Following in the footsteps of the immigrants he has long demonised, Robinson said he has now fled his home country “for my safety and the safety of my family”.

Tommy Robinson has been forced to flee the UK after he was informed by police of calls in an Islamic State publication for people to “commit violence” against him.

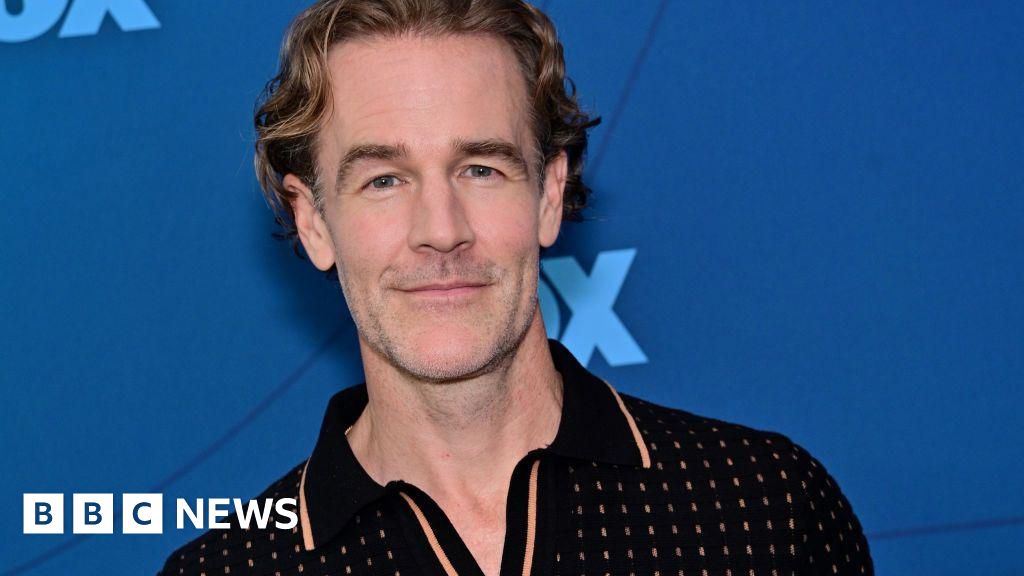

The far-right activist, whose real name is Stephen Yaxley-Lennon, posted a clip of a phone call from cops to his X account in which an officer told him he had been identified in a magazine called Yalghar, which is reportedly published by ISKP, Islamic State Khorasan Province. As reported by the Mirror, the clip captures the police officer saying officials had received intelligence calling for people “to commit violence against yourself”.

Following in the footsteps of the immigrants he has long demonised, Robinson said he has now fled his home country, “for my safety and the safety of my family”, he said in a statement.

The officer from Bedfordshire Police can be heard telling Robinson in the call: “So we have received intelligence that an Isis publication has stated… are encouraging others to commit violence against yourself.” The force, which covers Robinson’s hometown Luton, confirmed the phone call was legitimate and happened on Thursday.

Robinson asked in the footage if he could get a copy of the publication, but was told it is likely proscribed material, which people in the UK are banned from possessing under terrorism laws.

The officer goes on to tell Robinson in the call that he is not authorised to carry weapons or “take pre-emptive action” against other people. The officer continued: “Just remind, you know, because of this information, it doesn’t authorise you to carry weapons, anything like that, take any pre-emptive action against others, if you’re aware of any action…”

Alongside the video, the 43-year-old wrote a statement on X today proclaiming himself a “priority target for ISIS ” and saying he had left the country “to work things out” for his own and his family’s safety.

He wrote: “I have now left the country, I need time to work things out for my safety and the safety of my family. I will probably have to relocate them. I will update you when I can.” A spokeswoman for Bedfordshire Police confirmed the call’s legitimacy in a statement, revealing an individual’s name “appeared in prohibited material”.

She said: “Yesterday, officers contacted a man from Bedfordshire after being made aware that his name appeared in prohibited material produced by a proscribed organisation.

“He was provided with safeguarding advice and support in line with our standard processes.” The professional agitator also took the opportunity to beg for money from his followers, asking for people to “help me and my family” in a post in the replies, which was immediately flooded with calls for Robinson to find safety in Israel.

Get more Daily Record exclusives by signing up for free to Google’s preferred sources. Click HERE.