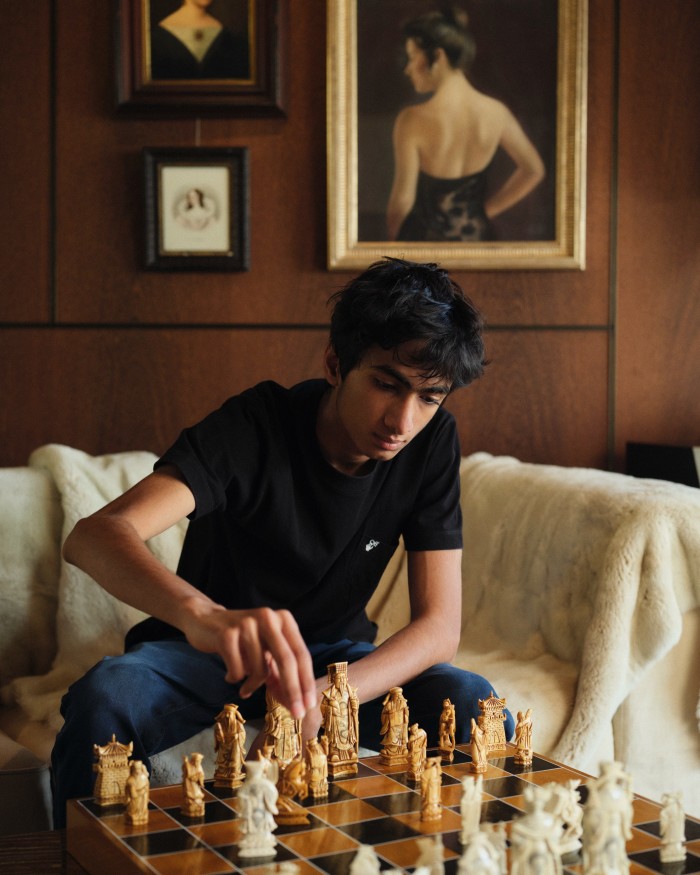

Sohum Lohia is trying to remember the first time he looked at a chessboard. “I started playing when we were living in Singapore,” recalls the lanky 15-year-old. “My dad and my grandfather didn’t really play seriously, but they were having a game. I was fascinated by the different pieces. I think I was about six at the time.”

Twisting uncomfortably in the manner of any teenager speaking to a stranger, Sohum is sitting with his mother Aarti in their home in Holland Park. The family relocated to London from Singapore in 2016: Sohum’s father, Amit, is the vice-chair of the petrochemical industry Indorama Corporation, one of the largest producers of polyester in the world. A graciously appointed Victorian mansion, the house sits in a sweeping crescent in west London and is filled with phenomenal sculptures and art, some of the 200 pieces Aarti has amassed to become one of the most significant collectors of contemporary works in the UK.

Today, however, she is not speaking of the future of Indian artists, or her philanthropic efforts, which are ambitious and wide-ranging, but of the role that now occupies most of her time. Aarti Lohia is a full-time “chess mum” and, as such, a mighty advocate for raising awareness, understanding and funding for what she considers a cruelly misrepresented sport.

She wasn’t always a chess crusader. Initially, Aarti and her husband were cautious of their son’s fascination with the game. “We discouraged him from playing, at least at the beginning,” says Aarti, who thought her son too young to understand it, as well as facing opposition from her family. “It was not cool to play chess when he started,” she says. “We are a traditional Indian family and they thought it was not a respectable sport.” They worried, she says, that he would turn out weird and introverted: “That he’d be that kid who, you know, played chess.”

Undeterred, Sohum undertook his own education and has since become a major talent. He won a double of British championships titles in 2019, the first time since 1996 that someone had scooped the under-11 and under-12 titles in the same year. In December 2021, he achieved an International Chess Federation ELO rating, a method for calculating a player’s skill level, of 2200, making him one of the top 10 juniors in the world. Currently, he is 97 points away from becoming a grandmaster, a title held by some 2,000 or so active players in the world.

“I follow Sohum Lohia’s career quite closely,” says the FT’s chess columnist Leonard Barden, “and can confirm that he is one of England’s most promising teenage talents… Given his progress so far, he has a good chance of making grandmaster by the age of 18-19. Beyond that, he can target a place in the England Olympiad team of five, where the current members are aged between 33 and 52.”

Likewise, Aarti has become her son’s biggest cheerleader, sometime coach (“She’s not very good at chess,” says Sohum, slyly) and champion. She follows Sohum to all his tournaments, helps him practise and has been known to collar former prime ministers to secure more funding for the game.

“I’ll tell you a little bit about my conversation with Rishi Sunak,” she says of an opportunity she seized while having dinner with the politician. He’s like, ‘I love hiking.’ I said, ‘That’s fine, but it’s not a sport.’” Sunak’s subsequent pledge to invest £500,000 to improve the game’s visibility last year, was “truth be told”, says Aarti, “because of me”.

