Crypto World

World War III Risks in 2026 and Bitcoin’s Likely Response: 4 AIs Speculate

“In a WW3 scenario, BTC may initially crash sharply from risk-off panic selling, but later rise like a phoenix from the ashes,” Perplexity predicted.

The USA launched a military operation in Venezuela, following which the leader of the South American country, Nicolas Maduro, and his wife were captured and taken to the States. The POTUS keeps insisting on the annexation of Greenland, which caused huge controversy between America and other NATO members. The USA warned Iran of possible military action over its nuclear program, while the Asian nation said it’s ready to retaliate and refuses talks under pressure. And it’s only January…

The looming conflicts across the globe since the start of the year, plus the war between Ukraine and Russia, which has been ongoing since 2022, have sparked fears that World War III might be knocking on the door. We asked four of the most widely used AI-powered chatbots whether such a devastating event could happen this year and how Bitcoin (BTC) might respond.

The Global Landscape Feels Like a ‘Tinderbox’

According to ChatGPT, World War III is unlikely in 2026. At the same time, though, it noted that numerous nations across the globe have confronted each other, meaning additional conflicts (apart from the Russia/Ukraine one) will not come as a surprise.

The chatbot claimed that the chances of a war between NATO and Russia this year, an outcome which can be devastating for the planet and humanity, are below 4%. If the worst-case scenario becomes reality, Bitcoin (BTC) is likely to crash by more than 50% immediately after the news. In the coming weeks, though, ChatGPT expects the asset to recover, especially if banking institutions and fiat currencies are deeply affected.

“Bitcoin could perform well in a world war if banks fail and fiat currencies are restricted, because it allows people to store and move value without relying on the traditional financial system. After an initial panic and sell-off, demand could rise as people seek a censorship-resistant alternative to failing money,” it added.

Google’s Gemini also doubts that a world war can erupt before the end of 2026, albeit noting that the global landscape feels more like a “tinderbox” than at any point in the 21st century.

It estimated that the next big war will most likely include nuclear weapons and major weapon power, which would be shocking and deadly, and most financial assets will be left behind as people will mainly think about their physical survival. Under these conditions, BTC will likely lose its short-term investment appeal, with its usefulness depending entirely on whether the Internet and power infrastructure remain intact.

BTC to Rise Like a Phoenix From the Ashes

Grok, the chatbot integrated within X, is skeptical that World War III can occur this year. The likely scenario for BTC if such a thing happens is a 20-30% dip, followed by accelerated adoption and price revival.

You may also like:

Perplexity argued that the risk of a global war is very low, reminding how the cryptocurrency usually reacts to military conflicts. At first, it is likely to experience a double-digit collapse, while later the interest in it can skyrocket, which might lead to a substantial price rally.

“In a WW3 scenario, BTC may initially crash sharply from risk-off panic selling, but later rise like a phoenix from the ashes as it gains traction as a decentralization hedge against fiat devaluation and global sanctions,” it predicted.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

DOGE chart targets $0.06 with weak volume, MAs still bearish

DOGE has slid below key weekly MAs, risking a drop toward $0.06 on weak volume and downside Bollinger pressure.

Summary

- DOGE trades below weekly 8 EMA, 34 EMA, 50 SMA and 200 SMA, keeping structure bearish until reclaimed.

- Price sits near the lower Bollinger Band with low volume, reinforcing downside risk toward the analyst’s $0.06 target.

- DOGE recently broke below the Oct. 10 crash low; next support aligns with the August 2024 bottom near prior weekly demand.

A cryptocurrency analyst has warned that Dogecoin (DOGE) could decline to $0.06, citing technical indicators that suggest continued downside pressure, according to a chart analysis posted on social media.

The analyst shared a weekly chart from TradingView showing the memecoin trading below multiple key moving averages on the Coinbase exchange, according to the post reviewed by NewsBTC.

The technical setup shows Dogecoin trading beneath the 8-period exponential moving average (EMA), 200-period simple moving average (SMA), 34-period EMA, and 50-period SMA, according to the chart. The positioning below these indicators suggests the weekly structure remains weak unless the price can reclaim those levels, the analyst stated.

Bollinger Bands displayed on the same chart place the asset closer to the lower band than the midline, consistent with downside pressure on the weekly timeframe, according to the analysis. The analyst’s $0.06 target would represent a move below the displayed lower Bollinger Band, framing the projection as a deeper continuation scenario.

The chart indicates continued low trading volume, with the price sliding after failing to hold higher levels visible earlier in the cycle, according to the data.

The token has fallen below the October 10 crash low, the chart shows. The next support level could be near a previous price point visited three weeks ago, which also marked the August 2024 bottom, according to the analysis.

The analyst’s thesis rests on the premise that the asset remains below near-term and medium-term trend references, with buyers needing to reclaim weekly indicator levels, starting with the EMA 8, to invalidate the bearish outlook.

Dogecoin, originally created as a satirical cryptocurrency, has experienced significant volatility throughout its trading history and remains one of the most widely traded memecoins by market capitalization.

Crypto World

Bitcoin Stalls Below $70K Amid Macro Rotation and Weak Institutional Demand

TLDR:

- Bitcoin remains trapped in the $64K–$67K range, failing multiple attempts to breach $70K.

- Macro rotation favors commodities, gold, and industrials, pressuring high-beta assets.

- Crypto derivatives show weak conviction: low basis, rising put skew, declining open interest.

- Short-term recovery bids are absent; the market is defensive, and early positioning lacks institutional support.

Bitcoin continues to trade within a tight $64,000–$67,000 range, unable to reclaim the $70,000 level after a recent liquidation event.

Market analysts at Wintermute note that BTC is increasingly behaving like a high-beta growth asset, moving in line with some large-cap altcoins.

Institutional demand remains muted, derivatives signal weakening conviction, and the broader macro backdrop is undergoing what many now describe as a structural regime change heading into 2026.

Macro Forces Are Driving a Broader Market Rotation

For much of this cycle, individual catalysts—tariff headlines, Fed commentary, and earnings results—drove short-term market reactions.

That framework is now breaking down, according to Wintermute’s latest market update. Investors are beginning to price in deeper, slower-moving structural forces that cannot be resolved with a single policy pivot.

Two concurrent trades are reshaping the macro landscape. The AI rerate is compressing growth multiples as software moats face reassessment.

Meanwhile, deglobalization continues as the Trump administration signals tariffs are structural, not temporary.

These forces are eroding the valuation premium embedded in globally integrated, software-leveraged growth businesses.

As a result, gold, hard commodities, industrials, and defense are outperforming. Growth assets are being sold off, and Bitcoin sits directly in the path of that rotation.

