News Beat

UK’s biggest concert arenas face huge tax hikes sparking ticket price fears

Major concert venues across England and Wales, including London’s iconic O2 Arena and Manchester’s Co-op Live, are facing unprecedented property tax increases that could see their bills more than double within three years.

Industry experts warn that these soaring costs will inevitably lead to higher ticket prices for concertgoers and could jeopardise the viability of smaller music venues.

An analysis of official government data, conducted for the Press Association by global tax firm Ryan, reveals a steep escalation in the valuations of these entertainment hubs. The Valuation Office Agency (VOA) data indicates that rateable values have surged by up to 300 per cent, setting the stage for a significant hike in tax liabilities.

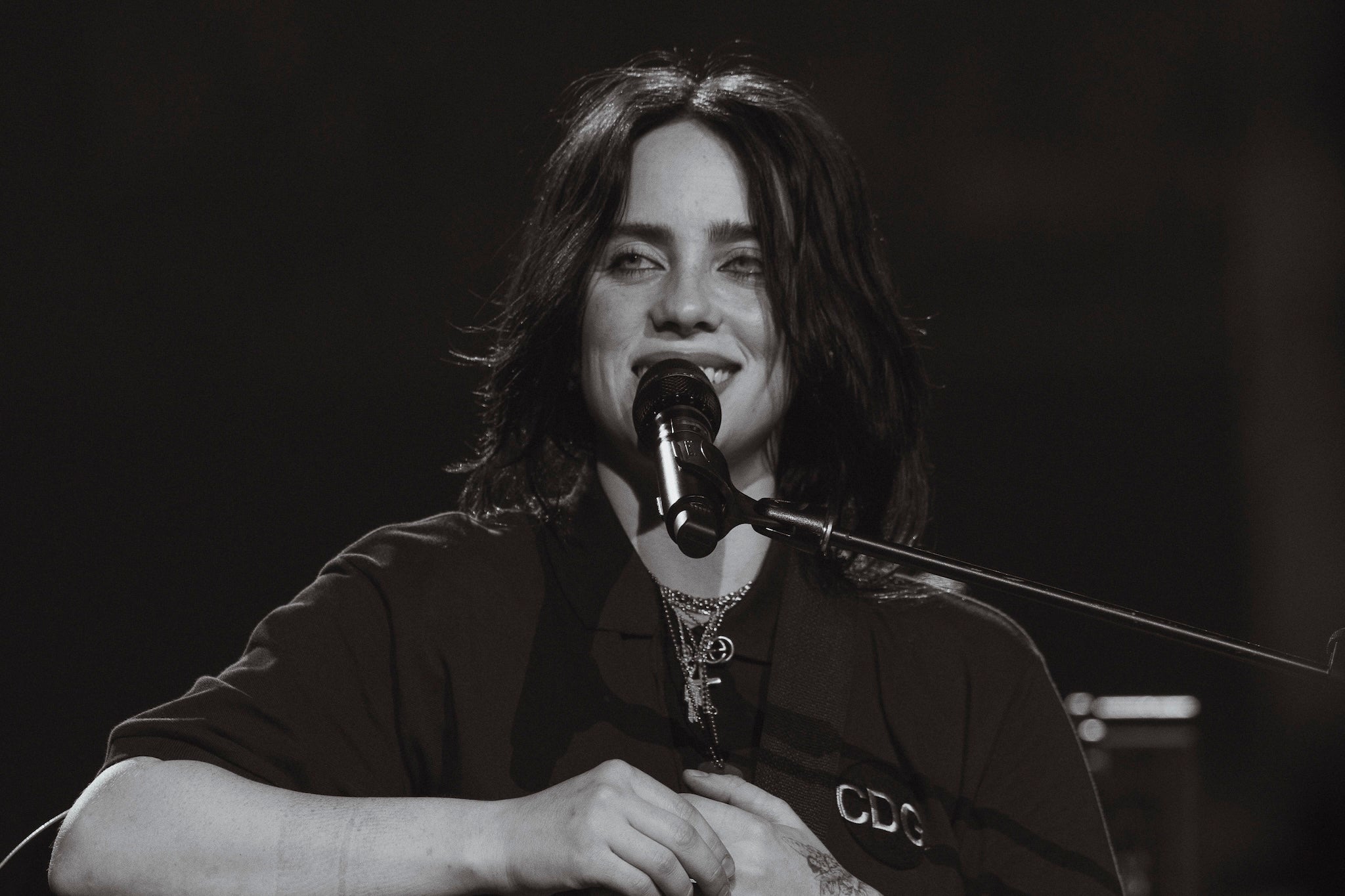

London’s O2 Arena, which has hosted global superstars such as Usher, Lady Gaga, and Billie Eilish this year, is among the hardest hit. Its property tax bill is projected to jump by nearly £2 million in the 2026-27 financial year. Other major venues, including the Co-op Live in Manchester, Manchester Arena, and Ovo Arena Wembley, are also bracing for substantial increases.

The Chancellor, Rachel Reeves, confirmed in her November 26 budget that new business rates payments for commercial properties would be based on 2024 valuations, alongside a new reduced multiplier for calculating overall bills. However, the unique nature of concert arenas, which are rarely let on the open market, means the VOA calculates their value based on economic performance rather than rental income.

This valuation method has been exacerbated by the timing of the data used by the VOA, which compares current figures with those from 2021. At that time, arenas were either shut down or heavily restricted due to the pandemic, artificially inflating the perceived growth in value.

While large properties benefit from transitional relief, capping bill increases at 30 per cent in the first year, the long-term outlook remains bleak. Ryan’s analysis suggests that tax liabilities for these venues could more than double within three years.

The impact extends beyond the major arenas, with smaller music venues across the UK also facing painful rates bill rises. Many in the sector, already under considerable pressure, are sounding the alarm.

Mark Davyd, chief executive of the Music Venue Trust, has urged the government to take immediate action by offering higher relief on business rates for music venues. He warned that many smaller establishments could be forced to close, while concertgoers would bear the brunt of increased costs.

