Business

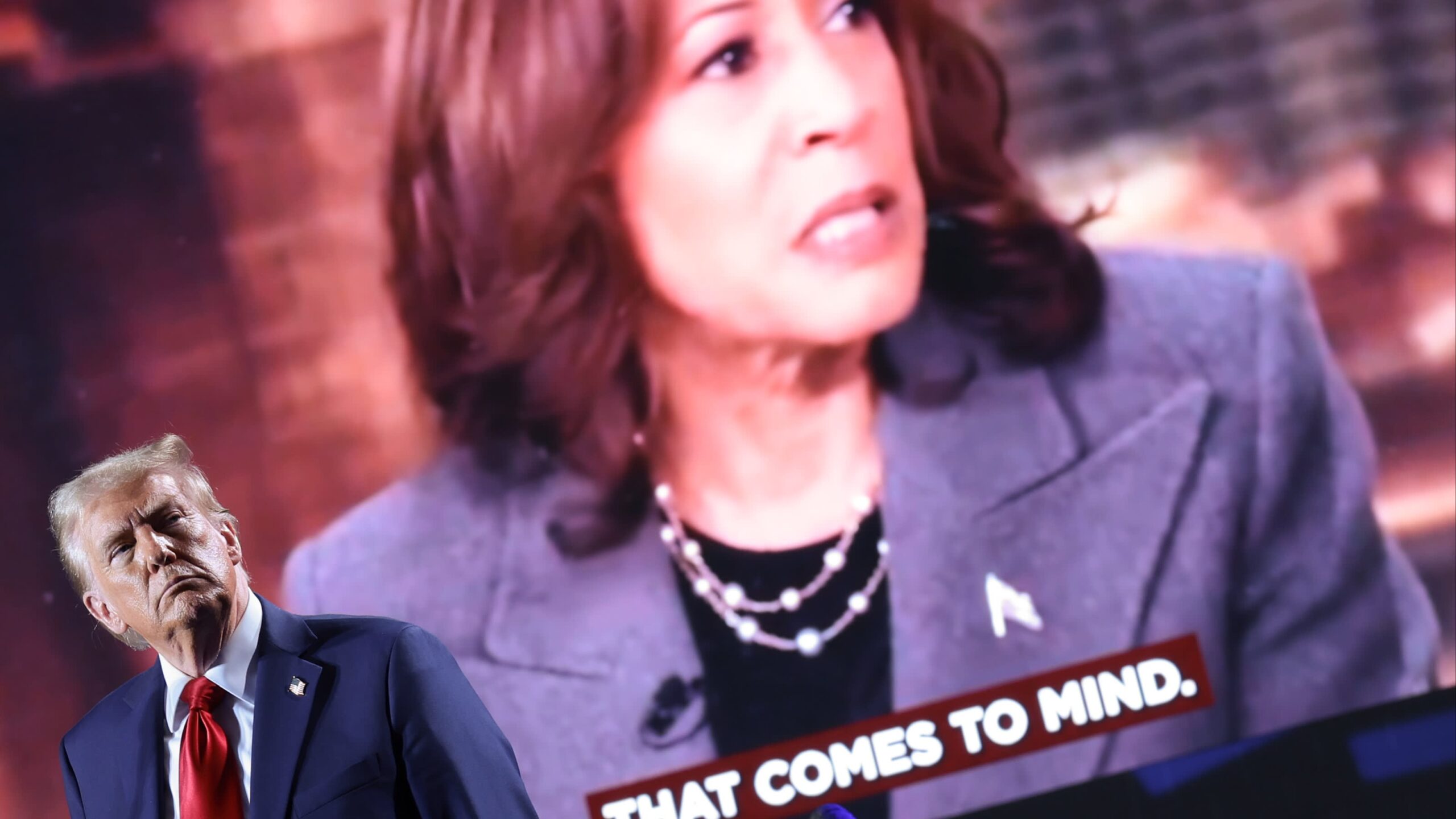

FirstFT: US voters trust Trump more than Harris with economy, FT-Michigan Ross poll shows

Also in today’s newsletter, Tesla’s turnaround and commercial property’s moment of truth

Money

Diary of an aspiring adviser: Tackling imposter syndrome

Apparently, one third of people are suffering from imposter syndrome at any given time, and 70% will experience it at some point.

