A judgment on the Legacy Act was issued by the Northern Ireland Court of Appeal, not the NI High Court as wrongly stated in an article on September 21. The appeal court criticised provisions that would give the NI secretary of state discretion over information to be released by the Independent Commission for Reconciliation and Information Recovery, not to the ICRIR as originally stated.

Business

Correction: Legacy Act

Business

How extremist settlers in the West Bank became the law

This is an audio transcript of the FT News Briefing podcast episode: ‘How extremist settlers in the West Bank became the law’

Sonja Hutson

Good morning from the Financial Times. Today is Friday, September 27th, and this is your FT News Briefing. The Labour party might U-turn on a major policy plan. And Saudi Arabia is admitting defeat on its oil price goals. Plus, the FT’s Allison Killing explains how Palestinians in the West Bank are experiencing more violence. I’m Sonja Hutson, and here’s the news you need to start your day.

[MUSIC PLAYING]

UK chancellor Rachel Reeves is thinking about scrapping her plan to claw back taxes from wealthy foreigners. That’s what officials said yesterday. You see, foreigners who live in the UK but say they have permanent homes abroad, also known as non-doms, benefit from some juicy tax perks. And Reeves promised to get rid of this. She said the move would raise £1bn each year, but now it’s looking like the numbers maybe don’t add up. Tax advisers are warning that wealthy residents are considering leaving the UK. No final call has been made yet, but Reeves was counting on the funds from the plan for Labour’s budget. That will be announced at the end of next month.

[MUSIC PLAYING]

Saudi Arabia seems to be giving up on its unofficial goal of $100 for a barrel of oil. For a while now, the world’s largest oil exporter has cut production in order to boost the price. But it hasn’t worked. Brent crude has averaged just $73 a barrel this month. So yesterday, Saudi Arabia said it was sticking with a plan to resume normal production on December 1st. Here to explain is Tom Wilson. He covers energy for the FT. Hey, Tom.

Tom Wilson

Hi.

Sonja Hutson

So first, can you give me some context about why Saudi Arabia cut oil production in the first place?

Tom Wilson

Yeah. So Saudi Arabia and the other members of the Opec+ cartel have often increased or decreased supply to meet the demand of the market. And since about November of 2022, the group has basically implemented a series of cuts for reduced production. And the main objective there was to try and maintain a period of higher prices. And that was particularly important for Saudi Arabia because under Crown Prince Mohammed bin Salman, the country’s embarked on a really ambitious economic reform program with a lot of huge megaprojects that need funding. And in order to pay for those projects, it’s much better for Saudi Arabia to have a higher price.

Sonja Hutson

But, you know, oil prices have not reached that unofficial $100 goal. And in fact, they’re very far from that. So why is Saudi Arabia in particular thinking about sticking with the original plan to increase production?

Tom Wilson

Look, look, you’re right. So we know our prices averaged about $99 a barrel in 2022 and then have been falling since. And really, Saudi Arabia and other Opec members have been trying to play a game of catch-up where they’ve kept either increasing or extending production cuts in an attempt to keep prices higher. And at the same time, you see the big increase in production from other parts of the world. So non-Opec+ producers like the US, Canada and Guyana have basically neutered the impact of the Saudi cuts. And the sense in the last few weeks in Riyadh is a growing recognition that basically enough’s enough. Well, let’s start to bring that supply back. While the kingdom remains, you know, incredibly dependent on the oil price for revenue, it does have other options available to it. And I think they really didn’t like this narrative that it developed in the market that they had effectively backed themselves into a corner and got to a position where they would never be able to bring back that supply.

Sonja Hutson

Yeah. So how have markets reacted to this shift in Saudi thinking?

