had not reclaimed it at the time of writing.

The asset has been trading sideways for the past two weeks, and the path of least resistance appears to be downwards.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Ethereum Foundation Outlines Main Priorities For 2026

The Ethereum Foundation has announced it is targeting faster transactions, smarter wallets, better cross-chain interoperability, and quantum-resistant security as its “protocol priorities” in 2026.

In a statement published on Wednesday, the Ethereum Foundation outlined several goals, including continuing to scale the gas limit — the maximum amount of computational work a block can handle — “toward and beyond” 100 million, a major topic of discussion among the Ethereum community in 2025.

Some members of the Ethereum community anticipate that the gas limit will increase significantly this year. In November, Ethereum educator Anthony Sassano said that the goal of significantly increasing Ethereum’s gas limit to 180 million in 2026 is a baseline, not a best-case scenario.

“Post-quantum readiness” is a focus for Ethereum

The foundation highlighted the Glamsterdam network upgrade, scheduled for the first half of 2026, as a major priority. It also emphasized “post-quantum readiness” as a priority in its trillion-dollar security initiative.

On Jan. 24, Ethereum researcher Justin Drake said in an X post that the foundation had “formed a new Post-Quantum (PQ) team.”

“Today marks an inflection in the Ethereum Foundation’s long-term quantum strategy,” Drake said.

The Ethereum Foundation said it will also focus on improving user experience in 2026, with an emphasis on enhancing smart wallets through native account abstraction and enabling smoother interactions between blockchains via interoperability.

“The goal remains seamless, trust-minimized cross-L2 interactions, and we’re getting closer day by day. Continued progress on faster L1 confirmations and shorter L2 settlement times directly supports this.”

The foundation said that 2025 was one of the “most productive years,” citing two major network upgrades, Pectra and Fusaka, and the community raising the gas limit from 30 million to 60 million between the upgrades, for the first time since 2021.

Buterin’s big plans for Ethereum and AI

Ethereum Foundation’s Mario Havel said in an X post on Wednesday that, “It took us a while to push out the announcement because we were preparing the biggest curriculum so far.”

Related: Ethereum reclaims 42% outflows from Solana — DeFi Report

It comes just days after Ethereum co-founder Vitalik Buterin shared his latest vision for Ethereum’s intersection with artificial intelligence on Feb. 10. Buterin explained that he sees the two working together to improve markets, financial safety and human agency.

Buterin said his broader vision for the future of AI is to empower humans rather than replace them, though he said the short term involves much more “ordinary” ideas.

Magazine: Is China hoarding gold so yuan becomes global reserve instead of USD?

Crypto World

Aptos Foundation proposes supply cap and reduced staking rewards in deflation push

The Aptos Foundation has proposed an overhaul of its tokenmomic and governance structure, which it says will replace the “bootstrap-era subsidy model” with a more sustainable and usage-driven economic model.

Summary

- Aptos Foundation proposed a 2.1 billion APT hard cap, lower staking rewards, and higher gas fees to curb emissions.

- The plan includes permanently staking 210 million APT and a potential buyback program.

“Aptos Foundation is proposing structural reforms that replace subsidy-based emissions with performance-driven mechanisms, establishing conditions for reduced emissions, increased burns, and potential decline in circulating supply,” it said on Wednesday.

Among the key proposals are plans to set a hard cap on total supply. Under the current structure, new tokens are continuously minted to support development, grants, and staking rewards across the ecosystem. The foundation is proposing a fixed 2.1 billion token hard cap.

“There are currently 1.196 billion APT in circulation. 1 billion APT was minted at mainnet, and 196 million APT has been distributed as staking rewards since mainnet. With a hard supply cap of 2.1 billion, this leaves 904 million APT of headroom or approximately 43% of this total cap,” the foundation said.

Over time, the additional tokens would be distributed in decreasing amounts as staking rewards and eventually phase out entirely as the network approaches the ceiling, at which point validators would be funded primarily through transaction fees rather than new token issuance.

Other policy changes include plans to reduce the annual staking rewards rate from 5.19% to 2.6% and transition to a revised staking framework that rewards “longer staking commitments.”

The foundation is also proposing increasing network gas fees by 10X, which are burned with every transaction, as another mechanism to reduce net emissions and tighten circulating supply.

“Even with a 10X increase, stablecoin transfers would still be the lowest in the world at around $0.00014, making it the ideal blockchain for stablecoins, payments, and any other similar high-volume transactions,” it said.

The team has also suggested permanently staking 210 million APT tokens, or about 18% of the current circulating supply, and supporting foundation operations using the staking rewards instead of selling treasury tokens into the market.

Meanwhile, the foundation also wants to transition to performance-based grants where tokens vest only after predefined milestones are achieved and are deferred until those targets are met.

Lastly, the foundation will explore launching a token buyback program or establishing an APT reserve funded through cash on hand or future foundation revenue to help balance supply dynamics over time.

Aptos Foundation is joining a slew of others that have proposed tokenomic overhauls and governance changes in recent months.

Last week, Aave Labs proposed redirecting all product-related revenue directly to the DAO treasury. Meanwhile, in late January, the Injective community approved a proposal to further reduce the INJ token’s long-term supply by cutting issuance and reinforcing existing burn mechanisms.

In December, Uniswap burned 100 million UNI tokens as part of the UNIfication proposal, which received overwhelming support from the community.

Crypto World

Fed Minutes Signal Hawkish Tone, Markets React

Bitcoin has emerged as the biggest underperformer since the release of the FOMC minutes for the January 28 meeting, while the US dollar index and bonds rally.

