The potential impact of Donald Trump on the Ukraine war and the western alliance is well understood. But what happens in Germany could be almost as important.

The Germans are the second-largest national aid donors to Ukraine, after the US, and they are central players in both the EU and Nato. But populist parties, sympathetic to Russia, are on the rise in Germany.

The Alternative for Germany party (AfD) almost won the elections in the state of Brandenburg on Sunday. This is the party’s third strong performance in a row, after coming first in state elections in Thuringia and a close second in Saxony.

Combine the AfD vote with that of the Sahra Wagenknecht Alliance (BSW) and something like a third of Germans — and many more in eastern Germany — are voting for populist parties that are militantly anti-migration, hostile to Nato and determined to cut off aid to Ukraine. When Volodymyr Zelenskyy addressed the Bundestag in June, all but four of the AfD’s 77 members boycotted his speech.

The policy stances taken by the AfD and BSW, combined with accusations that many AfD members have an undeclared agenda that is even more extremist, mean that Germany’s traditional parties will refuse to go into coalition with the populists — at least at the national level. But the rise of the political extremes is already having an influence on government policies. Germany’s decision to impose border controls with its EU neighbours reflects the angst about illegal migration that the populists have capitalised on.

Ukraine’s supporters worry that the next policy adjustments will involve a softening of German support for Kyiv. The Ukrainian army is already struggling to hold off Russian forces in the east of the country and is running short of ammunition and troops. A decline in German and American support for Ukraine could help Russia to win the war.

Even if Russian tanks do not roll into Kyiv, Ukraine’s supporters worry that the Zelenskyy government may soon be forced to make territorial concessions that would allow Vladimir Putin to claim victory. A bad peace deal could put Ukraine’s future as a viable nation in doubt and embolden Putin to threaten other countries.

Ukraine’s friends in Berlin see proliferating signs of a possible softening in German support. While Britain and the US are debating allowing Ukraine to use their long-range missiles to strike deep inside Russia, Germany has ruled out supplying its own Taurus missiles.

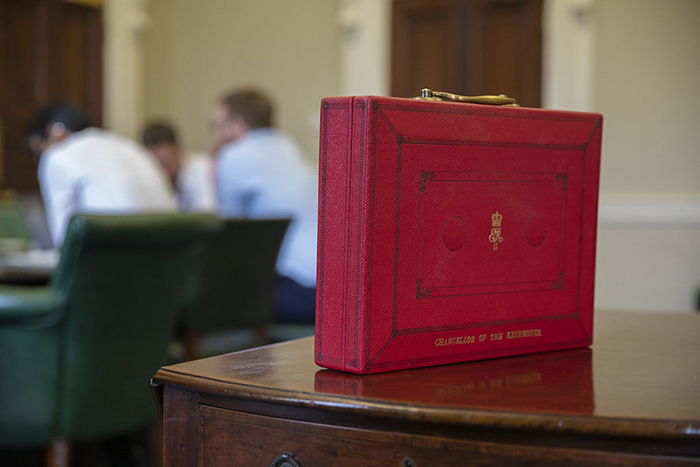

Germany’s finance minister, Christian Lindner, has said that there can be no further package of financial aid for Ukraine, without making politically impossible compensatory cuts in the budget. The EU’s decision to mobilise some frozen Russian assets to help Ukraine has taken the financial pressure off Berlin for now. But the question of German financial aid is certain to return.

Chancellor Olaf Scholz is lagging badly behind in national polls and looks to be heading for defeat in next September’s federal elections. Ukraine’s most ardent supporters worry that Scholz may be tempted to try to revive his political fortunes, by launching a pre-election peace initiative with Russia.

Nervousness about what Scholz might be up to was reflected in rumours doing the rounds in Berlin last week that a contact group, composed of members of his Social Democratic party, was in Moscow for secret talks.

These suggestions were waved away in the chancellery. Scholz’s key aides seem almost equally exasperated by the Russophile populists and by the hawks in Berlin that are demanding a sharp increase in aid for Kyiv. They see themselves as representing the moderate German middle on Ukraine. The government’s task, as Scholz sees it, is to keep a divided country together around a basically pro-Ukraine policy.

For the Ukrainians, however — long frustrated by what they regard as the snail-like pace of German aid — any suggestion that the Scholz government may become even more cautious is dismaying. Hawks in Kyiv and Berlin argue that if Putin is not defeated in Ukraine, he will move on to threaten Nato and ultimately Germany itself.

Scholz and his allies insist that he is not naive about the threat posed by Putin. They see the daily evidence of Russian brutality in Ukraine, as well as sabotage and disinformation inside Germany itself. Over the long term, German analysts worry that Russia has now fully converted into an economy primed for war and weapons production. They note that some of the most advanced weaponry that Russia is churning out is not being used in Ukraine, but seems to be being stored for some possible future conflict.

The German chancellor knows all this. But political leaders live in the moment and their outlooks are almost invariably dominated by domestic politics. Scholz has a very difficult election ahead and would like to run as the peace candidate.

He is also based in Berlin — a city that has seen so much darkness and tragedy — but which now feels a long way from the front lines of Ukraine. Last week, the pavement bars and bike paths near the chancellor’s office were full of people enjoying the late summer sunshine. The idea that dark times are returning to Europe is a hard thing for a government — or for a people — to face.

You must be logged in to post a comment Login