Rachel Reeves has been warned not to sharply ramp up government borrowing in a push for more public investment, as the chancellor considers a loosening of the fiscal rules in the October 30 Budget.

Analysis published by the Institute for Fiscal Studies think-tank on Thursday shows the government could create space to increase investment spending by more than £50bn if it targeted a broader measure of the public finances.

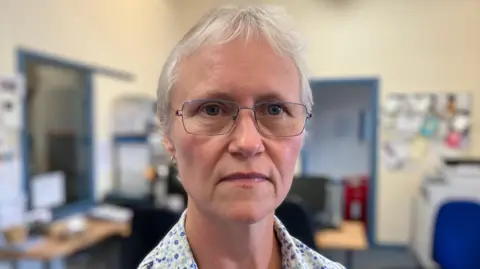

But Carl Emmerson, the IFS deputy director, said that even if the chancellor gained “lots of extra headroom”, she would need to be “very cautious” about using the extra borrowing capacity, given it would still mean higher debt interest payments.

If she were to boost investment, she would need to be “very clear about choosing the right programmes, making sure it is done well and that growth does materialise — and you can convince people it’s going to materialise,” Emmerson said.

Ben Nabarro, an economist at Citi whose forecasts underpin the IFS’s projections, said that while there was not a “buyers’ strike” in the gilts market, Reeves would need to make it clear she did not intend to use all the extra budgetary capacity she creates.

“There is clearly concern there,” he said, adding that international investors made no distinction between borrowing for immediate needs or for investment, and were not willing to give the UK the “benefit of the doubt”.

Gilt market investors are on edge as they await an overhaul to the chancellor’s fiscal rules in the Budget to better reflect the benefits of public investment and not just the costs. The fiscal rules currently require debt to fall as a share of GDP between years four and five of the UK’s official forecast, but the gauge of debt largely excludes public assets.

If the chancellor were to instead target public sector net financial liabilities (PSNFL), which includes a range of financial assets including the student loan book, or public sector net worth (PSNW), which tallies up physical assets including roads and railways, it would boost her budget headroom.

The IFS said, however, that the two alternative measures of debt were flawed, given the chancellor’s aim of convincing investors that higher capital spending would boost growth.

Paul Johnson, IFS director, said valuing assets such as roads and railways was uncertain and “bears no relation whatever to our ability to raise money in gilt markets”.

The PSNFL measure captures financial interests but excluded the roads and other physical assets that the chancellor wants to plough more money into.

Analysts said Reeves could win investors’ support if she made it clear she would only spend part of the headroom created by a change in the debt rule, scaled spending up slowly, and put firm institutional “guardrails” in place to ensure the money was well spent.

“We can’t just say we’re borrowing for good stuff. That’s not the way the world is likely to work for the UK unfortunately,” Nabarro said.

“After a recent market dislocation just two years ago, international investors in particular are not really willing to give the gilt market the benefit of the doubt.”

Extra headroom for investment spending would not make Reeves’s job any easier when it came to tackling the strains on day-to-day spending on public services, the IFS added.

Funding the recent increases to public sector pay on a permanent basis, and honouring Labour manifesto commitments, will require Reeves to top up plans for day-to-day departmental spending by £14bn in 2028—29, according to the IFS. A further £16bn would be needed to avoid real-terms cuts to all areas of public services.

Emmerson said this meant it would be “very challenging indeed” for the chancellor to meet her second fiscal rule, of keeping the current budget in balance with tax revenues covering day-to-day spending.

If the government wanted to go even further and raise day-to-day spending on public services in line with national income — reflecting growth in the population — it would need to increase taxes by a total of £25bn, the IFS said.

A government spokesperson said the Budget would “be built on the rock of economic stability” and noted the chancellor’s previous assurance that when it came to public investment, “this is not a race to get money out of the door”.

You must be logged in to post a comment Login