The January FOMC meeting, which saw two dovish dissents, reflected a deeply divided Federal Reserve (Fed).

Sponsored

Sponsored

Fed Minutes Reveal Hawkish Divide as Bitcoin Struggles

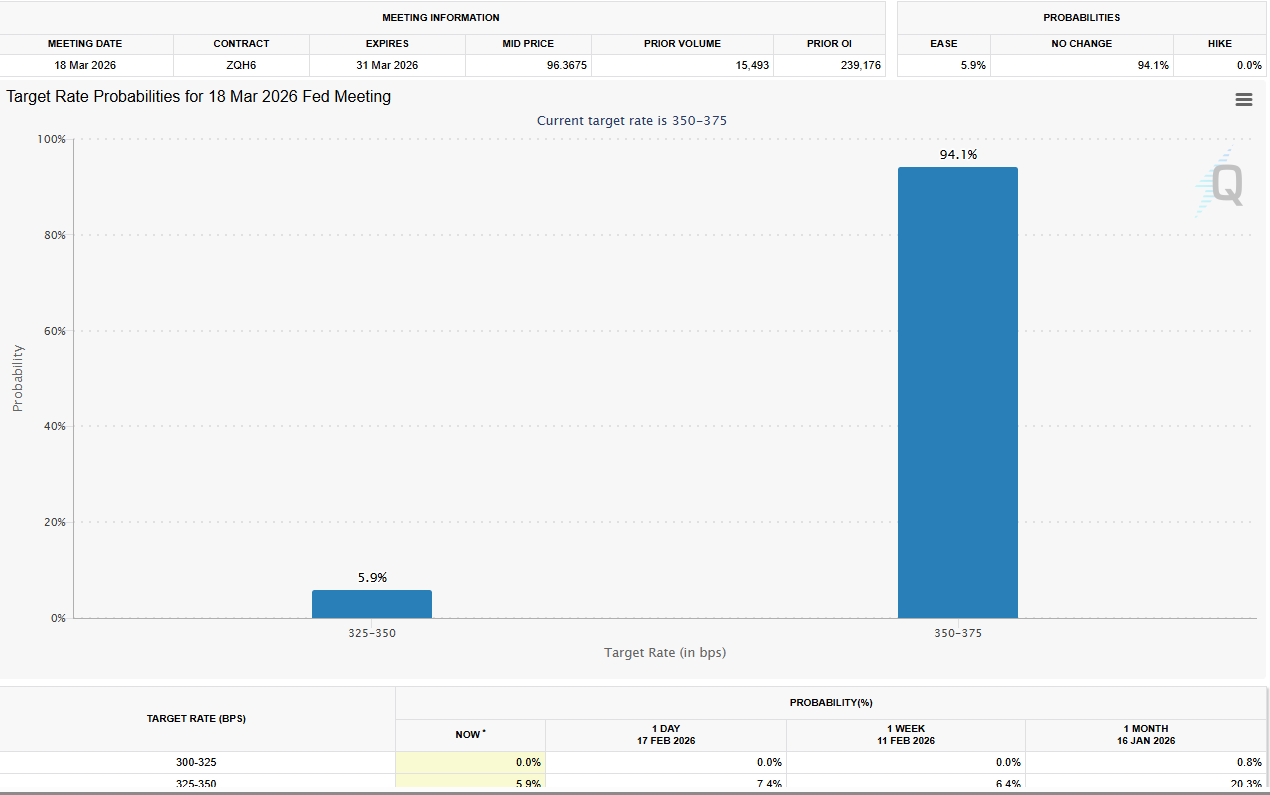

Almost all policymakers supported maintaining the federal funds rate at 3.50–3.75%, though a couple preferred a 25-basis-point cut, citing restrictive policy and labor market risks.

Several officials indicated that further rate cuts could be warranted if inflation declines as expected. Meanwhile, others cautioned that easing too early amid elevated inflation could compromise the Fed’s 2% target.

Some advocated for “two-sided” guidance, highlighting that rates might need to rise if inflation remains above target.

Recent macroeconomic data have reinforced Fed Chair Jerome Powell’s cautiously optimistic outlook.

Sponsored

Sponsored

Growth has surprised to the upside, inflation appears to be drifting lower, and the job market shows signs of steadying.

These developments have pushed 2026 rate-cut expectations higher, though a move in March is effectively off the table following last week’s stronger-than-expected payroll report.

Market vulnerabilities were also a focal point, with multiple participants noting risks in private credit and the broader financial system.

Analysts suggest that these concerns, combined with the Fed’s hawkish undertones, have contributed to safe-haven buying in bonds and the dollar, while Bitcoin continues to face downward pressure.

Equities showed modest gains, with the Dow Jones Industrial Average up 0.24%, the S&P 500 up 0.59%, and the NASDAQ up 1.00%, reflecting cautious optimism in markets amid signals from the Fed.

“The minutes show a Fed still divided but attentive to both inflation risks and growth momentum,” said a senior market strategist. “Bitcoin’s underperformance is partly a reflection of risk-off sentiment and the dollar’s continued strength.”

Investors will now watch for any further commentary from Fed officials as markets digest these minutes, weighing the balance between hawkish vigilance and dovish optimism in shaping 2026’s monetary policy trajectory.