The Federal Reserve remains paralyzed between sticky inflation and slowing growth. It cannot cut rates without risking inflation, and it cannot tighten without threatening growth. That paralysis is shaping the entire trade environment right now.

Crypto Derivatives Signal Weak Conviction as Selling Dominates Flow

Bitcoin has now failed the $70,000 level multiple times since the liquidation cascade two weeks ago. The absence of a recovery bid tells a clearer story than the range itself. Liquidity is thin, and price action lacks directional conviction throughout the week.

Ethereum also dipped below $1,900, a psychologically notable level for the market. However, Wintermute analysts point to $1,600 as the more technically relevant support zone for ETH to watch going forward.

Derivatives data paints a cautious picture across the board. Basis is sitting at multi-month lows, put skew is elevated and rising, and open interest has been declining since October.

These metrics confirm that institutional demand has not returned despite price stabilization seen at the earlier $85,000–$95,000 range.

On the trading desk, Wintermute reported that flow skewed heavily toward selling activity through the week. A brief midweek signal emerged when high-net-worth individuals stepped into select altcoins. That appetite faded quickly, however, leaving the market in a defensive posture.

The marginal activity remains protection-driven rather than conviction-driven, suggesting the market is not yet ready to reward early positioning in this environment.

Crypto World

The price range that decides MSTR’s fate

Strategy (formerly MicroStrategy) founder Michael Saylor has piled up cash for over two years of dividend payments and claims that the company can survive a bitcoin (BTC) crash all the way to $8,000.

Although the company itself might survive that crash, common shareholders will actually lose every last theoretical claim to the company’s treasury below a BTC price of $20,094 — far higher than Strategy’s $8,000 corporate survival threshold.

Claims on Strategy’s BTC are, in actual fact, entirely theoretical.

Despite the company’s proud publication of metrics like BTC per share (BPS) or multiple-to-Net Asset Value (mNAV), its lawyers carefully disclaim that neither common nor preferred shareholders have any redemption right to Strategy’s treasury.

No publicly-traded Strategy stock confers any ownership interest in the BTC the company holds.

Nonetheless, MSTR shareholders often talk about BPS or mNAV as shorthand, colloquial valuation metrics for their shares.

To that end, with BTC down over 40% in just six months and crashing below $63,000 last night, it’s worth recalculating the value of MSTR, the common stock of the world’s largest BTC treasury company.

$16.672 billion in senior claims above MSTR

Today, there are $16.672 billion in senior claims above MSTR on Strategy’s capital stack: $8.214 billion in debt and $8.459 billion in preferred shares.

Although preferreds don’t mature, they’re senior to commons in the event of bankruptcy. The company must also make $896 million in annual interest and dividend payments, not to mention salaries, compliance obligations, legal expenses, and other costs to service real estate, equipment, and payables.

As assets for all of its series of stock outstanding, Strategy owns a small software business, 717,722 BTC, and $2.25 billion in cash, worth a combined $47.65 billion at a BTC price of $63,270.

This is excluding the small software business that was worth less than $1.8 billion for the three years prior to Strategy pivoting into becoming a BTC acquisition company.

If BTC were to fall below $20,094, bondholders and preferred shareholders would consume the entire value of the company’s BTC and USD treasuries, leaving no claim for MSTR beyond residual, pure call option-like premium on the hope that BTC might rally again.

Read more: 100% of Strategy’s convertible debt is now out-of-the-money

MSTR can wave goodbye to Strategy’s treasury below $20,094

At $20,094 per BTC, the value of Strategy’s 717,722 BTC and $2.25 billion would equal its convertible and preferred claims of $16.672 billion, leaving nothing for MSTR.

Perhaps the software business might cushion a few hundred dollars more per BTC, although it’s been declining in both top and bottom line performance for years.

In any case, the calculation as to what BTC level consumes the entire treasury above MSTR on Strategy’s capital stack is a revealing exercise in basic accounting. Although Strategy prefers its own, self-serving calculators and dashboards, alternative tools exist to recalculate those figures using more conservative assumptions.

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

What’s Happening With Ripple ETFs as XRP Struggles at $1.30?

Here are the possible reasons behind XRP’s daily correction to under $1.35 and what’s next.

The cryptocurrency market is in retreat once again as of the start of the current business week, with BTC dumping to a new local low of under $63,000. Most altcoins have followed suit, and Ripple’s cross-border token is no exception.

The broader ecosystem’s state, in which over $150 billion left the total market cap in 36 hours, is the most apparent reason behind XRP’s 4.5% correction to $1.33. However, there might be another one lurking.

ETFs See No Action

Data from SoSoValue shows that investors who opt to gain XRP exposure through the spot Ripple ETFs in the US have seemingly disappeared. Half of the trading days last week saw no reportable net inflows, and the streak continued on February 23.

As of now, three of the last five trading days have seen an emphatic “$0.00” next to the total daily net inflow number. Consequently, the cumulative net inflows since the first such product saw the light of day in mid-November have remained flat at $1.23 billion.

The current investor behavior is entirely different than the products’ initial days, in which they surpassed the $1 billion mark in precisely a month.

XRP Price Down but Not Out

As mentioned above, XRP has declined by over 4.5% in the past 24 hours. It’s also down 8% weekly and a whopping 30% monthly. As such, it currently fights to stay above $1.30, prompting prominent analyst CryptoWZRD to conclude that the asset had, as expected, closed bearish yesterday.

However, they explained that the XRP/BTC trading pair “printed bullish,” and predicted more gains for Ripple’s token against the market leader. This, in turn, would help XRP “turn bullish.”

You may also like:

Merlijn The Trading said yesterday that the cross-border token was “holding structure while alts bleed.” He outlined the significance of the $1.36 support, but the asset has since broken below it.

Nevertheless, he added that the more macro XRP behavior is different than what people expect, as it’s trading less than a speculative altcoin at this point. In fact, it shows more signs of an infrastructure token as it’s being supported by “real utility narratives.”

“We are talking about payments, tokenization, on-chain settlement rails, and growing real-world activity on XRP.”

XRP IS HOLDING STRUCTURE WHILE ALTS BLEED.

Support: $1.36

Range high: $1.60 (no breakout yet)This isn’t hype price action.

It’s infrastructure positioning:Payments

Tokenization

Settlement railsUtility takes time to price in.

