Good morning. It’s EU leaders’ summit day here in Brussels, and my colleagues preview the biggest topic of debate — migration — below. While our competition correspondent drinks to the health of the European beer industry.

Returns ticket

European Commission president Ursula von der Leyen will attend a huddle with a select group of EU leaders this morning to find “innovative” solutions to the bloc’s long-running and politically divisive migration issues ahead of a formal summit in Brussels.

Context: Brussels proposed a landmark overhaul of the bloc’s asylum and migration rules in 2016 after almost 2mn people, many of whom were Syrian refugees, claimed asylum in the EU. But the new pact — only recently agreed after almost a decade of political wrangling — has far from eased the debate with a resurgence of right-wing forces in the EU spooking governments into taking a tougher stance.

The number of irregular migrants into the EU reached 385,445 in 2023, according to commission figures, but is still far below the 1.8mn people who arrived in 2015. About a fifth of non-EU citizens arriving in 2023 were forcibly returned.

Restrictions are appearing across the bloc. This week Polish premier Donald Tusk said that his government would suspend asylum rights for those crossing from Belarus, echoing a move taken by Finland on its long border with Russia. Germany has imposed checks at its national border. France has said it wants to increase deportations, and follow Germany’s move.

Italian premier Giorgia Meloni, one of the architects of today’s pre-summit gathering, has hailed her country’s new asylum processing centre in Albania, which opened this week, as “a new, courageous, unprecedented path”.

But the scheme got off to an inauspicious start yesterday after four of the first 16 migrants sent to Albania were returned — two for being potentially underage and two for being medically vulnerable.

Meloni’s meeting, co-organised with the Netherlands and Denmark, will include countries such as Poland, Czech Republic and Austria. The aim is some blue-sky brainstorming about solutions to so-called irregular migration — the crossing of international borders without permission to travel — ahead of the meeting of all 27 leaders.

Alexander Schallenberg, Austria’s foreign minister, told the FT that Tusk’s move was “an alarm bell” for the survival of the EU’s Schengen area, which allows the free movement of people.

“We want to keep the [Schengen] system . . . but it is brutally dysfunctional for the time being,” he said, before listing Italy’s scheme with Albania and the UK’s now thwarted scheme to deport migrants to Rwanda as “interesting” propositions.

More formally, member states are considering whether to make a statement during the summit to the effect of requiring the commission to propose measures to speed up returns from the EU “as a matter of urgency” and to find “new ways to prevent and counter irregular migration”, according to a draft.

But some are sceptical of putting demands down on paper for fear that it will result in tortuous hours of fighting over words.

“It’s the start of a discussion, not the end,” a senior EU official said.

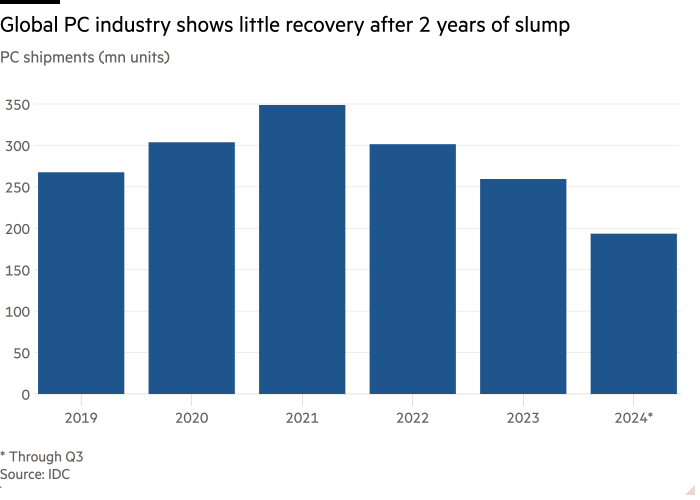

Chart du jour: Northvolt crisis

Why has Europe’s flagship green project become plagued by problems ranging from incompetent management and poor safety standards to over-reliance on Chinese machinery? “Too much money, too fast,” say insiders.

Cheers!

There’s fizz back in Europe’s beer industry, as a new report claimed that the sector was creating millions of jobs and billions in tax revenues despite lingering effects from the pandemic and rising costs, writes Javier Espinoza.

Context: Europeans drank €110bn worth of beer in 2022, according to a study commissioned by industry group The Brewers of Europe, with Czechs, Austrians and Poles drinking the most per capita. That boozing contributed a hearty €52bn in value-added to the bloc’s economy, it calculated.

Beer created just over 2mn jobs across the value chain that year, the report estimates, including 1.5mn jobs for those pulling and serving pints to thirsty punters.

Still, the sector faces challenges. Production costs have risen by 25 per cent since 2019, and while employment rose by 300,000 since 2020, the beer industry is still recovering from pandemic closures. Meanwhile, governments have been toasting the €40bn in tax revenues generated by beer, which includes excise duties and VAT from hospitality.

“Brewers play a major role in the European economy, deeply connected to their local communities, creating jobs and supporting growth. However, their contribution is often overlooked,” said Julia Leferman, secretary-general of The Brewers of Europe. “The beer sector and its long value chain continues to be a force for good, leading the way in moderation, driving economic growth, supporting communities, and championing sustainability.”

Just remember to drink responsibly.

What to watch today

Now read these

Are you enjoying Europe Express? Sign up here to have it delivered straight to your inbox every workday at 7am CET and on Saturdays at noon CET. Do tell us what you think, we love to hear from you: europe.express@ft.com. Keep up with the latest European stories @FT Europe

You must be logged in to post a comment Login