Crypto World

Cardano Price Flashes 35% Rally Hope Despite This Weak Metric

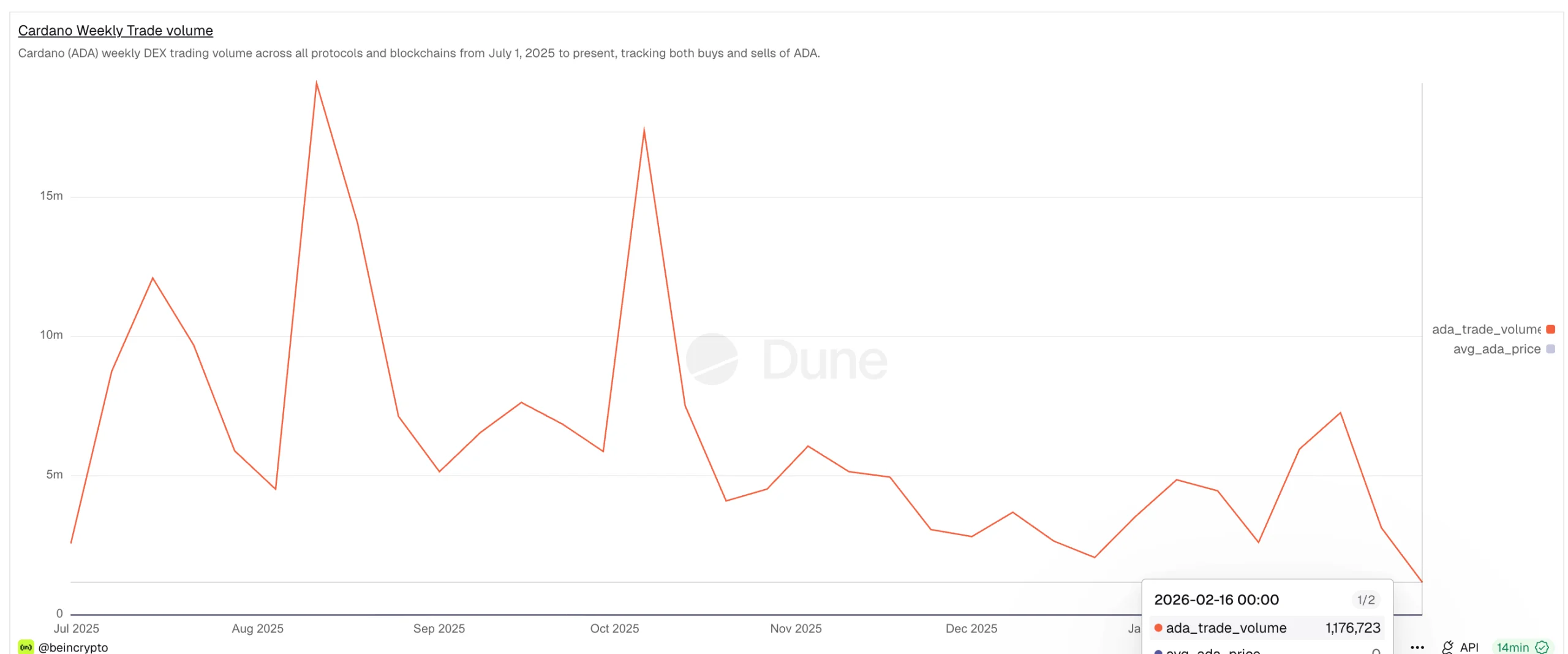

The Cardano price has declined sharply in recent months, reflecting weakening investor participation. This decline did not happen alone. Cardano’s on-chain trading activity has also collapsed during the same period. Decentralized exchange trading volume has dropped by over 94% since August, hitting a six-month low.

Yet despite this collapse in participation, technical charts now show early signs of a possible reversal. This creates a conflict between weakening network activity and improving price structure.

Sponsored

On-Chain Trading Activity Collapse Confirms Weak Trend

Cardano’s weekly decentralized exchange trading volume has dropped dramatically over the past six months. In August 2025, weekly volume peaked at 19,103,979 ADA. By February 16, 2026, this figure had fallen to just 1,176,723 ADA, highlighted exclusively by BeInCrypto’s Dune Dashboard.

This represents a 94% collapse in on-chain trading. This is also indicative of the low on-chain participation, as aggressively traded coins are often associated with sharp price moves.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

On-chain trading volume measures real buying and selling happening directly on the blockchain. It reflects user participation and demand. When volume falls this sharply, it shows fewer investors are actively trading the asset.

Cardano’s price has mirrored this weakness. ADA has dropped roughly 68% over the same six-month period. This confirms the downtrend was supported by declining participation and demand. However, price structure now shows early signs that this trend may be changing.

Sponsored

Bullish Price Pattern Emerges, But Profit-Taking Risk Remains

Cardano is currently forming an inverse head-and-shoulders pattern on the daily chart. This is a bullish reversal pattern that appears when selling pressure weakens, and buyers begin slowly regaining control.

The left shoulder formed in January. The head formed in early February. The right shoulder has now formed near similar levels, validating the structure. However, to confirm the breakout, the daily Cardano price candle must close above $0.30.

Momentum indicator, in the form of RSI, supports this formation. The Relative Strength Index, or RSI, has formed a bullish divergence. Between December 31 and February 18, Cardano’s price made a lower low. But during the same period, RSI made a higher low. This shows selling pressure is weakening even as the price tests new lows. It confirms buyers are slowly returning.

Sponsored

However, another on-chain metric introduces risk. The percentage of Cardano supply in profit dropped sharply from 27% to just 6% during the recent decline, from late January to mid-February. It has now started rising again and currently sits near 10%.

