Crypto World

XRP Price Prediction as token surges after Ripple CEO joins CFTC Advisory Committee

XRP price jumped after Ripple CEO Brad Garlinghouse joined the U.S. Commodity Futures Trading Commission’s (CFTC) Global Markets Advisory Committee, a move seen as strengthening Ripple’s regulatory standing in Washington.

Summary

- XRP surged after Ripple CEO Brad Garlinghouse joined the CFTC’s Innovation Advisory Committee, signaling stronger regulatory engagement.

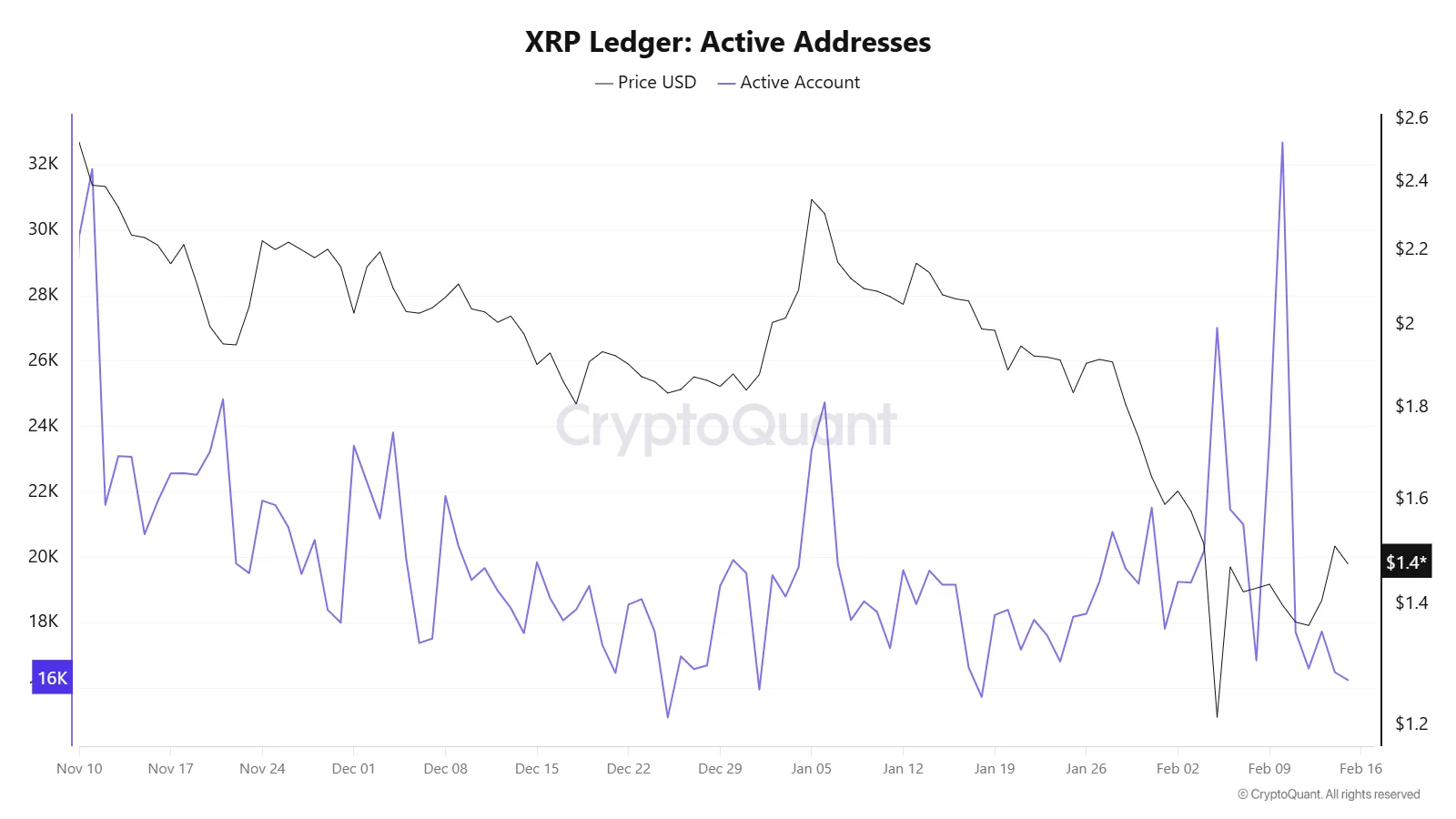

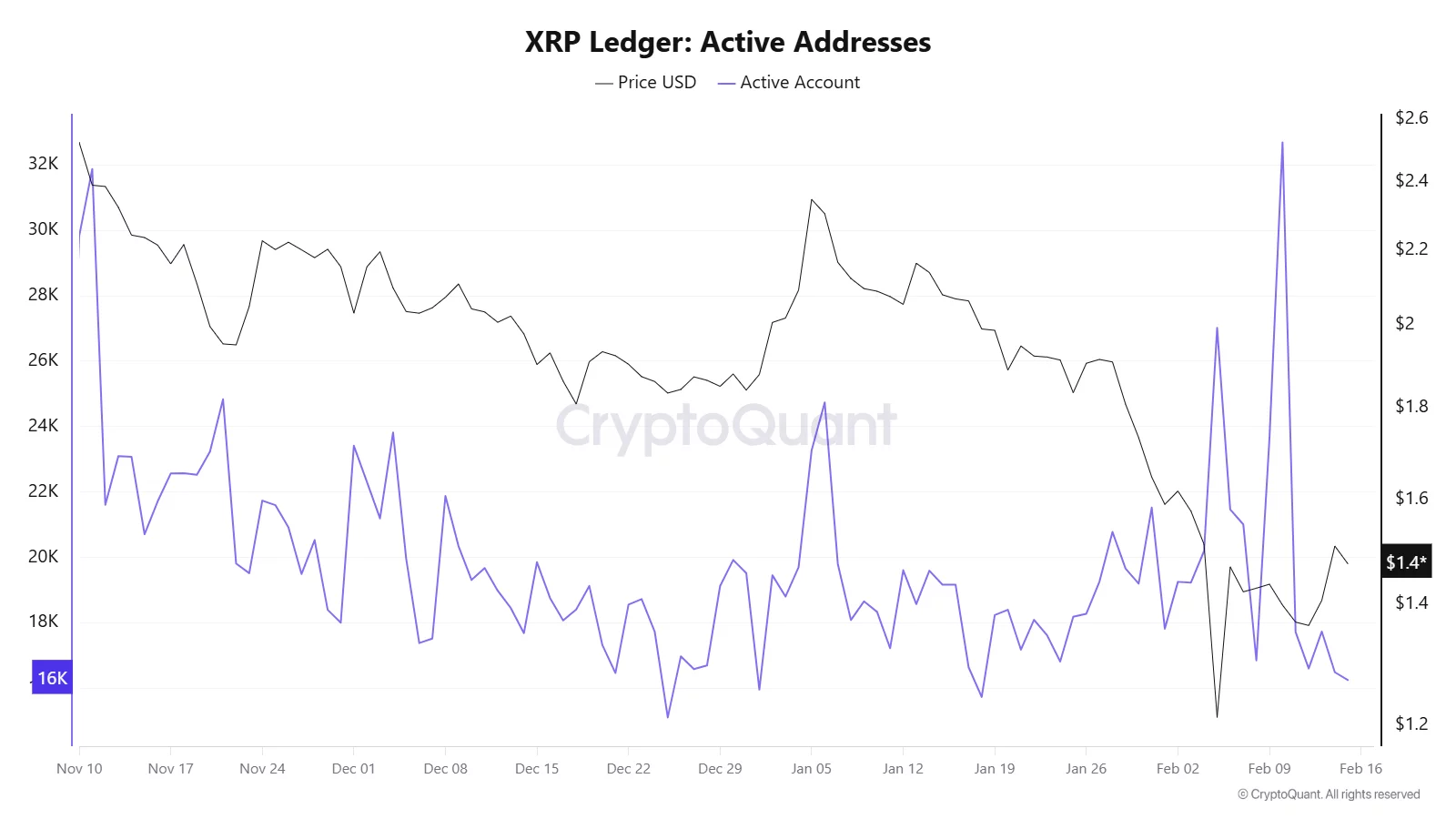

- On-chain data shows a recent spike in XRP Ledger active addresses above 30,000, pointing to renewed network activity and speculative interest.

- Technically, XRP trades near $1.46, with resistance at $1.60 and $1.74, while support stands at $1.35 and $1.20.

However, the token has since pulled back and is trading lower at press time.

Ripple CEO’s CFTC role sparks market reaction

Executives from Coinbase, Ripple and Solana were named to the CFTC’s Innovation Advisory Committee, a group focused on digital asset policy, market structure and emerging financial technologies.

The development signals deeper engagement between major crypto firms and U.S. regulators at a time when the industry is pushing for clearer oversight frameworks.

For XRP (XRP) investors, Garlinghouse’s appointment is being interpreted as a constructive step toward regulatory normalization following years of legal scrutiny.

On-chain data supports the renewed interest. The XRP Ledger active addresses chart shows notable spikes in network activity in recent weeks, including a sharp surge above 30,000 active accounts in early February.

While activity has since cooled toward the 16,000–18,000 range, the earlier spike coincided with heightened price volatility, suggesting speculative participation and renewed user engagement.

