Reuters exclusively reported that Arm Holdings aims to gain more than 50% of the Windows PC market in five years as Microsoft and its hardware partners prepare to launch a new batch of computers based on the British chip designer’s technology.

Business

Arm aims to capture 50% of PC market in five years, CEO says

Technology

03 June 2024, 8:32 pm 1 minute

Market Impact

Demand for use of Arm’s technology in personal computers got a boost after Microsoft unveiled ambitious plans last month to launch a new breed of PCs with artificial intelligence features to compete with Alphabet and Apple.

Article Tags

Topics of Interest: Technology

Type: Reuters Best

Sectors: Technology

Regions: Europe

Win Types: Exclusivity

Story Types: Exclusive / Scoop

Media Types: Text

Customer Impact: Significant National Story

Business

Britain takes aim at Microsoft’s $69 billion ‘Call of Duty’ deal

Deals

08 February 2023, 7:21 pm 1 minute

| Reuters reported that Britain placed another hurdle in the way of Microsoft’s $69-billion mega purchase of “Call of Duty” maker, Activision Blizzard, saying it could harm gamers by weakening the rivalry between Xbox and Sony’s PlayStation. |

Market Impact

The biggest-ever deal in gaming could result in higher prices, fewer choices, and less innovation for millions of players, as well as stifling competition in cloud gaming. Shares in Activision were down 3% in early trading in New York. Microsoft, which announced an AI-driven revamp of its search capabilities on Tuesday, was up 2.4%.

Article Tags

Topics of Interest: Deals

Type: Reuters Best

Sectors: Business & FinanceTechnology

Regions: EuropeNorth America

Countries: EnglandUnited States

Win Types: Overall Coverage

Story Types: Spot News

Media Types: Text

Customer Impact: Major Global Story

Business

Logistics giant Lineage raises $4.45 bln in biggest IPO in 2024

Business & Finance

24 July 2024, 9:31 am 1 minute

Reuters exclusively reported that Lineage, the world’s largest operator of cold-storage warehouses, raised $4.45 billion in its U.S. initial public offering, setting it up for the biggest stock market debut globally this year. Lineage priced just under 57 million shares in New York at $78 apiece, the upper end of its indicated range of $70 to $82.

Market Impact

The $4.45 billion IPO values Lineage at more than $18 billion and is the biggest since chip designer Arm’s $4.87 billion offering last September.

Article Tags

Topics of Interest: Business & Finance

Type: Reuters Best

Sectors: Business & Finance

Regions: Americas

Win Types: Exclusivity

Story Types: Exclusive / Scoop

Media Types: Text

Customer Impact: Important Regional Story

Business

KKR wins EU approval for Telecom Italia deal

Deals

24 May 2024, 2:27 pm 1 minute

Reuters exclusively reported that U.S. investment firm KKR was set to secure unconditional EU antitrust approval for its up to 22-billion-euro ($24 billion) acquisition of Telecom Italia’s (TIM) fixed-line network. The story was later confirmed by the European Commission. The deal is significant as it marks the first time that a former phone monopoly in a major European country is divesting its landline grid.

Market Impact

The deal is significant as it marks the first time that a former phone monopoly in a major European country is divesting its landline grid.

Article Tags

Topics of Interest: Deals

Type: Reuters Best

Sectors: Telecommunications

Regions: Europe

Win Types: Exclusivity

Story Types: Exclusive / Scoop

Media Types: Text

Customer Impact: Important Regional Story

Business

Keir Starmer to argue tough decisions needed for UK ‘national renewal’

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Sir Keir Starmer will warn that difficult times lie ahead for the UK as he tries to tackle an array of deep-seated challenges facing his government, but will insist that tough decisions taken now will lead to “national renewal”.

He will say on Tuesday there are “no easy answers” and “no false hope” as he issues a stern message in his first speech as UK prime minister to the annual Labour party conference in Liverpool.

Starmer will describe a country in which there are “decimated public services leaving communities held together by little more than goodwill”.

But he will argue that despite tight public finances his government can deliver a brighter future and “open the door to national renewal”, enabling the rebuilding of Britain.

Starmer has enjoyed only a brief honeymoon as the UK’s first Labour prime minister since 2010 and now faces falling poll ratings and infighting within his administration.

Last week saw damaging revelations about donations of clothing worth thousands of pounds made to Starmer, his wife, deputy leader Angela Rayner and chancellor Rachel Reeves during a cost of living crisis.