This increase shows more investors are returning to profit. While this can support recovery, it also creates selling risk. When holders return to profit, many choose to sell and secure gains. For example, on February 15, profitable supply rose near 11%. Cardano’s price dropped from $0.29 to $0.27 soon after. This was a 7% decline in a single trading session.

This shows rising profitability can trigger selling pressure even during recovery attempts, making support and resistance levels all the more important.

Sponsored

Cardano Price Faces Critical Breakout Level at $0.30

Cardano now sits near its most important resistance level. The neckline of the inverse head and shoulders pattern is located at $0.30. This level will decide the next major move.

If Cardano breaks above $0.30 and closes above it, the bullish pattern would be confirmed. Based on the structure, this could push ADA toward $0.40 and $0.41. This would represent a potential 35% to 38% rally from the neckline.

However, failure to break this level would weaken the recovery attempt. If Cardano falls below $0.27 (led by possible profit booking), the bullish structure would begin weakening. A further drop below $0.22 would completely invalidate the pattern and confirm continued downside.

For now, Cardano sits at a critical decision point. On-chain trading confirms participation has collapsed. But technical indicators suggest a possible reversal. The next move above $0.30 or below $0.27 will determine whether Cardano begins a true recovery or resumes its longer-term decline.

Crypto World

Goldman Sachs’ David Solomon says he owns ‘very little’ bitcoin

PALM BEACH, Fla. — Goldman Sachs CEO David Solomon said he owns “very little, but some” bitcoin, although he continues to follow the asset closely as part of a broader interest in how technology is reshaping finance.

“I’m an observer of bitcoin,” Solomon said at the World Liberty Forum on Wednesday, saying he’s still trying to understand how it moves.

While Goldman Sachs has taken a cautious approach to digital assets, the firm’s leadership sees crypto as part of a longer-term shift in financial infrastructure, Solomon noted.

He dismissed the idea that traditional banks and crypto firms are locked in a zero-sum fight. “It’s one system, it’s our system,” he said. “We have to do it the right way … and there’s going to be disagreements and that’s OK.”

Solomon said the evolution of markets is being shaped by large-scale technology platforms, and tokenization will play a central role.

“The evolution of those platforms … there’s obvious impact,” he said. “Tokenization … that I think is super important.”

While other banking giants such as JPMorgan and Morgan Stanley have pushed deeper into the digital asset space, Goldman Sachs’ involvement has been limited so far. The main reason, according to Solomon, is regulation.

“Until 10 minutes ago, the regulatory structure was extremely prohibitive,” he jokingly said, but suggested that as regulators begin providing greater latitude for companies to get “more involved” in the sector, Goldman may take another look.

Read more: Goldman Sachs sees regulation driving next wave of institutional crypto adoption

‘Got to get it right’

Solomon criticized the economic effects of overregulation.

“When you burden this system with excessive regulation, you start to extract capital,” he said. “That absolutely happened in the last five years.”

He emphasized getting the approach right. “It’s got to be done thoughtfully, and we’ve got to get it right.”

Solomon previously said that the banking giant is ramping up its research and internal discussions around crypto-adjacent technologies, including tokenization and prediction markets.

Read more: Goldman is ‘spending a lot of time’ on crypto, prediction markets efforts, CEO Solomon says

Crypto World

Crypto majors dive despite tech-led lift in Asian markets

Crypto prices fell across majors on Thursday, with ether, XRP and Solana leading declines as traders struggled to extend this week’s brief stabilization.

Bitcoin traded near $66,700, down about 1.7% over the past 24 hours, according to CoinDesk market data. Ether slipped a similar amount to around $1,965, while XRP fell nearly 5% and Solana dropped close to 4%. BNB and Dogecoin were also in the red, reflecting broad weakness rather than token-specific moves.

The slide came even as Asian equities pushed higher in thin holiday trading. MSCI’s Asia-Pacific index outside Japan rose about 0.5%, Japan’s Nikkei gained roughly 0.85%, and South Korea’s Kospi jumped around 3% to a record high.

The move followed a rebound in U.S. tech stocks after Nvidia signed a multi-year deal to supply Meta Platforms with AI chips.

Crypto did not participate in that optimism. Instead, price action remains heavy. Recent bounces have been met with steady selling, with gains fading as soon as momentum stalls.

Unlike earlier in the quarter, the market is no longer unraveling on every push lower, but it is also failing to attract sustained spot demand that would shift the tone.

The dollar firmed after minutes from the Federal Reserve’s latest meeting showed policymakers were in no rush to cut rates. Some officials even flagged the possibility of rate hikes if inflation remains sticky.

A stronger dollar typically tightens global liquidity and weighs on risk assets, and crypto’s pullback tracked that pattern.

Gold has been doing what gold does best, absorbing uncertainty with quiet strength even as risk assets chop around, and that contrast is sharpening the debate over whether bitcoin can still claim “digital gold” status.

Alex Tsepaev, chief strategy officer at B2PRIME Group, said in an email to CoinDesk that he metal’s resilience reflects investors reaching for the simplest hedge in a market still jittery on geopolitics, policy and the Fed.

“I believe that gold will continue to be a default haven and will probably attempt to break through the tough $5,000–$5,100 ceiling. That said, once risk appetite returns, ETF flows stabilize, and U.S. regulations stop dragging, Bitcoin may recover considerably more quickly,” he said.

“After all, Bitcoin attracts liquidity faster than gold, partly because it’s still sometimes referred to as a speculative asset.”