Tom Wilson

There was a huge market reaction yesterday. So oil prices dropped about 2 per cent. Prices of the major oil producers dropped. And I think what that really showed is how jittery the market is about the strength of future demand. I mean, effectively, a shift in Saudi thinking is relatively subtle. I mean, they had already said that they would bring back production from the 1st of December. The problem was that the market didn’t really believe them. Saudi had delayed those production increases before, and many people in the market thought it would happen again. So this confirmation that Saudi is actually committed to starting to increase production again, that’s what could put the cat among the pigeons. And that is what has pushed the price down.

Sonja Hutson

Tom Wilson is the FT’s senior energy correspondent. Thanks, Tom.

Tom Wilson

Thanks very much.

[MUSIC PLAYING]

Sonja Hutson

The private credit boom doesn’t look like it’s slowing down anytime soon. Citigroup announced yesterday that it’s teaming up with asset manager Apollo to finance over $25bn worth of loans. That money will go to private equity groups and low-rated companies who might have trouble getting a more traditional bank loan. Citi has gotten some pretty serious private credit FOMO since asset managers started poaching some of its most lucrative customers. That’s because traditional banks like Citi have typically avoided riskier corners of the market. The loans will trickle out over the next few years, but Citi and Apollo hoped to hit $5bn in year one.

[MUSIC PLAYING]

Violence against Palestinians in the West Bank has been on the rise since Prime Minister Benjamin Netanyahu formed a coalition with far-right parties about two years ago. That’s according to data from the conflict-monitoring group Acled. And that violence has gotten even worse since Hamas attacked Israel last October. It’s part of what locals and activists say is a systematic campaign aimed at driving Palestinians off their lands. The FT’s visual investigations team looked at how this is playing out in one village called At-Tuwani. Alison Killing led that investigation and she joins me now. Hi, Alison.

Alison Killing

Hi there.

Sonja Hutson

So before we get into what you found in this investigation, can you lay out for folks just how the West Bank is set up?

Alison Killing

Sure. So the West Bank was occupied by Israel after the 1967 war. And it’s an area that the Palestinians see as the heart of a future Palestinian state. Under the Oslo Accords in the 90s, it was divided into these areas A, B and C. And we’ve been looking at area C, which has been the focus of settlers’ efforts to seize Palestinian land. So there’s about 179 Israeli settlements through that area. And those settlements are deemed to be illegal by the UN and by most countries. But the Israeli government is generally supporting them by, for example, building roads. And they provide services like water and electricity.

Sonja Hutson

And how has the violence escalated in this area since Hamas’s attack last October? I mean, what kind of examples have you seen?

Alison Killing

After the Hamas attack on October the 7th, the violence soared and it also became more extreme. So the FT’s special investigations team spoke to more than 20 villagers and Palestinian, Israeli and international activists about the violence that locals face, both from settlers and from the Israeli state. And we reviewed hours of footage of incidents, including those with firearms. We obtained a video from October the 13th of last year. So right after the Hamas attack. And a settler from the nearby settlement of Ma’on has come into At-Tuwani and he’s armed with a rifle. And a Palestinian man from the village called Zakariya Adra, he goes to confront the settler. We see the settler then go up to him and he pushes him back. And then suddenly he shoots him at point-blank range. And Zakariya collapses.

[AUDIO CLIP OF PEOPLE SCREAMING]

He’s very seriously injured. Throughout this shooting, there’s an Israeli soldier that we can see who’s standing in the background, and he’s not doing anything. He’s just standing there watching.

Sonja Hutson

And is that unusual for soldiers to be involved or witness this kind of violence?

Alison Killing

The big thing that the people that we spoke to said had changed since October the 7th last year is that thousands of settlers have been called up to serve in the Army in the West Bank. That’s because a lot of Israel’s regular army are now deployed to Gaza or to the border with Lebanon. And as a result, these settlers have been granted new enforcement powers, including the ability to arrest people, for example. So Acled, this international conflict-monitoring group, they noted that aggressive acts are now increasingly carried out by people who have this quasi-military status. So shortly after October the 7th, this new military style observation post was set up on Palestinians’ villagers land, which was close to At-Tuwani. The villagers that we spoke to tell us that now there were men in uniform who sat there around the clock. And one day these men, they started cutting the branches of fig trees and grape vines, which belong to the Hureini family. And one man from that family, Mohammad, went to challenge them and they threatened him with guns. And then they followed him back to the village.