What XRP price analysis suggests

At press time, XRP is trading near $1.46 on the daily chart. The token recently rebounded from a sharp drop toward the $1.20 region but remains under technical pressure.

The Supertrend indicator (10,3) remains in bearish territory, with the trend line positioned around $1.74, signaling that the broader trend has not yet flipped bullish.

Meanwhile, the Awesome Oscillator, although still below the zero line, is printing rising green bars. This indicates bearish momentum is fading and a potential shift could be forming if buyers maintain pressure.

Immediate resistance sits near $1.60, followed by the stronger Supertrend barrier around $1.74. A daily close above that level could open the door toward the $1.90–$2.00 region.

On the downside, support lies near $1.35, with the recent swing low around $1.20 acting as critical structural support. A breakdown below $1.35 could expose XRP to another retest of that lower zone.

For now, XRP appears to be stabilizing, but a confirmed trend reversal will require a break above key resistance levels.

Crypto World

Binance Disputes Fortune Claims of Iranian Sanctions Breaches and Wrongful Terminations

TLDR:

- Binance conducted internal review and found no evidence of sanctions violations tied to Iranian transactions

- Exchange operates under Abu Dhabi Global Market regulation plus 21 local jurisdictions worldwide

- Company denies firing investigators for raising compliance concerns about alleged sanctions breaches

- Binance invested heavily in compliance infrastructure since 2023 regulatory settlement with authorities

Binance has formally disputed a Fortune investigation claiming the exchange processed over $1 billion in Iran-related transactions.