Oil prices held onto recent gains amid lingering U.S.-Iran tensions, keeping geopolitical risk in the background. Against that backdrop, crypto remains caught between periodic relief rallies and a macro environment that is not yet supportive enough to turn them into something more durable.

Crypto World

Why Address Poisoning Works Without Stealing Private Keys

Key takeaways

-

Address poisoning exploits behavior, not private keys. Attackers manipulate transaction history and rely on users mistakenly copying a malicious lookalike address.

-

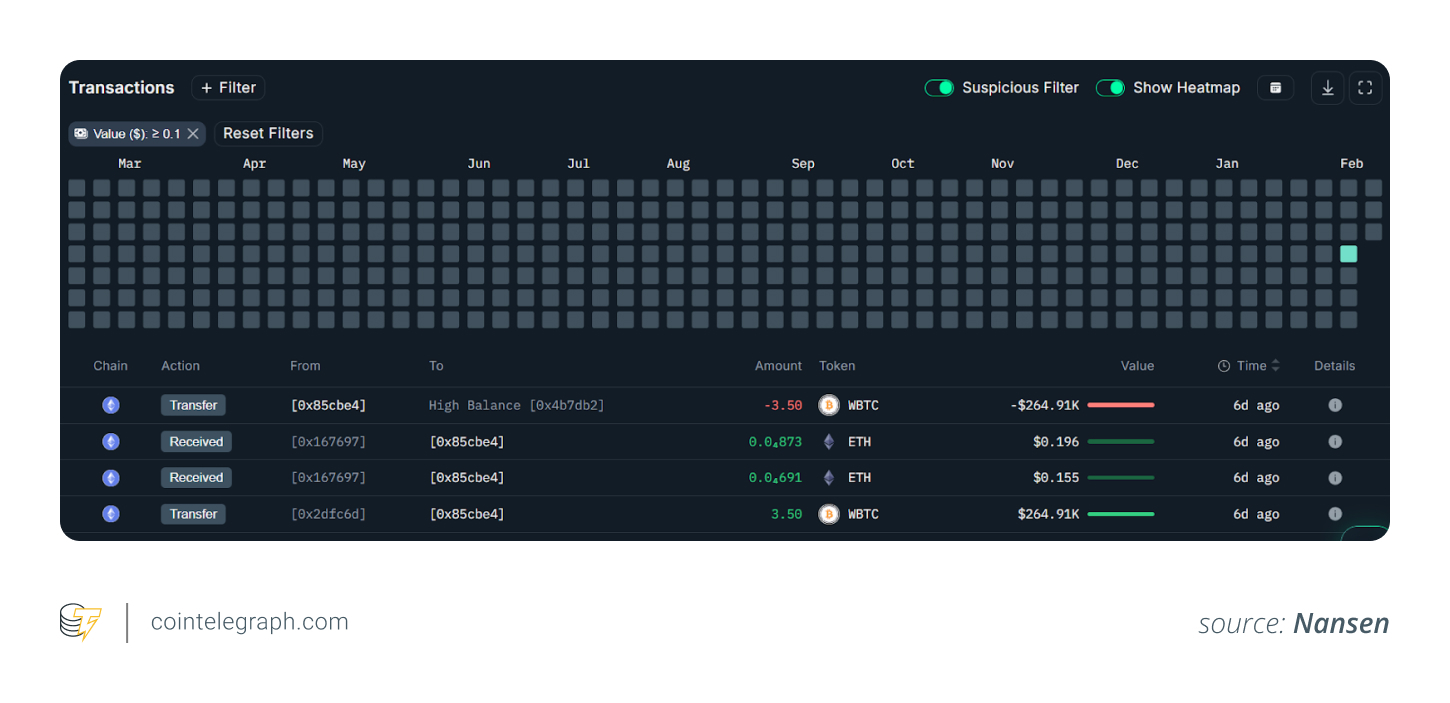

Cases such as the 50-million-USDT loss in 2025 and the 3.5 wBTC drain in February 2026 demonstrate how simple interface deception can lead to massive financial damage.

-

Copy buttons, visible transaction history and unfiltered dust transfers make poisoned addresses appear trustworthy within wallet interfaces.

-

Because blockchains are permissionless, anyone can send tokens to any address. Wallets typically display all transactions, including spam, which attackers use to plant malicious entries.

Most crypto users believe that their funds stay secure as long as their private keys are protected. However, as a rising number of scams show, this is not always the case. Scammers have been using an insidious tactic, address poisoning, to steal assets without ever accessing the victim’s private key.

In February 2026, a phishing scheme targeted a Phantom Chat feature. Using an address poisoning tactic, attackers successfully drained roughly 3.5 Wrapped Bitcoin (wBTC), worth more than $264,000.

In 2025, a victim lost $50 million in Tether’s USDt (USDT) after copying a poisoned address. Such incidents have highlighted how poor interface design and everyday user habits can result in massive losses.

Prominent crypto figures like Binance co-founder Changpeng “CZ” Zhao have publicly urged wallets to add stronger safeguards following address poisoning incidents.

This article explains how address poisoning scams exploit user behavior rather than private key theft. It details how attackers manipulate transaction history, why the tactic succeeds on transparent blockchains and what practical steps users and wallet developers can take to reduce the risk.

What address poisoning really involves

Unlike traditional hacks that target private keys or exploit code flaws, address poisoning manipulates a user’s transaction history to deceive them into sending funds to the wrong address.

