The writer is the former UK ambassador to Lebanon and foreign policy adviser to three prime ministers. His latest novel is ‘The Assassin’

Civilians across the Middle East are braced once again against the increasing possibility of a full-scale conflict between Israel and Hizbollah, the Iran-backed militant group. After the devastation in Gaza, they anxiously watch the reckless high-stakes poker of hardliners who want to keep the region on the brink of war in order to keep themselves in power.

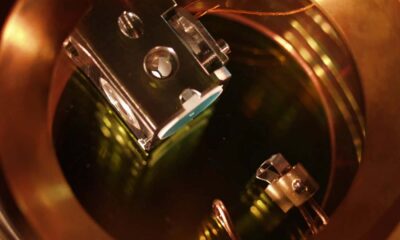

As every intelligence service is privately acknowledging, turning pagers and radios into lethal explosives was an audacious piece of tradecraft from Mossad, Israel’s spy agency. It hit Hizbollah’s command chain, communications and confidence. It is one of those moments in the Middle East that resonates beyond the immediate: it will be spoken about in hushed tones for years, perhaps decades. Social media makes the psychological impact even greater. Hizbollah is in shock, and seething. Its rank and file feel insecure.

The key question on the Hizbollah side is whether it absorbs this humiliating blow or hits back. It is probably a case of when, not if, it chooses to do so, alongside its threats of revenge for the assassinations of its leadership.

The key question on the Israeli side is whether this was a prelude to a serious land offensive, or just a psychological operation to degrade Hizbollah? I hear both explanations from the Israeli military, many of whom think it is only a question of when, not if, they launch a land invasion aimed at removing Hizbollah from the south of Lebanon and establishing some mirage of a “buffer zone”.

Faced with this moment of peril, the international community must focus on two urgent challenges.

First, civilian protection. The reality is that hundreds of thousands of civilians — in Lebanon and Israel — are on the brink of a devastating escalation of this conflict if the hardliners get their way. Many are already displaced, injured and killed. They must be our central concern.

Second, upholding international law, including legal constraints on the conduct of war. As we have seen with cyber and lethal autonomous weapons, the speed of technological change means that the systems designed to contain the ingenuity of humans to find new ways to kill each other struggle to keep up. But the basic rules are not complicated, whether the weapon is a pager or a rocket: don’t kill civilians.

Now, sadly, it appears that neither of those challenges is a major priority for the current leaders in Iran and Israel. Prime Minister Benjamin Netanyahu’s increasingly hardline government is focused on tactical wins. The Iranian regime is content to let others fight its battles. So we must also focus on preventing disastrous escalation.

There is space for diplomacy. It can build the off-ramps for both sides, for when leaders emerge with the wisdom to take them. UK foreign secretary David Lammy and others are working the phones to regional leaders. Wise voices and cool heads can prevail. The challenge is that both Israel and Lebanon are in political crisis — in Beirut, there is a caretaker government and no president, while in Israel, Netanyahu’s far-right coalition is fracturing.

International mediation on Israel and Lebanon needs to deal not only with the short-term cessation of hostilities, but land-border demarcation, a permanent peace (not just a ceasefire) and the return of state authority to south Lebanon. The Lebanese army has to be supported to provide security on the border, as we have helped it to do on the border with Syria.

From my discussions with the Lebanese prime minister, Najib Mikati, and others, it has become clear that ultimately the key to regional de-escalation lies in Gaza ceasefire talks and hostage releases. There are still fundamental differences to overcome — how to manage the Rafah crossing, prisoner releases and the future of the so-called Philadelphi corridor, a narrow strip of land along Gaza’s border with Egypt. But with the right collective pressure and political will these obstacles are surmountable.

Ultimately, the prize remains a big, bold agreement between Israel and the Arab world that includes the normalisation of relations; the creation of the long-promised Palestinian state; and the isolation of the Iranian regime. There is no way out of a wider crisis without hope that both Palestinians and Israelis have the right to security, justice and opportunity in lands they can call their own. This will require genuine partners for peace on both sides of the table.

So Britain and its allies should take the parameters for a two-state solution to the UN Security Council. Sometimes the immediacy of the danger can create space and urgency for negotiations.

Hamas, Hizbollah and Israeli hardliners want to bury a two-state solution, displace the other side and destroy the prospect of coexistence. The stakes are too high to let them do so.

You must be logged in to post a comment Login