[AUDIO CLIP OF GUNSHOTS]

And in the video that we’ve seen, they’re standing on top of a small hill between buildings and they’re shooting down into the village with some of the Palestinian villagers standing below.

Sonja Hutson

Allison, what have you heard from the Israeli military — you know, the Israel Defense Forces — about your investigation?

Alison Killing

So we put our findings to the IDF. They came back and they said that investigations had been opened by the Israeli police into both of the incidents in At-Tuwani that we’ve described. They said that they couldn’t provide details of an ongoing inquiry. But when they were commenting on the shooting of Zakariya, they said that a real-time examination revealed that the published video does not embody the incident in its entirety, and there are therefore no grounds to pursue further proceedings against the soldier.

Sonja Hutson

Just taking a step back, what do you think that this all tells us about how Israel views its relationship with Palestinians living in the West Bank? And how is that changing the situation on the ground there overall?

Alison Killing

Yeah. So Israeli society has shifted to the right a lot over the past couple of decades. And with that, support for the settlements has grown. And that’s become more extreme since Netanyahu returned to power in 2022. With his coalition, which is dependent on two far-right parties led by ultra nationalist settlers. So we spoke with a lawyer, an analyst called Diana Buttu, who previously advised the Palestinian president. And she just said, you know, once Palestinians lose their land, there’s no way to get it back. She said, once you’re gone, you’re gone. There’s just no turning back.

Sonja Hutson

Alison Killing is a senior reporter on the FT’s visual investigations team. Thanks so much, Alison.

Alison Killing

Well, thank you.

[MUSIC PLAYING]

Sonja Hutson

You can read more on all these stories for free when you click the links in our show notes. This has been your daily FT News Briefing. Check back next week for the latest business news. The FT News Briefing is produced by Neve Rowe, Fiona Symon, Kasia Broussalian, Marc Filippino and me, Sonja Hutson. Our engineer is Joseph Salcedo. We had help this week from Sam Giovinco, Breen Turner, David da Silva, Michael Lello, Peter Barber and Gavin Kallmann. Our executive producer is Topher Forhecz. Cheryl Brumley is the FT’s global head of audio. And our theme song is by Metaphor Music.

Travel

WeRide and Uber to bring autonomous vehicles to the UAE this year

Global leading autonomous driving technology company WeRide has teamed up with Uber Technologies, the world’s largest mobility and delivery technology platform, to bring WeRide’s autonomous vehicles onto the Uber platform, beginning in the United Arab Emirates

Business

China lifts investor hopes with promise of more support for economy

This article is an on-site version of our FirstFT newsletter. Subscribers can sign up to our Asia, Europe/Africa or Americas edition to receive the newsletter every weekday. Explore all of our newsletters here

Good morning. In today’s newsletter:

-

Saudi Arabia prepares to abandon its oil price target

-

China’s accelerating green transition

-

How a Chinese billionaire’s Silicon Valley splurge caught the FBI’s eye

But first, China’s leaders have vowed to intensify fiscal support for the world’s second-largest economy, raising market expectations for more intervention just days after the central bank announced the biggest monetary stimulus since the pandemic.

The politburo, led by President Xi Jinping, pledged yesterday to “issue and use” government bonds to better implement “the driving role of government investment”. The comments come as analysts warn that China is in danger of missing its official economic growth target this year.

The politburo usually does not hold economic sessions in September, suggesting “an increased sense of urgency” about growing deflationary pressures, Morgan Stanley analysts said.

But they said China’s government did not yet appear to have reached a “whatever it takes” moment on the economy. Here’s more on the politburo’s statement and how markets reacted.

And here’s what else I’m keeping tabs on today:

-

Economic data: Japan publishes August trade statistics and China reports industrial profit for the same month. On Sunday, Vietnam reports September inflation data and third-quarter GDP.

