Fethullah Gülen, an Islamic preacher who at his peak led hundreds of thousands of Turkish faithful but was accused of plotting a failed coup against President Recep Tayyip Erdoğan, has died while in exile in the US.

Gülen died in hospital late on Sunday, according to a post on X by Herkul, a website with ties to the 83-year-old cleric, which was widely reported in Turkish media.

Ahmet Kurucan, who is married to a niece of Gülen, confirmed his death to the Financial Times.

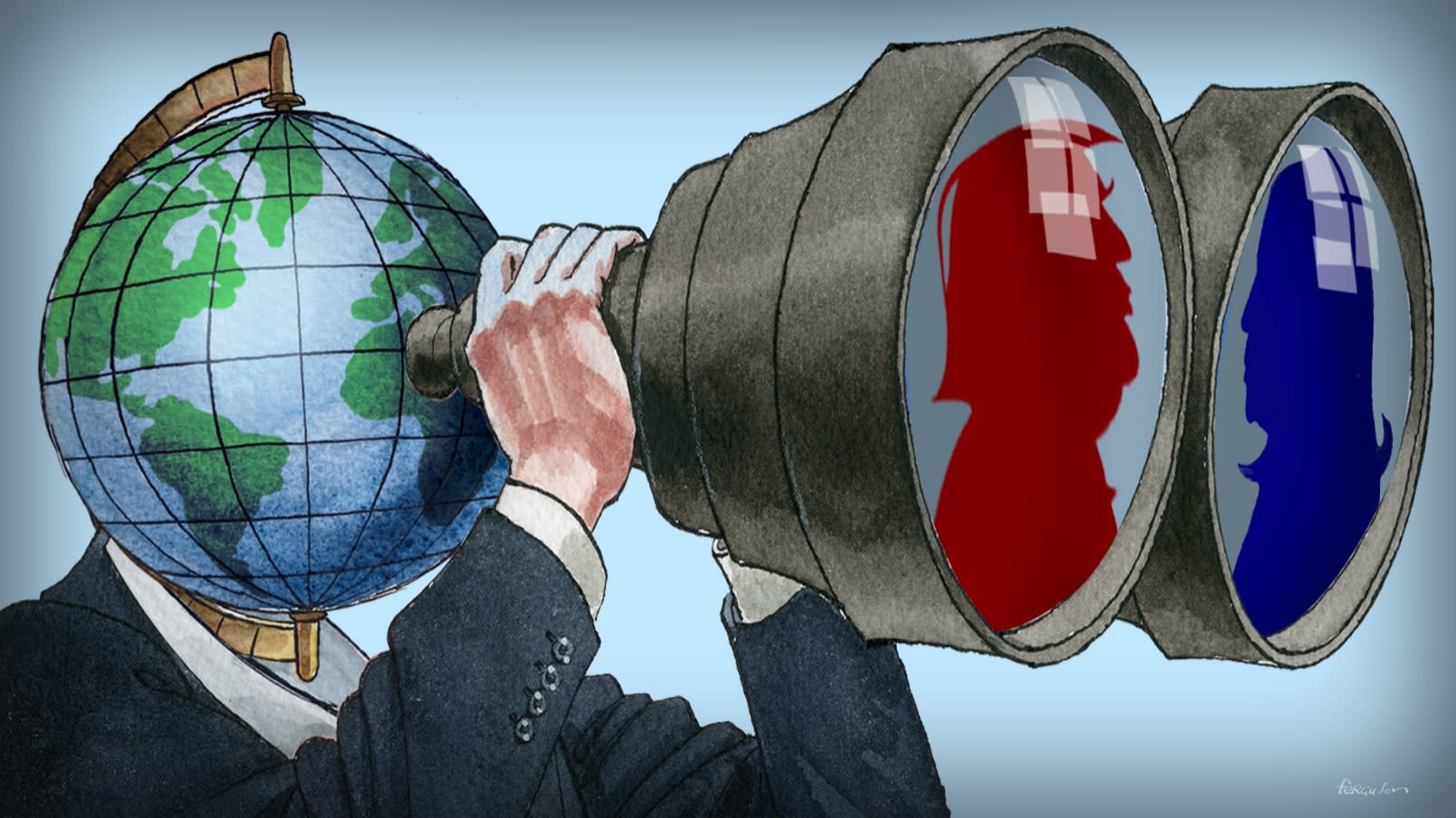

Gülen’s exile in the US had been a major irritant in Ankara’s relationship with Washington, which refused to extradite the cleric after a 2016 military insurrection that Erdoğan blamed on Gülen’s religious community.

The movement, which calls itself Hizmet, or service, is classified as a terrorist organisation in Turkey.

“Our nation and state will continue to fight against this organisation as they fight against all kinds of terrorist organisations,” Hakan Fidan, Turkey’s foreign minister, said on Monday, as he marked the death of the man he identified as “the leader of the dark organisation”.

Once a key ally of Erdoğan, Gülen denied having a hand in the abortive coup, in which more than 300 people died and rebel soldiers bombed parliament with commandeered fighter jets.

He remained in the US, where had he lived since 1999 and was increasingly depicted by Erdoğan as his principal enemy.

In Turkey the president intensified a crackdown against Gülen supporters who remained in the country after 2016. Erdoğan purged hundreds of thousands of people with suspected Gülenist links from state jobs, jailed tens of thousands more and seized banks, media outlets and other companies worth billions of dollars.

Turkish authorities claim Gülen’s network remains active within the country, with police and prosecutors launching frequent raids against alleged members.

The network also maintains international activities. There were thought to be at least 150 US charter schools linked to it as recently as 2017, according to a US congressional report. Analysts say organisations with ties to the cleric have also been active in Africa.

The cause of Gülen’s death was not immediately known. He had initially said his move to the US was to receive medical treatment for conditions including diabetes and heart disease. He spent his last years at a sprawling compound in the Pocono Mountains in Pennsylvania.

During the movement’s peak, Gülen’s followers numbered somewhere between 500,000 and 4mn and provided the cleric with considerable political leverage beginning in the late 1980s.

Gülen dispatched volunteers to Central Asia and the Balkans after the fall of the Soviet Union to open up schools in what eventually became a global network that educated millions of people and expanded Turkish soft power.

But it was after Erdoğan came to power in 2003 that the movement emerged as a full-blown political force. Erdoğan’s Islamist-rooted politics made the Gülenists, who had quietly risen through the judiciary and security forces over decades, his natural allies.

They worked together to curtail the secularist military’s interventions in politics, primarily through a series of mass criminal trials that led to the jailing of hundreds of former and serving army officers and their allies.

Once they had vanquished their common foe, the two camps turned on each other. The power struggle came to a head in 2016. Turkish officials alleged that Gülen suspected Erdoğan would discharge loyal military officers at an annual council in August and attempted to pre-emptively seize power on July 15.

After a single night of violence, the coup attempt was defeated.

Additional reporting by Adam Samson and Funja Güler in Ankara

You must be logged in to post a comment Login