Crypto World

Wrench Attacks Jump 75% in 2025, $41M Lost (CertiK)

Physical targeting of crypto users or their relatives—commonly described as “wrench attacks”—has moved from the periphery of risk discussions to a tangible threat, according to a security audit by CertiK. In a report on wrench attacks released on Sunday, CertiK said there were 72 verified cases worldwide in 2025 in which crypto holders faced direct physical harm. The firm notes that such attacks are “no longer edge cases,” with physical assaults and kidnappings rising by roughly 75% versus 2024. The early data indicate a crisis that could influence behavior across the ecosystem, from founders to high-net-worth individuals, as risk management extends beyond digital defenses into the real world.

“Beyond direct losses, the psychological and reputational fallout is reshaping behavior across the industry, pushing founders and high-net-worth individuals toward operational anonymity and geographical relocation,” CertiK stated. “2025 marks a clear inflection point: physical violence is now a core threat vector in the crypto ecosystem.”

According to the audit, losses confirmed to date total $40.9 million, though CertiK cautions the figure may be understated due to under-reporting, silent settlements, and ransoms that leave little trace. France recorded the largest number of attacks in 2025 with 19 confirmed incidents, while all of Europe accounted for about 40% of global wrench-attacks activity that year. The security community is now grappling with a threat that blends street-level danger with the same financial complexities that have shaped crypto crime for years.

In a related context, observers have highlighted that the threat matrix goes beyond the wallet. A piece on wrench-attacks dynamics, including rising violence, underscores how the community must adapt from purely digital security practices to holistic risk mitigation that acknowledges the real-world risks faced by holders. The discussion has also encompassed debates around how to improve safety without disclosing wealth or inviting targeted surveillance.

Among the most high-profile incidents in 2025 were cases that drew international attention: the kidnapping of Ledger founder David Balland and his wife, Amandine, in January, which underscored how high-profile crypto figures can become targets. A separate case in May involved an Italian crypto holder who was reportedly kidnapped and tortured during a visit to New York City. These events illustrate the severity and unpredictability of wrench-attacks, prompting calls for a more layered security approach that spans home security, travel protocols, and protective logistics for principals and their families.

Industry voices have long warned that no amount of online security can fully avert physical risk if wealth is openly discussed or visible. “Every week, there is a Bitcoiner, at least one in the world, who gets kidnapped, tortured, extorted, and sometimes even worse,” said Alena Vranova, founder of SatoshiLabs, in August, emphasizing that even in the crypto space, personal safety remains a critical concern. “We have seen cases of kidnappings for as little as $6,000 worth of crypto, and we have seen people murdered for $50,000 in crypto.”

Possible solutions to wrench attacks

To counter the threat, researchers and practitioners have proposed protective measures such as “panic wallets” that could trigger emergency responses, wipe balances under duress, or generate decoys to mislead attackers. The concept aims to provide a rapid, verifiable means of signaling danger without exposing a holder’s entire holdings or wealth. Nonetheless, security professionals caution that effective risk management goes beyond gadgetry; it requires disciplined personal security practices. Experts advise that crypto holders should limit the visibility of their holdings and avoid broadcasting wealth in public settings, a principle that remains a cornerstone of physical-security best practices.

Several voices in the field emphasize that technology alone cannot solve the problem. Even with new tools, industry watchers remind investors to exercise situational awareness at events and in daily routines, since high-profile gatherings can attract attention from would-be attackers. As the dialogue around wrench attacks evolves, the community continues to weigh the balance between privacy, precaution, and the practicalities of safeguarding digital assets in a world where violence can intersect with financial crime.

Magazine: 6 weirdest devices people have used to mine Bitcoin and crypto

https://www.youtube.com/embed/kyNQ5YoFkWo

Key takeaways

- 72 verified wrench-attack cases were recorded worldwide in 2025, with physical assaults and kidnappings up about 75% versus 2024.

- Confirmed losses reached $40.9 million, though actual figures may be higher due to under-reporting and untraceable ransoms.

- France had the most incidents in 2025 (19 confirmed), while Europe accounted for roughly 40% of global wrench-attacks activity.

- High-profile cases, including the January kidnapping of Ledger founder David Balland and his spouse, and a May kidnapping in New York City, highlight the real-world stakes.

- Experts advocate for safety innovations like panic-wallet concepts while stressing conventional precautions—don’t disclose wealth, stay aware at events, and integrate physical-security planning into crypto strategies.

Market context: The wrench-attacks trend unfolds against a backdrop of evolving crypto risk management. As custody services, insurance offerings, and regulatory scrutiny advance, physical risk remains a nontrivial factor that intersects with digital security and crime-fighting efforts, influencing how the industry approaches user protection and privacy.

Why it matters

For users and investors, the CertiK findings translate into a tangible reminder that wealth in crypto is not solely at risk from hacks or exploits. The realization that violence and coercion can threaten individuals and families adds a human dimension to risk models that previously focused on on-chain threats. Institutions, including exchanges and wallet providers, must weigh whether to integrate protective protocols for high-net-worth clients, alongside standard security measures like secure storage and risk assessments. The report also prompts developers and policymakers to consider pragmatic safety features—without creating new avenues for misuse—that can complement existing security protocols and insurance products.

For builders and operators, the wrench-attack phenomenon underscores the importance of a holistic security posture. This means blending digital safeguards with physical-security standards, controlled disclosure practices, and travel security guidance. In an environment where attackers may exploit social and geographical vulnerabilities, the industry’s resilience depends on coordinated efforts across technical teams, legal counsel, and security professionals to minimize exposure while preserving user privacy and decentralization principles.

What to watch next

- Updates from CertiK on wrench-attack patterns and any escalation in 2026, including regional hotspots and new attack vectors.

- Adoption and evaluation of panic-wallet concepts or other safety tools by crypto firms and high-net-worth individuals.

- Regulatory or insurer responses that address physical risk in crypto ownership, including travel and personal security guidelines for executives.

- Industry benchmarks on safe disclosure practices and privacy-preserving protections for holders in high-risk environments.

Sources & verification

- CertiK wrench-attacks report: 72 verified 2025 cases and $40.9 million in confirmed losses.

- France recorded 19 incidents in 2025; Europe accounted for about 40% of global wrench-attacks activity.

- High-profile cases: Ledger founder David Balland and spouse kidnapped in January 2025; a separate Italian investor reportedly kidnapped in NYC in May 2025.

- Quote from Alena Vranova, SatoshiLabs founder, on weekly kidnappings and related risk narratives.