Accumulation comes before expansion. pic.twitter.com/mGPffvRaG3— Merlijn The Trader (@MerlijnTrader) February 23, 2026

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

AI agents can’t run wild without on-chain identity

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

While you read this piece, countless AI agents are furiously negotiating contracts, initiating payments, managing treasury functions, and accessing sensitive data. Their remit is expanding from advisory tools to autonomous economic actors at a frenetic pace, yet there is still no standardized way to prove who they are, what they are authorized to do, or who is accountable when something goes wrong.

Summary

- AI agents are becoming economic actors: Autonomous systems are already executing payments, reallocating capital, and managing treasury functions, but lack standardized identity and accountability.

- The identity gap is a systemic risk: API keys and cloud credentials weren’t built for autonomous decision-makers. Without verifiable onchain identity, trust in AI-driven finance will fracture.

- Blockchain as the trust layer: Verifiable, programmable agent identity (KYA) could anchor authorization, liability, and auditability — or centralized platforms will fill the void.

As AI agents begin to transact at scale, blockchain-based identity and authorization infrastructure will become a crucial trust layer for the digital economy, not an optional enhancement. This argument may not sit comfortably with everyone, as some folks in crypto argue that decentralized identity has failed to gain traction and that enterprises will default to centralized cloud credentials and private APIs. Others firmly believe AI agents remain experimental and years away from meaningful financial autonomy.

Both views underestimate how quickly autonomous systems are integrating into enterprise workflows and how unprepared the current infrastructure is to manage the associated risk. Centralized infrastructure is too slow to keep pace with the unprecedented speed of AI adoption, underscoring the crucial need for decentralized infrastructure to bridge the gap.

AI agents are becoming economic actors

According to Gartner, more than 40% of enterprise workflows will involve autonomous agents in 2026. This near-term projection reflects a shift already visible across fintech, supply chain management, and treasury operations, where AI systems are increasingly authorized to execute transactions rather than merely recommend them.

As tokenization initiatives expand across global banks and asset managers, AI agents are being positioned to rebalance portfolios, route payments, and optimize liquidity in real time. Consumer behavior signals a similar shift.

A recent YouGov study found that 42% of US consumers would allow an AI agent to purchase on their behalf if it ensured the lowest price. At the same time, research from Keyfactor shows that 86% of cybersecurity professionals believe autonomous systems should have unique, dynamic digital identities. While demand for AI-powered commerce is accelerating, trust frameworks remain inadequate.

The missing identity and accountability layer

The core problem is not intelligence but verification. As AI agents begin to manage treasury operations, process payroll, or transact on decentralized exchanges, there is still no standardized way to verify an agent’s identity, evaluate its risk profile, or assign accountability if it misallocates funds. Traditional API keys and static credentials were designed for software tools, not for autonomous systems capable of independent decision-making.

This gap is particularly acute in blockchain environments, where transactions are irreversible and pseudonymous by design. If an AI agent interacts with tokenized assets, executes trades across DeFi protocols, or manages stablecoin flows, counterparties need cryptographic assurance about the agent’s authority and constraints. Blockchain-based identity frameworks, anchored in verifiable credentials and programmable permissions, offer a path forward by allowing agents to prove who issued their mandate, what limits apply, and how liability is structured.

Skeptics may argue that embedding identity into onchain systems risks undermining decentralization or increasing regulatory oversight. Others will contend that centralized identity providers can solve the same problem more efficiently. Yet centralized credentials do not provide the transparency, portability, or composability required for agents operating across multiple blockchains and jurisdictions.

Tokenization and AI demand new infrastructure

As ever, institutional skepticism remains strong. Many executives still treat AI agents as experimental, even as adoption accelerates across payments, treasury, and procurement. The same institutions are aggressively pursuing tokenization of real-world assets, stablecoin settlement rails, and automated compliance systems. The infrastructure supporting tokenized securities and programmable money cannot rely on ad hoc identity models if autonomous agents are expected to manage billions in digital assets.

The convergence of AI and tokenization creates a new market structure in which machine-driven actors may outnumber human traders in certain domains. Without standardized KYA (Know Your Agent) frameworks — verifying an agent’s identity, who it acts for, and what it’s authorized to do — the result will be fragmented trust silos and increased systemic vulnerability. With them, a new class of verifiable, accountable AI agents could transact across decentralized networks with clearly defined permissions and audit trails.

Looking ahead, payment providers that fail to integrate verifiable AI identity risk being sidelined as autonomous commerce scales. DeFi protocols that embed agent-level permissions and dynamic credentials may attract institutional capital seeking compliance-compatible automation. Conversely, a major failure involving an unverified AI agent could trigger regulatory backlash that slows tokenization and autonomous finance for years.

The debate now confronting the industry is not whether AI agents will transact, but how they will be trusted when they do. Blockchain’s most durable contribution may not be speculative tokens or memecoin cycles, but the ability to anchor machine identity, authorization, and accountability in tamper-resistant infrastructure. As autonomous systems begin executing payments and reallocating capital at machine speed, trust cannot remain an afterthought.

The next phase will test whether code can also carry identity, mandate, and responsibility for non-human actors. If blockchain fails to provide that foundation, centralized platforms will fill the void. If it succeeds, decentralized networks could become the default trust layer for an economy increasingly powered by autonomous agents.

Crypto World

Factors affecting the cost of Web3 game development in 2026

The overall cost of Web3 game development is rarely about the game itself. It is about the ecosystem behind it. The cost can typically range between $40,000 and $500,000+, depending on complexity, blockchain integration, NFT systems, multiplayer architecture, smart contracts, security requirements, and production quality. A practical Web3 game development cost breakdown is as follows:

- A simple Web3-enabled game can start around $40,000

- A competitive mid-scale Web3 game often lands between $150,000 and $300,000

- Large-scale, multiplayer, token-driven ecosystems frequently exceed $400,000 to $700,000+

However, these numbers are meaningless without understanding what is being built. The cost of Web3 games is usually determined by five structural layers:

- Game architecture

- Blockchain architecture

- Economic design

- Infrastructure scalability

- Security and compliance depth

Let us now dive deeper into understanding each layer and typically what percentage of cost it involves.

Detailed Web3 Game Development Cost Breakdown

Let’s break down cost drivers more specifically.

Layer 1: Gameplay & Core Game Architecture (20–30%)

Before blockchain enters the conversation, it is to be kept in mind that you are still building a game. Game development cost varies based on:

- Engine selection (Unity vs Unreal)

- Visual fidelity (2D vs stylized 3D vs high-end 3D)

- Gameplay complexity (casual loop vs real-time multiplayer combat)

- AI logic systems

- Cross-platform compatibility

A simple 2D Web3 game may require a small team of:

- 1–2 game developers

- 1 designer

- 1 UI/UX resource

A 3D multiplayer Web3 game may require:

- Gameplay engineers

- Network engineers

- Technical artists

- Environment artists

- QA specialists

This is exactly where the cost of Web3 game development tends to jump significantly.

