Hi from Taipei, where it’s really starting to feel like autumn! This is Cheng Ting-Fang, your #techAsia host for this week.

I just got back from a short trip to Bangkok, and I can still taste the refreshing flavours of pomelo salad with chilli, roasted peanuts and heart-shaped betel leaves. With its wide variety of crispy fish cakes, satay, spring rolls and pork wantons, not to mention curries and coconut treats, Thailand truly lives up to its nickname as the “kitchen of the world”.

During these overseas trips, I always love to observe my surroundings, especially at or near the airport, as they often provide insight into local developments that one can then dig into more deeply.

The boarding announcements at the airport on this visit showed frequent direct flights between Bangkok and numerous Chinese cities, including not only major metropolises like Shanghai, Beijing and Shenzhen but also smaller cities such as Jinan, Hefei, Kunming, Nanning and Fuzhou.

As soon as I left Suvarnabhumi Airport and hit the highway to downtown, I was greeted by a series of massive billboards. The first few showcased Huawei Technologies’ wearable devices and tablets, followed by a gigantic ad for ruby-red roadsters made by MG, a traditional British brand now owned by Chinese auto giant SAIC Motor.

The sight reminded me that Thailand is emerging as a key battleground for established carmakers like Toyota Motor, Honda Motor and Ford as well as rising Chinese electric vehicle producers such as MG, BYD and Neta Auto. It also illustrated that Huawei is still serious about maintaining its presence in overseas consumer electronics markets. The taxi driver kindly apologised for the traffic jam we ran into along the way — another sign of the buzzing economy.

Thailand has also benefited from the massive supply chain shift sparked by US-China trade tensions, as seen in the flow of foreign direct investment. In 2023, China was the top investor, contributing 24 per cent of total FDI, primarily in electronics manufacturing and automotive supply chains. FDI in the first nine months of 2024 hit its highest level in a decade, led by “American and Chinese companies’ units in Singapore”, according to government data.

With former US President Donald Trump set to return to office, supply chains are expected to experience further decoupling depending on how his policies play out.

Servers to order

Apple is looking to build its own data centre servers and is asking for help from one of its most important suppliers: Foxconn, the world’s biggest iPhone assembler.

Apple, a consumer tech giant, has less experience in building servers than companies HP and Google and is hoping to leverage the experience and expertise of Foxconn, which is also the world’s top AI data centre server maker, Lauly Li and Cheng Ting-Fang of Nikkei Asia write.

The talks come as Apple begins rolling out Apple Intelligence, the AI platform that has helped spur demand for the latest iPhones.

Apple hopes to build AI servers in the Taiwanese city of Hsinchu, sources said, the same location where Foxconn produces the latest servers for Nvidia. But that could be difficult, as space and manufacturing resources are constrained by soaring demand for Nvidia products.

Calling for investment

Just days into his presidency, Indonesia’s new leader has sent a strong message to foreign tech companies looking to sell in the world’s fourth-most populous country: invest locally or lose access to the market.

But analysts warn that strategy, which is hitting the likes of Apple and Google, could backfire as competition in the region for foreign direct investment heats up, write the Financial Times’ A. Anantha Lakshmi and Diana Mariska in Jakarta.

Over the past week, Prabowo Subianto’s government has banned sales of Apple’s iPhone 16 and Google’s Pixel phones, citing the companies’ failure to meet requirements that 40 per cent of products are made with locally sourced raw materials.

Indonesia, with a young, tech-savvy population, holds a lot of potential for Apple and Google. Neither company has manufacturing plants in the country, though Apple has one supplier with a factory in Indonesia.

The bans signal that south-east Asia’s largest economy could step up the use of restrictive trade policies to secure investments from foreign companies. However, experts warn the strategy may end up harming Indonesia as its neighbours, such as Vietnam and Malaysia, take a more investor-friendly approach.