Apparently, one third of people are suffering from imposter syndrome at any given time, and 70% will experience it at some point.

My former career as a scientist wasn’t all bad, but one example stands out as a low point. I don’t know if it was the origin of my imposter syndrome. But it certainly didn’t help.

Halfway through my PhD, I was giving my first talk at an international conference. After I’d finished, the floor was opened up to questions.

The best advice I’ve received is to remember that no one is perfect

The first hand raised was that of an older researcher and it turned out he didn’t really have a question; he just wanted to tell me and the rest of the audience that he thought my work was pointless. Although I’m not opposed to criticism, I do think it needs to be constructive.

It was easy, as a scientist, to feel like you were never doing enough — surrounded by professors and fast-rising superstars, all experts in their field. I remember worrying I wasn’t good enough and I would be exposed as a fraud.

I’m grateful my experience since changing to the advice profession has been one of night and day.

Whenever I have interacted with people in the wider industry, whether in a random email, at a conference or picking their brain over a coffee, I have been met with overwhelmingly helpful, friendly responses.

I’ve got better at recognising when negative thoughts start gnawing away at me

Contrast the above presenting experience with my first at a financial planning conference. Everyone was very welcoming, no one was rude and I even had several people approach me afterwards just to let me know they had liked the talk.

At work, I am hugely fortunate to have a supportive boss and leadership team, and a friendly group of colleagues.

Nevertheless, despite all these positive experiences I have had since changing career, imposter syndrome never completely goes away. I may have a great day, or even a great week, at work, but that doesn’t stop doubts creeping in the following week.

While I haven’t found the secret to eliminating imposter syndrome, I have taken steps to reduce it.

I’ve realised I need to stop comparing myself to others. There will always be someone better than you, but everyone is on their own journey and has their own trials.

One third of people are suffering from imposter syndrome at any given time

I’ve also got better at recognising when negative thoughts start gnawing away at me, and remembering that other people also experience this.

Finally, I think the best advice I’ve received to overcome it is to remember that no one is perfect — neither myself, nor the grouchy guy who didn’t like my work all those years ago!

Ryan Sharpe is a paraplanner at Almond Financial

This article featured in the October 2024 edition of Money Marketing.

If you would like to subscribe to the monthly magazine, please click here.

Business

What happened to Ratan Tata’s authorised biography that HarperCollins acquired in a record deal

Though Ratan Tata remained a titan in India Inc, no movie was ever made on him. He has penned several books about leadership and innovation, but for those eager to read about the entrepreneur’s life, the tidbits only came from his rare interviews and biographies.

But, the reports about his first authorised biography generated huge buzz after HarperCollins acquired the deal for a price of Rs 2 crore, a record in the history of non-fiction publishing in India.

Titled Ratan N. Tata: A Life, written by former senior bureaucrat and retired IAS officer Thomas Mathew, was tipped as the most anticipated release of the year 2023. It was said that the book contained anecdotes of Ratan Tata from interviewees who range from US Secretary of State Henry Kissinger to Karuna to the janitor at GT Hospital, Mumbai.

The fact that Mathew had access to the private papers, correspondence and photographs of Ratan Tata over the past decades made it a much-anticipated read.

Harper Collins had initially planned to release the book on November 2022, which was later pushed to March 30 2023, However, they had to further defer the release date to February 5. The release did not happen and the publisher has not yet given any update.

Though Mathew had shared the manuscript with Ratan Tata in 2022, reports indicated that his close aides, including some of the family members, were still considering the material that would be published in the book.

“Less than half a dozen people know the real reason behind the delay,” an executive with the publisher told The Mint in February. He added that a man of Ratan Tata’s stature needed time to process all that should be published. “Before you conclude on what parts are being objected to, please appreciate that this is an authorised book,” he said, adding that the author and the publisher have no objection to removing anything.