The cryptocurrency platform sent a detailed rebuttal letter on February 15, addressing allegations published two days earlier.

The company stated that a comprehensive internal review found no evidence of sanctions violations. Binance emphasized its commitment to regulatory compliance and cooperation with authorities.

Company Denies Evidence of Sanctions Violations

Fortune’s February 13 article alleged that internal investigators uncovered substantial transaction volumes tied to Iran.

The report suggested these transfers potentially violated international sanctions laws. Binance conducted a full internal review following the claims raised in the investigation.

The exchange stated it found no evidence supporting allegations of sanctions law breaches. This conclusion was reached after consultation with qualified legal counsel.

The company rejected assertions that violations were discovered and then suppressed. Binance characterized the Fortune report as containing material inaccuracies requiring correction.

The exchange operates under regulatory oversight from multiple jurisdictions worldwide. Binance holds authorization from the Abu Dhabi Global Market as its primary regulator.

The platform also maintains licenses and registrations across 21 different local jurisdictions. These regulatory relationships require ongoing compliance monitoring and reporting.

Chief Executive Officer Richard Teng addressed the allegations through the social media platform X. He stated that the record must be clear regarding the absence of sanctions violations.

Teng also denied that investigators were terminated for raising compliance concerns. The CEO requested corrections to what he described as inaccurate reporting.

Enhanced Compliance Framework Since 2023 Resolution

Binance referenced its 2023 regulatory settlement when addressing compliance capabilities. The company has invested substantially in its sanctions screening infrastructure since that resolution.

These investments included expanded staffing dedicated to compliance functions. The exchange allocated resources to anti-money laundering controls and transaction monitoring systems.

The platform described its compliance program as among the most robust in digital assets. Binance maintains internal standards that often exceed global regulatory requirements.

The company implements zero-tolerance policies on staff conduct violations and unauthorized data access. These policies extend to failures in observing internal compliance procedures.

The exchange questioned the sourcing and motivations behind the Fortune investigation. Binance noted the article relied heavily on anonymous sources while presenting speculation as fact.

The company emphasized that multiple legitimate channels exist for reporting compliance concerns. These include internal whistleblowing provisions and statutory protections for employees raising issues.

Binance requested that Fortune review its statements and correct misleading implications. The exchange offered to provide additional context for more accurate reporting.

The company stressed that accuracy is critical when publishing allegations related to sanctions compliance. Binance affirmed its continued cooperation in meeting monitorship obligations and regulatory commitments across all jurisdictions.

Crypto World

Wintermute adds tokenized gold to institutional OTC desk

Wintermute has rolled out institutional over-the-counter trading for tokenized gold, marking its entry into digital commodities amid rising interest in asset-backed tokens.

Summary

- Wintermute added tokenized gold to its OTC desk.

- Institutions can now trade and settle gold tokens on-chain.

- The market is forecast to reach $15 billion by 2026.

The firm said on Feb. 16 that its OTC desk now supports trading in Pax Gold and Tether Gold, the two largest gold-backed tokens by market value.

The service gives professional investors a way to gain exposure to physical gold through blockchain-based products, while keeping access to crypto-style settlement and liquidity. It comes in response to the increasing demand from institutions for transparent, stable assets that are easy to trade and settle fast.

Building on-chain access to gold markets

Wintermute will offer institutional clients algorithmically optimized spot execution as part of the new launch. Clients can settle trades in the way that suits them best. Transactions can be completed on-chain using major cryptocurrencies, stablecoins, or traditional fiat currencies.

This setup allows positions to be opened, adjusted, or closed instantly. It also helps move capital smoothly between markets while lowering settlement risk. For trading firms and investment funds, this structure makes it easier to manage liquidity and hedge exposure.

Instead of sticking to traditional choices like exchange-traded funds or buying physical gold bars and coins, more investors are starting to look at tokenized gold. These digital tokens are backed by real gold and allow investors to buy small fractions of it, making gold ownership more accessible.

They can also be traded easily, giving holders flexibility without the hassle of storing or transporting physical gold. That level of flexibility is hard to achieve in conventional markets.

Industry data shows that the total value of tokenized gold surged to around $5.4 billion by mid-February 2026, an increase of about 80% in just three months.

Growth outlook and institutional interest

Wintermute chief executive Evgeny Gaevoy said the tokenized gold market could reach $15 billion by the end of 2026, nearly three times its current size. He pointed to rising institutional participation and demand for asset-backed digital products as key factors behind the forecast.

Trading volumes have also increased. During the fourth quarter of 2025, tokenized gold products recorded over $126 billion in turnover, outpacing several major gold ETFs.

According to analysts, 24-hour trading and more transparent pricing are the main factors driving the growth. Prices are shown in real time, and investors are free to buy and sell whenever they want.

Despite the recent crypto market downturn, tokenized gold has remained popular among investors seeking stability and portfolio diversification. Wintermute’s most recent launch indicates a larger trend in the industry toward more reputable, institution-focused services.

Crypto World

Wallet Founder Warns of Coordinated Scam Targeting XRPL Users

XRPL users face coordinated scam surge, wallet founder says, as attackers deploy phishing, fake apps, and sign requests globally.

Xaman Wallet founder Wietse Wind has said that a “massive XRPL targeted scam effort” is underway, warning users about fake sign requests, phishing emails, and impersonation accounts.

His alert points to a rise in social engineering attacks aimed at crypto holders rather than flaws in the blockchain code.