Aarti may have to reframe her proposal, as the new chancellor Rachel Reeves is expected to slash the chess budget once again. Aarti is disappointed that the UK, with its great chess heritage, should not take the game more seriously. She is aghast at “the lack of respect for older chess players who have never made a good living, and the lack of recognition for the sport at the school level,” she adds. “Now there is a charity that is trying to put chess in schools: but it should be in schools as a sport. It’s not something you do just to sharpen your maths skills: you’re training the muscles of your brain.”

Nevertheless, in recent years, chess has undergone a revolution. Having boomed in the 1970s, with the famous rivalry between Bobby Fischer and Boris Spassky, the game is finding new popularity again. Says Barden: “First, the Covid-19 pandemic kickstarted a strong growth of fans, and then Netflix’s The Queen’s Gambit caused a bigger boom. Unexpectedly, we saw a third, even higher wave in late 2022 and early 2023, when millions of new fans started playing and following chess online. A big part of this revolution is that chess is not just something you do any more, but something you can watch. Content creators produce engaging content daily and encourage people to pick it up for the first, or the fifth, time.”

Sohum is coached by Luke McShane and Ramachandran Ramesh, an Indian grandmaster who started coaching full-time aged 32. The founder of the Chess Gurukul academy in Chennai, he has schooled players including Rameshbabu Praggnanandhaa of the winning Indian team at the Chess Olympiad in Budapest last month, at which they crushed the other teams.

“The world of chess is undergoing a few drastic changes,” says Ramesh, “with some nations falling behind and others climbing to the top. What is making this more exciting is the fact that it is the young teenagers who are taking the lead role in this transition. Players like [18-year-old] Gukesh Dommaraju, Rameshbabu Praggnanandhaa [19] and Arjun Erigaisi [21], from India, Vincent Keymer [19] from Germany and Iranian-French Alireza Firouzja [21] are some of the youngsters who are instrumental in bringing new dynamics into play.” He is equally optimistic about the UK’s new generation: “Nine-year-old Bodhana Sivanandan and Sohum Lohia are a few of the youngsters who have the potential to make it to the England team in their late teens.”

Ramesh puts the new surge of talent and interest down to several factors: “Access to quality training, cutting-edge technology, the internet, information and an abundance of playing opportunities are a few of the reasons for it becoming accessible and shortening the learning curve.”

So ardent is Aarti’s belief in the benefits of chess playing that she’s currently making a documentary about a charity that brings it into prisons to show how impactful the game can be.

“One thing that I’ve noticed universally, and without exception, is that chess players don’t think they’re doing anything great. It’s just a game.” Players, she argues, have a greater maturity, but most importantly the game teaches the value of consequence. “When you make a move, something’s going to happen,” says Aarti. “So you better think before you do. When prisoners learn chess, they internalise this understanding. Yes, they may have made careless moves, they’ve done silly things. And they see the chess game as a life imitated on the board.”

Her theories are now backed up by behavioural studies that have shown chess to have a calming effect on those who play. “You know [prisoners] are not usually educated,” Aarti continues. “They’re very troubled and emotionally unstable – everything that chess players should not be. Chess takes all the traits of being impulsive and helps reset a person’s mind.”

Sohum says the main skill he brings to chess is patience. “You’re always waiting a long time for the other player to make their move. You also learn to get a bit less emotional, so you don’t feel so bad if something goes wrong.” Slow and thoughtful in his manner, Sohum thinks hard before he talks. “You have to be willing to stay focused: that’s the main issue. When you’re seven or eight, you get bored easily so you just play very quickly [and make impulsive moves].” There’s also an inherent respect that comes with playing in a mixed-age category: “Age doesn’t matter. You play against everyone.”

He’s less enthused by the popular assumption that chess is a “STEM subject” and all its players are good at maths. Although his mother is quick to say that Sohum is actually very academic, he is more circumspect about his skills. “It’s a big stereotype that chess players are great at maths,” he shrugs. “Honestly, I think chess and maths are quite separate. I’m decent at maths, and so are other players, but they’re not very connected I don’t think.”

Despite counselling patience, intelligence and precision, chess is still a fierce competition. According to Barden, Sohum’s nearest rival is Shreyas Royal, who, at 15, is England’s youngest grandmaster. “Royal is at present on a higher trajectory than Sohum,” says Barden, “but that is not set in stone.”

Sohum himself insists he’s playing for “enjoyment”, and his only ambition at this point is to become a grandmaster. But what of the chess parents? Are they also calm? Or are they like any other sporting mentors when they’re watching their children play big tournaments?

There are some games that Sohum advises his mother to stay away from. Invariably, he says: “The parents are more stressed than the players. They get kind of flustered, and very nervous, and they think everything’s unfair to their child.” Adds Aarti: “It’s a long game and there’s a lot of build-up. It can be quite a cauldron of emotions, but fans also do good things for the game.”

As long as Sohum is playing, Aarti will be beside him. Her passion for the subject remains undimmed. “I think everybody knows you can’t play at a certain level of sport if one parent is not crazy,” she says of their dynamic. “And this is universal everywhere, there are literally zero exceptions to that rule. One of the two parents has to really be in it. And in this family,” she concludes brightly, “that parent is me.”

You must be logged in to post a comment Login