Reuters exclusively reported that CVS Health is exploring options that could include a break-up of the company to separate its retail and insurance units, as the struggling healthcare services company looks to turn around its fortunes amid pressure from investors.

Business

Inheritance tax increases expected for some in Budget

Getty Images

Getty ImagesThe government is planning to increase the amount of money it raises in inheritance tax at the Budget, the BBC has learned.

It is not known how many people are likely to end up paying more, nor how much more they would pay.

It is understood the prime minister and the chancellor are considering multiple changes to the tax, which currently includes several exemptions and reliefs.

Inheritance tax is charged at 40% on the property, possessions and money of somebody who has died above the £325,000 threshold.

It raises about £7bn a year for the government.

Around 4% of deaths result in an inheritance tax charge.

The tax includes a series of exemptions which over the years several governments have considered changing in order to raise more money.

It is thought changes to a number of these are under consideration.

Current exemptions and reliefs include rules around gifts that are given while you are alive.

If a person gives away more than £325,000 in cash or gifts but dies within seven years, recipients could be liable to pay inheritance tax.

There is also Business Relief for Inheritance Tax, and Agricultural Relief, which allows land or pasture that is used to grow crops or to rear animals to be free of Inheritance Tax.

It is not known what changes will be made in the Budget on Wednesday, 30 October.

A spokesman for the Treasury told the BBC: “We do not comment on speculation around tax changes outside of fiscal events.”

Ministers are attempting to plug what they claim is a £40bn shortfall between what they want to spend and the amount of tax they expect to collect.

Government sources say it is vital there is a “reset in the public finances” and are keen to emphasise what they see as the “scale of the challenge”.

This can be seen as part of the expectation management ahead of Rachel Reeves’ address.

Most new governments put up taxes immediately after a general election.

The Budget is expected to be billed as “Fixing the Foundations to Deliver Change”.

Both the prime minister and the chancellor have already appeared in front of lecterns branded “Fixing the Foundations” – an attempt to highlight what they claim is the mess they inherited from the Conservatives.

Getty Images

Getty ImagesFor several weeks, senior government figures have been strongly hinting that there will be increases to the amount of National Insurance paid by employers.

The Labour manifesto before the general election said that “Labour will not increase taxes on working people, which is why we will not increase National Insurance, the basic, higher, or additional rates of Income Tax, or VAT”.

This massively limits their options to raise more tax revenue.

But ministers appear willing to stretch the spirit if not the letter of their promise by putting up National Insurance on employers, some of whom – smaller businesses – would probably regard themselves as working people.

The chancellor is expected to give herself extra breathing space by changing the government’s self imposed rules on when it can borrow money, and has told some government departments that their budgets will be lower than they want.

A Labour source said that the negotiations on spending had provoked “significant angst” across the cabinet.

Shadow Chancellor Jeremy Hunt told the BBC: “During the election we repeatedly warned that Labour’s sums didn’t add up and that they were planning to raise taxes. The real scandal is that despite planning these tax rises all along, they didn’t have the courage to admit it to the public during the election campaign.

“Unfortunately, it looks like it will be people who have saved all their life to provide an inheritance to their family who will pay the price for Labour’s tax rises.”

Money

State pension warning as over one million risk £2,858 a year shortfall – exact amount you need to save for retirement