A Multi-Pronged Attack on XRPL Users

Wind wrote on X on February 16 that he had spent the weekend adding new filters and alerts to Xaman Wallet after detecting coordinated attempts to trick users into signing malicious transactions.

He listed several methods seen in recent days, including scam NFTs that promise token swaps, fake desktop wallet apps, and direct messages posing as support staff. The official wallet account repeated the warning, telling users not to click links, respond to DMs, or connect wallets to unknown websites.

According to Wind, the attacks usually focus on manipulating users rather than breaching software, with the scammers expanding beyond social media and sending phishing emails even though Xaman does not store user email addresses, suggesting attackers are relying on leaked data from unrelated breaches.

The tricksters are also reportedly promoting fake “desktop wallets,” despite Xaman being a strictly mobile application. Some fraudulent projects are even promising free tokens in exchange for users’ secret keys.

Wind stressed that funds will stay safe if people avoid approving unknown transactions or sharing their keys.

You may also like:

“No matter the amount of warnings, detection, filtering, alerts in the app and here on social: no scammer can get you if you don’t willingly / unknowingly interact with them,” he advised. “Your funds are perfectly safe in Xaman Wallet: just don’t sign any transaction you don’t trust, and don’t interact with anyone promising you free tokens.”

Scams Moving Beyond DeFi Exploits

The XRPL scam wave reflects a troubling industry-wide trend, with a PeckShield report from earlier in the year revealing that crypto scams and hacks drained more than $4.04 billion in 2025.

Of that total, $1.37 billion came from scams alone, a 64% increase from 2024. The firm said attackers are shifting toward tailored phishing campaigns that target individuals with large holdings instead of relying only on technical exploits.

Furthermore, the PeckShield report also found that centralized platforms and companies accounted for about 75% of stolen funds last year, up from 46% in 2024.

These high-value thefts tied to deception extend beyond software wallets. On January 17, 2026, blockchain investigator ZachXBT reported that a victim lost about $282 million in Bitcoin (BTC) and Litecoin (LTC) through a hardware wallet scam. According to his findings, the attacker later moved the funds through THORChain and converted them to Monero (XMR).

Wind’s posts framed the latest campaign as a reminder that wallet security often depends on user decisions.

“This is a cat and mouse ‘game,’ and the scammers will not win,” he stated.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Crypto.com Gets Certified on AI Amid Tech Rush

Crypto.com says it has become the first digital asset platform to receive an international certification for artificial intelligence systems management amid its continued expansion into the sector.

The company said on Monday that it received ISO/IEC 42001:2023 certification, an international standard governing the creation and implementation of an AI management system.

“Security and privacy continue to be a core focus for us, particularly as we scale our AI-driven infrastructure and services,” said Crypto.com information security chief Jason Lau, adding that the certification ensures “every AI system we develop and deploy is secure, transparent, and aligned with emerging regulatory expectations.”

Crypto.com co-founder and CEO, Kris Marszalek, said the certification was “an important step as we continue to leverage AI tools and technologies.”

Crypto.com recently leaned into offering AI services that tie in with its crypto offering, launching software development kits and tailored data services. It also recently launched the AI agent platform ai.com on Feb. 9, which it considers a core business.

The new website allows users to create AI agents that can perform everyday tasks such as trading and managing workflows.

Marszalek said the goal of the company was to accelerate the capabilities of AI “by building a decentralized network of autonomous, self-improving AI agents that perform real-world tasks for the good of humanity.”

Related: Do Super Bowl ads predict a bubble? Dot-coms, crypto and now AI

Crypto executives and users have been enamored with AI, with companies rushing to offer AI services to keep up with the hype surrounding the technology.

Crypto-focused AI agents, which can conduct transactions without human intervention, have grown in popularity as traders look to gain an edge in the always-on market.

Rival crypto exchange Coinbase has also begun to offer services tailored to AI, launching crypto wallet infrastructure on Feb. 11 that allows AI agents to spend, earn and trade crypto.

AI Eye: 9 weirdest AI stories from 2025

Crypto World

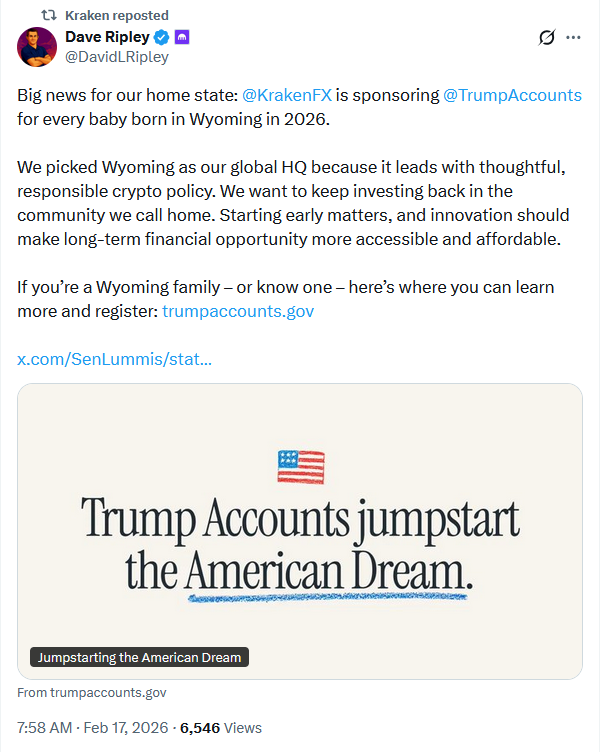

Kraken Will Sponsor Trump Accounts For All Wyoming Babies Born In 2026

Crypto exchange Kraken has become the latest company to heed calls from US President Donald Trump to support his “Trump Accounts,” a savings plan aimed at American children under the age of 18.