Layer 2: Blockchain Integration Complexity & Smart Contract Development (20–35%)

Web3 is not a plug-in. It changes how data flows. Traditional games store the following on centralized servers:

- Inventory

- Rewards

- Points

- Assets

On the other hand, Web3 games must decide:

- What goes on-chain?

- What stays off-chain?

- How frequently transactions occur?

- Who pays gas fees?

- How are assets validated?

Every blockchain decision affects:

- Development time

- Infrastructure cost

- Transaction efficiency

- User experience

Smart contract development alone can range from $20,000 to $80,000, depending on:

- Token complexity

- NFT minting rules

- Staking mechanisms

- Vesting logic

- Governance integration

Security audits can add another $15,000 to $60,000, depending on the overall scope of the project. However, many tend to underestimate this layer entirely.

Layer 3: Tokenomics & Economic Engineering (10–20%)

This is where Web3 projects either survive or collapse. Tokenomics design includes:

- Emission rates

- Reward balancing

- Inflation control

- Sink mechanisms

- Marketplace fee structure

- Liquidity strategy

Designing a sustainable economy is not “whitepaper work.” It directly affects:

- Backend logic

- Reward distribution

- Smart contract rules

- Player retention

- Long-term viability

Improperly designed token systems destroy ecosystems quickly. Professional economic modeling often adds $10,000 to $40,000 to total project cost. However, skipping it can cost millions later.

Layer 4: Infrastructure & Scalability (15–25%)

Web3 games often operate with a hybrid architecture:

- On-chain asset ownership

- Off-chain game logic

- Cloud-based state management

- API layers connecting wallet systems

Infrastructure must handle:

- Concurrent users

- Real-time gameplay (if multiplayer)

- Transaction logging

- Fraud detection

- Analytics pipelines

Initial backend setup may cost $25,000 to $100,000, depending on the complexity involved. In addition to this, ongoing cloud costs can range from:

- $3,000/month for moderate usage

• $15,000+/month for large-scale operations

This is exactly where enterprise-grade projects differ from hobby builds.

Layer 5: Security & Fraud Prevention (10–20%)

Web3 games attract exploit attempts. Attack vectors include:

- Smart contract vulnerabilities

- Reward manipulation

- Wallet exploitation

- Bot farming

- Marketplace abuse

Security engineering includes:

- Smart contract testing

- Load testing

- Anti-bot systems

- Activity anomaly detection

- Secure wallet session management

Skipping serious security is one of the fastest ways to destroy trust and lose credibility.

Want the Best Quote for Your Next Web3 Game Development Project?

Web3 Game Development Cost by Project Scale

Tier 1: Web3 MVP (Startup-Level Build)

Estimated Cost: $40,000 – $80,000

This tier includes:

- Basic gameplay loop

- Simple NFT asset structure

- Wallet integration (MetaMask or similar)

- Basic smart contract for rewards

- Limited backend infrastructure

- Minimal multiplayer support

This build is ideal for:

- Concept validation

• Token pre-launch engagement

• Community building

• Early-stage Web3 startups

What it does not include:

- Advanced tokenomics modeling

- Complex PvP systems

- Real-time multiplayer scaling

- In-game marketplace with high liquidity

- Multi-chain integration

Most early-stage founders fall into this category.

Tier 2: Mid-Scale Web3 Game (Growth Stage)

Estimated Cost: $100,000 – $250,000

At this level, you’re building a scalable product. This includes:

- Advanced gameplay mechanics

- NFT minting and trading

- In-game marketplace

- Token reward logic

- Multiplayer features

- Backend cloud infrastructure

- Security testing

- Analytics dashboard

- Admin control panels

This is suitable for:

- Venture-backed startups

• Web3-native gaming studios

• Token-launch ecosystems

• Projects targeting 50K+ users

At this stage, blockchain development and backend engineering significantly impact the budget.

Tier 3: Enterprise / AAA Web3 Game

Estimated Cost: $300,000 – $500,000+

This includes:

- AAA-level graphics

- Unreal/Unity advanced rendering

- Complex multiplayer networking

- Cross-chain asset compatibility

- Advanced tokenomics & staking

- DAO governance integration

- Fraud prevention systems

- High-scale backend architecture

- Full smart contract auditing

- LiveOps infrastructure

This is not just a game; it’s a Web3 platform. This tier is typical for enterprises or well-funded Web3 projects.

Timeline Correlation with Cost

Web3 game development timelines typically look like:

- 3–4 months: Basic Web3 MVP

- 6–9 months: Scalable mid-tier game

- 9–15 months: Enterprise-grade ecosystem

Shorter timelines require larger teams. Larger teams increase short-term budget burn. Time compression always increases cost.

Ongoing Operational Costs

It is to be always kept in mind that only development is not the final expense. You can expect:

- Smart contract audit: $10,000 – $50,000

• Cloud hosting: $2,000 – $15,000 monthly

• Security monitoring

• LiveOps management

• Token economy balancing

Web3 games require continuous maintenance for flawless performance.

Should You Hire Web3 Game Developers In-House or Outsource?

If you try to hire Web3 game developers in-house, it involves:

- Higher fixed cost

- Long hiring cycles

- Web3 talent scarcity

On the other hand, outsourcing the task to a trusted Web3 game development company often provides:

- Faster deployment

- Cross-domain expertise

- Scalable team allocation

- Lower operational overhead

- Reduced recruitment risk

It is exactly the reason as to why many startups as well as enterprises prefer outsourcing.

The Real Risk Behind “Cheap Web3 Game Development”

Cheap Web3 builds usually mean:

- No smart contract audit

- Weak backend

- Poor token balancing

- Inadequate security

- Limited scalability

Initial savings often lead to:

- Token collapse

- Security breach

- User churn

- Rebuild costs

This, in turn, can ultimately lead to doubling total expenditure and hence not recommended.

So How Much Should You Budget?

If you are a:

- Startup founder

Minimum realistic serious Web3 game development budget can range between: $75,000 and $150,000. - Mid-scale company

The budget can lie anywhere between $150,000 and $300,000. - Enterprise-scale vision

For enterprise-level game development, where the vision is crafting a sustainable Web3 economy, the budget can range from $300,000 to $700,000+.