-

Japan leadership vote: The Liberal Democratic party holds a leadership vote, in effect deciding the new prime minister. Here’s the crowded field to succeed current premier Fumio Kishida, who said last month he would not seek re-election.

How well did you keep up with the news this week? Take our quiz.

Five more top stories

1. Exclusive: Saudi Arabia is ready to abandon its unofficial price target of $100 a barrel for crude as it prepares to increase output. The prospect of Riyadh ditching its target is a sign that the kingdom is resigned to a period of lower oil prices, according to people familiar with the country’s thinking.

2. A company backed by Clayton, Dubilier & Rice and Hellman & Friedman, BlackRock and Singapore’s GIC is preparing one of the largest debt-fuelled dividend payouts in private equity history. Belron, the world’s biggest windscreen repair company, is in talks with lenders to raise €8.1bn through new bonds and loans to finance the €4.4bn dividend.

3. New York City mayor Eric Adams has been charged with fraud and bribery over an alleged long-running scheme to solicit cash and luxury travel from Turkish government officials and other wealthy foreign donors. The explosive charges mark the first criminal case in modern history against a sitting New York mayor.

4. Israeli Prime Minister Benjamin Netanyahu vowed yesterday that Israel would press on with its offensive against Hizbollah in Lebanon, casting doubts on a US-led diplomatic push for a ceasefire to prevent a full-blown war. Netanyahu spoke in New York, where he is due to address the UN General Assembly today.

5. Global companies have stepped off the sidelines in recent months to pursue blockbuster takeovers of rivals, with high-profile transactions such as Mars’s purchase of Kellanova and Verizon’s takeover of Frontier Communications spurring hopes of a dealmaking revival. While the overall number of deals sank to a nine-year low, bankers said boardroom sentiment had become more optimistic.

The Big Read

The scale and pace of China’s transition from fossil fuels has smashed international forecasts, exceeded Beijing’s own targets and put the rest of the world on notice. But to wean the country off coal, Chinese authorities need to push through a politically toxic shake-up of the electricity system, a long and thorny process that has already dragged on for decades.

We’re also reading . . .

Graphic of the day

Could this radically shaped plane change the future of commercial flying by 2030? Inspired by the US Air Force’s B-2 stealth bomber, JetZero’s new aircraft promises to be both less noisy and more fuel-efficient.

Take a break from the news

We’re celebrating the 30th anniversary of our iconic Lunch with the FT with a free, pop-up newsletter. Receive our favourite Lunches from the archives in your inbox, featuring fresh insights from the interviewer. Join us for a weekly serving of Lunch starting this Sunday, until November.

Additional contributions from Gordon Smith and Tee Zhuo

Travel

First glimpse at new £300m theme park that’s set to open in the UK – but it has NO rides

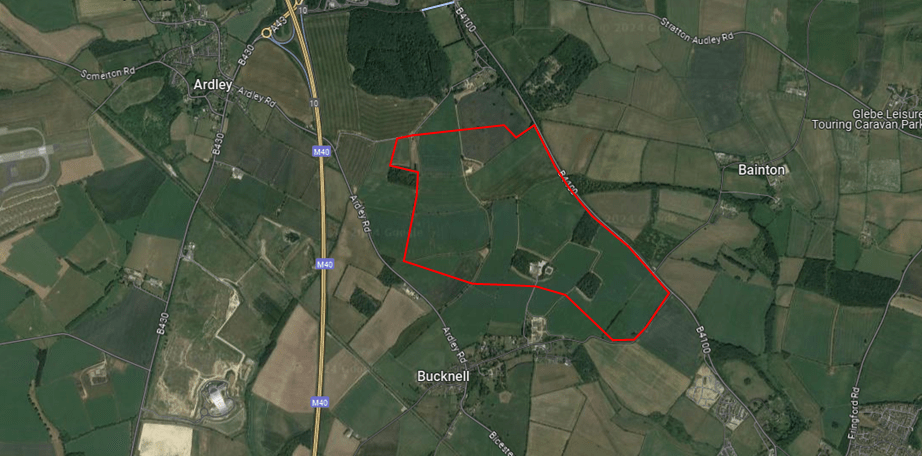

PLANS for a £300 million history-themed attraction spanning 400 acres of land have been unveiled – but there aren’t any rides.