Enjoy unlimited access to 100 million ad-free songs and podcasts with Amazon Music

Sign up now for a 30-day free trial. Terms apply.

ADVERTISEMENT. If you sign up to this service we will earn commission. This revenue helps to fund journalism across The Independent.

Enjoy unlimited access to 100 million ad-free songs and podcasts with Amazon Music

Sign up now for a 30-day free trial. Terms apply.

ADVERTISEMENT. If you sign up to this service we will earn commission. This revenue helps to fund journalism across The Independent.

“It’s going to have to be passed on (in ticket prices),” Mr Davyd told the Press Association. “People see these giant events, they see the flashing lights and all the incredible production there is at this level. Now it’s being done on a very small profit margin. That’s the reality. Live music is expensive to stage. There’s a huge number of people that you never see.”

He further cautioned that higher venue costs might deter international artists from touring the UK or lead them to shorten their British legs. “Music has been singled out to be attacked with incredibly high rateable values. It looks as though nobody realised that was going to happen and therefore there are no plans to manage it or mitigate it. The Government needs to step in as an urgent measure.”

Ovo Arena Wembley is set to experience the largest percentage increase among major arenas, with its value soaring by 300 per cent to £3 million. This will result in its property tax bill rising by £124,875 to £541,125 in 2026-27, according to Ryan.

However, the O2 in London is projected to face one of the most significant financial burdens, with its tax liability potentially increasing by an eye-watering £1.8 million to £8 million in 2026-27, following a 175 per cent jump in its rateable value to £30.5 million.

The Co-op Live, which opened in May 2024, is likely to see its bill climb by £432,900 to £1.9 million. Manchester Arena’s bill is expected to rise by £386,280, reaching £1.7 million in the next financial year.

Birmingham’s Utilita Arena is heading for a £166,500 business rate rise to £721,500, driven by a 131 per cent surge in its value, while the M&S Arena & Convention Centre in Liverpool will be hit with a £507,825 tax increase, bringing its total to £2.2 million.

Alex Probyn, practice leader for Europe and Asia-Pacific property tax at Ryan, commented: “Transitional relief will soften the first-year impact, but bills can still more than double over the three-year cycle. With valuations of this magnitude, operators should be scrutinising the VOA’s assumptions very closely.”