The book is also said to have contained details of Tata’s personal life and unreported events that led to the ouster of former Tata Sons chairman Cyrus Mistry.

Money

Thousands of dead pensioners sent winter fuel payment letters leaving grieving families horrified

THOUSANDS of dead pensioners have been sent winter fuel payment letters, leaving grieving families “horrified”.

The winter fuel payment was previously available to everyone aged 66 and above, the current State Pension age.

But in July the Government announced the payment would become means-tested meaning only those on certain benefits are eligible.

This includes those on income support, tax credits, Universal Credit, and largely Pension Credit.

This means that around 10million pensioners will no longer get the cash, which can be worth up to £300.

The Department for Work and Pensions (DWP) is now writing to 13.5million pensioners to alert them to the changes and also to let them know if they might be eligible for pension credit.

However, it’s understood that some letters are being sent to pensioners who have died – despite grieving families having told the DWP about their deaths already.

This is what happened to one woman, who then took to X, formerly known as Twitter, to voice her frustration.

Frances Coppola, a writer and economist, reported that she had received a letter about changes to the winter fuel payment from the DWP intended for her partner.

But she had already informed the government that he had died on September 19.

Ms Coppola said the letter was advising her partner that he could apply for pension credit to be backdated by up to three months – making him eligible for the cash payment.

Writing on X she said: “My partner’s state pension has already been stopped. I did not understand why they were writing to him about WFP, since clearly they knew he was dead.”

Ms Coppola then complained to the DWP about the letter and was told that letters were being sent out to all “who had ever made a claim” for the WFP – alive or not.

“So thousands of bereaved spouses, partners and relatives are receiving these letters,” she Tweeted.

This was to ensure as many people as possible find out about the changes to WFP, Ms Coppola was told.

She added: “DWP is ignoring official notifications of death and literally spamming the relatives of deceased WFP claimants. I am horrified.”

According to the DWP a representative of the deceased can call or email the department to report the death of a customer.

Once that’s happened, the department will then work with them, following what’s called a death arrears process.

This involves contacting the representative to gather information or confirm details to make sure the department holds the correct information to make a death arrears payment.

A DWP spokesperson said: “We are looking into what happened in this case and apologise for any distress caused.

“More broadly we are committed to ensuring pensioners are aware of the changes to the winter fuel payment and the wider support that is available to them.

“We are issuing letters to around 13.5 million pensioners and our drive to boost take up of Pension Credit has seen a 152% increase in claims, with other pensioners are also benefiting from the Warm Homes Discount and our extension of the Household Support Fund to help with their energy bills.”

The Sun’s Winter Fuel S.O.S Campaign

THE Sun’s Winter Fuel SOS Campaign is here to support households during these challenging times.

Due to government cutbacks, ten million pensioners are set to lose the £300 Winter Fuel Payment.

Since opening our phone lines to thousands of pensioners in October, we remain dedicated to providing tips and advice on how to stretch your finances further.

That’s why we have partnered with the poverty charity Turn2Us to launch a free benefits checker, helping you ensure that you are claiming all the benefits to which you are entitled.

Don’t miss our latest Sun Money coverage, which includes essential information on key deadlines, applying for support, and everything you need to know about Pension Credit.

If you have a story to share or wish to get in touch with our team, please email us at money-sm@news.co.uk.

Tom Selby, director of public policy at investment firm AJ Bell told The Sun that this “blanket approach” risks causing even more grief.

He said: “While the DWP’s desperation to boost take-up of the WFP among those who are eligible is understandable, taking a blanket approach risks creating extra admin stress for people at what will inevitably already be a really difficult time.

“If the government has the correct information about people, including whether or not they are still alive and likely to be entitled to the payment, then it should be using that information to make sure things like this don’t happen.”

“The response from the individual at DWP in this case, not to mention the convoluted process the individual had to go through, is particularly unforgivable and falls well below the standards most people would expect.”

Tom added that this isn’t the first time the DWP’s admin systems have been found wanting and “they need to get their house in order as a matter of urgency”.

What is the winter fuel payment and who is eligible?

The winter fuel payment is issued to state pensioners on certain benefits to help cover the cost of hiked-up energy bills over the colder months.

