A gas explosion at a coal mine in southeastern Iran has killed at least 33 people and about 20 others are believed to be trapped underground, state media reported on Sunday.

The death toll could be higher as local media, including the semi-official Tasnim news agency which is affiliated with the elite Revolutionary Guards, have reported a figure of 51 killed.

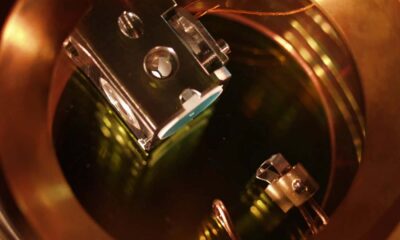

The blast, thought to have been caused by a sudden release of methane gas that then triggered a chain reaction, occurred on Saturday evening in one of the mine’s tunnels.

The incident happened as 69 miners were working in two sections of the privately owned mine operated by Madanjoo company in Tabas, a desert town about 540km south-east of Tehran.

Rescue efforts have been hampered by dangerously high levels of methane gas, with emergency services struggling to reach affected areas almost 500 metres underground. The concentration of methane remains a critical obstacle, preventing further entry into the mine, state television reported.

Iran’s President Masoud Pezeshkian, before he departed for the UN General Assembly in New York, ordered ministries to dispatch additional rescue teams to the site. Iran’s judiciary has also launched a full investigation into the incident, vowing to hold those responsible accountable.

The Tabas mine is one of the largest coal mining operations in Iran, a country rich in natural resources but whose mining sector has been stunted by a lack of foreign investment, largely due to US-imposed sanctions.

Saeed Samadi, secretary of the country’s coal association, told local media that coal mines generally suffered from inadequate equipment and he criticised the government for not allocating any budget for mine safety since last year.

However, he added that the Tabas mine had high compliance with technical and safety standards, having received no safety warnings in the past 20 years and importing top-quality equipment.

“It is too early to draw conclusions about the incident, but my 30 years of experience suggest that a sudden gas explosion is likely the cause of this large-scale incident,” he said.

“The Tabas mine accident appears to have occurred above the workers in one of the workshops and the explosion was so extensive that it resulted in a high number of fatalities, including the death of the mine’s safety manager.”

Previous major mining incidents in Iran include a similar coal mine explosion in 2017 that claimed the lives of at least 42 people.

You must be logged in to post a comment Login