The move was first announced by Wyoming Senator Cynthia Lummis on Monday, with the Republican official stating that Kraken would provide funding toward all Trump Accounts created for newborns in the state of Wyoming.

“Grateful to Kraken for their commitment to Wyoming’s next generation and to the Cowboy State’s economic future,” she said.

Kraken’s co-CEO Dave Ripley said the firm chose to support Trump Accounts in Wyoming due to the positive regulatory climate in the state, home to the firm’s headquarters.

“We picked Wyoming as our global HQ because it leads with thoughtful, responsible crypto policy. We want to keep investing back in the community we call home. Starting early matters, and innovation should make long-term financial opportunity more accessible and affordable,” he said.

In a blog post, Kraken said that the Wyoming government enabled the firm to become the US’s first Special Purpose Depository Institution and praised it for its work on helping launch the Frontier Stable Token.

Trump Accounts are a new type of retirement account in the US that can be established by parents or legal guardians for children under 18. Under a pilot program, the federal government will seed Trump Accounts with $1,000 for any child born between Jan. 1, 2025, and Dec. 31, 2028.

So far, traditional finance heavyweights such as JPMorgan, Bank of America and Wells Fargo have all put support behind Trump Accounts in varying degrees, alongside several other well-known names.

Kraken did not share how much funding it would contribute to each eligible newborn. Cointelegraph has reached out to Kraken for comment.

Crypto firms give back amid state support

This isn’t the only crypto-related firm to give back to its home state this month.

Last week, blockchain-based prediction market platform Polymarket opened a free grocery store in New York City and said it would donate 3 million meals across the five boroughs.

Related: CFTC adds Coinbase, Ripple execs to 35-member advisory committee

The store was open from Thursday to Sunday last week, followed by a food donation day on Monday, when people could donate food to be redistributed across the city.

The move from Polymarket followed a similar move by prediction market competitor Kalshi, with the platform offering a $50 grocery giveaway to over 1,000 Manhattan residents on Feb. 3.

Magazine: Bitcoin’s ‘biggest bull catalyst’ would be Saylor’s liquidation: Santiment founder

Crypto World

Crypto’s AI Pivot: Hype, Infrastructure, and a Two-Year Countdown

If Consensus Hong Kong 2026 had an unofficial theme, it wasn’t Bitcoin or regulation. It was artificial intelligence — and the scramble to figure out what it actually means for crypto.

AI surfaced in almost every context: main-stage keynotes, side-event panels, venture capital meetings, and even the post-conference mood. But the conversations weren’t uniform. They ranged from Hong Kong government officials endorsing the machine economy to venture capitalists declaring the AI hype cycle in crypto already over.

Enterprise AI Agents Are Already Deployed

At the Gate’s side event, Sophia Jin, Hong Kong Tech Director at Byteplus — ByteDance’s enterprise technology arm — revealed that multiple major crypto exchanges are already using the company’s AI agent products. She outlined three use cases in production: intelligent customer service that incorporates deep research and trading scenario matching; multi-agent research systems with parallel data collection; and AML workflow automation with human oversight at decision points.

The most notable detail was the safety architecture. Byteplus places guardrails outside the agent orchestration layer — a kill switch that can halt agents immediately if they breach defined boundaries. Jin projected that within two years, every exchange employee will have an enterprise-grade AI assistant, while onboarding new users will become dramatically easier through AI-powered personalized education.

Two Years Until AI Outthinks You

Ben Goertzel, CEO of decentralized AI marketplace SingularityNET, offered the conference’s most provocative timeline. He gave humans roughly two years before AI surpasses them in strategic thinking.

“The human brain is better at taking the imaginative leap to understand the unknown,” Goertzel said iat Consensus. It won’t last, though. “We should enjoy it for a couple more years.”

While his Quantium project can already predict short-term Bitcoin volatility with high accuracy, Goertzel noted that long-term strategic thinking remains uniquely human — for now. He described the current bear cycle as a “stress test” for infrastructure that will eventually host artificial general intelligence.

Bitget CEO Gracy Chen offered a more grounded view. On a panel about agentic trading, she compared current AI trading bots to interns — faster and cheaper but requiring supervision. Historical data-driven models have never encountered events like the 10/10 liquidations, she noted, making human intervention essential in unfamiliar conditions. But within three to five years, she projected, AI could replace many human roles.

Saad Naj, CEO of agentic trading startup PiP World, countered that humans may not be the right baseline. “As humans, we are too emotional. We can’t compete with AI solutions,” he said, noting that 90% of day traders lose money.

Building the Payment Layer for Agents

If the main stage provided the vision, side events tried to build the plumbing.

At the Stablecoin Odyssey event at Soho House, the panel “Building Payment Blockchains for the Agentic Economy” focused on what infrastructure AI agents actually need. Nellie Tan, Payment Head at Monad, introduced Coinbase’s X402 protocol — an HTTP-native on-chain payment standard — and argued that agentic payments would generate transactions “at the speed of data,” requiring throughput of thousands to millions per second.

Eddie, CEO of payment middleware AEON, framed the shift as an interface transition. When consumers interact through AI agents rather than apps, every commercial interaction funnels through a single point — and the last mile is always a payment. His company processes what he described as 80% of crypto payments through partnerships with OKX, Bybit, and others.