This is because households tend to use more energy for heating as temperatures drop.

The payment, which is made in November or December, is automatic meaning you don’t need to apply.

Those on Universal Credit with a joint claim where one member was over the state pension age previously had to apply to get the payment.

To automatically qualify this year, you need to be of state pension age and in receipt of one of the following benefits:

- Pension Credit

- Universal Credit

- income-related Employment and Support Allowance (ESA)

- income-based Jobseeker’s Allowance (JSA)

- Income Support

- Child Tax Credit

- Working Tax Credit

You must have an active claim for these benefits during the “qualifying week” which is from September 16 to 22 this year.

You only need to apply this year if:

- you moved to an eligible country before January 1, 2021

- you were born before September 23, 1958

- you have a genuine and sufficient link to the UK – this can include having lived or worked in the UK and having family in the UK

Households can claim by phone from October 28 via the number 0800 731 0160.

They have until March 31, 2025 to do this.

Or to claim by post, you’ll need to fill in the winter fuel payment claim form and post it to the Winter Fuel Payment Centre.

This is available at www.gov.uk/winter-fuel-payment/how-to-claim.

What energy bill help is available?

There’s a number of different ways to get help paying your energy bills if you’re struggling to get by.

If you fall into debt, you can always approach your supplier to see if they can put you on a repayment plan before putting you on a prepayment meter.

This involves paying off what you owe in instalments over a set period.

If your supplier offers you a repayment plan you don’t think you can afford, speak to them again to see if you can negotiate a better deal.

Several energy firms have grant schemes available to customers struggling to cover their bills.

But eligibility criteria vary depending on the supplier and the amount you can get depends on your financial circumstances.

For example, British Gas or Scottish Gas customers struggling to pay their energy bills can get grants worth up to £2,000.

British Gas also offers help via its British Gas Energy Trust and Individuals Family Fund.

You don’t need to be a British Gas customer to apply for the second fund.

EDF, E.ON, Octopus Energy and Scottish Power all offer grants to struggling customers too.

Thousands of vulnerable households are missing out on extra help and protections by not signing up to the Priority Services Register (PSR).

The service helps support vulnerable households, such as those who are elderly or ill, and some of the perks include being given advance warning of blackouts, free gas safety checks and extra support if you’re struggling.

Get in touch with your energy firm to see if you can apply.

More energy help for pensioners

In response to the government’s slash to the winter fuel payments, Octopus Energy has launched a scheme offering discretionary credit of between £50 and £200 to pensioners.

British Gas has also set aside over £140 million this winter for its Individual and Families Support Fund.

And Scottish Power‘s Hardship Fund has handed out more than £60 million to its struggling customers.

To find out what you can get, check the offers from your own supplier first by going to their website or asking someone on the phone.

Most schemes are exclusive to customers, but the British Gas Individual and Families fund is available to everyone if your own supplier can’t help.

Help can also be accessed from your local council via the Household Support Fund, which has renewed a fresh pot of £421million for vulnerable households.

To find out if you are eligible, go to your council’s website and read over the conditions of the scheme.

If you’re just looking for simple ways to reduce your bill this winter, each of these supplier schemes, as well as the Household Support Fund also offer free electric blankets as part of their deal.

For example, Octopus has said they will distribute 20,000 electric blankets from Dreamland to its most vulnerable customers, keeping them warm for “as little as 3p an hour”.

The “heat yourself not your home” approach is trending fast, with retailers such as B&M introducing ranges of affordable self-heating appliances.

However, it is important to note that the elderly should not avoid turning the heating on if they are cold – for energy help contact your provider or local council, or read our article here.

Do you have a money problem that needs sorting? Get in touch by emailing money-sm@news.co.uk.

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories

Business

Bloomsbury to beat expectations on ‘romantasy’ boom

Publisher reports best-ever first half as sales of authors such as Sarah J Maas and JK Rowling continue to soar

Money

The Morning Briefing: Value of ‘lost’ pension pots hits £31bn; diary of an aspiring adviser

Good morning and welcome to your Morning Briefing for Thursday 24 October 2024. To get this in your inbox every morning click here.