- Discussion of panic-wallet concepts as potential mitigation alongside cautions about public disclosure of holdings.

Why it matters

In sum, wrench attacks compel a rethinking of crypto security that bridges digital safeguards with real-world safety measures. The ongoing incidents reinforce the need for practical risk management among individuals and institutions, including physical-security planning, incident response protocols, and prudent communication about holdings. For users, this translates into a more cautious posture when traveling, attending events, or discussing wealth in public. For the broader market, the trend highlights how security challenges remain diverse—spanning on-chain exploits, regulatory developments, and the human element that underpins the crypto economy’s continued growth and trust.

Crypto World

PayPal pops nearly 7% on report Stripe is weighing an acquisition

Thomas Fuller | SOPA Images | Lightrocket | Getty Images

PayPal‘s stock surged nearly 7% on Tuesday following a report that fintech startup Stripe is weighing buying the payments platform.

Bloomberg reported the news, citing people familiar with the matter, and said the discussions are in early stages. The report said Stripe is considering buying all or some segments of PayPal’s business.

The news comes a day after reports that buyer interest has picked up in the company following its recent stock slump.

PayPal and Stripe declined to comment on the report.

PayPal, which is grappling with slowing growth in an increasingly competitive financial payments industry, has plummeted more than 19% since the start of the year. The company shed nearly a third of its value in 2025.

Earlier this month, the stock plunged on lackluster profit guidance and its board appointed HP’s Enrique Lores as its new CEO to start at the beginning of March.

Meanwhile, fintech startup Stripe hit a $159 billion valuation on Tuesday following a secondary stock sale for employees and shareholders.

That’s up from the $91.5 billion a year ago. Stripe said in a business update that its revenue suite is slated to reach an annual run rate of $1 billion this year.

Stripe, which ranked 10th on CNBC’s Disruptor 50 list last year, has transformed into one of the most valuable private companies yet and recently acquired billing startup Metronome in January.

Stripe co-founder and president John Collison told CNBC’s Andrew Ross Sorkin on Tuesday that the company isn’t yet aiming for an IPO, which would sidetrack its current product and business growth.

Read the full Bloomberg article here.

Crypto World

Why Bitcoin’s Rising HODL Cohorts Are a Bearish Signal This Time

Short-term coin activity remains near historic lows, highlighting weak participation from new buyers across the network.

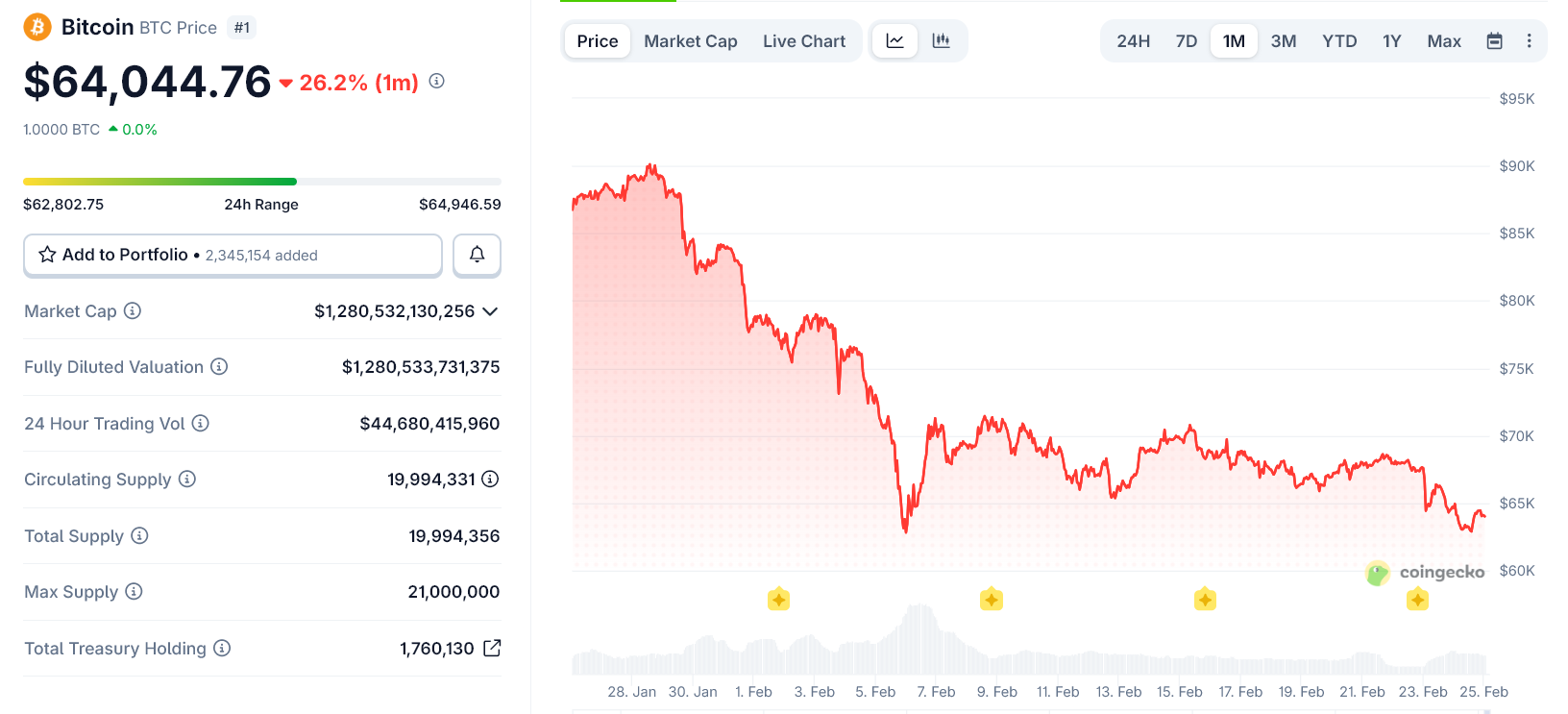

Bitcoin faced renewed sell pressure on Tuesday, briefly dragging the price down to $62,700 after a 5% decline, as macro concerns continued to weigh on investor sentiment.

New data suggest that BTC remains in a defensive phase as capital continues to exit the network and supply ages steadily without signs of renewed accumulation.

Peak Buyers Now Frozen

Realized Cap, which measures the aggregate value of all coins at the price they last moved, has declined for a second consecutive month. According to the latest analysis by Axel Adler Junior, this indicates that capital continues to exit the network rather than flow into it.