The famous French theme park, Puy du Fou, revealed its interest in building a UK version of the resort last year.

Spread across hundreds of acres, the Cherwell site is expected to be situated near Oxford but after speculation the local council has made a statement.

Cherwell District Council have got involved, stressing that the plans which have brought about excitement, are still in the unofficial stage and have not been submitted to them.

A spokesperson from the council told MailOnline: “On Puy Du Fou from our side, we’ve not received an application from them.”

Despite this discovery, a public consultation was held in July with residents voicing their thoughts on the possible attraction near Bicester.

During that time, a Cherwell District Council spokesperson said: “We are aware that Puy du Fou is consulting with local communities as they prepare their plans.

“We wait with interest to see what proposals emerge. They will of course need to be submitted to us for consideration through the planning process.

“We encourage residents to take the opportunity to engage with the promoters to hear more and provide their input.”

It has already been predicted that the unveiling of such a park could offer up to 2,000 new jobs in the area as a result with the site potentially employing 700 people directly.

The UK has been a top pick of the French theme park giant after it revealed its intention to open two new sites before 2030.

Likely to be located just off the M40, the yet to be confirmed plans, would reflect the two locations in existence with the first being in western France and another in Toledo, Spain.

The latter only joined its predecessor in 2021, with the original park being open since 1978.

Previous proposals suggest that a UK version would celebrate British history and culture rather than being a carbon-copy to the French location which sees a multitude of themes.

From the Roman Empire, the Musketeers, the Vikings, Joan of Arc, the First World War and the pioneers of cinema, it seems the French counterpart would remain unique in its own right.

Chief executive of Puy du Fou, Olivier Strebelle, told Oxford Mail: “We are not an attraction like you have ever experienced before.

“We do not have any rides or rollercoasters; there are no neon flashing lights.

“Instead, we create an authentic, natural and historical environment set within beautiful gardens, which become the setting for world-class shows and immersive cultural and historical experiences for the whole family to enjoy.

“With Britain’s rich history, and with so many British people already visiting us in France and Spain, we have been looking for a site in the country for many years, and we have now identified the perfect location near Bicester in Oxfordshire.”

The Sun has approached Cherwell District Council for comment.

Use these tips on your next theme park trip

Next time you visit a theme park, you may want to use our top tips to make the most of your adrenaline-inducing day out.

- Go to the back of the theme park first. Rides at the front will have the longest queues as soon as it opens.

- Go on water rides in the middle of the day in the summer – this will cool you off when the sun is at its hottest.

- Download the park’s app to track which rides have the shortest queues.

- Visit on your birthday, as some parks give out “birthday badges” that can get you freebies.

- If it rains, contact the park. Depending on how much it rained, you may get a free ticket to return.

Business

Chinese equities on track for best week since 2008

US money market funds hit a new record of $6.4tn in the wake of last week’s Federal Reserve rate cut.

Inflows from institutional investors topped $113bn in the week to Wednesday, the largest weekly inflow since the height of the 2023 regional banking crisis, according to the Investment Company Institute.

Shelly Antoniewicz, deputy chief economist, said pension funds, endowments and other large investors were taking advantage of the fact that yields on money market funds react more slowly to rate cuts than those on short-term bonds and loans.

“On the institutional side, inflows to money market funds tend to ramp up during the easing cycle,” she said.

Business

Striving for a new balance for renters and landlords

The renters’ rights bill 2024, which had its first reading in the House of Commons earlier this month, is proposing the most significant changes to the private rental sector in decades, including the ending of “no fault” evictions (Report, September 12).

