News Beat

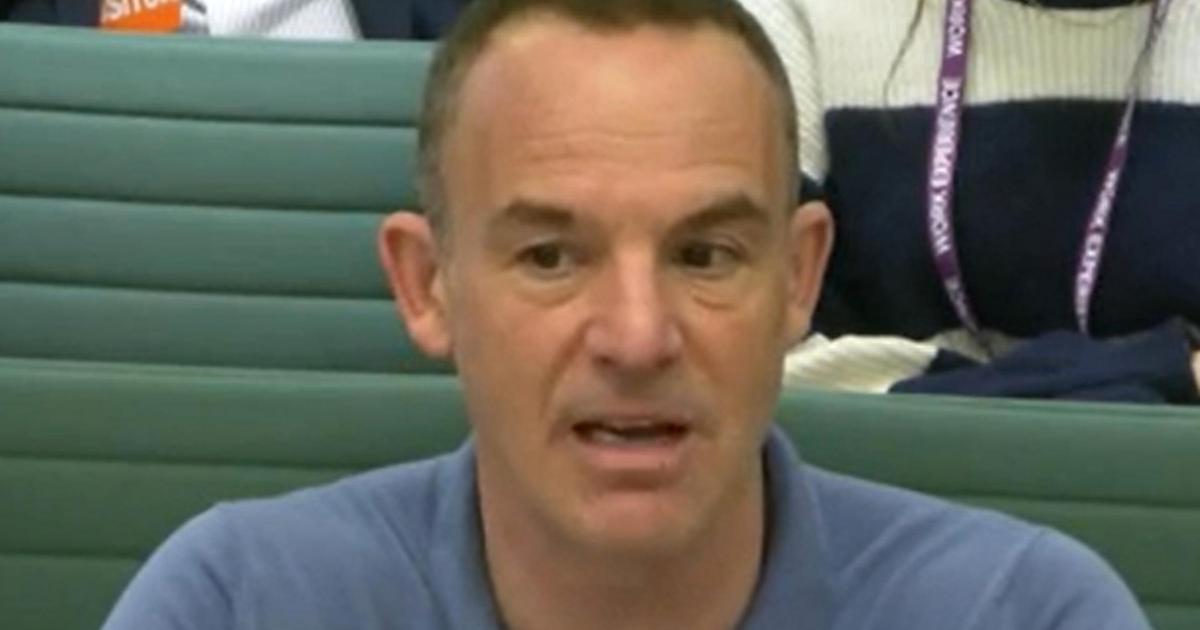

Martin Lewis responds to Rachel Reeves’s 2025 Budget

Posting on his X account, the Money Saving Expert founder quoted the chancellor, saying: “‘I will maintain all income tax and national insurance thresholds for a further three years from 2028’. Translation. Fiscal drag remains.

“Its a stealth tax. Freezing thresholds while average earnings rise mean people pay a bigger proportion of their income in tax.”

“I will maintain all income tax and national insurance thresholds for a further three years from 2028”.

Translation. Fiscal drag remains. Its a stealth tax. Freezing thresholds while average earnings rise mean people pay a bigger proportion of their income in tax. #Budget2026

— Martin Lewis (@MartinSLewis) November 26, 2025

As she announced the removal of the two-child benefit cap, he said: “Govt announced its ending the two-child benefit limit, but there’s a lot of confusion about what it is. So here is a bit of a primer…

Govt announced its ending the two-child benefit limit, but there’s a lot of confusion about what it is. So here is a bit of a primer…

1. It is nowt to do with Child Benefit, a universal payment for every child you have (clawed back from higher earners)

2. The two-child…

— Martin Lewis (@MartinSLewis) November 26, 2025

1. It is nowt to do with Child Benefit, a universal payment for every child you have (clawed back from higher earners)

2. The two-child benefit limit, often wrongly called a Cap, means those who get Universal Credit (a benefit for those in and out of work on lower incomes) won’t get any additional benefit if they incur extra costs because they’ve more than two children. This is what is being scrapped in April, so they will get more benefits if extra costs from more children.

Recommended reading:

3. Separately, there is also a Benefits Cap – which, in simple terms is a max amount you can get on benefits (including Universal Credit and Child Benefit). The cap for families, couples and single parents is £1,835/mth. Its more in greater London. So there you go. You’ve got Child Benefit rules, the two-child limit for Universal Credit and Tax Credits, and a benefits cap. There are lots of ifs and buts. I hope that helped clear it up a bit.”

The cap has prevented parents from claiming universal credit or tax credits for more than their first two children. It was introduced by the Conservative government in 2017 and has been widely criticised by Labour MPs and anti-poverty advocacy groups.

The move is estimated to cost £3 billion by 2029-30, according to the OBR.