CryptoCurrency

XRP ETFs Cross $1 Billion in Net Assets Amid Steady Inflows

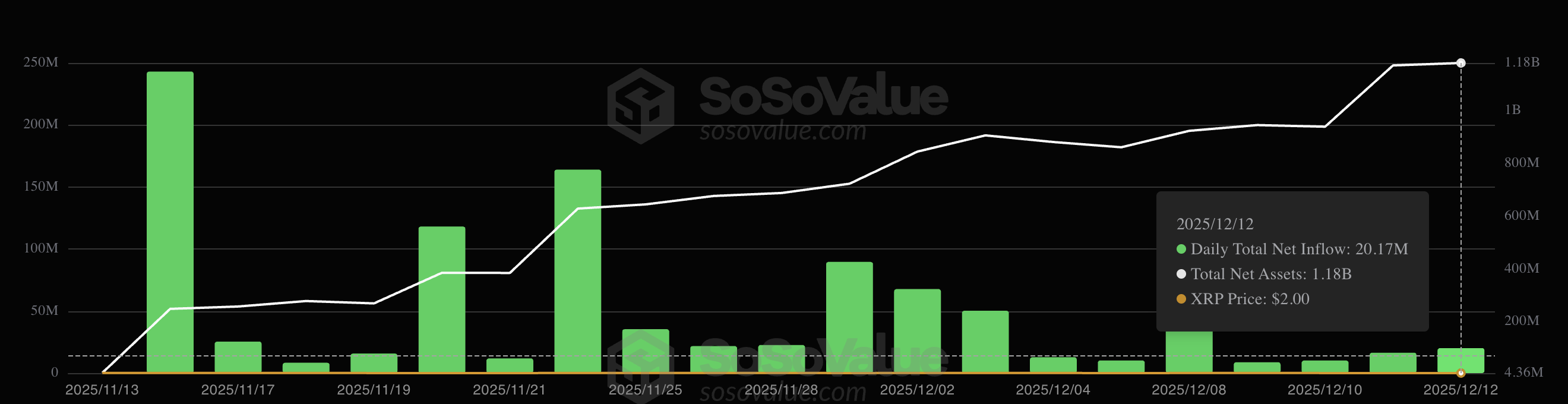

Spot XRP exchange-traded funds (ETFs) have surpassed $1 billion in net assets, with total inflows rising to $990.9 million.

Notably, analysts suggest that if current momentum persists, total ETF inflows could exceed $10 billion by 2026.

Sponsored

XRP ETFs Hit The $1 Billion Milestone

According to SoSoValue data, the total net assets held by spot XRP ETFs surpassed $1 billion last Thursday. At the time of writing, the figure stood at approximately $1.18 billion.

Steven McClurg, CEO of Canary Capital, noted that while Solana-based ETFs were launched earlier, XRP ETFs have now surpassed them in total AUM, reflecting stronger investor interest.

“I expected this. SOL is much more efficient to hold on-chain and to stake directly for retail audiences, whereas XRP has more institutional demand and no staking. As with everything, there will be an audience that prefers direct ownership, and an audience that prefers the ease of financial instruments. Some will do both,” McClurg wrote.

Meanwhile, XRP spot ETFs have recorded uninterrupted positive net flows. Cumulative inflows have reached $990.9 million.

Currently, five asset managers offer spot XRP ETF products, including Grayscale, Franklin Templeton, Bitwise, and Canary Capital. The most recent entrant, 21Shares, expanded the market with the launch of its XRP ETF, TOXR, further broadening investor access.

Sponsored

The arrival of these ETFs marks a turning point for investors. Regulatory uncertainty kept XRP out of traditional investment vehicles for years. Now, the spot ETFs have lifted that barrier, enabling wider participation through regulated channels.

Market analysts are optimistic about continued growth. An analyst emphasized that the recent growth has occurred despite the limited number of spot XRP ETFs currently available.

“This is just 5 spot ETFs. No BlackRock, No 10-15 ETFs exposure yet. but they are coming,” X Finance Bull posted.

Based on current trends, the analyst suggested that if weekly inflows were to remain near $200 million, cumulative inflows could surpass $10 billion by 2026

Sponsored

“Now imagine this flow. ~$200M/week. Continuing for the next 52 weeks into 2026. That’s over $10 BILLION in net inflows, with more than 5 BILLION XRP locked at this pace. At that level, the liquid supply becomes a myth. That’s how a supply shock is born. Retail is emotionally selling dips. Institutions are mechanically buying value,” he added.

XRP Long-Term Price Projection and Market Outlook

Despite strong inflows into spot XRP ETFs, the token’s price performance has remained subdued. BeInCrypto previously reported that ETF developments and Ripple’s expansion efforts have had a limited impact on XRP’s market price so far.

According to BeInCrypto Markets data, XRP has declined nearly 13% over the past month. At press time, the asset was trading at $2.00, down 0.91% over the past 24 hours.

Sponsored

Nonetheless, some analysts continue to project a potential upside. Market commentator Xaif Crypto noted that XRP trading activity remains influenced by large holders, commonly referred to as whales.

“Recently, XRP has been in a short-term decline, nearing its lowest price of the year. Nevertheless, XRP whales are leading the order. They are actively trading XRP even as the price has fallen,” he said.

According to the analyst, such behavior is often observed during market bottoming phases, when large investors build positions ahead of a potential trend reversal.

“Whales accumulate before a rally and do not buy during an uptrend. Their active buying indicates that they are preparing for an uptrend in XRP,” he remarked.

Overall, the rapid growth of spot XRP ETFs highlights rising institutional interest in the asset, even as price action remains muted. While inflows suggest strong long-term conviction, XRP’s near-term performance has yet to benefit. Whether analysts’ projection of an upcoming uptrend materializes or XRP faces further downside remains to be seen.