Usually, the attack proceeds in the following way:

-

Scammers identify high-value wallets via public blockchain data.

-

They create a wallet address that closely resembles one the victim often uses. For example, the attacker may match the first and last few characters.

-

They send a small or zero-value transaction to the victim’s wallet from this fake address.

-

They rely on the victim copying the attacker’s address from their recent transaction list later.

-

They collect the funds when the victim accidentally pastes and sends them to the malicious address.

The victim’s wallet and private keys remain untouched, and blockchain cryptography stays unbroken. The scam thrives purely on human error and trust in familiar patterns.

Did you know? Address poisoning scams surged alongside the rise of Ethereum layer-2 networks, where lower fees make it cheaper for attackers to mass-send dust transactions to thousands of wallets at once.

How attackers craft deceptive addresses

Crypto addresses are lengthy hexadecimal strings, often 42 characters on Ethereum-compatible chains. Wallets usually show only a truncated version, such as “0x85c…4b7,” which scammers take advantage of. Fake addresses have identical beginnings and endings, while the middle portion differs.

Legitimate address (example format):

0x742d35Cc6634C0532925a3b844Bc454e4438f44e

Poisoned lookalike address:

0x742d35Cc6634C0532925a3b844Bc454e4438f4Ae

Scammers use vanity address generators to craft these near-identical strings. The fake one appears in the victim’s transaction history thanks to the dusting transfer. To users, it looks trustworthy at a glance, especially since they rarely verify the full address string.

Did you know? Some blockchain explorers now automatically label suspicious dusting transactions, helping users spot potential poisoning attempts before interacting with their transaction history.

Why this scam succeeds so well

There are several intertwined factors that make address poisoning devastatingly effective:

-

Human limitations in handling long strings: Because addresses are not human-friendly, users rely on quick visual checks at the beginning and end. Scammers exploit this tendency.

-

Convenient but risky wallet features: Many wallets offer easy copy buttons next to recent transactions. While this feature is helpful for legitimate use, it becomes risky when spam entries sneak in. Investigators such as ZachXBT have pointed to cases where victims copied poisoned addresses directly from their wallet UI.

3. No need for technical exploits: Because blockchains are public and permissionless, anyone can send tokens to any address. Wallets usually display all incoming transactions, including spam, and users tend to trust their own history.

The vulnerability lies in behavior and UX, not in encryption or key security.

Why keys aren’t enough protection

Private keys control authorization, meaning they ensure only you can sign transactions. However, they cannot verify whether the destination address is correct. Blockchain’s core traits — permissionless access, irreversibility of transactions and trust minimization — mean malicious transactions get permanently recorded.

In these scams, the user willingly signs the transfer. The system functions exactly as designed, and the flaw lies in human judgment.

Underlying psychological and design issues involve:

-

Routine habits: People tend to repeatedly send funds to the same addresses, so they copy from their transaction history instead of reentering addresses.

-

Cognitive strain: Transactions involve multiple steps, such as addresses, fees, networks and approvals. Many users find scrutinizing every character tedious.

-

Truncated displays: Wallet UIs hide most of the address, leading to partial checks.

Did you know? In certain cases, attackers automate address lookalike generation using GPU-powered vanity tools, allowing them to produce thousands of near-identical wallet addresses within minutes.

Practical ways to stay safer

While address poisoning exploits user behavior rather than technical vulnerabilities, small changes in transaction habits can significantly reduce the risk. Understanding a few practical safety measures can help crypto users avoid costly mistakes without requiring advanced technical knowledge.

For users

Simple verification habits and transaction discipline can significantly reduce your chances of falling victim to address poisoning scams.

-

Build and use a verified address book or whitelist for frequent recipients.

-

Verify the full address. Use a checker or compare it character by character before making payments.

-

Never copy addresses from recent transaction history. Instead, reenter addresses or use bookmarks.

-

Ignore or report unsolicited small transfers as potential poisoning attempts.

For wallet developers

Thoughtful interface design and built-in safeguards can minimize user error and make address poisoning attacks far less effective.

-

Filtering or hiding low-value spam transactions

-

Similarity detection for recipient addresses

-

Pre-signing simulations and risk warnings

-

Built-in poisoned address checks via onchain queries or shared blacklists.

Cointelegraph maintains full editorial independence. The selection, commissioning and publication of Features and Magazine content are not influenced by advertisers, partners or commercial relationships.