The question of which blockchain AI agents would choose remained open. Mate Tokay, CMO of OP_CAT Layer, noted that no one yet knows whether agents will select chains based on training data, experience, speed, or security. The answer likely depends on the transaction — large asset transfers prioritize security, while consumer purchases prioritize speed.

Crypto as Currency for AI — or Just Another Hype Cycle?

The most striking endorsement came from outside the industry. Hong Kong Financial Secretary Paul Chan Mo-po used his appearance to frame AI agents as an economic force that crypto is uniquely positioned to serve.

“As AI agents become capable of making and executing decisions independently, we may begin to see the early forms of what some call the machine economy, where AI agents can hold and transfer digital assets, pay for services and transact with one another onchain,” Chan said.

Binance CEO Richard Teng pushed it further. “If you think about the agentic AI, so the booking of hotels, flights, whatever purchases that you would make, how you think that those purchases will be made — it’ll be via crypto and stablecoins,” he said. “So, crypto is the currency for AI, if you think about it.”

But venture capitalists poured cold water on the broader “AI + crypto” narrative. Anand Iyer of Canonical Crypto described the moment as a trough. “We went through a frothy period. Now it’s about figuring out where the real strength lies,” he said. Both Iyer and Kelvin Koh of Spartan Group criticized overinvestment in GPU marketplaces and attempts to build decentralized alternatives to OpenAI or Anthropic — projects that require capital far beyond what crypto can muster.

Instead, both see potential in purpose-built solutions that start with a specific problem. Proprietary data, regulatory edges, or go-to-market advantages now matter more than technical novelty. Koh’s advice to founders was blunt: “Twelve months ago, it was enough to have a wrapper on ChatGPT. That’s no longer true.”

What’s Forming

Conversations among industry participants pointed toward a framework taking shape: stablecoins serving as value rails for agent transactions, prediction markets handling information pricing, AI systems executing trades and operations, and physical robotics extending the loop into the real world. It’s not a single project or protocol — it’s a thesis about where crypto and AI intersect productively, without relying on the speculative cycles that drove previous bull runs.

A parallel thread runs through decentralized AI. Current systems are centralized and opaque. The idea of transparent, verifiable, community-governed AI networks aligns with crypto’s founding principles — and Goertzel, among others, pointed to the growth of such projects at the event as evidence that convergence is underway.

The pure speculation cycle may not return. But at Consensus Hong Kong, the argument that AI gives crypto a reason to exist beyond trading was made simultaneously from the government podium, the exchange boardroom, and the venture capital meeting. That’s a different kind of consensus.

The post Crypto’s AI Pivot: Hype, Infrastructure, and a Two-Year Countdown appeared first on BeInCrypto.