The 30-day Realized Cap Net Position Change currently stands at -2.26% and has remained negative for several weeks, which means that coins are either being transferred below their cost basis or that incoming capital is insufficient to offset ongoing outflows. Realized Cap peaked on November 26, 2025, at approximately $1.127 trillion and has since fallen to around $1.094 trillion – a compression of roughly $33 billion.

Daily net position changes continue to hover around zero or remain negative, amidst the absence of new capital entering the market. As long as the 30-day Realized Cap metric stays below zero, the network remains in net outflow mode. A move back into positive territory is the first condition required for a shift toward accumulation.

In addition, HODL Waves data revealed a sharp structural change in coin age distribution that is consistent with this defensive regime. Coins that last moved 3-6 months ago now make up about 26% of Bitcoin’s supply, up from 19% earlier this month. These coins were mostly bought near the last market peak and haven’t moved since.

The share of Bitcoin held for 6-12 months has grown to just over 20%, while coins moved within the past month account for less than 10% of the supply. This shows that few new buyers are entering the market, as per Adler Junior. Most circulating coins were bought at higher prices and are now sitting at a loss, which has left holders reluctant to sell and effectively locking supply in place.

You may also like:

The growth of older cohorts does not represent strategic accumulation but rather forced holding due to unfavorable price conditions. The structure would only see a meaningful change if coins in the 3-6 month band begin migrating into longer-term cohorts without triggering renewed selling pressure, alongside a measurable return of short-term activity.

Familiar Bear Signal Is Back

Against the backdrop of bleeding capital, an important technical signal that has appeared near the end of past Bitcoin bear markets is starting to form again. According to analyst Ali Martinez, a potential death cross on Bitcoin’s three-day chart is projected to occur in late February.

In previous cycles, this signal consistently showed up just before the final major drop. With the crypto asset still 50% below its October 2025 peak, Martinez warned that a similar setup could open the door to further downside.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Mark Zuckerberg’s Meta is planning stablecoin comeback in the second half amid U.S. regulatory shift

Meta, the U.S. tech giant helmed by Facebook creator Mark Zuckerberg, is aiming to enter the stablecoin space later this year, pending successful integration with a third-party firm to facilitate payments using the dollar-pegged token technology, according to three people familiar with the plans.

The tech giant, which owns Facebook, WhatsApp and Instagram and has more than 3 billion users, wants to begin its stablecoin integration early in the second half of this year, said one of the people, who spoke on condition of anonymity because the plans are not public. Meta is planning to integrate a vendor to help administer stablecoin-backed payments and implement a new wallet, the person said.

A second person said that Meta has sent out a request for product (RFP) to third-party firms and mentioned Stripe as a likely candidate for piloting Meta’s stablecoin.

Stripe, which acquired stablecoin specialist Bridge last year, is a long-time partner of Meta, and Stripe CEO Patrick Collison joined Meta’s board of directors in April 2025.

Meta, Stripe, and Bridge were approached for comment, but none responded by the time of publication.

Meta introducing stablecoins would let it open payment rails to its massive user base while bypassing expensive traditional banking fees, and potentially position it as a global leader in “social commerce” and cross-border remittances.

The move would also put the tech giant in direct competition with the likes of Elon Musk’s social media platform X as well as messaging platform Telegram, both of which are aiming to bring payments in-house by becoming “super apps.” This was one of the original goals for the planned Libra project — allowing the social media company to tap its vast networks, including WhatsApp’s peer-to-peer messaging service and Facebook and Instagram’s network and commerce tools, for payments.

Regulatory shift

Meta famously tried to introduce the Libra stablecoin, later renamed Diem, in 2019, only to face strong headwinds due to a less favorable regulatory climate than today’s and a lingering reputational hit from the Cambridge Analytica scandal.

In the face of a pushback against the project by U.S. lawmakers, the Libra Association, as it was then called, scaled back its ambitions in 2020, pivoting to the development of a number of stablecoins pegged to different currencies, as opposed to the original plan of a global digital currency backed by a basket of national currencies.

In the end, Meta’s stablecoin never formally launched, and the project was shut down and its assets sold off in early 2022.

The regulatory climate in the U.S. today is quite different. There are several crypto regulatory regimes underway, including President Donald Trump’s GENIUS Act, which, for the first time, established a legal foundation for U.S. stablecoin issuers and opened the floodgates for market entrants with new tokens. However, U.S. regulators are still only in the early stages of drafting the regulations governing issuers.

That said, the whole Libra/Diem experience has led Meta to prefer relying on a third-party stablecoin payments provider this time around, according to one of the sources.

“They want to do this, but at arm’s length,” said the source.

Crypto World

Global M&A stays strong in 2026 despite tightest capital squeeze in 30 years

A Goldman Sachs logo is displayed on the floor of the New York Stock Exchange in New York City, on Wednesday, August 11, 2010.

Ramin Talaie | Corbis Historical | Getty Images

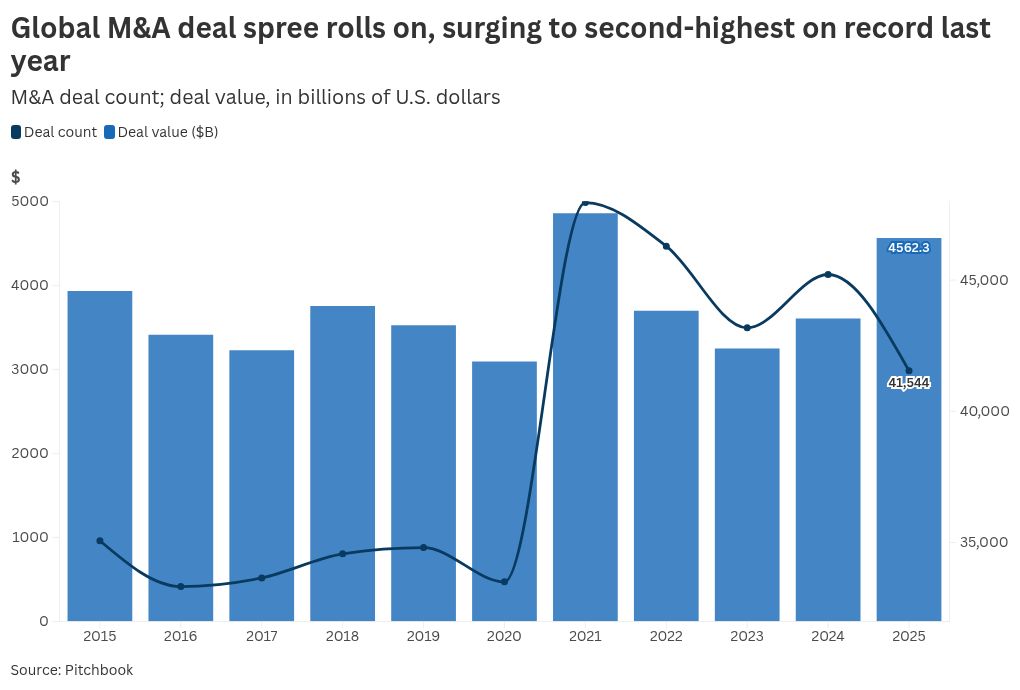

The global mergers and acquisitions boom that defined 2025 is carrying into 2026, as companies reassess their portfolios and artificial intelligence-led demand fuels large-scale transactions. However, a tightening capital pool is forcing executives to be more selective than ever.