Why Choosing the Right Web3 Game Development Company Matters

Choosing solely based on lowest bid can result in increasing the long-term cost. Antier, a capable Web3 game development company ensures:

- Secure smart contracts

- Sustainable tokenomics

- Scalable infrastructure

- Audit readiness

- Optimized gas usage

- Long-term viability

Ultimately, it is the overall development quality that determines ecosystem survival.

Final Thoughts

If you want to understand how much does it cost to develop a Web3 game, the answer varies dramatically based on ambition and scale. A realistic starting budget can be something around $40,000 for MVP-level builds and can exceed half a million dollars for enterprise-grade ecosystems. The difference lies in:

- Blockchain architecture

• Multiplayer complexity

• NFT systems

• Security measures

• Infrastructure scalability

If your goal is long-term sustainability and ecosystem growth, structured engineering investment is non-negotiable. You need to understand that Web3 game development is not simply about adding NFTs or tokens to a game. It is about building:

- A functioning digital economy

- A secure blockchain architecture

- A scalable multiplayer environment

- A sustainable reward system

The cost reflects the complexity of these systems working together. Working with a reliable Web3 game development company helps you clearly understand where the money goes allows you to invest intelligently instead of underfunding critical layers.

Frequently Asked Questions

01. What is the typical cost range for Web3 game development?

The cost of Web3 game development typically ranges from $40,000 to over $500,000, depending on factors like complexity, blockchain integration, and production quality.

02. What are the main cost drivers in Web3 game development?

The main cost drivers include game architecture, blockchain integration complexity, economic design, infrastructure scalability, and security and compliance depth.

03. How does the complexity of a Web3 game affect its development cost?

The complexity of a Web3 game affects its development cost significantly, with simple games starting around $40,000, mid-scale games ranging from $150,000 to $300,000, and large-scale games often exceeding $400,000 to $700,000+.

Crypto World

Russia Reportedly Investigates Telegram CEO Over Facilitating Terror

Russian authorities have initiated a criminal investigation into Telegram co-founder and CEO Pavel Durov, according to state media reports.

Durov is being investigated in Russia as part of a criminal case involving allegations of facilitation of terrorist activities, official state publication Rossiyskaya Gazeta reported on Tuesday, citing the Federal Security Service (FSB).

Kremlin spokesman Dmitry Peskov reportedly confirmed the investigation, saying the news reports were based on materials from the FSB, which was “carrying out its functions.”

The latest news adds to an ongoing pressure campaign against Telegram in Russia since state media regulator Roskomnadzor tightened messenger restrictions in early February.

Telegram had not responded to the reports by the time of publication. Cointelegraph contacted Telegram for comment but did not immediately receive a response.

Telegram refuses to cooperate with Russian authorities

The reported investigation builds on Telegram’s refusal to comply with Roskomnadzor’s demands to remove what it said was extremist-linked content.

According to the state-linked Komsomolskaya Pravda, Telegram has not removed almost 155,000 channels, chats and bots flagged for illegal or harmful content locally.

The largest categories include 104,093 channels containing false information, 10,598 promoting extremism, 4,168 justifying extremist activity and 3,771 related to drugs.

The investigation could lead to the entire platform being labeled as extremist, former Russian presidential internet adviser German Klimenko reportedly warned. He said that could criminalize payments for Telegram Premium subscriptions and advertising on the platform.

Durov accuses Russia of attacking Telegram to promote state-owned messenger

Durov has previously said the pressure is aimed at steering users toward a new state-backed messenger called MAX.

He added that other countries, including Iran, have attempted similar strategies and failed. “Despite the ban, most Iranians still use Telegram and prefer it to surveilled apps,” Durov wrote on his Telegram channel on Feb. 10.

“Restricting citizens’ freedom is never the right answer. Telegram stands for freedom of speech and privacy, no matter the pressure,” Durov added.

Related: TON Pay aims to turn Telegram into a crypto checkout layer for TON

The Russian investigation comes as Durov remains under scrutiny abroad. Durov is also part of an ongoing inquiry in France since his arrest in August 2024.

French authorities lifted Durov’s travel ban in November 2025 after previously saying he could face up to 10 years in prison.