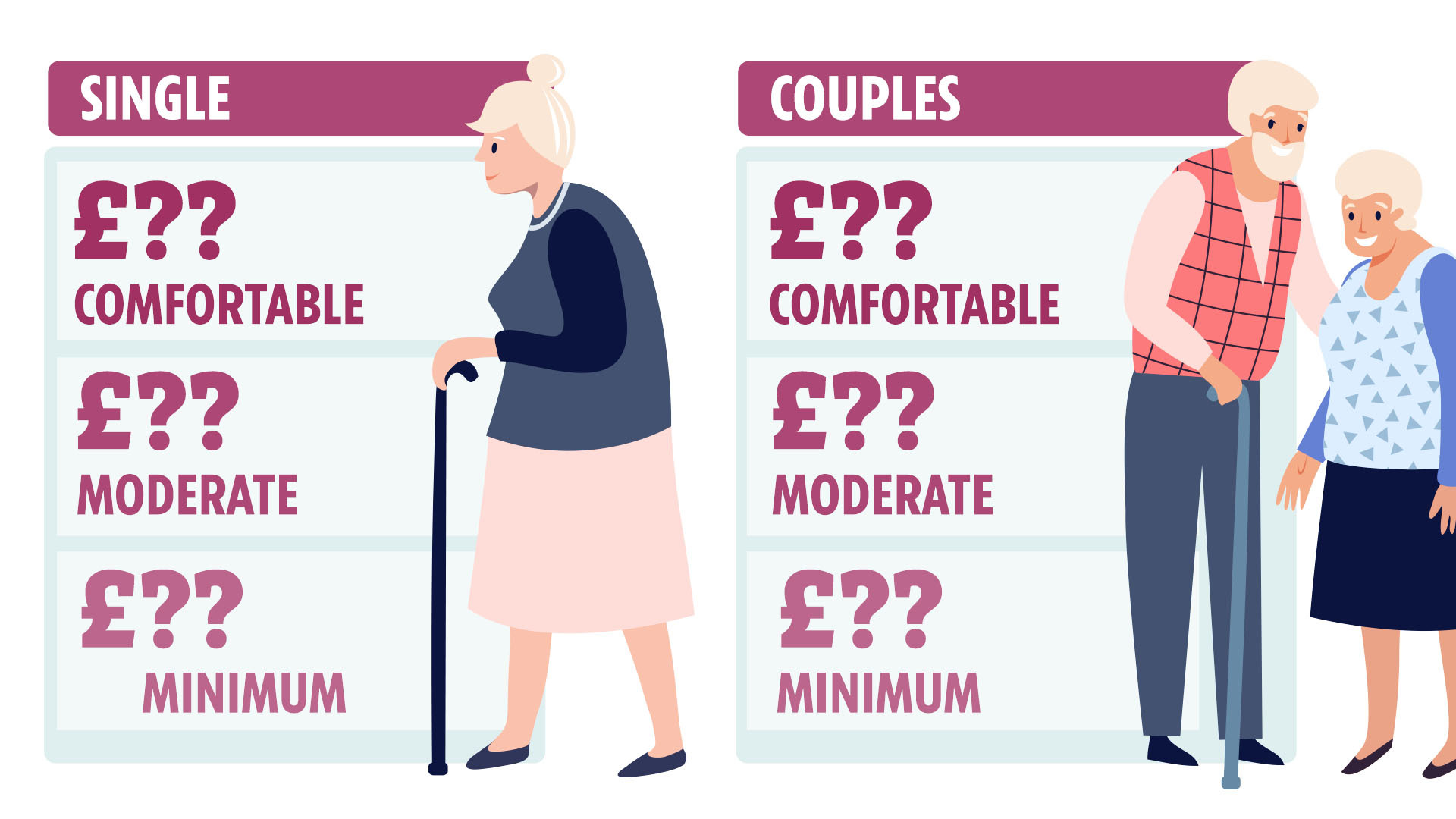

OVER one million people face a shortfall of £2,858 in retirement, experts have warned.

Anyone who has just the state pension to live off would run out of cash today, according to the Pensions and Lifetime Savings Association (PLSA),

A single pensioner needs an annual income of £14,400 to meet the what the PLSA calls a “minimum” standard of living.

It aims to cover all of a retiree’s basic needs as well as to have a small amount left over for leisure.

But the new state pension is currently worth just £11,542 annually.

That means that those without extra savings would exhaust their income by October 18, which the PLSA has branded “State Pension Shortfall Day” .

Around 1.2million retirees will need to contribute an extra £2,858 from a private pension or other savings to bridge the gap.

Pensioners aiming for “moderate” or “comfortable” retirement need more savings to cover annual expenditures of £19,758 and £31,558 a year respectively.

A moderate retirement is considered slightly more extravagant, while a comfortable one includes extra cash for multiple holidays abroad.

It means those relying solely on the full new state pension would run out of money even earlier in the year if their spending aligned with these higher standards.

The PLSA updates its retirement living standards each year to consider the rising cost of living.

They’re designed to help savers determine how much cash they’ll need when they stop working.

They don’t count mortgage payments or rent or any financial support you give your children or other dependents.

If you think you’ll still have those costs to meet when you retire, you’ll need to up your savings considerably.

Stephen Lowe, group communications director at retirement specialist Just Group, said: “At a time when government support for retirees’ finances is under scrutiny, State Pension Shortfall Day marks the day in the year when a pensioner living to a ‘minimum’ standard would theoretically run out of money if their only source of retirement income were the state pension.

“Despite two successive, significant increases, the full new state pension still falls nearly £3,000 a year short of meeting the ‘minimum’ of the PLSA’s Retirement Living Standards and is nearly £20,000 lower than the income required to support a ‘moderate’ standard of living.”

STATE PENSION BASICS

AT the moment the new state pension is paid to both men and women from age 66 – but it’s due to rise to 67 by 2028 and 68 by 2046.

It is a recurring payment from the government most Brits start getting when they reach the state pension age.

However, not everyone gets the same amount, and you are awarded depending on your National Insurance record.

For most pensioners, it forms only part of their retirement income, as they could have other pots from a workplace pension, earning and savings.

The new state pension is based on people’s National Insurance records.

Workers must have 35 qualifying years of National Insurance to get the maximum amount of the new state pension.