Despite a sluggish start as Trump’s sweeping tariffs early last year briefly scuttled acquisitions and new public listings, the total value of deal-making activity surged 40% to $4.9 trillion in 2025, according to Bain & Company’s annual M&A report.

That marked the second-highest level on record, trailing only the $5.6 trillion peak in 2021, when low borrowing costs and buoyant equity markets propelled a historic dealmaking frenzy.

Dealmaking activity last year rebounded as central banks cut interest rates, valuations improved and companies increased spending on artificial intelligence.

Markets are betting that the surge will continue, as Wall Street regains its appetite for large deals amid the prospect of lower borrowing costs.

A Bain survey of 300 M&A executives found that 80% expect to sustain or increase deal activity this year, citing improved macroeconomic conditions and a growing backlog of private equity and venture capital assets awaiting exit.

As abrupt shifts in trade policies settled into a pattern of less threatening change, relief turned into confidence and then a fear of missing out.

Jake Henry

Global co-leader, McKinsey’s M&A Practice.

Goldman Sachs, drawing on its own poll of 600 corporate and financial sponsor clients, found that 57% believe scale and strategic growth will be the primary driver of deal decisions this year.

“As abrupt shifts in trade policies settled into a pattern of less threatening change, relief turned into confidence and then a fear of missing out,” said Jake Henry, global coleader of McKinsey’s M&A Practice.

Central to the shift is a decisive push by companies to reassess their portfolios, as geopolitical risks, economic fragmentation and uneven global growth force boards to reconsider where they operate and the risks they are willing to take.

“Leaders across industries recognize that many traditional business models have reached the limits of their historical growth engines,” said Suzanne Kumar, executive vice president of Bain’s global M&A and divestiture practice.

“Companies urgently need to reinvent themselves to get out ahead of the big forces of technology disruption, a post-globalization economy, and shifting profit pools,” Kumar added.

Goldman topped the global M&A ranking last year, advising on nearly 40 deals worth $1.48 trillion in total volume. It marked the strongest period for mega-deals by volume, according to Reuters, citing LSEG records dating back to 1980.

Still, companies remain cautious. Boston Consulting Group’s M&A sentiment index rebounded to 75 from its low in late 2022 — but still remained well below the long-term average of 100, reflecting “an improving but cautious stance.” A higher value than the prior month indicates that M&A market momentum is accelerating, while a lower value suggests a deceleration.

Tightest funding squeeze in decades

While the appetite for deals remains strong, the pool of discretionary capital to fund them is historically thin, forcing executives to pursue only transactions that deliver clear returns.

The proportion of capital allocated to M&A hit a 30-year low in 2025, according to Bain, as companies directed more cash towards dividends, buybacks, capital expenditures as well as research and development.

“Executives must pressure test whether M&A pathways and specific deals will help the company better compete in the most attractive markets … rethink portfolio boundaries, and make bigger, bolder decisions about what capabilities they must own vs. access,” said Kumar.

“As competing demands for capital raise the bar for deals, disciplined reinvention and value creation are essential,” she added.

The funding crunch has pushed private capital to the center of dealmaking. Private equity firms are seeking to deploy idle cash, borrowers are turning to private credit funds for flexibility, and sovereign wealth funds are increasingly acting as lead investors rather than passive backers.

Private equity now accounts for roughly 40% of global M&A activity, according to Goldman. Despite signs of stress in the private credit market — now valued at roughly $2.1 trillion — Goldman expects the asset class to more than double by 2030, broadening the pool of capital available to fund large transactions.

AI capital expenditure ‘supercycle’

Blockbuster deals are fueling the resurgence in M&A, powered by AI-related demand, according to industry reports.

Mega-deals valued at greater than $5 billion accounted for more than 73% of the increase in deal value in 2025, according to Bain.

The number of deals exceeding the $10 billion threshold swelled to 60 last year, the highest level since 2021, said McKinsey’s Henry.

“We expect more big deals in 2026, with continued consolidation and geographic expansion,” Henry said, with AI-related service providers fueling “big-deal fever” this year.

However, the heavy capital spending in AI could constrain M&A activity in the near term, Brian Levy, global deals industries leader at PwC, said.

As AI adoption accelerates, demand for computing power has surged across digital infrastructure, energy, semiconductors, and hardware optimization. In response, many companies are opting to acquire rather than build across the technology stack.

Between the first quarter of 2024 and the third quarter of last year, U.S. hyperscalers’ capital expenditures averaged $760 million per day, according to Goldman Sachs.

The Wall Street bank estimates that by 2030, another 65 gigawatts of data center capacity will come online — more than double the amount added from 2019 to 2024.

“Investment in AI is being directed towards data centres, energy, and other infrastructure as well as technology development and customisation,” Levy said.

“In the near term, the scale of this multitrillion-dollar investment may divert capital and temper M&A activity.”

Crypto World

Meta Plans Stablecoin Return With Third-Party Partner

TLDR

- Meta plans to reenter the stablecoin market in the second half of 2026 through a third-party partnership.

- The company has issued a request for product to select a vendor for stablecoin payments integration.

- Stripe has emerged as a likely candidate to pilot the stablecoin payment system.

- Meta intends to integrate a new wallet to support dollar-pegged stablecoin transactions.

- The renewed effort follows the shutdown of the Libra and Diem projects in 2022.

Meta is preparing to reenter the stablecoin market later this year through a third-party partnership. The company aims to integrate a dollar-pegged token for payments across its platforms. Sources said the rollout could begin early in the second half of 2026, pending vendor selection.

Meta Revives Stablecoin Strategy With External Partner

Meta has sent a request for product to several payment firms, according to two people familiar with the process. One source said the company prefers a third-party issuer instead of launching its own token.