Value of ‘lost’ pension pots hits £31bn

The total value of ‘lost’ pension pots is now estimated to be £31.1bn, new data published by the Pensions Policy Institute (PPI) reveals.

This has risen by £4.5bn, from £26.6bn in 2022.

Almost 3.3 million pension pots are now considered lost, containing an average sum of £9,470.

Diary of an aspiring adviser

In this ‘Diary of an aspiring adviser’ column, Almond Financial paraplanner Ryan Sharpe recalls feeling imposter syndrome in their former career as a scientist when someone at an international conference said they though their work was pointless.

“I’m grateful my experience since changing to the advice profession has been one of night and day,” said Sharpe.

“Whenever I have interacted with people in the wider industry, whether in a random email, at a conference or picking their brain over a coffee, I have been met with overwhelmingly helpful, friendly responses.”

Wealthtime platform upgrade

Wealthtime has partnered with tech firm Wipro and software provider GBST on its platform technology upgrade.

The partnership will see the Wealthtime and Wealthtime Classic platforms brought together under one brand on a significantly enhanced platform.

Wipro and GBST will employ a joint co-delivery model to provide end-to-end platform services.

Quote Of The Day

Given the severity of the pandemic, we were always likely to see an improvement in life expectancy from the darkest days of 2020

– Stephen Lowe, group communications director at Just Group, comments on figures published by ONS reveal a bounce back in life expectancy in 2021-23.

Stat Attack

UK dividends fell to £25.6bn in the third quarter of 2024, according to the latest Dividend Monitor published by global financial services company Computershare.

£25.6bn

The amount UK dividends fell to during the third quarter.

8.1%

This was down 8.1% on a headline basis.

£25.3bn

Regular dividends, which exclude one-off special dividends, were down 3.5% to £25.3bn on a constant-currency basis.

4.5%

Median (or typical) growth at the company level was 4.5%.

3.6%

Mid-cap companies posted better underlying growth than the top 100 (4.4%) firms, reflecting ‘greater sensitivity to a resilient UK economy’.

Source: Computershare

In Other News

The Income Protection Task Force (IPTF) has announced its plans for 2025.

Next year will see the organisation restructure including the introduction of a Board to provide professional oversight.

Andrew Wibberley will step down as co-chair after four years, with Jo Miller becoming managing director and board chair, and Vicky Churcher becoming executive director and vice chair.

Commenting on his departure, Wibberley said: “In the last four years the shift from people working on IP because they felt they ought to, to people suffering FOMO if they’re not involved, has been great to see. Most importantly, this is translating into more people protecting their incomes, which is a fantastic thing.

“I’m looking forward to seeing the results of the next exciting things coming out of the IPTF and those sales continuing to grow.”

The plans outlined will also see the continuation of some of the organisation’s key work, including 7Advisers, IPAW, workstream meetings and the return of the Let’s Talk IP podcast.

Additionally, the group outlined plans for several projects for the year ahead focused on the organisation’s key objectives: education, collaboration and insight.

The news follows a busy year for IPTF so far, which has seen the continuation of the 7Advisers project, a celebration of the 7Families ten-year anniversary, the launching of the Let’s Talk IP podcast and profile of an income protection customer and the hosting of another Income Protection Action Week.

Reeves to announce major change to fiscal rules releasing £50bn for spending (The Guardian)

Nvidia CEO targets more India growth through fresh partnerships (Bloomberg)

Barclays third-quarter profit beats forecasts with 18% rise (Reuters)

Did You See?

M&G has launched its first sustainable corporate bond strategy in collaboration with responsAbility, the Swiss-based asset manager.

The M&G (Lux) responsAbility Sustainable Solutions Bond Fund has been designed following active engagement with institutional and wholesale investors seeking sustainable active fixed-income strategies.

The fund, which is classified as Article 9 under the EU’s Sustainable Finance Disclosure Regulation, will leverage M&G’s deep credit expertise and responsAbility’s long-standing track record on impact and sustainable investing.