You earn National Insurance qualifying years through work, or by getting credits, for instance when you are looking after children and claiming child benefit.

If you have gaps, you can top up your record by paying in voluntary National Insurance contributions.

To get the old, full basic state pension, you will need 30 years of contributions or credits.

You will need at least 10 years on your NI record to get any state pension.

The full rate of the new state pension is £221.20 a week – or £11,542 a year.

Under the old system, the full basic state pension is £169.50 per week and is paid to those who retired before April 6, 2016.

State pension payments are expected to rise by 4.1% in line with wages from April 2025.

This means someone on the full new state pension will see their payments rise by around £473 a year next spring.

THE ‘MINIMUM’ RETIREMENT

The PLSA’s minimum retirement living standard covers all of a retiree’s basic needs as well as having some money left over for fun.

It includes a week’s staycation each year, eating out once a month, and some affordable leisure activities twice a week – but no car.

The PLSA says to afford this retirement, you would need an annual budget of £14,400 as a single person and £22,400 as a couple.

It’s important to remember that the state pension will make up part of that income.

Retirees can start to claim the state pension at 66, though if you’re retiring after 2026, you’ll almost definitely see that minimum age rise.

Those claiming the full flat rate state pension now receive £221.20 a week, equal to £11,542 a year.

However, not everyone qualifies for the full amount.

If you had gaps during your working year, you may have paid less national insurance and would receive a smaller state pension to reflect that.

However, millions of retirees can still top up their national insurance contributions.

THE ‘MODERATE’ RETIREMENT

For a slightly more extravagant retirement, an individual will need an income of £31,300 a year or £43,100 for a couple.

The moderate retirement living standard includes a two-week holiday in Europe each year and eating out a few times a month.

Around half of single employees are estimated to be on track to achieve a minimum or moderate retirement, with couples more likely to be at the top end of this range.

THE ‘COMFORTABLE’ RETIREMENT

To live comfortably in retirement, the PLSA said an individual would need an income of £43,100 a year, and a couple would need £59,000 between them.

This includes a three-week holiday, plenty of money to spend on clothing and more on social activities such as birthdays.

It would also be enough to cover several UK minibreaks a year.

SAVING FOR RETIREMENT

ANYONE planning their retirement needs to do some careful calculations about how much they will need to afford the lifestyle they want.

A good starting point is the government’s state pension age calculator, which will tell you when you will receive your state pension.

Visit gov.uk/state-pension-age to find out more.

Pension calculators can also help you determine how much money you need to save to have the pension pot you want at retirement.

The earlier you start saving, the easier it is as your money grows longer.

And you’re not on your own when saving for retirement.

Your workplace will almost certainly contribute some money to your pension pot, too, and you get tax relief from the government, which reduces the amount you have to pay yourself.

Business

CVS explores options including potential break-up

Business & FinanceHealth

01 October 2024, 6:03 pm 1 minute

Market Impact

CVS has been discussing various options – including how such a split would work – with its financial advisers in recent weeks, sources told Reuters. The latest discussions come as CVS faces increasing pressure from investors such as Glenview Capital, which is said to be pushing for changes at the company to help improve its operations after it cut its 2024 earnings outlook for a third consecutive quarter in August.

Article Tags

Topics of Interest: Business & FinanceHealth

Type: Reuters Best

Sectors: Business & FinancePharmaceuticals & Healthcare

Regions: Americas

Win Types: Exclusivity

Story Types: Exclusive / Scoop

Media Types: Text

Customer Impact: Important Regional Story

Money

The Works shoppers rush to buy Christmas stationary perfect for stocking fillers & scanning from just £1

SHOPPERS are racing to get their hands on Christmas stationary perfect for stocking filler from The Works – and items start from just £1.

A thrifty shopper took to Facebook group Extreme Couponing and Bargains UK to share the bargains.

The post read: “The Works Christmas items from £1 – in store and online”.

Along with the post was a picture showing four different items from the range – including a bouncing putty for £1.50 and a pack of festive rubbers for just £1.

Festive item also include a glow in the dark squishy for just £2 and a light up yoyo for £1.

Delighted Facebook users planned trips to the discount retailer to nab the affordable stocking filler.

One wrote: “The elf’s first little gifts”, while another wrote: “cute for stockings”.

A different account commented: “Some good little bits for my Christmas Eve box”, and one was particularly keen on “the cute rubbers”.

And one thanked the original poster for sharing the bargain: “Thank you Just got these for my kids as stocking fillers.”

The Works describes its light up yoyo as a “bright and colourful flashing festive themed yoyo that is sure to provide hours of fun for both children and adults.”

Its pack of five 3D rubbers are shaped like Christmas trees, snowmen, and gifts.

And the “soft and stretchy” Christmas bouncing putty is “perfect for moulding, squishing, and bouncing into fun shapes”.