Crypto World

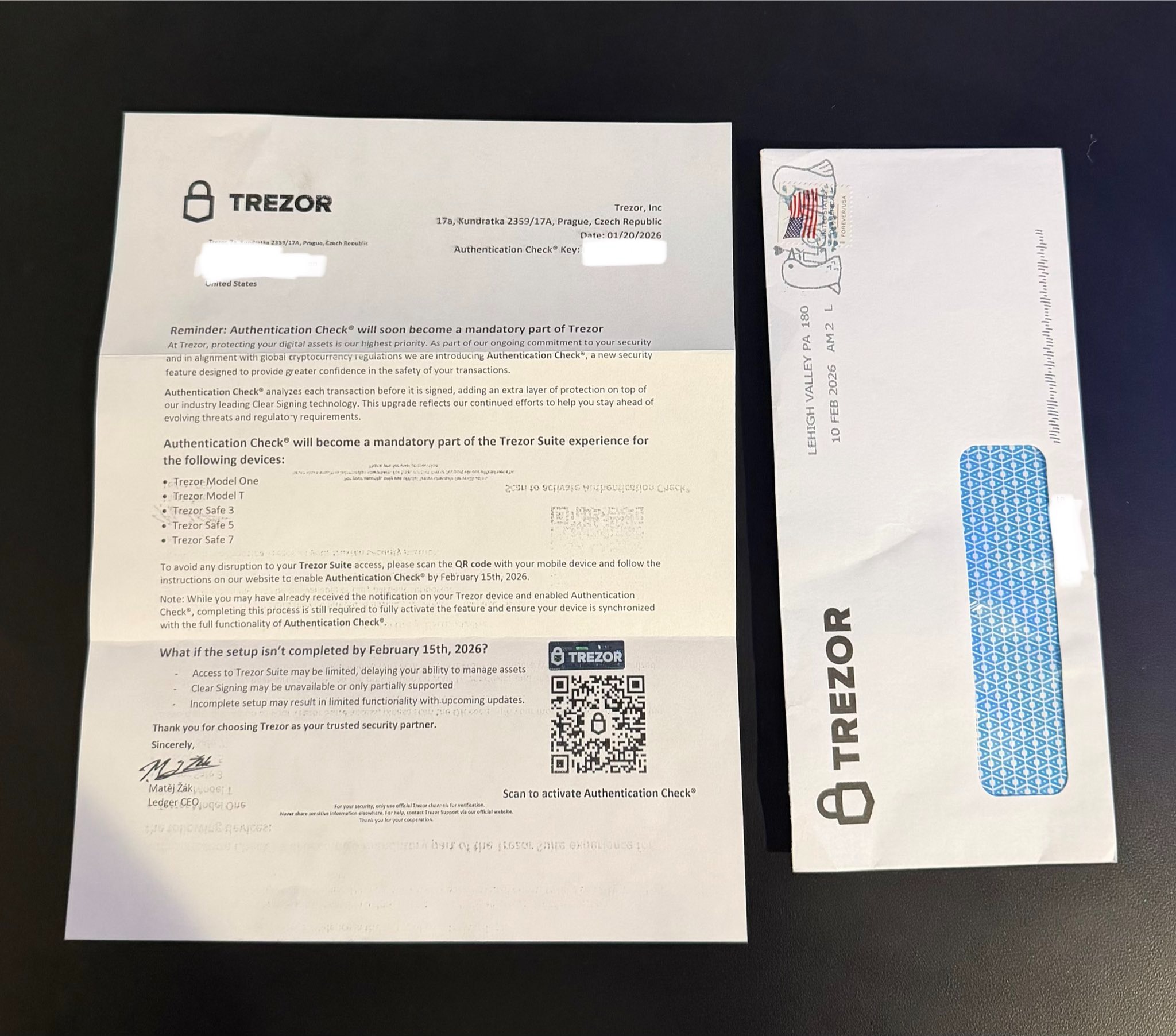

Fake Trezor, Ledger Letters Target Crypto Wallet Users

Users of crypto hardware wallets Ledger and Trezor are again reporting receiving physical letters aimed at stealing their seed recovery phrases — the latest attack on users exposed across numerous data leaks over the past six years.

Cybersecurity expert Dmitry Smilyanets was one of the first to report receiving a spurious letter from Trezor on Feb. 13, which demands users perform an “Authentication Check” by Feb. 15 or risk having their device restricted.

Smilyanets said the scam includes a hologram along with a QR code that takes users to a scam website. The letter is made to appear signed by Matěj Žák, who is described as the “Ledger CEO” (the real Matěj Žák is the CEO of Trezor).

A Ledger user reported receiving a similar letter last year in October, with the letter claiming recipients must complete mandatory “Transaction Check” procedures.

Scanning a malicious QR code for “mandatory” checks

The QR code reportedly takes the victim to a malicious website made to look like Ledger and Trezor setup pages, tricking users into entering their wallet recovery phrases.

Once entered, the recovery phrase is transmitted to the threat actor through a backend API, enabling them to import the victim’s wallet onto their own device and steal funds from it.

Related: Phishing scammers spoof Ledger’s email to send bogus data breach notice

Legitimate hardware wallet companies never ask users to share their recovery phrases through any method, including website, email, or snail mail.

Not the first time letters have been sent

Ledger and its third-party partners have suffered multiple large-scale data breaches over the past few years, resulting in leaks of customer data, including physical addresses used for postal purposes, and physical threats.

Meanwhile, Trezor flagged a security breach that exposed the contact information of nearly 66,000 customers in January 2024.

In 2021, scammers mailed counterfeit Ledger Nano hardware wallets to victims of the 2020 Ledger data breach.

Physical letters prompting victims to scan QR codes were sent in April 2025, while in May, hackers used fake Ledger Live apps to steal seed phrases and drain crypto from victims.

Ledger alerted users to the physical mail phishing scam on its website in October.

Magazine: Coinbase misses Q4 earnings, Ethereum eyes ‘V-shaped recovery’: Hodler’s Digest

Crypto World

Russian crypto trading tops $640M a day, finance ministry reveals

Russia’s cryptocurrency market is experiencing a surge in transactional activity, with daily trading volumes reaching an estimated 50 billion rubles, roughly $640 million, according to Deputy Finance Minister Ivan Chebeskov.

Summary

- Russia’s Finance Ministry says crypto trading volumes have reached 50 billion rubles ($640 million) per day, or roughly $129 billion annually, much of it outside formal oversight.

- Lawmakers are preparing a sweeping regulatory framework that would introduce mandatory exchange licensing by 2027 and stricter supervision of crypto platforms.

- Proposed rules include potential retail investment caps, asset approval controls by the central bank, and penalties for unlicensed operators, while keeping the ban on crypto payments in place.

Booming crypto trade meets regulatory push

Speaking at the Alfa Talk forum on digital assets, Chebeskov said this “turnover of more than 10 trillion rubles annually” highlights the depth of crypto involvement among Russians, much of it occurring outside formal regulatory oversight.

“We’ve always said that millions of citizens are involved in this activity, representing trillions of rubles in terms of use and savings. One example is the daily cryptocurrency turnover in our country—around 50 billion rubles. That’s a turnover of more than 10 trillion rubles per year, which is currently occurring outside the regulated zone, outside our control,” the deputy minister explained.

Officials note that millions of citizens are participating in crypto trading, investing and savings, but most of these transactions currently take place through unregulated channels, leaving them beyond the attention of authorities.

Against this backdrop, Russian regulators are pushing to bring much of the crypto market under formal scrutiny. Lawmakers plan to present a comprehensive crypto regulation bill to the State Duma by June 2026, with the aim of adopting a legal framework that would take effect by July 1, 2027.

Under the draft legislation, all cryptocurrency exchanges would need licenses, and operating without approval could be penalized similarly to illegal banking. Retail investors would face annual limits on crypto purchases — proposed at about 300,000 rubles (≈ $4,000) — and qualification tests before they can trade.

Privacy-oriented cryptocurrencies could be restricted, and the central bank would have discretion over which assets are approved for legal trading beginning in mid-2027.

Major Russian exchanges, including the Moscow and St. Petersburg exchanges, have been preparing to launch regulated crypto trading platforms once the legal foundation is finalized. These efforts reflect broader policy shifts aimed at moving users away from “gray market” activity toward licensed, transparent venues.