The source said Meta plans to integrate a vendor to manage stablecoin-backed payments and a new wallet. The person added that the company wants operational readiness before the second half launch window.

Stripe has emerged as a likely pilot partner, according to a second person. Stripe acquired stablecoin firm Bridge last year and maintains a long partnership with Meta.

Patrick Collison joined Meta’s board in April 2025, strengthening ties between the companies. However, Meta, Stripe, and Bridge did not respond to requests for comment.

Meta owns Facebook, Instagram, and WhatsApp, which together serve more than three billion users. The company aims to use stablecoin rails to reduce payment processing costs and expand digital transactions.

Sources said the integration would support cross-border transfers and in-app purchases. However, Meta has not disclosed technical specifications or launch markets.

Regulatory Shift Shapes Meta’s Renewed Effort

Meta attempted to launch Libra in 2019 but faced regulatory resistance in the United States and Europe. Lawmakers criticized the project and raised concerns about financial stability and data privacy.

The Libra Association later rebranded the project as Diem and narrowed its scope. It shifted from a global basket-backed currency to individual currency-pegged stablecoins.

Meta shut down the Diem project in early 2022 and sold its assets. The company has since avoided direct issuance of digital currencies.

The current regulatory landscape in the United States has evolved. President Donald Trump’s GENIUS Act established a legal framework for stablecoin issuers.

Regulators are still drafting detailed compliance rules for token providers. However, the new law has encouraged more companies to explore stablecoin services.

One source said the Libra experience shaped Meta’s new approach. The person stated that Meta now prefers to rely on an established stablecoin issuer.

The company aims to integrate payments without assuming direct regulatory responsibility for issuance. Sources said Meta continues internal planning while it evaluates vendor proposals.

Crypto World

Crypto’s biggest exchange fights back against allegations of moving billions of Iran-linked money

Crypto exchange Binance accused The Wall Street Journal Tuesday of publishing “false information” in a Monday article about the exchange allegedly firing employees investigating funds moving through the exchange to sanctioned entities.

Richard Teng, Binance co-CEO, accused the WSJ of “inaccurate reporting about our compliance program” in an X post. He included a letter to the news organization from the crypto exchange’s counsel in New York City, which said “The Wall Street Journal published defamatory claims,” despite the exchange’s attempts to “set the record straight.” The letter is similar to one Binance directed to Fortune last week over a similar article which said the exchange fired investigators who reported sanctions concerns.

The Journal’s article on Monday said the crypto exchanged fired staff investigators who identified $1 billion that moved to “a network funding Iran-backed terror groups.”. The report claimed to have Binance documents and statements from people familiar with Binance operations, saying that the crypto exchange dismantled the staff investigation into the $1 billion..

Binance claims staff were disciplined

The Journal article includes a statement from a Binance spokeswoman saying the investigators resigned and denied they were fired or suspended for raising compliance concerns.

“Documents, foreign law-enforcement officials and the people familiar with Binance’s operations said the same conduct that broke the sanctions and anti-money-laundering laws has persisted at the exchange,” the Journal article said, referring to Binance’s 2023 settlement with the U.S. Department of Justice and other authorities, in which the exchange and founder Changpeng “CZ” Zhao admitted to violating federal money laundering statutes..

The news report also mentions $1.7 billion more in 2024 and 2025 that were transferred from Binance-registered Chinese clients to Iran-backed groups, including Yemen’s Houthi militants. The New York Times’ article also published on Feb. 23 alleges the same information.

Both influential U.S. newspapers said the four individuals “fired” by Binance, who worked in compliance and market oversight roles, were dismissed after the crypto exchange concluded they had failed to adequately escalate red flags related to suspicious trading activity and potential policy violations.

A Binance spokesperson told CoinDesk the exchange conducted an “internal review and did not find evidence of violations of applicable sanctions laws or regulations related to the transactions described.”

However, the spokesperson, who stated no investigator was dismissed for raising compliance or potential sanctions issues, said suspicious activity was detected and reported, which is “evidence that our controls are working, not the opposite.”

Rachel Conlan, another spokesperson, told the Times, there is an ongoing investigation and that a full report will be sent to the U.S. Justice Department on Feb. 25.

Binance said in a blog post on Sunday that its “sanctions-related exposure is minimal.”

“Recent reporting on our top-tier compliance is, at best, inaccurate. It presents a distorted, jumbled account that relies on false claims by disgruntled former employees. This incomplete and flawed viewpoint reflects a lack of understanding of general compliance control processes for crypto exchanges,” the blog post, which was published prior to the Wall Street Journal’s report.