Last but not least is the glow in the dark squishy which for £2, offers some festive excitement for tots across the country.

Head to The Works’ website to check out their full Christmas range so far.

It comes just months after the budget kids retailer was flogging a set of football-themed stationery from just a pound.

The Extreme Couponing and Bargains UK Facebook group shared the bargain deal stating: “Football Stationery From £1 At The Works.”

Parents were quick to rush to the comments and share the deal.

One mum said on social: “Look at these!”

A second commented: “Fold out stationery set online.”A

nother pointed out the bits could be perfect for Christmas and posted: “Stocking fillers!”

A fourth wrote: “Need to go in, footy things!”

While a fifth said: “Love it all!”

How to save money on Christmas shopping

CONSUMER reporter Sam Walker reveals how you can save money on your Christmas shopping.

Limit the amount of presents – buying presents for all your family and friends can cost a bomb.

Instead, why not organise a Secret Santa between your inner circles so you’re not having to buy multiple presents.

Plan ahead – if you’ve got the stamina and budget, it’s worth buying your Christmas presents for the following year in the January sales.

Make sure you shop around for the best deals by using price comparison sites so you’re not forking out more than you should though.

Buy in Boxing Day sales – some retailers start their main Christmas sales early so you can actually snap up a bargain before December 25.

Delivery may cost you a bit more, but it can be worth it if the savings are decent.

Shop via outlet stores – you can save loads of money shopping via outlet stores like Amazon Warehouse or Office Offcuts.

They work by selling returned or slightly damaged products at a discounted rate, but usually any wear and tear is minor.

Travel

Indulge in Unlimited-Luxury at Secrets Moxché Playa del Carmen

Photo by Secrets Moche

The Riviera Maya, renowned for its pristine beaches, vibrant culture, and luxurious resorts, has a new gem in its crown – Secrets Moxché Playa del Carmen. This adults-only haven, located just a short drive from the bustling Quinta Avenida, offers a sophisticated and indulgent escape where every detail is meticulously crafted to pamper and delight. From the moment you arrive, you’ll be enveloped in an atmosphere of refined elegance, where lush tropical gardens, shimmering pools, and the mesmerizing turquoise waters of the Caribbean Sea create an idyllic backdrop for an unforgettable vacation.

Photo by Secrets Moche

One of the most remarkable aspects of Secrets Moxché is its exceptional dining scene. With over a dozen restaurants and bars, guests can embark on a global culinary journey without ever leaving the resort. Whether you’re craving authentic Italian cuisine, the vibrant flavors of Mexico, or you’re feeling like having a small snack or Asian food, Secrets Moxché has something to satisfy every palate.

Photo by Secrets Moche

No matter your preference, you’ll find an array of delectable options to choose from, whether you’re in the mood for a casual beachside lunch or a romantic candlelit dinner.

Photo by Secrets Moche

And with unlimited top-shelf spirits, natural fruit juices, and soft drinks included, you can raise a toast to your dream vacation at any time.

Photo by Secrets Moche

Beyond its culinary excellence, Secrets Moxché boasts an impressive array of amenities designed to enhance your stay and provide the ultimate relaxation and rejuvenation.

Photo by Secrets Moche

Unwind in the world-class spa, where a menu of rejuvenating treatments will leave you feeling refreshed and revitalized. Indulge in a massage, facial, or body wrap, and let the expert therapists melt away your stress and tension. Stay active during your vacation with a state-of-the-art fitness center, equipped with cardio machines, weights, and everything you need to maintain your workout routine.

Photo by Secrets Moche

Take a dip in one of the shimmering pools, including an infinity pool overlooking the ocean, or simply relax on the pristine stretch of white sand beach with comfortable loungers and umbrellas.

Photo by Secrets Moche

Secrets Moxché offers a variety of activities to keep you entertained throughout your stay. Join a yoga class, participate in water aerobics, play beach volleyball, or simply soak up the sun and enjoy the tranquil atmosphere. In the evenings, enjoy live music, theme parties, and other exciting entertainment options.

Photo by Secrets Moche

Whether you need assistance with booking excursions, arranging transportation, or simply have a question, the 24-hour room and concierge services are always available to cater to your every need.

Photo by Secrets Moche

Secrets Moxché isn’t just a haven for romantic getaways; it’s also an idyllic setting for a dream wedding. With its breathtaking beachfront location, elegant venues, and dedicated wedding planners, the resort offers everything you need to create a truly unforgettable celebration. Choose from a variety of customizable wedding packages, each designed to cater to your unique vision and preferences. Whether you envision an intimate ceremony on the beach or a grand reception in a luxurious ballroom, Secrets Moxché will ensure your special day is nothing short of perfect.

