Chancellor Rachel Reeves announced major modifications to ISA tax allowances in her Autumn Budget

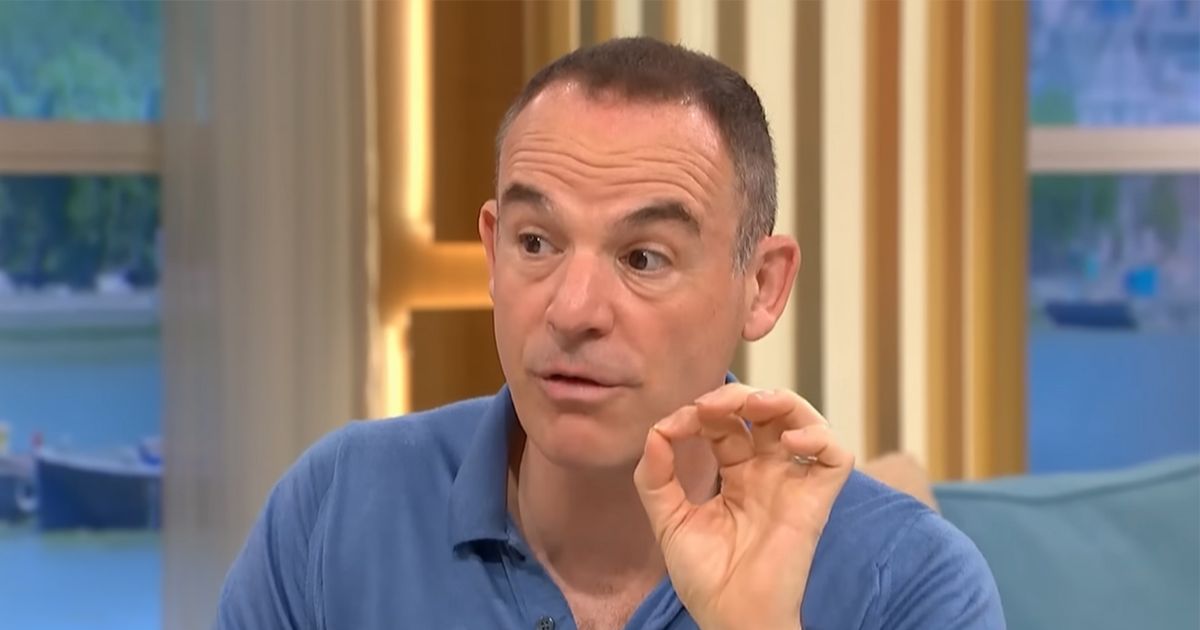

Martin Lewis has issued a warning about a fresh tax on ISAs that has been announced by the Government. Chancellor Rachel Reeves revealed in her Autumn Budget that major modifications to ISA tax allowances are on the horizon. These savings accounts are completely tax-free, and you can currently contribute up to £20,000 annually, split however you prefer between cash ISAs, stocks and shares ISAs or innovative finance ISAs.

However, Labour has revealed that from April 2027, only £12,000 of this allowance will be available for any type of ISA. The remaining £8,000 must be allocated to stocks and shares ISAs, in a bid to encourage savers to invest more. The new regulations will only affect savers under 65, with older people retaining the existing allowance.

Additional changes will also take effect from April 2027, including a new levy on certain ISA holders. A Government document stated that several measures will be implemented “to avoid circumvention of the lower limit for cash ISAs”.

One of these is “a charge on any interest paid on cash held in a stocks and shares or Innovative Finance ISA”. An innovative finance ISA allows you to invest in peer-to-peer lending, where funds are lent to borrowers and businesses via an online platform.

New tax charge

Mr Lewis discussed the new HMRC charge on his BBC podcast. He told listeners: “The Government is trying to get people to hold money in shares more than in cash, so it has cut the cash ISA limit. It has done a couple of things, of which this is one, to effectively stop people from effectively using a shares ISA as a cash ISA.

“When you have an investment platform, you tend to do it by depositing cash in there and then investing that cash, so they have access to facilities that pay cash, and some of them pay interest. What some people do is they simply hold cash inside a shares ISA and its tax-free, like a cash ISA is.

“The Government has said to prevent that, they are going to add a tax charge onto cash held inside shares ISAs for under 65s, from 2027.” ISA savers may be keen to know if they will be liable for the new tax.

But Mr Lewis said there are still some details the Government needs to confirm. He said: “It is unspecified how that tax charge will work.

“There are some dangers here, because if you want to take your money out of the market for a certain period to invest in something else, and you’re going to hold it for six weeks, it seems pretty unfair that you would have tax charge. If you are doing it to jemmy the system, and you’re effectively going to use your extra £8,000 allowance that you get on shares to hold cash in a shares ISA, that’s what the Government is trying to stop.

“My suspicion is there will be a consultation on exactly how they do it and how long you have to be holding cash for it to be taxed, and what the tax will be. But we’re not there yet, we just don’t know the rules for that yet.”

What other new restrictions are coming in on ISAs?

The Government is also introducing other measures from April 2027 to prevent savers from keeping cash savings in a stocks and shares ISA. These include prohibiting transfers from stocks and shares and Innovative Finance ISAs to cash ISAs.

There will also be new “tests” to determine if an investment is eligible to be held in a stocks and shares ISA, to ensure it is not “cash like”.