Crypto World

New Data Reveals Which Wall Street Firms Sold Bitcoin ETFs

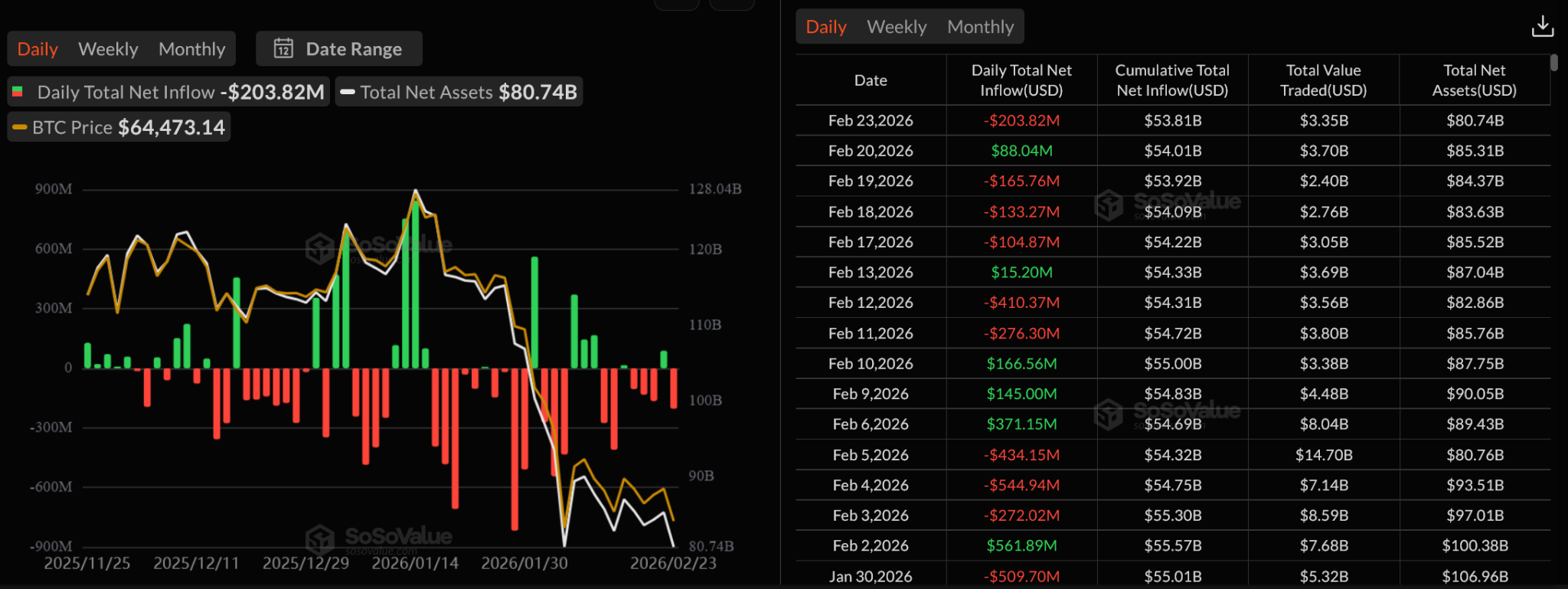

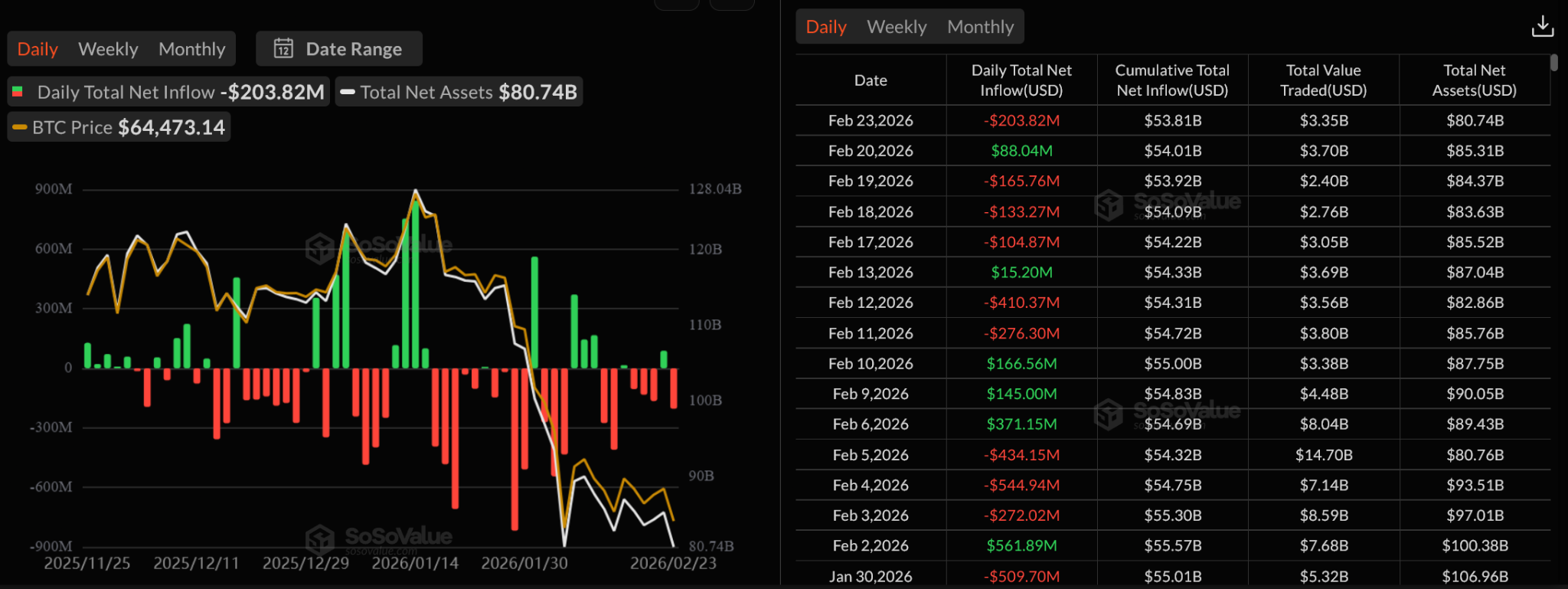

Large US investors reduced their Bitcoin ETF holdings in late 2025, and new breakdowns show the selling came mainly from a few specific groups rather than the entire market.

Bloomberg Intelligence data shared by analysts shows that 13F filers — large institutions that report quarterly holdings to the US SEC — were net sellers of Bitcoin ETFs in Q4 2025, cutting exposure by nearly $1.6 billion.

The biggest reductions came from investment advisors and hedge funds, the two largest holder categories.

13F Filers Sold Their Bitcoin Shares

A 13F filer is a large US money manager (usually with over $100 million in qualifying assets) that must report its holdings every quarter. These filings show a snapshot of positions at quarter-end.

These firm’s reported Bitcoin ETF holdings were lower in Q4 than in Q3. In other words, they reduced ETF shares, not necessarily that they sold physical Bitcoin directly on exchanges.

That helps explain why Bitcoin has remained under pressure even during short-term rebounds. ETF flow data shows repeated daily outflows in recent weeks, including several large red days in February.

Who Sold the Most

The category-level data shows the largest net reductions came from:

- Investment Advisors: about -21,831 BTC

- Hedge Fund Managers: about -7,694 BTC

Other categories, such as brokerages and banks also reduced exposure.

However, some groups increased holdings, including holding companies and government-related entities.

This does not mean “all institutions turned bearish.” Many firms use Bitcoin ETFs for hedging, arbitrage, or short-term trading, not just long-term bets.

However, the broader signal is clear. Big-money positioning weakened, and that matches the recent ETF outflow trend.

Until daily ETF flows stabilize and turn positive for more than a few sessions, Bitcoin may remain in a fragile, relief-rally phase rather than a full recovery.

Crypto World

China Never Stopped Buying Gold. Now It’s Building the Machine to Price It

Gold prices have recovered to $5,161 per ounce after January’s dramatic crash — and the epicenter of the rebound points squarely at China.

But this time, the story is bigger than speculation. Beijing is making a coordinated push to reshape the global gold market from the ground up.

The Hainan Arbitrage

Hainan’s new zero-tariff regime was designed to showcase China’s openness to foreign imports. The early numbers suggest it’s working — at least on the surface.