Photo by Secrets Moche

For those seeking an extra touch of exclusivity, the Preferred Club offers a range of enhanced amenities and services to elevate your stay even further.

Photo by Secrets Moche

Enjoy access to a private lounge with premium drinks and snacks, perfect for relaxing and socializing with other Preferred Club guests. A dedicated concierge will be available to assist you with all your needs, from booking dinner reservations to arranging special experiences.

Photo by Secrets Moche

Preferred Club guests enjoy upgraded suites in prime locations, offering breathtaking views and enhanced amenities.

Photo by Secrets Moche

Take a dip in the exclusive rooftop pool, offering panoramic views of the ocean and surrounding area.

Photo by Secrets Moche

Secrets Moxché provides the perfect setting for a romantic getaway or a relaxing escape. Whether you’re seeking adventure, rejuvenation, or simply a chance to unwind and reconnect with your loved one, this luxurious resort has everything you need to create lasting memories.

Photo by Secrets Moche

With its stunning location, exceptional dining, world-class amenities, and unparalleled service, Secrets Moxché promises an unforgettable experience that will exceed your expectations.

Business

Fraudsters steal £3m a day as cases rise

Fraud cases have risen by 16% with con artists stealing more than £3m a day, according to figures from the banking industry.

Criminals have particularly targeted victims by tricking them out of their one-time passcodes, trade body UK Finance said.

Despite the increase in reported cases, total losses have fallen slightly – totalling £572m in the first half of the year.

Banks said that fraud posed a “major threat” to the UK and called for support in tackling the crime.

The figures come after BBC Panorama revealed earlier this week a stream of cases involving e-money firm Revolut.

One victim told of how he lost £165,000 from his business account within an hour. Revolut said it had “robust controls” in place.

Changing tactics by fraudsters have seen cases rise in the first six months of this year, compared with the same period last year.

Unauthorised payments rose sharply, with losses up 5%, driven in part by fraudsters circumventing protection systems.

When a customer makes a payment online, they are often sent a one-time passcode to verify the transaction.

Fraudsters have found ways to trick people into telling them these codes, in order to steal money.

However, the latest data shows there were relatively large falls in romance and investment scams.

This may have been the result of the promise of stricter rules regarding so-called authorised push payment (APP) fraud prevention.

When criminals dupe their victims into sending them money by pretending to be a legitimate company, such as their bank or a tradesperson, or by selling goods that do not exist, this is known as APP fraud.

New mandatory rules took effect on 7 October which will see UK banks refund APP fraud victims up to £85,000 within five days.

Before the compulsory rules came in, most banks had signed up to a voluntary reimbursement code.

There were 97,344 cases of APP fraud in the first half of the year, with total losses of £214m.

“Fraud continues to pose a major threat in this country,” said Ben Donaldson, managing director of economic crime at UK Finance.

“In addition to the financial impact, this crime can cause severe psychological harm to victims.

“This isn’t a fight we will win alone.”

On Sunday, Charlie Nunn, chief executive of Lloyds Banking Group, accused Meta, the tech giant which owns social media platforms Facebook and Instagram, of “enabling” people to be contacted by fraudsters running online scams.

Meta said in response that its “pilot Fraud Intelligence Reciprocal Exchange programme (FIRE)” was designed to enable banks to “share information so we can work together to protect people using our respective services”.

Money

Water giants want even more cash from hard-pressed customers – by adding £100 to bills over five years

WATER giants want to flush out even more cash from hard-pressed customers by adding another £100 to bills over five years.

The biggest suppliers in England and Wales say they need price rises above the levels they have already asked for, despite the regulator telling them that even those amounts were too high.

In July, Ofwat said bills could go up by an average of £94 in the period up to 2030 — a 21 per cent hike, typically working out at an extra £19 a year.

But most companies have now submitted new plans, saying they need to cover urgent investment to cut sewage spills and combat leaky pipes, as well as higher debt interest costs.

It emerged as one provider, United Utilities, was yesterday accused of failing to report more than 100million litres of raw sewage being illegally dumped into Lake Windermere over a three-year period.

Southern Water has already asked to lift bills by 72 per cent from £420.35 a year to £627 a year. Ofwat said in July this should be limited to 44 per cent, but now bosses want more.

READ MORE ON WATER COMPANIES

Troubled Thames Water says it needs to raise bills by 59 per cent to survive, but Ofwat wants a limit of 23 per cent.

Thames creditors argue that unless Ofwat approves the bigger rise, investors will desert the business and it could run out of cash by the New Year.

They say that could create a domino effect, causing an overall lack of appetite to invest in UK infrastructure.

Family’s back at N Brown

THE fashion group behind Jacamo, JD Williams and Simply Be is being taken private in a £191million deal by the family that built the business up 60 years ago.

Joshua Alliance is to pay 40p per share for the 40 per cent of the N Brown Group that his family does not already own.