It will be co-managed by Mario Eisenegger and Ben Lord, who are long-standing members of M&G’s €161bn global fixed-income investment division.

Travel

Philippine Airlines to move into New Terminal One at JFK

PAL becomes the first Southeast Asian airline and 10th carrier overall to commit to operations at the new terminal

Continue reading Philippine Airlines to move into New Terminal One at JFK at Business Traveller.

-

Science & Environment1 month ago

Science & Environment1 month agoHyperelastic gel is one of the stretchiest materials known to science

-

Technology4 weeks ago

Technology4 weeks agoIs sharing your smartphone PIN part of a healthy relationship?

-

Science & Environment1 month ago

Science & Environment1 month ago‘Running of the bulls’ festival crowds move like charged particles

-

Science & Environment1 month ago

Science & Environment1 month agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Science & Environment1 month ago

Science & Environment1 month agoHow to unsnarl a tangle of threads, according to physics

-

Technology1 month ago

Technology1 month agoWould-be reality TV contestants ‘not looking real’

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoX-rays reveal half-billion-year-old insect ancestor

-

Science & Environment1 month ago

Science & Environment1 month agoSunlight-trapping device can generate temperatures over 1000°C

-

Science & Environment1 month ago

Science & Environment1 month agoLiquid crystals could improve quantum communication devices

-

Technology3 weeks ago

Technology3 weeks agoUkraine is using AI to manage the removal of Russian landmines

-

Science & Environment1 month ago

Science & Environment1 month agoQuantum ‘supersolid’ matter stirred using magnets

-

Womens Workouts1 month ago

Womens Workouts1 month ago3 Day Full Body Women’s Dumbbell Only Workout

-

TV3 weeks ago

TV3 weeks agoসারাদেশে দিনব্যাপী বৃষ্টির পূর্বাভাস; সমুদ্রবন্দরে ৩ নম্বর সংকেত | Weather Today | Jamuna TV

-

News3 weeks ago

News3 weeks agoMassive blasts in Beirut after renewed Israeli air strikes

-

Science & Environment1 month ago

Science & Environment1 month agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

Science & Environment1 month ago

Science & Environment1 month agoLaser helps turn an electron into a coil of mass and charge

-

Science & Environment1 month ago

Science & Environment1 month agoWhy this is a golden age for life to thrive across the universe

-

Technology3 weeks ago

Technology3 weeks agoSamsung Passkeys will work with Samsung’s smart home devices

-

Business3 weeks ago

Business3 weeks agoWhen to tip and when not to tip

-

Football3 weeks ago

Football3 weeks agoRangers & Celtic ready for first SWPL derby showdown

-

News3 weeks ago

News3 weeks ago▶ Hamas Spent $1B on Tunnels Instead of Investing in a Future for Gaza’s People

-

Technology3 weeks ago

Technology3 weeks agoMicrophone made of atom-thick graphene could be used in smartphones

-

News3 weeks ago

News3 weeks agoNavigating the News Void: Opportunities for Revitalization

-

Science & Environment1 month ago

Science & Environment1 month agoQuantum forces used to automatically assemble tiny device

-

Science & Environment1 month ago

Science & Environment1 month agoA slight curve helps rocks make the biggest splash

-

Science & Environment1 month ago

Science & Environment1 month agoNerve fibres in the brain could generate quantum entanglement

-

MMA2 weeks ago

MMA2 weeks ago‘Uncrowned queen’ Kayla Harrison tastes blood, wants UFC title run

-

Sport3 weeks ago

Sport3 weeks agoWales fall to second loss of WXV against Italy

-

Science & Environment1 month ago

Science & Environment1 month agoHow to wrap your mind around the real multiverse

-

Technology1 month ago

Technology1 month agoMeta has a major opportunity to win the AI hardware race

-

Science & Environment1 month ago

Science & Environment1 month agoPhysicists have worked out how to melt any material

-

Science & Environment1 month ago

Science & Environment1 month agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

Science & Environment1 month ago

Science & Environment1 month agoNuclear fusion experiment overcomes two key operating hurdles