Hainan launched island-wide customs-free operations on Dec. 18. The nine-day Spring Festival holiday was the first major test. Offshore duty-free sales hit 2.72 billion yuan ($390.8 million), up 30.8% year-on-year, with 325,000 shoppers, according to Haikou Customs data reported by the Moodie Davitt Report on Feb. 24. The momentum had been building since December. January sales reached 4.86 billion yuan ($693.5 million), up 46.8% year-on-year, per Xinhua.

Gold jewelry remained a top draw during the holiday. China Daily reported on Feb. 23 that zodiac-inspired pieces and investment-grade bullion flew off shelves even as prices vaulted back above 1,500 yuan per gram. The Moodie Davitt Report confirmed jewellery and watches ranked among the top-selling categories at CDF Sanya, the island’s flagship duty-free complex.

The Global Times reported on Feb. 25 that leading brands Laopu Gold and Chow Tai Fook launched aggressive promotional campaigns during the holiday, including gram-based discounts and fee waivers for craftsmanship. A Chow Tai Fook salesperson in Beijing confirmed the increased foot traffic and purchases.

The price advantage in Hainan remains significant. Yicai Global reported in January that Chow Tai Fook gold costs roughly 1,250 yuan per gram in Hainan versus 1,430 yuan on the mainland. A 40-gram bracelet can save buyers 13,000 to 14,000 yuan with government subsidies factored in.

The pattern suggests something deeper about China’s consumer economy. Given a tax break, the middle class isn’t spending on luxury — it’s hedging with gold.

Hong Kong’s Bid for Global Bullion Dominance

While retail buyers flock to Hainan, Beijing is playing a far larger game. Hong Kong’s Undersecretary for Financial Services Joseph Chan announced at the Year of the Horse’s first gold trading session that the government will make a “full push” to transform the city into a regional gold storage and trading hub.

The plan is ambitious: expand Hong Kong’s gold storage capacity to over 2,000 metric tonnes within three years, launch a fully state-owned gold clearing system with trial operations later this year, and deepen alignment between the Shanghai Gold Exchange and Hong Kong’s market.

The objective is explicit — expanding China’s market share and influence over international gold pricing. Western financial centers have historically controlled that domain.

The initiative goes beyond domestic ambitions. Several Asian nations have expressed interest in storing sovereign gold with the SGE as it expands offshore vaults. Cambodia’s central bank is expected to be among the first to use SGE offshore vaults. It may store part of its 54 tonnes of gold reserves in Shenzhen’s bonded zone.

The Structural Bid Beneath the Speculation

January’s blowout — gold down 9%, silver crashing 26% in a single day — exposed the speculative froth. Leveraged retail traders were wiped out, gold ETFs saw nearly $1 billion in single-day outflows, and exchanges hiked margin requirements.

Yet physical gold demand in China barely flinched. Shanghai Gold Exchange premiums widened to $30-32 per ounce above London spot even as global prices cratered. Bank deposit rates have been crushed by monetary easing, the property market offers no refuge, and gold remains the most compelling store of value for households with few other options.

With gold currently accounting for just 1% of Chinese household assets — compared to a projected 5% in the near term — the structural bid from the world’s largest gold consumer is far from over. And now, Beijing isn’t just buying gold. It’s building the infrastructure to price it.

Crypto World

Crypto isn’t losing to AI, its just ‘capitalism doing its job,’ says Dragonfly

SAN FRANCISCO, CA – As artificial intelligence dominates venture funding and headlines alike, some in crypto have begun to wonder whether the industry has missed its “ChatGPT moment” — or worse, whether capital is permanently rotating away.

Haseeb Qureshi, managing partner at crypto venture firm Dragonfly, rejects that framing outright.

“I would completely dispute this framing,” Qureshi said in an interview with CoinDesk at NEARCON 2026. “Less than 1% of AI users are paying. That means 99% are using the free tier. Crypto doesn’t have a free tier.”

Comparisons between AI’s explosive consumer adoption and crypto’s trajectory misunderstand the nature of the products, he argued. “There is no free Bitcoin. There’s no free Ethereum,” he said, noting that while roughly 80% of Americans have tried some form of AI tool, about 15% have owned crypto — a figure he calls “a mass-market phenomenon.”

To Qureshi, the better lens is global utility, particularly in payments. Stablecoins, he noted, have grown steadily regardless of price swings. “Stablecoin supply has been growing 50% year over year,” he said. “That’s exponential growth.”

Qureshi said the underlying fundamentals of crypto remain intact even if sentiment has cooled.

Following the money

Venture dollars have undeniably shifted toward AI. But Qureshi views that less as an indictment of crypto and more as the market doing what markets do.

“Money is a leading indicator,” he said. “Human beings respond to money — they don’t respond to the reality on the ground.”

Crypto, even after multiple drawdowns, remains a $2 trillion asset class. And unlike AI giants such as OpenAI, which employ thousands, crypto projects often scale with lean teams.

“We don’t have any 9,000-person companies like OpenAI — and that’s a good thing,” Qureshi said. “Crypto is incredibly high leverage as a technology. You don’t need very many people to build things that are world scale.”

He sees the recent contraction as a correction after years of overfunding. “To the extent that there were too many people building too many things in crypto, the market’s correcting that. That’s capitalism doing its job.”

In fact, Dragonfly recently announced a $650 million fund — a move some observers characterized as bold given the current market malaise.

“That’s the best time to double down,” Qureshi said. “Why would you want to double down when prices are high? If you’re raising money and deploying into all-time high prices, that’s when you should be nervous.”

Asked whether something more existential had changed in crypto over the past four months, he was blunt: “Did the fundamentals of the industry change that much? No.”

Crypto and AI: convergence or mirage?

While Dragonfly is exploring investments at the intersection of crypto and AI, Qureshi cautioned against assuming AI will revive crypto’s momentum.

“Is AI going to save crypto? F*** no,” he said. “AI agents using crypto are so far away — it’s going to take years.”

He sees a familiar pattern of crypto attaching itself to whatever technological trend is ascendant. “Chatbots are exciting? Great — we have chatbots with tokens. Agents are exciting? Great — you can buy the layer one for agents,” he said. “As an investor, you just have to slow down.”

That doesn’t mean crypto’s identity is shifting away from its roots. Recent narratives suggesting that the industry has capitulated to Wall Street miss the point, Qureshi said.

“There’s a lot of people saying crypto capitulated and became a tool of Wall Street. I think that’s stupid,” he said. “The whole point of bitcoin is that it encompasses everybody’s usage of the same technology. Nobody’s usage impinges on anybody else’s.”