Mike Ashley’s Frasers Group has 20 per cent and will make a sizeable profit after upping its stake in February when the shares were sitting at only 18p.

The stock price of N Brown, which recently called on TV’s Denise van Outen to front JD Williams adverts, jumped by 45 per cent yesterday on the back of the bid.

Mr Alliance, 35, has a 6.6 per cent stake while his father, 92-year-old Lord David Alliance, who bought the business in 1963, has 53.4 per cent.

Lord David was once known as the King of British Textile for his empire that included Coats Viyella.

He started his career working in bazaars in Iran before moving to Manchester to work in the rag trade.

Joshua Alliance said N Brown would be better off in private hands because, due to its current shareholder ownership, it is “not benefiting from being listed on the AIM market — whilst having to bear significant costs associated with its listing”.

He said: “In the business’s current cycle of evolution, we will be able to achieve this growth potential more successfully away from the public markets.”

Taking a break in revenue

KITKAT maker Nestle has halved its growth expectations for the year after blaming weaker demand and boycotts linked to the conflict in the Middle East.

The world’s biggest food group said its sales would grow by around 2 per cent this year, rather than the 4 per cent expectation it had at the start of the year.

It said its growth was impacted by “soft consumer demand and consumer hesitancy towards global brands, linked to geopolitical tension”.

The cost of living crisis has also prompted many shoppers to turn their back on many big brands, which have raised prices and shrunk packets to boost their profits.

The Swiss food giant follows global giants Starbucks and McDonald’s in being impacted by boycotts linked to the conflict in Gaza.

Nestle has become a target for the boycott due to its stake in Israeli food seller Osem.

Buy now, pay safer

SHOPPERS will be protected by new rules around “Buy Now, Pay Later” firms, the City watchdog has confirmed.

Regulation around BNPL products, such as Klarna and Clearpay, will finally kick in by early 2026, the Financial Conduct Authority has said.

Proposals to regulate BNPL were first touted in 2021. The new rules will mean firms must follow the same laws covering credit cards and customers will be protected if things go wrong.

30 fired at Meta

FACEBOOK’S Mark Zuckerberg has fired almost 30 workers on six-figure salaries for using meal credits to buy goods such as wine glasses.

Staff at Meta, the owner of Facebook and Instagram, were being paid £300,000 but still received perks including free meal vouchers to buy breakfast, lunch and dinner.

A probe found the sacked workers had used them to buy toothpaste and cosmetics.

Meta, worth £1.1trillion, has led an efficiency drive which has included 21,000 lay-offs in the past two years.

THE boss of Ladbrokes owner Entain has lifted its profit forecasts after a boost from the recent Euros and NFL matches. But Gavin Isaacs yesterday also warned the Government that a tax grab on the gambling sector would lead to job losses.

£571M in scams

BRITS had more than £571million stolen by fraudsters and scammers in the first six months of the year.

There were almost 2,000 cases of romance scams, with customers losing £14.5million, says UK Finance data.

Criminals posing as bank staff or police stole £32.3million, while fraudsters pretending to be bosses to trick victims into transferring cash led to a £7.8million loss.

Banks are calling on social media firms to help tackle scammers at source because most fraud starts online.

SHARES

- BARCLAYS up 8.05 to 245.10

- BP up 4.55 to 400.00

- CENTRICA up 0.90 to 125.60

- HSBC up 5.20 to 678.00

- LLOYDS up 0.66 to 61.86

- MARKS & SPENCER down 2.60 to 390.80

- NATWEST up 7.70 to 362.80

- ROYAL MAIL flat 0.00 at 343.80

- J SAINSBURY up 4.20 to 278.80

- SHELL up 22.00 to 2,554.50

- TESCO up 7.00 to 362.10

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoHyperelastic gel is one of the stretchiest materials known to science

-

Technology4 weeks ago

Technology4 weeks agoWould-be reality TV contestants ‘not looking real’

-

Technology3 weeks ago

Technology3 weeks agoIs sharing your smartphone PIN part of a healthy relationship?

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoHow to unsnarl a tangle of threads, according to physics

-

Science & Environment4 weeks ago

Science & Environment4 weeks ago‘Running of the bulls’ festival crowds move like charged particles

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoLiquid crystals could improve quantum communication devices

-

Womens Workouts3 weeks ago

Womens Workouts3 weeks ago3 Day Full Body Women’s Dumbbell Only Workout

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoX-rays reveal half-billion-year-old insect ancestor

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoQuantum ‘supersolid’ matter stirred using magnets

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoSunlight-trapping device can generate temperatures over 1000°C

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoWhy this is a golden age for life to thrive across the universe

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoNerve fibres in the brain could generate quantum entanglement

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoQuantum forces used to automatically assemble tiny device