-

News1 month ago

News1 month ago▶️ Hamas in the West Bank: Rising Support and Deadly Attacks You Might Not Know About

-

MMA3 weeks ago

MMA3 weeks agoJulianna Peña trashes Raquel Pennington’s behavior as champ

-

Business3 weeks ago

DoJ accuses Donald Trump of ‘private criminal effort’ to overturn 2020 election

-

MMA3 weeks ago

MMA3 weeks agoPereira vs. Rountree prediction: Champ chases legend status

-

Sport3 weeks ago

Sport3 weeks agoBoxing: World champion Nick Ball set for Liverpool homecoming against Ronny Rios

-

Sport3 weeks ago

Sport3 weeks agoMan City ask for Premier League season to be DELAYED as Pep Guardiola escalates fixture pile-up row

-

News1 month ago

News1 month ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

Technology4 weeks ago

Technology4 weeks agoWhy Machines Learn: A clever primer makes sense of what makes AI possible

-

Science & Environment1 month ago

Science & Environment1 month agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

MMA3 weeks ago

MMA3 weeks agoDana White’s Contender Series 74 recap, analysis, winner grades

-

Technology3 weeks ago

Technology3 weeks agoThis AI video generator can melt, crush, blow up, or turn anything into cake

-

Technology3 weeks ago

Technology3 weeks agoMusk faces SEC questions over X takeover

-

News3 weeks ago

News3 weeks ago‘Blacks for Trump’ and Pennsylvania progressives play for undecided voters

-

News3 weeks ago

News3 weeks agoFamily plans to honor hurricane victim using logs from fallen tree that killed him

-

News1 month ago

the pick of new debut fiction

-

News1 month ago

News1 month agoOur millionaire neighbour blocks us from using public footpath & screams at us in street.. it’s like living in a WARZONE – WordupNews

-

Sport3 weeks ago

Sport3 weeks agoWorld’s sexiest referee Claudia Romani shows off incredible figure in animal print bikini on South Beach

-

Technology3 weeks ago

Technology3 weeks agoMicrosoft just dropped Drasi, and it could change how we handle big data

-

Technology3 weeks ago

Technology3 weeks agoThe best budget robot vacuums for 2024

-

MMA3 weeks ago

MMA3 weeks agoPereira vs. Rountree preview show live stream

-

Business3 weeks ago

Business3 weeks agoChancellor Rachel Reeves says she needs to raise £20bn. How might she do it?

-

Business3 weeks ago

Sterling slides after Bailey says BoE could be ‘a bit more aggressive’ on rates

-

Money3 weeks ago

Money3 weeks agoWetherspoons issues update on closures – see the full list of five still at risk and 26 gone for good

-

Technology3 weeks ago

Technology3 weeks agoThe best shows on Max (formerly HBO Max) right now

-

Entertainment3 weeks ago

Entertainment3 weeks agoNew documentary explores actor Christopher Reeve’s life and legacy

-

Business3 weeks ago

Bank of England warns of ‘future stress’ from hedge fund bets against US Treasuries

-

MMA3 weeks ago

MMA3 weeks agoAlex Pereira faces ‘trap game’ vs. Khalil Rountree

-

Technology3 weeks ago

Technology3 weeks agoGmail gets redesigned summary cards with more data & features

-

Sport3 weeks ago

Sport3 weeks agoChina Open: Carlos Alcaraz recovers to beat Jannik Sinner in dramatic final

-

News3 weeks ago

News3 weeks agoGerman Car Company Declares Bankruptcy – 200 Employees Lose Their Jobs

-

Technology3 weeks ago

Technology3 weeks agoTexas is suing TikTok for allegedly violating its new child privacy law

-

Sport3 weeks ago

Sport3 weeks agoSturm Graz: How Austrians ended Red Bull’s title dominance

-

MMA3 weeks ago

MMA3 weeks agoUFC 307 preview show: Will Alex Pereira’s wild ride continue, or does Khalil Rountree shock the world?

