The capture of former Venezuelan president Nicolás Maduro by the US intelligence services and armed forces has resulted in a frenzy of speculation about its consequences. But there is no doubt that the events were closely linked to the oil riches of the country. While the political situation in Venezuela remains fluid, there is far more certainty about its position as an oil producer.

For a start, Venezuela has one of the highest proven oil reserves in the world. The number frequently thrown around is 300 billion barrels, more than any other country, including Saudi Arabia.

But it’s important to be cautious about the numbers coming from the outside of the Organisation for Economic Cooperation and Development (OECD). Statistics used within the OECD clearly distinguish between proved, probable, possible and contingent reserves and require consistency over time.

Proven reserves are defined as the oil in the ground that can be extracted economically, with the prevailing technology. It is a variable, not a constant – and the Venezuelan reserves estimate goes back to 2008.

As oil prices increase, the reserves increase too. This is because higher profits can justify the higher costs of extracting additional oil that would otherwise remain in the ground.

Initial production is usually easy due to the natural gas pressure of the well. Over time, this pressure falls and additional measures such as gas and water injection may have to be used – and these are expensive.

In 2008, the international oil prices approached US$140 (£104) a barrel. Currently, most of the Venezuelan oil sells at a US$25 discount to the Brent benchmark, at around US$35 a barrel. All other things being equal, the current proven oil reserves may be well below 100 billion barrels – less than a third of the figure that’s frequently cited.

The problem with Venezuela’s oil

Most Venezuelan oil is very heavy (tar-like) and contains a lot of sulphur. This makes production and transportation very expensive. Heavy oil needs to be diluted with naphtha (a liquid hydrocarbon) or gas oil first, and sulphur must be removed during the processing with expensive hydrogen.

Only very sophisticated refineries on the US Gulf Coast and some new refineries in India, the Middle East and China can process this kind of oil. It is no coincidence that Venezuelan oil is sold at huge discounts relative to other grades.

American oil companies started their activities in Venezuela almost a century ago, and by 1960s, the US was the largest foreign investor in the country. In line with most countries in the Organization of the Petroleum Exporting Countries (Opec), the Venezuelan oil industry was nationalised in 1971 and turned into the country’s oil monopoly, Petróleos de Venezuela SA (PDVSA).

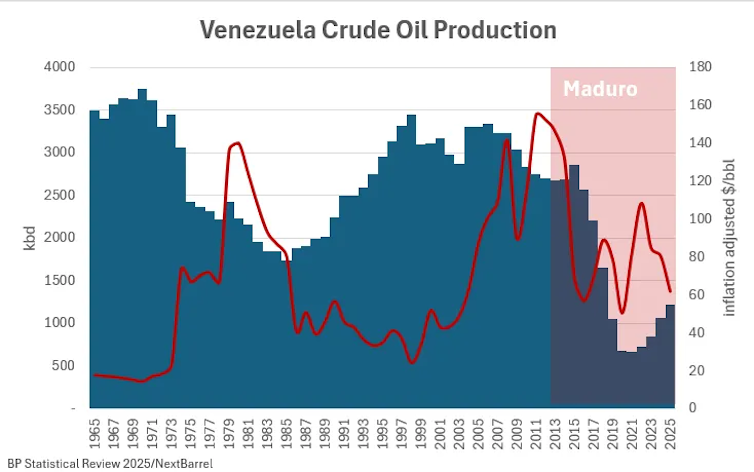

The Venezuelan oil industry then suffered from decades of political mismanagement, purges and US sanctions. Due to the lack of investment, production in the country has fallen from over three million barrels a day (mbd) in the early 2000s to below one mbd last year (see the graph below). This decline was particularly noticeable during the Maduro regime when the ruling party used PDVSA as a cash cow, investing little or nothing back into the industry.

À lire aussi :

What does international law tell us about the US seizure of an oil tanker off the coast of Venezuela?

Due to the state of the oil sector, even a relatively small increase in oil production in Venezuela would require billions of dollars of investment. A significant increase would require years of massive funding – even with a stable political environment.

It is not clear that events in Venezuela will have any significant immediate impact on the global oil market. The initial reaction was for the oil price to fall. But the global oil market is oversupplied right now and even the total loss of Venezuelan exports (which is unlikely) would have only a minor impact on the prices.

The decline of Venezuelan oil production:

Author provided (no reuse)

In the long term, the state of the industry can only improve (barring wars and civil strife). Additional barrels from Venezuela would only make life harder for Opec and other producers by making the oversupply worse. Indeed, oil prices tumbled again after US President Donald Trump vowed to seize up to 50 million barrels of Venezuelan oil.

Claims that the events would hurt China seem overblown. China (together with India) has been a major buyer of Venezuelan oil, but it represented no more than 5% of the volume of Chinese imports. Canada is another producer of heavy oil, and it has been shifting its exports from the US to China for some time. This trend is likely to continue.

Overall, there is little economic rationale for a “takeover” of the Venezuelan oil industry. If the US wanted Venezuelan oil, it could simply have lifted the sanctions imposed by Trump in 2019 and let their oil companies buy it, like everyone else.

It is the long-term political consequences of this legally dubious US action that are worrying the oil market. President Trump appears to have a growing appetite for military adventure which may include further attacks on Iran, a major oil-producing nation and a member of Opec.

Nobody is quite sure what Trump may do next, and the US action may also be used to legitimise Russia’s invasion of Ukraine. This had already rattled energy markets. The last thing the oil market needs right now is more uncertainty.