Fixed-term tenancies will be a thing of the past and the only way for landlords to regain possession of their properties will be to rely upon one or more of an expanded number of grounds for claims of possession. The grounds include that the landlord wants to occupy the property itself, wants to sell it or the tenant is in rental arrears.

One of the main concerns within the legal industry is how the court system will cope with the reform as noted by the British Property Federation.

The average timeline for obtaining possession has increased to 25 weeks. Our experience at Addleshaw Goddard is one of massive regional disparity. Recently a claim in Manchester has been dealt with in three months, whereas near identical claims in central London are taking eight months. And these claims have been under the current rules where no court hearing has been required.

Going forward, a hearing will be required for every possession claim. Without massive investment in the court system, we fear that these timescales will dramatically increase. This will have a knock-on impact for all claims (not just possession claims) going through the county court system and will further disincentivise private renting, particularly landlords with small portfolios who need to remove tenants that are disruptive or fail to pay rent.

The government hopes that the bill will level the playing field between landlords and tenants. The bill certainly gives tenants more rights, and this is important, but it must also strike a balance to ensure landlords are not discouraged from participating in the rental market.

Greg Simms

Real Estate Disputes Partner, Addleshaw Goddard

London EC1, UK

-

Womens Workouts3 days ago

Womens Workouts3 days ago3 Day Full Body Women’s Dumbbell Only Workout

-

News5 days ago

News5 days agoOur millionaire neighbour blocks us from using public footpath & screams at us in street.. it’s like living in a WARZONE – WordupNews

-

News1 week ago

News1 week agoYou’re a Hypocrite, And So Am I

-

Technology1 week ago

Technology1 week agoWould-be reality TV contestants ‘not looking real’

-

Sport1 week ago

Sport1 week agoJoshua vs Dubois: Chris Eubank Jr says ‘AJ’ could beat Tyson Fury and any other heavyweight in the world

-

Science & Environment1 week ago

Science & Environment1 week agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

Science & Environment1 week ago

Science & Environment1 week agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Science & Environment1 week ago

Science & Environment1 week agoHow to wrap your mind around the real multiverse

-

Science & Environment1 week ago

Science & Environment1 week agoSunlight-trapping device can generate temperatures over 1000°C

-

Science & Environment1 week ago

Science & Environment1 week ago‘Running of the bulls’ festival crowds move like charged particles

-

Science & Environment1 week ago

Science & Environment1 week agoHow to unsnarl a tangle of threads, according to physics

-

Science & Environment1 week ago

Science & Environment1 week agoLiquid crystals could improve quantum communication devices

-

Science & Environment1 week ago

Science & Environment1 week agoQuantum ‘supersolid’ matter stirred using magnets

-

Science & Environment1 week ago

Science & Environment1 week agoHyperelastic gel is one of the stretchiest materials known to science

-

Science & Environment1 week ago

Science & Environment1 week agoWhy this is a golden age for life to thrive across the universe

-

Science & Environment1 week ago

Science & Environment1 week agoPhysicists are grappling with their own reproducibility crisis

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoCardano founder to meet Argentina president Javier Milei

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoDZ Bank partners with Boerse Stuttgart for crypto trading

-

News1 week ago

News1 week agoIsrael strikes Lebanese targets as Hizbollah chief warns of ‘red lines’ crossed

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoEthereum is a 'contrarian bet' into 2025, says Bitwise exec

-

Womens Workouts6 days ago

Womens Workouts6 days agoBest Exercises if You Want to Build a Great Physique

-

Womens Workouts6 days ago

Womens Workouts6 days agoEverything a Beginner Needs to Know About Squatting

-

Science & Environment4 days ago

Science & Environment4 days agoMeet the world's first female male model | 7.30

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoBitcoin miners steamrolled after electricity thefts, exchange ‘closure’ scam: Asia Express

-

Science & Environment1 week ago

Science & Environment1 week agoQuantum forces used to automatically assemble tiny device

-

Science & Environment1 week ago

Science & Environment1 week agoNuclear fusion experiment overcomes two key operating hurdles

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoDorsey’s ‘marketplace of algorithms’ could fix social media… so why hasn’t it?