Crypto World

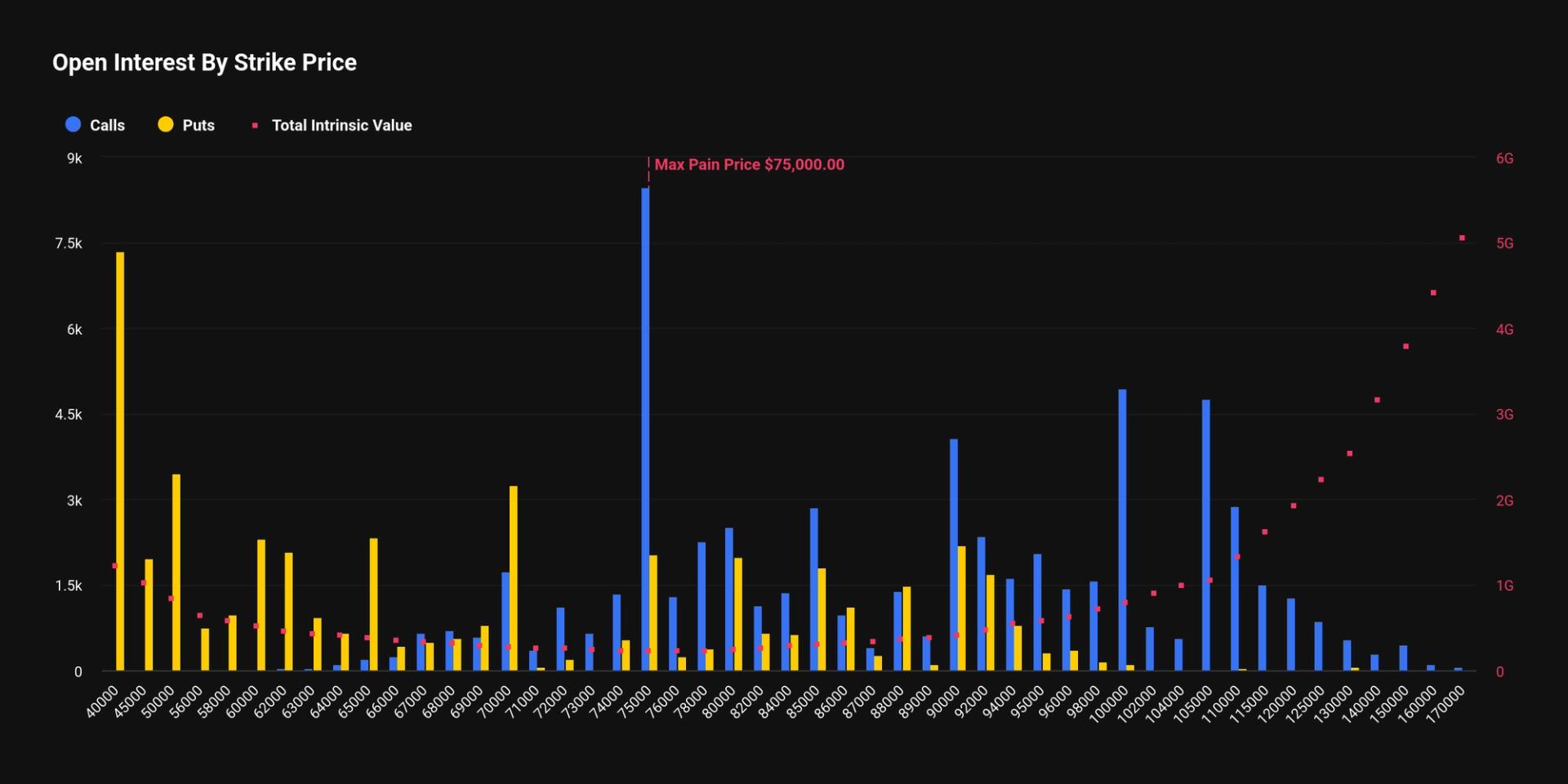

The $40k BTC put option emerges as second largest bet ahead of february expiry next week

The $40,000 put option has emerged as one of the most significant positions in bitcoin’s market ahead of the Feb. 27 expiry, highlighting strong demand for downside protection after a bruising selloff.

Options are derivatives that give holders the right, but not the obligation, to buy or sell bitcoin at a predetermined price before expiry. Put options act as insurance against price declines, paying out if BTC falls below a set strike.