Cycles, not collapse

Qureshi attributes much of today’s gloom to short time horizons and simple fatigue.

“People in crypto are pathologically short-time horizon,” he said. “Prices were down a lot of times.”

From ETF-driven rallies to tariff-induced pullbacks, volatility has defined the industry for over a decade. The pattern, he suggests, is neither new nor fatal.

“This idea that because prices are down, nobody’s going to use stablecoins anymore? Absurd,” he said.

For Qureshi, the story isn’t about AI replacing crypto, nor about crypto’s decline. It’s about cycles — and patience.

“Chill out,” he said. “It’s not a catastrophe.”

Read more: Kraken’s co-CEO could trust AI with 100% of his crypto — Dragonfly’s Haseeb Qureshi isn’t convinced

Crypto World

ETH Slides 35% in a Month as ETF Flows Turn Negative

A new report from BestBroker highlights ETH ETF assets shrinking since the start of the year.

U.S. spot Ethereum ETFs are recording major outflows as demand weakens across the crypto market, according to a new report from BestBrokers.

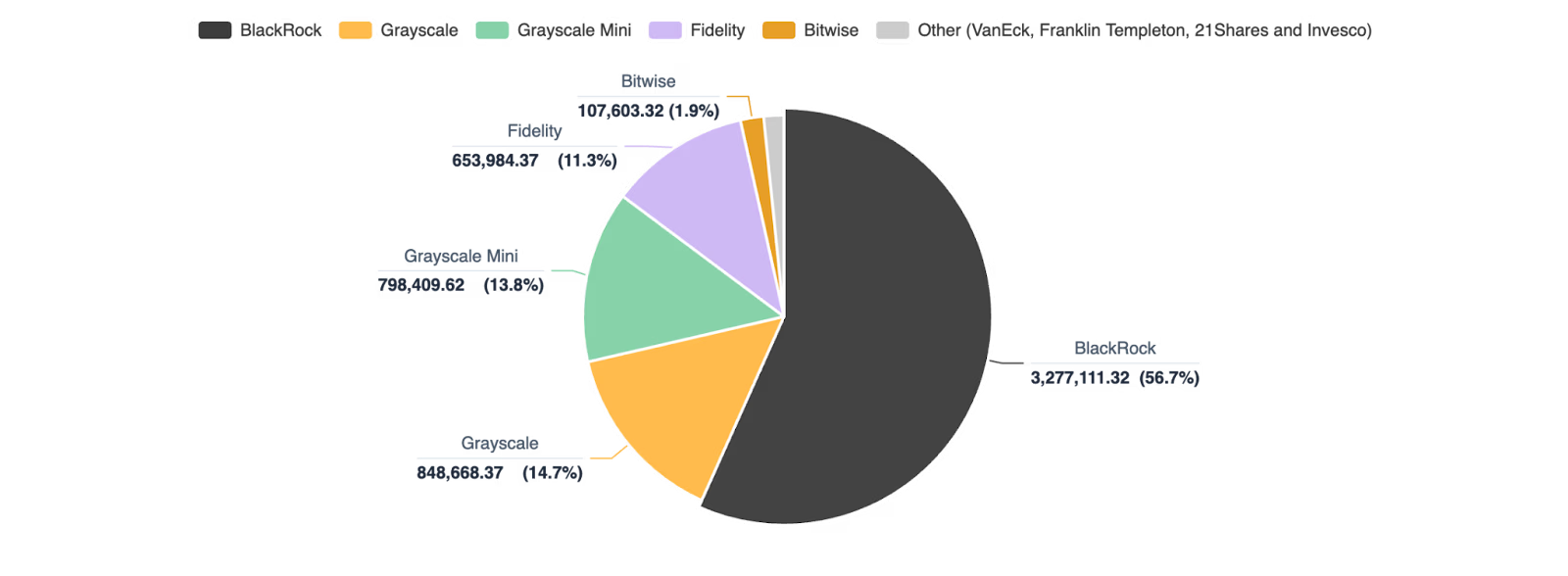

ETH ETF holdings dropped from more than 6.1 million ETH in late January to about 5.8 million by Feb. 23. Total assets in those funds also fell from $18.6 billion to about $11.9 billion. The data also shows that the market is highly concentrated, with BlackRock holding about 57% of all ETH in U.S. ETFs – well ahead of Grayscale and Fidelity.

Ether (ETH) has fallen sharply, down about 35% over the past month and nearly 40% over the past three months. Currently, the world’s second-largest cryptocurrency by market capitalization is trading at around $1,850, per CoinGecko.

The findings highlight how quickly sentiment toward crypto has soured over the past few months. It also shows how investors continue to pull money from riskier assets amid rising volatility.

Bitcoin Findings

On the Bitcoin side, the report said spot Bitcoin ETFs have also had a weaker start to 2026 after steady inflows in 2024 and 2025. BestBrokers estimates more than $4 billion in net outflows since the start of the year, with total ETF holdings slipping to 1.26 million BTC as of Feb. 23 – the first mid-quarter decline since launch.

BlackRock’s iShares Bitcoin Trust (IBIT) led the pullback, posting outflows of 19,300 BTC in February, while Grayscale and Fidelity also recorded outflows.

BestBrokers’ report said the divergence suggests institutions are treating Bitcoin as longer-term exposure, while Ethereum funds are more sensitive to market sentiment.

-

Video5 days ago

Video5 days agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Fashion4 days ago

Fashion4 days agoWeekend Open Thread: Boden – Corporette.com

-

Politics3 days ago

Politics3 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Entertainment7 days ago

Entertainment7 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Sports1 day ago

Sports1 day agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Politics1 day ago

Politics1 day agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Tech7 days ago

Tech7 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports6 days ago

Sports6 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Business3 days ago

Business3 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Crypto World19 hours ago

Crypto World19 hours agoXRP price enters “dead zone” as Binance leverage hits lows

-

Business2 days ago

Business2 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

Entertainment6 days ago

Entertainment6 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business7 days ago

Business7 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Tech2 days ago

Tech2 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat2 days ago

NewsBeat2 days ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

NewsBeat2 days ago

NewsBeat2 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Politics2 days ago

Politics2 days agoMaine has a long track record of electing moderates. Enter Graham Platner.

-

Crypto World6 days ago

Crypto World6 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Tech9 hours ago

Tech9 hours agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

NewsBeat4 hours ago

NewsBeat4 hours agoPolice latest as search for missing woman enters day nine