Starmer will try to reassure delegates in Liverpool — and the wider public — that the government is already taking steps to change the country.

He will cite planning reforms, settling the doctors’ strike, new solar projects, new offshore wind farms, an end to one-word Ofsted judgments, a ban on MPs’ second jobs, a new “border security command”, a ban on no-fault evictions and legislation to nationalise the railways. “And we’re only just getting started,” he will say.

The Labour leadership is drawing up a Budget and spending review next month, which are likely to include tax rises and continuing constraints on public spending given the country’s high levels of debt.

Starmer will say that ministers will have to rely on innovative reforms rather than turning on the spending taps.

“I have to warn you, working people do want more decisive government. They do want us to rebuild our public services and they do want that to lead to more control in their lives. But their pockets are not deep — not at all,” he will caution. “So we have to be a great reforming government.”

The Labour leadership has been walking a tightrope between warning that public finances are eye-wateringly tight while also offering a glimmer of hope for the future.

Ministers have claimed to have found a fiscal “black hole” of about £22bn that needs to be plugged — leading to predictions of tax rises and spending cuts.

“The politics of national renewal are collective. They involve a shared struggle. A project that says, to everyone, this will be tough in the short term, but in the long term, it’s the right thing to do for our country. And we all benefit from that,” Starmer will say.

Labour delegates will on Wednesday vote on a motion calling for the government to reverse its cuts to the winter fuel allowance, an issue that has prompted criticism from unions, charities and many of the party’s own MPs.

The prime minister will repeat his five priorities of higher economic growth, a better NHS, stronger borders, more opportunities for children and clean energy from low-carbon sources.

He will also touch on how he dragged the Labour party towards the political centre ground from its previous, more left-wing incarnation under former leader Jeremy Corbyn.

“I changed the Labour party to restore it to the service of working people. And that is exactly what we will do for Britain. But I will not do it with easy answers. I will not do it with false hope,” he will say.

Business

Canadian lender BMO to wind down retail auto finance business

Business & Finance

17 September 2023, 6:08 pm 1 minute

Reuters was ahead in reporting that Bank of Montreal (BMO) is winding down its retail auto finance business and shifting focus to other areas in a move that will result unspecified number of job losses, Canada’s third largest bank.

Market Impact

The move, applicable in Canada and the United States, comes after BMO’s bad debt provisions in retail trade surged to C$81 million ($60 million) in the quarter ended July 31 compared with a recovery of C$9 million a year ago, in a sign of growing stress consumers face from a rapid rise in borrowing costs.

Article Tags

Topics of Interest: Business & Finance

Type: Reuters Best

Sectors: Business & FinanceFinancial Services

Regions: AmericasNorth America

Countries: Canada

Win Types: Speed

Story Types: Exclusive / Scoop

Media Types: Text

Customer Impact: Significant National Story

Business

China tells some brokerages to conduct compliance checks on bond trading

Business & Finance

09 August 2024, 10:57 pm 1 minute

Reuters exclusively reported that China’s securities regulator has ordered some brokerages to inspect their bond trading activities as authorities seek to rein in frenzied buying of Chinese government bonds. The brokerages, all of which are domestic, have been told to conduct compliance checks on all parts of their bond trading operations.

Market Impact

A wobbly Chinese economy, long hobbled by a protracted property crisis, has sent investors scurrying away from the volatile stock market while banks have also continued to cut deposit rates. That’s sent investors – from large banks and insurers to mutual funds to rural financial institutions – pouring into the bond market.

Article Tags

Topics of Interest: Business & Finance

Type: Reuters Best

Sectors: Business & Finance

Regions: Asia

Countries: China

Win Types: Exclusivity

Story Types: Exclusive / Scoop

Media Types: Text

Customer Impact: Significant National Story

-

Womens Workouts4 hours ago

Womens Workouts4 hours ago3 Day Full Body Women’s Dumbbell Only Workout

-

News5 days ago

News5 days agoYou’re a Hypocrite, And So Am I

-

Sport4 days ago

Sport4 days agoJoshua vs Dubois: Chris Eubank Jr says ‘AJ’ could beat Tyson Fury and any other heavyweight in the world

-

News1 day ago

News1 day agoOur millionaire neighbour blocks us from using public footpath & screams at us in street.. it’s like living in a WARZONE – WordupNews

-

Technology6 days ago

Technology6 days agoWould-be reality TV contestants ‘not looking real’

-

Science & Environment5 days ago

Science & Environment5 days agoHow to unsnarl a tangle of threads, according to physics