The proposed rules also keep the long-standing ban on using crypto for domestic payments but open regulated trading as an investment vehicle. The combined push from the Ministry of Finance, the Bank of Russia, and the State Duma signals a strategic effort to balance market growth, investor protection and financial stability while reining in unregulated activity.

Crypto World

Coinbase retail traders buy Bitcoin and Ethereum dips, internal data shows

Coinbase CEO Brian Armstrong says retail users kept buying Bitcoin and Ethereum on price dips, with most Coinbase client balances in February at or above December levels.

Summary

- Coinbase internal data shows retail users increased BTC and ETH purchases during recent dips.

- Most Coinbase client crypto balances in February stayed equal to or higher than December levels.

- Analysts say resilient retail demand contrasts with softer institutional flows and may impact near-term market structure.

Coinbase CEO Brian Armstrong reported that retail investors increased cryptocurrency purchases during recent market declines, according to internal company data.

Armstrong stated in a post on social media platform X that individual investors on Coinbase demonstrated buying activity during price drops for Bitcoin and Ethereum. The executive cited internal trading data showing increased retail trading volume correlating with price declines.

“According to our data, individual users on Coinbase have been quite resilient in these market conditions: they took advantage of the dips to buy,” Armstrong stated. “We saw increases for retail users across Bitcoin and Ethereum.”

The Coinbase chief executive noted that retail investors exhibited holding behavior during short-term price volatility. Armstrong reported that most client cryptocurrency balances in February remained at or above December levels.

Bitcoin (BTC) and altcoin markets experienced sharp declines in recent weeks, with recovery attempts ongoing, according to market data.

Market analysts noted the contrast between retail buying activity and slower institutional fund inflows during the period. The divergence represents a significant factor in short-term supply and demand dynamics, according to industry observers.

Analysts stated that additional market catalysts would be needed for increased retail demand to shift broader market trends, given current macroeconomic conditions and derivatives market structure.

Coinbase operates as a cryptocurrency exchange platform serving retail and institutional clients.

Crypto World

Key macro data puts crypto markets on watch as CPI, PCE and Fed speak

Crypto and stock markets face a packed macro week, with CPI, PCE, Fed minutes and spending data set to test rate‑cut bets after mixed inflation and rising tensions.

Summary

- January CPI eased to its lowest core reading since 2021, briefly lifting crypto before gains faded.

- Markets now focus on retail sales, durable goods, PCE and Fed minutes to gauge rate‑cut timing.

- Bitcoin and Ethereum stay volatile as geopolitical risks and macro uncertainty cap risk appetite.

Financial markets are preparing for several key economic data releases this week that could influence cryptocurrency and stock prices, following mixed signals from last week’s inflation data.

January’s Consumer Price Index came in slightly below expectations, with headline inflation at 2.38% year-on-year and core CPI at 2.5%, marking the lowest level since early 2021, according to government data. The figures initially boosted stock and cryptocurrency markets on Friday, though cryptocurrency gains retreated over the weekend.

Traditional U.S. markets will be closed Monday for the President’s Day holiday. The ADP employment update is scheduled for Tuesday, followed by the January Retail Sales report. Wednesday will bring consumer spending data with the delayed December Durable Goods Orders numbers, along with Federal Reserve meeting minutes and 10 central bank speaker events.

The December Personal Consumption Expenditures (PCE) inflation report, considered a key indicator by the Federal Reserve, is expected to be released later this week. Goldman Sachs raised its PCE outlook following the January CPI data, estimating that the core PCE price index rose 0.40% in January, according to reports. The economists attributed the projection to rising consumer electronics and IT prices, which carry heavier weighting in PCE calculations than in CPI. A global shortage of RAM and storage components, driven by AI data center demand, has contributed to increased computer and component prices.

The CME Fed Watch Tool shows a 90% probability that interest rates will remain unchanged at the Federal Reserve‘s March meeting, according to current market pricing.

Cryptocurrency markets have declined in the past 24 hours, with total market capitalization falling. Bitcoin retreated from recent highs during early Asian trading on Monday and has remained rangebound for the past ten days. Ethereum prices have fallen sharply, while alternative cryptocurrencies have continued to decline.

The Kobeissi Letter noted that geopolitical tensions and macroeconomic uncertainty remain elevated, cautioning that volatility could continue this week.

-

Sports5 days ago

Sports5 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Tech6 days ago

Tech6 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

Crypto World7 days ago

Crypto World7 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Video12 hours ago

Video12 hours agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech2 days ago

Tech2 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video4 days ago

Video4 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Crypto World7 days ago

Crypto World7 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World5 days ago

Crypto World5 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World3 days ago

Crypto World3 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Video5 days ago

Video5 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World7 days ago

Crypto World7 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat1 day ago

NewsBeat1 day agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business5 days ago

Business5 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World6 days ago

Crypto World6 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Tech38 minutes ago

Tech38 minutes agoThe Music Industry Enters Its Less-Is-More Era

-

Crypto World4 days ago

Crypto World4 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

Politics6 days ago

Politics6 days agoWhy was a dog-humping paedo treated like a saint?

-

NewsBeat2 days ago

NewsBeat2 days agoMan dies after entering floodwater during police pursuit

-

Crypto World3 days ago

Crypto World3 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery

-

NewsBeat3 days ago

NewsBeat3 days agoUK construction company enters administration, records show