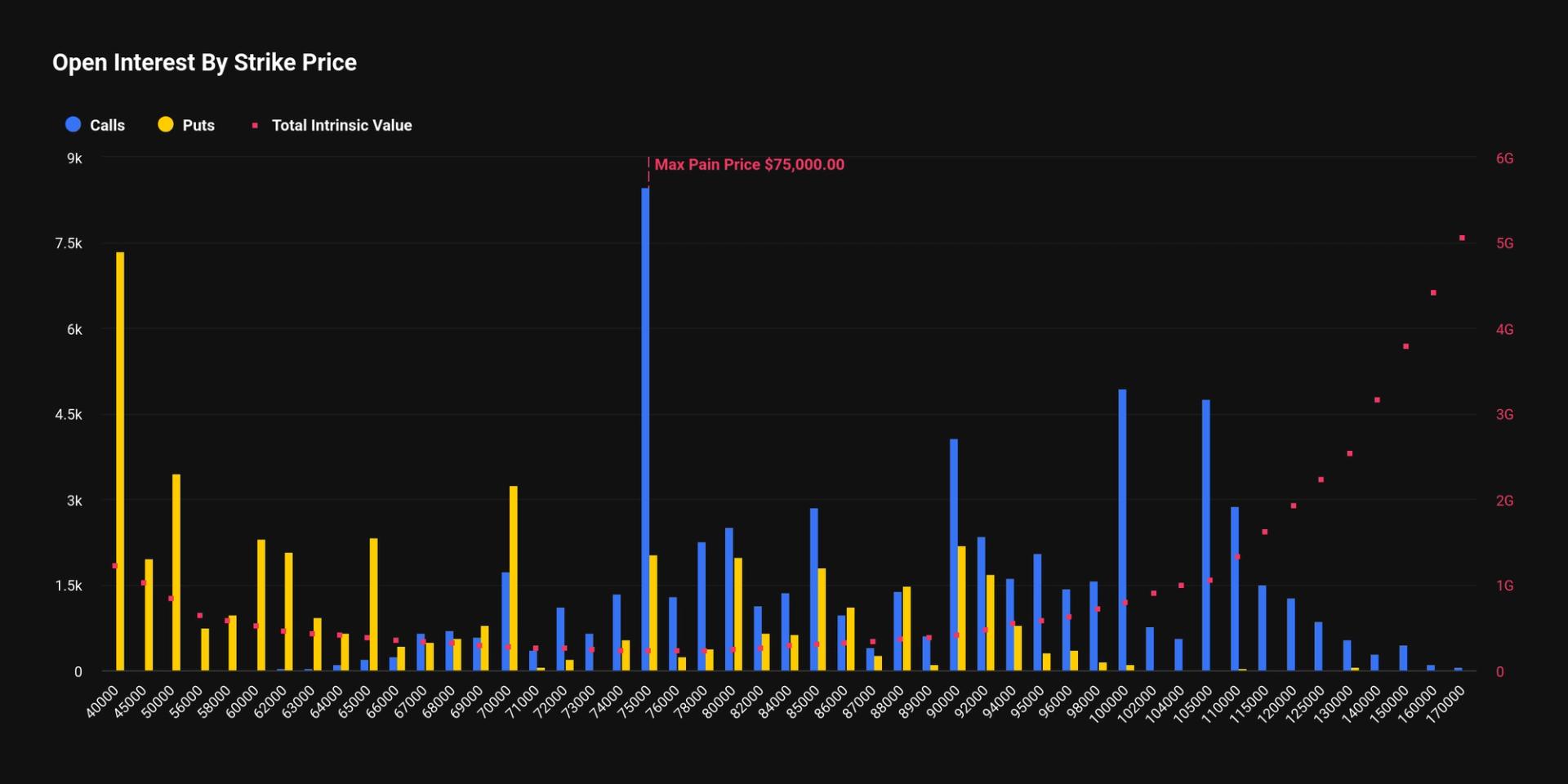

The $40,000 put is the second-largest strike by open interest, with roughly $490 million in notional value tied to that level, underscoring appetite for deep tail-risk hedges. BTC has declined by up to 50% from its October highs and is now trading around $66,000, reshaping positioning across the board as traders hedge against further losses.

Data from Deribit, the Dubai-based exchange owned by Coinbase, shows that roughly $7.3 billion in bitcoin options notional value is set to expire at the end of the month.

Meanwhile, $566 million sits at the $75,000 strike, which also represents the max pain level. Max pain refers to the price at which the greatest number of options expire worthless, minimizing payouts to buyers. With the spot price trading below $75,000, a move higher into expiry could reduce losses for call sellers.

Although calls outweigh puts overall, with 63,547 call contracts versus 45,914 puts, positioning is not purely bullish. The put-to-call ratio of 0.72 indicates that upside bets still dominate, but the concentration of sizeable put open interest at lower strikes highlights clear demand for downside insurance.

Traders retain exposure to a rebound, but are simultaneously hedging against the risk of another sharp leg lower.

Crypto World

BTC holding in tight range, but COIN, CRCL, IREN and RIOT enjoying gains

Bitcoin can’t seem to pick a direction, wildly swinging in the early hours of the Wednesday U.S. session with dips quickly bought and bounces erased just as fast.

Losing its overnight push above $68,500, BTC dumped below $67,000 at the start of U.S. trading. Buyers quickly stepped in, driving a sharp rebound to $68,300, but the bounce proved fleeting with prices quickly falling back to $67,000. Ether (ETH) followed a similar path, dipping back below $2,000 and down roughly 1% over the past 24 hours.

Part of the crosscurrents came from traditional markets. On one hand, a steadier tone in risk assets came as concerns around artificial intelligence disruption in the tech sector cooled. The iShares Expanded Tech-Software ETF (IGV), a proxy for the software sector that had been under pressure over the past weeks, bounced 1.9% in morning trading, suggesting some relief.

The broader Nasdaq was higher by 1.3% and the S&P 500 by 0.85%>

On the other hand, geopolitical jitters are back as traders increasingly brace for potential escalation between the U.S. and Iran. Traders on the prediction market Polymarket now assign more than 50% odds that the U.S. will launch strikes against Iran before March 15, up from about 30% just a day ago.

Gold climbed 2.5% to reclaim the $5,000 level, while silver surged 6%. U.S. crude oil jumped more than 3% to above $64 a barrel, underscoring heightened supply risks.

Despite the choppy crypto price action, crypto-related equities were bouncing. Exchange giant Coinbase (COIN), stablecoin issuer Circle (CRCL) and digital asset investment firm Galaxy (GLXY) were all 3%-5% higher.

Miners and AI-linked data center plays such as Riot Platforms (RIOT) and IREN (IREN) outperformed further, with each posting gains of 5.5%.

-

Video3 days ago

Video3 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech4 days ago

Tech4 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World2 days ago

Crypto World2 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports2 days ago

Sports2 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video6 days ago

Video6 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech2 days ago

Tech2 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business1 day ago

Business1 day agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment18 hours ago

Entertainment18 hours agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video2 days ago

Video2 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Crypto World5 days ago

Crypto World5 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Tech22 hours ago

Tech22 hours agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports3 hours ago

Sports3 hours agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment10 hours ago

Entertainment10 hours agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

NewsBeat4 days ago

NewsBeat4 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business7 days ago

Business7 days agoBarbeques Galore Enters Voluntary Administration

-

Business1 day ago

Business1 day agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Crypto World6 days ago

Crypto World6 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

Crypto World13 hours ago

Crypto World13 hours agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Crypto World7 days ago

Crypto World7 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat4 days ago

NewsBeat4 days agoMan dies after entering floodwater during police pursuit