-

Science & Environment4 days ago

Science & Environment4 days ago‘Running of the bulls’ festival crowds move like charged particles

-

CryptoCurrency4 days ago

CryptoCurrency4 days agoEthereum is a 'contrarian bet' into 2025, says Bitwise exec

-

CryptoCurrency4 days ago

CryptoCurrency4 days agoDZ Bank partners with Boerse Stuttgart for crypto trading

-

Travel1 day ago

Where Retro Glamour Meets Modern Chic in Athens, Greece

-

Science & Environment5 days ago

Science & Environment5 days agoWhy this is a golden age for life to thrive across the universe

-

Science & Environment5 days ago

Science & Environment5 days agoQuantum ‘supersolid’ matter stirred using magnets

-

Science & Environment5 days ago

Science & Environment5 days agoSunlight-trapping device can generate temperatures over 1000°C

-

Health & fitness6 days ago

Health & fitness6 days agoThe secret to a six pack – and how to keep your washboard abs in 2022

-

Science & Environment5 days ago

Science & Environment5 days agoLiquid crystals could improve quantum communication devices

-

CryptoCurrency4 days ago

CryptoCurrency4 days agoBitcoin miners steamrolled after electricity thefts, exchange ‘closure’ scam: Asia Express

-

CryptoCurrency4 days ago

CryptoCurrency4 days agoCardano founder to meet Argentina president Javier Milei

-

CryptoCurrency4 days ago

CryptoCurrency4 days agoDorsey’s ‘marketplace of algorithms’ could fix social media… so why hasn’t it?

-

CryptoCurrency4 days ago

CryptoCurrency4 days agoLow users, sex predators kill Korean metaverses, 3AC sues Terra: Asia Express

-

CryptoCurrency4 days ago

CryptoCurrency4 days agoBitcoin bulls target $64K BTC price hurdle as US stocks eye new record

-

News4 days ago

News4 days agoIsrael strikes Lebanese targets as Hizbollah chief warns of ‘red lines’ crossed

-

Science & Environment4 days ago

Science & Environment4 days agoHyperelastic gel is one of the stretchiest materials known to science

-

Science & Environment5 days ago

Science & Environment5 days agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Science & Environment5 days ago

Science & Environment5 days agoQuantum forces used to automatically assemble tiny device

-

News4 days ago

News4 days agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

Science & Environment5 days ago

Science & Environment5 days agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

Science & Environment5 days ago

Science & Environment5 days agoHow to wrap your mind around the real multiverse

-

Science & Environment5 days ago

Science & Environment5 days agoPhysicists are grappling with their own reproducibility crisis

-

Science & Environment5 days ago

Science & Environment5 days agoNuclear fusion experiment overcomes two key operating hurdles

-

CryptoCurrency4 days ago

CryptoCurrency4 days agoRedStone integrates first oracle price feeds on TON blockchain

-

CryptoCurrency4 days ago

CryptoCurrency4 days agoSEC asks court for four months to produce documents for Coinbase

-

CryptoCurrency4 days ago

CryptoCurrency4 days agoVitalik tells Ethereum L2s ‘Stage 1 or GTFO’ — Who makes the cut?

-

CryptoCurrency4 days ago

CryptoCurrency4 days agoBlockdaemon mulls 2026 IPO: Report

-

Science & Environment1 day ago

Science & Environment1 day agoMeet the world's first female male model | 7.30

-

Sport4 days ago

Sport4 days agoUFC Edmonton fight card revealed, including Brandon Moreno vs. Amir Albazi headliner

-

Technology4 days ago

Technology4 days agoiPhone 15 Pro Max Camera Review: Depth and Reach

-

Science & Environment4 days ago

Science & Environment4 days agoHow one theory ties together everything we know about the universe

-

Science & Environment5 days ago

Science & Environment5 days agoLaser helps turn an electron into a coil of mass and charge

-

Science & Environment5 days ago

Science & Environment5 days agoQuantum time travel: The experiment to ‘send a particle into the past’

-

CryptoCurrency4 days ago

CryptoCurrency4 days ago2 auditors miss $27M Penpie flaw, Pythia’s ‘claim rewards’ bug: Crypto-Sec

-

CryptoCurrency4 days ago

CryptoCurrency4 days agoJourneys: Robby Yung on Animoca’s Web3 investments, TON and the Mocaverse