Magazine: How crypto laws changed in 2025 — and how they’ll change in 2026

Crypto World

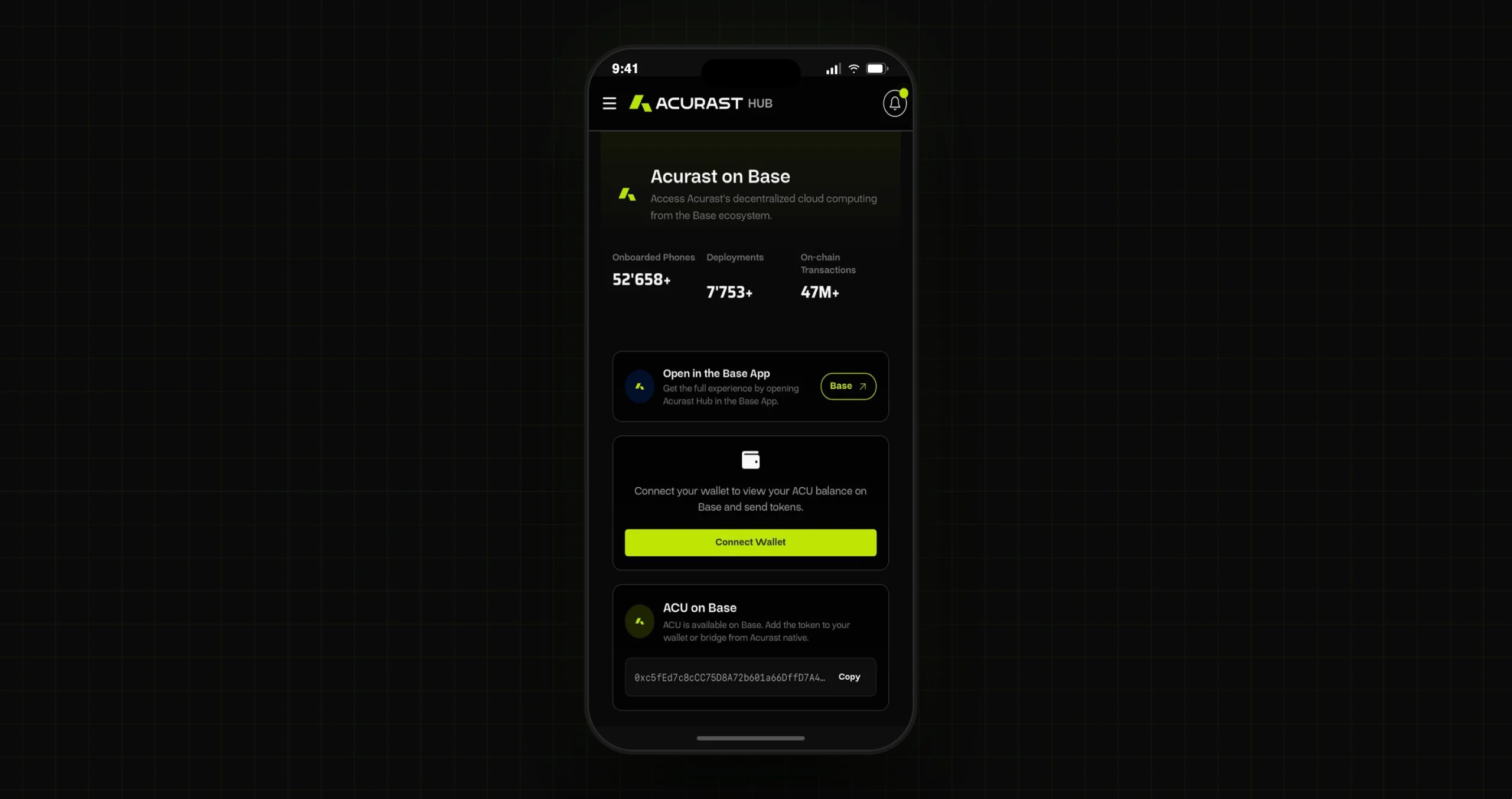

Acurast Launches 225,000-Smartphone AI Network on Base

Acurast, a decentralized network using everyday smartphones as secure compute nodes, has officially activated a 225,000-node smartphone compute network on Base. It’s a big development in bringing confidential onchain artificial intelligence (AI) into mainstream Web3.

The integration with Base, an Ethereum Layer-2 chain designed to make decentralized applications faster, cheaper, and more scalable, enables developers to run confidential AI workloads directly onchain using millions of smartphones worldwide.

Instead of relying on centralized infrastructure, this network uses Trusted Execution Environments (TEEs) built into mobile devices to execute sensitive tasks securely, preserving user privacy and maintaining verifiability.

Smartphones are the new cloud

Acurast has set out to leverage the billions of already-deployed smartphones around the globe to create a decentralized compute layer. Whereas traditional cloud providers have centralized servers that carry risks of censorship and data exposure, Acurast’s model distributes workloads across devices in over 140 countries, all running confidential AI inference tasks within secure hardware enclaves.

Jesse Pollak, Creator of Base, said:

“Base is about giving builders the best place to bring new ideas on-chain. Acurast is expanding that surface area by introducing decentralized, confidential compute powered by smartphones. That makes it possible for developers to run AI workloads on Base that are secure, verifiable, and not dependent on centralized infrastructure. This is the kind of infrastructure that helps move autonomous, real-world applications fully on-chain.”

The network just went live on Base’s mainnet, following its token generation event, and already handles production workloads securely.

Acurast’s founder, Alessandro De Carli, said:

“AI agents cannot rely solely on centralized servers if they are tasked with managing real assets onchain. By utilizing smartphone-based TEEs, we’re enabling confidential AI that is verifiable, decentralized, and owned by the users who power it.”

Confidential AI, native payments

A key part of this integration is the payment mechanism for compute.

Acurast now supports native USDC payments on Base’s network without the need for bridging or offchain settlement layers. By embracing the x402 payment standard (originally developed to enable instant, HTTP-native stablecoin payments), AI agents can autonomously pay for compute resources in real time.

This opens the door for a pay-per-request model in decentralized services, where AI agents can automatically settle fees in USDC as they process tasks. It’s a crucial building block for autonomous Web3 applications that interact with APIs, data services, and complex onchain logic without intermediaries.

A new layer for onchain AI workloads

Developers leveraging Acurast on Base can onboard devices and manage compute infrastructure via the Acurast Hub with a Base wallet.

Within the Hub, builders can deploy secure, autonomous AI agents, such as bots that execute trades, manage assets, or perform on-chain reconciliations. This happens while inputs and outputs remain encrypted and unseen by node operators.

All AI inference runs inside smartphone TEEs, meaning neither the device owner nor external observers can access confidential data during processing, key for privacy-focused applications in finance, identity, and enterprise workflows.

Beyond data centers

This move comes on the heels of strong growth for Acurast. Indeed, the decentralized compute network has expanded rapidly throughout 2025, moving from tens of thousands to hundreds of thousands of phones powering Web3 workloads.

Acurast is pushing forward the development of large-scale confidential computing, pulling together decentralized physical infrastructure (DePIN), onchain AI, and real-time machine-native payments.

With its native token now trading on major exchanges and the global network running live production jobs, Acurast aims to lay the foundation for a new class of onchain applications that are decentralized, verifiable, confidential, and autonomous by design.

Crypto World

Digital Assets Week Returns to New York, Featuring Deutsche Bank

Editor’s note: The following press release marks a pivotal moment for institutional dialogue at the intersection of traditional markets and digital asset innovation. As asset managers, banks, and regulators increasingly navigate tokenization, real-time settlement, and cross-border compliance, this year’s Digital Assets Week in New York promises to highlight concrete milestones, shared standards, and practical risk management. Deutsche Bank’s hosting underscores the role of established financial institutions in shaping scalable, regulated markets for tokenized assets. The insights below set the stage for informed conversations and future collaboration among market participants.

Key points

- Digital Assets Week returns to New York on May 13-14, hosted by Deutsche Bank.

- Event focuses on tokenization, market structure, settlement, custody, liquidity, and regulatory alignment.

- Audience comprises 400-500 senior institutional participants from banks, asset managers, policymakers, and infrastructure providers.

- Registration offers an earlybird rate through March 20 with potential complimentary access for qualifying senior executives.

Why this matters

As digital assets increasingly intersect with traditional capital markets, this conference offers a platform for regulators and market participants to discuss risk management, interoperability, and standards. It signals ongoing institutional interest in regulated tokenization and real-time settlement and may influence policy and market structure.

What to watch next

- Registration status and earlybird deadline (Mar 20) and final agenda release.

- Announcements of speakers and panel topics.

- Participation by major banks, asset managers, and regulatory authorities.

Digital Assets Week Returns to New York with Deutsche Bank

The world’s leading institutional conference is back in the heart of New York on 13-14 May, where capital markets transformation will be examined in depth, from issuance and market structure to settlement, custody, liquidity and regulatory alignment.

This year’s event will be hosted by Deutsche Bank with the underlying foundation of Global Asset Digitization projects. It is the only venue where the commercialization of tokenizing assets is discussed comprehensively and at scale.