-

Business3 weeks ago

Business3 weeks agoStark difference in UK and Ireland’s budgets

-

Sport3 weeks ago

Sport3 weeks agoAaron Ramsdale: Southampton goalkeeper left Arsenal for more game time

-

TV3 weeks ago

TV3 weeks agoLove Island star sparks feud rumours as one Islander is missing from glam girls’ night

-

Sport3 weeks ago

Sport3 weeks agoCoco Gauff stages superb comeback to reach China Open final

-

News3 weeks ago

News3 weeks agoWoman who died of cancer ‘was misdiagnosed on phone call with GP’

-

Technology3 weeks ago

Technology3 weeks agoOpenAI secured more billions, but there’s still capital left for other startups

-

Business3 weeks ago

Head of UK Competition Appeal Tribunal to step down after rebuke for serious misconduct

-

Business3 weeks ago

The search for Japan’s ‘lost’ art

-

MMA3 weeks ago

MMA3 weeks agoKetlen Vieira vs. Kayla Harrison pick, start time, odds: UFC 307

-

News3 weeks ago

News3 weeks agoHeavy strikes shake Beirut as Israel expands Lebanon campaign

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoMarkets watch for dangers of further escalation

-

Technology3 weeks ago

Technology3 weeks agoJ.B. Hunt and UP.Labs launch venture lab to build logistics startups

-

TV3 weeks ago

TV3 weeks agoPhillip Schofield accidentally sets his camp on FIRE after using emergency radio to Channel 5 crew

-

News3 weeks ago

News3 weeks agoHeartbreaking end to search as body of influencer, 27, found after yacht party shipwreck on ‘Devil’s Throat’ coastline

-

Football3 weeks ago

Football3 weeks agoWhy does Prince William support Aston Villa?

-

Health & fitness3 weeks ago

Health & fitness3 weeks agoNHS surgeon who couldn’t find his scalpel cut patient’s chest open with the penknife he used to slice up his lunch

-

News3 weeks ago

News3 weeks agoBalancing India and China Is the Challenge for Sri Lanka’s Dissanayake

-

Science & Environment1 month ago

Science & Environment1 month agoPhysicists are grappling with their own reproducibility crisis

-

Technology4 weeks ago

Technology4 weeks agoRussia is building ground-based kamikaze robots out of old hoverboards

-

Football3 weeks ago

Football3 weeks agoSimo Valakari: New St Johnstone boss says Scotland special in his heart

-

Technology3 weeks ago

Technology3 weeks agoPopular financial newsletter claims Roblox enables child sexual abuse

-

News3 weeks ago

News3 weeks agoHull KR 10-8 Warrington Wolves – Robins reach first Super League Grand Final

-

Technology3 weeks ago

Technology3 weeks agoHow to disable Google Assistant on your Pixel Watch 3

-

Business3 weeks ago

Can liberals be trusted with liberalism?

-

Technology3 weeks ago

Technology3 weeks agoA very underrated horror movie sequel is streaming on Max

-

MMA3 weeks ago

MMA3 weeks ago‘I was fighting on automatic pilot’ at UFC 306

-

Sport3 weeks ago

Sport3 weeks ago2024 ICC Women’s T20 World Cup: Pakistan beat Sri Lanka

-

Entertainment3 weeks ago

Entertainment3 weeks ago“Golden owl” treasure hunt launched decades ago may finally have been solved

-

Technology3 weeks ago

Technology3 weeks agoEpic Games CEO Tim Sweeney renews blast at ‘gatekeeper’ platform owners

-

News3 weeks ago

News3 weeks agoLiverpool secure win over Bologna on a night that shows this format might work

-

Technology3 weeks ago

Technology3 weeks agoAmazon’s Ring just doubled the price of its alarm monitoring service for grandfathered customers

-

Travel3 weeks ago

Travel3 weeks agoI transformed into Plague Doctor for horrors that awaited me at London Dungeon… I was still shaking by the end – The Sun

-

Technology3 weeks ago

Technology3 weeks agoApple iPhone 16 Plus vs Samsung Galaxy S24+

-

TV3 weeks ago

TV3 weeks agoMaayavi (මායාවී) | Episode 23 | 02nd October 2024 | Sirasa TV

You must be logged in to post a comment Login