-

CryptoCurrency4 days ago

CryptoCurrency4 days ago$12.1M fraud suspect with ‘new face’ arrested, crypto scam boiler rooms busted: Asia Express

-

CryptoCurrency4 days ago

CryptoCurrency4 days agoCertiK Ventures discloses $45M investment plan to boost Web3

-

CryptoCurrency4 days ago

CryptoCurrency4 days agoVonMises bought 60 CryptoPunks in a month before the price spiked: NFT Collector

-

CryptoCurrency4 days ago

CryptoCurrency4 days ago‘Silly’ to shade Ethereum, the ‘Microsoft of blockchains’ — Bitwise exec

-

CryptoCurrency4 days ago

CryptoCurrency4 days ago‘No matter how bad it gets, there’s a lot going on with NFTs’: 24 Hours of Art, NFT Creator

-

Business4 days ago

How Labour donor’s largesse tarnished government’s squeaky clean image

-

CryptoCurrency4 days ago

CryptoCurrency4 days agoCoinbase’s cbBTC surges to third-largest wrapped BTC token in just one week

-

News3 days ago

News3 days agoBangladesh Holds the World Accountable to Secure Climate Justice

-

Womens Workouts3 days ago

Womens Workouts3 days agoBest Exercises if You Want to Build a Great Physique

-

News4 days ago

News4 days agoChurch same-sex split affecting bishop appointments

-

Politics6 days ago

Politics6 days agoTrump says he will meet with Indian Prime Minister Narendra Modi next week

-

Technology4 days ago

Technology4 days agoFivetran targets data security by adding Hybrid Deployment

-

Politics4 days ago

Politics4 days agoLabour MP urges UK government to nationalise Grangemouth refinery

-

Science & Environment5 days ago

Science & Environment5 days agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

CryptoCurrency4 days ago

CryptoCurrency4 days agoHelp! My parents are addicted to Pi Network crypto tapper

-

CryptoCurrency4 days ago

CryptoCurrency4 days agoCrypto scammers orchestrate massive hack on X but barely made $8K

-

Science & Environment4 days ago

Science & Environment4 days agoWhy we need to invoke philosophy to judge bizarre concepts in science

-

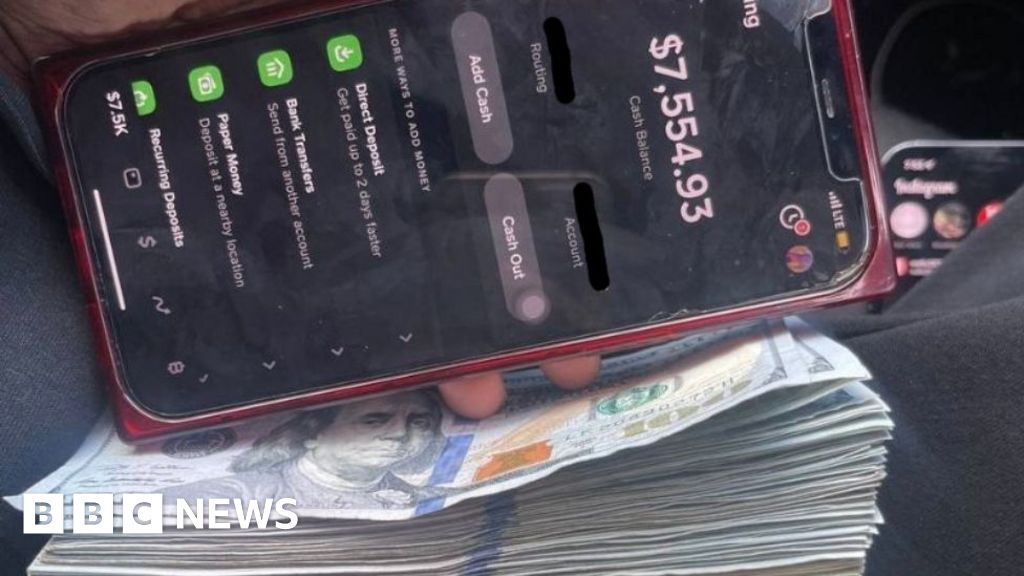

CryptoCurrency4 days ago

CryptoCurrency4 days agoSEC sues ‘fake’ crypto exchanges in first action on pig butchering scams

-

CryptoCurrency4 days ago

CryptoCurrency4 days agoElon Musk is worth 100K followers: Yat Siu, X Hall of Flame

-

CryptoCurrency4 days ago

CryptoCurrency4 days agoBitcoin price hits $62.6K as Fed 'crisis' move sparks US stocks warning

-

CryptoCurrency4 days ago

CryptoCurrency4 days agoCZ and Binance face new lawsuit, RFK Jr suspends campaign, and more: Hodler’s Digest Aug. 18 – 24

-

CryptoCurrency4 days ago

CryptoCurrency4 days agoTelegram bot Banana Gun’s users drained of over $1.9M

-

CryptoCurrency4 days ago

CryptoCurrency4 days agoEthereum falls to new 42-month low vs. Bitcoin — Bottom or more pain ahead?