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoRedStone integrates first oracle price feeds on TON blockchain

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoBitcoin bulls target $64K BTC price hurdle as US stocks eye new record

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoCoinbase’s cbBTC surges to third-largest wrapped BTC token in just one week

-

News1 week ago

News1 week agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

News4 days ago

News4 days agoFour dead & 18 injured in horror mass shooting with victims ‘caught in crossfire’ as cops hunt multiple gunmen

-

Science & Environment1 week ago

Science & Environment1 week agoCaroline Ellison aims to duck prison sentence for role in FTX collapse

-

Science & Environment1 week ago

Science & Environment1 week agoNerve fibres in the brain could generate quantum entanglement

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoCrypto scammers orchestrate massive hack on X but barely made $8K

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoLow users, sex predators kill Korean metaverses, 3AC sues Terra: Asia Express

-

CryptoCurrency1 week ago

CryptoCurrency1 week ago‘No matter how bad it gets, there’s a lot going on with NFTs’: 24 Hours of Art, NFT Creator

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoSEC asks court for four months to produce documents for Coinbase

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoBlockdaemon mulls 2026 IPO: Report

-

Sport1 week ago

Sport1 week agoUFC Edmonton fight card revealed, including Brandon Moreno vs. Amir Albazi headliner

-

Business1 week ago

How Labour donor’s largesse tarnished government’s squeaky clean image

-

Technology1 week ago

Technology1 week agoiPhone 15 Pro Max Camera Review: Depth and Reach

-

Womens Workouts6 days ago

Womens Workouts6 days agoKeep Your Goals on Track This Season

-

Travel3 days ago

Travel3 days agoDelta signs codeshare agreement with SAS

-

Science & Environment1 week ago

Science & Environment1 week agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

Science & Environment1 week ago

Science & Environment1 week agoLaser helps turn an electron into a coil of mass and charge

-

CryptoCurrency1 week ago

CryptoCurrency1 week ago$12.1M fraud suspect with ‘new face’ arrested, crypto scam boiler rooms busted: Asia Express

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoCertiK Ventures discloses $45M investment plan to boost Web3

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoBeat crypto airdrop bots, Illuvium’s new features coming, PGA Tour Rise: Web3 Gamer

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoTelegram bot Banana Gun’s users drained of over $1.9M

-

News1 week ago

News1 week agoChurch same-sex split affecting bishop appointments

-

CryptoCurrency1 week ago

CryptoCurrency1 week ago‘Silly’ to shade Ethereum, the ‘Microsoft of blockchains’ — Bitwise exec

-

Business1 week ago

Thames Water seeks extension on debt terms to avoid renationalisation

-

Politics1 week ago

‘Appalling’ rows over Sue Gray must stop, senior ministers say | Sue Gray

-

News1 week ago

News1 week agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

Womens Workouts6 days ago

Womens Workouts6 days agoHow Heat Affects Your Body During Exercise

-

News5 days ago

News5 days agoWhy Is Everyone Excited About These Smart Insoles?

-

Womens Workouts3 days ago

Womens Workouts3 days ago3 Day Full Body Toning Workout for Women

-

Health & fitness1 week ago

Health & fitness1 week agoThe secret to a six pack – and how to keep your washboard abs in 2022

-

News1 week ago

News1 week ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

CryptoCurrency1 week ago

CryptoCurrency1 week ago2 auditors miss $27M Penpie flaw, Pythia’s ‘claim rewards’ bug: Crypto-Sec

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoLouisiana takes first crypto payment over Bitcoin Lightning

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoJourneys: Robby Yung on Animoca’s Web3 investments, TON and the Mocaverse

-

Science & Environment1 week ago

Science & Environment1 week agoQuantum time travel: The experiment to ‘send a particle into the past’