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoA slight curve helps rocks make the biggest splash

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoLaser helps turn an electron into a coil of mass and charge

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoHow to wrap your mind around the real multiverse

-

News1 month ago

the pick of new debut fiction

-

News4 weeks ago

News4 weeks agoOur millionaire neighbour blocks us from using public footpath & screams at us in street.. it’s like living in a WARZONE – WordupNews

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoNuclear fusion experiment overcomes two key operating hurdles

-

Technology3 weeks ago

Technology3 weeks agoWhy Machines Learn: A clever primer makes sense of what makes AI possible

-

News1 month ago

News1 month ago▶️ Hamas in the West Bank: Rising Support and Deadly Attacks You Might Not Know About

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoPhysicists are grappling with their own reproducibility crisis

-

News4 weeks ago

News4 weeks ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

News4 weeks ago

News4 weeks agoYou’re a Hypocrite, And So Am I

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

Business3 weeks ago

Eurosceptic Andrej Babiš eyes return to power in Czech Republic

-

Technology3 weeks ago

Technology3 weeks agoMicrophone made of atom-thick graphene could be used in smartphones

-

Business2 weeks ago

Business2 weeks agoWhen to tip and when not to tip

-

Sport2 weeks ago

Sport2 weeks agoCoco Gauff stages superb comeback to reach China Open final

-

Science & Environment1 month ago

Science & Environment1 month agoCaroline Ellison aims to duck prison sentence for role in FTX collapse

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoPhysicists have worked out how to melt any material

-

Sport4 weeks ago

Sport4 weeks agoJoshua vs Dubois: Chris Eubank Jr says ‘AJ’ could beat Tyson Fury and any other heavyweight in the world

-

News1 month ago

News1 month agoNew investigation ordered into ‘doorstep murder’ of Alistair Wilson

-

News4 weeks ago

The Project Censored Newsletter – May 2024

-

Technology3 weeks ago

Technology3 weeks agoUkraine is using AI to manage the removal of Russian landmines

-

Technology3 weeks ago

Technology3 weeks agoUniversity examiners fail to spot ChatGPT answers in real-world test

-

Sport2 weeks ago

Sport2 weeks agoWales fall to second loss of WXV against Italy

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoRethinking space and time could let us do away with dark matter

-

Technology3 weeks ago

Technology3 weeks agoQuantum computers may work better when they ignore causality

-

Sport3 weeks ago

Sport3 weeks agoWatch UFC star deliver ‘one of the most brutal knockouts ever’ that left opponent laid spark out on the canvas

-

Health & fitness4 weeks ago

Health & fitness4 weeks agoThe secret to a six pack – and how to keep your washboard abs in 2022

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoA tale of two mysteries: ghostly neutrinos and the proton decay puzzle

-

Technology3 weeks ago

Technology3 weeks agoRobo-tuna reveals how foldable fins help the speedy fish manoeuvre

-

Business3 weeks ago

Should London’s tax exiles head for Spain, Italy . . . or Wales?

-

MMA3 weeks ago

MMA3 weeks agoConor McGregor challenges ‘woeful’ Belal Muhammad, tells Ilia Topuria it’s ‘on sight’

-

Football3 weeks ago

Football3 weeks agoFootball Focus: Martin Keown on Liverpool’s Alisson Becker

-

Technology2 weeks ago

Technology2 weeks agoThis AI video generator can melt, crush, blow up, or turn anything into cake

-

Business2 weeks ago

DoJ accuses Donald Trump of ‘private criminal effort’ to overturn 2020 election

-

Sport3 weeks ago

Sport3 weeks agoWorld’s sexiest referee Claudia Romani shows off incredible figure in animal print bikini on South Beach

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoFuture of fusion: How the UK’s JET reactor paved the way for ITER

-

News4 weeks ago

News4 weeks agoIsrael strikes Lebanese targets as Hizbollah chief warns of ‘red lines’ crossed

-

Technology3 weeks ago

Technology3 weeks ago‘From a toaster to a server’: UK startup promises 5x ‘speed up without changing a line of code’ as it plans to take on Nvidia, AMD in the generative AI battlefield

-

Technology1 month ago

Technology1 month agoThe ‘superfood’ taking over fields in northern India

-

Politics4 weeks ago

UK consumer confidence falls sharply amid fears of ‘painful’ budget | Economics

-

News4 weeks ago

News4 weeks agoWhy Is Everyone Excited About These Smart Insoles?