-

CryptoCurrency4 days ago

CryptoCurrency4 days agoETH falls 6% amid Trump assassination attempt, looming rate cuts, ‘FUD’ wave

-

Politics4 days ago

‘Appalling’ rows over Sue Gray must stop, senior ministers say | Sue Gray

-

News4 days ago

News4 days agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

CryptoCurrency4 days ago

CryptoCurrency4 days agoBitcoin options markets reduce risk hedges — Are new range highs in sight?

-

News1 day ago

News1 day agoWhy Is Everyone Excited About These Smart Insoles?

-

News1 day ago

News1 day agoFour dead & 18 injured in horror mass shooting with victims ‘caught in crossfire’ as cops hunt multiple gunmen

-

News4 days ago

News4 days agoPolice chief says Daniel Greenwood 'used rank to pursue junior officer'

-

Money5 days ago

Money5 days agoWhat estate agents get up to in your home – and how they’re being caught

-

Technology7 days ago

Technology7 days ago‘The dark web in your pocket’

-

Business6 days ago

Business6 days agoGuardian in talks to sell world’s oldest Sunday paper

-

Science & Environment4 days ago

Science & Environment4 days agoHow to wrap your head around the most mind-bending theories of reality

-

Technology6 days ago

Technology6 days agoCan technology fix the ‘broken’ concert ticketing system?

-

News7 days ago

News7 days agoDid the Pandemic Break Our Brains?

-

Fashion Models4 days ago

Fashion Models4 days agoAchtung Magazine

-

Politics6 days ago

Politics6 days agoTrump Media breached ARC Global share agreement, judge rules

-

Science & Environment5 days ago

Science & Environment5 days agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

Fashion Models4 days ago

Fashion Models4 days agoMixte

-

Science & Environment5 days ago

Science & Environment5 days agoHow Peter Higgs revealed the forces that hold the universe together

-

News5 days ago

News5 days ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

Science & Environment5 days ago

Science & Environment5 days agoTake a look behind the scenes at the world’s largest fusion experiment

-

Science & Environment5 days ago

Science & Environment5 days agoNerve fibres in the brain could generate quantum entanglement

-

Business6 days ago

Glasgow to host scaled-back Commonwealth Games in 2026

-

Politics6 days ago

Politics6 days agoLib Dems aim to turn election success into influence

-

CryptoCurrency4 days ago

CryptoCurrency4 days agoReal-world asset tokenization is the crypto killer app — Polygon exec

-

Science & Environment4 days ago

Science & Environment4 days ago‘Sound laser’ is the most powerful ever made

-

CryptoCurrency4 days ago

CryptoCurrency4 days agoDecentraland X account hacked, phishing scam targets MANA airdrop

-

CryptoCurrency4 days ago

CryptoCurrency4 days agoBeat crypto airdrop bots, Illuvium’s new features coming, PGA Tour Rise: Web3 Gamer

-

CryptoCurrency4 days ago

CryptoCurrency4 days agoMemecoins not the ‘right move’ for celebs, but DApps might be — Skale Labs CMO

-

Business4 days ago

Thames Water seeks extension on debt terms to avoid renationalisation

-

Politics4 days ago

The Guardian view on 10 Downing Street: Labour risks losing the plot | Editorial

-

Politics4 days ago

Politics4 days agoI’m in control, says Keir Starmer after Sue Gray pay leaks

-

Business4 days ago

UK hospitals with potentially dangerous concrete to be redeveloped

-

Politics4 days ago

‘Hundreds’ of prisoners freed early in England and Wales not fitted with tags | Prisons and probation

-

Business4 days ago

Axel Springer top team close to making eight times their money in KKR deal

-

News4 days ago

News4 days ago“Beast Games” contestants sue MrBeast’s production company over “chronic mistreatment”

-

News4 days ago

News4 days agoSean “Diddy” Combs denied bail again in federal sex trafficking case

You must be logged in to post a comment Login