-

CryptoCurrency1 week ago

CryptoCurrency1 week ago‘Everything feels like it’s going to shit’: Peter McCormack reveals new podcast

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoSEC sues ‘fake’ crypto exchanges in first action on pig butchering scams

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoBitcoin price hits $62.6K as Fed 'crisis' move sparks US stocks warning

-

Science & Environment1 week ago

Science & Environment1 week agoBeing in two places at once could make a quantum battery charge faster

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoVonMises bought 60 CryptoPunks in a month before the price spiked: NFT Collector

-

Science & Environment1 week ago

Science & Environment1 week agoWhy we need to invoke philosophy to judge bizarre concepts in science

-

Science & Environment1 week ago

Science & Environment1 week agoHow one theory ties together everything we know about the universe

-

Science & Environment1 week ago

Science & Environment1 week agoUK spurns European invitation to join ITER nuclear fusion project

-

Science & Environment1 week ago

Science & Environment1 week agoHow do you recycle a nuclear fusion reactor? We’re about to find out

-

Science & Environment1 week ago

Science & Environment1 week agoTiny magnet could help measure gravity on the quantum scale

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoVitalik tells Ethereum L2s ‘Stage 1 or GTFO’ — Who makes the cut?

-

Technology1 week ago

Technology1 week agoFivetran targets data security by adding Hybrid Deployment

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoEthereum falls to new 42-month low vs. Bitcoin — Bottom or more pain ahead?

-

News1 week ago

News1 week agoBrian Tyree Henry on his love for playing villains ahead of “Transformers One” release

-

Womens Workouts6 days ago

Womens Workouts6 days agoWhich Squat Load Position is Right For You?

-

News6 days ago

News6 days agoBangladesh Holds the World Accountable to Secure Climate Justice

-

Politics1 week ago

Politics1 week agoTrump says he will meet with Indian Prime Minister Narendra Modi next week

-

Technology1 week ago

Technology1 week agoCan technology fix the ‘broken’ concert ticketing system?

-

Health & fitness1 week ago

Health & fitness1 week agoThe maps that could hold the secret to curing cancer

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoHelp! My parents are addicted to Pi Network crypto tapper

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoCZ and Binance face new lawsuit, RFK Jr suspends campaign, and more: Hodler’s Digest Aug. 18 – 24

-

Science & Environment1 week ago

Science & Environment1 week agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

Science & Environment1 week ago

Science & Environment1 week agoSingle atoms captured morphing into quantum waves in startling image

-

Science & Environment1 week ago

Science & Environment1 week agoFuture of fusion: How the UK’s JET reactor paved the way for ITER

-

Fashion Models1 week ago

Fashion Models1 week agoMixte

-

Politics1 week ago

Politics1 week agoLabour MP urges UK government to nationalise Grangemouth refinery

-

Money7 days ago

Money7 days agoBritain’s ultra-wealthy exit ahead of proposed non-dom tax changes

-

Womens Workouts6 days ago

Womens Workouts6 days agoWhere is the Science Today?

-

Womens Workouts6 days ago

Womens Workouts6 days agoSwimming into Your Fitness Routine

-

News1 week ago

News1 week agoBrain changes during pregnancy revealed in detailed map

-

Science & Environment1 week ago

Science & Environment1 week agoA slight curve helps rocks make the biggest splash

-

News1 week ago

News1 week agoRoad rage suspects in custody after gunshots, drivers ramming vehicles near Boise

-

Science & Environment1 week ago

Science & Environment1 week agoHow Peter Higgs revealed the forces that hold the universe together

-

Science & Environment1 week ago

Science & Environment1 week agoA tale of two mysteries: ghostly neutrinos and the proton decay puzzle

-

Politics1 week ago

Politics1 week agoLib Dems aim to turn election success into influence

-

CryptoCurrency1 week ago

CryptoCurrency1 week agoDecentraland X account hacked, phishing scam targets MANA airdrop

You must be logged in to post a comment Login