The price of progress

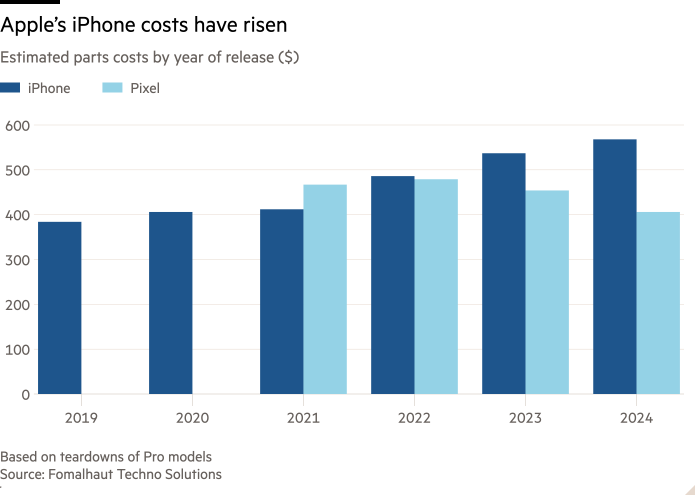

From chipsets to cameras, Apple spent more on key electronic components for its latest flagship iPhone than it did on last year’s offering, according to a teardown by Masaharu Ban and Yusuke Yagi of Nikkei in collaboration with Tokyo-based Fomalhaut Techno Solutions.

The total cost of materials for the iPhone 16 Pro reached $568, with much of the additional cost going to enable artificial intelligence computing, the analysis showed. The phone’s US retail price is $999.

The team also disassembled Google’s flagship Pixel 9 Pro released this August and found that the cost of its key parts has actually decreased over the years.

The most expensive component in the latest iPhone 16 Pro is the in-house designed A18 Pro core processor, which is about $135, made through the advanced 3nm process by Taiwan Semiconductor Manufacturing Co, the world’s top contract chipmaker. Google’s core chip cost is significantly less.

Extreme machines

The race to produce ever more advanced semiconductors continues as TSMC prepares to receive its first set of the world’s most cutting-edge lithography chipmaking machines from ASML, Cheng Ting-Fang of Nikkei Asia writes.

Known as high numerical aperture extreme ultraviolet — or high NA EUV — lithography machines, they cost around $350mn each, about the price of three F-35 fighter jets. They are nearly twice as expensive as a standard EUV machine but can print almost three times as many transistors. In chipmaking, the more transistors that can be packed into a given chip area, the more powerful and advanced the chip becomes.

Intel has already secured the first two sets of high NA EUV machines as part of the US chip giant’s efforts to accelerate its development and reclaim its leading position in the chip industry.

TSMC was an early adopter of EUV technology, introducing it into its chipmaking process in 2019, several years ahead of Intel, which only released its first EUV-based core chipset last year. The Taiwanese chipmaker will use its first set of high NA EUV machines for research and development purposes initially, with sources indicating that the company may not deploy them for mass production until after 2030.

Suggested reads

-

Trump win casts cloud over TSMC and Samsung US chip plans (Nikkei Asia)

-

Chipmaker TSMC hit by Taiwan’s soaring energy prices and growing outages (FT)

-

Malaysia expects its ‘remarkable’ IPO boom to continue in 2025 (Nikkei Asia)

-

US Space Force warns of ‘mind-boggling’ build-up of Chinese capabilities (FT)

-

China’s chipmaking equipment market to shrink next year (Nikkei Asia)

-

South-east Asia’s digital companies boost profitability after pandemic: report (Nikkei Asia)

-

US EV policy yet to help Pilbara’s battery chemical venture: CEO (Nikkei Asia)

-

Japan eyes customer safeguards against fall of foreign crypto exchanges (Nikkei Asia)

#techAsia is co-ordinated by Nikkei Asia’s Katherine Creel in Tokyo, with assistance from the FT tech desk in London.

Sign up here at Nikkei Asia to receive #techAsia each week. The editorial team can be reached at techasia@nex.nikkei.co.jp

You must be logged in to post a comment Login