-

Technology3 weeks ago

Technology3 weeks agoGet ready for Meta Connect

-

Politics3 weeks ago

Robert Jenrick vows to cut aid to countries that do not take back refused asylum seekers | Robert Jenrick

-

Health & fitness3 weeks ago

Health & fitness3 weeks agoThe 7 lifestyle habits you can stop now for a slimmer face by next week

-

Business2 weeks ago

Bank of England warns of ‘future stress’ from hedge fund bets against US Treasuries

-

Technology2 weeks ago

Technology2 weeks agoAmazon’s Ring just doubled the price of its alarm monitoring service for grandfathered customers

-

News2 weeks ago

News2 weeks agoHeartbreaking end to search as body of influencer, 27, found after yacht party shipwreck on ‘Devil’s Throat’ coastline

-

Business2 weeks ago

Ukraine faces its darkest hour

-

TV2 weeks ago

TV2 weeks agoPhillip Schofield accidentally sets his camp on FIRE after using emergency radio to Channel 5 crew

-

News2 weeks ago

News2 weeks agoMassive blasts in Beirut after renewed Israeli air strikes

-

News2 weeks ago

News2 weeks agoHull KR 10-8 Warrington Wolves – Robins reach first Super League Grand Final

-

Technology2 weeks ago

Technology2 weeks agoA very underrated horror movie sequel is streaming on Max

-

Entertainment2 weeks ago

Entertainment2 weeks agoChristopher Ciccone, artist and Madonna’s younger brother, dies at 63

-

News1 month ago

News1 month agoHow FedEx CEO Raj Subramaniam Is Adapting to a Post-Pandemic Economy

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoBeing in two places at once could make a quantum battery charge faster

-

CryptoCurrency4 weeks ago

CryptoCurrency4 weeks agoCardano founder to meet Argentina president Javier Milei

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoWhy we need to invoke philosophy to judge bizarre concepts in science

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoUK spurns European invitation to join ITER nuclear fusion project

-

Sport4 weeks ago

Sport4 weeks agoUFC Edmonton fight card revealed, including Brandon Moreno vs. Amir Albazi headliner

-

Politics4 weeks ago

‘Appalling’ rows over Sue Gray must stop, senior ministers say | Sue Gray

-

TV4 weeks ago

TV4 weeks agoCNN TÜRK – 🔴 Canlı Yayın ᴴᴰ – Canlı TV izle

-

News4 weeks ago

News4 weeks agoFour dead & 18 injured in horror mass shooting with victims ‘caught in crossfire’ as cops hunt multiple gunmen

-

Womens Workouts3 weeks ago

Womens Workouts3 weeks ago3 Day Full Body Toning Workout for Women

-

Servers computers3 weeks ago

Servers computers3 weeks agoWhat are the benefits of Blade servers compared to rack servers?

-

CryptoCurrency4 weeks ago

CryptoCurrency4 weeks agoDZ Bank partners with Boerse Stuttgart for crypto trading

-

Business4 weeks ago

Thames Water seeks extension on debt terms to avoid renationalisation

-

Womens Workouts4 weeks ago

Womens Workouts4 weeks agoEverything a Beginner Needs to Know About Squatting

-

News4 weeks ago

News4 weeks agoShocking ‘kidnap’ sees man, 87, bundled into car, blindfolded & thrown onto dark road as two arrested

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoMeet the world's first female male model | 7.30

-

Business2 weeks ago

Business2 weeks agoChancellor Rachel Reeves says she needs to raise £20bn. How might she do it?

-

MMA2 weeks ago

MMA2 weeks agoDana White’s Contender Series 74 recap, analysis, winner grades

-

Sport2 weeks ago

Sport2 weeks agoLauren Keen-Hawkins: Injured amateur jockey continues progress from serious head injury

-

MMA2 weeks ago

MMA2 weeks agoPereira vs. Rountree prediction: Champ chases legend status

-

Technology2 weeks ago

Technology2 weeks agoTexas is suing TikTok for allegedly violating its new child privacy law

-

Business2 weeks ago

Can liberals be trusted with liberalism?

-

News2 weeks ago

News2 weeks ago▶ Hamas Spent $1B on Tunnels Instead of Investing in a Future for Gaza’s People

-

News2 weeks ago

News2 weeks agoNavigating the News Void: Opportunities for Revitalization

-

Business2 weeks ago

LVMH strikes sponsorship deal with Formula 1

-

Football2 weeks ago

Football2 weeks agoRangers & Celtic ready for first SWPL derby showdown

-

TV2 weeks ago

TV2 weeks agoসারাদেশে দিনব্যাপী বৃষ্টির পূর্বাভাস; সমুদ্রবন্দরে ৩ নম্বর সংকেত | Weather Today | Jamuna TV

-

Technology2 weeks ago

Technology2 weeks agoMusk faces SEC questions over X takeover

-

Technology2 weeks ago

Technology2 weeks agoApple iPhone 16 Plus vs Samsung Galaxy S24+

-

Entertainment2 weeks ago

Entertainment2 weeks ago“Golden owl” treasure hunt launched decades ago may finally have been solved

You must be logged in to post a comment Login