Digital Assets Week is institution led and designed to support substantive dialogue between market participants and regulators on implementation, risk management and market structure as digital assets increasingly intersect with traditional capital markets.

The New York conference typically gathers 400 to 500 participants, with the audience highly curated to ensure senior institutional representation. Participants across the series include the majority of large banks and asset managers, alongside policymakers, supervisory authorities and infrastructure providers actively engaged in regulated market development.

This year’s action packed agenda includes a range of panel discussions and roundtables covering topics such as:

● Moving Public Markets ‘On Chain’ – Is This ‘Hype’ or ‘Reality’? (What Does This Mean in Reality?)

● Tokenized Private Markets and Secondary Liquidity – Where Have We Really Got To?

● The Vision of 24/7 Markets and Real-Time Settlement – Challenges and Opportunities?

● Tokenized ‘Yield’, ‘Deposits’, ‘MMFs’, ‘CBDCs’, ‘Rolling Contracts’… – Where is Product Innovation Taking Us? And where do stablecoins really fit?

● Tokenized Private Markets – Which Assets Are Moving On-Chain First and Why?

● Interoperability, Standards, Legacy Systems, Regional Boundaries – The Challenges for Tokenization Scale?

● Institutional Blockchain Adoption – Is It Re-Engineering the Post-Trade and Back-Office Space?

● Making ‘Dumb’ Assets ‘Smart’ – Is Tokenization Finally Delivering?

● The Global Roll-Out of Regulation – What’s the Current State for Stablecoins and Tokenized Assets?

● TradFi Custody vs. Token/Crypto Custody – Are The Two Worlds Now Merging?

● Defining the DeFi Boundary: How Institutions Can Access Innovation, Without Importing Risk

and many more crucial topics for the industry.

Past attendees of DA Week include senior executives from Bank of America, BlackRock, BNP Paribas, Citi, Franklin Templeton, Societe Generale Corporate and Investment Banking (SGCIB), State Street, J.P. Morgan, HSBC, Federal Reserve Bank of New York, BNY, DTCC, Fidelity Investments, WisdomTree, Morgan Stanley, Bank Julius Baer, Coinbase Asset Management, Bank Frick, Pantera Capital, SEI Investments, Wells Fargo Bank, New York Life Ventures, Outerlands Capital, U.S. Bank, Arta Global Markets, ClearBank, TD Bank & many more.

Registration for the event is open, offering the competitive earlybird rate until 20th March and the possibility to apply for complimentary access for certain senior executives from Institutional Banks, Fund Managers, Asset Managers and Hedge Funds whose primary business is investment management, with a minimum of $50m AUM.

Tickets can be accessed here: DIGITAL ASSETS WEEK NEW YORK TICKETS

For sponsorship and speaking enquiries, or to request the agenda and attendee sample please contact: Julia Simonova julia@daweek.org

Crypto World

Bitcoin 2026 ETF Sell-Off Purifies the BTC Bull Case, Analysis

Bitcoin (CRYPTO: BTC) stands at a turning point as institutional participation deepens and exchange-traded products reshape the trajectory of the largest crypto asset. Eric Jackson, founder of EMJ Capital, describes a coming wave of “purification” in which long-horizon capital becomes a more persistent buyer, even as price momentum remains tethered to ETF flows. Recent weeks have featured persistent net outflows from U.S. spot BTC ETFs, reinforcing a bearish tilt in the near term, yet Jackson argues that the industry is not failing as an asset class so much as redefining its owners and its catalysts. The market’s attention has shifted to the way Bitcoin interacts with broader markets, particularly through the lens of large equity ETFs and the evolving holdings of institutional investors.

Key takeaways

- Bitcoin has evolved into a high-beta tech position driven by ETF structures and institutional participation, with price dynamics increasingly echoing tech equities.

- Despite ongoing net outflows from U.S. spot BTC ETFs, the prevailing view is that the flow pattern may shift as longer-term institutional buyers re-emerge as meaningful holders.

- Stablecoin supply on exchanges needs to recover to counter prevailing bearish momentum and inject fresh liquidity into the market.

- Bitcoin’s price moves are closely tied to the performance of large ETFs like IGV (EXCHANGE: IGV), complicating the narrative that BTC is merely a store of value.

- The next wave of buyers could come from sovereign wealth funds, corporate treasuries, and other patient capital that plans to hold BTC for decades instead of quarters.

Tickers mentioned: $BTC, $IGV, $IBIT

Sentiment: Neutral

Price impact: Negative. BTC dipped below $63,000 amid ETF outflows.

Market context: The story sits at the intersection of ETF-driven liquidity, the risk-on attitude of macro markets, and the pursuit of longer-term capital that could redefine Bitcoin’s role beyond a short-term driver of price action.

Why it matters

The core argument explored by Jackson is that the current ETF environment is not a repudiation of Bitcoin’s thesis but a reconfiguration of who owns BTC and why. He notes that Bitcoin’s recent price action has been highly reactive to the behavior of large tech-focused baskets rather than gold-like stability, underscoring a shift toward a “high-beta tech position.” This is not a condemnation of Bitcoin as an asset; it highlights how ETF architecture can amplify or dampen moves depending on the flow dynamics of large holders.

In a contrast to 2021’s retail-driven exuberance, this cycle has institutions acting as the marginal buyers, with retail money gravitating toward other tech equities. The outcome, Jackson argues, could be a new equilibrium in which long-duration capital, less prone to rapid rebalancing, steps in as a stabilizing influence over time. This shift is underscored by the fact that the largest spot BTC ETF provider, via BlackRock, operates IBIT (EXCHANGE: IBIT), a vehicle that reframes who actually owns BTC and how its supply is interpreted in the broader market. In his words, “IBIT changed who owns Bitcoin.”

“BTC didn’t fail as an asset. It succeeded as an ETF. And that’s the problem.”

The analysis also points to a broader ecosystem dynamic: as exchange-traded products accumulate assets, their flows can become a dominant price driver, even if the asset itself remains in a longer-term growth trajectory. Jackson emphasizes that the true test is not immediate price action but the durability of new ownership patterns—whether sovereign wealth funds, corporate treasuries, and patient capital will embrace BTC as a decades-long holding rather than a quarterly rebalancing instrument. The evolution toward such ownership could act as a counterweight to cyclical pressures and help Bitcoin resist the pull of any single macro narrative.

“IBIT changed who owns Bitcoin.”

Market data cited in the commentary show a continued pattern of ETF outflows in the U.S. spot market, with sector-wide momentum often tied to the fate of the IGV (EXCHANGE: IGV), the BlackRock-run tech software ETF that remains a barometer for Bitcoin’s near-term price direction. Jackson notes a stark relationship: when IGV sells off, BTC tends to slide in tandem. This linkage reinforces the view that Bitcoin, for now, functions more as a risk-on tech proxy than as a pure store of value, a reality that could persist until a broader base of durable, long-horizon buyers emerges.

On the bearish side, data from Farside Investors indicate net outflows from US spot BTC ETFs topping the $200 million mark on a single day, reinforcing the delicate balance between supply and demand in the current environment. This outflow backdrop coincides with BTC/USD trading beneath recent support zones and with the market contemplating a potential macro bottom near the $50,000–$60,000 range. Yet the rhetoric around purification—an upgrade in the quality and durability of BTC ownership—offers a counter-narrative: the next phase could bring steadier demand from capital that does not chase quarterly returns but seeks a multi-year thesis aligned with the future of digital assets in institutional portfolios.

For observers, the key question remains: will the bears be proven right in the near term, or will the emergence of longer-duration capital push BTC toward new, steadier footing? Jackson’s framing suggests the latter, arguing that every cycle clears weak hands and paves the way for a more durable, patient class of buyers that can compress volatility over time. The bear-case focuses on current price behavior and ETF-outflow metrics; the bull-case centers on a structural shift in ownership that could re-anchor Bitcoin to a longer horizon rather than a shorter trading horizon.

As the market absorbs this tension, the role of stablecoins and liquidity in exchange ecosystems will be crucial. Jackson highlights a potential bullish trigger in the stabilization and expansion of stablecoin supply on venues where BTC trades, arguing that liquidity depth and cross-asset flows will better support a longer-duration investment thesis. The broader takeaway is not a single catalyst but a sequence of developments: improved ownership dispersion, more patient capital, and a liquidity backdrop capable of supporting larger, more durable bets on BTC’s future.

Ultimately, the narrative is not about abandoning the Bitcoin thesis but about reframing it in the language of institutions and ETFs. If “purification” proves to be a meaningful transition rather than a temporary lull, BTC could transition from a speculative cycle-driven asset to a more mature component of diversified institutional portfolios. That is the arc Jackson envisions: a gradual reweighting of the BTC thesis as the market benefits from a new class of owners who cross asset boundaries and commit to holdings that endure beyond quarterly reporting cycles.

For readers, the implications extend beyond price action. If the trend toward long-horizon ownership takes hold, Bitcoin could see more predictable demand patterns, reduced reliance on fickle retail speculation, and a broader acceptance within traditional investment portfolios. The coming months will be telling as ETF flows, stablecoin dynamics, and the behavior of IGV and IBIT converge to shape Bitcoin’s role in the institutional narrative.

What to watch next

- Watch for the end of IGV-driven selling pressure and any decoupling of BTC price from tech-equities movements.

- Observe whether stablecoin supply resumes growth on major exchanges, potentially altering liquidity dynamics.

- Track net flows into IBIT and other spot BTC ETFs as a gauge of increasing long-term institutional interest.

- Monitor commentary from sovereign wealth funds and corporate treasuries regarding BTC allocations and long-horizon positioning.

- Pay attention to price levels around the $50k–$63k range and any signals from volume that could precede a new phase of demand.

Sources & verification

- Eric Jackson’s X post discussing BTC price strength and the ongoing institutional exodus.

- Spot Bitcoin ETF net flows coverage detailing five weeks of net outflows.

- BlackRock’s position in BTC via IGV and the role of IBIT, the iShares Bitcoin Trust.

- Farside Investors’ data on netflows for Bitcoin ETFs.

- Historical references to BTC price behavior on macro timelines and timeline-based targets mentioned in market commentary.

Market reaction and the next phase for Bitcoin

Bitcoin (CRYPTO: BTC) is navigating a landscape where ETF mechanics and institutional involvement increasingly dictate price action, even as longer-horizon capital begins to align with a more durable ownership thesis. From Jackson’s perspective, the current environment is not a failure of Bitcoin’s core premise but a maturation of its ownership structure. He points to the fact that Bitcoin’s popularity as an ETF instrument has transformed who holds it and why, a transformation that could ultimately stabilize demand and reduce the volatility that has characterized the asset in previous cycles. In his framing, the “purification” process refines the Bitcoin thesis by pushing it toward a cohort of buyers capable of maintaining positions across a variety of market regimes.

IGV’s behavior—an influential proxy for tech-sector risk appetite—has underscored the degree to which BTC’s macro environment remains tethered to broader equity flows. The relationship is not a perfect one, but it has become a meaningful driver in days of outsized ETF activity. The linked commentary suggests that if IGV ceases its selling pressure, BTC could benefit from a re-tightening correlation and a broader base of liquidity that supports more stable trading ranges. IBIT, as a cornerstone of BTC exposure within a regulated ETF framework, represents a structural shift in ownership that could cement a longer-term, institutional footprint in the Bitcoin ecosystem.

Despite near-term headwinds, the long arc of this narrative remains optimistic for holders who are patient and disciplined. The prospect of sovereign wealth funds and corporate treasuries adopting BTC as a dedicated, multi-year allocation is the biggest potential inflection point described by Jackson. If realized, this shift would move Bitcoin beyond episodic cycles of price strength tied to fundraising or speculative sentiment, toward a steadier, more resilient accumulation that could redefine Bitcoin’s role in the global financial system over the coming decade. In the near term, traders will watch for liquidity signals, ETF flow trends, and the evolving interaction between BTC and large tech-equity benchmarks as the market slowly prices in a longer horizon reality.

-

Video4 days ago

Video4 days agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Fashion4 days ago

Fashion4 days agoWeekend Open Thread: Boden – Corporette.com

-

Politics2 days ago

Politics2 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Sports18 hours ago

Sports18 hours agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Politics19 hours ago

Politics19 hours agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Business7 days ago

Business7 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment6 days ago

Entertainment6 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Tech6 days ago

Tech6 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports5 days ago

Sports5 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Business2 days ago

Business2 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Crypto World5 hours ago

Crypto World5 hours agoXRP price enters “dead zone” as Binance leverage hits lows

-

Business2 days ago

Business2 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

Entertainment6 days ago

Entertainment6 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business6 days ago

Business6 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat1 day ago

NewsBeat1 day ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

Tech2 days ago

Tech2 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat2 days ago

NewsBeat2 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Politics2 days ago

Politics2 days agoMaine has a long track record of electing moderates. Enter Graham Platner.

-

Crypto World6 days ago

Crypto World6 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Crypto World5 days ago

Crypto World5 days ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market